Small merchants, global audience - How the payments industry can help small shops become international marketplaces - Arizent

←

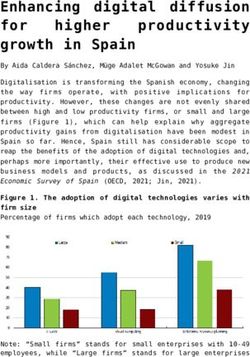

→

Page content transcription

If your browser does not render page correctly, please read the page content below

September/October 2018 www.isoandagent.com

Small merchants, global audience

How the payments industry can help small shops

become international marketplaces

001_ISO1018 1 9/11/18 4:52 PMNo Good Merchant

Left Behind.

1988

t a bl i shed

Es

e

On

im

e

Me

r chant At A T

CNP Specialists

Industry Leading Portfolio

Management Tools

Retail Experts

Latest Next Day Funding

Window in the Industry

Learn More

Call 866.211.0738

Visit emsagent.com

002_ISO091018_001 2 9/12/2018 2:05:14 PMContents

08

Small merchants,

global audience

How the payments industry can help

small shops become international

marketplaces.

Technology Technology Technology

03 12 17

Costco takes only a slice of the Google Pay stands firmly How Zillow is changing the market

Apple Pay wallet on shaky shoulders for digital rent payments

The warehouse store finally accepts The journey from Google Wallet to Zillow is far from the first company to

Apple Pay, but in a restrictive way that Google Pay was long and complicated try to modernize rent payments. But its

consumers may not expect. — and that’s a good thing. entry to the market raises the stakes.

Regulation Security Payments

06 14 18

Cannabis processors fight How new mPOS hacks made Trump’s policies threaten payments,

a complex war hardware vendors safer but with little effect

Cryptocurrency may be a solution to the A widely publicized hack of one’s hard- Trump’s administration has threatened

challenges of handling pot payments — ware should be a bad thing, right? It can remittances, mergers and partnerships.

but it invites a new wave of regulatory also be a catalyst for change. But overall the payments industry has

headaches. endured.

Payments

16

The battle over big-dollar

remittances

Several companies are allowing higher

limits for transfers in key markets.

isoandagent.com September/October 2018 ISO&AGENT 1

001_ISO091018 1 9/12/2018 11:50:44 AMEditor’s View

isoandagent.com

Going global

1 STATE STREET PLAZA, 27TH FLOOR

NEW YORK, NY 10004 • (212) 803-8200

EDITOR

Daniel Wolfe

212-803-8397

daniel.wolfe@sourcemedia.com

CONTRIBUTING EDITOR

David Heun

ART DIRECTOR

Robin Henriquez Small merchants have a big opportunity, and ISOs and

GROUP EDITORIAL DIRECTOR, BANKING

Richard Melville agents can help them on this path.

richard.melville@sourcemedia.com

VP, RESEARCH

Dana Jackson

SALES MANAGER, ADVERTISING

The internet long ago enabled the free exchange

Philip Redgate of ideas and culture around the world, but the flow of

212-803-8543

philip.redgate@sourcemedia.com money was still very much restricted.

EXECUTIVE DIRECTOR, CONTENT OPERATIONS AND That’s changing as new technologies and initiatives

CREATIVE SERVICES

Michael Chu make it possible for even the smallest shops to sell their

MARKETING MANAGER wares across the globe. The same trends are making

Deborah Vanderlinder

FULFILLMENT MANAGER it easier for international travelers to use their famil-

Christopher Onyekaba

iar payment products in unfamiliar countries, such as

CUSTOMER SERVICE

212-803-8500 Alipay users who venture to the U.S. from China.

help@sourcemedia.com

But merchants can’t tap into this trend without the right technology and sup-

port. Countries still have their own distinct regulations and currencies, meaning

there is still a need for someone to handle these complexities.

This presents an opportunity for ISOs and agents to deepen their relation-

ships with their merchant clients by serving as a guide to these newly available

markets.

And as technologies like blockchain and faster payments develop, more of

CHIEF EXECUTIVE OFFICER�����������������������������������Gemma Postlethwaite

these markets will open up and more merchants will want access to a global

CHIEF FINANCIAL OFFICER�����������������������������������������������������������Sean Kron

EVP & CHIEF CONTENT OFFICER ��������������������������������David Longobardi audience.

CHIEF SUBSCRIPTION OFFICER������������������������������������������� Allison Adams

SVP, CONFERENCES & EVENTS������������������������������������������ John DelMauro

SVP, HUMAN RESOURCES������������������������������������������������������������ Ying Wong

—Daniel Wolfe

© 2018 ISO&Agent and SourceMedia, Inc. and ISO&Agent.

ISO&Agent is published 6 times a year by SourceMedia,

Inc., One State Street Plaza, 27th Floor New York, NY

10004. For customer service contact us at (212) 803-8500;

email: help@sourcemedia.com; or send correspondence

to Customer Service, ISO&Agent, One State Street Plaza,

27th Floor New York NY 10004.

For more information about reprints and licensing content

from ISO&Agent, please visit www.SourceMediaReprints.

com or contact PARS International Corp. (212) 221-9595.

Those registered with the Copyright Clearance Center

(222 Rosewood Drive, Danvers, Mass., 01923) have

permission to photocopy articles. The fee is $10 per copy.

Copying for other than personal use or internal reference

is prohibited without express permission.

This publication is designed to provide accurate and

authoritative information regarding the subject matter

covered. It is sold with the understanding that the

publisher is not engaged in rendering financial, legal,

accounting, tax, or other professional service. ISO&Agent

is a trademark used herein under license.

2 ISO&AGENT September/October 2018

002_ISO091018 2 9/12/2018 11:51:13 AMTECHNOLOGY

Mobile Wallets

customers at the checkout point also

translates to more money in Costco’s

pocket, so adding contactless and mo-

bile payment is an advantage, accord-

ing to Crone.

“EMV checkout is painful and

slow, and Costco wants to find any

way around that, first through acti-

vating contactless for the Near Field

Communication-enabled Citi Costco

co-branded cards, and now by riding

the coattails of Apple Pay and others,”

Crone said.

Contactless cards are ubiquitous

outside the U.S., with mass merchant

adoption in Australia, the U.K. and

across most European markets. Up to

20% of all transactions are contactless

Costco takes only a slice

in most of these regions, according to a

report from A.T. Kearney.

of Apple Pay

U.S. issuers were late to the con-

tactless card movement because of a

false early start a decade ago when

terminals weren’t ready. Afterward,

Costco’s acceptance of Apple Pay doesn’t give it the full

in the rush to meet the October 2015

range of cards supported by Apple’s mobile wallet. EMV liability shift, most issuers skipped

adding contactless technology because

By Kate Fitzgerald

there was still no critical mass of NFC-

ready terminals.

Along with activating contactless Costco rolled out the Costco Any- Costco’s U.S. gas pumps are de-

payments at its store terminals, Costco where Visa card in mid-2016, equipping signed accept contactless payments,

has opened its checkout lines to Apple the entire 7 million-plus credit card but that feature is not yet live. The

Pay, Samsung Pay and Google Pay. But portfolio is with EMV contactless tech- chip-card liability shift goes into effect

there’s a catch. nology. For about two years, Costco for U.S. gasoline merchants in October

Costco confirms it still accepts only co-branded credit card users were un- 2020 and many are working to recon-

Visa credit cards at its stores, including able to use the feature at Costco stores figure their pumps.

through digital wallets, as part of the until the terminals went live this month. Citi was the first U.S. issuer to

deal it struck with Citigroup when it It’s no coincidence that Costco has commit to a fully contactless credit

split with longtime cobranded credit opened Apple Pay and others along card portfolio, embedding the latest

card partner American Express in 2015. with contactless card payment at its generation of EMV contactless in all of

Because Apple Pay and the other terminals, said Richard Crone, CEO of the Costco cards.

wallet apps are digital form factors for Crone Consulting LLC. EMV contactless card payments are

existing cards, the merchant sets the “Cobranded card deals include spe- accepted at a few major merchants,

parameters on which cards to accept, cific interchange pricing, and Costco is including McDonald’s and Walgreens.

and Citi’s deal with Costco specifically getting that pricing from Citi and theo- Most older contactless-enabled

narrows acceptance to Visa. The same retically on Visa cards, so Costco wants terminals, including unattended vend-

restriction does not apply to debit cards to stick to that plan,” Crone said. ing machines, do not recognize EMV

accepted at Costco. But time saved by speeding up contactless cards. ISO

isoandagent.com September/October 2018 ISO&AGENT 3

003_ISO091018 3 9/12/2018 11:51:25 AMREGULATION

Pot payments

na legislatively rather than through a

ballot initiative. The company is already

active in California and Arizona.

While state laws vex legal cannabis

payment providers, cryptocurrency reg-

ulations are also a challenge, given the

volatility of rulemaking. In late July, the

Financial Action Task Forcepublished

a report that contained recommenda-

tions for risk mitigation in cryptocur-

rency.

Alt Thirty Six hopes this provides

clarity to ease regulations for crypto-

currency.

Alt Thirty Six recently entered into a

partnership with CannTrade to support

the cryptocurrency Dash for cannabis

payments. The blockchain technology

allows real-time payments that take

less than one second, cutting the expo-

sure to rapidly changing cryptocurrency

valuations.

Cannabis processors

“FATF published reports with the

aim to help financial institutions fight

cryptocurrency money laundering and

fight a complex war terrorist financing,” Ramirez said. Alt

Thirty Six’s goal is go above and be-

yond current regulations, or to evolve its

The companies that want to process cannabis payments

compliance protocols as new guidelines

are also confronting crypto regulations. and laws develop. “In fact, many law

enforcement and state governments

By John Adams

frequently propose rules, bills and acts

to regulate cryptocurrency financial

State laws on marijuana are confusing “The medical and recreational institutions, which often causes confu-

and constantly changing, as are the cannabis industry is relatively new with sion.”

laws governing the cryptocurrency many gray areas in terms of regulation,” Cryptocurrency can work as a

that’s a possible solution to reduce said Ken Ramirez, co-founder and CEO cannabis payment alternative, but it is

dispensaries’ reliance on cash. of Alt Thirty Six, a Tempe, Ariz.-based a heavy compliance lift on the federal

Many cannabis sellers have trouble payments platform for the canna- level as well.

getting a bank account or acquirer bis industry. “These gray areas and Cannabis is still illegal under federal

relationship due to their conflicted legal different regulations within each state law and cryptocurrency regulations

status at the state and federal levels. can cause confusion, but also promote are, to be kind, confusing. The federal

Despite their category’s regulatory innovation.” government has taken a more permis-

complexity — or perhaps motivated by Alt Thirty Six is applying for money sive stance recently, with prior foes of

it — a new breed of merchant acquirers transfer licenses in Oregon, Nevada and legal cannabis such as former U.S. Rep

is slicing through the thick government Colorado and is considering an appli- John Boehneractually investing in the

red tape to process cannabis payments, cation in Vermont, which recently be- industry.

one state at a time. came the first state to legalize marijua- As the legal cannabis market

4 ISO&AGENT September/October 2018

004_ISO091018 4 9/12/2018 11:51:21 AMGrow with a

partner who

speaks ISO

As an ISO, your sales needs are unique and you

need a partner who can speak to them.

Prosper with merchant account longevity

With Worldpay, you get a payment processing partner that offers the

personalized service and flexibility you need for a better bottom line.

• Customized solutions: build your • Customer service: support

business with our flexible solutions from our award-winning team

• Legal and underwriting resources: • Sell your way: fast, simple

finance your growth using our underwriting, boarding and

debt and equity portfolio buyouts implementation

• Training: educate your team with • Dedicated support: access to

our comprehensive training a single-point-of-contact

See how we can help you to higher growth,

higher profit, higher value.

Contact your Worldpay ISO Sales Representative or

vantiv.com/WeSpeakISO today to learn more.

© 2018 Worldpay, LLC and/or its affiliates. All rights reserved. Worldpay, the logo and any associated brand names

are trademarks or registered trademarks of Worldpay, LLC and/or its affiliates in the US, UK or other countries.

005_ISO091018 5 9/12/2018 2:05:16 PMRegulation | Pot payments

expands, it has taken on the chal- rency and the legal status for cannabis sumer and businesses will adopt it.”

lenges of more traditional merchant as a product. And CanPay Tuesday By working within guidelines that

acquiring, such as CRM and inventory announced it has launched its payment appear to be ever-shifting, CanPay

management around seasonal spikes platform to 115 retailers in New York, developed a closed-loop debit network

such as the 4/20 “weed holiday” before Pennsylvania, New Hampshire, Massa- for cannabis stores, and is live in 17

shedding the rudimentary compliance chusetts, Maine, Maryland and Florida, states and Puerto Rico.

challenges such as figuring out where placing CanPay in 16 states plus Puerto CanPay works with approximate-

cannabis is legal as a product. Rico. It plans to enter Rhode Island, ly 25 banks to create a private debit

“The federal government can still New Jersey and Vermont sometime this network and uses ACH transactions to

apply its regulations, such as CFPB year. process the payments, not the Visa and

rules, as the cryptocurrency is likely to CanPay’s model is different, using Mastercard rails.

fall under prepaid regulations,” said a closed-loop network of about two The CanPay purchasing experience

Tim Sloane, vice president of payments dozen banks to support debit payments resembles that of using the Starbucks

innovation at Mercator Advisory Group, for legal cannabis. This makes compli- or Dunkin’ Donuts app — the app uses

adding compliance with the Bank ance easier because dispensaries in its a one-time token and PIN, and a QR

Secrecy Act could also be in play. “It network must be in a regulatory-ap- code that the cashier scans from the

would probably be wiser to identify the proved cannabis banking program, said smartphone’s screen.

regulations that would be the easiest Dustin Eide, CEO CanPay, adding there “We want to provide a stable and

to comply with and then address all are some complications since not all transparent payment alternative for re-

aspects of them, such as a prepaid states allow in-store, e-commerce and tailers to be able to offer to their retail

closed loop or restricted authorization delivery for cannabis. customers,” Eide said. “It’s seamless,

network.” CanPay also avoids blockchain and just like a Starbucks experience.”

Alt Thirty Six isn’t alone. Tokes uses other emerging payment models to It is hard not to draw similarities

a blockchain to manage compliance keep things simple for users, Eide said. between CanPay Debit and popular

for the entire cannabis supply chain, “The more traditional service we can mobile apps from the likes of PayPal,

anticipating risks beyond cryptocur- provide, the more likely it is that con- Venmo and Starbucks in terms of how

they operate. When CanPay customers

sign up for the service they are verified

with standard know-your-customer

procedures and are asked to download

an app.

But like Alt Thirty Six and Tokes, the

goal is to reduce cash payments and

other regulatory workarounds that are

risky for merchants and consumers.

“Cash is definitely still a major form

of payment in the industry because of

the banking issues that cannabis com-

panies face,” Ramirez said.

“There are many ‘reverse ATM’

platforms out there that use round-

about methods to enable customers

to use their debit/credit cards to make

purchases,” Ramirez said. “However,

many customers have been burned by

these companies because they often

lack proper licensing and are working

through loopholes.” ISO

6 ISO&AGENT September/October 2018

006_ISO091018 6 9/12/2018 11:51:22 AMMerchants need a countertop payment solution made

for the modern consumer—one that is purposefully

designed, lightning fast, and secured from end

to end. The V200c Plus checks every box.

It also accepts all payment options,

from EMV to contactless, and is

equipped with an interactive

interface that supports

third-party apps.

007_ISO091018 7 9/12/2018 2:05:19 PMSmall merchants, gl

H

s

I

Intern

these

nities

playe

W

grow

has t

trans

Rese

cross

dome

annu

twee

perce

To

that

are t

proce

ing o

for m

e-com

inclu

cross

high

ingly

the s

also

numb

of co

need

8 ISO&AGENT September/October 2018 iso

008_ISO091018 8 9/12/2018 11:51:16 AMTech

s, global audience

How the payments industry can help small

shops become international marketplaces.

By Cheryl Winokur Munk

I

International e-commerce is booming To compete effectively, many pay- e-commerce, given that the fraud rate

these days and so too are the opportu- ments providers are adding ancillary for international orders is around 1.5

nities—and challenges—for payments services beyond just processing. These times higher than domestic purchases,

players. include regulatory compliance, tax according to a 2016 report from Cyber-

Within the past decade or so, a compliance, shopper support, charge- Source, a unit of Visa.

growing number of payments platforms back and refund management and “There’s plenty of opportunity for

has targeted international e-commerce fraud detection analysis, payments others to get into this,” said Dangel-

transactions, and with good reason. professionals say. maier, who contracts with a third-party

Research firm Forrester predicts that “I think most processors and pay- provider for the company’s fraud detec-

cross-border e-commerce will outpace ments providers are looking for ways tion services.

domestic growth, with a compound to add value to merchants outside of One sticking point for would-be en-

annual growth rate of 17 percent be- just payments,” said Erich Litch, chief trants is that while a payments provider

tween 2017 and 2022, compared with 12 revenue officer at 2Checkout, a global may be well-versed at fighting fraud

percent for overall B2C ecommerce. e-commerce and payment platform in the U.S., replicating those services

Today, many payments providers that allows companies to accept online in other countries isn’t so easy. For

that focus on international e-commerce and mobile payments from buyers instance, in certain countries the tools

are trying to do more than simply worldwide, with localized payment available to ensure people are who

process transactions. They are focus- options. “Anything processors can do to they claim to be may not be as sophis-

ing on solving the various pain points do that is going to be a very important ticated, Dangelmaier said.

for merchants that make international area,” he said. Another problem payments provid-

e-commerce especially difficult. These ers are increasingly trying to solve is the

include significant decline rates for Global pain points difficulty merchants have with approval

cross-border credit card transactions, a Fraud prevention is one area some rates for international credit card trans-

high occurrence of fraud and increas- payments providers are focusing on to actions, according to Igal Rotem, chief

ingly burdensome tax requirements. At deepen relationships with international executive of Credorax, a full-service

the same time, payments providers are e-commerce merchants, according to acquiring bank specializing in e-com-

also running up against an increasing Ralph Dangelmaier, chief executive of merce payments and services.

number of challenges, including slews BlueSnap, an online payment platform. Many banks—issuers or acquir-

of complex local regulations and the Having stellar fraud protection is ers—will decline cross-border trans-

need to build appropriate scale. particularly pertinent to international actions for fear of fraud. So while an

isoandagent.com September/October 2018 ISO&AGENT 9

009_ISO091018 9 9/12/2018 11:51:17 AMTechnology | E-commerce

e-commerce merchant in the U.S. who “Anything that processors can do to One region at a time comm

solely does business domestically might simplify the transactions for merchants Because of all the complexities, it’s conti

expect that around 98 percent of the is an interesting area,” he said. not feasible for payments companies meth

transactions are approved, Rotem The consultative approach to specialize in every country. Instead, globa

estimates that about 30 percent to 35 Some payments companies, like In- payments companies should seek to be at 19

percent of cross-border transactions genico, consult with merchants to help strong in a few markets and not try to 7 per

are denied at the first attempt; denial them find the best approach for their be all things to all people. “Specializa- Bu

rates are even higher in less developed business. For some this might mean set- tion is key,” said Leija of Ingenico. prefe

areas of the world. ting up a legal entity within the region Accordingly, some payments pro- For e

“This is a very, very big number,” said where they want to expand. viders are finding success by focusing opera

Rotem, whose company was founded to This offers advantages for payment on one or two international markets for acce

help merchants improve their approval cost acceptance, but there are addi- e-commerce, while others are targeting princ

rates. “This is where the pain is and this tional costs and complexities as well. more niche markets around the globe. on ba

is where the opportunity is.” The rules and regulations are different dLocal, for example, focuses on Mexi

Tax management is another area for each type of payment, said Joe Lei- emerging markets. The company, throu

where payments providers are in- ja, general manager for North America whose biggest market is Brazil, is big p

creasingly seeking to help merchants. at Ingenico ePayments, the online and continually broadening its global reach. Brazi

Traditionally, payments processors mobile commerce unit of Paris-based In mid-August, dLocal announced the cards

didn’t get involved at all in taxes. That’s terminal manufacturer Ingenico Group. expansion of its payments platform Fo

because in the past, most online trans- A merchant can’t just put up a to the Middle East and North Africa, very

actions weren’t taxed. But little by little, website and expect to sell all over the starting with Egypt and Morocco. These shoc

countries realized they were missing out world. “It takes more knowledge and areas are both considered high growth prima

on sales revenue, and they are starting expertise now to expand globally,” he opportunities based on factors such as coun

to crack down. said. regulatory reform, technology advance-

Argentina, for instance, recently Certainly, payments providers that ments and demographics. In Egypt, for Wha

instituted a local tax on e-commerce do work in various markets around the example, a population of mostly young One

transactions and other countries are world need to have a local expertise shoppers (50 percent under age 30) is is the

weighing the possibility, said Eric Chris- and understanding of the requirements driving the transition to online shopping meth

tensen, group vice president of com- in each region. For example, there’s and payments, according to dLocal. you h

merce business infrastructure at Digital PSD2 and GDPR in Europe; and in “These nascent markets offer incred- meth

River, a global provider of e-commerce many markets, payments providers ible growth opportunities for innovative, to su

solutions and the merchant of record have to have a physical presence to do trail-blazing companies,” said Sebastian said

for major online brands. business. Kanovich, the company’s chief execu- On

If efforts in countries that tax inter- “Regulations can vary quite wide- tive, in a press release announcing its comp

national e-commerce are successful, ly from one market to the next,” and expansion. of cry

more countries are likely to develop it’s important for payments providers “While there are market barriers, e-com

tax schemes of their own, Christensen to get these things right, said Casey many cross-border e-commerce oppor- presi

said. “The local governments want their Bullock, general manager of global en- tunities are emerging in both Egypt and ment

share of those cross-border transac- terprise e-commerce for North America Morocco where governments are mak- speci

tions,” he said. at Worldpay. “The fines that are tied to ing efforts to improve financial inclusion mana

This trend signals a growth opportu- these things can be massive.” through digital banking supported by merc

nity for payments providers. As a result It’s also not always easy for a pay- payments solutions,” he said. cies c

of various new regulations, there more ments processor to start doing business Certainly, payments providers need wide

of a need to for payments companies in another country. For example, it took to acutely understand how customers little

to help merchants with tax-related is- Worldpay five years to get its credit want to pay in the various markets they going

sues such as proper withholding and re- card acquiring license in Japan in a are in. Fo

porting in accordance with a particular long and complicated process. “Markets According to 2Checkout’s first quar- respe

region’s rules, said Litch of 2Checkout. aren’t cookie cutter,” he said. ter 2018 benchmark report on digital crypt

10 ISO&AGENT September/October 2018 iso

010_ISO091018 10 9/12/2018 11:51:18 AMcommerce trends, Visa and Mastercard ing technology can keep up with large and sellers working together directly,

continue to dominate among payment number of payments and whether there but that’s changed as the marketplace

es methods, accounting for 68 percent of will be enough liquidity to make them a business model has evolved, said Hy-

ad, global online sales; followed by PayPal viable payment option for international perwallet’s Ting.

o be at 19 percent and American Express at e-commerce transactions, he said. Even “The fact that there are all these

to 7 percent. so, Spear predicts cryptocurrency will people who are earning really small

za- But certain countries show stronger eventually become a viable option for amounts of money and need to be paid

preferences for local payment methods. international e-commerce transactions. is a new phenomenon. It didn’t exist

o- For example, as a merchant, you can’t “It’s just a question of time before it 20 years ago,” he said. With thousands

ng operate in the Netherlands and not ends up happening,” Spear predicts. and thousands of individuals buy-

s for accept iDEAL, said Jochen Kaempfer, a The importance of scale ing and selling, modern marketplace

eting principal at A.T. Kearney who focuses It can be very difficult for start-up payments require technology and scale,

be. on banking and payments. To sell in payment companies to simply jump he said. A lot of the banks are now

Mexico, you need to accept payments into the global e-commerce market. providing more of the infrastructure

through OXXO, whereas in China, the A lot of companies don’t realize how to move the money, but leaving the

big payment method is Alipay and in much scale it takes to work globally, details to innovators to handle the user

each. Brazil, people tend to use local credit saud Michael Ting, senior vice presi- experience, he said.

he cards. dent of global markets at Hyperwallet, There are even opportunities for ISOs

m For payments companies that are a facilitator of cross-border payments to win business in the burgeoning space

a, very focused on the U.S., it can be a and payouts for sellers on online mar- of international e-commerce.

hese shock to realize that cards aren’t the ketplaces. (PayPal recently inked a deal Many startup merchants can

wth primary method of payment in many to buy the company; the transaction is bypass ISOs by working with a global

h as countries, Kaempfer said. expected to close in the fourth quarter.) payments company that deals with

ance- Consider, for instance, the prospect cross-border e-commerce. But there are

for What about crypto? of different tax laws in every region. also brick and mortar merchants that

ung One challenge for payments providers This could make it even more challeng- want to sell their wares online to people

) is is the proliferation of new payment ing for new and existing processors to in other countries. ISOs have an oppor-

pping methods. If you want to maximize sales, do business in multiple countries, saud tunity to forge partnerships to help their

l. you have to support those payment Christensen of Digital River. Companies merchants do this—and maintain and

red- methods across the world and you need may need to hire local experts in each enhance that merchant relationship in

ative, to support lots of different currencies, of the jurisdictions, or outsource to a the process, said Conal Cunningham,

stian said Litch of 2Checkout. third party. Either option has to be built general manager at Inovio Payments,

cu- One area to watch is how payments into a payment company’s economics. a global payment gateway provider

its companies will deal with the world whose parent company is North Ameri-

of cryptocurrencies for international Other opportunities for payments can Bancard.

e-commerce, said Brandon Spear, providers and ISOs While many merchants are interest-

por- president of MSTS, a global B2B pay- Another trend that is changing the ed in selling their wares online globally,

and ment and credit solutions provider that landscape for payments companies is a typical ISO won’t have the connec-

mak- specializes in commercial transaction the proliferation of online marketplaces. tions to allow them to do that. His com-

usion management. There are some online The growth of these marketplac- pany partners with several acquirers

by merchants who accept cryptocurren- es—and the desire for sellers to peddle and ISOs to allow their merchants to

cies currently, but there hasn’t yet been their wares internationally—also means sell their good internationally online.

eed widespread adoption. “There’s still a multiple opportunities for payments “ISOs don’t have to be out of this

ers little uncertainty about how this is all companies on both sides of the busi- race. They can compete, but they have

they going to play out,” he says. ness—payments collection and the to get out of their comfort zone and

For example, it’s still unclear how disbursement of mass payments. find some partners to help them deliver

uar- respective governments will regulate Payouts used handled solely by what the marketplace is demanding,”

al cryptocurrency, whether the underly- banks, when it was individual buyers Cunningham said. ISO

isoandagent.com September/October 2018 ISO&AGENT 11

011_ISO091018 11 9/12/2018 11:51:19 AMTECHNOLOGY

Mobile Wallets

a consumer could use Google Wallet

only with a Citi card on a Sprint mobile

phone. Getting traction was difficult at

best and near-impossible at worst.

“And the secure element meant the

hardware manufacturer had to partic-

ipate, but if we hadn’t gone through

that, we wouldn’t have moved to host

card emulation, which got rid of a lot of

the hardware dependencies,” Connors

said.

The payments industry wouldn’t have

moved as quickly to tokenization of

mobile payments without seeing what

Google was dealing with during its ini-

tial wallet experiment, Connors added.

“You have to start somewhere, and it’s

the iterations, I think, that have made

Google Pay stands firm

Google Pay what it is today.”

Google also didn’t hesitate in estab-

on shaky shoulders

lishing Near Field Communication as

its connection between the consumer

device and the POS. It was a technol-

ogy that the short-lived Softcard and,

The rocky journey from Google Wallet to Google Pay

eventually, Apple Pay would also adopt,

ultimately made the final product stronger. reinforcing what Google had in play at

its starting gate.

By David Heun

All mobile wallet providers have tak-

en a similar path “to reach their unique

Did it take Google seven years to boarding passes. value adds,” Connors acknowledged,

perfect its mobile wallet, or did Google “The different evolutions of Google’s but it was especially vital for Google

Wallet’s tough launch guide today’s payments ventures are well document- as a pioneer in the field to learn about

Google Pay? ed, but I would venture to say that what it would take to keep mobile pay-

Google can’t underestimate the we wouldn’t be where we are today” ments on an upward trajectory.

importance of its maiden voyage with without Google Wallet, Connors said at Google Pay is a significantly differ-

Google Wallet and the lessons the the annual Mobile Payments Confer- ent look than what the search-engine

company learned in being one of the ence. “Any time you are trying to do company deployed about 15 years ago

first to offer payments through cell- something new, it is difficult, but this is to get e-commerce merchants engaged

phones in the U.S., said Jack Connors, a multisided market.” with customers and receiving online

manager of merchant global partner- To make Google Wallet work, it payments.

ships at Google. needed to get the technology to work “We have always viewed ourselves

In the past year, Google has re- on smartphones and at point of sale as an enabler for merchants,” Connors

branded Android Pay as Google Pay, terminals, obtain bank support, ne- said. “If you wanted to sell something,

expanded into other markets, became a gotiate access to the secure element you could advertise on Google.com,

payment option through the Safari and of a handset to store credentials, and and the consumer would go to the mer-

Chrome browsers, and gained some educate merchants on acceptance and chant website and, hopefully, fill out a

adoption as a mobile pay method for consumers on its operation. web form with their name, address and

transit cards and storing tickets and That was a handful in 2011. Initially, credit card credentials.” ISO

12 ISO&AGENT September/October 2018

012_ISO091018 12 9/12/2018 11:51:04 AMMORE THAN A CASH DISCOUNT PROGRAM.

GAIN A SUITE OF SOLUTIONS FOR YOUR BUSINESS.

Terminal Choices POS Systems

Flexible Fee Options

Accepts all

Card Types

Powerful Gateway

Agent Training

Merchant Monitoring

BBB A+ Rated

Customer Service

Marketing &

Sales Support

Provide your merchants a new way to pay.

Most cash discount programs promise everything but “WHAT’S IN IT FOR YOU?”

fail to deliver on basic merchant needs. PayLo was the

> Make 3X more than traditional processing

first program on the market and has continued to lead

the way in technology, customer service, and sales > Keep what you earn – no bonus gimmicks

support. And now we offer even more – more bonus

> Get in-depth training and sales support

options, more marketing & sales support and more

equipment. From terminals to POS Systems to Mobile > Build your business with our marketing tools

devices and our new PayHub Plus Gateway – we have > Be backed by the most experienced team

the cash discount technology and support to take your in the industry

business to the next level. Call us today to get started.

888.981.9566 | SellPayLo.com

SignaPay is a registered ISO of Citizens Bank, Providence RI., Wells Fargo Bank, N.A., Concord, CA, and the Canadian branch of U.S. Bank National Association and Elavon

© Copyright 2006 - 2018, All Rights Reserved, SignaPay, LTD. 2006.

013_ISO091018 13 9/12/2018 2:05:15 PMSECURITY Sec

Point of sale

ic stripe and remote attacks such as that

denial of service. Square did not provide trans

an executive for an interview, but on ca

confirmed it has dropped Miura M010 fully”

readers in favor of contactless and chip attem

card readers. Miura did not return a Th

request for comment. on th

In a statement, Square said the For e

M010 was offered as a stopgap, adding send

Square accelerated plans to drop mPO

support for the M010 and transfer to cial-e

a free Square reader for contactless at ge

and chip.”It’s important to note that trans

this is not a vulnerability in any Square chan

hardware or software, and we have no W

indication that any Square sellers have actio

been impacted by it.” a $5

PayPal would not comment beyond like a

a statement saying: “Security is a top

How new mPOS hacks

er’s is

priority at PayPal and we recognize the attac

important role that researchers and effec

make vendors safer our user community play in helping to

keep PayPal secure. PayPal’s systems

a mo

can e

were not impacted and our teams have acco

Newly exposed mPOS vulnerabilities put vendors on the remediated the issues raised by the “N

spot to patch things up. researcher.” a bus

iZettle, a Stockholm-based mPOS paym

By John Adams and Karen Epper Hoffman company that PayPal is in the process their

of buying, provided a similar response: Leigh

After researchers exposed how problems comes as billions in invest- “Security is paramount to iZettle. The Black

hackable mobile point of sale systems ments flow through the mobile point of issue flagged to us by the researcher tion g

are, vendors quickly shored up their sale industry. is resolved, and the iZettle service and that

defenses — while also blaming some Mobile point of sale terminals have its community remain unaffected... the m

vulnerabilities on payment methods been a lifeline for micromercants and At iZettle, we comply with the highest relati

they characterize as outdated. small businesses for most of the cat- security standards in our industry. We acqu

iZettle, PayPal, SumUp, and Square egory’s existence, but the companies perform thorough security checks of mPO

all countered researchers’ contention of behind this technology are taking on every merchant who wishes to use the be as

security vulnerabilities via unattributed debt or shelling out billions of dollars iZettle service.” Th

statements saying they have fixed the in acquisitions to diversify services and Like PayPal and iZettle, SumUp also blam

vulnerability in question and minimized reach a larger range of retailers. There’s issued an unattributed statement: “Su- of sa

the scope of any threat. also security pressure on the industry, mUp can confirm that there has never less t

Researchers from Positive Tech- since PCI scope reduction is part of the been any fraud attempted through its ing th

nologies demonstrated at the recent appeal for mobile point of sale hard- terminals using the magnetic stripe- the d

Black Hat conference ways to hack ware. based method outlined in this report.” “C

seven mobile point of sale readers from The researchers demonstrated SumUp added more detail, saying the v

Square, SumUp, PayPal and IZettle, vulnerabilities that allow man-in-the- the “magnetic stripe” trick uses an term

which PayPal expects to own by the middle attacks, fake code, the ability obsolete technology that relies on Gallo

third quarter. The contention of security to alter transaction values via magnet- signatures rather than PINs. It noted lead

14 ISO&AGENT September/October 2018 iso

014_ISO091018 14 9/12/2018 11:50:59 AMSecurity | Point of sale

s that less than 0.22% of SumUp’s current outside provider, there’s less consider- into a card skimmer; shortly thereafter,

ovide transactions involve the magnetic stripe ation for the ecosystem.” Square received an investment from

on cards. SumUp says it has “success- There’s also a compliance factor, in Visa and began talking openly about

10 fully” removed any possibility of such an that companies rarely do more than plans to add encryption.

chip attempt at fraud in the future. protect their systems beyond what’s But there is some good news, since

The type of attack typically depends required, Galloway said. unlike retailer data breaches over the

on the ultimate goal of the attacker. Square manufactures its own hard- past few years, it wasn’t real crooks

For example, a cyber-criminal might ware, softening the risk, according to exploiting vulnerabilities in mobile point

ding send an arbitrary command to the Galloway (Square confirmed it manu- of sale systems.

mPOS system as part of a larger so- factures its hardware in-house). “If you “Mobile point of sale certainly has

o cial-engineering attack that is aimed manufacture your own product, there’s seen its share of security challenges

s at getting the cardholder to run their more of a holistic consistency across over the years, which is not surprising

t transaction again through a less secure the board,” Galloway said. given the pace of innovation here,” said

are channel. Square faced similar allegations dat- Julie Conroy, a research director at Aite

no Whereas by tampering with trans- ing back to when its only product was Group.

ave action amounts, hackers could make a small magstripe reader that plugged “I think what you have to keep in

a $5 transaction at point-of-sale look into the audio jack of a smartphone. mind is that the Black Hat revelations

ond like a $50 transaction to the cardhold- The rival terminal maker Verifone were mostly based on lab exercises—

op er’s issuing bank. RCE exploits allow demonstrated how a rogue application we haven’t seen a lot of these exploits

the attackers to access the device memory, paired with Square’s device could turn it in the wild yet.” ISO

d effectively turning a mPOS reader into

to a mobile skimmer from which they

ms can electronically collect cardholders’

have account information.

“Normally, a [customer] goes into

a business and interacts with the

S payment terminal directly, or hands

ess their card to the merchant,” researcher

nse: Leigh-Anne Galloway said during her

he Black Hat presentation. “The transac-

er tion goes to the merchant acquirer,

nd that talks to the issuer. … But with

the mPOS [transaction], there is no

est relationship directly with the merchant

We acquirer.” Merchants “work with the

f mPOS provider, who may or may not

he be assessing security risk.”

The researchers partly place the

also blame on lower prices for mobile point

Su- of sale hardware, which are offered at

ver less than $100 for some models, affect-

its ing the level of security that is put into

- the devices.

t.” “Commonly the manufacturer and

g the vendor of the mobile point of sale

terminal are separate.” said Leigh-Anne

Galloway, the cybersecurity resilience

d lead for Positive Technologies. “With an

isoandagent.com September/October 2018 ISO&AGENT 15

015_ISO091018 15 9/12/2018 11:51:01 AMPAYMENTS

Cross border

wants to defend it market share.

“We launched our service in India in

February 2015 in order to help India’s

hard-working overseas community have

a secure, fast, and affordable way to

send money back home,” said Josh Hug,

co-founder and COO of Remitly. “As a

part of that mission, we’ve launched an

industry-first same day $30k send limit

to ensure our customers are able to

send more when they need to.”

It should be noted that for consum-

ers to access these higher daily trans-

action limits, remittance companies are

required by law to collect critical KYC

information. These enable companies

to identify consumers, cross-check

against appropriate Treasury SDN and

The battle over big-

OFAC lists as well as provide the neces-

sary government reporting.

There are two major trends that

dollar remittances are shaping the remittance industry,

prompting companies such as Xoom,

Remitly, and even Ant Financial —

More companies are raising the dollar limit for cross-bor- which tried to purchase MoneyGram

der transfers in key markets. last year — to build or consolidate their

market share positions.

By Michael Moeser First, the payment volume of re-

mittances is on the rise. According to

In the combative U.S.-to-India remit- transmitter license just this March, and the World Bank, the volume of global

tance corridor, Seattle-based Remitly TransferWise, which cut its fees last No- remittances is expected to reach $642

just raised its game by increasing its vember in response to the heating up billion in 2018, up from $613 billion in

daily transfer limits to $30,000 and of global competition. Both companies 2017 which is almost 5% growth. The

hiring a Bollywood actor, R. Madhavan, are based in London. single largest recipient country in 2017

as its brand ambassador. “The market is competitive and was India which took in $69 billion,

Remitly’s moves are clearly in providers compete on not just price followed by China ($64 billion), the Phil-

response to the growing competitive but brand trust, ease of use, transfer ippines ($33 billion) and then Mexico

pressure being placed in a key U.S. amounts and transaction speed” noted ($31 billion).

outbound corridor. On June 4th Xoom Sarah Grotta, director, debit and alter- The second major factor is that the

(a unit of PayPal) increased its daily native products of Mercator. market remittances being sent from

transfer limit to $25,000 to 50 countries The U.S.-to-India remittance corridor the U.S. are going through a digital

including India, Canada, the U.K. and represents an almost $11 billion annual transformation and very likely globally

the Philippines. payment flow according to the Pew as well. Using mobile phones to send

Additional pressure comes from Research Group. This makes it the third money cross-border provides con-

digital cross-border specialists that largest U.S. outbound remittance corri- sumers with not only convenience, but

have made significant inroads to the dor after Mexico and China. also allows recipients greater ease to

U.S. market. These include WorldRemit, The U.S. to India corridor has been choose how they want the funds to be

which received its New York money very successful for Remitly, which likely disbursed. ISO

16 ISO&AGENT September/October 2018

016_ISO091018 16 9/12/2018 11:50:55 AMTECHNOLOGY

Rent payments

and shared economy marketplaces

including brands such as HomeAway

and VRBO. In May, YapStone launched

Kigo Marketplace with Kigo, a unit of

RealPage, to provide a platform for

vacation rental listings.

To fuel its expansion efforts, Yap-

Stone has been very active in raising

funds. In February 2018, YapStone com-

pleted its latest funding round, which

was led by Premji Invest and raised $71

million.

“It’s all for M&A, as acquisitions are

clearly part of our roadmap. I probably

spend 50% of my time evaluating com-

panies and opportunities,” said Tom

Villante, co-founder, chairman and CEO

of YapStone.

Zillow’s effect on digital This year’s round, which was its

Series C, followed a string of successful

rent payments fundraising and debt placements which

provided over $186 million in capital

according to Crunchbase, which tracks

As Zillow enters the market for digital rent payments, funding of private startups. Investors

existing providers must adapt to its presence. include Accel Partners, Mastercard,

and Meritech Capital Partners. Debt

By Michael Moeser financing came from Comerica Bank

and Bregal Sagemount in an earlier

As the digital rent market attracts new The other major challenge is frag- debt round in 2015.

entrants like Zillow, mainstays like Cozy mentation. Of the roughly 44 million YapStone expects to generate $350

and YapStone are pressured to diversify rental units currently available, Zahnd million in revenue for 2018, which is sev-

and seek new audiences for their digital estimates that up to 75% are owner/op- en-fold increase in the last seven years,

payments technologies. erators who have 20 rental units or less, added Villante.

Zillow is a formidable opponent — making it difficult for vendors to build YapStone partnered recently with

the company claims 35 million renters scale. “The small landlords invent their PPRO Group, a cross-border e-payment

visit its websites and mobile apps own way of working … As an industry, specialist to help it provide alterna-

each month in search of a home or we have barely scratched the surface in tive payment methods (APMs) local

apartment — and it’s far from the only the U.S., which is probably why Zillow to the various marketplaces serviced

challenge that niche providers face. has entered,” Zahnd said. by YapStone. Essentially this will allow

Not only is the digital rent check Cozy’s solution to this problem is to YapStone customers to be able to

market getting more crowded, it’s faced bundle payments with tools such as access dozens of APMs from around the

with other big challenges. tenant screening, lease capture and world, including iDEAL (Netherlands)

“The real estate industry is one of the maintenance management. and SOFORT (Germany).

last big industries to come online,” said As for YapStone, its growth strategy This effort is critical to YapStone’s

Gino Zahnd, founder and CEO of Cozy. now puts it on a collision course with geographic growth — in many coun-

According to the Federal Reserve, 80% payment processing powerhouses tries, consumers may prefer to use a

of rent is still paid by cash, check or such as Stripe, Adyen and PayPal. It bank transfer method, direct debit, or

money order. now targets the travel, vacation, rental other method, Villante added. ISO

isoandagent.com September/October 2018 ISO&AGENT 17

017_ISO091018 17 9/12/2018 11:50:48 AMPAYMENTS

Regulation

Trump’s policies threaten payments,

but with little effect

President Trump has put policies in place that threaten the payments industry, but

have seldom changed the course of the market.

By John Adams

Since his 2016 campaign, Donald Trump been relatively muted, and Maas’ wish development.

has loomed over the international pay- is probably just that. The tie between the Iran deal and

ments system with a series of threats This recent development in Germany payments, as Haas sees it, is European

that are proving increasingly empty. does not involve anything Trump has countries won’t be able to provide the

While it remains to be seen if Ger- said or promised directly; generally, he economic incentives to Iranian com-

man Foreign Minister Heiko Maas’ call has had little to say about the Europe- panies—particularly Iranian banks—if

for an independent payment system an payments market. European companies and banks face

to save the Iranian nuclear deal will Maas contends in an open letter that punishment from the U.S. for doing

actually happen, the potential severity independent European payment rails business with Iran.

of such a move joins a growing list of can save the Iran nuclear deal. Trump “In this situation, it is of strategic

Trump-era potential casualties includ- in May broke with European allies by importance that we clearly tell Wash-

ing remittance bans, foreign technology saying the U.S. would pull out of the ington [that we] want to work together.

worker visa shutoffs, canceled mergers 2015 Iranian deal, in which economic But we will not let you act on our heads

and choked fintech collaboration. sanctions would be lifted on Iran in [and] over our heads,” Maas wrote,

All that said, the impact to date has exchange for concessions on nuclear according to a translation. “That is why

18 ISO&AGENT September/October 2018

018_ISO091018 18 9/12/2018 11:50:40 AMREGISTER NOW AT

WNETONLINE.ORG

SEPTEMBER 25–26, 2018

The Westin Perimeter North • Atlanta GA

One event can change your life.

Come to learn, be inspired, build your network, and prepare for

your next opportunity. We welcome all women and men to join

us in Atlanta for the most exciting Summit ever!

http://wnetonline.org/2018-Wnet-Leadership-Summit

019_ISO091018 19 9/12/2018 2:15:35 PMPayments | Regulation

it is essential that we strengthen Euro-

pean autonomy by setting up payment

channels independent of the U.S., cre-

ating a European Monetary Fund and

building an independent Swift system.”

How that would happen is unclear,

as is the impact on the global econo-

my, the burgeoning cross-border pay-

ments market, gig economy payrolls

and the card networks. Maas himself

says the “devil is in a thousand details.”

It wouldn’t be the first dramatic

change to payments that was signaled

by Trump’s rhetoric but never came to

be. Trump’s plan to strong-arm Mexico

to pay for his border wall originally

hinged on shutting off remittance corri-

dors. That didn’t happen. Ant Financial’s bid to acquire U.S.-based Moneygram fell apart under regulatory pressure.

Other possible impacts of Trump’s

proposals on payments volume, such as India, where government-driven de- Chancellor Angela Merkel, a member of

as a crackdown on technology worker monetization has sparked a huge move the same political party as Maas, said

visas, or tariffs on Chinese goods, have toward digital payments, or China, she was opposed to an independent

yet to fully materialize. where government support for outside payment system.

Companies that process interna- payment processors is a moving target The concept of a distinct European

tional payments for contract workers that’s kept Visa and Mastercard from payment system has some political

have noticed an uptick in volume that developing business inside China. traction in the European Union over the

corresponds with possible changes to The underlying payments technol- years, though it’s not been successful,

visas. ogy for cross-border payments is also according to Eric Grover, a principal at

The payments industry’s most no- improving. Intrepid Ventures.

table casualty of the current political JPMorgan Chase has acquired The Monnet Project, for example,

environment in the U.S. is likely the WePay (a Redwood City, Calif.-based included about two dozen European

scuttled Ant/Moneygram acquisition, company unrelated to WeChat) to banks that would have provided a

though even in that case Ant has found support small businesses that sell Pan-European alternative to Master-

large market in the U.S. in supporting online internationally, while emerging card and Visa. The project failed in

travel payments for Chinese tourists technology such as blockchainmakes 2013 over regulatory uncertainty and

and temporary residents. it easier and less costly to process the concerns over the sustainability.

Travelers from China provide the frequent small transactions that are “If Maas were simply urging the

largest source of international tourist part of e-commerce. formation of a new payment system to

spending in the U.S., with more than While the Maas plan has some increase competition that would be a

a decade of double digit growth. comparison to Russia’s independent formidable challenge, but I’d applaud

Travel and tourism exports account for Mir payment system set up in response it,” Grover said, adding the concept of

nearly two-thirds of all U.S. exports to to Western sanctions as a way to dilute a distinct European payment system is

China. Chinese tourism is a particularly the market share of Visa and Master- borne more out of resentment toward

important source of revenue for large card, the Russian market is not nearly the U.S. “The supranational EU at its

U.S. cities such as Los Angeles and New as intertwined with the U.S. as the heart, however, is a political project.”

York. European market. The challenge for any Swift rival

These impacts fall far short of the Within hours of Maas’ declaration would be to achieve critical mass —

politically driven moves elsewhere, such of payments independence, German and relevance, Grover said. ISO

20 ISO&AGENT September/October 2018

020_ISO091018 20 9/12/2018 11:50:42 AMYou can also read