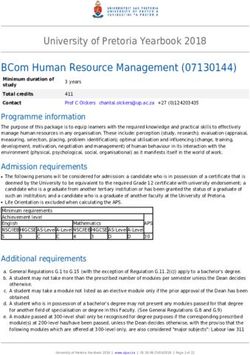

Market trends For week ending February 10, 2023

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

market trends

WEek ending February 10, 2023

Produce

MARKET OVERVIEW

Squash and bell peppers are readily available, and quality is

MARKET ALERT

outstanding. The corn market will be very short as the fallout from • Cabbage (Red) – ESCALATED

last month’s freeze is now affecting the crop, causing extremely • Carrots (Jumbo) – ESCALATED

low yields and more loss than expected. Honeydew and canta- • Celery - ESCALATED

• Corn – EXTREME

loupe have become quite a challenge due to cooler weather and

• Eggplant

will most likely not improve until mid-February. Weather in Yuma

• Garlic – ESCALATED

remains cool, with frost setting in most mornings. The forecast is • Ginger – EXTREME

for cooler weather will continue into early next week. • Green Beans – ESCALATED

• Chili Peppers – ESCALATED

• Iceberg

• Serrano and Anaheim Pepper – EXTREME

• Limes - ESCALATED

• Melons (Cantaloupe, Honeydew, & Watermelon) -

ESCALATED

• Mushrooms – ESCALATED

• Parsley (Curley & Italian) - ESCALATED

• Potatoes (40s & 50s) – ESCALATED

WATCH LIST

• Bananas

• Seedless & Mini Seedless Watermelon

• Table Grapes

TRANSPORTATION

As the month of January progressed, we saw the

freight market resume to normalized levels. Leading

into February, expect the market to remain loose.

Pockets of tightness in the refrigerated freight market

are occurring in the southern states that come online

at the beginning of the year. Expect tighter capacity

and higher rates coming out of Southwest Arizona,

South Texas, and Idaho. We have experienced a

milder winter so far, but the weather will remain a

factor that could throw a wrench into orders traveling

through affected areas. A recent ice storm in Texas

had shippers and receivers closed and orders needing

to be rescheduled. A larger cold snap will pull more

refrigerated capacity out of the market as beverage

shippers will need to protect their shipments from

freezing. The dry van market is wide open, with only

a few areas of tightness in South Texas, Minnesota,

Wisconsin, and the Carolinas. Diesel prices increased

week over week, with the national average going from

4.604 to 4.622.

2market trends

WEek ending February 10, 2023

Produce (continued)

JALISCO, MX FORECAST

FRUITS & VEGETABLES Pineapples

Excellent quality peaking on 7 and 8cts; larger sizes have

Apples, Pears & Stone Fruit

tightened up. The quality is good.

Apples: Washington State Apple Crop looks to be around

100M boxes vs. 122M the last two years and 132M 3 years Table Grapes

ago. With the number of Trees in the ground – this number WATCHLIST Domestic storage fruit is almost done, and we will

is shocking. The last crop we saw 100M boxes was in 2007. see less volume gradually increase over the next few weeks.

Mid-April 2022 – Eastern Washington experienced 20-degree Overall, import volume will remain down, but quality should be

temperatures with apple trees in bloom which caused a normal. Demand remains high, and prices escalated and are

significant loss in the crop. Additionally, cooler temperatures expected to remain this way through mid-February.

in the Spring with extreme summer temperatures also played

a negative role in the supply of apples combined with two

devastating hailstorms causing some blocks of Orchards not to

be harvested. Furthermore, Fujis and granny smiths are known

for alternate-bearing crops. Last year were heavy crops, so both

are down significantly this year.

Pears: This year’s pear crop will likely be down significantly

due to severe high temperatures last July and extremely low

temps in mid-April 2022. Cooler temperatures in the Spring with

extreme summer temperatures also played a negative role in

the supply of pears combined with two devastating hailstorms

causing some blocks of Orchards not to be harvested.

Avocados

The U.S. market has inventory in position for upcoming Super

Bowl ads, with over 67M pounds. With Mexico harvesting

steady volume, California avocado harvest volumes are not

likely to increase until after the Big Game. California Avocado

Commission pre-season crop estimate projects a 257M pounds

season to be mainly harvested within the 6-month window of

March-August. California growers that can hold fruit on the trees

to size up may prolong the start of their season’s harvest in

hopes of more robust markets.

Bananas

WATCHLIST: Volume is lighter due to weather and higher

global demand. No quality issues, but we are seeing smaller

fruit, discolor, and very light inventory entering the ports. Make

certain you are staying ahead of inventory during these next 8

weeks.

3market trends

WEek ending February 10, 2023

Produce (continued)

BERRIES CALIFORNIA CITRUS

Blackberries Grapefruit

Supply continues to increase gradually out of Mexico. We Good supply and quality out of Texas and California.

should continue to maintain current levels through February.

Domestic supplies remain minimal due to weather events. Imports/Specialties

The California mandarin season has started with good

Blueberries availability and outstanding quality. Bloods and Caras are

Mexico continues with strong volumes toward its spring peak available, and Minneolas have started in southern California.

in late February-early March. Peru is past peak arrivals, and we

will see good volumes for a few more weeks. Volume out of Lemons

Baja will slowly increase through the end of the month. Chilean Good supply and very good quality.

arrivals are at their peak, but volumes will begin to downtrend

after this week. Limes

ESCALATED: The market remains steady as the production of

Raspberries the new crop has already begun, and the old crop is expected

Volumes will remain lower than expected for the next 3-5 days to finish within the next two weeks. The overall quality and shelf

due to a gap in production caused by cooler temperatures. life have improved, as pack-out yields on U.S. #1-grade fruit

Mexico is expected to begin its uptrend towards the end of have increased approx. 5-10%. We are still anticipating the

next week and hit peak production by late May. California market to react in an upward trajectory within the next 10 days

volumes will remain over the next few months, and Baja as crops fully transition to the new crop. The second half of

volumes should reach peak production in 4-5 weeks. February through March is forecasted to be extremely tight.

Strawberries Oranges

Strawberry volume out of California will remain limited for the Navels are showing very good quality, with size structure peak

next 3-4 weeks due to cooler temperatures delaying the winter 88/113/72. Larger sizes remain fairly tight.

crop. Fortunately, we should see volume increase quickly by

the end of February. Florida saw favorable weather last week

and this week which should help promote more fruit ripening. WEST COAST

Mexico’s volume is expected to remain steady for the next Vegetables

several weeks.

Yuma had ice over the weekend, and rain earlier this week.

The rain was not enough to cause major harvesting issues but

will affect blister and cause fast acting decay. The weather is

supposed to be in the low to mid 70’s through the weekend.

Iceberg is showing epidermal peel and inconsistent growth

due to cold temperatures, and weights are starting to drop in

some fields. Romaine has some blister and fringe burn and

is currently ribby with heavy cupping. Green Leaf is okay with

windburn.

Iceberg lettuce

Lettuce supplies are fair, but the cold weather is impacting the

timing of the fields and quality. Growth has slowed down, and

we will start to see smaller head sizes and lighter weights on

cartons in the future.

4market trends

WEek ending February 10, 2023

Produce (continued)

EASTERN & WESTERN VEGETABLES French Beans

French bean supplies are steady from Guatemala and Mexico,

Bell Peppers

and quality is fair to good.

East Coast and Mexico have started to produce steadier

supplies on green bells. The field level pricing is reflecting the

Green Beans

current supply and demand levels. The volume is primarily in

ESCALATED: Beans are still in light supply in Florida, with

bigger-sized and #1 quality pepper with a limited amount of

harvests taking place mostly in the Homestead and Immokalee

choice fruit. Red bell pepper supplies have adjusted down to

areas. Some new fields are set to be harvested next week, but

promotable levels. Quality has been excellent all around.

overall yields could be lighter due to prior cool weather causing

bloom drop.

Eggplant

ESCALATED: Florida’s eggplant supply continues at light levels

Jalapenos/Chili Peppers

as cool temperatures and reduced winter acreage affect the

ESCALATED: Eastern chili pepper production is limited to the light

volumes produced. Spring crops should begin in April. Until

volumes in South Florida, with mostly jalapenos and poblanos

then, we expect a continued light supply. Quality is hit or miss

available in any volume. Look for overall volume and variety to

with mostly older fields in production.

improve when Spring crops get rolling in April. As for the West,

supplies are moderate and improving in a slow but sure way.

Crops need some warm weather to kick things in gear. Serranos

and habaneros are the shorter items of the assortment, but there

is more this week than last.

Mini Sweet Peppers

Stable supply and quality available loading in Nogales.

Pickles

Steady volume available this week, and quality will be mixed

out of Mexico.

Cucumbers

Market pricing is continuing to adjust gradually. This trend is

primarily driven by heavier crossings out of Mexico. Eastern

supplies continue to be limited, with better supplies forecasted

in the next few weeks.

Zucchini/Yellow Squash

Excellent supply and quality available in Nogales and Florida,

with deals being made on mediums.

HERBS

Labor shortages have affected harvest times and packing

slowdowns on all herbs from Mexico. Both imported and

domestic chervil production has continued to be impacted

by the weather. Supply is tight on dill and oregano due to the

weather. Weather continues to affect all herbs from Colombia.

Basil is expected to be limited for the next 7-10 days due to

weather affecting supply and quality.

5market trends

WEek ending February 10, 2023

Produce (continued)

MELONS Cantaloupe

ESCALATED: Cantaloupe arrivals are slowly improving;

The colder temperatures that hit the growing regions have however, sizing is heavy 9’s and 12’s, which is an aftereffect

disrupted the market. So many weather patterns have affected of the cooler temperatures. Quality remains strong, but we

the growing regions that have impacted yields and quality. Cold are seeing a greener cast than normal. Internal brix levels of

temperatures and some moisture immediately after Christmas 11-14%.

affected harvests for almost two weeks. The past ten days have

seen a significant and unexpected drop in arrivals on the East Honeydew

Coast, but expect some return to normalcy by next week. The ESCALATED: Honeydews remains in a demand exceeds

West Coast, on the other hand, will continue to feel the effects supply situation in all areas (Central America and Mexico), and

of this disruption of supply until Mid-February. there is not enough supply to cover the needs of everyone.

We expect supply to begin to pick up to more consistent levels

by next week in Florida, but we are anticipating a shift in sizing

to peak on 5/6’s. Advanced ordering and size flexibility may

be necessary until supply increases.

Watermelon

ESCALATED: Overall quality is very nice; still seeing firm pricing

and moderate demand. Nogales and McAllen are the primary

shipping points, and mini watermelons are easing back in

price as store sets change and demand drops. Offshore

watermelons are limited, but we are shipping a few 4/5ct this

week.

MIXED VEGETABLES

Artichokes

Expect lighter supplies to continue over the next several

weeks.

Arugula

Quality and supply are very good.

Asparagus

ESCALATED: Weather remains cool in both growing regions

in Mexico, but that will change this weekend, and production

should improve next week. Peruvian production continues to

decrease due to seasonality. We should see Peru wrapped up in

the next ten days. Markets have leveled off and started to come

off due to more expected volume next week from Mexico.

Broccoli/Broccoli Florets

Quality is very good, with good supplies. The desert is seeing

some slightly cooler weather, so we could see supplies

affected slightly, but no severe shortages are anticipated.

6market trends

WEek ending February 10, 2023

Produce (continued)

Brussels Sprouts Mushrooms

Good available supplies with very good quality, and the market ESCALATED: Quality is good despite supply being lighter than

is steady. expected. We continue to see a lack of labor, shortages in

growing components such as peat moss, and other inflationary

Carrots (Jumbo) pressures. We expect this to continue to be a challenge

ESCALATED: Overall, supplies are improving, although until some of the growing costs can get under control of this

shippers continue to struggle with supply on Jumbos as sizing particularly labor intensive and cost sensitive item.

remains small in California.

Napa Cabbage

Cauliflower Market continues to be very active; quality continues to

ESCALATED: Quality is very good, but supply continues improve.

to be extremely light due to the cold weather. The market

will continue in a demand exceeds supply situation at least

through next week.

Celery

ESCALATED: The market continues a slow downward

trend. Quality continues to improve.

Cilantro

ESCALATED: Pricing is still escalated, but supplies are

improving. The quality is very good.

Corn

EXTREME: Markets remain firm out of Nogales and South

Florida; quality will start to decline as we are harvesting in those

younger fields affected by last month’s freeze. We are seeing

heavy losses and mixed quality, which will be the expectation

through February and March.

Fennel

Excellent quality. Supplies are lighter due to the cooler weather.

Garlic

EXTREME Quality is good with moderate supplies.

Ginger

EXTREME: Chinese supply will be very sporadic due to delays

in unloading containers and inspecting at the ports. Pricing will

be climbing daily.

Green Cabbage

Supply is improving, and quality is very good.

Green Onions

Quality is very good, and supplies continue to improve.

Kale (Green)

Supply is steady, and quality is good.

7market trends

WEek ending February 10, 2023

Produce (continued)

Parsely (Curly, Italian) Spinach (Bunched & Baby)

ESCALATED: Supply continues to be light, and the quality is Quality and supplies are very good.

very good.

Spring Mix

Rapini Quality and supplies are very good.

We are seeing lighter supplies from the cooler weather. Quality

is good. Sweet Potatoes and Yams

New crop is in full swing out of North Carolina and

Red Cabbage Mississippi, and the quality is looking very nice. Supply is very

ESCALATED: Supplies are improving, but the market remains good.

very active, and pricing is steady. Quality is good.

Snow Peas & Sugar Snap Peas ONIONS

Production of snow peas is steady, and sugar snap production We saw FOBs in the Northwest fall slightly this week across all

continues to improve out of Guatemala. Excellent supply of colors and sizes. Demand has continued to be relatively slow,

sugar snaps and a good supply of snow peas from Mexico. and growers in the Northwest are having to compete with

new crop onions out of Mexico. All colors started to cross this

week and have been a good option for many with the freight

advantage. We should continue to see opportunities for good

buys out of all shipping points for the next few weeks. Freight

continues to be soft, with plenty of trucks around and fair rates

to just about anywhere in the country.

POTATOES

Temperatures in Idaho were below freezing this week, which

limited the sheds’ ability to transport potatoes from storage

and run them in production. This has caused some delays,

but potato demand has continued to be slow, so the situation

has not turned dire. FOBs have dropped a bit over the last few

weeks, and we should expect to see the market continue to

stabilize from the highs we’ve seen so far this season. There

have been good opportunities to buy larger-sized potatoes in

volume out of Wisconsin and Washington. Similar to onions,

trucks hauling potatoes have been plentiful, and rates are solid

across the country.

TOMATOES

Markets are steady. Round tomato pricing has leveled off due

to improved supplies and subpar demand. There are deals to

be made on bigger-sized fruit. Roma and grape tomatoes are

in good supply and at minimum pricing levels. The quality has

been solid, with minimal arrival issues reported.

8market trends

WEek ending February 10, 2023

Beef, Veal & Lamb

Last week, the average USDA Choice boxed-beef cutout declined 1.9% from the prior week, and it was 7.5% lower than a year ago.

Beef production increased 1.9% from the prior week but was 1.3% smaller than a year ago. Year-to-date beef output is pacing 1.7%

less than a year ago, which is a smaller deficit than the USDA’s forecasted Q1 2023 loss of 4.7% (y/y). Spot live cattle prices are currently

8.2% higher (y/y). Per the USDA, on Dec. 31, total domestic cold storage boneless beef stocks were up 6.5% (or 30k pounds) (y/y), rose

by 4.1% (m/m), and were only 5.3% less than the 2016 monthly record high. The “jury is still out” as to how high wholesale beef prices

will go this spring and in 2023 with fewer available cattle numbers and smaller beef production. Per the USDA, domestic beef output

this year is expected to be 6.6% (or 1.8 billion pounds) less than in 2022. This data surely suggests that higher beef prices are imminent,

but demand appears to be waning with declining retail beef prices occurring, plus gasoline costs for the U.S. consumer are still high. The

current USDA Choice rib primal and current USDA Choice loin primal prices are 5.5% and 6.0% higher, respectively, vs. their 2022 price

average. Since 2018, the USDA Choice rib primal and Choice loin primal have averaged (cumulative) 14.0% and 21.2% higher, respec-

tively, during Q2 compared to the previous Q1. The Average, USDA, FOB per pound.

Description Market Trend Supplies Price vs. Last Year

Live Cattle (Steer) Decreasing Steady-Available Higher

Feeder Cattle Index (CME) Decreasing Short Higher

Ground Beef 81/19 Decreasing Steady Lower

Ground Chuck Decreasing Steady Lower

109 Export Rib (ch) Decreasing Available Higher

109 Export Rib (pr) Decreasing Available Higher

112a Ribeye (ch) Increasing Steady-Available Higher

112a Ribeye (pr) Decreasing Steady-Available Higher

114a Chuck, Shlder Cld(ch) Decreasing Steady Lower

116 Chuck (sel) Decreasing Steady-Available Lower

116 Chuck (ch) Decreasing Steady-Available Lower

116b Chuck Tender (ch) Decreasing Steady Lower

120 Brisket (ch) Increasing Steady Lower

120a Brisket (ch) Increasing Steady Lower

121c Outside Skirt (ch/sel) Increasing Short Higher

121d Inside Skirt (ch/sel) Increasing Short Lower

121e Cap & Wedge Decreasing Steady-Available Lower

167a Knckle, Trimmed (ch) Decreasing Steady Lower

168 Inside Round (ch) Decreasing Steady Lower

169 Top Round (ch) Decreasing Steady Lower

171b Outside Round (ch) Decreasing Steady Lower

174 Short Loin (ch 0x1) Increasing Short Higher

174 Short Loin (pr 2x3) Decreasing Available Lower

180 0x1 Strip (ch) Increasing Short Higher

180 0x1 Strip (pr) Increasing Available Lower

184 Top Butt, boneless (ch) Increasing Steady-Short Lower

184 Top Butt, boneless (pr) Decreasing Steady Lower

184-3 Top Butt, bnls (ch) Increasing Short Lower

185a Sirloin Flap (ch) Increasing Short Lower

185c Loin, Tri-Tip (ch) Increasing Short Lower

189a Tender (sel, 5 lb & up) Increasing Short Higher

189a Tender (ch, 5 lb &up) Decreasing Available Higher

189a Tender (pr, heavy) Decreasing Steady-Available Higher

193 Flank Steak (ch) Increasing Steady Lower

50% Trimmings Decreasing Short Lower

65% Trimmings Decreasing Steady Lower

75% Trimmings Decreasing Steady Lower

85% Trimmings Decreasing Steady Lower

90% Trimmings Decreasing Steady Lower

90% Imported Beef (frz) Increasing Steady-Available Lower

95% Imported Beef (frz) Increasing Steady Lower

9market trends

WEek ending February 10, 2023

Grains

Last week the grain markets had a mostly strong week with nearby hard red wheat futures up 2.5% but nearby soybean oil futures

were down 2.2% (w/w). It was mostly quiet on the fundamentals front with the improving weather situation in Argentina still the main

focus, especially for the soybean complex. Last Thursday’s export sales report from the USDA was another strong one, with all three

of the major grains showing a significant improvement over the past three weeks. This week’s report (for the week ending Jan. 26) is

expected to continue that momentum with 230,000 and 648,000 metric tons (mt) of private export sales reported last week for corn

and soybeans, respectively. That soybean total represents the biggest week of private sales since early December, so expect that to

translate down to a sizeable total in this Thursday’s report. While corn sales might be improving seasonally, inspections are still trending

along five-year lows as we approach the March-May window when corn shipments are usually at their height, and that should keep

the downward pressure on corn prices at least in the near term. Prices USDA, FOB.

Description Market Trend Supplies Price vs. Last Year

Soybeans, bushel Increasing Steady Higher

Soybean Oil

Crude Soybean Oil, lb Decreasing Available Lower

Soybean Meal, ton Increasing Steady-Short Higher

Corn, bushel Increasing Steady-Short Higher

Price(lb.)

Crude Corn Oil, lb Steady Steady-Available Higher soybean oil-23

High Fructose Corn Syrup Increasing Short Higher soybean oil-22

Distillers Grain, Dry Increasing Short Higher

Crude Palm Oil, lb BMD Decreasing Steady Lower

HRW Wheat, bushel Increasing Steady Higher

1/6 2/6 3/6 4/6 5/6 6/6 7/6 8/6 9/6 10/611/612/6

DNS Wheat 14%, bushel Decreasing Steady-Available Lower

Durum Wheat, bushel Decreasing Available Lower

Pinto Beans, lb Decreasing Short Lower

Black Beans, lb Steady Steady Lower

Rice, Long Grain, lb Steady Short Higher

Dairy

Last week, CME nearby class III milk futures rose a modest 0.11% (w/w) and are 3.6% lower than a year ago. CME cheese

block prices added 0.3%, but cheese barrel prices lost 2.9% (w/w). CME spot butter prices fell 3.7% (w/w) and are the lowest

in 13 months. The milk, cheese, and butter markets appear to have established a downward trend after mixed signals earlier

this month. Per the USDA, December domestic milk production was 0.8% (or 144 million pounds) larger (y/y) and was up 4.0%

(or 730 million pounds) from the prior month. The solid December milk output was impressive considering the extreme winter

weather during the month. On Dec. 31, U.S. frozen butter inventories were up 8.7% (y/y) and grew by a whopping 8.3% during

the month, so post-holiday butter manufacturing has been impressive and is a big reason butter prices have fallen sharply in

recent weeks. Class I Cream (hundredweight), from USDA.

Description Market Trend Supplies Price vs. Last Year

Cheese Barrels (CME) Decreasing Available Lower Cheese Block (CME)

Cheese Blocks (CME) Increasing Steady-Available Higher

American Cheese Decreasing Steady-Available Lower

Cheddar Cheese (40 lb) Decreasing Steady-Available Lower

Price(lb.)

Mozzarella Cheese Decreasing Steady-Available Lower block-23

Monterey Jack Cheese Decreasing Steady-Available Lower block-22

Parmesan Cheese Decreasing Short Higher

Butter (CME) Decreasing Available Lower

Nonfat Dry Milk Decreasing Available Lower 1/6 2/6 3/6 4/6 5/6 6/6 7/6 8/6 9/6 10/611/612/6

Whey, Dry Decreasing Steady Lower

Class 1 Base Steady Available Lower

Class II Cream, heavy Decreasing Available Lower

Class III Milk (CME) Decreasing Steady-Available Lower

Class IV Milk (CME) Increasing Steady-Available Lower

10market trends

WEek ending February 10, 2023

Pork

Last week, the weekly USDA pork cutout average added 1.1% from the prior week and was 16.2% lower than a year ago.

Pork production increased 0.7% from the prior week and was unchanged compared to a year ago. Year-to-date pork output is

running 1.9% more than a year ago, which is in line with the USDA’s Q1 2023 production forecast gain of 1.9% (y/y). Spot lean

hog prices are down 9.1% (y/y). Per the USDA, on Dec. 31, total U.S. cold storage pork inventories were up 15.5% (y/y), grew

by 1.5% (m/m), but were still 26.7% below the 2019 monthly record high. Other cold storage pork items stocks (y/y) on Dec. 31

were: pork bellies up 65.6%, ribs up 41.6%, trimmings up 5.0%, but hams were down 12.9%. We took note that cold storage

pork trimmings stocks built by a whopping 18.7% (m/m). The quarterly pivot model for the USDA pork cutout still shows the

support level at $0.790 (S1) still holding up, but if breached (lower) due to lackluster pork demand, the pivot model hints that the

USDA pork cutout could fall to the next support level at $.700 (S2), which would equal another 11.3% decline from here (current

level). Prices USDA, FOB per pound.

Description Market Trend Supplies Price vs. Last Year

Live Hogs Decreasing Available Higher

Pork Belly

Sow Increasing Available Lower

Belly (bacon) Increasing Steady-Available Lower

Sparerib(4.25 lb & down) Increasing Steady Lower

Price(lb.)

Ham (20-23 lb) Increasing Steady Higher belly-23

Ham (23-27 lb) Increasing Steady-Short Higher belly-22

Loin (bone in) Increasing Steady Lower

Babyback Rib (1.75 lb & up) Increasing Short Lower

Tenderloin (1.25 lb) Increasing Short Lower

1/6 2/6 3/6 4/6 5/6 6/6 7/6 8/6 9/6 10/6 11/612/6

Boston Butt, untrmd (4-8 lb) Increasing Steady-Available Lower

Picnic, untrmd Decreasing Available Higher

SS Picnic, smoker trm box Decreasing Available Higher

42% Trimmings Increasing Steady Higher

72% Trimmings Decreasing Steady Lower

11market trends

WEek ending February 10, 2023

Poultry

Last week, the National Composite Whole Bird Index declined by 0.12% (w/w). For the w/e Jan. 21, the weekly number of

chickens slaughtered was down 7.0% from the previous week but 3.6% more than a year ago. The average bird weight was

0.6% heavier (y/y). Ready-to-cook chicken production for the w/e Jan. 21 was 7.4% smaller (w/w) and up 4.3% (y/y). In 2023,

ready-to-cook chicken output is running 2.0% greater than 2022, which is a smaller gain than the USDA’s Q1 2023 forecasted

rise of 2.7% (y/y). The large shell egg market (weekly national average) lost 14.7% (w/w) but is still up 158.1% (y/y). On Dec. 31,

total domestic cold storage chicken stocks were up a whopping 25.2% (y/y), rose by 2.2% (m/m), and were only 4.9% less than

the 2019 monthly record high. Other cold storage chicken items stocks (y/y) on Dec. 31 were: chicken breasts and breast meat

up 63.4%, wings up 11.0%, leg quarters up 21.6%, and drumsticks up 0.3%. On Dec. 31, cold storage U.S. turkey stocks

were 14.4% larger (y/y) and rose by an aggressive 35.2% (m/m). From a seasonal and value perspective, the various chicken

markets have nominal downside risk (unless the U.S. consumer’s purchasing power is that weak). The turkey breast markets

have softened modestly, but lower prices should still materialize. Large shell egg prices have fallen 37.3% in the last four weeks

and more weakness is expected, but prices should be higher than year-ago levels for most of this year. FOB per pound except

when noted.

Description Market Trend Supplies Price vs. Last Year

Whole Birds WOG-Nat Decreasing Available Lower

Boneless Skinless Chicken Breast

Wings (jumbo cut) Increasing Steady-Short Lower

Wing Index (ARA) Increasing Steady Lower

Breast, Bnless Skinless NE Increasing Steady-Short Lower

Price(lb.)

Breast, Bnless Skinless SE Increasing Steady-Short Lower breast-23

breast-22

Breast Boneless Index (ARA) Increasing Steady Lower

Tenderloin Index (ARA) Increasing Steady-Available Lower

Legs (whole) Increasing Steady Lower

Leg Quarter Index (ARA) Increasing Steady Higher 1/6 2/6 3/6 4/6 5/6 6/6 7/6 8/6 9/6 10/6 11/612/6

Thighs, Bone In Increasing Steady-Available Lower

Thighs, Boneless Increasing Steady-Available Lower

Whole Turkey (8-16 lb) Steady Steady-Short Higher

Turkey Breast, Bnls/Sknls Decreasing Steady Higher

Eggs

Description Market Trend Supplies Price vs. Last Year

Large Eggs (dozen) Decreasing Available Higher

Medium Eggs (dozen) Decreasing Available Higher

Liquid Whole Eggs Decreasing Available Higher

Liquid Egg Whites Decreasing Steady-Available Higher

Liquid Egg Yolks Decreasing Available Higher

Egg Breaker Stock Central Decreasing Available Higher

12market trends

WEek ending February 10, 2023

Seafood

Since the USDA’s December seafood import price release, we’ve discussed at length how many of the seafood items we

monitor may have bottomed out toward the end of 2022 and are now resetting for 2023, with many now sporting possible

bullish outlooks. The safest bet out of the nine items to go higher between now and the end of Q2 is probably fresh Atlantic

salmon filet. Throughout 2022, it statistically adhered closest to its usual seasonality, making it one of the most predictable

items in a year when most everything else in seafood was up in the air. After falling to a 19-month low in December and

rebounding slightly in the January import release, it looks slated to steadily climb from now into July when it usually hits its

peak, just as it did in 2022. Since January is usually salmon’s calendar-year low point, it is currently slightly inflated over usual

pricing, but we don’t see that stopping it from going higher throughout Q1 and Q2. Prices FAS monthly imports.

Description Market Trend Supplies Price vs. Last Year

Shrimp (16/20 frz) Steady Short Higher

61/70 Shrimp

Shrimp (61/70 frz) Steady Available Lower

Shrimp Tiger (26/30 frz) Steady Short Higher

Snow Crab, frz Steady Steady-Available Lower

Price(lb.)

61/70 shrimp-23

Tilapia Filet, frz Steady Available Lower

61/70 shrimp-22

Cod Filet, frz Steady Short Higher

Tuna Yellowfin, frsh Steady Available Lower

Salmon Atlantic Filet, frsh Steady Steady-Available Lower

Pollock Filet, Alaska, frz Steady Short Higher 1/6 2/6 3/6 4/6 5/6 6/6 7/6 8/6 9/610/611/612/6

13market trends

WEek ending February 10, 2023

Paper and Plastic Products

Description Market Trend Supplies Price vs. Last Year

WOOD PULP (PAPER)

NBSK- Paper napkin Steady Available Higher

42 lb. Linerboard-corrugated box Steady Available Higher

PLASTIC RESINS (PLASTIC, FOAM)

PS-CHH-utensils, cups, to-go cont. Steady Available Higher

PP-HIGP-heavy grade utensils Steady Available Lower

PE-LLD-can liners, film, bags Steady Available Lower

Retail Price Change from Prior Month

Description Dec-22 Nov-22 Oct-22

Beef and Veal Decreasing Decreasing Decreasing

Dairy Increasing Increasing Increasing

Pork Decreasing Decreasing Decreasing

Chicken Decreasing Decreasing Decreasing

Fresh Fish and Seafood Decreasing Decreasing Increasing

Fresh Fruits and Vegetables Decreasing Increasing Decreasing

Various Markets

Last week the softs markets had an overwhelmingly bullish week with nearby Arabica futures up 9.7%, nearby global sugar

#11 futures up 6.3%, and nearby cocoa futures up 2.3% (w/w). Most of the strength in all three major items can be attributed

to U.S. Q4 GDP growth and/or the continued strength in the Brazilian real. Last week’s morning release of the U.S. Bureau

of Economic Analysis’s advance estimate of Q4 U.S. gross domestic product showed the country’s GDP grew 2.9% (y/y) in

Q4 2022, slightly ahead of the average pre-report estimate of 2.7% but slower than Q3’s pace of 3.2%. Consumer spending

grew 2.1% (y/y), which was also slightly behind the Q3 mark but still enough to quell fears (for the time being at least) over

lower stateside consumer demand for coffee, sugar, and chocolate. Price bases noted below.

Description Market Trend Supplies Price vs. Last Year

Whole Peeled, Stand (6/10) Steady Short Higher

Tomato Paste-Industrial (lb) Steady Short Higher

Coffee lb ICE Increasing Steady Lower

Sugar lb ICE Increasing Steady-Short Higher

Cocoa mt ICE Increasing Steady-Short Higher

Orange Juice lb ICE Increasing Steady Higher

Honey (clover) lb Increasing Steady-Available Higher

14You can also read