What we learned from our 2019 winners

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Volume 16 Issue 7, 2019

What we learned

from our 2019 winners

The Thing About… Whistleblower In-House Insights:

Shruti Ajitsaria investigations Andrew Cooke

Head of Fuse on tech Keys to responding We talk to the GC of

innovation in law to a dynamic event Flash Entertainment

| MAGAZINE FOR THE IN-HOUSE COMMUNITY ALONG THE NEW SILK ROAD |Now in its 21st year, the In-House

Community Congress series is the region’s

original and largest circuit of corporate

counsel events, bringing together over

3,000 corporate in-house counsel and

compliance professionals along the The annual gatherings

of the In-House Community

New Silk Road each and every year.

along the New Silk Road

n Abu Dhabi

n Bangkok

n Beijing

n Dubai

n Ho Chi Minh City

Do you have a regular dialogue

n Hong Kong

n Jakarta

n Johannesburg

n Kuala Lumpur

with your peer In-House Counsel n

n

n

London

Manila

Mumbai

along the New Silk Road?

n Seoul

n Shanghai

n Shenzhen

n Singapore

n Sydney

“In-House Community provides a unique combination of best n Yangon

practice sharing, networking, news and technical updates that

all practitioners need in order to meet the competing

pressures of legal coverage, compliance and commerce.

In-House Community empowers the modern lawyer to work

smarter and become a trusted business partner”

Trevor Faure, Global Adviser, Legal Transformation.

Former General Counsel, Ernst & Young Global,

Tyco International, Dell & Apple EMEA.

Join your colleagues at an

In-House Congress near you

FORUMS FOR THE

For more information email us at: In-House Community

congress@inhousecommunity.com www.inhousecommunity.comFeature contributors

Michael Olver is the managing director of Pacific Strategies & Assessments Group. He

has been a corporate investigator for 14 years and has acted as an investigative

Nick Ferguson – Managing Editor

nick.ferguson@inhousecommunity.com responder on matters in Africa, the Middle East and Asia.

Leo Yeung – Design Manager

leo.yeung@inhousecommunity.com

Wendy Chan – Global Head of Events

wendy.chan@inhousecommunity.com

Rahul Prakash – Publisher

rahul.prakash@inhousecommunity.com Patrick Gearon is head of Charles Russell Speechlys’ Middle East practice, based in

Bahrain. He specialises in all areas of dispute resolution with particular emphasis on

Yvette Tan – Head of Research and

Community Development banking, intellectual property, insolvency, professional negligence and company dis-

yvette.tan@inhousecommunity.com

putes.

Yannie Cheung – Office Administrator

yannie.cheung@inhousecommunity.com

Tim Gilkison – Managing Director

tim.gilkison@inhousecommunity.com

Gareth Mills is a partner at Charles Russell Speechlys in Bahrain. He advises on com-

Patrick Dransfield – Publishing Director

patrick.dransfield@inhousecommunity.com mercial dispute resolution and international arbitrations with particular focus on the

Arun Mistry – Director communications sector. He has special experience in international arbitrations having

represented clients in LCIA, UNICTRAL and ICC Arbitral proceedings across a range

Editorial Enquiries of jurisdictions.

Tel:........................ (852) 2542 4279

editorial@inhousecommunity.com

Advertising & Subscriptions

Tel: ....................... (852) 2542 1225

rahul.prakash@inhousecommunity.com

FIND AN ARBITRATOR ...

Published 10 times annually by Search now for an Arbitrator, Mediator or Expert Witness

Pacific Business Press Limited as per your requirements - online. Scan QR Code to Search

Room 2008, C C Wu Building,

302-8 Hennessy Road, Wan Chai, Select Experience Arbitration Centre

Hong Kong S.A.R. Select Jurisdiction / Expertise Panel/Membership

All Jurisdiction ... All Areas ... All Arbitration Firm Membership ...

Publishers of

• ASIAN-MENA COUNSEL

TM

Magazine and Weekly Briefing

• IN-HOUSE HANDBOOK

TM

Organisers of the

• IN-HOUSE CONGRESS events

TM

Denis Brock LiYu Jin Denning Ali Al Zarooni Hiroo Advani Sinseob Kang Dr. Andreas Respondek Dr Christian Konrad

HONG KONG CHINA UAE INDIA SOUTH KOREA SINGAPORE AUSTRIA

Hosts of

• www.inhousecommunity.com

• www.mycareerinlaw.com

Forums for the In-House Community

along the New Silk Road Mysore Prasanna Hoil Yoon Gordon Oldham Ngo Thanh Tung David Foster Caroline Duclercq Piotr Nowaczyk

INDIA SOUTH KOREA HONG KONG VIETNAM LONDON FRANCE POLAND

© 2019 Pacific Business Press Limited

and contributors

Opinions expressed herein do not constitute

legal advice, and do not necessarily reflect the

views of the publishers. Liu Chi Rebecca Andersen David R. Haigh Dato’ M. Rajasekaran Lee Fook Choon Ing Loong Yang David Perkins

CHINA SINGAPORE CANADA MALAYSIA SINGAPORE HONG KONG UNITED KINGDOM

www.InHouseCommunity.com/FindAnArbitrator/

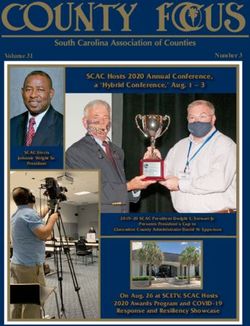

ISSN 2223-8697In this issue Volume 16 Issue 7, 2019

In-House Community

Counsels of the Year

2019

27. The winners of this year’s

awards once again set the

benchmark for excellence and

demonstrate that inspiring

leadership is alive and well

among in-house teams in Asia,

the Middle East and Africa

JURISDICTION UPDATES

Key legal developments affecting the In-House Community along the New Silk Road

4 Local content and participation in Ghana’s electricity supply

04 industry

By Araba Attua-Afari and Patience Emieaboe of LEX Africa

6 Settlement of disharmony between laws and regulations through

mediation

By Vincent Ariesta Lie, Towy Aryanosa and Putri Rachelia Azzura of

Makarim & Taira S.

08 8 Revisiting the AMLA in light of transnational money laundering

By Kristian Angelo P Palmares of ACCRALAW

10 The value of a citizen’s participation trial

By Charlina Jean Ahn of Lee International

12 New law on competition takes effect

By Nguyen Thu Huyen of bizconsult

10

14 OFFSHORE UPDATE

Crypto and blockchain fundraising – 2019 market update

By James Twigg and Daniel Lo of Walkers

2 www.inhousecommunity.com16 THE BRIEFING

Along with the latest moves and jobs, we take a closer look at Luckin

Coffee’s Nasdaq IPO and review our inaugural event in London, as well

as our outbound and Thailand events

12

26 SPOTLIGHT ON CIA (Collections, Investigation & Audit)

Forensic investigations and cross-border matters

Head of forensics, Erick Gunawan, looks at the constant evolution in

data types and volumes, and the ever-tightening data privacy laws and

regulatory intervention

36 IN-HOUSE INSIGHTS

Andrew Cooke 26

We speak to the head of strategy and general counsel for Flash

Entertainment, and our In-House Community Counsel of the Year, about

running an in-house legal team and his outlook for the profession.

SPECIAL FEATURES

40 Whistleblower investigations: Keys to responding to a dynamic event

In-house teams should be prepared for an inevitable increase in

incidents requiring investigation as whistleblower protections grow, 36

writes Michael Olver, Pacific Strategies & Assessments

44 The growth of third-party funders

Growing awareness of litigation funding is making it easier for

businesses to pursue disputes, write Patrick Gearon and Gareth Mills,

Charles Russell Speechlys

46 Q&A

Kirsty Dougan

46

The former head of Axiom and newly appointed Asia managing director

of Vario talks about her new role and the future of NewLaw.

50 THE THING ABOUT…

Shruti Ajitsaria

The head of tech innovation space Fuse and a partner at Allen & Overy

talks to Patrick Dransfield about legaltech, entrepreneurship and

London’s role in the future of law

54 ASIAN-MENA COUNSEL DIRECT

Important contact details at your fingertips 50

Asian-mena Counsel is grateful for the continued editorial contributions of:

Volume 16 Issue 7, 2019 3JURISDICTION UPDATES

AFRICA

Bentsi-Enchill, Letsa & Ankomah

4 Momotse Avenue, Adabraka - Accra

Contact: T: (233) 302 208888 / 220516 / 221171

Kojo Bentsi-Enchill E: kojo.bentsi-enchill@belonline.org

Written By: W: www.belonline.org

Araba Attua-Afari and

Patience Emieaboe

Local content and participation in Ghana’s electricity

supply industry

I n line with the national push for a more struc-

tured approach to increasing local content and

participation, the Regulations came into force on

Restrictions on the transfer of interest/

equity – with certain exceptions (such as a com-

pany engaged in manufacturing), the rights and

Penalties – the penalty for breach of the

Regulations are, for a first offence, a fine of up to

C6,000 (US$1,100) or to or to a term of impris-

December 22, 2017. Prior to the passing of the interests of a Ghanaian citizen under a contract, onment of between one and two years.

Regulations, only the general local content provi- and the equity stake in a company, in the electric- Subsequent offences attract a fine of up to

sions set out in the Ghana Investment Promotion ity supply industry may only be transferred to a C12,000 or a term of imprisonment of between

Centre Act, 2013az (Act 865) applied to the Ghanaian. six months and two years.

electricity supply industry. This newsletter high-

lights some of the local content requirements Partnership – A foreign company must partner Whilst the rationale behind the passing of

introduced by the Regulations. with an indigenous Ghanaian company to pro- the Regulations is commendable, the current

vide goods and services. The levels of participa- form of the Regulations raises concerns. For

Establishment of Electricity Supply tion are set out in the Regulations. instance, the impact of the equity transfer prohi-

Industry Local Content and Local bition on the attractiveness of Ghanaian power

Participation Committee (the Committee) Registration of service providers – All per- projects to foreign sponsors cannot be ignored.

– The Committee established by the Regulations sons service providers in the electricity supply In light of the restrictions on the transfer of local

to oversee the development and of local content industry must register with the Committee by equity, lenders must now reconsider the suitabil-

and participation in the industry, and to monitor March 22, 2018. ity of their security packages as a charge over

the implementation of the Regulations was inau- Ghanaian-held shares of the project company

gurated on May 2, 2019. Exemptions – the Regulations allow for local can only be transferred to another Ghanaian.

content exemptions for the provision engineering The prohibition also imposes a fetter on a

Ghanaian equity participation – the levels and of technical consultancy and maintenance ser- Ghanaian company’s ability to exit the electricity

of local content for certain activities in the elec- vices. The exemptions apply where (i) proprietary supply industry when there is no willing Ghanaian

tricity supply industry range from an initial 15 equipment or technology is needed; or (ii) the buyer.

percent to 80 percent, rising to between 49 service provider or any other entity engaged in any

percent and 100 percent. Service providers activity in the electricity supply industry can show

operating in the industry before the coming into that the expertise required does not exist locally.

force of the Regulations have five years from the

LEX Africa is an alliance of law firms with over

date of the Regulations to comply with the rele- Incentives – tax incentives are available to a

600 lawyers in 25 African countries formed in

vant initial level. All other service providers must company that establishes a plant to manufacture

1993. More information may be found on

be complaint with the initial level requirements or assemble electrical equipment, electrical

www.lexafrica.com.

from the commencement of the activity. appliances or renewable energy.

Empowering In-House Counsel along the New Silk Road

4 www.inhousecommunity.comTHE BRIEFING

INDONESIA

Summitmas I, 16th – 17th Floors, Jl. Jend. Sudirman Kav. 61-62, Jakarta 12190, Indonesia

Tel: (62) 21 5080 8300 / Fax: (62) 21 252 2750

E: vincent.lie@makarim.com

E: towy.aryanosa@makarim.com

By Vincent Ariesta Lie, Towy Aryanosa and E: putri.azzura@makarim.com

Putri Rachelia Azzura E: info@makarim.com

W: www.makarim.com

Settlement of disharmony between laws cluding and reading out the mediation result.

The mediation result can be:

and regulations through mediation (1) an agreement between the parties to be

implemented within 30 calendar days or as

O n February 12, 2019, the Minister of Laws

and Human Rights (MOLHR) issued

Regulation No. 2 of 2019 on The Settlement of

(1) individuals or groups of individuals;

(2) agencies/institutions/ministries/non-ministerial

government institutions/regional governments;

agreed; or

(2) a recommendation from the MOLHR, if (i) the

Relevant Parties were not present in the

Disharmony between Laws and Regulations and hearing(s); (ii) the parties did not reach an

through Mediation (MOLHR Reg 2/2019), which (3) public/private entities. agreement; or (iii) the mediation was ordered

came into effect on February 14, 2019. The application must be submitted in writing by the MOLHR.

MOLHR Reg 2/019 replaces the previous in the Indonesian language, and provide at least The parties must implement the recommen-

regulation on the same subject, MOLHR the following information: dation within 60 calendar days of its receipt.

Regulation No. 32 of 2017 on The Procedure for (1) the applicant’s identity; Otherwise, the recommendation will be submit-

the Settlement of Disputes over Laws and (2) his/her/their date of birth/age; ted to the President of the Republic of Indonesia

Regulations through Non-Litigation. (3) the type of laws and regulations for which within 30 calendar days of the expiry of the imple-

mediation is being applied; mentation time limit. The recommendation will

Scope (4) the grounds for the application; and then be used as a consideration for the program

MOLHR Reg 2/2019 reinstates the non-litigation (5) the matters to be resolved (petition). for the drawing up of the regulation of the minis-

settlement of disharmony issues between laws and ter, non-ministerial institution, non-structural insti-

regulations by introducing mediation. The types of The application must be submitted to the tution, or law or regulation at regional level.

laws and regulations between which disharmony MOLHR with a copy to the DGLR. The DGLR

can be resolved through mediation include: will then assign a Preliminary Assessment Team Comments

(1) Ministerial regulations; — consisting of administrative officials at the This procedure is different from court proceedings

(2) Non-ministerial government institution regula- Directorate for the Litigation of Laws and or judicial review at the Supreme Court or

tions; Regulations — to check the completeness of the Constitutional Court, which rulings are enforcea-

(3) Non-structural institution regulations; and application and then register the application. ble. MOLHR Reg 2/2019 does not provide any

(4) Regional laws and regulations. Otherwise, the application will be returned to the clear and detailed provisions on how to enforce

The above regulations can be submitted for applicants to be completed. A copy of the applica- the mediation result, whether it is a recommenda-

mediation if they vertically and horizontally contra- tion will then be delivered to the parties within tion issued by the MOLHR or an agreement

dict each other and (i) cause disharmony between seven days of the date of its registration. between the parties.

legal norms; (ii) conflicts of authority between In addition, Reg 2/2019 also defines Related In addition, the submission of the MOLHR’s

ministries/institutions; (iii) cause injustice for com- Parties as those who have a direct interest in any recommendation to the President seems unusual,

munities and business actors; or (iv) disrupt the mediation application, either in relation to their as ideally it should be submitted to the authorities

investment climate, business, as well as national rights and/or authorities. which issued the disputed regulations. Further,

and regional economic activities. MOLHR Reg 2/2019 is also silent on how the

Mediation can commence upon receipt of The mediation procedure recommendation should be implemented after

the following: The mediation must be conducted in a public the President has received it.

(1) an application from the parties; or hearing and chaired by the Examining Panel, We anticipate a problem may also arise if the

(2) an order from the MOLHR; in which case, appointed and established by the DGLR. The MOLHR’s recommendation is not in the appli-

MOLHR will assign the Director General of Examining Panel has five members; three from the cant’s favour, as under Article 16 of Reg 2/2019,

Laws and Regulations (DGLR) to conduct the Ministry of Law and Human Rights and two from mediation cannot be applied for if the issues are

mediation without first receiving an application scholars. the same as those which have already been

from any party. The mediation procedure includes: (i) hear- resolved through the mediation under MOLHR,

ings of the testimony of the applicant and Relevant unless the parties (ie the applicant and the relevant

Parties and applications Parties, (ii) experts providing legal opinions, (iii) institutions stated above) agree to make amend-

The following can apply for mediation: providing clarification to the parties and (iv) con- ments to their agreement.

6 www.inhousecommunity.comJURISDICTION UPDATES

PHILIPPINES

By Kristian Angara Abello Concepcion Regala & Cruz Law Offices (ACCRALAW)

Angelo P Tel: (63) 2 830 8000

E: kppalmares@accralaw.com

Palmares

W: www.accralaw.com

Revisiting the AMLA in light of transnational ments under Republic Act No. 10927, which

included casinos, including internet-based casinos

money laundering and ship-based casinos, with respect to their cash

transactions related to their gaming operations. On

F or several decades, money laundering has

extended the reach of transnational organised

crime throughout various nations. As seen in pop

“With the rampant money

this note, the AMLC requires casinos to report

transactions over Ps5 million (US$96,000) or

other currency equivalent within five working days.

culture, drug lords and mobsters regularly ship off laundering schemes that This means players should keep their bets and

“dirty money” from their illegal trade into offshore proliferated recently, transactions well under Ps5 million if they do not

bank accounts, thus making such funds appear “clean”. want to be flagged by this rule and reported to the

In a more real and contemporary setting, it the AMLA and its IRR authorities. Casino owners must also yield to com-

was recently reported that more than US$1 billion find relevance now more pliance checks and investigations by the AMLC if

was laundered in Venezuela through a sophisticated they suspect money laundering or terrorism

scheme which involved the embezzlement of funds than ever” financing, at the risk of severe penalties and fees.

from a state-owned oil company and the corre- The 2018 IRR likewise feature new rules on

sponding utilisation of a foreign exchange system to initiate civil forfeiture, asset preservation and freez- the AMLC’s obligation to work in coordination with

convert such funds at a fixed rate for US dollars, ing of properties representing, involving or relating law enforcement agencies in the conduct of its

considerably below the true economic rate. to an unlawful activity or money laundering cases, ascertain beneficial ownership relative to

As the IMF estimates that the amount of offence. Indeed, the state imposes stiff penalties on legal entities, enhancement of customer due dili-

money laundering occurring on a yearly basis could money laundering due to its pernicious effects, gence, national risk assessment and management,

range between 2 and 5 percent of the world’s such as reduced tax revenues and proliferation of and AMLC supervision and compliance checking.

GDP, or somewhere between US$600 billion and underground economies that stifle legitimate busi- Additionally, the AMLC also established guidelines

US$1.5 trillion, various states have taken efforts to nesses and financial institutions. on keeping databases for customer records, report-

curtail money laundering in the form of multina- The Anti-Money Laundering Council (AMLC), ing, registration, to name a few. Adoption of these

tional treaties, regional agreements and local legis- composed of the governor of the BSP as chairman, measures would enable the AMLC to easily enforce

lation. Thus, amid persuasion from the international and the commissioner of the Insurance compliance in the financial and business sectors.

community, the Philippines and many other Commission and the chairman of the Securities Indeed, with the rampant money laundering

nations enacted local laws to curtail such acts. and Exchange Commission as members, is the schemes that proliferated recently, the AMLA and

In response to the recent trends in transna- lead agency tasked with implementing the provi- its IRR find relevance now more than ever.

tional money laundering, the Bangko Sentral ng sions of the AMLA. To date, the AMLC has effi- Whether the current state of our justice system is

Pilipinas (BSP) emphasised the need to strictly ciently carried out its mandate by successfully sufficient to speedily and efficiently rectify the con-

implement the Anti-Money Laundering Act initiating cases for violations of the AMLA and stantly-evolving money laundering concern

(AMLA) of 2001 as means of fortifying the securing successful forfeiture cases relative to remains to be seen. At any rate, there is no ques-

Philippines from money laundering activities. unlawful proceeds thereof. tion that the AMLA and the AMLC’s recent issu-

Under the AMLA, money laundering is a The Philippine stance on money laundering ance of the IRR is a great step forward in addressing

crime wherein the proceeds of an unlawful activity remains just as dynamic more than a decade after transnational money laundering.

are transacted, thus making them appear to have the passage of the AMLA. Recently, the AMLC

originated from legitimate sources. While the approved the 2018 Implementing Rules and The views and opinions expressed in this

AMLA presupposes the commission of a distinct Regulations (2018 IRR) of the AMLA shortly before article are those of the author. This article is

for general informational and educational

unlawful act (eg kidnapping, qualified theft, graft and the Venezuelan expose and in the wake of the

purposes, and not offered as, and does not

corruption), money laundering itself contemplates results of the Second National Risk Assessment, constitute, legal advice or legal opinion.

the entry of dirty money into a legitimate financial where the AMLC led a thorough evaluation of the

institution to give it a semblance of legality. In addi- country’s preparedness against money laundering. (Note: This article first appeared in Business World,

tion to criminal prosecution, the state may also The 2018 IRR incorporated certain amend- a newspaper of general circulation in the Philippines.)

8 www.inhousecommunity.comJURISDICTION UPDATES

SOUTH KOREA

Poongsan Bldg. 23 Chungjeongro, Seodaemun-gu, Seoul 03737, Korea

Tel: 82 2 2262 6219 / Fax: 82 2 2273 4605

By Charlina Jean E: cjahn@leeinternational.com

Ahn W: www.leeinternational.com

The value of a citizen’s participation trial ter. In fact, using one’s moral compass and life

experiences to evaluate a given scenario is some-

thing most people do on a daily basis. Expertise in

S ince February 2008, pursuant to the Act on

Citizen Participation in Criminal Trials,

defendants in many types of criminal cases in

“A fundamental

the law is not a necessity; common sense and a

rational mind are considered equally valuable.

If creating a more democratic process is the

Korea have had the right to a “citizen’s participa- assumption of the jury goal, the law should be presented to the people in

tion” trial, where a group of five to nine jurors acts system is that laypersons a way that is clear and easy to understand because

as both finders of fact and rulers on the law (Article the system should be accessible to all citizens

12, section 1). In a traditional trial, a judge or are fully capable of equally. If citizen’s participation trials become

group of judges makes all factual and legal deci- making decisions more widely used, defense attorneys and prose-

sions, in much the same way as would a judge in cutors alike will engage more with an audience

an American bench trial. regarding guilt in a (the jury), and over time perhaps mitigate the air

Under Article 1 of the Act, Korean jury trials criminal matter” of exclusivity that is oftentimes perceived by the

were created to “raise democratic legitimacy” and public.

to inspire more confidence in the judicial process It goes without saying that having a jury sys-

as a whole. While similar to an American jury trial, tem is not a guarantee that justice will prevail, or

a citizen’s participation trial has some striking dif- Historically, in common law jurisdictions, a that a defendant who chooses a traditional trial is

ferences. Under Article 46, the decision of a jury jury trial was believed to increase fairness for the somehow less likely to receive justice. The value

is non-binding. Jurors may request guidance from defendant based on the assumption that members here lies in the defendant being able to choose

the presiding judge if they cannot reach a decision. of the defendant’s community, from whom a jury between the two methods. A flawless judicial

Consensus is not necessarily required. Jurors may would be drawn, knew the defendant’s character system does not and cannot exist because people

even make sentencing recommendations. and could therefore balance the scales of justice create judicial systems and people are not perfect.

In the US, jurors act almost exclusively as for a wayward defendant who was an otherwise Even with a jury’s best intentions, guilty persons

finders of fact. In other words, they are responsi- law-abiding citizen. Of course, this could also have may walk free and innocent defendants put behind

ble for determining the merits of any given mate- the opposite effect and a defendant’s reputation bars, in neither case offering justice to the victim.

rial fact of a case, and ultimately whether a could work against him or her. In either case, a Although inevitably imperfect, a jury system

defendant is culpable enough to be found guilty of jury trial allowed for a more democratic process offers democratic legitimacy to what would other-

the charged offence(s), based on the evidence where a defendant’s fate was not tied to the opin- wise remain an autocratic system. This is the very

provided. Generally, they play no role in matters ion of a single judge. reason why citizen’s participation trials were cre-

related to sentencing. In contrast, a judge is the Detractors of the jury system may argue that ated; to build more confidence in the judicial sys-

arbiter of the law. The judge also controls court- matters regarding the law should be determined tem as it applies to criminal law. Even if an

room proceedings and determines sentencing. by people who are actually trained in the law, i.e. arguably more democratic process like the citi-

For example, a judge decides whether an objec- judges and attorneys. While the sentiment is zen’s participation trial yields a socially or morally

tion is sustained or overruled, and whether evi- understandable, a fundamental assumption of the undesirable result in certain cases, the merits of

dence will be admitted or excluded from jury system is that laypersons are fully capable of the system as a whole are more valuable than any

consideration in a given case trial. making decisions regarding guilt in a criminal mat- single outcome.

Find the Asian-mena Counsel JURISDICTION UPDATES archived at

www.inhousecommunity.com

10 www.inhousecommunity.comJURISDICTION UPDATES

VIETNAM

Hanoi: VNA Building, 20 Tran Hung Dao Street, Hoan Kiem District, Hanoi, Vietnam

Tel: (84) 0 24 3933 2129, Fax: (84) 0 24 3933 2130, Mobile: (84) 91 290 8579

By Nguyen E: huyennt@bizconsult.vn

Thu Huyen E: info-hn@bizconsult.vn

Ho Chi Minh: Room 1103, 11th Floor, Sailing Tower, 111A Pasteur, District 1, Ho Chi Minh City, Vietnam

Tel: (84) 0 28 3910 6559, Fax: (84) 0 28 3910 6560

E: info-hcm@bizconsult.vn

W: www.bizconsult.vn

New law on competition takes effect or sources of supply of goods and services of

parties not participating in the agreements; and

other agreements which have or may have a

V ietnam’s National Assembly passed the new

Law on Competition (New Competition

Law) on June 12, 2018 and it will be taking effect

“There are significant

competition-restraining impact. In addition, the

New Competition Law provides the new term of

“significant market force”, which is a ground to

changes in regulating

on July 1, 2019, 14 years after the implementa- verify “a dominant market position” of an

tion of the Law on Competition 2004. ‘acts in restraint of enterprise, apart from the one of “holding of 30

The New Competition Law governs (i) the percent or more of the market share in the

competition’, which are

acts in restraint of competition, economic relevant market”.

concentrations which have or may have a defined as actions that The management of economic concentration

competition-restraining impact on Vietnam’s is another noteworthy change of the New

cause or may cause a

market; (ii) unfair competitive acts; (iii) Competition Law. Unlike the 2004 version of the

competition legal proceedings; (iv) dealing with competition-restraining law, which determines the prohibited economic

breaches of the law on competition; and (v) State concentration by relevant market share ratio,

impact”

administration of competition. presently, economic concentration shall be

The New Competition Law extends the prohibited if it causes the effect or is capable of

scope of its applicable entities that consist of Law, the “acts in restraint of competition” apply causing the effect of significantly restricting

“related domestic and foreign agencies, only to enterprises and consist of “economic competition in the market of Vietnam. The

organisations and individuals”, apart from concentration”, meanwhile, these matters are “significantly restricting competition effect” shall

organisations and individuals conducting business now no longer provided. be also confirmed by the National Competition

and industry and professional associations The approaching method under the 2004 Committee based on specific elements provided

operating in Vietnam. These broadened version of the law to control “agreements in in this New Competition Law. Regarding “the

regulations aim to create the mechanism to settle restraint of competition” is solely based on unfair competitive acts”, the New Competition

anti-competitive acts and/or cases which may be “combined market share”. At present, the New Law does not re-provide and refer to other acts

implemented overseas but have or may have a Competition Law manages these agreements by that are governed under other relevant laws, and

competition-restraining impact on Vietnam’s its nature or ability to have a significant “illegal multi-level sales” are excluded from unfair

market and to control acts relating to competition competition-restraining impact in the market. competitive acts.

of state authorities. This content is to meet the The term “significant competition-restraining One last remarkable point of the New

requirements of economic integration and create impact” is newly provided and shall be Competition Law is to strengthen and ensure the

a fair competition environment for both domestic determined by the National Competition independence of the state administration of

and foreign organisation/individuals. Committee according to market share ratio, competition by having new regulation on the

Pursuant to the New Competition Law, barriers to market access or expansion, restriction National Competition Committee, which is an

there are significant changes in regulating “acts in of research, development and renovation of agency under the Ministry of Industry and Trade,

restraint of competition”, which are defined as technologies, etc. The New Competition Law being in charge of advising and assisting the

actions that cause or may cause a competition- further provides three more types of agreements Minister of Industry and Trade in exercising the

restraining impact, including “practices of in its list of “agreements in restraint of function of state administration of competition;

agreement in restraint of competition, abuse of competition”, including: agreements not to trade carrying out competition legal proceedings and

dominant market position, and abuse of with parties not participating in the agreements; to perform other duties in accordance with the

monopoly position”. Under the 2004 version of agreements to restrain the product sale market laws.

12 www.inhousecommunity.comJURISDICTION

OFFSHORE UPDATE

UPDATES

Walkers (Singapore) Limited Liability Partnership

3 Church Street, #16-02 Samsung Hub, Singapore 049483

T: (65) 6595 4670

E: james.twigg@walkersglobal.com

T: (65) 6603 1699

By James Twigg and Daniel Lo

E: daniel.lo@walkersglobal.com

T: (65) 6603 1669

W: www.walkersglobal.com

Crypto and blockchain fundraising – in fundraising volume. To date, there are almost

170 STOs, with ICO Bench reporting that 120

2019 market update have completed and 50 are continuing. The larg-

est STO so far is by tZERO in 2018 raising

E ver since the introduction of bitcoin more

than a decade ago, we have seen the expan-

sion of the cryptocurrency ecosystem, with over

“Amid this cooling period

US$134 million. For STOs to continue to gain

institutional acceptance, key elements of the

critical market infrastructure needs to mature

2,000 cryptocurrencies in existence today and for the crypto community, a such as regulated exchange platforms moving

growing daily. In the race towards cryptocur- into the crypto space or crypto exchanges receiv-

new fundraising method has

rency and blockchain dominance, came the ing regulatory approval and reliable crypto ratings

emergence of a fundraising method for crypto- arisen that many believe and research.

founders to finance their companies, known as

will eventually completely

the initial coin offering (ICO). An ICO is a Looking forward to asset tokenisation

method whereby new projects sell their underly- replace the ICO” In addition to the popularity of STOs, asset

ing crypto tokens/coins in exchange for fiat cur- tokenisation will be a prevalent trend in 2019.

rencies or cryptocurrencies of immediate and Asset tokenisation describes the process of con-

liquid value such as bitcoin and/or ether. the fourth quarter of 2018, according to ICO verting assets into digital tokens on a blockchain,

Bench. Crypto market participants will continue to commonly referred to as a tokenised security

ICOs in review face sustained pressure if they continue to sell ICO offering (TSO). TSOs are tokenising “things”,

As of April 2019, over 3,500 ICOs have tokens/coins to retail investors. Many companies rather than making the token that has the charac-

completed their fundraising, according to CoinLore. have been able to sidestep regulatory scrutiny by teristics of a security such as with STOs. As

In 2017, CB Insights reported that ICOs raised holding ICOs for “accredited investors” only. CoinPip CEO Anson Zeall has written, the

approximately US$6.3 billion, while in 2018 the Interestingly, amid this cooling period for the appeal of TSOs is their applicability to assets that

amount jumped to approximately US$19.2 billion, crypto community, a new fundraising method has cannot be securitised by mainstream finance such

according to Strategy & with some of the biggest arisen that many believe will eventually completely as art, collectables and intangible goods, and

ICOs to date, the top four being: EOS (US$4.1 replace the ICO, commonly referred to as a secu- assets where banks will not securitise. A TSO’s

billion), Telegram (US$1.7 billion), TaTaTu (US$575 rity token offering (STO). attributes mirror that of the underlying asset/

million), and Dragon (US$320 million). It is worth- security, but it does not have the same rights and

while to note that EOS and TaTaTu have both The rise of the STO claims like an STO. The benefits of a TSO include

chosen the Cayman Islands as their domicile, while The STO is similar to an ICO, but is generally a but are not limited to fractional ownership,

Telegram and Dragon have both chosen to domi- more developed and regulated version. The increased liquidity of assets, lower costs and

cile in the British Virgin Islands. underlying tokens/coins entitle the investor with faster settlement.

Despite this growth in ICO activity in 2018, ownership rights, voting rights, dividend rights or

the second half of the year saw a steep decline in some other incentive in exchange for their invest- Conclusion

ICO levels due to increasing regulatory concern ment. Regulation of STOs is based on local As we start to emerge from the crypto-winter of

over fraudulent offerings, leading to what the security laws, including KYC/AML requirements, 2018, we are seeing crypto and blockchain pro-

industry has dubbed the crypto-winter of 2018. In so each jurisdiction is able to leverage their exist- jects place increased attention to the maturing

the first quarter of 2019 there were around half ing securities regulations as their framework for regulatory landscape. The emergence of new

the number of ICO projects that have raised funds STOs. STOs are gaining popularity, which signals fundraising methods such as the STO and TSO is

compared to Q4 2018 and there was also a sharp a shift towards fully regulated securities in the indicative of the declining appeal of ICOs.

decline in the overall amount raised from ICOs crypto space. STOs first appeared in 2017 with Maintaining an continuing dialogue between

compared with previous quarters. However, two STOs raising a total of US$22 million. Fast industry participants and regulators will be vital

average amounts raised per ICO in the first quar- forward to 2018 and STO activity has skyrock- for the adoption of these fundraising methods

ter of 2019 is higher by US$2 million compared to eted to 28 successful STOs and US$442 million going forward.

14 www.inhousecommunity.comTHE BRIEFING

EVENT REPORTS

Hong Kong In-House-Outbound Forum 2019

P rior to Counsels of the Year Awards in

the evening, the In-House Community

hosted the In-House-Outbound Forum on

investment and an employment law update

from the Philippines. After a short break,

Christopher Gunson, partner from UAE

Emerico O. De Guzman

Managing Partner

ACCRALAW

PHILIPPINES

May 30 at the HKIAC. The forum brought law firm AMERELLER took the stage to talk

together about 50 senior in-house counsel about various legal systems in the Middle Christopher Gunson

in Hong Kong — mostly representing large East and how they have evolved, as well Partner

multinational corporations. Over the course as touching on the Dubai Free Zones and AMERELLER

of two hours, the attendees were updated dispute resolution in the region. The last UAE

on the legal landscape in four jurisdictions, presentation of the forum was given by

Justin Gisz

namely, India, the Philippines, UAE and Viet- Justin Gisz, partner from Vietnam law firm Partner

nam. The forum started with a passionate Frasers Law Company, who gave the attend- Frasers Law Company

presentation on the changing regulatory ees an overview on foreign investment rules VIETNAM

regime and growing opportunities in India in Vietnam, opportunities for investment

by Vaibhav Kakkar, partner at L&L Partners. and some challenges which in-house counsel Vaibhav Kakkar

Partner

Emerico O De Guzman, managing partner may face when doing business in Vietnam.

L&L Partners (formerly

of ACCRALaw, followed with his presenta- Our thanks go to all the speakers and Luthra & Luthra)

tion on recently liberalised areas for foreign co-hosting firms mentioned above. INDIA

16 www.inhousecommunity.comOnline, Cloud and e-Resources ...

www.inhousecommunity.com

The online home of the In-House Community,

www.inhousecommunity.com features vital daily legal

updates for in-house counsel, company directors and

compliance managers, and archived content from

asian-mena Counsel contributors.

2019

Add us to

Your Home Screen

“The In-house Community website provides the

window on the development of commercial law,

practice and compliance in the growth markets of Asia

and the Middle East”

Dr Justine Walker, advisor to

the British Banking AssociationTHE BRIEFING

Inaugural London event for In-House Community TM

B ritain and the City of London can be

described as being in a special place

right now and our inaugural In-House Con-

More than 90 delegates – the majority from

in-house departments – but including leading

barristers, professors of law and company

terparts and the progress of the Chinese

judiciary relating to patent cases. The event

also included a bomb shell from economist

gress event in London on June 3 was con- directors – engaged in topics relating to Michael Taylor that the city of Shenzhen

ceived specifically to address this situation Asia, the Middle East and Africa – and went alone accounted for 8 percent of all global

by bringing the best legal and business minds into some depth regarding the opportunities patent filings in 2016 – and this figure is only

together to help change perspectives and and risks relating to China and especially increasing. The programme ended with vet-

explode myths and misconceptions regard- regarding the Greater Bay Area and the Belt eran general counsel Evangelos Apostolou of

ing the emerging markets of Africa, the & Road Initiative. Of particular note was the Major Lindsey & Africa and Duc Trang shar-

Middle East, India and Greater China. revelation that foreign companies litigating ing their experiences, both good and bad, of

“Bringing It All Back Home – Asia and in China were statistically more likely to the reality of working as an in-house lawyer

the City of London” proved a great success. win their cases than their Chinese coun- in the Middle East and Asia.

Keynote speaker:

Christina Blacklaws, president of the

Law Society of England and Wales

Co-hosts and partnership

organisations:

In-House Community, Law Society of

England & Wales, Institute of Directors,

The China Britain Business Counsel,

American Bar Association

Co-Hosts:

Llinks Law Offices, Major Lindsey &

Africa, Praxonomy, Quinn Emanuel,

Reed Smith, Winston & Strawn

A special thanks on behalf of the In-House Community™

to all our speakers, which included: Bringing It

“A great event and very insightful about the role of in-house counsel in

Asia” – General counsel of a multinational company, based in London

All Back Home

Asia and the City of London

Michael J. Taylor Stefan M. Gannon Amir Singh Pasrich Charles Qin Patrick Zheng

Director Commissioner, Managing Partner Partner Partner

Cold Water Economics Resolution Office I.L.A. Pasrich & Llinks Law Offices Llinks Law Offices

Hong Kong Monetary Company, New Delhi

Authority

Evangelos Apostolou Sir William Blair Kate Vernon Sam G. Williamson Stephen C.

In-House Practice Group Associate Member of Partner Partner Mavroghenis

and Advisory Services 3 Verulam Buildings and Quinn Emanuel Quinn Emanuel Partner

EMEA and APAC Professor of Financial Urquhart & Sullivan, Urquhart & Sullivan, Quinn Emanuel

Law and Ethics

Major Lindsey & Africa LLP LLP Urquhart & Sullivan,

Queen Mary University of

London, Centre for LLP

Commercial Law Studies

Xiao Liu Gautam Bhattacharyya Mei Sim Lai OBE DL John N.M. McLean OBE Christina Blacklaws

Partner Partner and India Chairman Vice-Chair President

Quinn Emanuel Business Team Head The British Malaysian The Institute of Directors The Law Society of

Urquhart & Sullivan, Reed Smith Society (IoD) for the City of England and Wales

Hon Secretary and London and

LLP

Chairman Board Member

China Interest Group China Britain Business

Institute of Directors (IoD) Council (CBBC)

Stephen Denyer Dr Justine Walker Brinton M Scott Campbell M Steedman Patrick Dransfield

Director of Strategic Director of Sanctions Managing Partner Managing Partner Publishing Director

Relationships Policy Shanghai Middle East Asian-mena Counsel

The Law Society of UK Finance Winston & Strawn LLP Winston & Strawn LLP and Co-Director,

England & Wales Shanghai Representative In-House Community

Office (US)

18 www.inhousecommunity.com17th annual gathering of the Bangkok

In-House Community

T he most pressing challenges cited by

our In-House Community members

in Thailand this year were “keeping up with

data privacy and cyber security regula-

tions” and “the changes in legal work in an Desarack Teso, Microsoft

increasingly digital world”, so it was apt that

our 17th annual Bangkok In-House Com-

munity Congress on June 5 should open

with a practical presentation by Desarack

Teso, corporate, external & legal affairs

director at Microsoft Thailand on “Meeting

your privacy and security obligations in the

Satoshi Kawai, Managing Partner of

digital era”. Chaired by In-House Com- ing up your lawyers to do more important,

Chandler MHM cuts a cake in celebra-

munity founding director, Tim Gilkison, high-value work), and the importance of tion of the firm’s 15 years support of

Teso then joined a stellar panel including providing the right professional develop- the In-House Congress in Bangkok

Jackson Pek, chief legal officer at AirAsia ment environment to attract and retain the

Group, former in-house counsel and now best talent. The Congress closed with an engaging

a partner at Pisut & Partners, David Law- The Sofitel, Sukhumvit proved a com- session on anti-trust law developments from

rence, V Joseph Tisuthiwongse, a partner fortable venue for a day of vibrant com- Chandler MHM, but not before In-House

at Chandler MHM, and Peter Shelford, munity networking and engaging workshops Community’s Tim Gilkison thanked the firm

country managing partner in Thailand and for our over 130 attendees, including ses- for 15 straight years of support for the In-

co-head of DLA Piper’s Asia insurance sions on director’s liability risks and mitiga- House Community gathering in Thailand,

sector practice, to discuss technology and tion plans presented by Kudun & Partners, inviting the firm’s managing partner, Satoshi

talent management in the legal department, investment and financing opportunities in Kawai, to cut a cake in celebration.

with key discussion takeaways including the Thailand’s EEC, by Chandler MHM, recent Our thanks to all our speakers and

need to understand why you should invest dispute resolution trends and notable cases co-hosting firms for their support of this

in a particular technology (to reduce risk, presented by Pisut and Partners, and changes 17th annual Bangkok In-House Community

save time or eliminate repetitive tasks, free- in Thai labour law presented by DLA Piper. Congress.

A special thanks on behalf of the In-House Community™ to all our speakers, which included:

“The Congress went beyond my expectations” … “I can take [what

I’ve learnt] and apply it to my work” – Bangkok Congress delegate

Jackson Pek David Beckstead Nopamon Thevit Pranat Laohapairoj V. Joseph

Chief Legal Officer Counsel Intralib Counsel Tisuthiwongse

AirAsia Group Chandler MHM Limited Senior Associate Chandler MHM Limited Partner

Chandler MHM Limited Chandler MHM Limited

Komson Peter Shelford Kongkoch Pariyapol Kamolsilp Desarack Teso

Suntheeraporn Country Managing Yongsavasdikul Partner Corporate, External &

Of Counsel Partner Partner Kudun & Partners Legal Affairs Director

DLA Piper (Thailand) DLA Piper (Thailand) Kudun & Partners Limited Microsoft Thailand

Limited Limited Limited

David Lawrence Pisut Rakwong Wayu Tim Gilkison

Partner Founder and Managing Suthisarnsuntorn Founding Director

Pisut & Partners Partner Partner In-House Community

Pisut & Partners Pisut & Partners

Volume 16 Issue 7, 2019 19THE BRIEFING

MOVES

The latest senior legal appointments around Asia and the Middle East

AUSTRALIA

Jones Day has added Shannon Finch as a partner in the firm’s M&A tion, employment and labour disputes, and white-collar crime. Chan is a

practice in Sydney. Finch brings extensive experience in capital markets member of the Law Society of Hong Kong’s Arbitration Committee. He is

transactions, including IPOs, retail bonds, dual-tracks and crowdfund- admitted to the court in Hong Kong and New Zealand, and speaks English,

ing; public mergers, acquisitions and restructures; corporate govern- Cantonese and Mandarin. He qualified as a solicitor in New Zealand in

ance, including matters relating to directors’ duties and shareholder 2007 and in Hong Kong in 2014, and attended the University of Auckland.

activism; and listed entities and securities law. She is a guest lecturer

on securities law and disclosure regulation masters courses at the Uni- Reed Smith has added Mark West as a part-

versity of Sydney and University of NSW. She is also a regular speaker ner in its litigation practice in Hong Kong. West

at equity capital markets, global M&A, hybrids, directors’ duties and has extensive experience in advising and repre-

securities law conferences. senting Hong Kong-listed companies, multina-

tional companies and high net-worth individuals

on a wide array of regulatory investigations,

HONG KONG high-value and complex commercial litigation

Mark West

K&L Gates has hired Guiping Lu as a cor- and arbitration, white collar crimes and fraud

porate and capital markets partner in its Hong investigations, and prosecution defense. Previously co-head of regulatory

Kong office. Lu joins K&L Gates from the Hong at Kennedys in Hong Kong, he is a member of the Law Society of Hong

Kong office of Beijing-based Haiwen & Partners. Kong. He was admitted to the court in Hong Kong in 2002 and in England

His practice is focused on equity and debt capi- and Wales in 2009. West attended the University of Southampton and

tal market deals and cross-border M&A trans- the College of Law in the UK, and the Chinese University of Hong Kong.

actions, in addition to advising clients on private

equity, pre-IPO, venture capital financing, and Guiping Lu

various U.S. securities law matters. INDIA

Cyril Amarchand Mangaldas has added Richa Roy as a partner in its

King & Wood Mallesons has added Rachel Yu IBC and policy practice. She will be based out of Mumbai. She comes with

as a partner in the dispute resolution practice in an experience of over 12 years in banking and finance, debt restructuring

the Hong Kong office. Yu is a next generation dis- and bankruptcy, public policy, microfinance and social enterprises, private

pute resolution lawyer, who joins from Herbert equity and funds. Roy has served on and contributed to multiple financial

Smith Freehills. She has over 12 years of experi- sector reform committees of the Ministry of Finance, Ministry of Corpo-

ence advising clients, primarily on complex finan- rate Affairs and the RBI. Under the aegis of the Bankruptcy Law Reform

cial disputes. She regularly advises on regulatory Committee, she was instrumental in drafting the corporate insolvency

Rachel Yu

investigations by regulatory and enforcement provisions of the Insolvency and Bankruptcy Code 2016 and the CIRP

authorities, such as the Securities and Futures Commission, the Hong Kong Regulations. She is a 2005 NLSIU Bangalore graduate and a 2017 Oxford

Stock Exchange and the Hong Kong Monetary Authority, and on commer- (MPP) graduate. Roy has worked with ICICI Bank, where she was group

cial disputes, including mis-selling, fraud, injunctions, debt recovery, security head of the international banking legal team. She later moved to AZB &

enforcement, joint venture and shareholders’ disputes. Yu also advises Partners, where she worked for over eight years before attending Uni-

clients on associated PR and internal crisis management strategies. She is versity of Oxford to get her Master’s degree in Public Policy, following

fluent in English, Mandarin and Cantonese. Her clients include Chinese and which she worked on a range of public policy projects in trade policy and

global investment banks, retail banks, private equity funds, asset managers, banking regulation. As an expert, her views are often quoted in the media

brokerages, Chinese listed companies and high net worth individuals. and she has also authored various articles, which have been published in

legal journals and publications.

Reed Smith has added Stephen Chan as a partner in its litigation

practice in the Hong Kong office of Reed Smith DSK Legal has hired senior partners Aparajit Bhattacharya and

Richards Butler. He was previously a dispute Anjan Dasgupta, as well as partners Sharath Chandrasekhar, Nand

resolution partner in the Hong Kong office of Kishore, Aninda Pal and Harvinder Singh from HSA Advocates. The

Oldham, Lie & Nie. Before relocating to Hong hires add practice capability across finance and projects, core corporate

Kong in 2013, Chan was with McVeagh Fleming and M&A, and disputes and tax practices, and will also bring their entire

in New Zealand. He is an experienced advocate, respective teams across offices in New Delhi, Mumbai and Bangalore.

who focuses on commercial litigation, interna- The firm has also added projects partner Geeta Saha, who previously

Stephen Chan

tional arbitration, intellectual property litiga- practised at her own independent firm, to its Mumbai office.

20 www.inhousecommunity.comJAPAN

K&L Gates has added Tsuguhito Omagari speare joins KorumLegal’s Singapore office,

as a corporate / M&A partner in its Tokyo after spending the last three years building

office. He rejoins the firm from local Tokyo the Asia-Pacific corporate practice at Squire

firm Sonderhoff & Einsel. Omagari focuses Patton Boggs in Singapore. With nearly 15

on domestic and cross-border M&As, private years’ experience in corporate transactions,

investment in public entities, private equity, he brings strong legal expertise and a passion

domestic and international joint ventures, real to drive legal innovation, which he sees as

Tsuguhito Omagari Tessa Whittle

estate investment transactions, and various ripe for change. On the other hand, Whittle

other corporate and related regulatory matters. He also advises inter- expands her role in KorumLegal, having previously been a managing

national companies on investing and doing business in Japan. consultant working with one of KorumLegal’s key financial institution cli-

ents for the last 18 months. With over 14 years of experience advising on

corporate, commercial and compliance / regulatory legal matters, she

SINGAPORE will help drive quality legal solutions and legal operations at KorumLegal.

Baker McKenzie Wong & Leow, the

member firm of Baker McKenzie International

in Singapore, has added Kunal Katre as a UAE

local principal in the finance and projects prac- Akin Gump has added Rizwan Kanji as

tice and Xavier Amadei as local principal in a partner in its Dubai office. He joins from

its capital markets practice. Joining from Allen another large international law firm in Dubai,

& Overy, Katre has broad banking experi- where he served as the lead of that firm’s

Kunal Katre

ence spanning a wide range of transactions, global capital markets working group and as

including general syndicated loans, leveraged one of the deputy heads of its financial ser-

and acquisition financing, private equity led vices industry focus group. Kanji’s practice

Rizwan Kanji

sponsor financing, margin lending, structured focuses on debt capital markets, finance and

financings, and P2P loans. His practice focuses securitisations using both conventional and Islamic finance structures.

on matters in South and Southeast Asia, par- Particularly active in the Middle East and Turkey for over a decade

ticularly in India, Indonesia and Malaysia. Katre and, more recently, in Africa, he advises investment banks, financial

is admitted to practise in India and England & Xavier Amadei

institutions, multilateral development banks, sovereign states, insur-

Wales. Amadei, who joins from Linklaters, has ance companies and multinational regional corporations on high-profile

extensive experience acting on cross-border equity and debt offerings, transactions. Well known for his excellent client and technical skills, and

advising investment banks, issuers (including sovereigns) and sharehold- his ability to structure conventional financing, as well as Shari’a- com-

ers throughout the Asia Pacific region. His transactional experience pliant sukuk, Kanji has developed a particular reputation for advising

includes SEC-registered offerings and offerings pursuant to Regulation on “first of its kind” transactions. For example, he advised on the first

S, Rule 144A, as well as other private placements. He has also advised sukuk out of Turkey, the first syndicated Murabaha financing out of

clients on matters of bribery, corruption, fraud and economic sanction Russia, the first “Blue Bond” in the world and the establishment of the

regimes and on the implications of the EU Alternative Investment Fund largest sukuk program to date. He received his LLB from the University

Managers Directive. He is admitted to practise in Hong Kong, Paris and of Leicester and his LLM from Southampton University. He is qualified

New York. in England and Wales.

KorumLegal has expanded its capabilities Ashurst has further strengthened its Middle East oil and gas team

and offerings with the addition of Rob Shake- with the addition of Luke Robottom as a partner in its global projects

speare and Tessa Whittle to their HQ practice, based in Abu Dhabi. Robottom joins from White & Case in Abu

team. Shakespeare joins as general manager Dhabi, where he has been based since 2009. He has extensive experi-

and managing consultant for Southeast Asia, ence advising on the development and financing of major infrastructure,

while Whittle, previously a consultant with power and oil and gas projects, including numerous midstream and

KorumLegal, has expanded her role to head of downstream deals. He also has a strong transactional construction

Rob Shakespeare

legal, as well as managing consultant. Shake- practice. He advises sponsors, owners and lenders, from pre-contract

speare and Whittle, located in Singapore and Hong Kong, respectively, negotiation through contract administration and post-contract dispute

bring extensive private practice and in-house legal experience. Shake- resolution.

Volume 16 Issue 7, 2019 21You can also read