A MESSAGE FROM THE OFFICE OF HUMAN RESOURCES - Weber County

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

A MESSAGE FROM THE

OFFICE OF HUMAN RESOURCES

Dear Valued Employee,

Weber County remains dedicated to helping you be the best you can be,

especially in uncertain and challenging times. Throughout this guide you

will find benefit plan options to help keep you well and to prepare

yourself for a secure future.

Open Enrollment is your annual opportunity to evaluate and choose

which benefit plans are the best fit for you and your family.

Enroll: October 21 – November 21, 2020 by 11:59 p.m.

It’s important to note that after Open Enrollment ends on November 21,

2020, you will no longer be able to make changes to most of your 2021

benefit plans without a qualifying life event.

Use this Guide and the HR team as your resources to help educate

yourself and choose the options that are best for you.

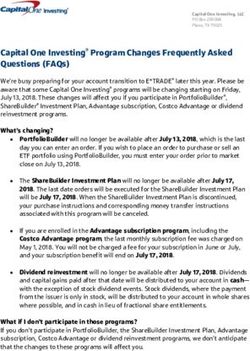

What’s New in 2021?

Weber County has changed their contribution to 90% for the High

Deductible plan and continued with the same contribution to your HSA

accounts! For the traditional plan the County contribution will be 80%.

Starting January 1, 2021, we will be changing out life insurance, short

term disability, accident, and critical illness to The Standard. If you

would like to add any of these coverages, please log into Employee

Navigator and complete your open enrollment changes. If you are

currently enrolled in these products and want to keep plans the same,

your current elections will be continued with The Standard.

Dental is staying with Dental Select with no change in cost or coverage!

If you want to enroll in the Medical FSA or Dependent Care FSA YOU

MUST go into Employee Navigator to make your elections for 2021.

Log into Employee Navigator to find access to all 2021 employee

benefit plans through the single open enrollment action found in your

Employee Navigator. Remember to submit this action in the final step

and keep a copy of your confirmation form for your records.

You can also call Weber County Human Resources at 801-399-8623.

Sincerely,

Weber County Human Resources

1When can I enroll or

change my benefit Benefits

elections? Enrollment

AT OPEN ENROLLMENT AS A NEW HIRE OR REHIRE DURING THE YEAR

During open enrollment you are When newly hired into a benefit- During the calendar year you may

choosing your plans for the eligible position you will have 30 experience a qualified life event. You

upcoming calendar year days from your hire date to choose will have 30 days from the event

(January 1 - December 31) your plans for the remainder of the date to submit your plan changes in

calendar year in which you are Employee Navigator.

hired.

All your benefit plan All of your benefit plan For qualified life events, you will

elections/changes are processed elections/changes are processed have to create your own benefit

through Employee Navigator. For through Employee Navigator for election event in Employee

open enrollment, log into your new hire or rehired employees. Navigator based on the type of

Employee Navigator account to event: marriage/divorce, gain/loss of

choose plans and submit your other coverage, etc. Support

elections. documentation of the event may be

required prior to approval of

changes.

If you do not have Employee

Navigator access, contact Weber

County HR prior to the

November 21 Open Enrollment

deadline.

WE ARE HERE TO HELP Web: webercountyutah.gov/HR

YOU ENROLL AND MAKE

Phone: 801-399-8623

THE BENEFIT SELECTIONS

THAT ARE RIGHT FOR YOU. Email: humanresources@co.weber.ut.us

2Benefit Plan

Premiums

Listed below are the monthly premiums for medical insurance for full-time employees. The amount you pay for coverage is

deducted from your paycheck on a pre-tax basis. Deductions are taken from the first two paychecks each month.

Total Premium Per Month Employer Contribution Per Employee Cost Per Month

Month

Medical

Employee Employee + Family Employee Employee + Family Employee Employee Family

Only One Only One Only + One

SelectMed $544.70 $1,282 $1,552.70 $435.76 $1,025.60 $1,242.16 $108.94 $256.40 $310.54

Traditional

SelectMed $462.70 $1,088.90 $1,318.80 $416.43 $980.01 $1,186.92 $46.27 $108.89 $131.88

HDHP

SelectValue $502.30 $1,182.70 $1,433.00 $401.84 $946.16 $1,146.40 $100.46 $236.54 $286.60

Traditional

SelectValue

$426.10 $1,002.90 $1,215.20 $383.49 $902.61 $1,093.68 $42.61 $100.29 $121.52

HDHP

Listed below are the monthly premiums for dental insurance. The amount you pay for coverage is deducted from your

paycheck on a pre-tax basis. Deductions are taken from the first two paychecks each month.

Total Premium Per Month Employer Contribution Per Month Employee Cost Per Month

Dental

Employee Employee Employee Employee Employee Employee

Family Family Family

Only + One Only + One Only + One

Dental

Plan 1

$29.30 $55.86 $83.79 $26.20 $49.97 $74.91 $3.10 $5.89 $8.88

Listed below are the monthly premiums for vision insurance. The amount you pay for coverage is deducted

from your paycheck on a pre-tax basis. Deductions are taken from the first two paychecks each month.

Total Premium Per Month Employer Contribution Per Month Employee Cost Per Month

Vision

Employee Employee Employee Employee Employee Employee

Family Family Family

Only + One Only + One Only + One

Vision Plan

1

$6.20 $11.66 $17.22 $6.20 $11.66 $17.22

3Benefit Carrier Information

Selecthealth-Medical

www.selecthealth.com

800-538-5038

Dental Select-Dental

www.dentalselect.com

800-999-9789

Dental Select-Vision

www.dentalselect.com

800-999-9789

The Standard- Life, Disability, Accident, Critical Illness

800-759-8702

www.standard.com

Intermountain Employee Assistance Plan

1-800-832-7733

1-801-442-3509

www.intermountainhealthcare.org/EAP

Flexible Spending Account-NBS

1-801-532-4000

www.NBSBenefits.com

Health Equity- HSA Accounts

866-382-3510

www.healthequity.com

Keyes Insurance Services, Inc. - Broker/Claims Assistance

www.keyesinsuranceservices.com

Dirk Keyes- 801-394-2600

dirk@keyesinsuranceservices.com

Toll Free: 800-331-0167

Utah State Retirement Systems

www.URS.org

1-800-695-4877

411

The following chart outlines the dental benefits we offer.

55

1213

you must re-enroll for 2021.

1415

q

www.healthequity.com

1617

18

19

$300,000

$50,000

$10,000

$.049 $.057 $.072 $.100 $.150 $.230 $.370 $.433 $.623 $1.054

$10,000

$2.50

20$800

$50 2

$550

$550

$800 $550/1100 once per bone/accident

$50 $550/1100 once per bone/accident

$50,000

$200 $15,000

$4.05

$6.47

$7.65

$11.98

21VOLUNTARY CRITICALILLNESS

THEl

HARTFORD

What is critical illness insurance? Critical illness insurance is coverage by your employer

which you pay for through convenient deductions from your paycheck. It can assist you financially if you

or a covered dependent are ever diagnosed with a covered critical illness (shown below).

The benefits are paid in lump sum amounts and can serve as a source of cash to use as you wish,

whether to help pay for health care expenses not covered by your major medical insurance, help replace

income lost while not working, or however you choose. This highlight sheet is an overview of your critical

illness insurance. A certificate of insurance will be available you enroll to explain your coverage in

detail.

Who is eligible? You are eligible if you are an active full-time employee who works at least 30 hours per

week on a regularly scheduled basis, and are less than age 80. Your spouse's eligibility is based upon

your age, and your dependent child(ren) must be under age 26 to be eligible.

How much coverage can I purchase?

You may enroll for $10,000, $20,000, or $30,000 in coverage. You may also enroll your dependent(s)

for the following amounts of coverage:

• Spouse: 50% of your elected coverage amount

• Child(ren): 25% of your elected coverage amount

A benefit reduction of 50% will apply to the coverage amount for you and your dependent(s) when you

reach the age of 70.

Am I guaranteed coverage? During designated enrollment periods, this coverage is without

having to provide information about your health for coverage amounts up to $30,000. This is called

"guaranteed issue (GI)" coverage- all you have to do is check the box to enroll and become insured. All

amounts of dependent coverage are guaranteed issue.

What illnesses are covered? This insurance will pay a lump sum benefit if you or a dependent are

diagnosed with any of the covered illnesses while insurance is in effect, subject to any pre

existing condition limitation.

Cancer Conditions

Vascular Conditions

Heart Attack; HeartTransplant; Stroke; Coronary Artery Bypass

Other Specified Conditions

Major Organ; End Stage Renal Failure; Coma; Paralysis; Loss of Vision; Child Diseases

*subject to any plan limitations and exclusions*

22Monthly Critical illness cost with The Standard

236th

90 Days

$.546 $.621 $.676 $.469 $.406 $.452 $.531 $.703 $.848 $.923

$.923

24Input your information, including all your dependents information

21

2526

27

You can also read