Vale: Constructing a Brand - Vale.com

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2007

1931

1944

CHAPTER 10

Vale: Constructing a Brand

10.1 An international brand copper, manganese ore, iron ore, nickel, bauxite, phosphate, potash, 335

coal, uranium, diamonds and platinum group metals.4 The sum of

For 65 years, the CVRD logo was spread out across the four all the results obtained in the year made the company the world’s

corners of the world: on train cars, on ships, on train stations, on second largest miner.5

calendars, on appointment books and pens, on the doors of offices

and in trade contracts. However, when joining together those

letters, everyone – whether engineers, geologists, the company CEO,

office assistants, secretaries, mine workers, locomotive engineers, 10.2 A global company

shareholders, or passengers at a station – saw only one thing: Vale.

Popularly, CVRD was always Vale. Vale and Brazil entered 2007 with good growth prospects. At

On November 29, 2007, at Copacabana Fort in Rio de Janeiro, the start of the year, the United Nations issued its annual report,

Vale CEO Roger Agnelli brought together around 500 employees to in which the United Nations Conference on Trade and Development

announce one of the biggest changes in the company’s history.1 The (UNCTAD)6 ranked the country the 12th largest foreign investor in

reasons for the modification may be summed up in just one word: the world in 2006. That year, a total of US$28 billion was invested by

globalization. The word “Vale” is easily read throughout the world Brazilian companies.7 Brazil had left behind companies in important

and, as of 2006, when it acquired Canadian company Inco, Vale was powers, such as Australia, China and Russia, which invested US$22

expanding across the globe. billion, US$16 billion and US$18 billion, respectively.8 Vale played a

From that point onward, Vale changed its name and logo. The major role in Brazil’s high position in the UN ranking, as the company

logo shows a stylized letter “V” that can represent either a mining accounted for more than 50% of that year’s investment. This was

pit or a heart. The easy-to-read brand reinforced Vale’s image as a largely due to the acquisition of Canadian company Inco, the world’s

global company. No longer were different brands and images used fifth biggest takeover in 2006. It was also the largest transaction ever

in different areas.2 Vale – modern and plural – was unified. made by a Latin American company.9

As it changed its brand, Vale was a company that would The UN report diagnosed the new times being experienced

end 2007 with net income of US$11.8 billion – up 62.9% from by Brazil. The economy had not been dynamic in the 1980s and

the previous year – and new records in all sectors.3 Vale was now 1990s, with growth rates below the world average, but this had now

present in more than 30 countries and was developing an extensive

mineral prospecting program, with projects in 21 countries around

the world. The company was mainly looking for new deposits of 4 - See Vale’s 2007 Sustainability Report.

5 - 2008 Press Book, produced by Vale’s Press Office.

6 - The United Nation’s annual investment report is published by the United Nations

1 - “Simplesmente Vale,” IstoÉ Dinheiro, December 5, 2007. Available at . 7 - See Vale’s 2006 and 2007 Form 20-F Reports.

2 - Idem. 8 - See “Brasil é o 12o maior investidor no mundo, aponta ONU,” O Estado de S.Paulo, October

3 - US GAAP 4Q07 Results. Available at . 9 - Idem.

Vale Our History Vale Our HistoryPhoto at start of Chapter 10:

Vale’s global headquarters

in Rio de Janeiro, 2011.

336 changed. In the 2000s, Brazil’s annual GDP growth rate increased of Vale Inco, which was very strong, with revenue from nickel 337

from 1.7% to around 4% in 2006.10 The rise in GDP that year was activities reaching US$11.78 billion. This amount was four times

a foretaste of what was to come in 2007, when growth hit 6.1%.11 higher than the previous year’s figure of US$2.8 billion, due to

Vale’s share of the total volume traded by Brazil on the seaborne the fact that Vale Inco’s results were only incorporated in the last

market in 2007 reached approximately 32.5%.12 The company quarter of 2006. In 2007, 60.3% of total nickel sales were delivered

confirmed its vocation as a growth driver of the Brazilian economy, to customers in Asia, 26.5% in North America, 11.6% in Europe and

and this would become even more palpable with the results it 1.6% in other locations.15

would achieve year after year. Over the course of 2007, Vale’s shares were the most traded among

In 2007, Vale’s gross operating revenues increased by 62.6% all foreign companies on the New York Stock Exchange, surpassing

to US$33.11 billion. Segmented investments, the pursuit of even those of BHP Billiton, the global leader in the mining sector.16

excellence in work methods and the good moment the country was Average daily trading volumes were around US$725.5 million. This

experiencing made it possible to predict an even better future for was partly related to the company’s strong performance in iron

the company. ore production in Brazil and its sales arrangements with Asian

The former “country of the future,” as Brazil had been described steelmakers, which in February 2008 agreed to an average price

by Austrian writer Stefan Zweig, was now joining the list of increase of 68%.17

emerging countries that were leading global growth. As declared As a consequence of its expansion program, in April 2008 Vale

by the UN report, “external investment by Brazilian companies is announced a partnership with Columbia University to establish a

to some extent part of an expansion and consolidation process research and technical training center.18 A program for training

that is also occurring at home. Brazilian companies are looking to young geologists and engineers developed professionals to conduct

consolidate their industries, such as mining and steel, by buying work in locations such as Kazakhstan.19

foreign competitors in order not to lose markets or become Vale’s presence outside Brazil was not restricted to commercial

targets themselves.” 13 investments. In May 2008, an earthquake measuring 7.9 on the

The investment made by purchasing the Canadian company Richter scale hit southwest China, killing around 90,000 people. 20

marked Vale’s entry into the international nickel market, making Hundreds of houses, schools and hospitals collapsed in less than

it the world’s second biggest producer of the metal.14 For the first a minute. That same month, Vale donated US$1.4 million to the

time, the 2007 figures encompassed the annual performance

15 - See Vale’s 2007 Form 20-F Report.

10 - See Brazil, Finance Ministry. “Economia brasileira em perspectiva.” Special year 2010 16 - “Vale é a ação estrangeira mais negociada na Bolsa de Nova York,” Folha de S.Paulo,

edition. Available at . 17 - “O gol de placa da Vale,” Carta Capital, February 20, 2008.

11 - Idem. 18 - “Vale faz parceria com Columbia para criar centro de pesquisa,” Valor Econômico, April

12 - See Vale’s 2007 Form 20-F Report. 30, 2008.

13 - The document was translated by BBC Brazil in “Brasil bate recorde de investimentos no 19 - “Vale lançará três programas para contratação de recém-formados,” O Globo, May 4,

exterior, diz UNCTAD,” October 16, 2007. Available at . 20 - “A tragédia das crianças,” Veja, May 21, 2008. Available at .

Vale Our History Vale Our HistoryRight: Cateme Elementary

School in Moatize, 2011.

338 International Red Cross to help the victims of the tragedy. In strategic objectives and reward performance, among various other 339

addition to this direct donation, Vale undertook to build three improvements implemented.

“Vale Hope Schools” in Sichuan Province, through a contribution

of US$400,000. African expansion: Moatize, Mozambique

On June 4, 2010, Vale’s Executive Director of Ferrous Metals, Mozambique was the first place outside Brazil to receive a

José Carlos Martins and China Country Manager, Michael Zhu, branch of the Vale Foundation, whose purpose is to contribute to

leading a group of company employees, attended the opening integrated development in the regions where Vale operates. The

ceremony of the Vale Hope School in Yongxing Town, the last Foundation’s investments in the African country have prioritized

of the three schools handed over in Sichuan. The 6,500-m² projects in the areas of health, farming, infrastructure, sport

elementary school has ten classrooms on three floors and is and education. In addition, an initial 1,108 families were

designed for 200 students. 21 resettled in Moatize, Tete Province, the coal-rich central region

of Mozambique. 22 This process was finalized in 2010 with the

Strike in Canada resettling of 1,365 families.

By 2008, Vale had more than 62,000 employees across the world. Seeking better results for the local community, Vale’s investment

The Human Resources Department, with the support of the Legal in the resettlement involved building schools, health centers and

Department, faced the challenge of administrating and conciliating police stations, enabling the creation of functional neighborhoods

various types of labor relations existing in different countries. for the new residents. The projects included the refurbishment of

Relations between employees and companies differ from one Tete Provincial Hospital, Moatize Health Center and the Moatize

country to another, and multinationals are subject to the rules of Intermediate Institute of Geology and Mines, as well as the

the countries where they operate. development of local farming.23 The company worked in a range

A significant number of employees at Vale’s Canadian nickel of areas to integrate the social, cultural and economic life of the

operations in Sudbury and Port Colborne, Ontario went on strike from region. For example, Vale organized a training course in Moatize for

July 2009 to July 2010. Some mining operation employees in Voisey’s Mozambican teachers and school principals, which was completed

Bay, Newfoundland and Labrador also went on strike, from August by around 1,000 participants.

2009 to January 2011. To enable the coal mine to be developed in Moatize, families were

Collective agreements lasting five years were made with the unions moved from the communities of Malabwe, Chipanga, Bagamoio

representing the striking employees, offering incentives to improve and Mithete. Based on various studies and a socioeconomic census

these operations’ long-term productivity and competitiveness, as well conducted to identify the people to be resettled, two areas were

as their capacity to continue generating value. These agreements selected to receive the families: the rural area of Cateme, and the

include a defined-contribution pension plan for new employees and urban neighborhood of 25 de Setembro. The process of producing

adjustments to variable pay programs to enable Vale to achieve

22 - See Vale press release “Vale realiza primeira exportação da Mina Carvão Moatize,”

21 - “Vale entrega a terceira ‘Escola da Esperança’ na China.” Available at . 23 - Idem. Ontario, Canada.

Vale Our History Vale Our HistoryLeft: a Vale train at

sunset in Moatize, 2011.

340 341

a Resettlement Action Plan involved extensive public engagement In Tete, Vale has participated in meetings held at the foot of a

and participation. Before resettlement began, three public baobab tree – locally considered the “tree of life” due its water storage

hearings were conducted, as well as 20 theater performances in capacity. The tree is found in various parts of Africa and many

the predominant local language (Nyungwe), 110 meetings with specimens reach 40 meters in height and 10 meters in diameter.

communities and their leaders using illustrated materials, 4,927 In a tradition arising in ancient African tribes, many community

home visits to families and leaders for mobilization and social decisions are taken around this tree. When the Vale Foundation

assistance purposes, and 639 social consultations. During the arrived in Mozambique, this traditional custom became part of the

process, alternative solutions were considered to avoid or minimize company’s community relationship practices.24 Knowing how to

physical or economic displacement. incorporate local culture into its operating methods was essential

The following infrastructure was built or modernized for the to a company seeking to expand around the world.

communities in both the new Cateme and 25 de Setembro areas: In March 2008, Vale laid the foundation stone of the Moatize

houses, an elementary school, a high school, a library, houses for Project. A little over two years later, in September 2010, it bought

school principals and teachers, information technology rooms, a 51% stake in Sociedade de Desenvolvimento do Corredor do

laboratories, a health and maternity center, a police station, streets, Norte S.A. (SDCN), a company controlling two railroad systems

and electric power facilities along main roads. on the east coast of Africa. The amount paid was US$21 million.

Equipped with 18 classrooms and a library, Cateme Elementary Through two subsidiaries, SDCN participated in two railroad

School is designed for around 1,200 students. Armando Emílio systems in Africa, extending for a total of approximately 1,600

Guebuza High School, in the same neighborhood, is designed for kilometers, in Mozambique and Malawi. It will also be necessary

650 students. It has 12 classrooms, a library, accommodations to construct some additional stretches of track, as well as a new

for 270 boarding students, an information technology room and port in the Nacala region. 25 The acquisition of SDCN was designed

one hectare for practical classes on horticulture, composting and to permit expansion in Moatize and the creation of logistics

processing of cassava flour. Both schools are administered by the infrastructure, supporting the company’s operations in central

Mozambican government’s District Education Department. and eastern Africa. 26 After constructing these new stretches, the

Improvements are made regularly to the infrastructure in the two systems will be interconnected at a point near the Moatize

resettled people’s communities and Vale is taking measures to mineral province.

support families, together with the government authorities, to The first batch of coal from Moatize Mine left Mozambique on

meet their demands. Examples of such improvements include September 14, 2011, on board the ship Orion Express, which sailed

house repairs, maintenance of drainage systems, public roads and

the water supply system, expansion of the electricity network, the

construction of sports facilities, investment in health and farming, 24 - See Vale Foundation, Atuação Internacional. Available at .

Actions are also being implemented to establish alternative ways of 25 - “Vale compra ferrovias no leste da África,” O Estado de S.Paulo, September 22, 2010.

Available at .

training, and vocational courses. 26 - Idem.

Vale Our History Vale Our HistoryCeremony to open Vale’s distribution center

and pelletizing plant in Oman, 2012. Left to

right: Marco Beluco, Vale’s Country Manager

in Oman; Marcelo Figueiredo, Vale’s Director

of Projects in Oman and Malaysia; Ahmed

Al Wahaibi, CEO of the Oman Oil Company;

José Carlos Martins, Vale’s Executive Director

of Ferrous Metals and Strategy; Nasser

Al Jashmi, the Omani Sub-Secretary of

Oil and Gas; Murilo Ferreira, Vale’s CEO;

and Ahmed Al Futaisi, the Minister of

Transport and Communications of Oman.

to Lebanon. The shipment of 35,000 metric tons of thermal coal For the strategy to succeed, ideal conditions would be needed in

342 was taken for 575 kilometers along the Sena-Beira Railroad, which order for the products to be ready for export at a reasonable cost. 343

links Moatize to the Port of Beira in Sofala, central Mozambique.27 Part of the response to this need was provided in September 2011,

The railroad had previously been closed for 28 years due to the when an iron terminal at the Port of Sohar was completed, for use

civil war. Mining operations began in May 2011 and the project’s by Vale. Sohar’s favorable location, next to deep waters outside

implementation has contributed to the dynamism of the Mozambican the Persian Gulf, enabled Vale to take Valemax vessels, capable of

economy, generating jobs and income. transporting 400,000 metric tons, from Brazil to the Omani port.

From there, the iron ore would be transferred onto smaller ships

Oman and taken to nearby locations. In addition to Sohar, only nine ports

At the same time that it was laying the foundation stone in Moatize, in across the world are currently capable of receiving bulk carriers of

2008 Vale also began constructing a pelletizing plant and distribution Valemax size.31

center in the Middle East, at the Port of Sohar Industrial Complex in Together with direct actions for exporting its products, Vale

Oman, a country on the Arabian Peninsula. The facility was opened offered a series of reciprocal benefits to Omani society. One

in March 2012.28 example is an agreement forged by Vale, between the government

The Middle East as a whole was a growing purchaser of the of Oman and the Federal University of Viçosa in Minas Gerais,

company’s products, especially pellets, due to the type of furnace Brazil, to attempt to solve pest problems affecting fruit crops.

predominantly used by steel plants in the region. In May 2008, Vale Signed in October 2010, the agreement provided for an investment

announced a strategic partnership with the government of Oman of around R$10 million over four years. Vale brokered the

through the sale of a 30% stake in Vale Oman Pelletizing Company agreement through the Vale Institute of Technology (Instituto

LLC (VOPC) for US$125 million.29 Tecnológico Vale, or ITV).32

Oman covers slightly more than 300,000 square kilometers and Created in 2009, ITV has the objective of coordinating science

it has a vast coastline, enormous oil reserves and frontiers with and technology actions, with an emphasis on long-term research

Saudi Arabia and the United Arab Emirates, two major commercial carried out in partnership with scientific communities on a national

powers in the region. Under the plans drawn up by Vale, ore and international scale.33 Within a short period of activity, ITV had

processed in two pelletizing plants (each capable of producing 4.5 signed 97 research and development agreements and provided

million metric tons of pellets per year)30 would be transported from more than 50 research scholarships. ITV’s participation in foreign

an iron ore and pellet distribution center in Oman (able to store initiatives has not been restricted to Oman. The Institute has also

40 million metric tons) to customers in Asia and the Middle East. established partnerships with 36 institutions in Brazil and other

31 - Available at .

14, 2011. Available at . 32 - Interview with Luiz Mello, CEO of the Vale Institute of Technology, given to Vale on

October 25, 2011; and the text “Combate a pragas em Omã,” Portal Vale.com (Home -

28 - See Vale’s 2009 Form 20-F Report. Sustentabilidade - Destaques - Combate a pragas em Omã). Available at . Ship unloader at Vale’s

30 - See “Vale no mundo,” Available at . in Oman, 2011.

Vale Our History Vale Our Historycountries, such as Brazilian agricultural research agency Embrapa, Australia

344 the National Council for Scientific and Technological Development Vale also expanded into Australia and, as in Mozambique, coal 345

(CNPq), the Massachusetts Institute of Technology (MIT), and École was once more the point of entry. In April 2007, Vale paid US$656

Polytechnique Fédérale de Lausanne (EPFL) in Switzerland.34 million to acquire 100% of AMCI Holdings Australia Pty. The company,

which operated assets and possessed projects in the area of coal

Guinea and Zambia exploration, was renamed Vale Australia.35 The acquisition of AMCI,

In Guinea, West Africa, Vale is investing in an iron mining project. which had nominal production capacity of 8 million metric tons per

In 2010, the company unveiled the Simandou Project, which will year and reserves of 103 million metric tons, was another step in

involve developing one of the best untapped world-class iron ore Vale’s new mining policy. It also confirmed the company’s efforts to

deposits on the planet. Simandou is also the biggest integrated become a global player in coal – especially metallurgical coal, which is

iron ore mining and infrastructure project in the whole of fundamental to steel production.36

Africa, and it also involves education and human and economic Once the AMCI deal and the creation of Vale Australia had been

development programs. finalized, in 2007 the company was capable of producing 10 million

The first phase of the project involves developing Zogota mine metric tons of coal per year, including its joint ventures in China

in southern Simandou. Its planned total production capacity is 15 (which contributed up to 2 million metric tons per year). Around

million metric tons per year and total investment will be US$1.260 80% of the coal produced by Vale’s new Australian operations was

billion. The aim of the Simandou Project is to replicate in Africa the of the metallurgical type, the remainder being thermal coal. At that

successful mine-railroad-port model developed in Brazil for iron time, of global annual coal production of 5 billion metric tons, just

ore operations. 15% was metallurgical coal.37

In 2010, Vale launched the Konkola North copper project in the Two years later, in September 2009, mining began using the

Zambian Copper Belt, through a joint venture with African Rainbow longwall method (in which the machinery itself functions as

Minerals (ARM). The project’s estimated nominal production excavation tunnels)38 at Carborough Downs coal mine. Using this

capacity is 45,000 metric tons per year of copper in concentrate. method significantly reduced the work accident risk and enabled

Start-up is planned for 2013 and maximum capacity should be higher output – it was estimated that the project would increase

reached in 2015. Construction work began in August 2010. the nominal annual production capacity considerably to 4.8 million

At first, the South and East Limb mines will be developed, and metric tons in 2011.39

then the deeper, larger layers of higher grade ore will be mined. Vale

has a 50% interest in the joint venture that controls the project.

At the end of the 2000s, Vale was also present on the African

continent conducting prospecting in Congo (copper, cobalt and

manganese), Angola (copper and nickel) and South Africa (coal 35 - See Vale’s 2007 Form 20-F Report.

and manganese). 36 - See Vale’s 2006 and 2007 Form 20-F Reports.

37 - See “Vale compra produtora australiana de carvão,” O Globo, February 27, 2007.

Available at .

Mount Simandou 34 - See Vale press release “Vale investe em ciência e tecnologia para garantir a mineração

in Guinea, home to do futuro,” October 18, 2011. Available at . 39 - See Vale’s 2009 Form 20-F Report.

Vale Our History Vale Our History346 347

Previous page: Integra

coal mine, Australia.

Above: Tres Valles

copper plant, Chile.

Left: Carborough Downs

coal mine, Australia.

Vale Our History Vale Our HistoryEmployee handling

copper plates at Tres

Valles, Chile, 2011.

349

Chile and Colombia Good performance in Asia – boosted by sales in China – was

In the fourth quarter of 2010, production began at the Tres Valles repeated, though to a lesser extent, in the rest of the world.

copper unit.40 Located in Salamanca in the Coquimbo region of European customers, for example, accounted for 22.1% of the

Chile, the operation includes mines and a plant producing copper company’s sales in 2007. 44

cathode (metal plate). There are two copper oxide mines: the Don Vale’s commercial relationship with China grew even closer with

Gabriel open-pit mine and the Papomono underground mine. In all, the completion of the Dalian nickel processing plant in northeast

the company invested US$140 million in the project.41 China. Operations at the plant, capable of producing 35,000 metric

In December 2008, Vale acquired 100% of the coal assets tons of refined nickel per year, started up in April 2008.

of Cementos Argos S.A. (Argos), in Colombia, for a total sum of

US$306 million.42 Presence on five continents

In 2012, in line with its continuous efforts to optimize its Growing trade with China contributed to the expansion in Vale’s

portfolio of assets, Vale sold its coal operations in Colombia to CPC international transactions. At the start of 2008, the company had

SAS, an affiliate of Colombian Natural Resources SAS, for US$407 operations, offices and joint ventures spread across five continents.

million in cash. By 2011, the company had a presence in more than 35 countries

and had 136,000 employees and long-term contractors.

China: international challenge After 70 years, Vale was now present in Angola, Argentina,

By the start of 2008, China had become the world’s main consumer Australia, Austria, Barbados, Canada, Chile, China, the Democratic

of mineral resources. In 2007, the country alone was responsible Republic of Congo, France, Gabon, Guinea, India, Indonesia, Japan,

for approximately 49% of global demand for seaborne iron ore, Kazakhstan, Liberia, Malawi, Malaysia, Mongolia, Mozambique,

24.2% of global nickel demand, 33% of aluminum demand, and New Caledonia, Oman, Paraguay, Peru, the Philippines, Singapore,

26.3% of copper demand.43 The percentage of Vale’s total gross South Africa, South Korea, Switzerland, Taiwan, Thailand, the

revenue arising from sales to Chinese customers was 17.7% United Arab Emirates, the United Kingdom, the United States

in 2007. Adding in the percentage of total gross revenue from and Zambia.

Asian countries other than China, which was 23.3% in the Notwithstanding its numerous achievements as its

same year, Asia therefore accounted for 41% of Vale’s sales. international trade expanded, the company also faced occasional

difficulties and surprises. The main setback was triggered in the

second half of 2008.

40 - Idem, p. 23.

41 - “Vale inaugura projeto de cobre no Chile e amplia meta de produção,” O Globo,

December 2, 2010.

42 - See Vale’s 2009 Form 20-F Report.

43 - Idem. 44 - Idem.

Vale Our History Vale Our History352 353

10.3 Results of the recession of 2008-2009 million to US$802 million, due to a 4.7% rise in average sales prices.

Aluminum revenues expanded by 14.3%.47

In 2008, the global economy was shaken by a crisis rated by Manganese sales rose by 40% in 2007, reflecting a 52% leap in

specialists as on a par with the crash of 1929. In an ever more average sales prices and a 9.1% decline in volume. This reduction

globalized world in which businesses are interconnected, crossing was caused by a temporary shutdown at Azul Mine in Carajás

frontiers, crises spread like waves. A crisis that began in the real between July and December 2007. Vale’s ferroalloy business saw

estate market in the United States expanded in a relatively steady revenue growth of 40%, due to a 47.9% increase in average sales

manner over the course of 2007 and became a global problem the prices and a 6.5% fall in volumes, which was largely the result of

following year. a shutdown at the company’s ferroalloy plant in France between

Before experiencing the effects of the recession, Vale had been August and September 2007, due to technical problems.48

growing rapidly. In 2007, all of the company’s business areas The excellent results obtained in 2007 continued into 2008,

performed strongly. Gross revenue from iron ore sales grew by 18.8% despite the sudden slowdown in the economy, particularly in the

in relation to 2006, thanks to an average rise of 13.3% in sales prices fourth quarter of the year. The global crisis took some time to affect

and a 4.8% increase in the volume sold. The same occurred in the Vale’s performance. In 2008, the good results attained in previous

iron ore pellet area, where gross revenue rose by 38.4%, largely due years were maintained, and indeed Vale’s revenues, operating

to a 32.8% increase in the volume sold.45 profit and net profit all rose for a sixth consecutive year.49 Gross

In January 2007, in Carajás, Pará, work on expanding the annual operating revenue rose by 16.3% to US$38.5 billion, while

operation’s annual iron ore production capacity to 100 million net operating revenue grew by 16.1%. The following sales records

metric tons was finalized. After this, the Board of Directors approved were also set in 2008: 264 million metric tons of iron ore; 276,000

a new project to increase output to 130 million metric tons per year. metric tons of nickel; 320,000 metric tons of copper; 4.2 million

In 2007, iron ore production in Carajás reached 91.7 million metric metric tons of alumina; 3,000 metric tons of cobalt; 2.4 million troy

tons, up from 81.8 million the previous year. Brucutu Mine in Minas ounces (unit of measurement used for precious metals, equivalent

Gerais, opened in September 2006, produced 22 million metric tons to 31.1 grams) of precious metals; 411,000 troy ounces of platinum

of iron ore in the year following its inauguration.46 group metals; and 4.1 million metric tons of coal. New markets

Potash, kaolin, copper and aluminum grew at a similar pace in made a fundamental contribution to these results, enabling Vale

2007. Gross potash revenue rose by 24.5%, driven by a 35.4% rise to minimize the effects of the crisis.

in average sales prices. Kaolin sales expanded by 9.2%, thanks to China accounted for 28.7% of iron ore and pellet shipments in

an 18.9% increase in average prices. Meanwhile, profits from copper 2008, and the figure for Asia as a whole was 47.8%. After this came

concentrate rose by 3% between 2006 and 2007, from US$779 Europe (24.4%) and Brazil (19%). During the year, 56.2% of total

Stockyard and embarkation

47 - Idem.

facilities at Brucutu Mine,

45 - See Vale’s 2007 Form 20-F Report. 48 - Idem. São Gonçalo do Rio Abaixo,

46 - Idem. 49 - See Vale’s 2008 Form 20-F Report. Minas Gerais, 2009.

Vale Our History Vale Our HistoryRight: Vale’s CEO,

Murilo Ferreira, in 2011.

In 2008, the good results attained in previous years were

maintained, and indeed Vale’s revenues, operating profit

and net profit all rose for a sixth consecutive year

354 355

nickel sales went to Asia, 27.2% to North America, 11.6% to Europe South Mine in the Sudbury mining area of Ontario, Canada, whose Vale was not immune from the crisis. Its share of the seaborne

and 5% to other destinations.50 annual refined nickel production capacity was 8,000 metric tons, iron ore market fell from 30.2% to 24.9%, reflecting the strong

Achieving these results, however, was no easy task. The was shut down for an indefinite period.56 impact of the global recession on the European steel industry, one

deterioration of the international financial crisis in the fourth As a further effect of the crisis, in April 2008 the Valesul plant of the company’s major iron ore markets.61 That wasn’t all: the

quarter reduced demand for iron ore and pellets, and also led in Rio de Janeiro was reconfigured from an aluminum smelter recession hit practically all areas of Vale. Murilo Ferreira

to large falls in the prices of non-ferrous minerals. 51 China’s – producing metal through primary reduction of alumina – to a The company’s gross operating revenue fell by 37.8%, from

economic growth slowed after 10 years of continuous expansion plate mill using primary aluminum bars and scrap metal as raw US$38.5 billion in 2008 to US$23.9 billion in 2009. Net income When Murilo Pinto de Oliveira Ferreira (Uberaba, Minas

in its steel production and iron ore imports. This slowdown was materials. In October of the same year, its production was reduced declined from US$13.2 billion to US$5.3 billion. Likewise, the Gerais, 1953) was appointed Vale’s CEO in May 2011, people

the result of strict internal credit controls and a reduction in the to 40% of its annual nominal capacity of 95,000 metric tons.57 benchmark prices of iron ore fines and pellets fell by 28.2% and

in the mining industry knew exactly who he was: before

country’s exports. 52 Due to weak demand for kaolin, Vale subsidiary Caulim da 44.5%, respectively.62 In 2009, gross iron ore revenue shrank by

To stay competitive and retain healthy cash levels, Vale needed Amazônia S.A. (Cadam), in Pará, cut its output by around 30%. 27.8%, due to a 13.2% decline in sales volumes and a reduction in reaching the top job, Ferreira had built up nearly 30 years

to restructure. In line with changes in global economic conditions, The kaolin production of another subsidiary, Pará Pigmentos S.A. average prices. Gross revenue from iron ore pellets fell by 68.6% as of experience in the sector, having joined the company in

the company adjusted its production plans as of November, (PPSA), was also reduced by 200,000 metric tons per year.58 These a result of price reductions caused by lower demand.63 1988 as Director of Vale do Rio Doce Alumínio (Aluvale).

shutting down some iron ore mines in the South and Southeast drastic measures to bring production into line with demand were A 45.5% fall in gross manganese ore revenue mainly occurred After then, he held various management positions before

systems in Minas Gerais.53 Just three of Vale’s 10 pelletizing plants necessary in 2008, and the situation grew even worse the next year. due to price declines in 2009, although this was partially offset being appointed CEO of Vale Inco (now Vale Canada), where

remained in operation during the crisis: the company closed five In 2009, Vale – like everyone else – experienced difficult times. by a rise in sales volumes due to strong Chinese demand.64 Gross he remained until 2008. 1

of its seven plants at Tubarão Complex in Vitória (Espírito Santo), revenue from ferroalloy operations fell by 69.3%, thanks to a 48.5%

Murilo Ferreira has an undergraduate degree in

one in São Luís (Maranhão) and another in Fábrica (Minas Gerais). Vale in the challenging year of 2009 decrease in average sales prices and a 36.1% drop in sales volumes.

Four pelletizing plants at Tubarão Complex belonging to Vale’s joint The year 2009 began with concern for the brutal fall in demand There was a 49.6% decline in gross nickel product revenue and a Business Administration from Fundação Getulio Vargas in

ventures were also closed.54 in 2008 and the need to make adjustments, and it ended with a 32.6% fall in gross revenue in the aluminum sector.65 São Paulo, a postgraduate diploma in Administration and

Also due to the crisis, the company shut down its manganese rare annual decline in global GDP.59 The Brazilian economy shrank Kaolin and copper also registered declines in 2009. Sales of Finance from Fundação Getulio Vargas in Rio de Janeiro,

ore and ferroalloy operations in Brazil between December 2008 and by 0.6%, according to IBGE figures, while the USA, Japan and the kaolin fell by 17.2%, mainly due to a 25.8% decrease in volumes, and a specialist diploma in M&A from the International

January 2009. Its ferroalloy plant in Dunkirk, France, was closed European Union contracted by 2.4%, 5% and 4.2%, respectively.60 partially offset by an 11.6% rise in average sale prices. Sales of Institute for Management and Development (IMD) in

until April 2009, and in Mo i Rana, Norway, a planned stoppage to do copper concentrate were down 23.6%, due to a 5.3% decline in

Lausanne, Switzerland. 2 Since taking over as Vale’s

maintenance work on the plant’s furnace was extended until June volumes and a 19.3% drop in the average sales price.66

CEO, he has prioritized the responsible execution of the

of the same year.55 In the nickel area, Vale stopped using its thermal 56 - Idem. Over the course of the year, China accounted for approximately

power plants in Indonesia for a time. In January 2009, Copper Cliff 57 - Idem. 68% of global demand for seaborne iron ore, 44% of global demand company’s investments, employee training, and health

58 - Idem. and safety initiatives.

59 - See Vale’s 2009 Form 20-F Report.

50 - Idem. 61 - See Vale’s 2009 Form 20-F Report.

60 - See Fiesp, “A política de desenvolvimento produtivo,” Competitiveness

51 - Idem. and Technology Department, Decomtec, November 2009. Available at .

53 - Idem. 64 - Idem.

and BBC Brasil, “Desempenho do PIB brasileiro foi 6 o melhor do G20 em 2009.” 2 - “Vale apresenta novo diretor-presidente, Murilo Ferreira,” Exame.com, May 20,

54 - Idem. Published on March 11, 2010, available at .

Vale Our History Vale Our Historyfor nickel, 39% of global aluminum demand, and 40% of global copper 10.4 The art of overcoming crises:

356 demand. The percentage of Vale’s operating revenues generated by investments and disinvestments 357

sales to Chinese customers was 38%. China bought 56.8% of the

company’s iron ore and pellet shipments, while Asia as a whole After selling a stake in Usiminas in 2008, Vale continued with

received 72.7%. After this came Europe (13.4%) and Brazil (10.2%).67 its restructuring policy, disposing of its remaining 2.93% interest

As of the second half of 2009, the figures showed a gradual in the company in the second quarter of 2009. The US$273

recovery in the global economy and an upturn in demand for million transaction made a positive contribution in 2009. As a

minerals. As a result, Vale resumed operations at its iron ore result of a strategic review of its nickel refining and distribution

mines in the South System and increased the pace of production operations, in December 2009 Vale sold its American subsidiary,

in Carajás. The pelletizing plants at Tubarão Complex in Vitória the International Metals Reclamation Company (INMETCO), for

(Espírito Santo) belonging to Itabrasco and Hispanobras were US$38.6 million. 70 Also in the nickel sector, Vale disposed of its

started up once more in July and August 2009, respectively. Vale’s 65% interest in Chinese company Jinco Nonferrous Metals Co.

Fábrica plant in Congonhas (Minas Gerais) and the plant in São Ltd. (Jinco) for US$6.5 million. The same month, Vale entered into

Luís (Maranhão) resumed operations in the first quarter of 2010. an agreement to sell its 76.7% stake in Inco Advanced Technology

By the start of that year, all the company’s pelletizing plants were Materials (Dalian) and its 77% interest in Inco Advanced

operating once more.68 Technology Materials (Shenyang), which operates nickel foam

In the third quarter of 2009, Vale also restarted part of its plants in China, for US$7 million, to affiliate companies of other

manganese and ferroalloy operations. In general, the figures show shareholders. 71

a return to growth by the end of the year, but the company’s In January of that year, Vale reached an agreement to sell its

full-year results were poor in almost all sectors, in line with the manganese and iron ore exploration rights (as well as related

weak Brazilian economy. An exception was potash, used to make properties) in Bahia for a total sum of US$16 million. It also sold

fertilizers, which performed excellently in 2009. Vale’s gross potash three small hydroelectric plants, used to supply some of the

revenues expanded by 40% as a result of the strong performance of power consumed by the company’s ferroalloy plants in Minas

the agriculture sector in Brazil.69 Gerais, for US$20 million. 72 At the same time, wholly owned

subsidiary Valesul made an agreement to sell its aluminum assets

to Alumínio Nordeste S.A., a Metalis group company. Among the

assets included in the deal were an anode plant, a reduction

facility, industrial and administrative service areas, a foundry

and inventories. 73

70 - Idem.

Ore reclaimer in 71 - Idem.

stockyard at Ponta 72 - Idem.

67 - See Vale’s 2009 Form 20-F Report.

da Madeira Maritime 73 - “Vale vende US$ 31,2 milhões em ativos da Valesul para a Alumínio Nordeste S.A.,”

Terminal in São 68 - Idem. O Globo, January 22, 2010. Available at .

Vale Our History Vale Our HistoryLeft: alumina being

shipped from Alunorte in

Barcarena, Pará, 2008.

358 359

The disinvestment program continued in July 2010, when Vale The company made an important acquisition in September the Santa Cruz neighborhood in the West Zone of Rio de Janeiro.

sold its 86.2% stake in Pará Pigmentos S.A. (PPSA), as well as other 2009, when it completed its purchase of 100% of Rio Tinto’s iron ore As a strategic partner of ThyssenKrupp, Vale was TKCSA’s sole and

kaolin mining rights in Pará, to Imerys S.A. for US$74 million.74 operations in Corumbá, Mato Grosso do Sul. The US$750 million exclusive iron ore supplier.82

Finally, in February 2011, all of the aluminum operations of deal included associated logistics assets.79 In 2009, Vale defined In November 2007, Vale signed a memorandum of understanding

Albras, Alunorte and Companhia de Alumina do Pará (CAP) were Corumbá iron ore mine as “a world-class asset characterized by with Dongkuk Steel, one of South Korea’s largest steel producers,

transferred to Norwegian company Norsk Hydro.75 According its high grade reserves, rich in lump ore, convertible by a direct to build a steel plate mill in the Brazilian state of Ceará, at the

to the terms of the agreement, Vale, through its wholly owned reduction process. Its logistics assets meet 70% of the operation’s Pecém Industrial and Port Complex in São Gonçalo do Amarante.

subsidiaries, transferred to Hydro a 51% stake in Albras, a 57% transportation needs.”80 In 2008, Corumbá Mine produced 2 million Called the Pecém Steel Company (Companhia Siderúrgica do

interest in Alunorte and 61% of CAP.76 Through this transaction, metric tons of iron ore.81 Pecém), the operation will have an initial production capacity of

Vale received US$503 million in cash and 22% of Norsk Hydro’s The purchase of these assets in Corumbá brought yet another 2.5 million metric tons per year. 83

outstanding common shares.77 country onto Vale’s map: Paraguay. In the logistics area, the acquisition Elsewhere in Brazil, Vale invested in expanding the production

included a contract for transporting goods along a 42-kilometer capacity of Carajás Complex in Pará. As of the first quarter of 2010,

Investments: new equity stakes and operations railroad – whose concession belongs to América Latina Logística (ALL) the company began operating new facilities there that added 20

While it was willing to dispose of businesses that were no longer – and an iron ore loading port to ship products down the Paraná and million metric tons to the site’s annual iron ore production capacity.84

priorities, Vale also perceived that, to resume its growth, it could Paraguay rivers to Paraguayan and Argentinean customers. Two more

not give up on its diversification and investment drive. In 2009, the river ports were leased and, through a port in Buenos Aires Province, Vale and MBR

company began to see the results of its investment in constructing the ore reaches the seaborne market. In May 2007, Vale increased its stake in Minas Gerais-based subsidiary

the Carajás Hydrometallurgical Plant. Located at the Sossego In 2010, the iron and manganese mines of Corumbá – under Vale’s Minerações Brasileiras Reunidas S.A. (MBR). The company, whose

mining unit in Pará and completed in December 2008, the plant control as of 1994, when it acquired a 100% stake in Urucum Mineração direct stake in MBR was 49%, considered the subsidiary’s iron

was designed to test industrial-scale processing of complex copper S.A. – were transformed into the Center-West System. The company ore assets “among the best in the world.”85 The other 51% of the

ores to produce copper cathode. now has four integrated mine-railroad-port systems in Brazil: South, company belonged to Empreendimentos Brasileiros de Mineração

Vale’s Vargem Grande pelletizing plant in Nova Lima, Minas Southeast, North and Center-West. S.A. (EBM). As of May 2007, Vale had an 80% interest in EBM’s

Gerais was completed in the first half of 2009. This plant, built with In the third quarter of 2009, Vale entered into an agreement capital. Through new transactions, the company acquired a further

the capacity to produce 7 million metric tons of iron ore per year, with German group ThyssenKrupp Steel Europe AG in order to 6.25% of EBM’s equity and signed an agreement guaranteeing

now operates with an annual production capacity of 10 million raise its stake in ThyssenKrupp CSA Siderúrgica do Atlântico Ltda. it the use of the remaining 13.75% stake for the next 30 years. 86

metric tons.78 (TKCSA) from 10% to 26.87%, for an investment of US$1.42 billion.

TKCSA was building an integrated steel plate mill, with nominal

production capacity of 5 million metric tons of plate per year, in

74 - See Vale’s 2010 Form 20-F Report.

75 - Idem.

82 - See Vale’s 2009 and 2010 Form 20-F Reports.

76 - See Vale press release “Vale conclui gestão de portfólio de ativos de alumínio,” February 79 - Idem.

28, 2011. Available at . 83 - See Vale’s 2007 Form 20-F Report.

80 - See Vale’s 2009 Form 20-F Report.

77 - Idem. 84 - See Vale’s 2010 Form 20-F Report.

81 - See also “Vale prevê investir US$ 2 bilhões em Corumbá,” O Estado de S.Paulo, September

78 - See . 86 - Idem.

Vale Our History Vale Our HistoryPrevious page: convoy of 16

barges transporting iron ore on

the Paraguay River in 2011; and

itabirite ore processing facility

in Itabirito, Minas Gerais.

Left: train on the Carajás

Railroad (EFC) in 2012.

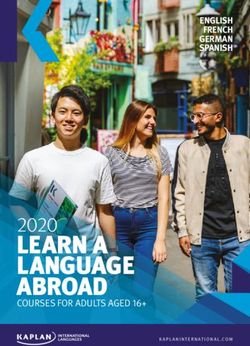

360 MBR was the second largest iron ore producer and exporter in Vale, as a large Brazilian exporter, played a major role in TABLE 1 361

Brazil, with a strong presence in the seaborne market. It sold to improving the country’s solvency and sustainability indicators, VALE’S ExportS comparED WITH OTHER SELECTED produCts (US$ milLION)

practically all iron ore consuming markets in the world, exporting particularly in terms of international reserves and the external

around 90% of its output. 87 It had been growing steadily, and its debt. Brazil’s large trade surpluses and ample liquidity in

reserves exceeded 1.4 billion metric tons of hematite and 4.4 international financial markets helped the country to improve its VALE’S

SoYBEANS* SUGAr* MEAT* AutomOBILES* COFfEE* AIRCRAFT

billion metric tons of high-grade itabirite. Operating in the Iron external debt indicators, and allowed the Central Bank to dispense EXPORTS

Quadrangle region of Minas Gerais, MBR exported its goods from with International Monetary Fund (IMF) support in 2005.90

its own maritime terminal on Guaíba Island in Sepetiba Bay, Rio 2001 3,297 5,206 2,279 2,629 4,239 1,393 2,839

de Janeiro State. 88

2002 3,173 5,906 2,094 2,879 4,510 1,362 2,335

10.5 The boom of 2010 2003 4,229 7,935 2,140 3,729 5,827 1,516 1,939

Vale’s commercial leap forward in 2010, a year in which the

company attained its best ever results, can be summed up by its 2004 5,534 9,822 2,640 5,648 7,307 2,025 3,269

export volumes. That year, Vale’s net Brazilian exports (its total

exports from the country minus its total imports) were around 2005 7,021 9,232 3,919 7,391 9,189 2,879 3,168

US$29 billion. For comparison, during the same year, Brazil’s total

soybean exports (including grains, bran and other byproducts)

were less than US$17 billion. The difference is even greater when 2006 9,656 8,911 6,167 7,701 10,366 3,311 3,241

Vale’s net exports are compared with those of products such as

automobiles (including passenger vehicles, tractors, engines, 2007 12,492 10,888 5,100 9,559 10,396 3,829 4,719

parts and components) and aircraft, which together amounted

to less than US$15 billion. 89 Vale’s 2010 exports were therefore

almost twice as large as automobile and aircraft exports 2008 17,606 17,300 5,483 12,046 11,109 4,697 5,495

combined. Although 2010 was a record year, Vale’s importance as

a major Brazilian exporter was apparent throughout the decade 2009 13,719 17,058 8,378 9,602 7,122 4,222 3,860

(Table 1).

2010 29,090 16,953 12,762 11,375 10,348 5,717 3,972

87 - See Vale press release about Caemi Mineração e Metalurgia S.A., October 8, 2003.

Available at .

* Soybeans include grains, crushed soy, bran, oil, and oil extraction residues; sugar includes cane, raw and refined sugar; meat includes various processed forms of chicken, pork and

88 - Idem.

beef; automobiles include passenger cars, tractors, components, parts and engines; and coffee includes raw beans and instant coffee.

89 - In this comparison, imports are not subtracted, as before, but instead total export 90 - According to Cintra, Marco Antonio Macedo, “Suave fracasso: a política macroeconômica

Source: Vale (Results, financial information and press releases), Central Bank of Brazil and MDIC/Secex.

data are analyzed. brasileira entre 1999 e 2005.” Novos Estudos Cebrap, no. 73, 2005.

Vale Our History Vale Our HistoryGRAPH 1

BRAZILIAN INTERNATIONAL RESERVES (US$ billions)

288.575

In 2010, Vale experienced its best ever annual results, 300

with record operating revenue, operating margin and 250

238.52

net income. Operating revenue reached US$46.5 billion, 180.334 193.783

while operating profit measured by EBIT (earnings before 200

interest and taxes) amounted to US$21.7 billion 150

85.839

100

362 363

35.866 37.823 49.296 52.935 53.799

50

0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Source: Central Bank of Brazil.

Brazil was experiencing a new situation, as it cut its total external End of the storm In the light of the emerging economies’ strong performance, alongside In December of the same year, the Central Bank announced

debt and expanded its international reserves (Graph 1) in a context of Driven by strong results in emerging economies – major generators the continued economic crisis in rich countries, the IMF decided new measures, this time to reduce credit, further slowing down

growing exports. The result was an overall improvement in indicators. of demand for minerals and metals – the global economy saw fast to reassign more than 6% of its voting quotas from developed to the economy in order to control inflation. These measures included

The direct effect of this was strengthened solvency in the face of growth in 2010, rising above the low levels recorded in late 2008 and developing countries, increasing their influence in the institution’s an increase in banks’ compulsory deposits (with the Central Bank)

external financial commitments and greater credibility in international early 2009.92 The Brazilian economy followed the same path, ending decision making. China then became the third largest member of the to remove R$61 billion from the economy, restrictions on long-

markets, reflected by the country’s investment grade rating.91 2010 with annual growth of 7.5%, according to IBGE data. In current Fund, whose executive committee has 24 member countries.95 term loans to individuals, and removal of support from the Credit

By analyzing Brazil’s main external economic data, one can values, the sum of all income produced in the country came to R$3.67 The overheating Brazilian economy then began to present Guarantee Fund (Fundo Garantidor de Crédito, or FGC) to small

perceive that at the end of the millennium’s first decade, Vale trillion. Per capita GDP reached R$19,016.93 It was a firm response to side effects, and in May 2010, public spending cuts of R$10 billion banks.97 By the end of the year, the Brazilian economy had created

was a fundamental company for the development of the country, the crisis experienced since mid-2008. were announced by the Brazilian government. The idea was to 2.86 million formal jobs, according to the Ministry of Work. This

capable of harnessing favorable international circumstances, Brazil’s rate of expansion was surpassed by China (which contain inflation and respect the domestic economy’s production was a new record, surpassing the previous record of 1.6 million new

with higher demand and prices, to consolidate its contribution to experienced growth of 10.3%) and India (8.6%), but it exceeded the capacity. Two months previously, the federal government had jobs set in 2007.98

domestic growth. growth seen in South Korea (6.1%), Japan (3.9%), the USA (2.8%) and already announced a R$21.8 billion reduction in the 2010 budget.96

the euro zone region (1.7%).94

95 - See “Países emergentes ganham influência e FMI duplica cotas,” Folha de S.Paulo, 97 - See “BC anuncia medidas para segurar crédito e tira R$ 61 bi da economia,” Folha de

92 - See IBGE, “Em 2010, PIB varia 7,5% e fica em R$ 3,675 trilhões,” published on March 3, October 23, 2010. Available at .

96 - See “Governo vai cortar gastos em R$ 10 bi para conter inflação, diz Mantega,” 98 - See “Brasil criou 2,86 milhões de vagas formais em 2010,” O Estado de S. Paulo, May

93 - Idem. Folha de S.Paulo, May 13, 2010. Available at .

Vale Our History Vale Our History364 365

The biggest net profit in the history of mining In terms of diversification, Vale also enjoyed results that

In 2010, Vale experienced its best ever annual results, with record consolidated its position following its major resumption of

operating revenue, operating margin and net income. Operating investment. Gross manganese revenue grew by 77.9%, due to

revenue reached US$46.5 billion, while operating profit measured a 56.5% rise in the average price and a 13.3% increase in sales

by EBIT (earnings before interest and taxes) amounted to US$21.7 volumes. Ferroalloy revenues expanded by 78.5%, due to a 60.7%

billion. The company’s operating margin, measured as operating increase in volumes and a 10.9% rise in average sales price.103

profit as a proportion of net operating revenue, was 47.9%. The In the coal sector, revenues increased by 52.5%, mainly due to

year’s net profit came to US$17.3 billion. Vale also allocated the consolidation of Vale’s sales in Colombia. The average selling

more resources than any other mining company to fund the price also rose in line with better market conditions.104

construction of new platforms for growth and value creation. The Nickel production, which had been weak since the workers’

company invested US$12.7 billion in new growth opportunities strike in Canada beginning in July 2009, also started to grow again.

and the maintenance of existing assets. Another US$6.7 billion In July 2010, a new five-year collective agreement was signed by

financed acquisitions, mainly of fertilizer assets in Brazil.99 representatives of production and maintenance employees at

Less than a year after facing the biggest crisis in its history, Vale the striking mines, bringing an end to the dispute.105 Gross nickel

overcame its problems and had enough power to continue growing. revenue rose by 19.4% during the year.

Due to strong demand and economic recovery across the world, Gross revenue from copper increased by 37%, caused by a 40.5%

the company’s gross revenue from iron ore sales rose by 105.6% in increase in the average sales price. Gross revenues from sales of

2010. This growth in revenue was mainly caused by an 84.9% aluminum and related products rose by 24.6%. On the other hand,

increase in average sales prices, as well as an 11.2% rise in the potash revenues fell by 32.2%, caused by a 21.2% fall in average

volume sold. 100 Making greater use of its production capacity, sales prices and a 13.9% decline in the volume sold in 2010.106

the company’s gross revenue from pellets rose even more in 2010,

by 373.5%, thanks to a 118.5% rise in sales volumes and an increase

of 118.7% in average sales prices, also caused by strong demand. 101

In 2010, China purchased 42.9% of the company’s shipments of

iron ore and pellets, while Asia as a whole bought 60.7%. Europe’s

share was 20.7%, followed by Brazil, with 13.7%. 102

99 - See Vale’s 2010 Sustainability Report - Investors’ Summary. 103 - Idem.

Aerial view of iron

100 - See Vale’s 2010 Form 20-F Report. 104 - Idem.

ore processing plant

101 - Idem. 105 - Idem. at Carajás Mine in

102 - Idem. 106 - Idem. Pará, in 2010.

Vale Our History Vale Our HistoryYou can also read