Funding Update Alexander von zur Mühlen - Group Treasurer Investor Meeting, 24 February 2011 - Deutsche Bank

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Deutsche Bank

Funding Update

Alexander von zur Mühlen

Group Treasurer

Investor Meeting,

Meeting 24 February 2011

Deutsche Bank Financial transparency.

TreasuryDeutsche Bank’s funding costs are a source of competitive

advantage

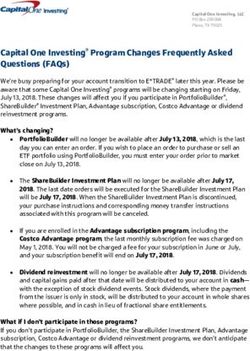

Funding cost development Observations

European Sovereign CDS — Challenging

Ch ll i market

k t conditions

diti d

due tto

In bps

iTraxx Senior Financials

240 DB 5yr Senior CDS economic concerns, regulatory

DB issuance spread developments and Eurozone difficulties

DB funding activity

200 — DB ffunding

di spreads

d remained

i d relatively

l ti l

stable and market access unaffected

160 throughout 2010

120

— € 23 b

bn iissued

d iin 2010 att an average

spread of L+66; 42% sold via retail

networks

80

— Modest

M d t 2011 F Funding

di Pl Plan off € 26 bbn

40 (€ 22 bn debt issuance, € 4 bn term

retail deposits), flexibility to adjust split

1Q2010: € 2Q2010: 3Q2010: 4Q2010: YTD depending on market conditions;

0 € 8 bn € 7 bn € 4 bn € 4 bn € 6.8 bn

45% completed YTD

31 Dec 31 Mar 30 Jun 30 Sep 31 Dec

2010 2011

Source: Bloomberg

Deutsche Bank Financial transparency. 2

TreasuryTimely and cost-effective funding through the crisis

~ €150 bn raised in capital markets since 2007

S i benchmark

Senior b h k issuance:

i Deutsche

D t h B Bankk vs. peers

Bps over Euribor / Libor

350 350

DB 5yr EUR new issue spread

DB 5

5yr senior

i CDS

European Peer

300 US Peer 300

European Peer

250 250

200 200

150 150

100 100

60

50 50

0 0

Jul‐07 Dec‐07 Jun‐08 Dec‐08 Jun‐09 Dec‐09 Jun‐10 Dec‐10 Feb - 11

DB sourced € 30bn through …result: no benchmark DB returns 2010 issuance 2011: $2.6 bn plus

benchmark issuance at attractive funding needed during crisis after 14 month plan completed €2 bn in

prices… months hiatus by September benchmarks YTD

1) Triangles represent government-guaranteed issues and diamonds unguaranteed; all of Deutsche Bank’s issues are non-government-guaranteed

Deutsche Bank Financial transparency. 3

TreasuryFunding update

45% of plan completed YTD

2011: YTD Funding vs. Plan

Funding Plan 2011

in € bn Plan 2011 YTD

– Issuance plan comprises both benchmark transactions together with

arbitrage-driven structured note and plain vanilla private placements Capital 0 0

– Deposit

D it campaigns

i with

ith contractual

t t l maturity

t it emphasis

h i off >1yr

1 Plain Vanilla Senior 11 4.6

– Fungibility between deposits and debt issuance allows flexibility

Structured Senior 9 2.2

depending on market development

Pfandbrief 2 0

Issuance activities YTD T t l Issuance

Total I 22 68

6.8

– YTD issuance at € 6.8bn (vs, € 3.1bn pro-rata plan), avg. tenor: 4.2yrs,

avg. spread: 61bps Stable Deposits 4 4.9

– Raised $ 2.6bn in US market at favourable levels relative to Euromarket Total 26 11.7

– Issued €2 bn 2yr

y FRN at 3m€+45bps; p ; jjoint largest

g and tightest

g 2yy FRN

from non-AAA bank in 2011 DB YTD Issuance Activities

240 DB 5y CDS

Deposit campaign update 220 iTraxx Senior Financials

– € 4.9bn generated YTD from 12-month deposit campaign vs. € 4bn full 200 European Sovereign CDS

year plan

l 180

Basis points

$1bn

160

– Above-plan deposit generation allows more flexible approach to issuance 3.25% 5y

$0.5bn $0.75bn

140 fixed €2bn

2y FRN $0.3bn

plan 5y

2y FRN 5y fixed tap

120 extendible

Pfandbrief program 100

80

– Up to € 2bn mortgage Pfandbrief planned for 2011

60

– Significant cost saving vs unsecured funding, particularly for longer

40

tenors 31-Dec 06-Jan 12-Jan 18-Jan 24-Jan 30-Jan 05-Feb 11-Feb 17-Feb

Source: Bloomberg

Deutsche Bank Financial transparency. 4

TreasuryBalanced maturity profile

Capital markets maturities as per 31 Dec 2010

25

20

15

€bn

10

5

0

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021+

2021

Concious decision, also during crisis, not to compromise duration of portfolio for

short term gains

short-term

Capital markets maturities of €18bn in 2011; balanced outflows for the next

10yrs not exceeding € 20bn p.a.

Provides flexibility to increase stock of term debt as response to regulatory

changes (NSFR: Net Stable Funding Ratio)

Deutsche Bank Financial transparency. 5

TreasuryCautionary statements

This presentation contains forward

forward-looking

looking statements. Forward

Forward-looking

looking statements are statements that are not historical

facts; they include statements about our beliefs and expectations and the assumptions underlying them. These

statements are based on plans, estimates and projections as they are currently available to the management of Deutsche

Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to

update publicly any of them in light of new information or future events.

events

By their very nature, forward-looking statements involve risks and uncertainties. A number of important factors could

therefore cause actual results to differ materially from those contained in any forward-looking statement. Such factors

include the conditions in the financial markets in Germany, y, in Europe,

p , in the United States and elsewhere from which we

derive a substantial portion of our revenues and in which we hold a substantial portion of our assets, the development of

asset prices and market volatility, potential defaults of borrowers or trading counterparties, the implementation of our

strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in

our filings with the U.S.

U S Securities and Exchange Commission.

Commission Such factors are described in detail in our SEC Form 20-F

of 16 March 2010 under the heading “Risk Factors.” Copies of this document are readily available upon request or can be

downloaded from www.deutsche-bank.com/ir.

Deutsche Bank Financial transparency. 6

TreasuryYou can also read