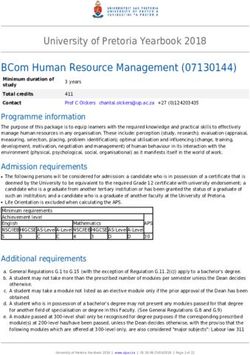

Market trends For week ending June 10, 2022 - Performance Foodservice

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

market trends

WEek ending June 10, 2022

Produce

MARKET OVERVIEW

We continue to see improving volume on mid-sized to small

MARKET ALERT

limes; however, the larger sizes will continue to be short and • Avocados – ESCALATED

are expected to continue through June. Tomato volume will • Bell Pepper – ESCALATED

be light out of the east as the Florida season is ending, and • Cabbage – ESCALATED

• Carrots (Jumbo) – ESCALATED

we are seeing light harvesting out of South Carolina this week.

• Celery – ESCALATED

Out west, light demand and slowly improving volume continue

• Garlic – EXTREME

to keep inventories and FOB prices manageable, but we are • Ginger – EXTREME

seeing a wide range in quality. On the veg side of things, new • Green Beans (West) - ESCALTED

crop production in South Georgia has ramped up. Good volume • Chili Peppers – ESCALATED

is available on cucumbers, cabbage, soft squash, and bell • Italian Parsley - ESCALATED

pepper. Corn quality is very nice this week, and the green bean • Limes (110’s & 150’s) – ESCALATED

market is split with high prices and short supply in the west • Mushrooms – ESCALATED

while new crop is ramping up out of South Georgia. • Oranges - ESCALATED

• Tomatoes (Round & Roma) - ESCALATED

FRUITS & VEGETABLES WATCH LIST

Apples & Pears • Snow Peas

Apples: West coast new crop apples are being packed; however • Sugar Snap Peas

small sizes remain tight. East coast apples are available as well.

Market price remains firm on small fruit as local schools take most

of the volume. Grapes

Pears: This year’s pear crop was down significantly, with mostly Deals are being made on the remaining offshore

larger fruit available. Growers are trying to drag out supply as best inventories while we see new crop volume crossing from

as possible until new crop starts next August. Mexico. Overall, demand has been light.

Avocados Pineapples

ESCALATED: Last week volume harvested for the U.S. was under Pineapple availability continues to be okay. The size profile

48 million pounds. In preparation for Holiday ads, volume from all is trending to size 5 and 6cts, and availability on 7cts

origins ramped up a bit, which has left the U.S. inventory at around remains limited.

53 million pounds. Mexico is approximately 62% of the inventory,

California about 27%, Peru a little over 9%, and Colombia just

under 2%. Available orchards continue to decrease, which seems

to be holding on to the strong field pricing. Estimated projections

report that Mexico should supply approximately 30 million pounds

weekly to the U.S. market through the remainder of the current

season (end of June). The Flora Loca crops are expected to be

released to harvest by July 4th, pending dry matter levels. We are

hearing the summer crop is expected to be larger compared to

the year prior. We expect the summer crop to favor the 60 counts

and smaller, with a good supply of 48 counts and a limited supply

of 40s and larger at the beginning of the season. California harvest

volume continues to be around 2 million pounds per day. The size

curve favors 48 and 60 counts, with limited availability on large

sizes. We have passed the halfway point of the season.

Bananas

Steady volume and good quality available. However, we are seeing

firm pricing this quarter due to record-high fuel prices.

2market trends

WEek ending June 10, 2022

Produce (continued)

SALINAS, CA FORECAST

Raspberries

Mexico continues to downtrend and will do so until the end of

TRANSPORTATION June. Additionally, Central Mexico has seen higher decreasing

After watching rates drop for almost two months, at yields due to quality issues. Baja is in peak season and will

the end of May we experienced an uptick in rates start a downtrend in the next 5-7 days. The U.S. regions will

as expected. Several factors such as month-end, continue to see uptrends which will help alleviate the lower

Memorial Day, and the beginning of summer are volumes out of Mexico.

the obvious explanations for capacity tightening up

over the last week or so. We also saw contracted Strawberries

carrier rejections rise during the 2nd and 3rd weeks Due to warmer weather, we are seeing growers reach

of May- which is a sign of the market tightening peak volume and expect this to continue for the next few

up and causing more truckload shipments to hit weeks. Quality out of Salinas, Watsonville and Santa Maria is

the spot market. As we enter the final month of exceptional and looks to continue.

Q2, we anticipate rates to continue to spike as

shippers push to make their quotas and fully stock

warehouses for the busier warmer months to

come, as well as preparing for the 4th of July. Fuel

continues to be a sticking point as carriers push

for higher rates, citing the continuing exponential

rise in operating costs. Expect to see the same

trend of loads going south being somewhat easier

to move, and anything coming out of the south or

areas near ports to be difficult / more expensive to

get covered.

BERRIES

Blackberries

Central Mexico yields are lower than anticipated, and the

season will likely conclude by mid-June. The U.S. will be the

main producing region through June. North Carolina has

begun, and its season will be in peak production in the next

3-4 weeks.

Blueberries

The San Joaquin Valley is in peak volumes and will continue

over the next week. Baja is past its peak and will begin to

see decreasing volumes over the next several weeks. North

Carolina production continues to ramp up and should be in

peak season in the next 3-5 days. Quality is good with minor

defects.

3market trends

WEek ending June 10, 2022

Produce (continued)

CALIFORNIA CITRUS WEST COAST LETTUCE

Grapefruit Butter Lettuce

Ruby grapefruit is now available. Size is peaking on 32s, and Steady volume with overall very good quality, and markets

larger fancy and all small sizes 36s and smaller are tight. Texas remain active at steady prices.

is expected to start very late.

Green Leaf

Imports/Specialties Production in Salinas is steady with very good quality, and

Blood oranges are available in good supply. Imported markets are stable with overall good demand.

clementines will be available soon.

Iceberg

Lemons Weather has been ideal for growing, so we are seeing good

Lemons are in full swing, and quality has been good. Best supplies and good quality. Market is slightly lower than last

buys are on 95-140F/Ch. Argentine lemons will be arriving by week, although overall demand remains very good.

next week on the east and west coasts.

Red Leaf

Limes Production in Salinas is steady with very good quality. The

ESCALATED: (150 counts and larger) The volume will continue market is stable with overall good demand.

improving on small limes; however, the crop is not sizing up.

Growers are optimistic we should see a much-improved size Romaine and Romaine Hearts

distribution by the middle of June. With this update, we expect Quality is very good with just some very light windburn. Overall

larger-sized fruit to be an issue and ask to be flexible on sizes demand is good with a slightly better demand for hearts. Market

until we see an improvement in volume on large-sized fruit. on romaine 24ct is slightly lower, and romaine hearts remain

steady.

Oranges

ESCALATED: Small oranges remain fairly tight, with market

pricing in the low $20’s for choice grade. Few navels remain, EASTERN & WESTERN VEGETABLES

but many growers are on to Valencias. Size structure peaking Bell Peppers

56/72, with about 75% being fancy grade. ESCALATED Markets are active on all colors. Green bell

pepper production out of Georgia is lagging while Florida

is coming to their season’s end. The demand, particularly

on off-grade products, is still strong, and it is exceeding the

available supplies. The season out of Mexico has come to an

end, leaving Coachella as a primary source of bell peppers

out West until Bakersfield starts in the next couple of weeks.

We’ll be in active markets for another two to three weeks at a

minimum.

Eggplant

Still some lingering volume remaining in Florida, but the

majority of production has moved to South Georgia, where we

see good volume and quality on the first picks. Coachella is

about one week out from production.

French Beans

Out of the west, quality and production levels remain fair as

labor continues to be a challenge. Guatemalan production

continues to be excellent, but rain may affect shelf life in the

coming weeks.

4market trends

WEek ending June 10, 2022

Produce (continued)

Green Beans Pickles

ESCALATED: Mexico is winding down, and Coachella is We are seeing stable volume out of South Florida this week as

already wrapped up. There are few stragglers, but with less well.

acreage planted, the season closed sooner than expected,

and we should transition to Fresno and the coast over the next Cucumbers

ten days. In the east, we are seeing stronger numbers out of SLICER: Florida supply will be wrapping up this week. South

South Georgia, and Florida is done for the season. Georgia is seeing strong productions and outstanding quality.

Volume and quality crossing through McAllen and Nogales was

Jalapenos/Chili Peppers lighter this week and driving FOB prices higher in the west.

ESCALATED: Plant City has plenty of Cubanelles and good ENGLISH: Good quality and supply available out of Mexico

volumes of jalapenos, but the supply is very light on poblanos and Canada, as well as afew crossings at Otay as well.

and serranos. They should continue to work fields into June,

as quality and distribution allow. Georgia is on deck for the Zucchini/Yellow Squash

chili pepper game, and we’ve already seen jalapenos get Lighter production numbers coupled with steady demand are

started in a light way. Over the next two weeks, Georgia farms keeping the market pricing on yellow squash firm. Production

will branch out to include almost all the mainstream chilies numbers on zucchini have improved, bringing on a slight

except for tomatillos. From there, we’ll see regional pockets of weakness in the market pricing. Reported quality out of

supply in late June/early July. FOBs are a few dollars lower on Georgia and California has been good.

jalapenos and poblanos but are holding steady on Cubanelles.

HERBS

Mini Sweet Peppers Rain continues in Colombia, causing quality issues and some

Good supply and quality available. shortages. Expect shelf life and availability on specialty varieties

to vary.

MELONS

Cantaloupe

Cantaloupe production has started to increase as growers

moved into the holiday weekend. As is typical for the desert

region, sizing has been primarily larger fruit 9cts and 9 jumbos

which will most likely continue being the trend in the short term.

Early quality from Arizona has been solid. We have good sizing,

and cantaloupes also have a nice shell color with good internal

quality.

Honeydew

Honeydew availability is very short. Domestic honeydews

production is limited as few dews are grown from the desert

for various reasons. Some areas are susceptible to whitefly

while others are prone to higher winds during the growing

period, which negatively affects the external quality, so growers

either go with cantaloupe or other commodities. Because

of this, Mexican production crossing through Nogales will

be heavily relied upon over the next 2-3 weeks. Currently,

Mexican production is also limited. The current sizing profile for

the honeydews has been leaning more to the 6 and 8 cts, with

larger fruit being scarce.

5market trends

WEek ending June 10, 2022

Produce (continued)

Watermelon Broccoli/Broccoli Florets

Watermelons are the king of summer melons and are in full Market continues steady with very good quality.

swing shipping out of several Southern US states. Currently,

east coast watermelons are finishing in southern and central Brussels Sprouts

Florida and are beginning to harvest in north Florida. Southern We will continue to see lighter supplies for the coming week

Texas is harvesting as well, and as the weeks progress, Texas with very strong demand, and prices are higher.

will also move north through the state. Mexico is shipping

melons into both McAllen, Texas, and Nogales but will slow Carrots

down as we transition into further north regions. With the ESCALATED: Current demand exceeds predicted supply while

holiday pull finished, we have seen pricing across the board lower than average yields caused by cold, wet weather has

soften as demand is not keeping up with supply. Georgia has limited availability. Shippers continue to struggle with labor due

been extremely hot, which is pushing that crop ahead and will to COVID and not having enough workers show up daily to

likely create even a larger overlap in supplies. It is likely we will pack carrots.

see pricing soft through the next 10-14 days and then perk

back up once the 4th of July demand starts. Cauliflower

Quality is very good, with a good supply.

MIXED VEGETABLES Celery

Artichokes ESCALATED: Pricing remains escalated although the market has

Quality is very good with moderate supply, and the market is a weaker undertone, quality is improving. A few shippers have

steady. started in Salinas as we look for volume to increase. Oxnard will

still be shipping through the month of June, at which time all

Arugula Celery will be moving to the Salinas / Santa Maria growing areas

Supply and quality are good. for the remainder of the season.

Asparagus Corn

Southern Baja continues with good production in all sizes. Good volume and quality available this week out of South

Guanajuato should start up in the next 7 to 10 days. Peruvian Georgia and Coachella.

production has slowed down due to some field closures due to

market conditions. Markets are less active after the holiday, and Fennel

with Mexico/Peru/USA regions in production. Good supply continues with very good quality.

Garlic

EXTREME: Domestic supply is very tight, and shippers are

holding to averages, but we expect this volatile market to

continue through the summer. Garlic Company is now shipping

products from Mexico until the new garlic crop gets started in

mid-July.

Ginger

EXTREME: Ginger is very volatile due to very inconsistent

supply, and the market is higher. Supply remains tight for the

foreseeable future.

Green Cabbage

ESCALATED: Quality is good; supplies continue to be light.

The market is very active.

Green Onions

Supply is good with very good quality. Market is steady.

6market trends

WEek ending June 10, 2022

Produce (continued)

Jicama ONIONS

Steady supply available crossing through McAllen.

The Imperial Valley will be finishing up their onions this week

before moving up north to the San Joaquin Valley. White

Kale (Green)

onions were the first to finish, with yellows beginning to wrap

Supply is steady, quality is very good.

up as well. There is still good availability on red onions out of

Brawley, with some deals to be had on straight load volume.

Mushrooms

New Mexico started in a small way this week, with plans

ESCALATED: Quality is good, although supply is down and

to start really ramping up next week. The sizing is smaller

markets are higher primarily due to a lack of labor, shortages

compared to California, but there will be availability on all

in the component of growing such as peat moss, and other

colors. Truck capacity out of California was tight, and rates

inflationary pressure. We expect to see this continue to be

were elevated after the Memorial Day weekend. They should

a challenge until some of the growing costs can get under

continue to remain steady as more volume continues to come

control of this particularly labor intensive and cost sensitive

out of that region.

item.

Napa Cabbage

POTATOES

Quality is good, and supplies are improving.

The market continued its rise this week across all sizes and

Parsely (Curly, Italian) grades. 60/70/80 count potatoes continue to be the most in

Quality is good; fair supply of curly parsley with good demand. demand size, and it is getting increasingly more difficult to find

Very light supply continues, and the market is escalated with volume on those. Production is dropping significantly now that

much higher pricing. most are in their Burbanks which are just not packing out like

the Norkotahs. We will continue to see the market rise as we

Rapini get deeper into the remaining crop and will not see any relief

Excellent supply this week and next. until the new crop in the Fall. We recommend that buyers plan

ahead for their orders as it is getting more difficult to get orders

Red Cabbage turned around quickly. Truck capacity out of Idaho bounced

ESCALATED: Quality is good, the market continues to be back relatively well after the Memorial Day weekend. Trucks

active. were plentiful this week, but rates were still a bit elevated.

Snow Peas & Sugar Snap Peas

WATCHLIST: Rain in Guatemala continues to slow down the TOMATOES

production of snow peas, and quality will be affected in the Markets are active on all varieties this week due to a lack of

coming weeks. Sugar snap supply is steady and production in availability on both coasts. Florida volumes are limited as their

the U.S. continues to ramp up. season winds down. Mexican production is slowly transitioning

to the Baja region. Expect escalated prices over the next two

Spinach (Bunched & Baby) to three weeks until West and East Coast growers transition

Supply and quality are good. their crops to new growing regions.

Spring Mix

Supply and quality are good.

Sweet Potatoes & Yams

Demand continues to be stable across all sizes and varieties.

There are deals to be had on both #1’s and Jumbos out of

North Carolina. FOB’s out of Mississippi are a bit higher but

quality out of that region has been outstanding. We should see

prices gradually start to rise throughout the summer months

and into the new crop.

7market trends

WEek ending June 10, 2022

Beef, Veal & Lamb

Last week, the weekly average USDA Choice cutout was up 1.2% (w/w) but dropped 19.2% (y/y). Beef production declined 5.8% last

week (w/w) but was 3.0% higher than a year ago (y/y). Year-to-date, beef production was also 0.9% higher than last year, with USDA

projecting a gain of 1.8% for H1 (’22) beef output (y/y). This past Memorial Day weekend along with the warm weather was a reminder

that grilling activity has arrived. According to the USDA, on April 30, boneless-beef cold storage stocks were 16.7% larger (y/y) but fell by

0.6% during the month. Foodservice will monitor the various beef trim and ground beef markets this late spring and summer, especially

with record-high boneless skinless chicken breast prices still materializing (which typically are at a discount to ground beef prices). The

most recent weekly 81/19 (percent) ground beef market is $2.902/lb., up only 0.2% (y/y). Ground chuck is $3.029/lb. up 1.5% (y/y), and

the ArrowStream Boneless Skinless Chicken Breast Index is $3.595/lb., up 65.8% (y/y). Therefore, there may be only modest downside

price potential for ground beef and ground chuck; however, chicken breast prices likely have notable downside risk, especially during this

time of year (seasonal top). The Average, USDA, FOB per pound.

Description Market Trend Supplies Price vs. Last Year

Live Cattle (Steer) Decreasing Available Higher

Feeder Cattle Index (CME) Decreasing Available Higher

Ground Beef 81/19 Increasing Short Higher

Ground Chuck Increasing Short Higher

109 Export Rib (ch) Decreasing Steady-Available Lower

109 Export Rib (pr) Increasing Steady-Short Lower

112a Ribeye (ch) Increasing Steady-Short Lower

112a Ribeye (pr) Decreasing Available Lower

114a Chuck, Shlder Cld(ch) Increasing Steady Lower

116 Chuck (sel) Increasing Steady-Short Lower

116 Chuck (ch) Increasing Steady-Short Lower

116b Chuck Tender (ch) Increasing Steady-Available Lower

120 Brisket (ch) Increasing Available Lower

120a Brisket (ch) Decreasing Steady Lower

121c Outside Skirt (ch/sel) Increasing Steady Lower

121d Inside Skirt (ch/sel) Increasing Steady Lower

121e Cap & Wedge Increasing Steady Lower

167a Knckle, Trimmed (ch) Increasing Steady-Short Lower

168 Inside Round (ch) Decreasing Steady-Available Lower

169 Top Round (ch) Increasing Available Lower

171b Outside Round (ch) Increasing Steady Lower

174 Short Loin (ch 0x1) Increasing Short Lower

174 Short Loin (pr 2x3) Decreasing Available Lower

180 0x1 Strip (ch) Increasing Steady-Short Lower

180 0x1 Strip (pr) Increasing Steady Lower

184 Top Butt, boneless (ch) Increasing Steady Lower

184 Top Butt, boneless (pr) Increasing Short Lower

184-3 Top Butt, bnls (ch) Increasing Steady Lower

185a Sirloin Flap (ch) Increasing Available Lower

185c Loin, Tri-Tip (ch) Increasing Short Lower

189a Tender (sel, 5 lb & up) Decreasing Available Lower

189a Tender (ch, 5 lb &up) Increasing Steady-Available Lower

189a Tender (pr, heavy) Increasing Steady Lower

193 Flank Steak (ch) Increasing Steady Lower

50% Trimmings Increasing Steady-Available Higher

65% Trimmings Increasing Steady Higher

75% Trimmings Increasing Short Lower

85% Trimmings Increasing Steady Higher

90% Trimmings Increasing Steady Higher

90% Imported Beef (frz) Decreasing Available Higher

95% Imported Beef (frz) Decreasing Available Higher

Live Cattle (Steer) Decreasing Available Higher

Feeder Cattle Index (CME) Decreasing Available Higher 8market trends

WEek ending June 10, 2022

Grains

The grains markets had a mostly lower week, with the only gainers being soybeans and spring wheat (w/w). Nearby corn

futures corrected upward late in the week as the trade pondered the effects of the new trade deal between Brazil and China,

which will loosen the restrictions Chinese importers face when importing Brazilian corn. China had similar agreements with the

U.S., Ukraine, and Argentina, its three main sources of corn and soybeans up until this point. The move is probably in reac-

tion to Ukraine’s inability to export corn anywhere right now because of the war, and earlier last week, the market’s sentiment

seemed to be for less export corn demand here in the U.S. as a result of the deal. But, we don’t think that may end up being

the case. There may be a shake-up in who the U.S. ships corn to, but demand will likely remain firm nonetheless, which most

likely explains Friday’s higher price correction. New crop corn export sales have tapered off in the past few weeks vs. 2021’s

blistering pace, but were still the second-best on record seasonally, and China has accounted for almost 50% of those sales.

There are a number of factors putting downward pressure on the corn market right now, but this new trade deal between China

and Brazil will not be one of them which may be some good news for U.S. buyers. Prices USDA, FOB.

Description Market Trend Supplies Price vs. Last Year

Soybeans, bushel Increasing Steady-Short Higher

Crude Soybean Oil, lb Decreasing Steady Higher

Soybean Meal, ton Increasing Steady Higher

Corn, bushel Decreasing Available Lower

Crude Corn Oil, lb Decreasing Steady-Short Higher

High Fructose Corn Syrup Decreasing Available Lower

Distillers Grain, Dry Decreasing Available Higher

Crude Palm Oil, lb BMD Increasing Steady Higher

HRW Wheat, bushel Decreasing Steady-Short Higher

DNS Wheat 14%, bushel Increasing Short Higher

Durum Wheat, bushel Decreasing Steady-Short Higher

Pinto Beans, lb Steady Steady Higher

Black Beans, lb Steady Short Higher

Rice, Long Grain, lb Steady Short Higher

Dairy

Last week, the cheese block and cheese barrel markets finished 2.4% and 4.2% lower, respectively (w/w), but these markets are

still near levels not seen since November 2020. The average CME spot butter market was up 3.1% (w/w) and the highest since

January when it hit the highest level ($2.935) since 2015. Later this year, better year-over-year milk production is expected to oc-

cur, which could equal lower milk prices and lower operating costs for cheese and butter manufacturers. The U.S. dairy products

(prices) have been supported for many months due mostly to strong exports, but the international dairy markets have experienced

weakness in recent weeks, which could slow exports and temper seasonal price gains for the cheese and butter markets this

summer. During the last 10 years, cheese block and spot butter prices averaged (cumulative) 6.1% and 5.5% higher respectively

in June compared to the previous month’s (April) average. Class I Cream (hundredweight), from USDA.

Description Market Trend Supplies Price vs. Last Year

Cheese Barrels (CME) Decreasing Steady Higher

Cheese Blocks (CME) Decreasing Steady Higher

American Cheese Increasing Short Higher

Cheddar Cheese (40 lb) Increasing Steady-Short Higher

Mozzarella Cheese Increasing Steady-Short Higher

Monterey Jack Cheese Increasing Steady-Short Higher

Parmesan Cheese Increasing Short Higher

Butter (CME) Increasing Short Higher

Nonfat Dry Milk Increasing Steady Higher

Whey, Dry Decreasing Available Lower

Class 1 Base Steady Short Higher

Class II Cream, heavy Increasing Steady-Short Higher

Class III Milk (CME) Increasing Steady Higher

Class IV Milk (CME) Increasing Short Higher

9market trends

WEek ending June 10, 2022

Pork

Last week, the weekly average USDA pork cutout increased 3.6% (w/w); however, it was 14.0% lower (y/y). Over the last

week, pork production declined 2.7% (w/w), but was 0.9% greater than 2021 (y/y). Year-to-date, pork output is still 4.3%

below last year (y/y), a small improvement from last week, and closer to USDA’s H1 (’22) projection of a 4.1% reduction in

annual pork production (y/y). As mentioned earlier, U.S. exports of pork seem to be lackluster this year, especially to China. It

is worth noting that USDA’s WASDE expectation is that total supply and demand should be balanced, with imports increasing

19.3% (y/y) and exports declining 6.4% (y/y). Imports are rather minor compared to the other components and will have a

limited market impact. The WASDE export number may be a bit optimistic, given the data from the export sales report thus

far and the continued strength of the U.S. dollar. The average USDA pork cutout value lost some steam this past week and

hovered in the $1.07-$1.08/lb. range, then fell to $1.06/lb. on Friday. Pork production is the lowest in Q2, thus the downside

price risk may be small at this time. Since 2011, the USDA pork cutout averaged (cumulative) 3.8% higher in June compared

to the previous May (average). Prices USDA, FOB per pound.

Description Market Trend Supplies Price vs. Last Year

Live Hogs Steady Short Higher

Sow Decreasing Available Higher

Belly (bacon) Increasing Steady Lower

Sparerib(4.25 lb & down) Decreasing Steady-Short Lower

Ham (20-23 lb) Increasing Steady-Short Higher

Ham (23-27 lb) Increasing Steady-Short Higher

Loin (bone in) Increasing Steady Lower

Babyback Rib (1.75 lb & up) Decreasing Available Lower

Tenderloin (1.25 lb) Decreasing Steady Lower

Boston Butt, untrmd (4-8 lb) Increasing Steady-Short Lower

Picnic, untrmd Increasing Steady-Short Lower

SS Picnic, smoker trm box Increasing Short Higher

42% Trimmings Decreasing Steady-Available Lower

72% Trimmings Decreasing Available Lower

10market trends

WEek ending June 10, 2022

Poultry

Last week, USDA’s national whole broiler/fryer index dropped 0.1% (w/w), although was 64.1% above a year ago. For the week

ending May 21, chicken slaughter was 1.0% higher (w/w), while the average bird weight was 0.48% heavier (y/y). Ready-to-cook

chicken production was up 0.7% (w/w), but still 0.7% below a year ago. Year-to-date, ready-to-cook broiler production is running

larger by 0.7% (y/y), which is below USDA’s expected gains of 1.8% (y/y) for H1 (’22). Last Wednesday’s Poultry Slaughter report

indicated lower levels of chilled and frozen chicken certified wholesome in April. Certified chilled chicken dropped 10.7% from

March (m/m) and 3.3% from last year (y/y), while frozen chicken meat certified was 13.1% lower than in March (m/m) and 9.0%

below April 2021 (y/y). Despite the weakness in April certifications, YTD levels of certified chilled and frozen chicken are still 1.0%

above last year. May is usually the turning point in price seasonality for chicken breasts, with the ArrowStream Boneless Skinless

Chicken Breast Index usually peaking for the year during the third week of May (cumulative average over the last five years). FOB

per pound except when noted.

Description Market Trend Supplies Price vs. Last Year

Whole Birds WOG-Nat Steady Steady-Short Higher

Wings (jumbo cut) Decreasing Available Lower

Wing Index (ARA) Decreasing Available Lower

Breast, Bnless Skinless NE Increasing Short Higher

Breast, Bnless Skinless SE Increasing Short Higher

Breast Boneless Index (ARA) Increasing Short Higher

Tenderloin Index (ARA) Increasing Short Higher

Legs (whole) Increasing Short Higher

Leg Quarter Index (ARA) Increasing Short Higher

Thighs, Bone In Increasing Short Higher

Thighs, Boneless Increasing Short Higher

Whole Turkey (8-16 lb) Decreasing Short Higher

Turkey Breast, Bnls/Sknls Increasing Short Higher

Eggs

Description Market Trend Supplies Price vs. Last Year

Large Eggs (dozen) Decreasing Steady-Available Higher

Medium Eggs (dozen) Decreasing Steady-Available Higher

Liquid Whole Eggs Steady Short Higher

Liquid Egg Whites Steady Short Higher

Liquid Egg Yolks Steady Steady Higher

Egg Breaker Stock Central Decreasing Available Higher

11market trends

WEek ending June 10, 2022

Seafood

Canada’s Gulf of St. Lawrence reached 73.0% of its 2022 snow crab quota last week, and the season should start to wind

down from here on with 23 grid closures announced in the southern half of the Gulf due to right whale sightings. The Gulf’s

regional quota for the current season increased pretty much across the board from 2021, especially in the southern half, and

seems to have helped temper price increases for the U.S. from the ban on Russian seafood imports. Canada itself joined in

on those import bans last week, announcing a halt to “luxury goods” imports from Russia, which Canada’s minister of foreign

affairs clarified would include seafood products. This probably won’t ripple down to the U.S. seafood market in any notable

way, however. Canada’s at the front of many seafood supply chains here in the U.S. rather than a middleman like China,

who continues to test imported food packages for coronavirus which is keeping the seafood industry on edge. New seafood

import monthly prices are due out next week but expect prices to remain elevated compared to a year ago going forward.

Prices FAS monthly imports.

Description Market Trend Supplies Price vs. Last Year

Shrimp (16/20 frz) Steady Available Higher

Shrimp (61/70 frz) Steady Available Higher

Shrimp Tiger (26/30 frz) Steady Available Higher

Snow Crab, frz Steady Available Higher

Tilapia Filet, frz Steady Available Higher

Cod Filet, frz Steady Available Higher

Tuna Yellowfin, frsh Steady Available Higher

Salmon Atlantic Filet, frsh Steady Available Higher

Pollock Filet, Alaska, frz Steady Available Higher

12market trends

WEek ending June 10, 2022

Paper and Plastic Products

Description Market Trend Supplies Price vs. Last Year

WOOD PULP (PAPER)

NBSK- Paper napkin Steady Short Higher

42 lb. Linerboard-corrugated box Steady Short Higher

PLASTIC RESINS (PLASTIC, FOAM)

PS-CHH-utensils, cups, to-go cont. Steady Short Higher

PP-HIGP-heavy grade utensils Steady Steady Higher

PE-LLD-can liners, film, bags Steady Short Lower

Retail Price Change from Prior Month

Description Apr-22 Mar-22 Feb-22

Beef and Veal Decreasing Increasing Increasing

Dairy Increasing Increasing Increasing

Pork Increasing Increasing Increasing

Chicken Increasing Increasing Increasing

Fresh Fish and Seafood Increasing Increasing Decreasing

Fresh Fruits and Vegetables Increasing Increasing Increasing

Various Markets

The softs markets were steady to higher last week with coffee leading the way after reversing earlier-week losses on drier

weather forecasts in Brazil’s growing regions. Cocoa showed some odd price action late in the week, negating early losses as

well. This is despite reports from private group IRI that chocolate demand here stateside is starting to see some destruction in

the face of higher prices. IRI pegged sales down 6.0% and prices up 11.0% in the 13-week period between mid-February and

mid-May (y/y). ICE-monitored cocoa inventories recently rose to a six-month high, making the current cocoa price level seem

high and could equal a downward correction. Price bases noted below.

Description Market Trend Supplies Price vs. Last Year

Whole Peeled, Stand (6/10) Steady Short Higher

Tomato Paste-Industrial (lb) Steady Short Higher

Coffee lb ICE Increasing Steady-Short Higher

Sugar lb ICE Decreasing Steady-Available Higher

Cocoa mt ICE Increasing Steady-Available Higher

Orange Juice lb ICE Increasing Steady-Short Higher

Honey (clover) lb Decreasing Steady-Available Higher

13You can also read