Stellar metrics just the start for near-term developer Theta Gold

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

THETA GOLD MINES | GOLD

GOLD OUTLOOK

OUTLOOK

Stellar metrics just the

start for near-term

developer Theta Gold

Theta Gold Mines is poised for a see the long-term future at Theta,” Guy said. “These guys

know how to build a mine in South Africa and deliver a

rerating as it rapidly moves to project.”

become a key player in South He said the input from ex-Harmony experts had helped

Africa’s mining industry. hone the company’s focus on starting with the higher-grade

underground ore, to get the initial capex paid off.

The company is bringing a new shine to an historical, Theta’s existing 1.4Moz openpit resources would form part

multimillion-ounce gold field, looking to initially start with of future expansions.

an eight-year, low-cost underground development set to

provide an internal rate of return around 100% at the Underground mining is well understood in South Africa and

current gold price. However the excellent metrics are just the phase one TGME underground mines are within a

the beginning, chairman Bill Guy is quick to point out, at granted Mining Right (MR 83). Non-conforming changes to

what the company believes will be a circa 30-year operation. Environmental Management Plan (EMP) will require further

permitting.

Theta has more than 6 million ounces of gold under

management at its flagship TGME project, putting it in the A prefeasibility study released in April for the TGME

top three undeveloped gold resources among ASX-listed underground development – based on three of the 43

peers. former mines – outlined initial capex of US$79 million

(GOLD OUTLOOK | THETA GOLD MINES

“We really see this as

He noted the TGME PFS was based on only 16% of the 4.5

million ounces in the project’s underground resources, and

a good investment

said the project held plenty of further upside.

The next cab off the rank is the Rietfontein mine, which has

an indicated 242,200oz grading 8.2g/t and an inferred opportunity – we’re

undervalued against

537,600oz at 14g/t.

Theta is planning to upgrade Rietfontein’s 2017 scoping

study to a prefeasibility study in the third quarter, to feed

into a larger feasibility study on the phase one

our peers.”

development.

The company then has a multitude of near-surface targets The sentiment is echoed by Zacks Small-Cap Research

near the existing, fully permitted processing plant, which is analyst Steven Ralston, who described Theta as being on the

set to be upgraded and expanded. threshold of becoming a gold producer and highlighted

management’s moves to optimise the project by initially

“The resource pipeline into the future is strong and the scale targeting higher-grade, near-surface deposits and

of the potential resources and the geology in South Africa optimising mining and processing methods.

should not be underestimated,” Guy said.

Ralston said Theta’s preferred method of mechanised long

“Over 40% of the world’s gold has come from the small hole stoping would result in higher grade ore, dramatically

corner of South Africa that we call home.” improving cost efficiency per ounce.

Guy envisages a debt and equity combination for likely well- He indicated a target price of US69 cents per share, based

timed project funding. on the calculation of share value of attributable resources.

“We feel there is a lot of money going towards projects and This target converts to about AU88 cents, compares with

at the moment, but there’s a relatively few number of pre- Theta’s current share price of A24 cents on its primary ASX

development projects around,” he said. listing.

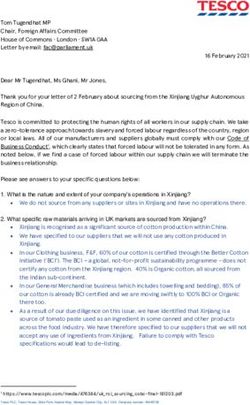

The top of Theta Gold Mines’ TGME gold plant in South Africa

26 May 2021THETA GOLD MINES | GOLD OUTLOOK

Ralston expected Theta’s stock to react to upcoming

announcements concerning the Rietfontein PFS, resource

upgrades and process towards refurbishing the CIL

processing plant, along with plant design and metallurgical

upgrades.

Focus on ESG

Theta said Environmental, Social and Governance (ESG)

considerations were integral to its development strategy in

South Africa.

It has assembled a highly-competent team to deal with all

“licence to operate” aspects and said local communities

were highly supportive of Theta’s projects.

The company believes TGME will be the biggest employer in

the region and its projects are structured for broad-based

economic participation.

Theta itself owns 74% of the assets, with the balance held

by Black Economic Empowerment entities.

Guy also highlighted the support being shown for the

resources sector in South Africa, with both president Cyril

completing a PFS on Rietfontein, which could further

Ramaphosa and mines minister Gwede Mantashe having

increase the initial production profile.

mining backgrounds.

The company is aiming to upgrade its phase one

Ramaphosa recently said mining would be a key

development plans to a feasibility study within the year and

component of post-COVID-19 economic recovery and job

transition to producer status in 2022.

creation in South Africa. Mantashe also recently reiterated

the government’s commitment to expediting the approvals “This is the beginning of a very long story,” Guy said.

process in the sector.

The pro-mining sentiment gives Theta confidence of

gaining approvals for its proposed amended works Theta Gold Mines – at a glance

programme and associated environmental approvals.

“You have two key persons in the country politically who Head Office

have a very deep understanding of mining and are very Level 35, Intl Tower One

supportive of it,” Guy said. 100 Barangaroo Ave, Sydney NSW 2000

“The outlook for South Africa is picking up and through Tel: +61 2 8046 7584

Theta, you have a chance to get access to a re-emerging Email: info@thetagoldmines.com

economy. Web: www.thetagoldmines.com

“It’s got the best infrastructure on the African continent … Directors

it’s a very important jurisdiction globally.” Bill Guy, Finn Behnken, Bill Richie Yang, Rob Thomson,

Looking ahead, Theta’s 160,000oz per annum production Simon Liu, Brett Tang

aim is based on a six-mine operation and the project hosts a Shares on Issue

multitude of expansion opportunities to further increase 503.25 million

the resource base and production for more than three

decades. Market CAP (at April 29, 2021/A24c)

A$123 million

Meanwhile there are a suite of upcoming catalysts set to

draw investors’ attention. In the coming months, Guy said Major Shareholders

Theta was working on an increase to the mining reserve and Top 10 (68%), Directors and management (9.5%)

May 2021 27You can also read