Battery Metals Report 2021 - Everything you need to know about the battery metals lithium, nickel, cobalt and copper! - Swiss Resource Capital AG

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Battery Metals Report 2021

Everything you need to know about the battery metals

lithium, nickel, cobalt and copper!Disclaimer

Dear reader, present only the opinion of the respective author. blications of the shares and products presented in Neither by subscription nor by use of any publi- and liabilities reports of the companies at the Secu- mineralization, the success of the planned metallur-

They are neither explicitly nor implicitly to be under- all publications of Swiss Resource Capital AG have cation of Swiss Resource Capital AG or by expres- rities and Exchange Commission (SEC) under www. gical test work, the significant deviation of capital

Please read the complete disclaimer in the stood as guarantee of a particular price develop- in part foreign exchange risks. The deposit portion sed recommendations or reproduced opinions in sec.gov or other regulatory authorities or carrying and operating costs from the estimates, failure to

following pages carefully before you start rea- ment of the mentioned financial instruments or as a of single shares of small and micro cap companies such a publication will result in an investment ad- out other company evaluations. Neither Swiss Re- receive necessary government approval and en-

ding this Swiss Resource Capital Publication. By trading invitation. Every investment in securities and low capitalized securities like derivatives and vice contract or investment brokerage contract bet- source Capital AG nor the respective authors will vironmental permits or other project permits, chan-

using this Swiss Resource Capital Publication mentioned in publications of Swiss Resource Capi- leveraged products should only be as high that, in ween Swiss Resource Capital AG or the respective guarantee that the expected profits or mentioned ges of foreign exchange rates, fluctuations of com-

you agree that you have completely understood tal AG involve risks which could lead to total a loss case of a possible total loss, the deposit will only author and the subscriber of this publication. share prices will be achieved. Neither Swiss Re- modity prices, delays by project developments and

the following disclaimer and you agree comple- of the invested capital and – depending on the in- marginally lose in value. source Capital AG nor the respective authors are other factors.

tely with this disclaimer. If at least one of these vestment – to further obligations for example addi- All publications of Swiss Resource Capital AG Investments in securities with low liquidity and professional investment or financial advisors. The

point does not agree with you than reading and tional payment liabilities. In general, purchase and are exclusively for information purposes only. All small market cap are extremely speculative as well reader should take advice (e. g. from the principle Potential shareholders and prospective investors

use of this publication is not allowed. sell orders should always be limited for your own information and data in all publications of Swiss Re- as a high risk. Due to the speculative nature of the bank or a trusted advisor) before any investment should be aware that these statements are subject

protection. source Capital AG are obtained from sources which presented companies their securities or other finan- decision. To reduce risk investors should largely di- to known and unknown risks, uncertainties and

We point out the following: are deemed reliable and trustworthy by Swiss Re- cial products it is quite possible that investments versify their investments. other factors that could cause actual events to dif-

This applies especially to all second-line-stocks source Capital AG and the respective authors at the can lead to a capital reduction or to a total loss and fer materially from those indicated in the for-

Swiss Resource Capital AG and the authors of in the small and micro cap sector and especially to time of preparation. Swiss Resource Capital AG – depending on the investment – to further obliga- In addition, Swiss Resource Capital AG welco- ward-looking statements. Such factors include but

the Swiss Resource Capital AG directly own exploration and resource companies which are dis- and all Swiss Resource Capital AG employed or en- tions for example additional payment liabilities. Any mes and supports the journalistic principles of con- are not limited to the following: risks regarding the

and/or indirectly own shares of following Com- cussed in the publications of Swiss Resource Capi- gaged persons have worked for the preparation of investment in warrants, leveraged certificates or duct and recommendations of the German press inaccuracy of the mineral reserve and mineral re-

panies which are described in this publication: tal AG and are exclusively suitable for speculative all of the published contents with the greatest pos- other financial products bears an extremely high council for the economic and financial market re- source estimates, fluctuations of the gold price,

Alpha Lithium, Canada Nickel, Copperbank Re- and risk aware investors. But it applies to all other sible diligence to guarantee that the used and un- risk. Due to political, economical or other changes porting and within the scope of its responsibility will risks and dangers in connection with mineral explo-

sources, Hannan Metals, IonEnergy, Kutcho securities as well. Every exchange participant tra- derlying data as well as facts are complete and ac- significant stock price losses can arise and in the look out that these principles and recommenda- ration, development and mining, risks regarding the

Copper, Millennial Lithium, Standard Lithium, des at his own risk. The information in the publica- curate and the used estimates and made forecasts worst case a total loss of the invested capital and tions are respected by employees, authors and edi- creditworthiness or the financial situation of the

Surge Copper. tions of Swiss Resource Capital AG do not replace are realistic. Therefore, liability is categorically – depending on the investment – to further obliga- tors. supplier, the refineries and other parties that are

an on individual needs geared professional invest- precluded for pecuniary losses which could poten- tions for example additional payment liabilities. Any doing business with the company; the insufficient

Swiss Resource Capital AG has closed IR ment advice. In spite of careful research, neither the tially result from use of the information for one’s liability claim for foreign share recommendations, insurance coverage or the failure to receive insuran-

consultant contracts with the following compa- respective author nor Swiss Resource Capital AG own investment decision. derivatives and fund recommendations are in prin- Forward-looking Information ce coverage to cover these risks and dangers, the

nies which are mentioned in this publication: will neither guarantee nor assume liability for actua- ciple ruled out by Swiss Resource Capital AG and relationship with employees; relationships with and

Canada Nickel, Hannan Metals, Millennial Lithi- lity, correctness, mistakes, accuracy, complete- All information published in publications of Swiss the respective authors. Between the readers as well Information and statements in all publications of the demands from the local communities and the

um. ness, adequacy or quality of the presented informa- Resource Capital AG reflects the opinion of the res- as the subscribers and the authors as well as Swiss Swiss Resource Capital AG especially in (transla- indigenous population; political risks; the availabili-

tion. For pecuniary losses resulting from invest- pective author or third parties at the time of repara- Resource Capital AG no consultancy agreement is ted) press releases that are not historical facts are ty and rising costs in connection with the mining

Swiss Resource Capital AG receives compen- ments in securities for which information was tion of the publication. Neither Swiss Resource Ca- closed by subscription of a publication of Swiss Re- forward-looking information within the meaning of contributions and workforce; the speculative nature

sation expenses from the following companies available in all publications of Swiss Resource Ca- pital AG nor the respective authors can be held res- source Capital AG because all information cont- applicable securities laws. They contain risks and of mineral exploration and development including

mentioned in this publication: Alpha Lithium, Ca- pital AG liability will be assumed neither by Swiss ponsible for any resulting pecuniary losses. All ained in such a publication refer to the respective uncertainties but not limited to current expectations risks of receiving and maintaining the necessary

nada Nickel, Copperbank Resources, Hannan Capital Resource AG nor by the respective author information is subject to change. Swiss Resource company but not to the investment decision. Publi- of the company concerned, the stock concerned or licences and permits, the decreasing quantities and

Metals, IonEnergy, Kutcho Copper, Millennial Lit- neither explicitly nor implicitly. Capital AG as well as the respective authors assu- cations of Swiss Resource Capital AG are neither, the respective security as well as intentions, plans grades of mineral reserves during mining; the global

hium, Standard Lithium, Surge Copper. res that only sources which are deemed reliable and direct or indirect an offer to buy or for the sale of the and opinions. Forward-looking information can of- financial situation, current results of the current ex-

Any investment in securities involves risks. Politi- trustworthy by Swiss Resource Capital AG and the discussed security (securities), nor an invitation for ten contain words like “expect”, “believe”, “assu- ploration activities, changes in the final results of

Therefore, all mentioned companies are cal, economical or other changes can lead to signi- respective authors at the time of preparation are the purchase or sale of securities in general. An in- me”, “goal”, “plan”, “objective”, “intent”, “estima- the economic assessments and changes of the pro-

sponsors of this publication. ficant stock price losses and in the worst case to a used. Although the assessments and statements in vestment decision regarding any security should te”, “can”, “should”, “may” and “will” or the negati- ject parameter to include unexpected economic

total loss of the invested capital and – depending all publications of Swiss Resource Capital AG were not be based on any publication of Swiss Resource ve forms of these expressions or similar words factors and other factors, risks of increased capital

on the investment – to further obligations for ex- prepared with due diligence, neither Swiss Resour- Capital AG. suggesting future events or expectations, ideas, and operating costs, environmental, security and

Risk Disclosure and Liability ample additional payment liabilities. Especially in- ce Capital AG nor the respective authors take any plans, objectives, intentions or statements of future authority risks, expropriation, the tenure of the

vestments in (foreign) second-line-stocks, in the responsibility or liability for the actuality, correct- Publications of Swiss Resource Capital AG must events or performances. Examples for forward-loo- company to properties including their ownership,

Swiss Resource Capital AG is not a securities small and micro cap sector, and especially in the ness, mistakes, accuracy, completeness, adequacy not, either in whole or in part be used as a base for king information in all publications of Swiss Resour- increase in competition in the mining industry for

service provider according to WpHG (Germany) and exploration and resource companies are all, in ge- or quality of the presented facts or for omissions or a binding contract of all kinds or used as reliable in ce Capital AG include: production guidelines, esti- properties, equipment, qualified personal and its

BörseG (Austria) as well as Art. 620 to 771 obliga- neral, associated with an outstandingly high risk. incorrect information. The same shall apply for all such a context. Swiss Resource Capital AG is not mates of future/targeted production rates as well as costs, risks regarding the uncertainty of the timing

tions law (Switzerland) and is not a finance compa- This market segment is characterized by a high vo- presentations, numbers, designs and assessments responsible for consequences especially losses, plans and timing regarding further exploration, drill of events including the increase of the targeted pro-

ny according to § 1 Abs. 3 Nr. 6 KWG. All publica- latility and harbours danger of a total loss of the in- expressed in interviews and videos. which arise or could arise by the use or the failure of and development activities. This forward-looking duction rates and fluctuations in foreign exchange

tions of the Swiss Resource Capital AG are explicit- vested capital and – depending on the investment the application of the views and conclusions in the information is based in part on assumption and fac- rates. The shareholders are cautioned not to place

ly (including all the publications published on the – to further obligations for example additional pay- Swiss Resource Capital AG and the respective publications. Swiss Resource Capital AG and the tors that can change or turn out to be incorrect and undue reliance on forward-looking information. By

website http://www.resource-capital.ch and all ment liabilities. As well, small and micro caps are authors are not obliged to update information in pu- respective authors do not guarantee that the ex- therefore may cause actual results, performances its nature, forward-looking information involves nu-

sub-websites (like http://www.resource-capital.ch/ often very illiquid and every order should be strictly blications. Swiss Resource Capital AG and the res- pected profits or mentioned share prices will be or successes to differ materially from those stated merous assumptions, inherent risks and uncertain-

de) and the website http://www.resource-capital.ch limited and, due to an often better pricing at the re- pective authors explicitly point out that changes in achieved. or postulated in such forward-looking statements. ties both general and specific that contribute to the

itself and its sub-websites) neither financial analysis spective domestic exchange, should be traded the- the used and underlying data, facts, as well as in Such factors and assumption include but are not possibility that the predictions, forecasts, projec-

nor are they equal to a professional financial analy- re. An investment in securities with low liquidity and the estimates could have an impact on the forecas- The reader is strongly encouraged to examine all limited to: failure of preparation of resource and re- tions and various future events will not occur. Neit-

sis. Instead, all publications of Swiss Resource Ca- small market cap is extremely speculative as well as ted share price development or the overall estimate assertions him/herself. An investment, presented serve estimates, grade, ore recovery that differs her Swiss Resource Capital AG nor the referred to

pital AG are exclusively for information purposes a high risk and can lead to, in the worst case, a total of the discussed security. The statements and opi- by Swiss Resource Capital AG and the respective from the estimates, the success of future explorati- company, referred to stock or referred to security

only and are expressively not trading recommenda- loss of the invested capital and – depending on the nions of Swiss Capital Resource AG as well as the authors in partly very speculative shares and finan- on and drill programs, the reliability of the drill, undertake no obligation to update publicly other-

tions regarding the buying or selling of securities. investment – to further obligations for example ad- respective author are not recommendations to buy cial products should not be made without reading sample and analytical data, the assumptions regar- wise revise any forward-looking information

All publications of Swiss Resource Capital AG re- ditional payment liabilities. Engagements in the pu- or sell a security. the most current balance sheets as well as assets ding the accuracy of the representativeness of the whether as a result of new information, future

2 3events or other such factors which affect this infor- Exploitation and distribution rights respective authors can guarantee the correctness, Information from the Federal Financial Super- use of the contents of website http://www.resour- disclosure of these data or by entry of anonymized

mation, except as required by law. accuracy and completeness of the facts presented visory Authority (BaFin) ce-capital.ch and its sub-websites is at the user’s data or pseudonyms. Swiss Resource Capital AG

Publications of Swiss Resource Capital AG may in the sources. Neither Swiss Resource Capital AG risk. Specially marked articles reflect the opinion of points out that the data transmission in the internet

neither directly or indirectly be transmitted to Great nor the respective authors will guarantee or be liab- You can find further information on how to pro- the respective author but not always the opinion of (e.g. communication by email) can have security

48f Abs. 5 BörseG (Austria) and Art. 620 to 771 Britain, Japan, USA or Canada or to an US citizen le for that all assumed share price and profit de- tect yourself against dubious offers in BaFin bro- Swiss Resource Capital AG. breaches. A complete data protection from unau-

obligations law (Switzerland) or a person with place of residence in the USA, Ja- velopments of the respective companies and finan- chures directly on the website of the authority at thorized third party access is not possible. Accor-

pan, Canada or Great Britain nor brought or distri- cial products respectively in all publications of www.bafin.de. dingly no liability is assumed for the unintentional

Swiss Resource Capital AG as well as the res- buted in their territory. The publications and their Swiss Resource Capital AG will be achieved. Liability limitation for availability of website transmission of data. The use of contact data like

pective authors of all publications of Swiss Resour- contained information can only be distributed or postal addresses, telephone and fax numbers as

ce Capital AG could have been hired and compen- published in such states where it is legal by applica- Liability limitation for links Swiss Resource Capital AG will endeavour to of- well as email addresses published in the imprint or

sated by the respective company or related third ble law. US citizens are subject to regulation S of No guarantee for share price data fer the service as uninterrupted as possible. Even similar information by third parties for transmission

party for the preparation, the electronic distribution the U.S. Securities Act of 1933 and cannot have The www.resource-capital.ch – website and all with due care downtimes can not be excluded. of not explicitly requested information is not permit-

and publication of the respective publication and access. In Great Britain the publications can only be No guarantee is given for the accuracy of charts sub-websites and the www.resource-capital.ch – Swiss Resource Capital AG reserves the right to ch- ted. Legal action against the senders of spam mails

for other services. Therefore the possibility exists accessible to a person who in terms of the Financial and data to the commodity, currency and stock newsletter and all publications of Swiss Resource ange or discontinue its service any time. are expressly reserved by infringement of this prohi-

for a conflict of interests. Services Act 1986 is authorized or exempt. If these markets presented in all publications of Swiss Re- Capital AG contain links to websites of third parties bition.

restrictions are not respected this can be perceived source Capital AG. (“external links”). These websites are subject to lia-

At any time Swiss Resource Capital AG as well as a violation against the respective state laws of bility of the respective operator. Swiss Resource Liability limitation for advertisements By registering in http://www.resource-capital.ch

as the respective authors of all publications of the mentioned countries and possibly of non menti- Capital AG has reviewed the foreign contents at the – website and its sub-websites or in the http://www.

Swiss Resource Capital AG could hold long and oned countries. Possible resulting legal and liability Copyright initial linking with the external links if any statutory The respective author and the advertiser are resource-capital.ch – newsletter you give us per-

short positions in the described securities and op- claims shall be incumbent upon that person, but not violations were present. At that time no statutory exclusively responsible for the content of advertise- mission to contact you by email. Swiss Resource

tions, futures and other derivatives based on theses Swiss Resource Capital, who has published the pu- The copyrights of the single articles are with the violations were evident. Swiss Resource capital AG ments in http://www.resource-capital.ch – website Capital AG receives and stores automatically via

securities. Furthermore Swiss Resource Capital AG blications of Swiss Resource Capital AG in the respective author. Reprint and/or commercial dis- has no influence on the current and future design and its sub-websites or in the http://www.resour- server logs information from your browser including

as well as the respective authors of all publications mentioned countries and regions or has made avai- semination and the entry in commercial databases and the contents of the linked websites. The place- ce-capital.ch – newsletter as well as in all publica- cookie information, IP address and the accessed

of Swiss Resource Capital AG reserve the right to lable the publications of Swiss Resource Capital AG is only permitted with the explicit approval of the ment of external links does not mean that Swiss tions of Swiss Resource Capital AG and also for the websites. Reading and accepting our terms of use

buy or sell at any time presented securities and op- to persons from these countries and regions. respective author or Swiss Resource Capital AG. Resource Capital AG takes ownership of the cont- content of the advertised website and the adverti- and privacy statement are a prerequisite for permis-

tions, futures and other derivatives based on theses ents behind the reference or the link. A constant sed products and services. The presentation of the sion to read, use and interact with our website(s).

securities. Therefore the possibility exists for a con- The use of any publication of Swiss Resource All contents published by Swiss Resource Capi- control of these links is not reasonable for Swiss advertisement does not constitute the acceptance

flict of interests. Capital AG is intended for private use only. Swiss tal AG or under http://www.resource-capital.ch – Resource Capital AG without concrete indication of by Swiss Resource Capital AG.

Resource Capital AG shall be notified in advance or website and relevant sub-websites or within www. statutory violations. In case of known statutory vio-

Single statements to financial instruments made asked for permission if the publications will be used resource-capital.ch – newsletters and by Swiss Re- lations such links will be immediately deleted from

by publications of Swiss Resource Capital AG and professionally which will be charged. source Capital AG in other media (e.g. Twitter, Face- the websites of Swiss Resource Capital AG. If you No contractual relationship

the respective authors within the scope of the res- All information from third parties especially the book, RSS-Feed) are subject to German, Austrian encounter a website of which the content violates

pective offered charts are not trading recommenda- estimates provided by external user does not reflect and Swiss copyright and ancillary copyright. Any applicable law (in any manner) or the content (to- Use of the website http://www.resource-capital.

tions and are not equivalent to a financial analysis. the opinion of Swiss Resource Capital AG. Conse- use which is not approved by German, Austrian and pics) insults or discriminates individuals or groups ch and its sub-websites and http://www.resour-

quently, Swiss Resource Capital AG does not gua- Swiss copyright and ancillary copyright needs first of individuals, please contact us immediately. ce-capital.ch – newsletter as well as in all publica-

A disclosure of the security holdings of Swiss rantee the actuality, correctness, mistakes, ac- the written consent of the provider or the respective tions of Swiss Resource Capital AG no contractual

Resource Capital AG as well as the respective au- curacy, completeness, adequacy or quality of the rights owner. This applies especially for reproducti- In its judgement of May 12th, 1998 the Landge- relationship is entered between the user and Swiss

thors and/or compensations of Swiss Resource Ca- information. on, processing, translation, saving, processing and richt (district court) Hamburg has ruled that by pla- Resource Capital AG. In this respect there are no

pital AG as well as the respective authors by the reproduction of contents in databases or other cing a link one is responsible for the contents of the contractual or quasi-contractual claims against

company or third parties related to the respective electronic media or systems. Contents and rights of linked websites. This can only be prevented by ex- Swiss Resource Capital AG.

publication will be properly declared in the publica- Note to symmetrical information and opinion third parties are marked as such. The unauthorised plicit dissociation of this content. For all links on the

tion or in the appendix. generation reproduction or dissemination of single contents homepage http://www.resource-capital.ch and its

and complete pages is not permitted and punisha- sub-websites and in all publications of Swiss Re- Protection of personal data

The share prices of the discussed financial inst- Swiss Resource Capital AG can not rule out that ble. Only copies and downloads for personal, priva- source Capital AG applies: Swiss Resource Capital

ruments in the respective publications are, if not other market letters, media or research companies te and non commercial use is permitted. AG is dissociating itself explicitly from all contents The personalized data (e.g. mail address of con-

clarified, the closing prices of the preceding trading are discussing concurrently the shares, companies of all linked websites on http://www.resource-capi- tact) will only be used by Swiss Resource Capital

day or more recent prices before the respective pu- and financial products which are presented in all Links to the website of the provider are always tal.ch – website and its sub-websites and in the AG or from the respective company for news and

blication. publications of Swiss Resource Capital AG. This welcome and don’t need the approval from the http://www.resource-capital.ch – newsletter as well information transmission in general or used for the

can lead to symmetrical information and opinion website provider. The presentation of this website in as all publications of Swiss Resource Capital AG respective company.

It cannot be ruled out that the interviews and generation during that time period. external frames is permitted with authorization only. and will not take ownership of these contents.”

estimates published in all publications of Swiss Re- In case of an infringement regarding copyrights

source Capital AG were commissioned and paid for Swiss Resource Capital AG will initiate criminal pro- Data protection

by the respective company or related third parties. No guarantee for share price forecasts cedure. Liability limitation for contents of this website

Swiss Resource Capital AG as well as the respecti- If within the internet there exists the possibility

ve authors are receiving from the discussed compa- In all critical diligence regarding the compilation The contents of the website http://www.resour- for entry of personal or business data (email ad-

nies and related third parties directly or indirectly and review of the sources used by Swiss Resource ce-capital.ch and its sub-websites are compiled dresses, names, addresses), this data will be di-

expense allowances for the preparation and the Capital AG like SEC Filings, official company news with utmost diligence. Swiss Resource Capital AG sclosed only if the user explicitly volunteers. The

electronic distribution of the publication as well as or interview statements of the respective manage- however does not guarantee the accuracy, comple- use and payment for all offered services is permit-

for other services. ment neither Swiss Resource Capital AG nor the teness and actuality of the provided contents. The ted – if technical possible and reasonable – without

4 5Table of Contents Imprint

Editor

Swiss Resource Capital AG

Disclaimer 02 Poststr. 1

9100 Herisau, Schweiz

Table of Contents | Imprint 07 Tel : +41 71 354 8501

Fax : +41 71 560 4271

Preface09

Invest with the commodity professionals

info@resource-capital.ch

www.resource-capital.ch

Battery production is exploding! – And with it the prices for

battery metals! 10 Editorial staff

Jochen Staiger

Interview with Vincent Pedailles 28 Tim Rödel

EU Advisor on Future Security of Supply

Layout/Design

Interview with Gianni Kovacevic32 Frauke Deutsch

Copper expert and book author

All rights reserved. Reprinting

material by copying in electronic

Company Profiles form is not permitted.

You do not have to be a stock market professional SRC Mining & Special Situations Zertifikat

Alpha Lithium�������������������������������������������������������������������������������������������������������������������������������� 34 Editorial Deadline 04/31/2021

to make wise investment decisions. ISIN: DE000LS9PQA9

Invest together with Swiss Resource Capital AG and WKN: LS9PQA Canada Nickel������������������������������������������������������������������������������������������������������������������������������ 38 Cover: shutterstock.com

Asset Management Switzerland AG in the mega- Currency: CHF/ Euro* Page 13: ©ser_igor/stock.adobe.com

Copperbank Resources������������������������������������������������������������������������������������������������������������ 42 Page 14: markus-spiske, unsplash

trend commodities. Since 05.03.2020 the experts‘ Certificate fee: 0.95 % p.a. Page 22: A.Ocram (CC BY-SA 3.0)

specialist knowledge has been available as a Performance fee: 15 % p.a. Hannan Metals������������������������������������������������������������������������������������������������������������������������������46 Page 24: D-Vu©Pixabay

Wikifolio certificate: *Trading in Euro is possible at the Euwax in Stuttgart.

IonEnergy���������������������������������������������������������������������������������������������������������������������������������������� 50 Back:

# 1: ssarwas0, Pixabay

Currently the following titles are represented in the SRC Mining & Special Situations Certificate (5/2021): ENDEAVOUR SILVER CORP. | Kutcho Copper����������������������������������������������������������������������������������������������������������������������������� 54 # 2: TravelCoffeeBook, Pixabay

# 3: andreas160578, Pixabay

MAPLE GOLD MINES LTD | FREE MCMORAN COP | COPPER MOUNTAIN MINING CORP. | MAG SILVER CORP. | SKEENA RES LTD NEW | URANIUM

Millennial Lithium������������������������������������������������������������������������������������������������������������������������� 58 # 4: Hookyung Lee, Pixabay

ENERGY CORP. | FRANCO NEVADA | SIBANYE STILLWATER LTD. | RIO TINTO | R.DUTCH SHELL B | AGNICO EAGLE | BHP BILLITON | ISOENER-

GY LTD. O.N. | FIORE GOLD LTD | ANGLO AMERICAN | VIZSLA SILVER CORP. | OSISKO GOLD ROYALT. | KARORA RES INC. | OCEANAGOLD CORP. Standard Lithium��������������������������������������������������������������������������������������������������������������������������62 All images and graphics are, unless

otherwise stated, by the companies.

| TOTAL FINA ELF SA B EO 10 | MILLENN.LITHIUM CORP. | KUYA SILVER CORP. | CHEVRON | TRILLIUM GOLD MINES INC. | CALEDONIA MINING

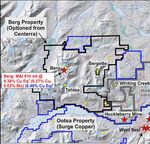

Surge Copper���������������������������������������������������������������������������������������������������������������������������������66

O.N. | ENWAVE | GOLDMINING INC. | CANADA NICKEL CO. INC. | FURY GOLD MINES LTD. | NEWMONT CORP. DL 1,60 | AURANIA RES CAD R.S. | Charts 05/18/2021

JS Charts by amCharts

KORE MINING LTD. | BLUESTONE RESOURCES | VICTORIA GOLD CORP. | GOLD TERRA RESOURCES |

HANNAN

6 METALS LTD | BARRICK GOLD CORP. | ADVENTUS MNG CORP. | MAWSON GOLD LTD | 7

OSISKO METALS INC. O.N.Preface

The whole world of

commodities in one App:

Dear Readers,

Commodity-TV We are pleased to present the eleventh editi-

on of our Battery Metals Report.

hensively about various commodities and

mining companies.

On our website www.resource-capital.ch you

Our special report series started in the fall of will find more than 30 companies and a lot of

2016 with lithium, as we see this metal, as information and articles about commodities.

well as cobalt, nickel and copper, as one of

the major energy metals of the future and as a We would like to give you the necessary

great opportunity with a lot of potential. insights and inform you comprehensively

E-mobility is on the rise and for a good year through our special reports. In addition,

now, the eagerly awaited hybrid and all-elec- our two commodity IPTV channels www. Jochen Staiger is founder and CEO

tric models from many well-known manufac- Commodity-TV.net & www.Rohstoff-TV.net of Swiss Resource Capital AG,

turers have finally been coming onto the mar- are available to you free of charge at any time. located in Herisau, Switzerland. As

ket. What began with the founding of Tesla For on the go, we recommend our new Com- chief-editor and founder of the first

Motors 18 years ago is now unstoppable. modity TV App for iPhone and Android, which two resource IP-TV-channels

Volkswagen alone is planning around 70 new provides you with real-time charts, quotes Commodity-TV and its German

electric models by 2030, as are Mercedes, and also the latest videos. counterpart Rohstoff-TV, he reports

Audi and BMW. The electric car is well estab- about companies, experts, fund

lished and has won a place among consu- My team and I hope you enjoy reading the managers and various themes

mers, partly because politicians have recog- Battery Metals Special Report and we hope around the international mining

nized that a world that is as CO2-free as pos- to provide you with lots of new information, business and the correspondent

sible will only be possible with electric impressions and ideas. metals.

mobility and are promoting this accordingly

by means of start-up funding.

Yours, Jochen Staiger

Lithium, nickel and cobalt are the main com-

ponents of all batteries and accumulators

available in large series and thus the main link

in the electric vehicle dream. The movements

in Germany are interesting, where not only

Tesla is building a factory (Gigafactory), but

several well-known battery manufacturers

have now pitched their tents.

All these factories will be enormous drivers of

demand for lithium, cobalt and nickel, but

also for copper. Millions of tons of copper will

be needed in the future not only for cars, but Tim Rödel is Manager Newsletter,

especially for the charging infrastructure. Threads & Special Reports at SRC

2020 was clearly the start of a decade for AG. He has been active in the

• CEO and expert interviews commodities, as they are – and will remain – commodities sector for more than

Free download here: the basis of everything we do economically. 15 years and accompanied

• Site-Visit-Videos Supply will barely be able to keep up with the several chief-editor positions, e.g. at

demand that will set in once the Corona virus Rohstoff-Spiegel, Rohstoff-Woche,

• Reports from trade shows and conferences around the world is overcome. Rohstoffraketen, the publications

Wahrer Wohlstand and First Mover.

• Up-to-date mining information

Swiss Resource Capital AG has made it its He owns an enormous commodity

• Commodity TV, Rohstoff-TV and Dukascopy TV created by business to inform commodity investors, expertise and a wide-spread

interested parties and those who would like network within the whole resource

• Real-time charts and much more! to become one, up-to-date and compre- sector.

9

Swiss Resource Capital AG | Poststrasse 1 | 9100 Herisau | Schweiz | www.resource-capital.ch | info@resource-capital.chBattery production is exploding! –

And with it the prices for battery metals!

How a fixed idea led to a world graphite. The good thing about this from the ready firmly planned a ban on the sale of in- Peugeot: 80% conversion to electric dri-

wide revolution ... point of view of raw material investors is that ternal combustion vehicles from 2030, such ve by 2023;

the quantities required for this cannot even be as Italy (2030), Spain (2040) and Germany Porsche: Conversion of 90% of the pro-

Although the electric motor was invented in provided with the current mines. There is a (2050). In the event of a Green government duct range to electric drives;

the mid-19th century, it was the South Afri- threat of supply bottlenecks, which will cause participation, the phasing out of the combus- Renault/Nissan: 1.5 million vehicles from

can Elon Musk who, at the beginning of the prices for most of these materials and metals tion era in Germany will certainly be brought 2021;

21st century, had the obsession of elec- to soar to previously unimagined heights. forward further. China officially wants 20% Tesla: 1 million vehicles as of now;

trifying locomotion on two or four wheels. Some of these prices have already risen, but electric vehicles sold by 2025 and an end to Toyota: 50% conversion to electric drive

When he founded Tesla Motors in 2003, he investors still have an excellent opportunity to the sale of internal combustion vehicles by and hybrid by 2030 ;

and his colleagues were probably not (yet) enter the world of battery metals, as we will 2050. VW Group: By 2025, 20 to 25% of all ve-

aware that it would take almost 20 years for explain in detail below. hicles produced are to be purely electric,

the entire world to be electrified by his idea. which means a total of around 2 to 3 milli-

Today, Tesla is a global brand and Musk is Car manufacturers plan to build on vehicles. By 2030, 300 electric models

one of the richest people on the planet. Ho- The „electric revolution“ is many millions of electric vehicles are to be launched on the market.

wever, this was certainly not the intention, catching on ...

which is why Musk took on a lot of risk and, In the EU in particular, many internal combus-

in the meantime, a lot of ridicule as well as Electric locomotion is only one of several as- tion engines are likely to be phased out very The lithium-ion battery will be the

headwind from all kinds of opponents of pects of the electric revolution. The leap from quickly and the corresponding car manufac- non-plus-ultra for many years ...…

electric mobility. For him, as a visionary, it the age of fossil combustion and the most turers will have to switch to electric vehicles

was more about creating something new, immediate possible consumption to the at an accelerated pace in order to comply In addition to the engine, the heart of every

away from old ways of thinking and towards decentralization of energy generation, the with the strict environmental requirements of electric vehicle is the energy storage unit,

a cleaner and smarter world. corresponding need for on-site storage of the EU. The following plans should only be i.e., a rechargeable battery. In order to be

electrical energy and, ultimately, to a true re- seen as a basis, which will be increased year operated economically in the long term, elec-

volution in mobility has begun, but the electric by year: tric vehicles, but also increasingly emerging

... and now also electrifying the boom will really take off from now on, and not decentralized storage systems – for photo-

commodity markets only in automotive engineering. BMW: By 2025, 15 to 25% of all vehicles voltaic or wind power plants, for example –

produced are to be purely electric, which require ever more powerful rechargeable bat-

Almost 20 years later, well over 100 electric means a total of around 300,000 to teries. The lithium-ion battery has now emer-

car models are already on the market world- ... and above all, electromobility is 600,000 vehicles; ged as the clear favorite. One of the reasons

wide. By 2022, there will be 500. In 2015, the picking up speed! The Chinese automakers, which now for this is that within a lithium-ion battery, the

number of new electric vehicles registered number more than 170, plan to put at voltage is achieved by exchanging lithium

each year was just 450,000 worldwide. In least 4.5 million electric vehicles on the ions. Because of their high energy density,

2020, the figure was 1.7 million. According to However, the automotive industry is clearly road starting this year; lithium-ion batteries deliver constant power

estimates by Bloomberg experts, there will playing a pioneering role here, as many coun- Daimler: Ten new electric models by over the entire discharge period and do not

be 8.5 million in 2025, 26 million in 2030 and tries have jumped on the electromobility 2022. 15 to 25% of all vehicles produced exhibit any so-called memory effect, i.e.,

54 million in 2040. Mind you, per year, not in bandwagon and introduced measures to ac- are to be purely electric by 2025, which successive loss of capacity over many years

total. Taken together, there were about 8.5 celerate the move away from the internal means a total of around 300,000 to of use or frequent partial discharge. The

million electric vehicles on the roads world- combustion engine and towards the electric 600,000 vehicles; name „lithium-ion battery“ is only the generic

wide in 2020. In 2030, there will be about 120 motor at the same time, particularly in order Ford: By 2022, at least 13 models are to term for a whole range of possible chemical

million. to achieve the climate targets they have set be electrically powered, which is about 10 structures, such as the lithium-cobalt (dioxi-

This requires vast quantities of materials and themselves. Many cities, regions, and coun- to 25% of the complete model range; de) battery, the lithium-manganese (dioxide)

metals that are or were only used in small tries around the world have already made a General Motors: 20 new electric models battery, the lithium-iron phosphate battery

quantities or not at all in conventional vehicles concrete commitment to the end of the inter- by 2023 and complete conversion to elec- and – less commonly – the lithium-titanate

with internal combustion engines. First and nal combustion engine. For example, most tric mobility – timeframe still open; battery and the tin-sulfur lithium-ion battery.

foremost, these include materials that are U.S. states have set an end to the sale of in- Honda: In 2030, two-thirds of all models The most common battery is currently the lit-

necessary for the battery and for the connec- ternal combustion vehicles for the years bet- are to run on electric motors – around 3.3 hium-nickel-manganese-cobalt (abbreviated

tions between individual components. These ween 2030 and 2050. The EU officially wants million as things stand today; NMC) battery.

are primarily the battery metals lithium, nickel, only 30% sales of electric vehicles by 2030, Hyundai: At least 10% electric vehicle

manganese and cobalt, as well as copper and although many member states have also al- share by 2025 – 800,000 vehicles;

10 11... but the development continues Asians dominate the battery

steadily – away from cobalt, sector Composition and operating principle of a lithium-ion accumulator

towards nickel!

Today, China alone provides a large share of

Although not much has changed in the basic the total demand for lithium-ion batteries.

principle of the lithium-ion battery over time, China is expected to continue to see the Composition of a lithium-ion accumulator

development continues all the time. The main strongest annual increase in lithium and co-

focus is on efficiency and charging capacity balt demand of all major market players over Essentially a lithium-ion accumulator consists of the following components and materials:

(in the case of electric vehicles, this is often the next 5 to 10 years, largely due to an ex-

referred to as range), but also on the use of pected multiplication in the number of units of

metals and elements. In this respect, a trans- rechargeable batteries. Other key suppliers of Positive electrode (cathode):

formation is currently taking place away from lithium-ion batteries, including South Korea Lithium-Cobalt(III)-oxide LITHIUM-ION BATTERY

high proportions of cobalt (NMC 111, where and Japan, are also expected to guarantee Lithium-Nickel-Manganese-Cobalt-Oxide CHARGE

the numbers indicate the ratio of nickel, man- robust growth in lithium and cobalt demand. Oxygen ELECTROLYTE

SEPARATOR

ganese and cobalt) to a higher proportion of Foremost among these are electronics giants Aluminum as conductor material ANODE (-)

nickel (NMC 811), although development is Panasonic, Samsung, LG Chem, BYD, Bos- COPPER

CATHODE (+)

currently still at corresponding intermediate ton Power, Lishen, CATL, Dynavolt and Great Negative electrode (anode): ALUMINIUM

stages (NMC 622 / NMC 532). NMC 111 is Wall. Experts estimate that by the end of Graphite or related carbon materials

considered the simplest battery version, ba- 2021, 77% of global lithium-ion production Silicon

sed on an equal amount of the atoms of the capacity will be located in China. Based on Tin dioxide

three elements, NMC 532/622 have a higher current plans in the pipeline, China will still Copper as conductor material

energy density and a lower price than NMC account for 67% of global lithium-ion battery

111 due to a lower cobalt content, and NMC capacity in 2030. Electrolyte (solution)

811 is the latest and most advanced battery CARBON

version with the highest theoretical lithium Polymer membrane separator (GRAPHITE)

and cobalt performance. It was precisely The EU is now really stepping on LITHIUMION

because of this trend toward higher nickel the gas! OXYGEN + METAL

content that Tesla CEO Elon Musk literally ELECTRON COBALT/NICKEL/MANGANESE

begged relevant mining companies to de- The EU, which seemed to sleep through the

velop new nickel mines in 2020. development of battery production for years,

has been able to catch up powerfully with

China thanks to many governmental and also Functionality of a lithium-ion battery

Manufacturing facilities (gigafac- private support programs and not least

tories) for rechargeable batteries thanks to its strong industrial base. In simple terms a lithium-ion accumula- largely electrically neutral. The negative

and corresponding materials are tor generates an electromotive force by electrode is a so-called graphite inter-

springing up like mushrooms Tesla‘s Gigafactory near Berlin and North- the movement of lithium-ions. During calation compound where lithium exists

volt‘s Gigafactory in Skellefteå in northern charging the positive lithium-ions migra- as cation. During discharge the intercala-

While European and North American manu- Sweden are just a taste of what is to come in te through the electrolyte and the sepa- tion compound emits electrons which

facturing pipelines have increased signifi- the next 10 years. By 2030 alone, more than rator from the positive to the negative flow back to the positive electrode viathe

cantly over the past 12 months, China re- 25 corresponding production sites for batte- electrode. In the process the lithium-ions extern circuit. Simultaneously many

mains by far the most aggressive country in ries and/or cathode materials are planned. can move freely between the two elec- Li+ ions migrate from the intercalation

building lithium-ion cell manufacturing capa- Currently, the planned battery capacity is at trodes through the electrolyte within the compound through the electrolyte also

city to support its electric vehicle and energy least 800 GWh by 2030. (see graphic p. 30) accumulator. Unlike the lithium-ions the to the positive electrode. At the positive

storage industries. Currently, 148 of the wor- transition metal and graphite structures electrode the lithium-ions do not receive

ld‘s approximately 200 manufacturing facili- of the electrodes are stationary and pro- the electrons of the external circuit but

ties, or „gigafactories,“ are in the pipeline in North America is Tesla country tected by a separator from a direct con- the present structures of the transition

China, while Europe and North America have tact. The mobility of the lithium-ions is metal compounds. Depending on the

only 21 and 11 gigafactories in the pipeline, In North America, Tesla holds the dominant necessary for the compensation of the type of accumulator these are cobalt, ni-

respectively. 122 gigafactories are already in position in lithium-ion battery production. The external current during recharging and ckel, manganese or iron ions that change

operation, with many of them currently ram- company has been operating the so-called discharging so that the electrodes stay their charge.

ping up production. „Gigafactory 1“ in Nevada since 2016. Lithi-

um-ion batteries, battery packs, electric mo-

12 13Lithium

The element lithium

Lithium is a light metal from the group of alka-

[HE] 2s1 3

li metals. It has the lowest density of all known

Li

solid elements. It is only about half as heavy

as water, naturally silvery white and relatively

soft. Lithium is highly reactive, which is why it

basically always occurs as a lithium com-

pound in the wild. It tarnishes rapidly in air, Melting Point 180,54° C

due to the formation of lithium oxide and lithi- Boiling Point 1330°C

um nitride. In pure oxygen, it burns with a LITHIUM

bright red flame at 180°C to form lithium oxi-

de. Lithium reacts very strongly with water to

form lithium hydroxide.

Lithium extraction is either lengthy There are two types of lithium

or expensive deposits

The world lithium production is divided into Lithium is generally obtained from two diffe-

several different branches, which produces rent sources.

the following types of lithium compounds:

(Source: markus-spiske, unsplash) 1. So-called „brine“, i.e. (salt) sheet or brine

1. Lithium carbonate, deposits: Mainly in salt lakes, lithium car-

2. Lithium hydroxide, bonate is extracted from lithium-cont-

tors and drive units for up to 500,000 electric Lithium-ion batteries are the 3. Lithium chloride, aining salt solutions by evaporation of the

vehicles per year are built there. „Gigafactory current state of the art and market 4. Butyllithium and water and addition of sodium carbonate.

2“ is a photovoltaic factory and is located in leader 5. Lithium metal. To extract metallic lithium, the lithium car-

Buffalo, New York. „Gigafactory 3“ was com- bonate is first reacted with hydrochloric

pleted in record time in China, near Shanghai, In addition to the already mentioned raw ma- Metallic lithium is usually produced from lithi- acid. This produces carbon dioxide, which

and is expected to produce the same number terials lithium, cobalt, nickel and manganese, um carbonate in a multi-stage process and is escapes as a gas, and dissolved lithium

of vehicles as the Nevada plant. a lithium-ion battery essentially also consists usually traded with a purity of 99.5%. This chloride. This solution is concentrated in a

of aluminum, copper, graphite, zinc, tin, silver metallic lithium is used as a catalyst in the vacuum evaporator until the chloride

and steel. The majority of (lithium-ion) batte- chemical and pharmaceutical industries and crystallizes out.

More gigafactories are emerging ries currently on the market are lithium-cobalt for the production of aluminum-lithium alloys. 2. So-called „hard rock spodumene“, i.e.,

in North America (dioxide) batteries, which is why this report hard rock pegmatite deposits: Here, lithi-

deals primarily with the battery metals lithium, The industry essentially distinguishes bet- um compounds are not extracted from the

Tesla is far from the only lithium and cobalt nickel and cobalt. We will also take a look at ween three types or qualities of lithium com- salt of lakes, but from spodumene, a lithi-

consumer planning major lithium-ion battery copper, which is becoming increasingly im- pounds: um-bearing aluminum silicate mineral.

production. LG Chem already started pro- portant. Mined by conventional mining technology,

duction for Chevy in Michigan in October 1. „Industrial Grade“, with purity over 96%, the concentrate obtained is often conver-

2015. Foxconn, BYD (the world‘s largest pro- mainly for glass, casting powder and lu- ted to lithium carbonate with a purity of

ducer of rechargeable batteries, especially bricant, more than 99.5%. The intensive thermal

for cell phones), Lishen, CATL and Boston 2. „Technical Grade“, with a purity of about and hydrometallurgical process required

Power are also working on the construction 99.5%, mainly for ceramics, lubricants for this is considered to be very costly.

of their own gigafactories, including for and batteries, and Such deposits are currently exploited al-

so-called power banks, i.e., decentralized 3. „Battery Grade“, with purity above 99.5%, most exclusively in Australia, with further

electricity storage. mainly for high-end cathode materials in processing largely taking place in Chinese

batteries and rechargeable batteries. facilities.

14 15Advantages and disadvantages of hours instead of using natural evaporation. entire lithium market is very opaque, which is accumulator and battery production. Lithium

the different funding sources The processes of Tenova Bateman and IBC why the large battery and accumulator manu- carbonate – crystalline, granulated or in pow-

Advanced Technologies are worth mentioning facturers, such as Panasonic, have recently der form – is used, for example, in the elect-

The two sources (brine deposits/hard rock in this context. relied primarily on long-term supply contracts rolytic production of aluminum, in the cera-

deposits) each have opposite advantages In addition, several lithium development com- with relatively small development companies, mics and pharmaceutical industries, and in

and disadvantages with regard to the extrac- panies have identified a third lithium source. some of which will not produce before 2023. alloying technology. Special purity grades of

tion of lithium. While the extraction of one ton There is the possibility to extract lithium from As a consequence of this supply oligopoly, lithium carbonate in the form of very fine pow-

of lithium hydroxide from brine deposits re- old, exploited oil reservoirs. The lithium is ex- lithium is currently not traded on the stock der (battery grade powder) are suitable as a

quires about 469 cubic meters of water, one tracted from the wastewater remaining in the exchange, the actual trading prices are strict- raw material for the production of lithium-ion

ton of lithium hydroxide from hard rock depo- reservoirs. It has already been proven several ly confidential. batteries. The extraction and processing of

sits requires only about 170 cubic meters of times that this process works. In addition, this One reason for this, which the few suppliers (especially high-grade) lithium is considered

water. The opposite is true for the CO2 balan- unusual lithium extraction process also appe- always like to give, is that the available and very costly.

ce. While the extraction of one ton of lithium ars to be economically feasible. Thus, bri- required lithium qualities are too different for a

hydroxide from brine deposits produces only ne-bearing (former) oil fields are also beco- standardized exchange trading place.

about 5 tons of CO2, one ton of lithium hydro- ming a focus of the lithium industry. The production of lithium-ion

xide from hard rock deposits produces about batteries requires a large amount

15 tons CO2. Main applications are alloys, of lithium

The question is: What weighs more with the Major lithium deposits are con- lubricants and accumulators

battery and car manufacturers? And CO2 centrated in a few regions A large amount of lithium is required for the

neutrality seems to have the edge here. By Its above-mentioned special and versatile production and operation of lithium-ion batte-

the way, currently about 60% of all lithium hy- Lithium accounts for about 0.006% of the properties make lithium a sought-after mate- ries. Each smartphone contains between 5

droxide mined worldwide is extracted from earth‘s crust, making it slightly less abundant rial in very many different areas of application. and 7 grams of lithium carbonate equivalent

hard rock deposits and only 40% from brine than zinc, copper, and tungsten, and slightly It should therefore come as no surprise that (LCE). For a notebook or tablet, the figure is

deposits. more abundant than cobalt, tin, and lead. Esti- the main area of application for lithium has 20 to 45 grams. Power tools such as cordless

mates from the U.S. Geological Survey suggest changed constantly in the past. Initially used screwdrivers or electric saws require about

that about 21 million metric tons of lithium are mainly in medicine, the element began its tri- 40 to 60 grams for their batteries. A 10 KWh

recoverable as reserves and 86 million tons are umphant advance in the 1950s as a compo- storage unit for household use requires about

recoverable as resources worldwide. About nent of alloys. Its low weight, but also its po- 23 kilograms of LCE, while batteries for elec-

53% of the reserves in the South American sitive properties in terms of tensile strength, tric cars need between 40 and 80 kilograms.

countries of Chile and Argentina alone. The lar- hardness and elasticity, made it an integral An energy storage system with 650 MWh ca-

gest lithium carbonate production currently oc- part of aerospace technology in particular. In pacity needs about 1.5 tons of LCE.

curs in the Salar de Atacama, a salt lake in the the past 20 years, this picture has changed

northern Chilean province of Antofagasta. Ho- once again. As the electric revolution got un-

wever, about 49 percent of global lithium pro- derway, it was quickly recognized that its low Lithium production will (and must)

duction of about 82,000 metric tons in 2020 normal potential made it almost perfect for increase sharply

came from Australia, but at a much higher cost use as an anode in batteries. Lithium batte-

than in South America. In addition, significant ries are characterized by a very high energy In 2020, global lithium production was around

(Source: Vulcan Energy) lithium deposits are found mainly in North Ame- density and can generate particularly high 430,000 tons LCE. Projections assume that

rica and China. voltages. However, lithium batteries are not this figure could rise to a maximum of about

rechargeable. Lithium-ion batteries, on the 580,000 tons LCE with today‘s mining activi-

other hand, have this property, with lithium ty, whereby only very few efforts for concrete

New processing and lithium Lithium production is currently metal oxides such as lithium cobalt oxide mine expansions or new mines have been

sources could revolutionize pro- concentrated mainly in four coun- connected as the cathode. However, as a raw made so far, so that lithium is practically likely

duction tries and a few companies material for the production of accumulators to run into a huge supply deficit. In addition,

and batteries, purity levels higher than 99.5% recent reports about several postponed mine

Recently, more and more exploration and de- Australia, Chile, China and Argentina current- are required. Lithium hydroxide in the „Indus- starts caused additional uncertainty on the

velopment companies are focusing on new ly account for around 95 percent of the wor- trial“ grade is used, among other things, as a supply side.

technologies that will help to extract lithium ld‘s total lithium production, which is shared raw material for lubricants and coolants; with

from brine deposits within days and even among only a few companies. As a result, the the higher „Technical“ grade, it is also used in

16 17You can also read