RURAL COMMODITIES WRAP - MARCH 2020 Author Phin Ziebell, Senior Economist - Agribusiness - NAB Business ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

KEY POINTS

Let’s start with the good news: Australia is a net agricultural

CONTENTS exporter, in a normal season producing enough food for more

NAB RURAL COMMODITIES INDEX

than double its population. Most food that Australians eat is National and by state

3 | In focus

grown in Australia. Coronavirus is wreaking havoc on Australia 200

4 | Seasonal conditions National NSW

5 | Farm inputs and the world but people still need to eat and at this stage we 180 VIC QLD

6 | Livestock have not seen any real disruptions to Australian food supply WA SA

outside of panic buying and hoarding from Australian 160 TAS

7 | Winter crops

8 | Summer crops, sugar supermarkets. Overall, Australian agriculture will play a vital

140

9 | Rainfall data role in keeping Australians in good health through the crisis.

The virus will have an impact on Australian agriculture, likely 120

CONTACTS increasing demand in domestic markets but potentially limiting 100

export demand and making trade more complex.

Phin Ziebell 80

Senior Economist On the domestic front, panic buying at supermarkets will bring 2010 2012 2014 2016 2018 2020

+61 (0) 475 940 662 forward demand for Australian agricultural products across the

board, although some specialty products destined for MONTHLY COMMODITY PRICE CHANGES

Alan Oster restaurants will be in surplus. However, with much of the

Group Chief Economist buying now for hoarding, inventories are being transferred into Dec 19 Jan 20 Feb 20

+61 3 8634 2927 households, and these will eventually be run down (assuming Wheat ▲ 3.6% ▲ 4.1% ▼ 1.6%

Dean Pearson limited spoilage).

Beef ▼ 3.9% ▲ 7.6% ▲ 25.9%

Head of Economics With global trade now coming under immense pressure, there

+61 3 8634 2331 is potential for more disruption to Australia’s agricultural Dairy ▲ 0.8% ▲ 2.3% ▲ 3.1%

exports. But, on balance this means more food for domestic Lamb ▼ 5.0% ▲ 7.0% ▲ 15.8%

consumers.

Wool ▼ 2.1% ▲ 2.9% ▼ 0.1%

The NAB Rural Commodities Index had its best month on record

in February – rising 8.5% month-on-month, largely reflecting Sugar ▲ 4.1% ▲ 6.5% ▲ 9.6%

booming livestock markets. Big rains in many areas have driven

re-stocker markets into a frenzy, with hope that the big dry has Cotton ▲ 0.6% ▲ 4.4% ▼ 0.3%

now broken in New South Wales and Queensland. However,

substantial climatic risks remain, and if we don’t see a good Source: NAB Group Economics, ABARES, Meat

and Livestock Australia, Australian Pork,

season from here livestock prices are almost certainly overdone Ausmarket Consultants, Australian Bureau of

2

at this level. Statistics, Bloomberg and Profarmer.IN FOCUS: CORONAVIRUS AND FOOD SECURITY

COVID-19 has effectively shut down global

travel and is likely to put pressure on AUSTRALIAN WHEAT PRODUCTION AND USE

transport links, particularly air freight. Million tonnes per annum

35

The AUD has collapsed, now trading at

30

around 57-58c. This is good news for

25

Australian agricultural exporters, but only to

20

the extent that global trade flows can

15

continue in the face of the virus threat.

10

From first principles, we are well placed 5

with food security as a net export of food 0

products. Australia produces roughly

enough food for 60-75m people and with a

population of 25m much of our agricultural

output is exported. production domestic use exports

Despite a miserable 2019-20 harvest, there CORONAVIRUS CASES COVID-19 IMPACT, SELECTED STRATEGIES

is still grain in storage and the livestock

Total – Australia Health system, UK, Imperial College modelling

industry can still provide meat. Likewise,

fruit and vegetables are still readily

available.

There are two key risks for Australian food

production. Firstly, labour requirements –

particularly for horticulture and livestock

processing – may become an issue. This

could be compounded as the virus spreads

through the community, potentially

shutting sites. Secondly, some inputs such

as agricultural chemicals and fertiliser are

substantially imported. If trade flows break

down these could be affected.

Overall, Australian agriculture will play a Source: ABARES, www.covid19data.com.au, Imperial College London and NAB Group Economics

vital role in keeping Australians in good

3

health through the crisis.SEASONAL CONDITIONS

2019 was a very tough season in many parts

of Australia. New South Wales and parts of

ROOT ZONE SOIL MOISTURE BOM RAINFALL OUTLOOK

Queensland saw the most severe rainfall 27 February, relative to average April – June 2020

deficits over the year.

Since January, many – but not all – of these

areas have seen excellent rainfall. This is

clearly an extremely welcome relief for

producers. Soil moisture levels across

northern New South Wales, the Darling

Downs and central Queensland are

especially encouraging and have led to very

spirited activity in the cattle restocker

market.

However, it is worth comparing underlying

conditions now compared to the last great THREE MONTH RAINFALL DECILES THREE MONTH RAINFALL DECILES

EYCI rally in 2016. EYCI peaked at 726c/kg in December 2019 – February 2020 May – July 2016

August 2016, amid the best seasonal

conditions in arguably decades. The map on

the bottom right shows three months of

rainfall (relative to average) in the lead up

to August 2016 – a sea of blue, with most

areas above average and many very much

above average. Compared to the three

months leading up to the present (map

bottom left) conditions were substantially

better in 2016. While some areas now have

enough moisture to see them through for a

good period, many areas still need a full

season of above average rain.

Source: Bureau of Meteorology

4FARM INPUTS

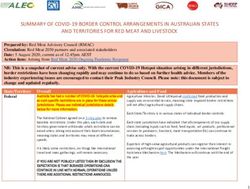

Farm input prices have been pushed lower

NAB FERTILISER INDEX NATIONAL AVERAGE FUEL PRICES by global events, albeit this is partly offset

AUD index AUc/litre by a lower AUD and potential supply issues -

180 petrol particularly for fertiliser and agricultural

240

diesel chemicals.

220

160

200 Petrol prices have absolutely tanked,

reflecting a collapse in crude oil prices –

180

140 Brent is now just USD26/bbl. This partly

160 reflects a sharp drop in demand due to

140 120 coronavirus but also the Saudi-induced

120 breakdown of the OPEC+ supply restrictions.

Diesel is yet to fall to the same extent, but is

100 100 now seeing downside as well. While a lower

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

AUD has blunted some of this impact, oil

price falls are so substantial that we are

NAB WEIGHTED FEED GRAIN PRICE INDEX ENTITLEMENT TRADE PRICES likely to see cheap petrol at the bowser

AUD/t $/ML, selected valleys unless there is a supply interruption.

400 700 Meanwhile, fertiliser prices fell very

substantially in 2019, but 2020 could be a

600

rollercoaster. Lower oil prices point to

300 downside, but possible supply issues

500

combined with a lower AUD, bears watching

400

200 closely.

300

Feed prices have trended lower this year,

200 3 Lower Goulburn

100 reflecting lower feed demand in NSW and

6 VIC Murray Dart-Barmah

100 Queensland. While this trend is likely to

continue, there are two key caveats. Firstly,

0 0

a lower AUD will push up local prices and

2010 2012 2014 2016 2018 2020 Jul-18 Jan-19 Jul-19 Jan-20

secondly, local demand for human

Source: Bloomberg, Profarmer, consumption may increase.

Department of Agriculture, NAB Group Economics

5LIVESTOCK

2019 was a generally tough year for the

CATTLE LAMB Australian cattle industry, reflecting poor

AUc/kg National Trade Lamb Indicator, AUc/kg seasonal conditions in much of the country.

900 EYCI

1000 But this all changed in 2020, in response to

800 very good rains in many areas. Restocker

US live cattle future 800 interest has been through the roof and

700

600 domestic prices have responded accordingly.

600

500 EYCI has now taken a breather, falling from a

400 record 767c/kg to 742c/kg (it started the year

400

300 on 487c/kg0. A lack of rain in the last two

200 200 weeks combined with coronavirus ravaging

100 export markets, suggests risks are now on the

0 0 downside.

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

Lamb prices have likewise been boosted by

rainfall but look to have peaked for now –

GDT AUCTION RESULTS WOOL likely reflecting the rainfall situation and

AUD/tonne Southern region, by micron, AUc/kg coronavirus concerns. NTLI now stands at a

Butter 17 19 21 23 very respectable 923c/kg. While China still

9000 3,500

Cheddar 25 28 30 needs protein following African Swine Fever,

8000 Skim milk powder 3,000 export logistics are going to become more

7000 Whole milk powder

2,500 difficult. Wool prices have held up, but

6000 demand is very uncertain in the current

5000 2,000 environment.

4000 1,500

Global Dairy Trade auction results have been

3000

1,000 lower in the last four auctions, although the

2000 sharply lower AUD will offset much of this.

500

1000 Where the market goes from here is difficult

0 0 to predict. On the one hand, China is a

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020 massive buyer and has been otherwise

Source: NAB Group Economics, ABARES, Meat and Livestock Australia, Australian Pork, Ausmarket Consultants, occupied over the last two months, but

Australian Bureau of Statistics, Bloomberg and Profarmer. given the situation in Europe, it is

possible that EU supply could suffer.

6WINTER CROPS

2019-20 provided a pretty miserable crop

overall, with ABARES’ latest wheat

WHEAT PULSES

assessment standing at 15.2mmt, AUD/t AUD/t

1,400 Chick peas Field peas Lupins

representing the worst winter cropping 500

season since 2007-08. Apparent domestic 1,200

400

use (human consumption, stock feed, seed) 1,000

was just under 9mmt in 2018-19. We expect

300 800

the domestic consumption figure for 2019-

2020 to be comparable, or perhaps slightly 200

600

lower.

400

Australian grain continues to trade well 100 ASX east Aust future

200

above international benchmarks, although AUD denominated CBOT

there are signs of this moderating following 0 0

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

good rains in NSW and Queensland.

Australian grain is still being exported,

although it is unclear how coronavirus will COARSE GRAINS CANOLA

affect shipping and demand for product. AUD/t AUD/t, Newcastle

500 barley (feed) 800

Looking ahead to the 2020-21 crop, some barley (malting, Geelong)

sorghum (Newcastle) 700

areas have now received good enough

400 oats (feed, Albany)

rainfall to have sufficient profile for some 600

months. Planting is likely to be in full swing 500

300

in a month from now. It remains too early

400

to forecast the size of the 2020-21 crop.

200 300

200

100

100

0 0

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

Source: NAB Group Economics, ABARES, Meat and Livestock Australia, Australian Pork, Ausmarket

Consultants, Australian Bureau of Statistics, Bloomberg and Profarmer.

7SUMMER CROPS, SUGAR AND HORTICULTURE

Good summer rains have been a welcome

relief for summer crop prospects, with

COTTON SORGHUM AND RICE

Sorghum prices having come down a good AUD/bale AUD/t

1,400

700

deal. While the season will see lower than sorghum (Newcastle)

average production (on low plantings), it’s 1,200 600 rice (US rough)

not a bad result given where it started. 1,000 500

Cotton prices have held up, although 800 400

serious questions have to be asked about 600 300

demand in 6 months if coronavirus

continues to smash the global economy. 400 200

200 100

Fruit and vegetable prices were both higher

in February, increasing 12.4% and 5.4% 0 0

respectively. Fresh produce continues to be 2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

widely available in shops, likely reflecting

the folly of panic buying produce that SUGAR FRUIT AND VEGETABLES

rapidly spoils. Labour availability will be an AUD/t Index

issue for horticulture this year, as will the 300

1,000

possibility for outbreaks among workers, Fruit

potentially shutting down operations at 250

800 Vegetables

farms.

200

600

150

400

100

200 50

0 0

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

Source: NAB Group Economics, ABARES, Meat and Livestock Australia, Australian Pork, Ausmarket Consultants, Australian Bureau of Statistics, Bloomberg and Profarmer.

8MONTHLY AVERAGE RAINFALL IN WINTER CROPPING REGIONS (MM)

Long run average 1900-01 to 2013-14 El Nino years 2019 2018

NEW SOUTH WALES VICTORIA QUEENSLAND

150 150 150

100 100 100

50 50 50

0 0 0

Oct

Oct

Oct

Nov

Feb

Mar

Apr

Sep

Sep

Nov

Feb

Sep

Nov

May

Feb

Mar

Apr

May

Mar

Apr

May

Jul

Jul

Jul

Jun

Aug

Dec

Jun

Aug

Dec

Jun

Aug

Dec

Jan

Jan

Jan

WESTERN AUSTRALIA SOUTH AUSTRALIA TASMANIA

150 150 200

150

100 100

100

50 50

50

0 0 0

Oct

Oct

Oct

Nov

Feb

Sep

Nov

Mar

Apr

Sep

May

Feb

Sep

Nov

Mar

Apr

May

Feb

Mar

Apr

May

Jul

Jul

Jul

Jun

Aug

Dec

Jun

Aug

Dec

Jun

Aug

Dec

Jan

Jan

Jan

Source: Bureau of Meteorology and NAB Group Economics

9Important Notice

This document has been prepared by National Australia Bank Limited ABN 12 004 044 937 AFSL 230686 ("NAB"). Any advice contained in this document has been prepared without taking into account your objectives,

financial situation or needs. Before acting on any advice in this document, NAB recommends that you consider whether the advice is appropriate for your circumstances.

NAB recommends that you obtain and consider the relevant Product Disclosure Statement or other disclosure document, before making any decision about a product including whether to acquire or to continue to

hold it. Please click here to view our disclaimer and terms of use.

Photo | Mai ThaiYou can also read