Young Professionals Global Impact Survey Summary - Current - Green Bay, WI Date 14 July 2008

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

E info@nextgenerationconsulting.com

W nextgenerationconsulting.com

T 888.922.9596

F 608.310.5586

Current - Green Bay, WI Date 14 July 2008

Young Professionals Global

Impact Survey SummaryCurrent – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

CONTENTS

Page

INTRODUCTION 2

COMMUNITY RESULTS: Perceptions of Green Bay 3

YP RESULTS: Involvement and Impact 7

PROFESSIONAL RESULTS: Experience, Entrepreneurship, and Engagement 8

DEMOGRAPHICS 9

ABOUT NEXT GENERATION CONSULTING 10

*Along with this report, you will also receive an Excel Workbook with the results or “raw data” for all questions,

as well as the responses to open-ended questions.

1Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

INTRODUCTION

Young Professionals Global Impact Survey Methodology

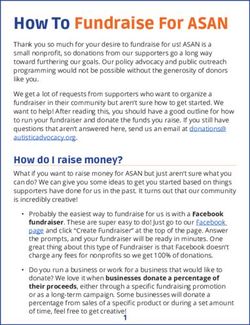

Next Generation Consulting (NGC) administered a web-based survey of young professionals in Green Bay,

WI, between May 23, 2008 and June 30, 2008. A total of 254 valid responses were collected.

Most of the survey respondents were not members of Current Green Bay’s Young Professionals Organization.

Of the 254 valid responses, 116 (46%) were members of Current, 132 (52%) were non-members, and 6 (2%)

were unsure of their membership status. More information on Current involvement can be found on page 6.

Survey Design and Organization

The Young Professionals Global Impact Survey is comprised of over 50 multiple choice and open-ended

questions. The questions can be divided into four sections:

(1) Community: Perceptions of Green Bay

(2) Current: Involvement and Impact

(3) Professional: Experience, Entrepreneurship, and Engagement

(4) Demographics

The survey results and detailed analysis presented on the following pages are organized by section. In

addition, a separate Excel workbook is provided with the raw data for each question and the open-ended

responses.

2Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

COMMUNITY RESULTS:

Perceptions of Green Bay

Relationship to Green Bay

Survey respondents were asked about their relationship to Green Bay, and chose one of three categories to

best describe them: Lifer, Transplant, or Boomeranger. The majority (45%) of respondents were Transplants,

as shown in the pie chart below.

What do YP’s think about the Quality of Life in Green Bay?

Most respondents (84%) had a very positive or somewhat positive perception of the quality of life offered in

Green Bay. The chart below matches respondents’ perception of the quality of life with their relationship to

the community. Specifically, 91% of Lifers had a positive perception of the quality of life compared to 86% of

Boomerangers and 79% of Transplants.

3Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

Should I stay or should I go?

Over a third of respondents (36%) said they plan to live in Green Bay for 16 or more years, while another third

of respondents (31%) were undecided about their plans. Additionally, 10% plan to stay in Green Bay for 1-4

years, 9% plan to stay for 5-9 years, 8% plan to stay for 10-15 years, and 7% plan to leave within a year.

Perhaps most young professionals plan to stay because of Green Bay’ reasonable cost of living: 85% of

respondents said they feel they can afford to live in their preferred area of the community.

The Seven Community Indexes

Next Generation Consulting has developed a proprietary system to “see” a community through the lens of the

next generation. Specifically, the next generation analyzes a community according to seven indexes: Vitality,

Earning, Learning, Social Capital, Cost of Lifestyle, After Hours, and Around Town.

We asked respondents two questions about the seven indexes:

o How important are these amenities to you (Value)?

o How well does Green Bay provide these amenities (Perception)?

Table 1 (below) provides a comparison of young professionals’ value and perception. The “Value” column

represents the percent of respondents who chose “most important” or “somewhat important” for each index.

The “Perception of Green Bay” column represents the percent of respondents who chose “completely agree”

or “agree” with how well Green Bay offers amenities in each index. The “variance” column represents the

difference between value and perception.

Table 1: Value vs. Perception of Green Bay in the Seven Indexes

Perception

Value of Green Bay Variance

COST OF LIFESTYLE: I want a community where I can afford to live,

work, and play. 98% 90% -8%

EARNING: I want a broad choice of places to work and an environment

that is friendly to entrepreneurs. 97% 56% -41%

VITALITY: I value a vibrant community where people are ‘out and

about’ using public parks, trails and recreation areas, attending farmers’

markets and living in a healthy community. 94% 62% -32%

LEARNING: I want to plug into a community that offers life-long

learning and values being ‘smart.’ 91% 75% -16%

AROUND TOWN: I want to live in a community that’s easy to get

around in; I don’t want long commute times. 89% 86% -3%

AFTER HOURS: I want to be able to find authentic local places to have

dinner, meet for coffee, hear live music, or just hang out. I want to be

able to attend art openings, theatre, and cultural festivals. 88% 51% -37%

SOCIAL CAPITAL: I value living in a diverse community, where people

are engaged and involved in community life. 84% 39% -45%

Peach highlighting = greatest mismatch between value and perception

Blue highlighting = closest match between value and perception

4Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

Matches and Mismatches

The closest matches between value and perception were in Green Bay’s Cost of Lifestyle and Around Town

indexes. Nearly all respondents (98%) valued cost of lifestyle, and most of them (90%) agreed that Green Bay

is an affordable community. Similarly, 89% of respondents valued “around town” amenities like short

commute times, and 86% agree that Green Bay ranks well in providing these amenities – a difference of only

3%. Cost of Lifestyle and Around Town are clearly areas of strength that Green Bay should highlight in efforts

to attract and retain young professionals.

The greatest mismatches between value and perception were in the Earning and Social Capital indexes, with

discrepancies of over 40%. After Hours and Vitality were also areas with significant mismatches (37% and

32%, respectively). Next Generation Consulting strongly recommends a deeper examination of each of these

indexes, with a focus on opportunities specifically geared toward Green Bay’s young professionals.

Force Ranking: Seven Community Indexes

This portion of the survey asked respondents to rank the seven community indexes in order of importance to

them. Below is the overall ranking, with 1 representing the most important factor.

1. Cost of Lifestyle (20.3%)

2. Earning (15.4%)

3. Vitality (14.7%)

4. After Hours (14.0%)

5. Learning (13.2%)

6. Social Capital (11.6%)

7. Around Town (10.9%)

Respondents ranked Cost of Lifestyle, Earning, and Vitality in the top three spots in both the Force Ranking

question and the Value question (see previous page). Young professionals value Cost of Lifestyle more than

any other index, which is an asset that Green Bay should continue to emphasize.

Net Promoter Score: Community

The community Net Promoter Score (NPS) measures residents’ likelihood – on a scale of 1 to 10 – to promote

Green Bay to friends or family who are considering relocating.

Residents who rate their likelihood of promoting Green Bay with a 9 or 10 are considered “promoters.”

Residents who give a score of 6 or less are considered “detractors.” Scores of 7 or 8 are considered neutral

and do not count toward the NPS.

We calculate the NPS by subtracting the percentage of detractors from the percentage of promoters, as

follows:

Net Promoter Score (NPS) = % Promoters – % Detractors

For Green Bay, 29.8% of respondents were promoters, and 25.4% were detractors, resulting in a Net

Promoter Score of 4.4%.

The NPS can range from -100% (all detractors) to 100% (all promoters). For comparison, organizations with

intensely loyal and engaged clients have Net Promoter Scores ranging from 50-80%, while the average

organization “sputters along” at 5-10%. The Net Promoter Score is based on years of research on customer

loyalty and profitability spanning several industries and decades. To learn more about the Net Promoter

Score and how it’s being used by a variety of industries, see http://www.netpromoter.com/.

5Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

Community Engagement: Additional Questions

Green Bay respondents were asked several questions about their community, in particular about Green

Bay’s downtown area. Approximately 20% of respondents said the health of downtown played a part in their

decision to work in Green Bay, while 72% said the health of downtown did not play a part, and 8% said they

were unsure.

In the chart above, the “Other” category included activities like visiting the Farmers’ Market, Art Street, or the

Library.

Additionally, respondents were asked an open-ended question about what improvements could be made to

the downtown area. The results can be found in the attached Microsoft Excel Workbook, “Current Green Bay,

Raw Data & Open-ended Responses.”

6Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

YP RESULTS:

Involvement and Impact

Current Involvement

We asked respondents several questions about their involvement in Current, as well as its impact on the

community. Although 116 respondents (46%) identified themselves as current members of Current, only 51

respondents (20%) considered themselves to be active participants in Current. Most members became

involved in Current for business networking, as shown in the chart below. Some other popular reasons for

involvement included social networking and leadership/professional development.

Involvement in Current had a relatively positive impact on the quality of life: 58% of members said their

perception of the quality of life in Green Bay was very positively or somewhat positively impacted by Current,

compared to 38% of all respondents (members and non-members). However, only 23% of members (and

only 12% of all respondents) said they were more likely to stay in the community because of Current.

Net Promoter Score: Current

The Young Professionals Net Promoter Score measures respondents’ likelihood to promote their young

professionals organization to friends or family. We calculate the NPS by subtracting the percentage of

detractors (scores of 6 or less) from the percentage of promoters (scores of 9 or 10).

Net Promoter Score (NPS) = % Promoters – % Detractors

For Current members, 45% were promoters and 22.5% were detractors, resulting in an NPS of 22.5%. For all

respondents (members and non-members), 26.8% were promoters and 48.5% were detractors, resulting in

an NPS of –21.7%.

7Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

PROFESSIONAL RESULTS:

Experience, Entrepreneurship, and Engagement

Professional Experience

Over one third of all respondents (38%) were well-experienced young professionals (over 7 years in the field),

28% were moderately experienced (4-7 years), and 21% were relatively new (2-3 years). The pie chart below

shows the complete picture of respondents’ professional experience and employment situation.

The vast majority of respondents (86%) said they were not actively looking for a new job or career move at the

time of the survey, though 29% said they would be open to jobs within the Green Bay community.

Entrepreneurship

Of all respondents, 24 (or approximately 9%) identified themselves as entrepreneurs or business owners. Of

these 24 entrepreneurs, the majority (63%) had 10 or fewer employees.

Entrepreneurs were also asked about their annual top-line revenue. The majority (63%) of entrepreneurs

reported annual top-line revenue of $200,000 or more. Approximating midpoints for each revenue category,

we estimate that the total annual top-line revenue from all entrepreneurial respondents was $36 million. The

approximate average annual top-line revenue was $1.5 million.

8Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

Employee Engagement

The Next Generation Company’s six dimensions of employee engagement are based on interviews and

surveys with over 25,000 respondents in the U.S., Canada, and Western Europe. It shows that workplaces

that engage both the heads – and hearts – of their employees are not only great places to work, but also

generally outperform their competitors.

Respondents were asked to rank the six dimensions of engagement in order of importance to them, with 1

representing the most important factor:

1. Life-work Balance (20.6%)

2. Trust (17.4%)

3. Development (16.3%)

4. Management (15.6%)

5. Rewards (15.5%)

6. Connection (14.6%)

The #1 and #2 spots went to Life-Work Balance and Trust, indicating that young professionals in Green Bay

value flexibility that allows them to meet the needs of their professional and personal lives, as well as working

in an environment where people act with integrity and respect.

DEMOGRAPHICS

Overall, the majority of respondents were:

o Well-educated (83% have a four-year degree or higher)

o Mobile (65% do not have children/dependents)

o Living with a partner, spouse, or significant other (63%)

o Working in Professional, Scientific, and Technical Services (15%) or Manufacturing (15%)

o Charitable: 83% donated over $50 in the last 6 months; the approximate total charitable donations

from all respondents over the last 6 months was $106,050

o Home-owners (69%), with the average home value at approximately $182,000

o Registered Voters (98%), with 79% voting in the last local election

o 25-34 years old (71%), with a mean age of 30

o Female (62%)

o White (94%)

o Heterosexual (94%)

More detailed demographic information can be found in the attached “Current Green Bay, Raw Data & Open-

Ended Responses” Excel Workbook under the “Demographics” section.

9Current – Green Bay, WI YP Global Impact Survey Summary Date 14 July 2008

About Next Generation Consulting

Next Generation Consulting is a market research firm committed to engaging the next generation.

We started interviewing young people in 1998 to help employers figure out how to keep Gen X employees.

Remember Casual Days? Foosball machines? Take-your-dog-to-work? We were there.

By 2001, we’d branched off into other lines of inquiry: what kind of shoes does the next gen prefer?

(consumer goods) How do they choose a city to live in? (mayors, workforce and economic development)

What gets them to attend performing arts events? (arts organizations)

Bottom line: if you want to engage the next generation, we’d like a chance to earn your business.

Who We Are / What We Stand For

NGC is a collective of smart, balanced people committed to building better places to live and work. As Jim

Armstrong, our communication guru says, “A business isn’t a brand to be built, but a cause to be believed

in.” ® We believe passionately in Next Generation Companies™, Cool Communities and the Arts.

Who We Serve

We work primarily with companies who want to become great places to work for the next generation and

communities that want to attract and keep young professionals. We work occasionally with consumer brands

on marketing campaigns.

For more information, please visit www.nextgenerationconsulting.com.

10You can also read