Tourism growth Improvements to infrastructure Diversifying economy - Savills

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

EMEA Commercial – 2019

S P OT L I G H T

Saudi Arabia

Savills Research

Hotel Market

Tourism growth Improvements to infrastructure Diversifying economySaudi Arabia Hotel Market

International visitor arrivals in Saudi Arabia topped

16.1m in 2017, alongside a 10.5% increase in expenditure to

$14.8bn

Overview

Recent tourism growth in

Saudi Arabia has been

driven by three key demand

pools - leisure, pilgrim and

corporate visitors.

Each demand pool has

played a pivotal role in the

growth of the country’s

tourism industry. This has

been complemented by

various government-led

initiatives, broadening KSA’s

tourism offer.

The introduction of luxury

resorts, entertainment

centres as well as key

international events have

added to the tourism offer

of the country.

As a result, KSA has

considerably increased its

hotel inventory, with rooms

Demand drives hotel growth

in construction set to

expand current supply

levels extensively.

Saudi Arabia’s large

Extensive visitor growth outlook for the three key tourist demand

population bodes well for

additional hotel supply pools is accelerating hotel requirements across Saudi Arabia

growth, with domestic Saudi Arabia has dramatically attracting a number of levels of interest amongst some

tourism levels expected to increased its hotel offering in international brands of the world’s largest hotel

rise significantly. recent years following growing A rapidly emerging tourism sector groups. For example, Marriott

Domestic travel will interest from international hotel has boosted hotel requirements International opened the

become an increasingly groups. Hotel supply in terms across Saudi Arabia, driven by country’s first two Aloft hotels in

popular option given the of rooms grew by 13% over 2017 the three key demand pools of Riyadh and Dhahran in 2016. 2017

range of luxury resort with rooms in construction set to corporate, leisure and religious saw Rocco Forte Hotels open the

developments underway, increase current stock levels by visitors. Travel and tourism Assila hotel in Jeddah and in 2018

coupled with various 51.4%, with over 48,000 rooms, alone accounted for 9.4% of the both Hilton and Swiss-Belhotel

entertainment projects according to STR. country’s total GDP over 2017. International each opened three

planned across the nation. This accounted for a 37.9% Total international overnight hotels over the course of the

Numerous high-profile share of all rooms in construction visitor arrivals in Saudi Arabia year. Groups including Accor and

transport infrastructure across the Middle East, according topped 16.1m in 2017, alongside InterContinental are also looking

projects currently in to STR as of October 2018. While a 10.5% year-on-year increase to expand into new locations

development will ease travel cities such as Riyadh, Jeddah, in expenditure to $14.8bn. This across the country.

both domestically and Makkah (Mecca) and Madinah encouraging growth is forecast

internationally, improving (Medina) continue to lead the to continue, with international Luxury resorts in construction

way, considerably increasing their arrivals due to increase on average will widen choice for both

Saudi Arabia’s overall

hospitality offering, a number of by 4% per annum to 2025 to reach domestic and international

connectivity.

smaller destinations are beginning 22.1m according to the World visitors

to rise as attractive opportunity Travel and Tourism Council The Kingdom of Saudi Arabia

markets, such as Dammam and (WTTC), which would exceed (KSA) has an array of large-scale

Jazan. Dubai’s current level of visitor leisure-focused developments in

arrivals by almost 40%. the pipeline, to meet the needs of a

An expansive tourism sector is This has sparked significant growing number of visitor arrivals.

Rooms in construction are set to increase current stock

levels by 51.4%, delivering over 48,000 new rooms

savills.com/research 2Saudi Arabia Hotel Market

Saudi Arabia accounts for

59.5% of the total

population of all GCC

59.5%

nations.

This includes the Public Investment also shows no sign of abating, with Hajj and Umrah visitor are set to

60m expected

Fund (PIF) backed Red Sea GDP forecast to grow by an average draw 30 million visitors by 2030

passenger numbers

each year on the

Development project, set to include of 3.6% per annum over the next Perhaps the cornerstone of KSA’s

Haramain High- over 2,500 rooms across 40-50 five years. This is particularly inbound tourism are the annual

Speed Rail line. hotels – enticing a number of global strong when compared to other pilgrimages of Hajj and Umrah,

brands, including Intercontinental GCC nations, outperforming the which drew 2.4m and 6.5m visitors

Hotels Group. This giga-project likes of UAE and Kuwait. respectively over the two most

is due to complete in 2022 and The government has existing recent events – forecast to increase

forecast to attract an estimated one plans, under the Vision 2030 to 30m visitors collectively by

million visitors annually. implementation, to capitalise on 2030. A 30-day Visa extension

Amaala, a new ultra-luxury this domestic demand having set available for Umrah visitors has

tourism megaproject, will consist of aside $64bn to invest in culture, undoubtedly contributed to the

developing 2,500 luxury hotel keys leisure and entertainment projects increase in average length of stay

alongside 700 villas and marinas over the next decade. One major from overseas visitors (from 9.7

$500bn NEOM

by 2028. While attracting millions example of this is the multi- days in 2016 to 11.3 in 2017). This,

project, opening in

2025, will

of overseas visitors, projects like purpose entertainment resort of alongside recent restrictions on the

significantly the above will undoubtedly appeal Qiddiya, due to welcome the world’s use of non-hotel accommodation in

increase KSA’s to domestic visitors, who have largest Six Flags theme park and Makkah during Hajj (such as home-

corporate demand. historically spent a great deal of estimated to attract 17m visitors stays) has helped to boost hotel

money travelling overseas. per annum by 2030. occupancy levels in the area during

In line with this, Riyadh this period.

Prospects for domestic demand now plays host to various key Upgrades to cultural sites across

are also positive international events. This includes the country will improve access

KSA has a significantly large the likes of the International Half and capacity for pilgrim visitors.

population, accounting for 59.5% Marathon, Time Entertainment’s The Grand Mosque of Makkah is

of the total population of all Gulf Comic-Con as well as the first currently undergoing restoration,

Cooperation Council (GCC) Formula E event held in the Middle increasing its capacity to 2.5m with

countries. In GDP terms, Saudi East, in December 2018. This was the city constructing the first new

22.1m international

Arabia is the largest in the Middle also the first event to introduce the Islamic Faith Museum of Makkah

overnight visitor

arrivals expected by

East and 1.7x that of the next largest Sharek international events visa, just 7km away. This is alongside

2025. from the GCC countries (UAE). allowing overseas visitors to easily the Jabal Omar Project, which

Economic growth in Saudi Arabia obtain a 30-day electronic visa. is expected to see over 12,000

International Arrivals Overnight arrivals in Saudi Arabia are expected to

reach 22.1m by 2025.

Overseas visitor arrivals

25,000

13% growth in hotel 2017-2025

room supply over 4% annual average

2017. growth rate

Overnight visitors (000’s)

20,000

15,000

10,000

91.8m passenger 5,000

numbers across all

airports in KSA last

year. -

Source Savills Research, WTTC

3Saudi Arabia Hotel Market

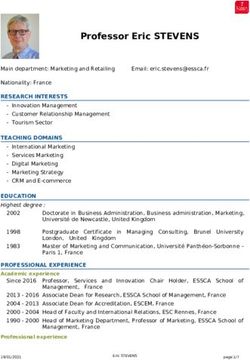

GDP Outlook vs Employment Growth Saudi Arabia is one of the largest and EXTENDED STAY

fastest growing economies of the GCC. OPERATORS EYE GROWTH

Key Size of bubble = size of GDP (2018)

OPPORTUNITIES

3.5% The extended stay market has recently

become a well-established sub sector

Total Employment Growth (2018-23)

3.0% in hospitality globally, with a number of

international operators expanding into

Bahrain Saudi Arabia new emerging geographies.

2.5%

The expanding corporate sector

across Saudi Arabia continues to

2.0%

provide widespread investment

Kuwait opportunities for extended stay

1.5%

operators. However, many brands

Oman could just as easily capitalise on

1.0% UAE Qatar the increasing leisure and pilgrim

visitor markets, which is generally

0.5% characterised by families travelling

together – well suited to more cost-

0.0% effective extended-stay options. Saudi

3.0% 3.2% 3.4% 3.6% 3.8% 4.0% 4.2% Arabia’s largely young, and increasingly

GDP Growth (2018-23)

more cosmopolitan, population unlocks

Source Savills Research, Oxford Economics further opportunities for lifestyle-

focused operators.

hotel rooms introduced across international hub for business being supported by widespread A number of global extended-stay

15 international hotels (with the visitors, arising as a focal point investment into travel providers have taken advantage of the

likes of Marriott, Hilton and Hyatt for trade and travel within the infrastructure. opportunity to open apartments within

Regency). Middle East. For example, 52.8% Airport connectivity has Saudi Arabia’s relatively undersupplied

of tourist spend in Riyadh is significantly improved across market, with the likes of Frasers

Investment into alternative accounted for by corporate visitors KSA, which has led to a boost Hospitality opening their first site in

sectors will drive growth in alone, according to the WTTC’s in passenger numbers. Last the country with a 95-key aparthotel in

corporate demand 2018 report. The impacts of this year, airport passenger numbers Riyadh in February 2018. Likewise, both

While there has been a historic were felt in September 2018 with increased by 7.7% to 91.8m across Citadines and Staybridge Suites have

reliance on the oil sector in KSA, the city experiencing a 33.4% rise all airports in KSA, according introduced sites to Jeddah over the

the Vision 2030 initiative focuses in hotel demand (rooms booked) to the Saudi Arabian General past two years.

on investment opportunities in following four major events Authority of Civil Aviation.

alternative industries. Not only held at the Riyadh International Saudi Arabian Airlines now

will this broaden the country’s Convention & Exhibition Center. serves over 70 international

corporate profile, it will also widen This triggered a 10.7% year-on- locations, while smaller airlines in

and drive corporate traveller year increase in RevPAR figures. KSA continue to expand. Flynas,

demand which will become key for In general across KSA, recent for example, are extending current

Saudi Arabia’s hotel market. stock growth has caused some stock significantly while passenger

This broadening in corporate headwinds in terms of RevPAR numbers in 2017 increased to 6.4

demand will be supported by

projects such as the $500bn

performance, however we expect

these impacts to wane over the

million.

The recent opening of the 3.6%

NEOM project, also financed by longer term when taking into Haramain High-Speed Rail, Average annual GDP

PIF and due to open in 2025. It account the strong economic linking major hubs of Makkah

is a cross-border sustainable outlook (when compared to other and Madinah via Jeddah, is

growth rate in Saudi Arabia

economic city focusing on a GCC nations), coupled with high rumoured to transport 60m over the next 5 years.

number of alternative industries levels of growth in both arrivals passengers per annum when in

including energy, biotech, tourism and spend across the three key full use. The connection will open

and media. While accommodating demand pools. opportunities for domestic leisure

a number of permanent residents, and pilgrim visitors alike, allowing

the project is set to attract both Various expansion projects to travel between the two key

domestic and overseas corporate transportation hubs continue to historic cities within 3 hours.

travellers on a regular basis. increase connectivity

Riyadh has become an The growth in hospitality is

A diversification of Saudi Arabia’s economy has provided a

boost for employment and its GDP outlook

savills.com/research 4Savills Middle East

Working alongside investors, developers, operators and owners, we inject market insight and provide

evidence-based advice at every stage of an asset’s lifecycle. We have unrivalled reach across the Middle

East with extensive hospitality market experience in Egypt, Saudi Arabia, Bahrain, UAE, Qatar and Oman.

Savills Commercial Research

We provide bespoke services for landowners, developers, occupiers and investors across the

lifecycle of residential, commercial or mixed-use projects. We add value by providing our clients

with research-backed advice and consultancy through our market-leading global research team.

Hotels

Nick Newell George Nicholas David O’Hara Richard Paul Vikram Malhotra

Hotel Valuations Global Head of Hotels Head of Kingdom of Saudi Head of Professional Head of Hospitality Advisory,

+44 (0)20 7409 5953 +44 (0)20 7904 9904 Arabia Services & Consultancy Middle East

nnewell@savills.com gnicholas@savills.com +966 11 484 7161 Middle East +971 4 365 7700

david.ohara@savills.sa +971 4 365 7700 vikram.malhotra@savills.me

richard.paul@savills.me

Research

Joshua Arnold Marie HIckey Swapnil Pillai

Commercial Commercial Commercial

+44 (0)20 7299 3043 +44 (0)20 3208288 +971 4 365 7700

josh.arnold@savills.com mlhickey@savills.com swapnil.pillai@savills.me

Savills plc: Savills plc is a global real estate services provider listed on the London Stock Exchange. We have an international network of more than 600 offices and associates throughout the Americas, the UK,

continental Europe, Asia Pacific, Africa and the Middle East, offering a broad range of specialist advisory, management and transactional services to clients all over the world. This report is for general informative

purposes only. It may not be published, reproduced or quoted in part or in whole, nor may it be used as a basis for any contract, prospectus, agreement or other document without prior consent. While every effort has

been made to ensure its accuracy, Savills accepts no liability whatsoever for any direct or consequential loss arising from its use. The content is strictly copyright and reproduction of the whole or part of it in any form

is prohibited without written permission from Savills Research.You can also read