OTCQX: TPRFF - Mid-Tier Latin American Gold Producer - www.grancolombiagold.com

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Mid-Tier Latin American Gold Producer TSX: GCM OTCQX: TPRFF www.grancolombiagold.com August 2021 Presentation 1

Disclaimer Forward-Looking Statements This presentation contains "forward-looking information", which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company and its projects, and, specifically, statements concerning anticipated growth in annual gold production, future cash costs, AISC and All-in costs, future G&A and capex, free cash flow, future repayments of its gold-linked notes, and other statements that are not historical facts. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Gran Colombia to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from those anticipated in these forward-looking statements are described under the caption "Risk Factors" in the Company's Annual Information Form dated as of March 31, 2021 which is available for view on SEDAR at www.sedar.com. Forward-looking statements contained herein are made as of the date of this presentation and Gran Colombia disclaims, other than as required by law, any obligation to update any forward-looking statements whether as a result of new information, results, future events, circumstances, or if management's estimates or opinions should change, or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, the reader is cautioned not to place undue reliance on forward-looking statements. All amounts are denominated in U.S. dollars, unless indicated otherwise. Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF

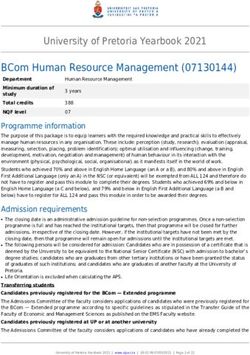

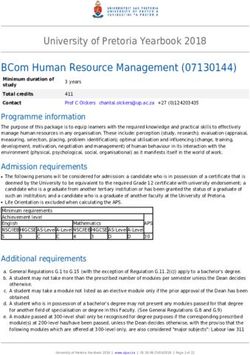

Mid-Tier Latin American Gold Producer

Growth Through Diversification

Two Cornerstone Assets with 8.8 Mozs Total M&I Gold Resources

Segovia Toroparu Diversified Portfolio

Colombia

Consistently ranked in

the world’s top 5

+ Guyana

One of the largest

undeveloped gold

= Latin American Gold Producer

Gran Colombia’s diversified portfolio within the

mining friendly jurisdictions of Colombia and

highest-grade deposits in the Guyana, combined with its strong balance sheet

underground gold Americas with 7.35 and qualified management, position the Company

mines million ounces as a leading Latin American gold producer

Measured & Indicated

Paying a monthly Dividend with an

annual yield equivalent to > 3%

Strong Balance Sheet with Proven Track Record of Mine Building

and Operating in Latin America

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 3Growth Through Diversification

Latin American Gold Producer

Segovia Operations Toroparu Project

Colombia Guyana

100% ownership 100% ownership

High-Grade Underground Mines One of the Largest Undeveloped

Gold Deposits in the Americas

One of the Top 5 Highest-Grade

7.35 Million Ounces M&I Gold

Underground Global Gold Mines.

Resources

14.5 g/t in 2020

2020 Production 196,000 ozs; Advanced Development Stage

1.3 Million Ounces Over Last Project with Key Permits in Place

10 Years

RPP Title in Historic Mining 2020/2021 Drilling has Identified

District with Significant Higher-Grade Gold Structures

Exploration Upside Being Incorporated in a New

Geologic Model

60,000 m of Drilling in 2021 at Guyana is Poised to be the

Existing Mines and Brownfield World’s Fastest Growing

Targets in the Mining Title Economy According to the IMF

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 4Capital Structure

Exchanges Market Capitalization Warrants

CA$467.8 million (1)

TSX: GCM GCM.WT.B: 10.4 million @ CA$2.21 (2024 expiry)

Unlisted: 3.3 million @ CA$5.40 (2023 expiry)

OTCQX: TPRFF Common Shares Unlisted: 7.1 million @ CA$6.50 (2023 expiry)

98.5 million Unlisted GLDX (2): 6.5 million @ CA$1.90 to CA$5.76 (2022-2024 expiry)

52 Week High/ Low Stock Options

CA$8.40/ CA$4.94 2.5 million @ CA$2.55 to CA$6.88 (2022-2026 expiry)

Fully Diluted Convertible Debentures

132.1 million shares CA$18 million @ CA$4.75 (2024 expiry)

$9 1,000,000

$8

$7 800,000

$6

$5 600,000

$4 400,000

$3

$2 200,000

$1

$0 0

Volume Close (1) Based on C$4.75 at close on July 31, 2021.

(2) Adjusted to reflect the 0.6948 Exchange Ratio.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 5Shareholder Returns

CA 1.5 cents/share

Next Dividend: Record date: July 30, 2021

Payment date: August 16, 2021

Dividends

Continuing to Pay a Monthly Dividend

6.31% Returning ~CA$1.5 Million of Free Cash Flow to shareholders each month

6.10%

5.77%

Added to the OTCQX Dividend Index (.OTCQXDIV) in January 2021

Track's dividend-paying U.S. and international OTCQX companies

GCM remains one of the Highest Yields in the Sector and the Only

3.81% 3.79%

3.51% Producer (Non-Royalty) Providing a Monthly Dividend

2.68%

2.40%

2.16%

1.99% 1.83% Average = 1.93%

1.75% 1.67% 1.65%

1.59% 1.55%

1.23% 1.23% 1.21% 1.18%

1.04% 1.02% 1.00% 0.99%

0.79% 0.75% 0.67%

0.50%

0.13%

GCM Dividend Yield Relative to Comps

Source: Company reports. Market data as of July 31, 2021

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 6Core Investments

Opportunities for Growth & Value Creation

Marmato 44% equity interest Lomero 27% equity interest

Colombia TSX: ARIS Spain TSX-V: DSLV

• Building Colombia’s next major gold mine – fully funded and permitted • Located in the north-east part of the Spanish/Portuguese Iberian Pyrite

• 2020 Production: 24,000 ozs Belt in the Huelva Province of Southern Spain

• 2020 PFS and Wheaton stream validate underground mine expansion into • The Iberian Pyrite Belt is the largest concentration of massive sulphides in

the Deeps Zone the world

• Successfully negotiated a 30-year extension of the mining title at the • The estimated historical production at the Lomero-Poyatos Project was at

Marmato mine to October 2051 least 2.6 million tonnes of massive sulphide ore grading 5g/t Au, 80g/t Ag,

• PFS Highlights Include: Gold 2P Mineral Reserves of 2.0Moz @3.2g/t; Total 1.20% Cu, 1.10% Pb and 2.91% Zn

Processing Capacity of 5,500 tpd; M&I Gold Mineral Resources of 4.1Moz • Exploration conducted by prior ownership (Behre Dolbear 2012 NI 43-101

@3.2g/t; Production (LOM avg.) of 165k oz per year; Inferred Gold Mineral mineral resource) indicates an inferred resource of 20.93 MT at the

Resources of 2.2Moz @ 2.6g/t; Lower Mine Project Development Capex of following grades: 3.08 g/t Gold; 62.38 Silver; 0.90% Copper; 0.85% Lead;

US$269M; 13-Year Mine Life (Reserves Only); US$880/oz AISC (LOM avg.) 3.05% Zinc

Guia Antigua High-grade Segovia mining district. Have been in

continuous operation for over 150 years and over that

An advanced exploration-stage gold project located within the Colombia

Juby Shining Tree area in the southern part of the Abitibi greenstone

time have produced roughly 5 million ounces of gold.

Ontario belt about 100 km south-southeast of the Timmins gold camp Past-producing, high-grade Titibirí Mining District. Option

Zancudo Agreement in place with IAMGOLD for further mineral

Colombia exploration.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 7The Right Team

Seasoned Experience in Latin America

Demonstrated operating and mine Management Team

building experience in Latin America Serafino Iacono, Director and Executive Chairman

Lombardo Paredes, CEO

Mike Davies, CFO

Alessandro Cecchi, VP Exploration

Track record of improvement

Board of Directors

Miguel de la Campa, Vice Chairman

Strong health & safety record at Jaime Perez Branger

Robert Metcalfe

Segovia

Hernan Martinez

De Lyle Bloomquist

Focused on building strong

community relationships; ESG is in

our DNA

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 8Results

Performance Drivers

Met guidance for fifth consecutive year Higher gold prices fueling Adjusted EBITDA growth

Segovia Marmato $200

240

200 $150

kozs 160 $M

$100

120

80

$50

40

- $-

2018 2019 2020 2018 2019 2020

Free Cash Flow is servicing debt, paying dividends and

AISC reflects focus on controlling costs

building cash

$1,400 $140

Operating Cash Flow

AISC Total Cash Cost $120

Free Cash Flow

$1,050 $100

$80

US$/oz

$700 $M

$60

$40

$350

$20

$- $-

2018 2019 2020 2018 2019 2020

Refer to Company’s MD&A for computations.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 9Results

Cash & Debt (1)

$100

Gold Notes Convertible Debentures Cash

$80

$60

$40

$20

$-

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

2019 2020 2021

Gran Colombia’s balance sheet remains strong in 2021

The Company completed early redemptions of 10% of its Convertible Debentures with shares in April 2021 and $10 million of its Gold Notes with cash in May 2021.

(1) Aggregate principal amount of debt outstanding. Excludes Aris Gold’s (formerly Caldas Gold) cash and debt.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 10Gold Notes

Exposure to Upside on Gold

o Issued April 30, 2018 and mature on April 30, 2024

o Senior secured obligation of Gran Colombia

o Listed on the TSX under the symbol GCM.NT.U B+ (Stable Outlook)

o 8.25% annual coupon paid monthly in cash Affirmed as of July 28, 2021

o Quarterly principal repayments in cash with gold kicker above

US$1,250/oz

o Company sets aside physical gold each month into a Gold Trust Account 120

to meet quarterly principal payment obligations Original Amortization

Current Amortization

80

o US$18,006,250 outstanding as of August 3, 2021

US$M

o A total of 14,405 ounces of gold, representing less than 3% of

Segovia’s projected future production, will be required to meet the 40

remaining principal repayments through April 30, 2024

0

Issued 2018 2019 2020 2021 2022 2023 2024

Aggregate Principal Amount Outstanding

at December 31st

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 11Why Colombia

A Great Mining Jurisdiction $745

Annual GDP

(4th largest in

Colombia is an OECD member country with a growing economy, (US$B)

Latin America)

and one of the lowest inflation rates in Latin America. Population 49.8 Million

Under the latest Colombia Tax Reform corporate income tax is GDP Per Capita ($US) $14,943

31% for 2021 and expected to be 30% for 2022 and onwards.

5-Year GDP CAGR (%) 2.8%

Inflation 3.2%

Public Debt to GDP 50.5%

100 2020 Corruption Perceptions Index (1)

8 countries

The CPI scores 180 countries & territories by their perceived Free Trade

80 (including the US,

levels of public sector corruption, according to experts and Agreements

businesspeople. Canada, and EU)

Scores scale from 0 to 100 (0 is highly corrupt).

60 Ease of Doing Business 3rd best in Latin America

2/3 of Countries score below 50, and the average score is 43. Ranking (65th Globally out of 190)

40

Investor 1st in Latin America

Protection Ranking (15th Globally out of 190)

20

Economic Freedom

45th Globally out of 180

Index Ranking

0

New Zealand Canada US Argentina Colombia Brazil Mexico Venezula Somalia Investment Grade by Moody’s, Fitch

(Rank: 1) (Rank: 11) (Rank: 25) (Rank: 78) (Rank: 92) (Rank: 94) (Rank: 124) (Rank: 176) (Rank: 179) Credit Rating

and DBRS

(1) Transparency International 2020 Report.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 12Segovia Operations

Segovia Operations

100%

owned

Massive land packages for Segovia

& Carla makes for the biggest gold

producer in Colombia

Over 6 million ounces of gold

recovered from Segovia title over last

100+ years

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 13Segovia Operations Segovia Operations

Production Stage

One of the Top 5 Highest Grade Underground Global Gold Mines

Comparative Asset Milled Grade g/t

Kitco commentaries November 27, 2020 based on Q1 2020 results.

40

30 14.9 g/t Q1-20

Segovia Milled Grade

20

10

0

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 14Segovia Operations Latest NI 43-101 Technical Report Filed on May 13, 2021

Historical Progression of Mineral Resource and Reserve Estimates

From 2010 through 2020, Segovia has produced 1.3 Mozs at 13.8 g/t

3

Reserves Other M&I Inferred

2.5

2 Total

Inferred

Mozs 1.21 Mozs

1.5

1

Total M&I

0.5 1.43 Mozs

Drilling suspended during

period of low gold prices

0

2010 2012 2013 2014 2015 2016 2017 2018 2019 2020

M&I

Grade 13.1 12.1 15.2 12.0 11.4 11.8 11.7 11.2

(g/t)

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 15Segovia Operations

Regional Exploration Program

Currently operating mines on

only 3 of 27 known veins in the

RPP-140 license.

• On June 9, 2021, announced multiple high-grade

intercepts from the latest 62 diamond drill holes, totaling

13,056 meters, from the 2021 in-mine and near-mine

drilling programs and a further 11 diamond drill holes,

totaling 3,190 meters, from the 2021 brownfield drilling

programs at its Segovia Operations.

• The Company also announced the assay results from four

additional kick-off diamond drill holes (2,319 meters) from

the ongoing directional drilling program at the El Silencio

Deep Zone.

• The 2021 exploration program includes approximately

40,000 meters of in-mine and near-mine diamond drilling

at the El Silencio, Providencia, Sandra K and Carla mines at Denotes existing operating

a total cost of approximately US$10 million. Company mines

Denotes regional

• The 2021 exploration program also includes a multi-phase exploration target in

fieldwork program for each of the high-priority brownfield process

targets at Vera (ongoing), Cristales, Marmajito and San

Nicolas, including 20,000 meters of drilling, at a total cost

of approximately US$4 million.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 16Segovia Operations

Maria Dama Processing Plant & El Chocho Tailings Storage

Maria Dama El Chocho

Processing Plant Tailings Storage

o Plant has capacity to handle 1,500 tpd and expanding to 2,000 tpd to be completed by end of 2021.

o Plant includes crushing, grinding, gravity concentration, gold flotation, cyanidation of the flotation concentrate, Merrill-Crowe precipitation and refining of both the Merrill-

Crowe precipitate and gravity concentrate to produce a final doré.

o Construction of the new polymetallic plant for recovery of zinc, lead, gold and silver from the tailings into concentrate at Segovia is expected be completed in third quarter

2021 and we expect to commence commissioning shortly thereafter.

o Onsite lab provides quick turnaround of development samples; exploration samples processed in SGS Medellin.

o The “El Chocho” tailings storage facility and a filter press commissioned in 2019 enables tailings to be dry stacked; onsite water treatment facility is treating excess water to

Colombian standards before being discharged.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 17Segovia Operations

ESG is in Our DNA Learn more about our ESG

Artisanal Miner Contract Model Environment initiatives in our video

o Agreements with 50+ third party miner groups o Signed agreement to construct an 8 MW

‘Beyond Gold’

who mine in designated areas within our title Renewable Energy Electricity Project in Colombia

o GCM pays for recovered gold at fixed price o Exceeded environmental permits by planting over

o Contractors manage miners & fund own costs 12,000 trees in 16 hectares of GCM’s mining title.

o GCM processes ore and sells the gold/silver Reforestation ratio of 5:1

o GCM provides health & safety training o New filter press enables tailings to be dry stacked,

o Environment, economic and H&S benefits complying with international best practices

Improving Health & Safety Governance

o Our number one priority in our operations o ESG Committee of the Board provides

o Investment in training and awareness initiatives oversight

o Improved underground mine ventilation and o Corporate ESG Manager focused on

personal protective equipment, resulting in enhancing ESG reporting at investor level

major reductions in lost-time injuries o ESG Report to be published mid-June Health

Funding Education & Community Programs Education

o In partnership with Fundacion Angelitos de Luz, GCM administers the local elementary school, Gimnasio

Environment

la Salada. In 2020, the school had ~500 students enrolled in kindergarten through to grade seven

o Construction of high-school completed in 2020, which enrolled ~200 students in its first year

o In partnership with SENA, constructed the Agribusiness Mining Technology Center, which will benefit

more than 139,000 people in Northeast Antioquia

Community

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 18Why Guyana

The World’s Fastest Growing Economy

English speaking democratic republic.

Resource Endowment

Member of Commonwealth of Nations, World Trade Organization, and CARICOM

headquarters located in Georgetown. Gold: Omai, Aurora, Karouni, Toroparu, Aremu,

Courts governed by British Common Law. Peters Mine

Financing supported by - International Finance Corporation (IFC) - Overseas Oil: 8 bn barrel gross recoverable resource

Private Investment Corp (OPIC) - Export Development Bank of Canada - US from ExxonMobil’s 16 discoveries in the

Import-Export Bank (EXIM). Stabroek Block (25% explored). 3 Production

Projects w/ 120 mbo/d production in 2020

100 2020 Corruption Perceptions Index (1)

growing to 560 mbo/d by 2023

The CPI scores 180 countries & territories by their perceived

80 levels of public sector corruption, according to experts and

businesspeople.

Bauxite: Guyana’s 350 M-ton bauxite reserve is

Scores scale from 0 to 100 (0 is highly corrupt). one of the world’s largest deposits with current

60

projects belonging to First Bauxite (US), Rusal

2/3 of Countries score below 50, and the average score is 43.

(RUS), Bosai (CHN)

40

Manganese: 30 M-ton reserve being

20 developed by Bosai (CHN) with 600kt/y

expected to begin in 2021

0

New Zealand Canada US Argentina Guyana Brazil Mexico Venezula Somalia

(Rank: 1) (Rank: 11) (Rank: 25) (Rank: 78) (Rank: 83) (Rank: 94) (Rank: 124) (Rank: 176) (Rank: 179)

(1) Transparency International 2020 Report.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 19Toroparu

Infrastructure

Gran Colombia’s 100% controlled Upper Puruni

Concession contains 53,283-hectare(s) of mineral

leases located in the Cuyuni-Mazaruni Region (Region

7) of Western Guyana.

The region’s hilly terrain is accessible by air and road.

Facilities at Toroparu include a 150-person camp and

2,500-foot all-weather airfield.

~50 km

Toroparu is currently accessed overland via the 240-

km Itiballi-Puruni-Papishao Landing Road, which was

rehabilitated by Gold X in 2003, and is a major

corridor for both western Guyana and one of its

important gold producing areas.

Plans include completion of a second access road

extending to the north to Buckhall on the Essequibo

River.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 20Toroparu

Resource Potential

Upper Puruni Concession

The Puruni Shear zone is a regional structure extending

100 km into Venezuela.

Medium to large batholiths identified as low magnetic

features align with the southern boundary of the shear.

The Toroparu and Sona Hill deposits occur at the

margin between the batholiths and surrounding

metavolcanic host rocks.

Several exploration targets within the 20km x 7km

hydrothermal alteration halo surrounding Toroparu

represent satellite deposit targets.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 21Toroparu

Latest Drill Results

Confirmed 4-Km Strike Length of

Structurally Controlled High-Grade

Gold Mineralized Structures

The recently completed, two-phase diamond drill program

comprised a total of 20,750 meters in 114 drill holes and has

confirmed a 4-kilometer ("km") strike length of high-grade

structurally controlled gold mineralization.

The program identified a repeated pattern of intersections of

NW-SE and E-W oriented sub-vertical structures containing

high-grade zones extending over mineable widths up to 100

m vertically (“jewelry boxes”) that support our belief that a

high-grade resource amenable to underground mining

methods lies at the core of this very large, disseminated gold

deposit.

View the full release from July 6, 2021, here

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 22Toroparu Project

Mineral Resource Estimate as of September 26, 2018

Notes on Resource Estimate:

• All resources in the September 26, 2018 mineral resource statement are in-

pit resources reported within an optimized pit shell (Resource Pit Shell)

above an economic cut-off grade of 0.30 g/t Au. The optimized pit shell was

determined for Measured, Indicated and Inferred resources using a gold

price of US$1,350/oz, a copper price of US$3.00/lb; an average

metallurgical recovery of 88.2% for gold, and 81.5% for copper mill feed

Ag sent to the copper flotation circuit. The optimized pit shell was determined

using an average mining cost of US$1.60/t mined, saprolite processing cost

of US$2.50/t, CIL processing cost of US$8.50/t, flotation processing cost of

US$10.47/t, and G&A cost of US$1.24/t processed. Other costs included

US$125/oz Au for gold refining and royalties, and US$1.036/lb for copper

concentrate transportation and smelting with 97% pay for terms. Pit slopes

used in the pit optimization were 45°. Copper and Silver resources have not

been estimated at Sona Hill.

• Mineral Resources are reported in accordance with Canadian Securities

Administrators (CSA) National Instrument 43-101 (NI 43-101) and have

been estimated in conformity with generally accepted Canadian Institute of

Mining, Metallurgy and Petroleum (CIM) “Estimation of Mineral Resource

and Mineral Reserves Best Practices” guidelines;

• Mineral resources are not mineral reserves and do not have demonstrated

economic viability. There is no certainty that all or any part of the mineral

resources estimated will be converted into mineral reserves estimate;

• Mineral resource tonnage and contained metal have been rounded to

reflect the accuracy of the estimate, and numbers may not add due to

rounding;

While the estimate of mineral resources may be materially affected by

environmental, permitting, legal, title, taxation, socio-political, marketing, or

other relevant issues, the Company is not aware of any such issues;

• The quantity and grade of reported Inferred resources in this estimation are

uncertain in nature and there has been insufficient exploration to define

these Inferred resources as an Indicated or Measured mineral resource and

it is uncertain if further exploration will result in upgrading them to an

Indicated or Measured mineral resource category; and “(000)” = thousands,

“g/t” = gram per metric tonne. Tonnes are rounded to the nearest one

thousand tonnes, gold to nearest 1,000 oz Au, gold grade to nearest 0.01

g/t Au, and copper to nearest million pounds

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 23Why Invest in Gran Colombia Gold

01 02 03

Strong management with Cornerstone assets in Strong free cash flow

Latin American mining attractive mining yield and healthy

experience jurisdictions balance sheet

04 05 06

Pays monthly dividend Significant exploration “Sum of the parts”

upside at Segovia and undervalued versus

Toroparu peers

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 24APPENDIX

25Segovia Operations

Mineral Resource Estimate as of December 31, 2020

Measured Indicated Measured & Indicated Inferred

Au Au Au Au

Project Deposit Type Tonnes Grade Tonnes Grade Tonnes Grade Tonnes Grade

Metal Metal Metal Metal

(kt) (g/t) (kt) (g/t) (kt) (g/t) (kt) (g/t)

(koz) (koz) (koz) (koz)

LTR 218 18.5 130 237 14.9 114 455 16.6 243 171 9.9 55

Providencia

Pillars 109 22.3 78 99 10.2 32 208 16.5 110 384 19.8 245

LTR 413 10.0 132 413 10.0 132 384 9.9 122

Sandra K

Pillars 156 11.1 56 156 11.1 56 17 27.5 15

Segovia LTR 1,277 9.8 404 1,277 9.8 404 1,279 9.0 371

El Silencio

Pillars 1,326 10.6 454 1,326 10.6 454 395 11.4 145

Verticales LTR 771 7.1 176

Subtotal LTR 218 18.5 130 1,927 10.5 650 2,145 11.3 780 2,605 8.6 724

Segovia Project Pillars 109 22.3 78 1,581 10.7 542 1,690 11.4 620 796 15.8 405

Subtotal Carla

Carla LTR 132 6.0 25 132 6.0 25 260 9.7 81

Project

December 31, 2020 (1) 327 19.8 208 3,639 10.4 1,217 3,967 11.2 1,425 3,661 10.3 1,209

December 31, 2019 (2) 226 20.8 151 3,385 11.1 1,205 3,611 11.7 1,356 4,098 9.6 1,265

% Change vs previous 45% -5% 38% 8% -6% 1% 10% -4% 5% -11% 7% -4%

(1) The Mineral Resources are reported at an in situ cut-off grade of 2.9 g/t Au over a 1.0 m mining width, which has been derived using a gold price of US$1,700 per ounce and suitable benchmarked technical and economic parameters for the existing

underground mining (mining = US$85.0/t, processing = US$24.0/t, G&A = US$24.0/t, Royalties = US$11.1/t) and conventional gold mineralized material processing (90.5%). Each of the mining areas have been sub-divided into Pillar areas (“Pillars”),

which represent the areas within the current mining development, and long-term resources (“LTR”), which lie along strike or down dip of the current mining development. Mineral Resources are reported inclusive of the Mineral Reserve. Mineral

Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate. All composites have been capped where appropriate.

(2) Sourced from the NI 43-101 Technical Report, Prefeasibility Study Update, Segovia Project, Colombia dated May 14, 2020 and effective as of December 31, 2019, prepared by SRK Consulting (US) Inc. (“SRK”). Some production at Segovia is sourced

from mining areas that are not currently included in the Company’s MRE.

In the 2020 MRE update, Gran Colombia more than replaced what it mined in the year

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 26Segovia Operations

Mineral Reserve Estimate as of December 31, 2020

Tonnes Grade Au Metal

Area Category

(kt) (g/t) (koz)

Providencia Proven 187 13.9 83

Providencia Probable 176 10.4 59

Sandra K Probable 273 9.1 79

El Silencio Probable 1,472 8.3 394

Carla Probable 88 6.3 18

December 31, 2020 (1) Total 2,196 9.0 633

December 31, 2019 (2) Total 1,985 10.5 670

% Change vs previous 11% -14% -6%

(1) Ore reserves are reported using a gold cutoff grade ranging from 3.11 to 3.86 g/t depending on mining area and mining method. The cutoff grade calculations assume a $1,600/oz Au price, 90.5% metallurgical recovery, $6/oz smelting and refining

charges, $24/t G&A, $24/t processing cost, and projected LOM mining costs ranging from $85/t to $110/t. The reserves are valid as of December 31, 2020. Mining dilution is applied to a minimum mining height and estimated overbreak (values

differ by area/mining method) using a zero grade. Reserves are inclusive of Mineral Resources. All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding. Mineral Reserves have been stated on the

basis of a mine design, mine plan, and economic model. There are potential survey unknowns in some of the mining areas and lower extractions have been used to account for these unknowns. The Mineral Reserves were estimated by Fernando

Rodrigues, BS Mining, MBA, MMSAQP #01405, MAusIMM #304726 of SRK, a Qualified Person.

(2) Sourced from the NI 43-101 Technical Report, Prefeasibility Study Update, Segovia Project, Colombia dated May 14, 2020 and effective as of December 31, 2019, prepared by SRK.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 27Segovia Operations

Regional Exploration Program

Currently operating mines on

only 3 of 27 known veins in the

RPP-140 license.

2021 Drill Program results in this appendix include

key intercepts at:

• Providencia

• Sandra K

• El Silencio

• Chumeca

• Vera

• Marmajito

View the full news release here

Denotes existing operating

Company mines

Denotes regional

exploration target in

process

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 28Providencia

Key Highlights

Multiple medium to high gold grades were intersected from 13 drill holes (2,929

meters)

owned

Maximum intersection grades of 37.33 g/t Au with 24.2 g/t Ag over 0.55 meters

on an interpreted footwall structure of the Providencia Vein (PV-EU-023)

Multiple high gold grades were intersected from 5 drill holes (2,364 meters) on the

main vein system with maximum intersection grades of 211.68 g/t Au with 253.6

g/t Ag over 0.33 meters on the Providencia Vein (PV-ES-008).

Key intercepts as reported in the June 9, 2021 press release. Results from in-mine drilling are reported for 11

holes (1,957 m) at Providencia (PV-EU-017 to PV-EU-024, MAR-EU-002, 004 and PV-HYDRO-003), of which

there are no results above cut-off grade for 6 holes and so these holes are not listed in the table.

Results from near-mine surface exploration drilling are reported for 11 holes (4,724 m) at Providencia (PV-ES-

001 to PV-ES-010), of which one was lost, and there are no results above cut-off grade for 6 holes and these

holes are not listed in the table.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 29Sandra K

Key Highlights

Multiple high gold grades were intersected from 12 drill holes (1,905 meters) on the

owned

main vein system with maximum intersection grades of 147.91 g/t Au with 194.8

g/t Ag over 0.74 meters on the Sandra K Techo Hanging-wall Vein (SK-IU-175).

This new orebody offers the potential for another phase of resource growth and the

high-grade gold mineralized intercepts encountered so far confirm the higher-grade

mineralization at depth.

Drill hole SK-ES-001 returned 8.88 g/t Au with 4.4 g/t Ag over 0.58 meters on the

Sandra K Techo Vein.

Key intercepts as reported in the June 9, 2021 press release. Results from in-mine drilling are reported for 15 holes

(2,339 m) at Sandra K (SK-IU-163 to SK-IU-178), except for hole SK-IU-174 whose results are still pending. There are

no results above cut-off grade for 6 holes and so these holes are not listed in the table.

Results from near-mine surface exploration drilling are reported for 5 holes (1,995 m) at Sandra K (SK-ES-001 to SK-

ES-005), of which there are no results above cut-off grade for 4 holes and these holes are not listed in the table.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 30El Silencio

Key Highlights

Discovery of two additional high-grade veins announced on July 12,

2021. The ongoing directional drilling program on the El Silencio Deep

owned

Zone is targeted to better delineate the southern ore-shoot down-

plunge below Level 40, the deepest level of historical mining on the

Manto Vein by Frontino Gold Mines.

Multiple high gold grades were intersected from 4 kick-off holes (2,319

meters) with maximum intersection grades of 37.16 g/t Au with 52.5

g/t Ag over 0.55 meters on the 450 Vein (ES-MH08-02) and 70.56 g/t

Au with 289.5 g/t Ag over 0.57 meters on the Manto Vein (ES-MH08-

03).

Key intercepts as reported in the June 9, 2021 press release. Results from directional drilling from one purpose-built station

at El Silencio are reported from 4 kick-off holes (ES-MH07-07 and ES-MH08-01 to ES-MH08-03), totaling 2,319 m, all drilled

on the southern ore-shoot. In addition, 527 meters were drilled in one mother hole (ES-MH-008).

Drilling on the southern ore-shoot continues to be successful in

confirming the high-grade nature of the 450 Vein and the down-

plunge continuity of the two distinct high-grade domains, previously

combined, on the Manto Vein. The 450 Vein, interpreted as a low angle

vein or manto, occurs in the hanging-wall of the Nacional Vein, some

40 meters vertically above.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 31Chumeca

Key Highlights

Multiple medium to high gold grades were intersected from 20 drill

owned

holes (2,041 meters) on the main vein system, which identified two

distinct structures named as the Chumeca hanging-wall and footwall

veins interpreted as a split of the main Chumeca Vein, with maximum

intersection grades of 187.11 g/t Au with 242.2 g/t Ag over 0.43

meters on the hangingwall structure (CH-IU-030) and 15.90 g/t Au with

20.5 g/t Ag over 0.56 meters on the footwall structure (CH-IU-032).

Key intercepts as reported in the June 9, 2021 press release. Results from in-mine drilling are reported for 20 holes (2,041

m) at Chumeca (CH-IU-015 to CH-IU-033 and CH-IU-028A), of which one was lost, and there are no results above cut-off

grade for 16 holes and so these holes are not listed in the table.

In-mine infill drilling from underground station CH5110, installed off

Level 2, aimed to extend a cluster of potential ore-shoots outlined by

mining within the upper levels of the past operation, was completed.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 32Vera

Key Highlights

Exploration drilling from surface station VER5340 confirmed the

continuity of the high-grade gold and silver mineralization in the

upthrown fault block, below the deepest level of the historical mine.

Key intercepts as reported in the June 9, 2021 press release. Results from brownfield exploration drilling are reported for 7

holes (2,140 m) at Vera (VER-ES-009 to VER-ES-015) of which there are no results above cut-off grade for 6 holes and these

are not listed in the table.

A bonanza silver grade coupled with a high gold grade was intersected

in drill hole VER-ES-010, one of the latest 7 drill holes (2,140 meters)

completed on the main vein system, with maximum intersection grades

of 31.78 g/t Au with 8,150 g/t Ag over 0.30 meters on the Lluvias

Vein.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 33Marmajito

Key Highlights

The ongoing brownfield exploration drilling program commenced in

owned

February 2021 with one diamond drill rig operating from the

underground drill station PV5630, installed off Level 16 of the

Providencia mine. This drilling program is aimed at exploring the

down-dip extension of the historical Marmajito Vein operated by Key intercepts as reported in the June 9, 2021 press release. Results from brownfield exploration drilling are reported for 4

holes (1,050 m) at Marmajito (MAR-EU-001, 003, 005 and 006), of which there are no results above cut-off grade for 3 holes

Frontino Gold Mines (FGM) until early 2000. and these are not listed in the table.

FGM developed the mine on 18 levels, the longest (Level 4) with an

approximate length of 800 meters. Historical records report 232,000 t

with 18 g/t of Au as reserves. Gold mineralization at Marmajito is

contained predominantly within a N40-50W trending massive white

quartz vein gently dipping (35-45°) to the north, averaging in width

0.33 m, hosted by intrusive rocks, mainly granodiorite.

The style of mineralization is characterized by narrow veins hosting two

main stages of mineralization: “Stage 1” is represented by milky

quartz+disseminated pyrite and sphalerite, while “Stage 2” is

characterized by grey quartz+banded pyrite intergrown with galena.

A total of 4 drill holes totaling 1,050 meters) have been completed so

far, with maximum intersection grades of 123.65 g/t Au with 172.60

g/t Ag over 0.93 meters on the Marmajito Vein.

Gran Colombia Gold | Corporate Presentation | August 2021 TSX: GCM | OTCQX: TPRFF | 34For Further Information:

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

35You can also read