VAT Compliance 2019 Filings: Types of Returns and Other Considerations - Deloitte

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

86 VAT Compliance 2019 Filings: Types of Returns and Other Considerations

Conor Walsh

Senior Tax Manager, Deloitte

VAT Compliance 2019 Filings:

Types of Returns and Other

Considerations

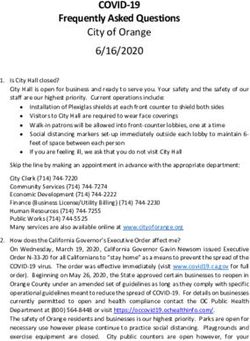

Introduction VAT Returns

This article provides an overview of the Every VAT-registered person is obliged to

various types of returns associated with VAT file a VAT return for each taxable period.

compliance. It outlines who is obliged to file the Generally, VAT returns are filed on a bimonthly

returns, how often the returns need to be filed, basis, but other filing periodicities may be

the statutory due dates for filing and payment permitted; in certain cases returns may be filed

(where applicable), and details of what needs on a monthly, triannual, biannual or annual

to be included in the returns. The article also basis. Unlike in many other jurisdictions, a

identifies some areas that should be considered quarterly periodicity is not available for VAT

as part of the VAT compliance process. returns in Ireland.2019 • Number 02 87

In practice, such returns must be filed Annual Return of Trading Details

electronically on or before the 23rd day of the

All VAT-registered traders should submit an

month following the end of a taxable period.

Annual Return of Trading Details (ARTD). As

If the return gives rise to a net VAT payable

its name suggests, the return is filed once per

position, that liability should be discharged by

year, with Revenue stipulating that it should

the same deadline. For example, the January/

be filed on or before the 23rd day of the

February bimonthly VAT return must be filed

month following a trader’s accounting year-

on or before 23 March. If the return gives rise to

end. VAT-registered persons with a year-end

a liability, it should be discharged on or before

of 31 December should file their ARTD on or

this date too.

before 23 January each year.

The VAT return is completed as follows:

The ARTD is a statistical return that contains

the net values (i.e. VAT-exclusive amounts)

Box T1: Output VAT of a year’s trading details. It is intended to

Box T2: Input VAT be a detailed summary of all supplies that

a business made and received during its

Box T3/T4: et VAT payable/repayable

N

accounting year.

position

Box E1: ecords the net (i.e. VAT-

R The return is essentially an audit tool to

exclusive) amount of goods assist Revenue in verifying the accuracy

dispatched to other EU countries of a taxpayer’s VAT returns. Revenue has

Box E2: ecords the net (i.e.

R emphasised this point in recent guidance by

VAT-exclusive) amount of stating that when a nil ARTD is filled for a

goods acquired from other period in which values have been declared in

EU countries the VAT returns covering the accounting year, it

Box ES1: ecords the net (i.e.

R will be rejected.

VAT-exclusive) amount of

services supplied to other EU There are four sections/questions to be

countries completed on the ARTD:

Box ES2: ecords the net (i.e.

R

VAT-exclusive) amount of Question 1: “ Supplies of Goods & Services

services received from other Net of VAT”

EU countries Question 2: “ Acquisitions from EU Countries

Net of VAT & VAT free imported

In recent times, two new features were added parcels”

to the VAT return filing process: there is now

Question 3: “ Stock for Resale (purchases,

an option to provide additional information to

Intra-EU acquisitions & imports)

Revenue regarding any unusual expenditure

Net of VAT”

incurred during the period; and a “confirmation

screen” has been added, with the intention of Question 4: “ Other Deductible Goods &

reducing the potential for submission of returns Services (purchases, Intra-EU

containing errors or omissions. acquisitions & imports) Net

of VAT”

I maintain my long-held view that Ireland’s

VAT reporting process will be overhauled in Failure to submit an ARTD may result in

the next few years. Revenue’s seeking to withhold tax refunds for

any tax type. Revenue may also refuse to issue

a tax clearance certificate.88 VAT Compliance 2019 Filings: Types of Returns and Other Considerations

VAT Information Exchange Revenue and VIES, Intrastat and Mutual

Assistance (VIMA) monitor the figures declared

System Returns

in boxes E1 and ES1 of traders’ periodic VAT

Where a VAT-registered person supplies goods returns to establish whether they should be

or services to business customers registered registered for VIES. Despite this, the onus rests

for VAT in another EU jurisdiction, that person on the taxpayer to determine whether they

is required to complete a statistical return should be registered.

known as a VAT Information Exchange System

(VIES) return. This is Ireland’s version of the

It is common for tax authorities to collaborate

EC Sales List/ESL.

on a cross-border basis in an effort to prevent,

deter and detect fraudulent behaviour.

The return does not extend to the receipt

of supplies of goods or services by a VAT-

registered person. There is no threshold for the Intrastat Returns

requirement to register for VIES, but there are Where a business dispatches goods from

some limited exceptions to this. Ireland to another EU country, or brings

goods into Ireland from another EU

VIES returns are required to be filed on a country, there is a requirement to file an

monthly or quarterly basis. Monthly filing is Intrastat return if certain thresholds are

required only where the trader’s reportable breached (there are some exceptions to this

supplies of goods are relatively significant. requirement):

For traders that have only reportable

supplies of services, returns can be filed • Intrastat arrivals returns must be filed where

quarterly irrespective of the value of the the value of arrivals of goods into Ireland

supplies made. from other EU Member States exceeds

€500,000 annually.

In practice, such returns must be filed

• Intrastat dispatches returns must be filed

electronically on or before the 23rd day of

where the value of dispatches of goods

the month following the end of a monthly/

to other EU countries exceeds €635,000

quarterly period. For example, the quarter

annually.

1 VIES return is required to be filed on or

before 23 April.

Traders who exceed just the dispatches

threshold only have to file a return recording

VIES returns normally contain the following

their dispatches. Similarly, traders who exceed

information:

just the arrivals threshold only have to file a

return recording their arrivals.

• the trader’s VAT number,

• the recipient’s foreign VAT number, Intrastat returns are filed on a monthly basis.

• the total value of supplies made to each They should be filed on or before the 23rd

customer, day of the month following the end of the

monthly period. For example, the January

• the indicator “S” in the flag column where

Intrastat returns should be filed on or before

the supply relates to services and

23 February.

• the indicator “T” in the flag column where

goods were the subject of the triangulation Intrastat arrivals returns normally contain the

procedure. following information at a minimum:2019 • Number 02 89

• country of consignment, to VAT in the country where the customer is

• country of origin, based. Ordinarily, absent any specific scheme,

a business that makes such supplies would be

• nature of transaction, required to register for VAT in every country

• mode of transport, where it has customers. The Mini One-Stop

Shop (MOSS) regime was created to relieve the

• commodity code,

administrative burden associated with doing so.

• number of supplementary units (depending

on the applicable commodity code), There are two MOSS schemes; the non-Union

• net mass and scheme (for suppliers established outside the EU)

and the Union scheme (for suppliers established

• invoice value (expressed in euro).

in the EU). For businesses established in Ireland,

the Union scheme would be applicable.

Intrastat dispatches returns normally contain

the following information at a minimum:

With the exception of the registration criteria

that determine which scheme a business

• country of destination,

can use, the two are very similar. The MOSS

• nature of transaction, regime allows businesses to file and pay the

• mode of transport, VAT due in respect of supplies of the relevant

services to all EU jurisdictions in a single return.

• commodity code,

Unsurprisingly, most businesses that make such

• number of supplementary units (depending supplies have opted to register for this regime.

on the applicable commodity code),

• net mass and MOSS returns are filed on a quarterly basis.

They must be filed electronically on or before

• invoice value (expressed in euro).

the 20th day of the month following the end of

a calendar quarter. The associated VAT liabilities

More detailed Intrastat returns are required

(if any) should be discharged by the same

when the value of the goods being moved is

deadline. For example, the quarter 1 MOSS

very significant.

return must be filed on or before 20 April. If the

return gives rise to VAT liabilities, they should

Revenue and VIMA monitor the figures declared

be discharged on or before this date too.

in boxes E1 and E2 of traders’ periodic VAT

returns to establish whether they should

In the event of a “no-deal” Brexit, businesses

be registered for Intrastat arrivals and/or

that are registered for either the Union or the

dispatches. Despite this, as with VIES returns,

non-Union MOSS scheme in the UK can expect

the onus rests on the taxpayer to determine

to be automatically de-registered immediately.

whether they should be registered. The value of

As part of Brexit preparations, businesses that

goods acquired from and dispatched to other

are registered for the non-Union scheme in

EU Member States should therefore be tracked

the UK have been “moving early”, and Ireland

and reviewed on an ongoing basis.

seems to be the destination of choice in most

cases. Businesses registered for the Union

Mini One-Stop Shop Returns scheme in the UK (i.e. those established there)

Since 1 January 2015, supplies of cannot move their MOSS registration before

telecommunications, broadcasting and Brexit, in accordance with EU law. After Brexit,

electronically supplied services made by if a deal is not agreed, UK businesses will

EU suppliers to private individuals and be able to register for the non-Union MOSS

non-business customers have been subject scheme in Ireland.90 VAT Compliance 2019 Filings: Types of Returns and Other Considerations

Businesses established in Ireland that currently • quantity and nature of the goods/services

declare and pay the UK VAT due on supplies supplied,

of telecommunications, broadcasting and • description of the goods/services supplied and

electronically supplied services under the

Union MOSS scheme would likely be required • if the supply is subject to the reverse-charge

to register for UK VAT in the event of a no- mechanism, a reference to the “reverse

deal Brexit. charge” and the customer’s VAT number.

Reverse-charge VAT

Other Points

It is important to declare VAT due on the

Having provided an overview of the various reverse-charge basis arising from the

types of return associated with VAT acquisition of goods and services from abroad,

compliance, I outline some areas below that as well as on certain domestic transactions.

should be considered as part of the overall VAT Where applicable, the net value of those

compliance process. transactions should also be recorded in one of

the statistical boxes on the VAT return.

Preparation of returns

Firstly, still in the area of returns, return details This is an area that Revenue will typically review

can be submitted online “live” to the Revenue as part of a VAT audit.

Online Service (ROS).

Adjustment of deductible VAT

With the exception of ARTDs, draft returns can As part of the periodic VAT return process,

also be prepared “offline” using the ROS offline VAT-registered persons should conduct a

application. Once completed, these forms review of their aged creditors.

can be reviewed and authorised before being

uploaded to ROS. This serves as an internal If a VAT-registered trader deducts VAT in a VAT

control procedure as it reduces the risks return but has not, within six months of the end

associated with filing incorrect returns “live”. of that taxable period, paid the supplier in full

for the goods or services, then the amount of

Invoicing requirements VAT originally claimed as a deduction should

Although there has been a body of recent be adjusted in the current VAT return. There are

European case law that has arguably reduced limited exceptions to this.

the obligation to be in possession of valid

VAT invoices to support input deduction, Where a restriction has been applied previously

it is advisable to ensure that the invoicing and a payment has since been made to a

requirements contained in the Irish VAT supplier, a re-adjustment can be made to

regulations are adhered to. reclaim the VAT incurred.

The key requirements of a valid VAT invoice are: In practice, when raising “aspect queries” or

“verification checks”, Revenue will typically

• supplier’s name, address and VAT number, request details of aged creditors to ensure that

• customer’s name and address, such adjustments are being made.

• date of invoice,

Tax coding

• sequential invoice number, Although some businesses assign tax coding

• VAT rate(s) applying to the supply/supplies, to transactions in enterprise resource

planning (ERP) systems, there are still a

• amount of VAT stated in euro,

significant number that do not. Implementing2019 • Number 02 91

tax coding (for both accounts receivable most are yet to consider the application of

and accounts payable) typically reduces robotics process automation (RPA) to their

the time spent on the preparation of VAT VAT reporting processes, which can bring

returns and the need for manual intervention. significant benefits to repetitive tasks. For

Implementing a tax determination engine can example, a robot (a piece of software) can be

also be very beneficial, especially in more configured to run reports from ERP systems

complex companies. and then save those reports. In businesses

where there are large or numerous reports to

VAT compliance software run, the prospect of automating such tasks

Where tax codes are assigned to transactions, is extremely appealing, especially given that

businesses can explore using VAT return the software can be programmed to run off-

preparation software. Such software is typically peak, when systems often lie idle. You can, of

designed to “map” a business’s tax coding logic course, design the robot to do far more, such

and then generate draft VAT returns across as preparing VAT returns, filing returns and

different jurisdictions. sending automated emails to those responsible

for preparing returns.

Reporting functionality

The standard “off the shelf” tax reporting Conclusion

features in ERP systems are often suboptimal As outlined above, every VAT-registered

but, with a level of investment, can be person is obliged to file periodic VAT returns

adapted to provide long-term benefits and should also file ARTDs. Depending

(such as a significant reduction in the time on the nature of the transactions entered

and effort required to prepare VAT returns into, they may also be required to file VIES

while mitigating or even eliminating instances returns and/or Intrastat returns. Typically,

of human error). Investing in improving the such obligations are placed on businesses

quality of data that can be extracted from ERP that are engaged in international trade. In

systems normally provides instant results. addition, businesses that make supplies

of telecommunications, broadcasting and

Monitoring statutory deadlines electronically supplied services to private

Many businesses continue to monitor statutory individuals and non-business customers in

compliance deadlines in an Excel spreadsheet other EU countries will normally register for

saved locally or on a shared drive. This can the MOSS scheme and file quarterly MOSS

work for some businesses, but moving to a returns, rather than registering for VAT in each

cloud-based tracker gives greater visibility to jurisdiction in which their customers are based.

staff and saves the time required to update

other staff separately. The information can also To minimise the amount of time spent on meeting

be shared with or viewed by a third party (such compliance obligations and the level of errors

as an adviser where a compliance outsourcing arising from human intervention, the use of

or co-sourcing relationship exists). technological advancements could be considered

as part of the tax compliance process.

Robotics process automation

For most businesses, the amount of time

being spent on tax compliance has increased Read more on VAT and VAT on

considerably over the past decade. However, Property, 2017You can also read