U.S. CELLULAR - BRAND NEW RELOCATION STORE - ADJACENT TO WALMART - CORPORATE GUARANTY 1620 E JACKSON ST. | MACOMB, IL

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

U.S. CELLULAR – BRAND NEW RELOCATION STORE – ADJACENT TO WALMART – CORPORATE GUARANTY

1620 E JACKSON ST. | MACOMB, IL

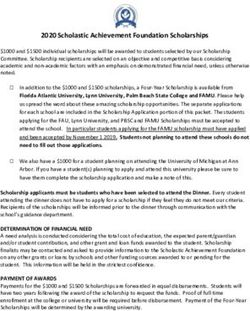

Actual Site - October 2020

BRAD TEITELBAUM EVAN BEESON

PRESIDENT VICE PRESIDENT

Office: 312-285-2946 Office: 773-455-1856

CONFIDENTIAL

Cell: 480-205-7637 Cell: 612-432-9935 OFFERING MEMORANDUM

Email: brad@bellagiorep.com Email: evan@bellagiorep.com

W W W . B E L L A G I O R E P . C O MCONTENTS

EXECUTIVE SUMMARY����������������������� 3

Price/CAP/Base Rent

Summary and Highlights

AERIALS������������������������������������������������� 4

Market

Closeup

SITE PLAN���������������������������������������������� 6

LEASE ABSTRACT��������������������������������� 7

RENT ROLL�������������������������������������������� 8

TENANT OVERVIEW���������������������������� 9

AREA OVERVIEW�������������������������������10

Narrative, Demographics

Area Map

DISCLAIMER����������������������������������������11

Actual Site - October 2020

Bellagio Real Estate Partners

940 W. ADAMS STREET

SUITE 302

CHICAGO, IL 60607

w w w. b e l l a g i o r e p . c o mEXECUTIVE SUMMARY

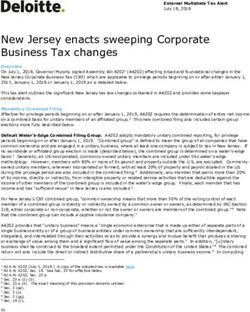

$1,212,000 6.65% $80,600

PRICE CAP NOI

10% every

2,600 SF Net Lease

5 years

BUILDING SIZE INCREASES LEASE TYPE

Bellagio Real Estate Partners, LLC is pleased to present the opportunity

to acquire a new construction, single tenant, and corporately guaranteed

U.S. Cellular net leased asset located at 1620 E Jackson St., Macomb, IL.

This is an opportunity to acquire a newly constructed asset adjacent

to construction adjacent to a Walmart Supercenter that also features

attractive escalations and strong corporate credit. Surrounding retailers

include Walmart Supercenter, Hy-Vee, Farm King, Aldi, McDonald’s, Arby’s

(new construction), Buffalo Wild Wings, Starbucks, and McAlister’s Deli,

among others.

Investment Highlights

⨇ Brand new 2020 - 2021 construction adjacent to Walmart

Supercenter

⨇ Outlot to new Farm King, which is a relocation and expansion

⨇ Corporate U.S. Cellular (NYSE: USM) 10-year lease

⨇ U.S. Cellular relocated from successful store in the submarket

⨇ Adjacent to brand new Arby’s relocation store

⨇ Home to Western Illinois University (9,400 students)

⨇ 10% escalations every 5 years

⨇ Heart of main retail corridor with national tenants

⨇ Tenant Headquartered in Chicago with 4.9M customers across

426 markets Actual Site - October 2020

3 1620 E Jackson St. | Macomb, ILMARKET AERIAL

67

101

CHICAGO - KANSAS CITY EXPY

E UNIVERSITY DR

101

LINCOLN

67 SCHOOL

MACOMB

STATION

101 136

67 136 E JACKSON 67 136

SUBJECT

®

PROPERTY

S CANDY LN

EDISON ELEMENTARY

SCHOOL

W GRANT ST

4 1620 E Jackson St. | Macomb, ILCLOSEUP AERIAL

E WHEELER ST

N BOWER RD

DRIVE-THRU

PROPOSED, FUTURE

ONE STORY

BUILDING

PYLON

67 136 E JACKSON 67 136 67 136

SUBJECT

PROPERTY

5 1620 E Jackson St. | Macomb, ILSITE PLAN

PRIVATE DRIVE C

DRIVE-THRU

PROPOSED, FUTURE

ONE STORY

BUILDING

PYLON

136 67 E JACKSON 136 67 US HWY 136 136 67

6 1620 E Jackson St. | Macomb, ILLEASE ABSTRACT

Tenant USCOC of Central Illinois, LLC

United States Cellular Operating Company,

Lease Guarantee

LLC (Corporate)

Building Size 2,600 SF

Lot Size 0.46 Acres

Estimated Delivery Date February 1, 2021

The sooner of: (1) The opening of the

Premises for business; or Seventy Five (75)

days from the last to occur: (A.) Delivery

Rent Commencement

of Premises or (B.) Landlord’s approval of

Tenant’s plans for Tenant’s work and tenant

obtaining all final permits and approvals.

Lease Term 10 Years

Tenant has a one-time termination right at

Termination Option the beginning of lease year 8 with 180 days’

written notice.

NOI $80,600

Renewal Options Three, 5-year options

Rent Increases 10% every 5 years Actual Site - October 2020

Lease Type Net Lease

Roof, Structure & Parking Landlord responsible for capital improve-

Lot ments. LL can amortize over the useful life.

Landlord responsibility – fully reimbursed

CAM

by tenant.

Admin fee 10% of CAM

HVAC Tenant maintains, repairs, and replaces.

Taxes Tenant Reimburses

Utilities Tenant pays utilities directly. Actual Site - October 2020 Actual Site - October 2020

7 1620 E Jackson St. | Macomb, ILRENT ROLL

Term Net Annually Monthly Rent Rent Increase Annual Return

Year 1 - Year 5 $80,600 $6,717 N/A 6.65%

Year 6 - Year 10 $88,660 $7,388 10.00% 7.32%

Year 11 - Year 15 (1st Option) $97,500 $8,125 10.00% 8.05%

Year 16 - Year 20 (2nd Option) $107,250 $8,938 10.00% 8.85%

Year 21 - Year 25 (3rd Option) $117,975 $9,831 10.00% 9.74%

*Tenant has a one-time termination right at the beginning of lease year eight with 180 days written notice.

Actual Site - October 2020 Actual Site - October 2020

8 1620 E Jackson St. | Macomb, ILTENANT OVERVIEW

United States Cellular Corporation provides wireless telecommunications

services in the United States. Its wireless services include postpaid and prepaid

service plans with voice, messaging, and data services; and smartphone

messaging, data, and Internet services, which allow the customer to access

the Web, social network sites, email, text, picture, and video messaging, as well

as to utilize GPS navigation, and browse and download various applications.

As of December 2019, it operates 262 retail stores and kiosks. The company was

founded in 1983 and is headquartered in Chicago, Illinois. United States Cellular

Corporation is a subsidiary of Telephone and Data Systems, Incorporated.

Tenant Facts

Tenant USCOC of Central Illinois, LLC

Company United States Cellular Corporation

(NYSE: USM)

Number of Customers 4.9 million customers across 426 markets

Revenue and Net Income $4.022 billion | $127 million

Full-Time Employees +10,300

Company Headquarters Chicago, IL

Website www.uscellular.com Actual Site - October 2020

9 1620 E Jackson St. | Macomb, ILAREA OVERVIEW

The subject property is located in Macomb, IL, county seat of McDonough County. The city is home to DEMOGRAPHICS

NCCA Division I Western Illinois University. Western Illinois University has over 9,400 full time students and

1,200 employees, serving as an anchor for the city and its economy. The city of Macomb also features a POPULATION 3 Mile 5 Mile

number of major manufacturing companies, including NTN Bower (651 employees), Pella Corporation (475

TOTAL POPULATION 17,484 19,242

employees), and Vaughan & Bushnell (238 employees).

AVERAGE HH INCOME $59,891 $62,280

In addition to large employers and educational institutions, McDonough District Hospital has been serving

Macomb and surrounding areas since 1958. The 48-bed health care facility provides an impressive spectrum

of advanced medical treatments and personalized health services for its patients. In September 2015, the NTN Bower – 651 Employees

hospital opened a three-floor expansion which included a new Emergency Department with 10 large private

treatment rooms, an ambulance garage, direct access to diagnostic technology, and a spacious waiting area

along with pediatric waiting area.

The subject property is situated in the main retail corridor of the market – while also enjoying the benefits of

its close proximately to the downtown area (1 mile) and Western Illinois University (2 miles). National tenants

surrounding the site include Walmart, Hy-Vee, Farm King, Aldi, McDonald’s, Arby’s (new construction),

Starbucks, McAlister’s Deli, and Buffalo Wild Wings, among others.

5-MILE

Western Illinois University

9,400 students and 1,200 staff

3-MILE

1-MILE

McDonough District Hospital – 48 Beds

10 1620 E Jackson St. | Macomb, ILDISCLAIMER Bellagio Real Estate Partners, LLC (“Bellagio REP”) has been retained as the exclusive broker by the owner of record (the “Owner”) of 1620 E Jackson St., Lot 3, Pad 2, Macomb, IL 61455 (the “Property”) in connection with its sale as described in this Offering Memorandum. This Offering Memorandum is solely for the use of the person or entity whose name appears herein. You are not permitted to distribute, reproduce or divulge the contents of this Offering Memorandum, either in whole or in part, without the express written consent of Bellagio REP. By accepting this Offering Memorandum, the recipient agrees not to disclose the contents hereof to any third-party, except for the recipient’s professional advisors. This Offering Memorandum is not a contract nor does it purport to provide an all-inclusive accurate summary of the physical or economic aspects of the Property, or any documents related thereto. Certain information contained in this Offering Memorandum, while believed to be true, is based on other sources, assumptions about the general economy and competition, and other factors beyond the control of Bellagio REP and Owner. For the foregoing reasons, Bellagio REP and Owner make no representations as to the accuracy or completeness of this Offering Memorandum, including, but not limited to, the budgets and projections. No such information contained in this Offering Memorandum is or shall be relied upon as a promise, representation or warranty whether as to the past or future performance. Neither Bellagio REP nor the Owner, nor any of their agents shall be held liable for any improper or incorrect use of the information described and/or contained herein and assumes no responsibility for anyone’s use of the information. Although the information contained in this Offering Memorandum was produced and processed from sources believed to be reliable, no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. The contents of this Offering Memorandum should not be construed as investment, legal or tax advice. Each prospective purchaser is urged to seek independent investment, legal and tax advice concerning the consequences of purchasing the Property. No assurance can be given that existing law, general economy, competition, or other factor beyond the control of Bellagio REP and Owner will not be changed or interpreted adversely to the Property or a purchaser thereof. Additional information and an opportunity to inspect the Property will be made available upon written request to interested and qualified prospective investors. In making a purchase decision, a potential purchaser must rely on their own examination of the Property and the terms of purchase. Owner expressly reserves the right, at its sole discretion, to reject any or all expressions of interest or offers regarding the Property, and/or terminate discussions with any potential purchaser at any time with or without notice. Owner shall have no legal commitment or obligations to any person or entity reviewing the Offering Memorandum or making an offer to purchase the Property unless and until such offer is approved by Owner and a written agreement for the purchase of the Property has been fully executed, delivered and approved by Owner and its legal counsel, and any conditions to Owner’s obligations hereunder have been satisfied or waived. 11 1620 E Jackson St. | Macomb, IL

U.S. CELLULAR – BRAND NEW RELOCATION STORE – ADJACENT TO WALMART – CORPORATE GUARANTY

1620 E JACKSON ST. | MACOMB, IL

Actual Site - October 2020

BRAD TEITELBAUM EVAN BEESON

PRESIDENT VICE PRESIDENT

Office: 312-285-2946 Office: 773-455-1856

CONFIDENTIAL

Cell: 480-205-7637 Cell: 612-432-9935 OFFERING MEMORANDUM

Email: brad@bellagiorep.com Email: evan@bellagiorep.com

W W W . B E L L A G I O R E P . C O MYou can also read