SMITHS CONSTRUCTION EMPLOYEE ASSOCIATION AGREEMENT FOR 2020, 2021 - ARTICLE 1 - Ontario.ca

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

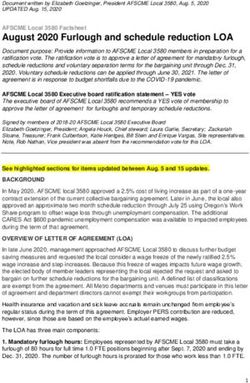

SMITHS CONSTRUCTION EMPLOYEE

ASSOCIATION

AGREEMENT FOR 2020, 2021

ARTICLE 1

Smiths Construction Employee Association I Agreement 2020-2021This document represents a Collective Agreement between the Smiths Construction Employees

Association and the Company known as Smiths Construction, a division of Miller Paving

Limited, of Arnprior, in the Province of Ontario.

ARTICLE2

We, the Bargaining Committee of Smiths Construction Employees Association for this purpose

and upon Certification by the Ministry of Labour on March 10, 1995, is so recognized as the sole

bargaining agent for all employees in the Province of Ontario for Smiths Construction, a division

of Miller Paving Limited, of Arnprior, Ontario, for the purpose of a Collective Agreement, save

and except non-working Forepersons and those above the rank of non-working Forepersons and

persons covered by an existing Collective Agreement and any Employee or whom any Trade

Union holds the Bargaining rights.

ARTICLE 3: GRIEVANCES

(1) Between Employee and Employer, Employer and Grievance Committee and between

Grievance Committee and Employee.

(2) All grievances between the above mentioned shall be filed in writing within thirty (30)

working days of the event and shall be reviewed with the Grievance Committee and

Employer within twenty (20) working days thereafter.

(3) All employees shall submit such grievances with their elected member of the Grievance

Committee.

(4) Failure to comply with all or any of the above will result in the grievance being deemed as

void.

ARTICLE 4: PUBLIC HOLIDAY PAY

(1) Public Holiday pay shall be paid in accordance with the Employment Standards Act (ESA).

The amount of public holiday pay to which an employee is entitled is all of the regular wages

earned by the employee in the four work weeks before the work week with the public holiday

plus all of the vacation pay payable to the employee with respect to the four work weeks

before the work week with the public holiday, divided by 20.

Smiths Construction Employee Association I Agreement 2020-2021(2) Ontario has nine (9) public holidays, Smiths Construction employees are entitled to public

holiday pay for the Civic Holiday in August. Public holidays for the purpose of this

agreement include; New Year's Day, Family Day, Good Friday, Victoria Day, Canada Day,

Civic Holiday (August), Labour Day, Thanksgiving Day, Christmas Day, Boxing Day.

ARTICLE 5: VACATION PAY

(1) Shall be paid to all employees from starting date to five (5) years of service at a rate of four

(4%) percent of gross earnings.

(2) Shall be paid to all employees with five (5) years of service at a rate of seven (6%) percent of

gross earnings.

(3) Shall be paid to all employees with six (6) to fifteen ( 15) years of service at a rate of seven (7%)

percent of gross earnings.

(4) Shall be paid to all employees with sixteen (16) years to twenty (20) years of service at a rate

of eight point five (8.5%) percent of gross earnings.

( 5) Shall be paid to all employees with twenty-one (21) years to twenty-five (25) of service at a

rate of nine (9%) percent of gross earnings.

(6) Shall be paid to all employees with twenty-six (26) or more years of service at a rate of ten

( 10%) percent of gross earnings.

ARTICLE 6: STANDBY TIME

( 1) An Employee shall be paid a minimum of four (4) hours pay at the applicable rate or for each

time he/she is actually required or asked by the employer, whichever is greater, plus travel

time or board allowance if applicable.

ARTICLE 7: CALLED OUT TIME

(1) An Employee shall be entitled to a minimum of four (4) hours pay at the applicable rate or

for the time the Employee is actually required or asked by the employer, whichever is

greater, plus travel time if applicable. Snow removal is excluded.

Smiths Construction Employee Association I Agreement 2020-2021ARTICLE 8: WAGES

(1) Effective April1, 2020, all employees shall receive a pay increase of two point three percent

(2.3%) of their hourly rate.

(2) Effective April 1, 2021, all employees shall receive a pay increase of two point three percent

(2.3%) of their hourly rate.

(3) Any employee who is required to travel more than 160 km one way to work to get to a job

site shall be paid their hourly rate one way (from either the employees designated head

office, or the departure location, whichever is shorter).

(4) Should an employee be working away from home and is required to work on a Saturday, but

not on a Sunday, the employee shall receive 4 hours regular pay for Sunday.

(5) Should an employee be working away from home and is not required to work on a Saturday

or a Sunday, the employer shall shut all operations down on Friday to allow the employee

sufficient travel time to travel to his or her residence. This will be reviewed on the job-by-job

basis.

(6) The purpose of Night Shift is to recognize that work performed on a regular basis on a shift

other than a day shift or afternoon shift may cause disruption to the normal living pattern of

employees.

a. The Night Shift Premium applies to Smiths Construction Summer seasonal

Construction employees and is applicable during the spring, summer and fall

construction season. The premium is not applicable to winter works operations.

b. The Night Shift Premium for employees who regularly work on a Night Shift shall be

one dollar and twenty-five cents ($1.25) per hour worked on that shift.

c. "Night Shift" means a scheduled nightshift wherein the employee is expected to sleep

throughout the day and work during the night.

(7) After the probation period being one season or six (6) months, whichever one occurs first, all

equipment operators shall receive an operator's wage.

ARTICLE 9: ROOM AND BOARD ALLOWANCE

(1) In regards to room and board allowances, it is understood that if Smiths requires an employee

to be out-of-town overnight, the rate of Room and Board Allowance shall be eighty dollars

($80.00) per day if the employee chooses to arrange for his or her own accommodations for

the duration of this Collective Agreement.

Smiths Construction Employee Association I Agreement 2020-2021(2) In regards to room and board allowances, it is understood that if Smiths requires an employee

to be out-of-town overnight and Smiths provides a room for the employee Smith will pay the

employee a board allowance of fifty dollars ($50.00) per day for the duration of this

Collective Agreement.

(3) The radius, in order for an employee to qualify for "shall be seventy (70) kilometers from

either the Amprior head office or the employee's home to the center of the job for the

duration of this Collective Agreement. When travel time combined with working time

constitutes a safety hazard, accommodations and board allowance will be paid by the

Company.

(4) All employees on a mobile operation that have to drive to his or her own vehicle in excess of

seventy (70) kilometers (given no Company vehicle is available) from their residence or the

designated head office and whether or not they qualify for board allowance shall be paid a

rate of fifty-three cents ($0.53) per kilometer both ways, beyond the 70km radius (from either

the employees designated head office, or the departure location, whichever is shorter).

For example, if an employee drives lOOkm one way, they will be paid for 30km one way. If

they drive 200km return, they will be paid for 60km total.

(5) If upon dispute of who qualifies for Board Allowance, the placement of the circle radius shall

then be reviewed and agreed upon by Committee member(s) and Supervisor(s) of the

Contract.

(6) Employees will be paid board allowance when working on a job which is considered to be

outside of the circle radius, with no reference made to where the employee starts or finishes

his/her day.

(7) Employees will be paid c;ontinuously for down time while traveling from one job site to

another at their regular rate of pay.

(8) Any employee who is required to use their own vehicle to go from one job site to another

during working hours shall be paid a rate of fifty-three cents ($0.53) per kilometer.

(9) Employees who are hired locally to work on a job outside of the radius will not be eligible

for the Board Allowance while on that job.

Smiths Construction Employee Association I Agreement 2020-2021ARTICLE 10: TOOL ALLOWANCE

( 1) After one ( 1) year from the date of hire all Shop Mechanical employees will be reimbursed

fifty (50%) percent of the cost of tools purchased up to a maximum payment of Six Hundred

and fifty ($650.00) dollars.

(2) Reimbursement for the cost of tools as set out above shall be paid to the employee once

he/she has provided receipt(s) for same.

(3) This Policy shall be extended to other eligible employees on an individual basis.

(4) It is recommended that employees confirm first that they are eligible for reimbursement prior

to purchasing tools.

(5) Second year technician apprentices shall be eligible to submit receipts they incurred during

their first year apprenticeship with the Company under the clauses above. This is a one-time

reimbursement and both first and second year entitlements may be combined iri year two

only for a max of$1,300.00 only.

ARTICLE 11: TRANSFER OF EMPLOYEES

( 1) Employees shall receive a minimum of forty-eight (48) hours notification period prior to all

transfers. "Transfer(s)" shall mean "on loan or moved to other Miller Groups).

(2) When transfer occurs, all other benefits shall remain constant under this Collective

Agreement.

(3) The forty-eight (48) hour notification period to employees may be waived if agreed upon by

Employee(s) and Supervisor(s).

ARTICLE 12: RE-HIRE/TERMINATION OF EMPLOYEES

(1) All re-hiring of prior employees shall be on a generally considered seniority basis.

(2) All termination of employees shall be on a generally considered seniority basis.

•

Smiths Construction Employee Association I Agreement 2020-2021ARTICLE 13: BOOT ALLOWANCE

( 1) Those employees, with at least two (2) seasons of employment shall be reimbursed up to a

maximum of One Hundred and Fifty ($150.00) dollars per year as a boot allowance. The

employee shall provide a receipt for the purchase of safety boots at which time he/she will be

reimbursed for the same.

(2) Those employees, with at least two (2) seasons of employment may carry their boot

allowance forward to the second year for a maximum of three hundred ($300.00) dollars. The

employee shall provide a receipt for the purchase of the safety boots at which time he/she

will be reimbursed for same.

(3) Safety boots must meet the requirements of the Miller Group Safety Policy to qualify for this

reimbursement.

(4) For the purpose of this Article, "a season" shall be defined as six months of employment.

ARTICLE 14: BEREAVEMENT LEAVE

(1) An employee shall be paid for a maximum ofthree (3) days absence due to a death of a

family member.

(2) An employee shall receive ten (10) hours pay per day for the three (3) days he/she would

have worked.

(3) An employee is only eligible for bereavement leave for working days from the date of death

through to the day after the funeral inclusive.

(4) For the purpose of this Article, "family member" is:

• your spouse (legal or common law)

• you or your spouse's natural grandparent or great grandparent

• you or your spouse's parent including stepmother or stepfather

• you or your spouse's child including natural, stepchild, legally adopted, foster child,

son-in-law or daughter-in-law

• you or your spouse's niece or nephew

• you or your spouse's grandchild or great-grandchild

• You or your spouse's brother-in-law or sister-in-law

Smiths Construction Employee Association I Agreement 2020-2021ARTICLE 15: GROUP BENEFITS

(1) Employees are eligible after 3000 hours of service. Applications are available through the

Human Resources Department.

(2) Premiums will be 60% company paid, 40% employee paid.

(3) The employee's portion of the premium will be deducted weekly over 24 pay-periods. If

for some reason the employee is not employed for 24 pay-periods, it is the employee's

responsibility to continue to pay the monthly premium by cheque (made payable to Miller

Paving Limited) in order to remain covered under the Group Benefit Plan while off.

ARTICLE 16: GROUP PENSION PLAN

(1) Employees are eligible after 4000 hours of service.

(2) The Plan is a defined contribution pension plan where both the employee and Miller

contribute to a pension fund administered by Canada Life. Employee contributions are

fully tax deductible. The Miller contribution does not have any immediate tax effect but

must be taken into account when considering any additional RRSP contributions outside of

the plan.

(3) Employees will be required to contribute 5% of your basic earnings. Miller will contribute

5% of your basic earnings, and as such matches your required contributions dollar for dollar.

(4) Employees may also decide to make additional voluntary contributions to the Plan which are

not matched by Miller. Total employee and employer contributions may not exceed the

annual Canada Revenue Agency maximums which are revised from time to time.

(5) Employee tax deductible contributions to the Plan are made conveniently through payroll

deductions. The sum of employee's contributions plus the Miller contributions is remitted to

Great West Life once per month. Your pension contribution or pension account is invested

in your choice of available investment options. Employees are responsible for both the

selection and monitoring of the suitability and performance of their own account.

(6) An application form and information package is available through Human Resources.

ARTICLE 17: PERSCRIPTION SAFETY GLASSES

(1) Those employees with three (3) months of service shall be reimbursed up to a maximum of

One Hundred and Fifty ($150.00) dollars every two years for prescription safety glasses. The

employee shall provide a receipt for the purchase of prescription safety glasses at which time

he/she will be reimbursed for the same.

Smiths Construction Employee Association I Agreement 2020-2021.•

ARTICLE 18: SCOPE

(1) The contents of this Collective Agreement may be changed as agreed upon by both the

Bargaining Committee of Smiths Construction Employees Association and Smiths

Construction, a division of Miller Paving Limited of Arnprior, Ontario. However, the

length of the term may not be changed.

(2) This Collective Agreement shall terminate on April 1, 2022. A new Collective

Agreement shall be in progress by the Bargaining Committee thirty (30) days prior to

April 1, 2022. A new Collective Agreement shall be entered into between the parties

within thirty (30) days after April 1, 2022.

(3) This Collective Agreement has been signed under the pretense that it was drafted to the

best of the parties' knowledge and is within the boundaries set forth by the Ministry of

Labour within the Labour Relations Act.

Per:

Smiths Construction Employee Association I Agreement 2020-2021You can also read