A word in private - /8 Talking Business

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Talking Business /9

Bill Ford, chief executive officer of

General Atlantic, talks about how his

private equity firm drives growth as well

as captures it, and where he sees new

opportunities emerging

Q: General Atlantic (GA) has always been focused on

global growth equity investing. In which sectors and

regions do you see growth coming from in the next

word

five years?

A: We are continuing to identify interesting growth compa-

nies in each of our six sectors: financial services, busi-

ness services, healthcare, energy and resources, internet

and technology and emerging markets consumer. We are

particularly excited about the emerging markets, notably

private

Brazil, India and China, since globalization and population

shifts in these regions are creating large consumer-driven

economies and businesses with a focus on addressing

domestic consumption. Nearly half of our portfolio compa-

nies are based outside the US. This year, we have made

several investments in companies that target emerging

markets including Peixe Urbano, a collective buying

website in Brazil, and Studio Moderna, a leading multi-

channel e-commerce and direct-to-consumer retailer in

central and eastern Europe.

Q: What trends are you seeing in private equity investing?

Is the investor base changing? And are the returns

coming under pressure?

A: Investors are looking for more differentiated and unique

approaches to investing and a demonstrated ability to add

value to portfolio companies. It is no longer sufficient or

even possible for private equity firms to generate returns

from financial leverage alone. Investors are looking at how

private equity firms can access the best companies and

what they can offer these companies that will fundamen-

tally increase shareholder value over time. In fact, many

firms are moving to the GA model by focusing on investing

in growth companies in targeted sectors and regions, and

increasing company value by leveraging expertise, global

networks and operational knowledge. Proprietary access,

industry knowledge, a strong global network and differ-

entiated resources are all important to investors − those

Summer 2011 – the markit magazine/10 Talking Business

“It is no longer sufficient or offices in Beijing, Hong Kong, Mumbai and Singapore to

focus on these markets.

even possible for private equity Q: How does GA add value to its portfolio companies?

firms to generate returns from Do you spot under-appreciated companies or do you

attempt to improve the performance of the companies

financial leverage alone.” in which you invest, and if so, how do you go about

doing that?

private equity firms that already have or can develop these A: Our strategy is to identify successful companies that are

capabilities will have a competitive edge. GA’s approach poised for their next stage of growth. The companies we

is compelling because we can follow industry trends and invest in have proven and profitable business models. They

help companies expand beyond their country of origin. have talented people and strong organizations. We add

value by helping our companies accelerate their growth

Q: You have a different investment model to that of other by expanding and extending products and services to

growth equity houses. How does your funding struc- current and new markets. We also help derisk the next

ture influence your investment decisions? phase of that growth by focusing on building manage-

ment teams, developing functional organizations – such as

A: Our funding structure offers us flexibility in several impor- finance, technology and human resources – and ensuring

tant ways. Our evergreen capital base decouples us that the company has an infrastructure of processes and

from the traditional fundraising cycle and its impact on systems that can support continued rapid growth. Growth

investment strategy. Other firms often accelerate new can be organic as well as through M&A, and regional as

investment activity and portfolio company exits in order well as global. Pursuing acquisitions and expanding glob-

to complete a fund and move on to the next fundraising ally requires expertise that many companies do not have

process. We can be patient investors during hot market

cycles when valuations are high and we do not have to

force exits during down cycles when valuations are low.

Our investors have a longer-term investment horizon − five

to seven years − which supports our strategy of working

closely with our companies to really make a positive

difference and build shareholder value over time. Some

strategic initiatives take years to develop, execute and

generate a significant payoff. We have the flexibility to

make these investments on a global basis and work with

companies to build leaders.

Q: Everyone is looking East − what are the truly attractive

opportunities in this region?

A: We have been active investors with on-the-ground teams

in India and China for the past decade, pursuing compa-

nies with global aspirations focused on business services.

Now we also see massive population shifts from rural to

urban areas and the rapid growth of the emerging middle

class with disposable income for consumer goods and

services. The new five-year plan in China focuses on

domestic consumption which will fuel economic and busi-

ness growth and bring about attractive investment oppor-

tunities in China and south-east Asia. Our investments

in Zhong Sheng, a Chinese car retailer, SouFun, one of

China’s largest real estate portals, and Asian Genco, a

provider of power in India, are just a few examples of our

portfolio companies benefiting from consumer-driven

economies in the emerging markets. We now have local

the markit magazine – Summer 2011Talking Business /11

in-house. Access to experts, advisors and local contacts

helps ensure the success of an acquisitions strategy and “Political leaders and regulators

accelerates the pace of new market entry and the success

of newly established global operations.

need to balance the goal of

systemic risk mitigation with

Q: When looking back on some of your less successful

investments, what have you learned and how has your the need for vibrant global

investment strategy evolved as a result?

capital markets and innovative

A: We have two objectives as investors: select the right

companies to invest in and then work very closely with

financial services firms.”

management to both capitalize on opportunities and ride

through more difficult times. To select the best companies, Q: What attracted you most to Markit?

we have learned to be thorough in our due diligence and

dig deep to understand the competitive environment, the A: Markit has a highly differentiated set of valuable products

market opportunity, the business model and the manage- and services as well as a strong team and culture. Markit’s

ment team. Helping companies requires a patient and focus on its customers has pushed it to the forefront of

active approach with a focus on strategic growth objec- innovation and to become a proud partner of financial

tives that really add to shareholder value. One important services firms globally. We are very excited to be part-

lesson is to get involved right away, have a proactive nering with such a great firm.

100-day and annual plan, really work closely with the team

to establish the right objectives and milestones and work Q: Financial regulation has undoubtedly become a much

diligently toward those goals. Developing the appropriate bigger issue in the past few years. What impact do

corporate governance is also critical for oversight and stra- you think this regulation will have on the financial

tegic counsel to the CEO. services industry?

Q: How do you determine the right mix of skills and A: Regulation in the financial services industry will continue

experiences that create the most effective board to change and evolve. It will certainly be a factor that all

of directors? firms will have to anticipate, watch, consider and then

react to in an appropriate way. Reregulation of this industry

A: The most effective board has individuals with a breadth is a natural follow-up to the global financial crisis and will

of skills and experiences that can add value to the likely play out over the next few years. It will take time as

decision-making process and provide a helpful sounding political leaders and regulators need to balance the goal

board to management. Effective board members bring of systemic risk mitigation with the need for vibrant global

a mix of skills and experiences to help accomplish these capital markets and innovative financial services firms.

primary goals. Financial expertise, an understanding of

the industry and its competitive dynamics, experience Q: What do you see as the main drivers of growth or

of managing businesses facing similar challenges, and change in the financial services sector and do you

broad and relevant contacts and networks are all impor- anticipate consolidation in the market? How will this

tant attributes of an effective board. Assembling the right impact Markit and what are the opportunities for the

team of directors with complementary skills and experi- firm long-term?

ences that can work together effectively is as much an

art as a science and it is something we do every time A: There will continue to be several drivers of change within

we invest. the financial services industry including globalization

and the need to move capital from savers to users, rapid

Career in brief innovation in technology, ongoing regulation, continued

consolidation and new opportunities on a global scale.

Bill Ford is the chief executive officer of General Atlantic LLC, where he has worked

since 1991. He was named president of General Atlantic in 2005, and CEO in Consolidation is inevitable as large firms look to quickly

2007. He is the chair of the firm’s Executive Committee and is a member of the add to their product and service offerings or enter new

Investment and Portfolio Committees. Ford serves on the board of a number of markets. Markit is well positioned because it is well

financial institutions, banks and exchanges.

funded, innovative and nimble and therefore will be able

Prior to joining General Atlantic, Ford worked at Morgan Stanley & Co. as an to adjust to market changes and pursue new opportuni-

investment banker. He received his BA in Economics from Amherst College in ties aggressively and proactively. We are very enthusiastic

1983 and an MBA from the Stanford Graduate School of Business in 1987.

about the many opportunities ahead.

Summer 2011 – the markit magazine/12 Focus: Aviva Investors

With more new mandates and

consistently higher risk-adjusted

returns, Aviva Investors remains

one of the world’s largest fixed

income players. But its credit

management team is attracting

more attention thanks to a

makeover by Mark Wauton.

Rachael Horsewood reports

the markit magazine – Summer 2011Focus: Aviva Investors /13

Credit’s

next top

model T he last financial crisis

forced institutions to

rethink how they dealt with

credit and risk. The old

models were inappropriate

for the reshaped land-

scape but new emerging models had

yet to be tested.

Someone who could claim to have

more ideas than most about the

optimum makeover is Mark Wauton,

who was tasked with revamping Aviva

Investors, the asset management

arm of Aviva, the world’s sixth largest

insurance group. He had more than

two decades’ experience in credit

management, working at ABN Amro,

UBS and Gartmore, before he took up

the newly created position as head of

credit at Aviva Investors in April 2009.

Now, two years on, he has overseen a

re-engineering of Aviva Investors’ credit

investment process and has built a

comprehensive risk-based model that

uses a combination of fundamental,

technical and quantitative analysis.

At the end of last year, Aviva Inves-

tors had almost £260bn in assets

under management.

Summer 2011 – the markit magazine/14 Focus: Aviva Investors

“ The credit crisis

showed how

inefficient the

bond markets

are and proved

that fundamental

analysis on its own

is not enough.”

“The credit crisis showed how inef-

ficient the bond markets are and proved

that fundamental analysis on its own is

not enough,” he explains. “We needed

to consider a wider range of factors if

we were to take advantage of these

inefficiencies.” He says Aviva Inves-

tors’ approach is more diligent than the

industry standard in terms of appraising

risks and understanding where they

come from. “The status quo is more

qualitative by nature,” he adds.

Having run a hedge fund and been

a prop trader at an investment bank,

Wauton believed the driving focus of the

new credit process should be to identify

risk drivers and their correlation to other

markets. “We must take everything into

account in order to generate alpha,”

he says. “Whether it is volatility, market

momentum or our ability to interact with

the Street, we must understand the risks

involved.” “We do our best to under-

stand company fundamentals but we

also factor in other considerations such

as market drivers and whether a hedge

is able to neutralise risk or whether it

becomes a source of unintended vola-

tility. We need to consider all of this in

order to meet our clients’ expectations.”

The new process has also increased

transparency at the firm, providing much

more risk information for its clients.

As Wauton points out, technical

analysis was becoming more topical in

the credit management world before

the markit magazine – Summer 2011Focus: Aviva Investors /15

“ Investors essentially have the same

technology so it does not add a competitive

advantage. What makes managers different

is how they use it.”

the collapse of Lehman Brothers in industrial credit research process.

September 2007. “We have to challenge Rovelli, a former portfolio manager in

how well-established relationships the loan exposures group at Deutsche

in the market are holding up and whether Bank, was hired to cover industrial and

breakdowns contain vital insight,” he consumer sectors.

says. “To do this, we need forecasting

models at the market level, sector level Wauton says Aviva Investors’ analysts

and security level. These models act are “a major source of alpha generation,

as goalposts to help us see how the particularly when it comes to issuer-

market can develop. We have developed specific relative value trade recommen-

a number of models that provide us dations”. He says the secret ingredients

with insight into the short and medium to successful credit management have

term. Such insights add objectivity to less to do with technology and more to

our decision making and assessment of do with how these analysts digest data.

risk. This is much more technical than “Technology takes you back to base

fundamental analysis and it requires a lot camp,” he says. “Investors essentially

of clean and robust data. It also requires have the same technology so it does

a willingness to constantly search out not add a competitive advantage. What

information that can help add value.” makes managers different is how they

use it.

One of Wauton’s first moves was to

create a research team in Mumbai. “This “Technology enables investors to

team adds support to our fundamental look inside portfolios and gives them

analysts in London by allowing them tools such as value at risk (VaR) and

to get to know company management tracking error analysis. These are

even better. The team in India also helps outputs you would expect a sophisti-

us on the timing, sizing and hedging cated fund manager to have. You have

aspects of our business,” he explains. to be more insightful and statistical if

He says India’s time zone allows much you want to have an edge. Our models

of the analysis to be done in the period are proprietary. They involve analysis

between the US markets closing and that you cannot buy off the shelf and

the European markets opening. require a significant amount of time for

design, testing and programming. Our

Aviva Investors now has over 140 desire is to look at the market from as

fixed income investment professionals many different dimensions as possible.

in the UK, France, Australia, India and No third party analytics can do this on

Poland. In May, it appointed Nancy our behalf.”

Mark Wauton, head of credit, Utterback and Alessandro Rovelli

Aviva Investors

as senior credit analysts in London. However, a model is only as good

Utterback, who joined from European as the data that feeds it. Dinesh Pawar,

Credit Management, has over 25 years Aviva Investors’ head of credit flow

of experience in credit research. She trading, says: “There are a lot more infor-

was brought in to integrate further Aviva mation sources in the market compared

Investors’ offshore research team in with three years ago. The real challenge

Mumbai. She now also oversees the for fund managers is how to manipulate

Summer 2011 – the markit magazine/16 Focus: Aviva Investors

Wauton is quick to mention Markit you hold is limited. When it comes to the

Markit Liquidity Metrics provides Desktop, the unique viewer screen long-only world, this is especially true

liquidity scores and metrics for CDS, application for cross-asset content – with financials.”

bonds, loans and asset-backed Markit’s fixed income, cash and deriva-

securities (ABS) with municipal tive pricing combined with third-party He says the impact from regulatory

bonds and agency ABS in the pipe- data and news. It is real-time and flex- changes has become more apparent

line. The metrics combine number ible for implementation into proprietary in financials, considering new require-

of dealers quoting a security with systems – Aviva Investors customised ments related to Ucits, US “40 Act”,

number of quotes sent, along with it for its own needs. Wauton says Aviva Mifid, FAS 157/TOPIC 820, IASB,

inputs such as observed bid/offer, in Investors built a propriety model around Solvency II and Basel. “It is impor-

order to produce a liquidity score on Markit’s Desktop liquidity feeds so it tant to try and see whether a regula-

an asset by asset basis. The service could supplement its own variables with tory trade has been priced into the

– powered by direct data contribu- the Markit data. market or not. That is something that is

tions to Markit as well as aggregated intangible. It can be a potential source

quotes sent by dealers to their clients Pawar says firms that managed of risk that we need to factor into our

– can be used to track the liquidity to weather the crisis that started in decision making,” he adds.

risk embedded in a given security. 2007 were those that used dynamic

It can also be used as an input into approaches such as this. “The market Wauton says Aviva Investors plans to

calculating reserves, valuation adjust- can change very quickly in terms of launch more funds. It branched out into

ments and risk charges such as the volatility and liquidity,” he explains. “Our the absolute return sector initially with

Basel III Incremental Risk Charge. dynamic process allows us to posi- the Global Absolute Credit Fund, which

tion ourselves accordingly in terms targets Libor +3.5-5.5 per cent net and

of taking into account the downside then moved into the Libor +10 per cent

the data in terms of gathering it, repro- risks and hedging ourselves appropri- area via a Credit+ strategy with a bias

gramming it and making it more mean- ately. It helps us to make sure we are towards capital structure trading that

ingful for our portfolios. We are privy to well compensated for the risks that we incorporates equity long/short. “If you

so much information whether it is from are taking.” look at the nature of the trades that we

third-party data providers, investment use and the backgrounds of the people

banks or issuers. Our team in Mumbai “Not many long-only funds are able we have recruited, they are the founda-

digs through it all, filtering out biases and to short the market using CDS. We tions required for these types of strate-

formatting it for our purposes.” have worked out how to hedge our gies,” he says. “The credit process we

long-only positions. This not only gives have put in place has made a big differ-

Pawar refers to Markit’s Evaluated us compensation for our risks, it also ence to our retail and institutional funds

Bonds service, which provides pricing, provides us with a good measurement in terms of the risk-adjusted returns they

transparency and liquidity data on corpo- of what liquidity is,” he adds. have produced.

rate, government, sovereign, agency and

municipal bonds. He says the liquidity Pawar says the investor base in credit “But as we all have learned, past

scores and measurements that this has not changed that much since the performance is no guarantee for what

service offers are particularly useful given crisis. “Although the number of market is going to happen in the future. We

the uncertainty associated with trading in participants has reduced, there are continue to analyse every trade from the

these markets. Markit’s Evaluated Bond periods when new ones come in,” he perspective of which risk can be offset

prices are derived using price inputs says. “To a certain extent, the market and how well compensated we are for

from a variety of sources that are fed into has become more polarised. Bonds assuming it. It is on an on-going basis,

a dynamic option-adjusted spread (OAS) that were illiquid can quickly become not a last-minute one.”

model. This model produces a price vali- liquid and vice versa. We see liquidity in

dated against a number of parameters this market come and go but it is really Career in brief

– not simply a mark-to-market price from about the speed of it. You have to be Mark Wauton is head of credit at Aviva

a dealer. very nimble and aware that anything Investors. Before joining Aviva, he was at ABN

Amro from 2006 to 2008 as head of Strategic

Propriety Credit Trading. From 2003 to 2006

Wauton was co-manager of the AlphaGen

credit fund at Gartmore, where he worked

“You have to be very nimble and aware that after spending four years as UBS Global Asset

Management as head of European Fixed

anything you hold is limited.” Income from 1999 to 2003.

the markit magazine – Summer 2011/18

Source: Reuters Focus: Eurozone

The eurozone sovereign debt crisis is testing the single

currency to the extreme, with the fragile state of the

peripherals putting strain on the core. Gavan Nolan at

Markit assesses the likely shape of Europe’s landscape

Frayed around

the edges

Notwithstanding the recent indecision and impotence. Nowhere is

bout of financial volatility, the this more evident than in the eurozone

world economy still looks sovereign debt crisis.

well set for continued robust

growth in 2007 and 2008”. The opening When the euro came into being in

sentence of the IMF’s World Economic January 1999, the concept itself was

Outlook published in April 2007 the subject of heated debate among

captures the overconfidence that was economists. Most of it centred on the

endemic during the “Great Moderation”. theory of the optimum currency area,

Economists, bankers, politicians: all pioneered by Robert Mundell. This posits

were guilty of hubris. But as we live with that a geographical region would be best

the consequences of this remarkable served by a single currency, regardless

period, history will surely record that the of whether there are national borders.

aftermath was marked by uncertainty, Interest rates and monetary policy would

the markit magazine – Summer 2011Focus: Eurozone /19

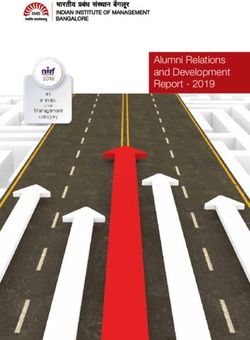

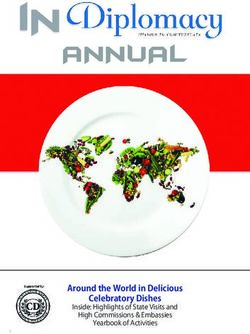

be set by a single central bank. Differ- Government Net Debt/GDP

ences in factors of production – labour

%

and capital – would adjust as the region

180

would have sufficient linkages to cope.

Ireland

160 Spain

As the years went by, it became

Portugal

clear that the internal imbalances the 140

Greece

naysayers feared had come to frui-

120 UK

tion. Four countries, in particular,

were exposed by the tsunami that hit

100

the capital markets in 2008. But the

four, known as the “peripherals”, are 80

far from homogenous and ended up

in their current predicament in quite 60

different ways.

40

Greece’s entry to the eurozone in 20

2001 was highly controversial; the

country had a long history of fiscal prof- 0

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

ligacy. Indeed, recent work by Carmen Year

Reinhart and Kenneth Rogoff, the inter-

national economists, has shown that Source: International Monetary Fund

Greece has been in default one out of

every two years since it gained inde-

pendence from the Ottomans in the first Portugal’s economy shared some and gorged themselves on housing. In

half of the 19th century. However, the of Greece’s flaws, if not to the same Ireland, home prices tripled between

euro has always been a political project extremes. It too went into the crisis with 2000 and 2006, financed by banks that

and Greece’s high public debt levels high debt levels, in this case 58 per cent were more than happy to lend. A classic

were not viewed as an impediment to of GDP. One could see how it could be speculative bubble was the result, and

membership by Europe’s elite. vulnerable to capital market discipline. this was already fit to burst before the

The same could not be said about crisis began. Spain’s consumers were

The Greek government then went Spain and Ireland, if only judging by the similarly overleveraged, though their

on a “positive orgy of borrowing and same metric. Both entered the finan- banking system on the whole was less

spending”1, as it was able to raise cial crisis with government surpluses reckless. So, even if both countries had

funds at more or less the same interest and relatively low levels of public debt. low levels of public debt, their private

rates as Germany i.e. very low. Greek Spain’s debt/GDP ratio was a creditable sectors more than made up for it.

governments had a habit of using public 26 per cent while Ireland’s was a mere

money to maintain social harmony, and 12 per cent − less than a quarter of that But if the debt was private, how did

this one was no different. Inefficiency model of prudence, Germany. Govern- Ireland’s government, in particular, end

and overstaffing were rife in the public ment fiscal indiscipline was clearly not up in 2011 dependent on external aid

sector. The total number of civil serv- the problem here. to stay solvent? The answer lies in the

ants was 768,009 in July 2010 – figures irresponsible lending by Ireland’s banks.

before this date are unavailable as it However, consumers took advan- Once the housing bubble had burst,

was the first time the number of state tage of rock-bottom mortgage rates the deterioration in asset quality that

employees had been counted2. There

was also a tradition of tax avoidance.

By 2007, Greece’s net debt to GDP ratio

had spiralled to 105 per cent − nearly

double the level permitted under the EU “ Greece has been in default one out of every

Stability Pact.

two years since it gained independence

from the Ottomans in the first half of the

Greece’s ‘Odious’ Debt, Jason Manolopoulos (2011)

19th century.”

1

2

ibid

Summer 2011 – the markit magazine/20 Focus: Eurozone

“ Bond yields and CDS spreads are at record parliament. But Spain has also imple-

mented tough austerity measures. De

levels; indeed they are at levels at which Grauwe is convincing in his argument

that the difference lies in sovereignty

debt reduction is all but impossible.” of currency. The UK issues debt in its

own currency. If international investors

take a dim view of the country’s fiscal

state, they can sell sterling-denomi-

followed left banking balance sheets The last comparison is particularly nated government bonds. They would

− several times Ireland’s GDP − in a interesting. In a recent paper 4, Paul de then probably wish to sell the ster-

miserable state. I was criticised in 2008 Grauwe of Leuven University looks at ling proceeds in the foreign exchange

by an executive at one of the major Irish what he calls the paradox of the UK and market, thereby driving the value of the

banks for describing the Irish banks as Spain. Since the financial crisis began, currency down. As a last resort, the

“vulnerable”. This proved to be an under- the UK’s net debt has risen faster than Bank of England can step in and fill the

statement. One by one, these banks that of Spain. In 2011, the UK’s debt/ liquidity gap. Thus, not only can it avoid

were shut out of the capital markets, GDP ratio is forecast to be 75 per cent, a liquidity crisis, the real economy will

prompting the government to provide while Spain’s is expected to be about benefit from a sterling depreciation.

liquidity and recapitalise their balance 53 per cent. It will also have lower fiscal

sheets. By the time this process was deficits until 2014. Yet Spain’s CDS Spain, on the other hand, has limited

finished – it took several iterations – spread is over four times that of the options. If investors take flight, the

Ireland’s budget deficit had climbed to UK’s. What can explain this? proceeds from the sale of the euro-

a record 32 per cent of GDP and its net denominated Spanish government

debt/GDP ratio had reached 95 per cent, The UK government would no bonds will no doubt be reinvested

with further increases a certainty. Private doubt point towards its commitment to in safer pastures, such as Germany.

debt had been transferred on to the austerity and its aim of eliminating the Liquidity will therefore be sucked out

public accounts and the country with the deficit over the course of the current of the Spanish monetary system. The

lowest national debt in the EU five years

earlier now had one of the highest.

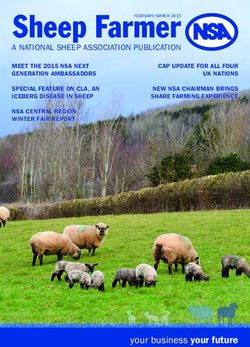

UK and Spain Five Year CDS

The fiscal predicament of Greece,

Basis Points

Portugal and Ireland is now regarded as

400

unsustainable by the financial markets.

UK

Bond yields and CDS spreads are at

350 Spain

record levels; indeed they are at levels

at which debt reduction is all but impos- 300

sible. But what role does their euro

membership play in making their situa- 250

tion so desperate? Here, it is instructive

to look at the example of Spain, perhaps 200

the best placed of the peripherals.

150

Spain is widely perceived as having

100

decoupled from the other three

laggards of the eurozone. Its five-year 50

CDS spreads trade significantly tighter

at around 250 basis points (bps), 0

compared with just under 700 bps 1 Jan 1 May 1 Sep 1 Jan 1 May 1 Sep 1 Jan 1 May 1 Sep 1 Jan 1 May 1 Sep 1 Jan 1 May

2007 2007 2007 2008 2008 2008 2009 2009 2009 2010 2010 2010 2011 2011

for Portugal and over 1,400 bps for Date

Greece (the highest of any sovereign

in the world)3. But this is still consider- Source: Markit

ably wider than the “core” countries

of Germany and France at 40 bps and

72 bps respectively and the UK, which 3

Data as of June 2 2011

trades at around 57 bps. 4

The Governance of a Fragile Eurozone, Paul de Grauwe, April 2011

the markit magazine – Summer 2011Focus: Eurozone /21

European Central Bank (ECB) can Grauwe and many other economists The receipt of ESM funds in return

provide liquidity as a lender of last resort argued before the creation of the euro for strict austerity measures will involve

– and has done in recent times – but that it would run into problems if the a loss of national sovereignty, and is

it isn’t controlled by Spain and would mechanisms for fiscal transfer between therefore a step towards political inte-

be reluctant to do so on an indefinite member states didn’t exist. The sover- gration. The idea of a eurobond, jointly

basis. The markets are aware of this, eign debt crisis appears to have proved issued by the participating countries,

hence the higher credit risk attached to them right. Yet we have seen that the has also won admirers. But this would

Spanish bonds. piecemeal attempt at addressing this surely be a step too far for Germany

and other AAA-rated countries; the

issue of moral hazard would loom large

“ In bailout-fatigued countries, the political in their thinking. Greece has already

piggybacked on to Germany’s credit

case for private sector participation is clear.” rating, and Germany would be loath

to let this happen again. Perhaps a

more amenable solution would be

to create institutional measures that

If Spain and the other peripherals are flaw – the European Financial Stability would co-ordinate economic policies in

to stay in the euro, then they will have Facility (EFSF) – has caused resent- the eurozone. But the social unrest in

to regain competitiveness. And there ment within the more prudent coun- Greece and the recent arguments over

is no doubt they have become uncom- tries, Germany and Finland. This, in foreign control of privatisations suggest

petitive. Relative unit labour costs for turn, has led to relatively punitive terms that it would be politically unfeasible.

the peripherals rose dramatically over being attached to the bailout funds,

the last decade, with Spain seeing one with interest rates well above those of So, if a break-up of the euro is too

of the sharpest increases. A country the core. Debt reduction is hard under painful to contemplate and political

with an independent, floating currency those circumstances. union is unrealistic, it leaves us with the

would normally allow a depreciation current approach of muddling through.

to make its exports more competitive. The ECB has been propping up the More bailout funds, attached to strict

As members of the eurozone, Spain system by buying peripheral govern- austerity measures, are expected for

and the others don’t have this option, ment bonds directly through its Securi- Greece. How long can this can this go

leaving them little choice but to engineer ties Markets Programme and indirectly on for? We know that Greece won’t be

an internal devaluation, i.e. lower wages by accepting government bonds as able to return to the capital markets

and prices. This will weigh on growth collateral. Some would say that this is next year. Will it be able to in 2015?

and make it even harder to reduce debt. right and proper given its role to provide The austerity measures are making

The peripherals have taken this route liquidity and maintain financial stability. debt reduction all but impossible. A

and are now experiencing the hardship Others believe that it has gone too far as hard debt restructuring – principal

associated with it. a lender of last resort. writedowns – is being priced in by the

market, though this has been ruled out

Given the pain associated with this The European Stability Mechanism by the EU. But it is hard to see how

adjustment, and the threat to social (ESM), due to be introduced when the else Greece can be put on an even

harmony, would it make sense for the EFSF expires in 2013, is a de facto keel. The contagion that EU govern-

peripherals to leave the eurozone? permanent European Monetary ments fear could then ensue, and we

The shock of a break-up of the single Fund. Unlike the EFSF, this will force will find out just how fragile the euro-

currency would be enormous, particu- bondholders in the private sector zone really is.

larly to the region’s financial system. to share in any restructuring costs.

German and French banks are heavily Germany, in particular, was insistent

exposed to the periphery, never mind on this measure being introduced.

the domestic banks themselves. The Some have argued that this will make

“core” euro that would remain would it even harder for peripheral countries

probably see a large appreciation and to raise funds because investors will

worsen the competitive position of be very much aware that they could

Germany, France and the rest. be taking a haircut in the future. But in

bailout-fatigued countries, the polit- Gavan Nolan, director,

The second option is to proceed ical case for private sector participa- credit research, Markit

towards greater political union. De tion is clear.

Summer 2011 – the markit magazineFocus: Leveraged finance /23

As the refinancing of a glut of maturing loans collides

with investors seeking high yields in a low interest

rate environment, it is turning out to be a year of rapid

growth for the leveraged finance markets, writes

Mathew Cestar, head of leveraged finance, EMEA at

Credit Suisse

Tearing

down the

“maturity wall”

T

he global leveraged From the start of 2008, there was

finance markets have been roughly $1,000bn that needed refi-

extremely active so far this nancing, of which somewhere between

year, especially in the high- a half to two-thirds has now been

yield bond sector which completed and where there is more to

is on course to set a new do, it tends to be in industries that are

issuance record. There has been about readily refinanceable.

$195bn of global issuance so far this

year, of which Europe has contributed On an even more positive note for the

around $55bn, or about a third of global high-yield bond market, corporates are

volumes. To put these numbers in benefiting from new economic activity

context, $178bn was roughly the global and there has been a noticeable uptick

volume for the whole of 2009 and 2010 in M&A activity. If this gathers pace, the

saw $315bn in new issuance. This new high yield and leveraged loan markets

issuance activity has largely been driven should continue their rallies.

by refinancing which has addressed the

lion’s share of the concerns about the Still water (no bubbles)

“maturity wall”, or the high volume of Some have wondered if the returns and

loans originally slated to mature in 2013- all the cash inflows into the high-yield

2014, particularly in the sponsor-driven markets signal the beginning of another

part of the market. bubble, similar to the years leading up to

Summer 2011 – the markit magazine/24 Focus: Leveraged finance

European High Yield and Leveraged Loans Debt Maturity Profile the financial crisis. In short, the answer

is no − the dynamics are different. In the

€ Billions

post-crisis world, particularly in Europe,

90

leverage levels and transaction terms

81.7

West Euro High Yield and Leveraged

77.4 have been more conservative. At the

80 Loans Maturing by Year

(As of 31 Dec 08)

72.9 same time, corporate default rates have

70 66.1 64.3

come down below 2 per cent which,

West Euro High Yield and Leveraged

Loans Maturing by Year combined with strong corporate earn-

60 (As of 29 Apr 11) ings, have led investors to seek out

48.9

47.5 corporate cash flows.

50

41.0

40 On the investing side, the equity

33.6

27.4

30.2 culture in Europe is not quite as devel-

30 oped as it is in the US and there is an

underlying preference for higher-yielding

20 15.7

12.5 corporate debt. In the current low

7.9 7.7 8.5

10 5.7 interest rate environment, investors have

3.0

been moving down below investment

0 grade in an effort to pick up yield.

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Year

The historical 10-year average yield

Source: Credit Suisse in Europe for high-yield bonds is nearly

10.5 per cent but yields are currently

between 6.75-7 per cent, so the

Historical European High Yield Bond Yields markets are trading 400 basis points

(bps) below the long-term average.

%

However, spreads are around long-term

20

Historical Average

averages of roughly 460bps, which is

Current clearly a reflection of the fact that base

rates are so low and this creates a

very attractive issuing opportunity for

15

borrowers. Yet, despite the impressive

growth in issuance in this market, there

10.39% has not been an unhealthy relaxation in

10 underwriting standards.

6.81%

Of CLOs and M&A

There has already been a pick-up in

5

Jan 00 Jan 02 Jan 04 Jan 06 Jan 08 Jan 10 activity in the collateralised loan obli-

Month/Year gation (CLO) market in the US and it is

expected that, towards the end of this

Source: Credit Suisse year and into the beginning of next year,

there will be new CLO activity in the

European market as well.

In addition to the CLO buyers and

European banks, there have been new

“ Despite the impressive growth in issuance institutional lenders coming into the

market who are following the deal flow as

in this market, there has not been an M&A activity picks up in the region. Now

that the leveraged loan market and high-

unhealthy relaxation in underwriting yield bond markets are firing on all cylin-

ders, private equity buyers are becoming

standards.” increasingly active in Europe, refinancing

the markit magazine – Summer 2011Focus: Leveraged finance /25

their existing portfolio companies and Shift in Share of New Issuance

doing new entry financings.

%

100

M&A activity is up very sharply 4.1%

13.7% 12.0%

with first-quarter volumes in EMEA at 90 10.3%

$287bn, up 64 per cent from the same 7.2% 6.3%

80

period a year earlier. Much of the activity

50.5%

has been concentrated in the more 70 59.9%

defensive sectors. As activity picks 60

up, more cyclical industries will attract

50

interest. Most of the activity has been 85.6%

1.4%

79.1% 81.7%

new buying but there have also been 40 2.4%

some consolidation plays here in the UK

30

and across Europe. 48.1%

20 37.7%

Souring sovereigns, sweetening 10

corporates

0

As interest in corporates has picked up, 2006 2007 2008 2009 2010

financials have suffered, which is not Year

altogether surprising as, in many cases,

Leveraged Loans Mezzanine HY Bonds

financials are simply second-order plays

on the sovereign states in which they Source: S&P LCD (Note: HY volume excludes PIK instruments and short-term bonds; reflects corporate bonds only – in case

function. The sovereign crisis in Europe, of a global issue, the portion allocated to European HY investors is counted (if unknown, the entire global issue is counted))

There has been a very large structural

“ Investors have not shied away from all shift from loan issuance to bonds.

Pre-crisis, leveraged companies were

European credits in peripheral Europe capitalised broadly at 75-80 per cent

although that is something we are in loans and the balance was in public

capital market bonds. That had inverted

monitoring.” in 2008-2009 but is now normalising

into more of a 50/50 split and we see

the shift continuing further towards

loans in the future.

specifically among the debt-laden Traditionally, investors have tended

peripherals, has been well covered by to stay within western Europe because

analysts and the press and concerns of the more developed regulatory

about the debt exposure of these banks framework and greater understanding

to certain sovereigns has kept investors of how the region’s legal systems

cautious on the sector. operate. To some extent, regulatory Mathew Cestar, head of leveraged

finance, EMEA, Credit Suisse

uncertainty in the developed European

Investors have not shied away from all nations following the financial crisis

European credits in peripheral Europe Career in brief

has emboldened investors to explore

although that is something we are moni- other markets. Mathew Cestar is a managing director in the

investment banking division of Credit Suisse,

toring. Many companies that we would London. He is head of leveraged finance and co-

finance in the European capital markets There are currently some interesting head of the EMEA credit capital markets group.

are large and have revenues that are high-yield market opportunities in the Prior to this, Cestar was co-head of EMEA

pan-European or global in nature. Vigi- European emerging markets. In Poland, leveraged finance capital markets. In 2004,

he was appointed head of high yield capital

lance should be maintained in case the for example, which has weathered the markets in Europe. He began his career in M&A

crisis becomes more acute, but so far it global financial crisis reasonably well, at James D. Wolfensohn Inc in New York and

seems that the risk of contagion to the there has been significant M&A and held various high yield capital markets positions

European corporate credit markets has private equity activity to foster new at Goldman Sachs and Credit Suisse between

1996 and 2004.

been mitigated. financing needs.

Summer 2011 – the markit magazine/26 Source: Getty Images Focus: Market transparency the markit magazine – Summer 2011

Focus: Market transparency /27

Intuitive acceptance of irrational ideas coloured the

Ancient Greeks’ view of the world. It even persists

today in the financial markets, skewing the arguments

around transparency, writes Eugene McErlean,

advisor to Transparency International Ireland

The

Persephone

complex

I

n Greek mythology, the Persephone and the causes of the financial crisis.

theory explained the four seasons. For example, one of the core argu-

Hades, God of the Underworld, ments running through financial

kidnapped Persephone, goddess of regulation and risk management is

Spring, and later allowed her to return that transparency and disclosure are

to earth for part of the year in return good for markets. The news confer-

for marrying him. When Persephone ence held by Ben Bernanke, chairman

was in the Underworld, her mother, of the Federal Reserve, following the

Demeter, goddess of the harvest, April Federal Open Market Committee

became sad and cooled the world so meeting, was the latest example of the

that nothing could grow. For an ordinary regulator’s commitment to openness

Athenian, this was a credible explana- and transparency.

tion for the four seasons. Who would

have doubted the causal connection, However, it is also one of the para-

which was reinforced every year by the doxes of the recent credit crunch that

regularity of the repeating pattern? after 30 years of measures to improve

transparency in financial markets, it

It would appear that the Persephone was the very opacity of bank balance

problem is not confined to Ancient sheets that precipitated the freezing

Greece. Intuitive acceptance of irrational of the credit markets. No one believed

ideas based on inner values and beliefs that the published financial statements

are in abundant supply in debates as represented the true state of health

diverse as the origins of global warming of many of the world’s banks. In July

Summer 2011 – the markit magazine/28 Focus: Market transparency

last year, Irish banks passed Euro- impose a one-size-fits-all model and are in 1995, FASB relented and proposed

pean stress tests. Four months later, backward-looking.” FAS 123, a watered-down require-

the country had to seek assistance ment for companies to either expense

from the European Union/International “No regulation, no rule, prohibited us or at least disclose in the footnotes the

Monetary Fund bailout fund. Bank of from participating in subprime, CDOs, impact of options awards on earn-

Ireland claimed a core Tier 1 ratio of high-yield bonds, covenant-light loans, ings per share. However, following

about 8 per cent, yet it found itself shut all of these toxic, toxic assets,” Waugh the dotcom bubble and the Enron

out. It was significant that in the Irish continued. He added that Basel regula- accounting scandal, the issue was

bank stress tests in March, central bank tions actually encouraged institutions revisited in 2004 when FASB issued

governor Patrick Honohan and Matthew to buy European sovereign debt from a new rule, 123(R), finally requiring

Elderfield, the financial regulator, countries such as Iceland and Ireland, companies to expense option awards in

placed significant emphasis on the new because the rules did not require capital their financial statements. The predic-

detailed transparency of the process. to be put up against it. “History has tions of economic disaster were proven

The initial market reaction indicated that shown that no amount of prescribed to be unfounded and the disclosure

the transparency had the desired effect regulation can replace sound manage- measures became generally accepted –

although it does set a new standard of ment and principles-based governance, further evidence that after several thou-

granularity expected for the rest of the or a board or a management team sand years, the Persephone problem is

European bank stress tests due later in who are accountable for results to their still alive and well.

the year. shareholders,” he said. Waugh’s obser-

Some empirical studies have shown

that greater bank disclosure and the

“ New rules being put in place to govern consequences of bank transparency

have positive economic effects on the

the global financial system, such as Basel stability of the banking sector.

III, and the US Dodd-Frank legislation, • Findings indicate that banking crises

are less likely in countries where

impose a one-size-fits-all model and are transparency and regulatory disclo-

backward looking.” sure are high. A high level of trans-

parency leads to a higher supervision

level, lower financing cost and also

a lower risk profile, thus limiting the

So the question that really has to be vations represent a general view often likelihood of failure.

answered by advocates of transpar- expressed in the industry about the gap

ency is does it produce any different between the objectives of financial regu- • However, transparency may be

outcomes? Does all the trouble and lation and the reality of its effectiveness “bad” if banks in difficulty have

strife caused by complying with trans- on the ground. suffered an exogenous shock. More

parency obligations make any differ- disclosure of financial informa-

ence or are they just another example Conversely, history also shows that tion generates market reaction that

of the Persephone problem? anticipated fears about the negative can exacerbate − often unfairly − a

impact of new disclosure measures bank’s situation.

Rick Waugh, chief executive of can be misplaced. In 1993, FASB, the

Canada’s Bank of Nova Scotia and vice- professional accounting standards • In other words, transparency can

chairman of the Institute of International organisation, proposed mandatory make a bad situation worse and lead

Finance, which represents 460 of the expensing of option grants for execu- to a banker’s worst nightmare − a run

world’s largest financial institutions, tives. Large portions of the business on the bank.

spoke for many when he said at a community were alarmed and lobbied

recent AGM: “Financial regulation will against the measure, claiming that Consequently, it is entirely rational for

not prevent the next financial crisis and expensing options would destroy the bank executives to be concerned about

it can work against firms in financially growth of the high-tech sector, costing increased transparency on the basis that

sound countries such as Canada. New jobs. A study by the Employment Policy any bank, no matter how well managed,

rules being put in place to govern the Foundation claimed that the loss to may be negatively impacted by external

global financial system, such as Basel the US economy would be more than events. The natural instinct of bank

III, and the US Dodd-Frank legislation, $2,300bn over a decade. Consequently, executives to protect the interests of their

the markit magazine – Summer 2011Focus: Market transparency /29

“ If the architecture and operation of the of leaders in the industry who have

proposed meaningful changes that will

system are constructed in an open and make a substantive difference to the

clarity surrounding how market partici-

transparent manner, it will enable the pants trade and account for derivatives.

derivatives market to develop in a long- What is clear in my view is that if

term sustainable way, consistent with free the architecture and operation of the

system are constructed in an open

market principles.” and transparent manner, it will enable

the derivatives market to develop in a

long-term sustainable way, consistent

institution may militate against the very impractical. First, many of these markets with free market principles. Recently,

thing that is necessary for the protection do not lend themselves to any further Phil Angelides, the chairman of the US

of the whole system, transparency and improvements in transparency because Financial Crisis Inquiry Commission,

disclosure. The apparent conundrum of the high degree of trade customi- remarked that he was very concerned

remains as to why countries boasting sation caused by the need to create about US Treasury’s decision to exempt

some of the most far-reaching disclosure perfect hedges. Second, how can we foreign exchange swaps and forwards

and transparency measures (and with square the circle of achieving a high from being traded on exchanges. “We

banks subject to the most sophisticated level of transparency while at the same learned one big thing. Transparency

regulation) were at the centre of the time not compromising the liquidity of is good and I believe that having this

recent financial crisis. the markets by requiring either explicit $3,000bn market on exchanges where

or implicit disclosure of participants’ people can see the pricing, where

One view is that the potential positions? These types of disclosure there’s transparency for both regulators

systemic benefits of market transpar- problems are not unique to the deriva- and the marketplace, is good,” he said.

ency measures may have been more tives market and, with some creativity,

than offset by the build-up of hidden risk the industry can design and calibrate Both the perception and practice

through the growth of opaque deriva- systems that mitigate these concerns. of a fair and transparent market will

tive instruments. By way of example, the build confidence, safety and long-term

consequences of this absence of trans- One benefit that transparency liquidity. However, if changes are prin-

parency have been particularly perni- would bring to the market is clarity on cipally regulator-led with a push back

cious in Ireland. Sean Quinn, formerly infrastructure costs. The derivatives from the industry, then Waugh’s predic-

one of Ireland’s richest men, built up a market today reminds some experts tion of another financial crisis is more

hidden 30 per cent stake in Anglo Irish of the early days of the Nasdaq stock than likely correct.

Bank using contracts for difference. The market. Following the introduction of

attempts to cover over the unravelling reforms and electronic trading systems The views expressed are my personal

of this position were at the epicentre of in the 1990s, excessive margins were views and do not represent the views of

the loss of confidence in the govern- exposed and Nasdaq stock trading Transparency International.

ance systems regulating the Irish costs were reduced to one 20th of their

banking system. It almost goes without former level. Other anticipated benefits

saying that examples of opacity leading include a better-managed risk profile

to the build-up of hidden risk can be for participants. Transparency should

repeated several times over throughout improve market discipline because risk

the subprime crisis. Consequently, the taking can be monitored more easily, Eugene McErlean,

spotlight is now very firmly focused on and with improved price discovery the advisor to Transparency

International Ireland

the levels of transparency and disclo- likelihood of failure should be reduced.

sure in the financial markets, particularly

Career in brief

the over-the-counter markets. To be a supporter of transparency

Eugene McErlean is an independent banking

in the market is to be part of a broad

consultant and has been an advisor to

However, some leaders in the church. It is one of the ironies of the Transparency International Ireland since 2009.

industry think that there is sufficient crisis that Erin Callan, the former chief He spent 11 years at Allied Irish Banks (AIB),

disclosure in the markets already and financial officer of Lehman Brothers where he was group compliance officer from

point to some features that would 1995 to 1997 and group internal auditor from

was a noted advocate of transparency.

1997 to 2002.

make the application of new measures However, there is a narrower supply

Summer 2011 – the markit magazine/30 Environmental: Redd February 2011 saw the first certification of a project in the $143bn-plus global carbon markets to earn carbon credits achieved by preserving forests. This was a landmark moment for Redd (Reducing Emissions from Deforestation and Degradation), which, it is hoped, will be a cornerstone of the fight against climate change. Mike Scott writes Reddy steady go the markit magazine – Summer 2011

Environmental: Redd /31

Source: Julian Prolman

D

eforestation and forest Forests outside the industrialised

degradation contribute countries contain 538 gigatonnes

at least 18 per cent of of carbon, equivalent to 40 years of

global greenhouse gas manmade greenhouse gas emissions

emissions, conservation at 2004 rates. With most measures

groups say, and without to deal with climate change initiated

addressing these emissions the world in the industrialised or fast-growing

will not be able to keep global warming emerging economies, forest projects

to below 2°C, the level targeted by the offer a chance to get some of the

United Nations Intergovernmental Panel world’s poorest people involved in the

on Climate Change (IPCC). Deforesta- fight against climate change in a way

tion is the permanent removal of forests that also allows them to benefit from

and withdrawal of land from forest their actions.

use, while forest degradation refers to

damage to forests caused by activi- South and Central America, Africa,

ties such as logging, large-scale and Asia and Oceania are all significant

open forest fires, collection of fuelwood stores of forest carbon. However, under

and non-timber forest, production of business-as-usual scenarios, Africa will

charcoal and grazing, limiting produc- lose the biggest proportion of its forests

tion capacity. to logging, agriculture and other devel-

opment – 67 per cent or almost 300m

The main drivers of rapid deforesta- hectares. This equates to more than 58

tion are industrial-scale agriculture such gigatonnes of carbon emissions. Asia

as soya and palm oil production and and the Americas are also predicted

cattle ranching; industrial logging driven to lose more than half their forests if

by international demand for timber; nothing is done, so the consequences

poverty and population pressure as of not addressing the problem are huge.

people seek farmland, fuelwood and

building materials and infrastructure Between 1990 and 2005, about

development, especially for roads, 13m hectares of forests were lost per

mining and dams. Most of this deforest- year, mainly through forests being

ation is taking place in developing coun- converted to agricultural land. Defor-

tries in Asia, Latin America and Africa estation results in the release of the

– the very countries that will be hardest carbon originally stored in trees as CO 2

hit by the changing climate. emissions and about 1.7bn tonnes of

Summer 2011 – the markit magazineYou can also read