Purchasing Card Procedure

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Purchasing Card Procedure 21/08/2014 D Bowman

Index 1.0 Introduction 2.0 Security and Liability 3.0 Card Limits 4.0 Transactions and use of Card 5.0 Suppliers 6.0 Placing an Order 7.0 Monthly Transaction Log 8.0 Monthly Statement Reconciliation 9.0 Card Housekeeping 10.0 Contact Names Appendix 1 - Employee Agreement Appendix 2 - Monthly Transaction Log

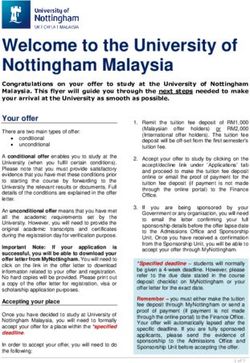

1.0 INTRODUCTION

1.1 The Purchasing Card is a tool to be used by Departments/Individuals to order and pay for ad-

hoc goods and services where other means of ordering and payment are not appropriate.

(I.e. Internet purchases, conference, hotel and travel bookings).

The main purpose of the Purchasing Card is to reduce paperwork, administration time and

cost involved in the ordering and invoice process and to enable Departmental Cost

Controllers to have greater visibility and control of their departmental expenditure.

2.0 SECURITY AND LIABILITY

2.1 The Purchasing Card is issued to a named individual within a Department and this person

shall be responsible for the safe keeping and appropriate use of the card.

Whilst the Purchasing Card is embossed with the individual name of the cardholder, the

account and therefore the liability is in the name of the University. Consequently there is no

impact on the personal credit status, or personal liability of the Cardholder.

2.2 Cards issued for Departmental use should not be removed from the Department and should

be kept in a secure place at all times. When the Cardholder is away from the office, a

delegated person shall be responsible for the Card and may use it to make purchases on

behalf of the Cardholder. The Cardholder shall ensure that the delegated person is fully

aware of his/her responsibilities outlined in this procedure. Cardholders should be aware that

sending card details by email is not considered a secure method of transmission and they

should only use secure websites for transactions.

2.3 PIN Numbers are not issued with the Departmental Purchasing Card. It cannot therefore be

used to purchase goods or services from a retail organisation that requires PIN authorisation.

If you have been issued with a PIN number for business use for your card, you are

responsible for the safe keeping of the individual PIN Number. You must not divulge the

PIN Number to anyone.

2.4 Lost/Stolen cards

If a card is lost or stolen, advise The Royal Bank of Scotland plc immediately (they operate a

24-hour customer service) by telephone.

Telephone 0870 6000459

Lost and Stolen Cards

The Royal Bank of Scotland plc

Commercial Cards Division

Card Customer Services

PO Box 5747

Southend–on-Sea

SS1 9AJ

2.4.1 The Purchasing Card Administrator must also be informed (Purchasing Department).

3.0 CARD LIMITS3.1 There is a standard monthly credit limit of £5,000 and a maximum per transaction limit of

£1,500 set for your card. Under normal circumstances, the card should not be used for

purchases in excess of this limit. Attempts to do this will be met with a decline when

authorisation is sought for the transaction. This limit is inclusive of any VAT, carriage charges

etc. If there is a need to temporarily increase the transaction limit, please contact the

Purchasing Card Administrator.

4.0 TRANSACTIONS AND USE OF THE CARD

4.1 The Card is intended to be used to order and pay for ad-hoc goods and services where

standard means of ordering and payment are not appropriate. This will generally include

making travel, hotel and conference bookings where the University’s nominated Travel

Provider has been unable to match or improve price (proof of cost savings achieved may be

required by the Purchasing Department).

4.2 The Card may also be used to pay for miscellaneous low value, non-contracted items.

4.3 Contracted items (ie.computers, stationery, laboratory equipment, furniture, tools etc) should

always be purchased from one of the University’s contracted suppliers. For details of

contracts, please contact the Purchasing Department.

4.4 Appropriate use of the card will be monitored on a regular basis to ensure that these

Procedures, Purchasing and Finance Regulations are not contravened.

5.0 SUPPLIERS

5.1 The Purchasing card can be used to buy goods or services (except those listed in 4.3) with

any Supplier that accepts MasterCard Purchasing Cards.

5.2 Suppliers that accept Purchasing Cards fall into two categories; -

a) Suppliers who are MasterCard Purchasing Card capable (special electronic equipment is

installed by the suppliers to have this facility).

b) Suppliers that accept MasterCard

5.3 When purchasing from a Supplier in group (a) above, it is not necessary to obtain an invoice

as Customs and Excise have approved Mastercard Statements as evidence of payment of

VAT.

5.4 When purchasing from a Supplier in group (b) above, an invoice should be provided to you.

5.5 The Royal Bank of Scotland plc pays the supplier the transaction amount within 4 days of the

transaction date. The University of Kent pays the Bank monthly in arrears by Direct Debit.

6.0 PLACING AN ORDER

61. In accordance with the University Finance Regulations, the correct level of authorisation must

be obtained from the Budget Controller before making a financial commitment to a Supplier.

This should be in the form of a completed and signed F2. (Tick the ‘Credit Card’ box to

identify payment method). This authorisation document must be retained with the Purchasing

Card records as evidence that such approval was given prior to the commitment being made.

6.2 The order can be placed in one of the following ways:

6.2.1 Ordering the goods/service by telephone and quoting the card number. Telephone

orders should be delivered to a site address and not to the Cardholder’s private

address.6.2.2 Ordering by mail where an application form can be completed with details for Card

payment.

6.2.3 Ordering by fax, providing the necessary card and delivery details.

6.2.4 Personally visiting the supplier’s premises and signing for the goods. (NB: The

supplier must accept the card without the need to enter a PIN).

6.3 In all instances, the Cardholder must provide the following details to the Supplier:

6.3.1 The full card number and date of expiry.

6.3.2 The full name of the Cardholder (as shown on the card).

6.3.3 The University name.

6.3.4 The University VAT No. 202060535

(When quoting our VAT no. to an overseas supplier, prefix the above number with

GB).

6.3.5 The Customer Code which may be constructed of 16 characters (alpha / numeric.

This can be the cost code).

6.3.6 The full delivery address.

6.3.7 A clear description of the goods required.

6.3.8 The CVV number (last three digits on reverse of card.

6.4 The Cardholder should request:

6.4.1 Confirmation of the price, to include all costs and VAT.

6.4.2 If required, a VAT Invoice (see section 5).

6.4.2 That the Delivery note and Invoice are marked:

- “Mastercard Purchasing Card”

- The Cardholder’s Name and Location

7.0 MONTHLY TRANSACTION LOG

7.1 Once a transaction has been made the Cardholder will record the transaction details on a

Monthly Transaction Log (Appendix 2). The Log must be updated when the goods or services

are received and all paperwork pertaining to the transactions must be kept together with the

Log.

7.2 Where the supplier is required to send an invoice it must be sent directly to the Cardholder. It

is imperative that these invoices are retained and to be submitted at the end of the month with

the Cardholder transaction statement and Monthly Transaction Log. Failure to comply will

result in the University not having the evidence to enable the reclaim of VAT on the

transaction (if applicable).

8.0 MONTHLY STATEMENT RECONCILLIATION

th

8.1 On the 4 day of each month, The Royal Bank of Scotland will send a statement to the

Purchasing Office from where the statements are forwarded to individual Cardholders.

8.2 Upon receipt of the statement the Cardholder will check each line of the Monthly Transaction

Log against the Monthly Statement, ensuring that transaction values match and that

goods/services and invoices have been received. If there are any discrepancies, the

Cardholder should immediately contact the Purchasing Office, providing copies of all relevantpaperwork.

8.3 If there are any items under dispute with the supplier they should be clearly marked as such.

They should also remain as an outstanding entry on the Monthly Transaction Log.

8.4 Once the statement has been checked, receipts/delivery notes and invoices should be

attached and the document signed by the Cardholder and approved by the Budget Holder. A

copy should be retained for outstanding issues and personal record purposes.

The original statement and associated receipts/delivery notes and invoices should be sent to

the Payments Office within 5 working days of receipt. If there is any delay, advise the

Payments Office before the end of the reporting period.

8.5 Credit values appearing on the statement will be for settlement of previously disputed items.

The Cardholder should make reference next to the entry detailing which item it resolves. A

photocopy of the original statement with the disputed item on should be signed as cleared and

passed to the Payments Office with a copy of the completed Monthly Transaction Log.

8.6 If there are any transactions on the Monthly Transaction Log that do not appear on the

monthly statement, these should appear on the next month’s statement. Delete the

transaction from this month’s log and transfer to next month’s log.

8.7 The value of the monthly statement will have been posted to your Government Purchasing

Card (GPC) Account by the Payments Office. The value will appear on the GL Transaction

Report. The Cardholder is responsible for creating a journal each month to clear the GPC

account, ensuring that the costs are allocated to the correct account codes. The completed

and authorised journal should be sent to Management Accounts.

8.8 If a cost is to be allocated to a research project, the Research Department will be need to be

informed and that part of the journal initialled by the Research Accounts Manager.

8.9 Rejection of Goods/Goods Incorrect

If the goods are rejected, the Cardholder must immediately advise the Supplier, who will

either arrange for a replacement delivery or credit to the Purchasing Card account. A credit

will appear on the monthly statement. It should be entered on the Daily Transaction Log to

aid reconciliation. Do not wait until receipt of the statement to contact the Supplier.

8.10 Incorrect Amount Billed

If an amount recorded on the Monthly Transaction Log does not correspond to the value on

the Monthly Statement, contact the Supplier for an explanation or an adjustment. In the event

that the discrepancy remains unresolved contact the Purchasing Office for further instructions.

8.11 Billed But Goods Not Received

If there is a charge on the Monthly Statement for something that has not been received

contact the supplier to ensure that the goods have been despatched. It is a Visa regulation

that the transaction is not processed until the goods are despatched. Inform the Payments

Office this regulation has been breached.

8.12 Missing Transactions

Any purchases made just prior to statement date will show up on the following month’s

Cardholder statement. If any transactions do not turn up as anticipated it is possible that the

supplier has forgotten to enter the purchase into the MasterCard system. In these

circumstances contact the Payments Office before taking any action.

9.0 CARD HOUSEKEEPING

9.1 New Card ApplicationsIf a new card is required, contact the Purchasing Card Administrator. You will be required to

complete an application form and a signed memo from the Head of Department will be

required to confirm agreement to the issue of a card. Once the application is authorised it is

sent to The Royal Bank of Scotland. A card is normally issued within 2-3 weeks. The card

will be sent to the Purchasing Card Administrator who will contact the card holder to make

arrangements for collection.

9.2 Amended cards - change of name

If it is necessary to amend the name on the card (e.g. because of marriage etc.) contact the

Purchasing Card Administrator. The obsolete card should be cut in half across the magnetic

strip and then returned to the Purchasing Card Administrator following receipt of the new one.

9.3 Replacement of expired cards

A replacement card should be received by the Purchasing Office approximately 14 days

before the renewal date. The Purchasing Card Administrator will contact the Cardholder to

arrange for collection of the card.

9.4 Job Change/Department Change

Upon notice of a job change and/or departmental change, the Cardholder should advise the

Purchasing Card Administrator as soon as possible.

9.5 Leaving University employment

Upon leaving the employment of the University the card must be cut in half and returned to

the Purchasing Card Administrator.

9.6 Card Declined

If a transaction is declined, the Cardholder should refer to the Purchasing Card Administrator.

Some potential causes are exceeding monthly card limit, exceeding individual transaction limit

or using a supplier that is within a Merchant Category not allowed by the University. The

Purchasing Card Administrator is able to make amendments if there is a genuine reason for

the transaction.

10. Contact Names and Locations

Contact Name Telephone Number

Purchasing Card Administrator

Purchasing Office, Jill Andrews 01227 823061

Darwin College

The Royal Bank of Scotland plc

Commercial Cards Division 0870 6000459

Lost / Stolen Cards Card Customer Services

(24 hour, 7 days a week) PO Box 5747

Southend–on-Sea

SS1 9AJ

Payments Office Nicola Bushell 01227 823888

Darwin College Emma Hyland 01227 823618

Finance Reporting Office 01227 827976Employee Agreement

a) I, XXXX hereby request a Purchasing Card. As a Cardholder I agree to comply with the following

terms and conditions regarding my use of the Card.

b) I have received and understood that I am being entrusted with a Purchasing card and will be

making financial commitments on behalf of the University.

c) I understand that the University is liable to the card provider for all the charges made on the card.

d) I agree to use this card for University of Kent business purchases only and agree not to charge

personal purchases. I understand that the University will audit the use of this card and report and

take appropriate action on any discrepancies.

e) I understand that personal expenses incurred using the card must adhere to the terms and

conditions of the Employee Personal Expenditure Policy https://www.kent.ac.uk/finance-

staff/docs/payments/EP1_Expenses_Policy.pdf

f) I will follow the established procedures for the use of the card. Failure to do so may result in either

revocation of my use privileges or any other disciplinary actions, including termination of

employment.

g) I have been given a copy of the Purchasing Card Procedure and understand the requirements for

the Card’s use.

h) I agree to return the Card immediately upon request or upon termination of employment (including

retirement). Should there be any organisational change, which cause my purchasing

requirements to change, I agree to return my card and arrange for a new one, if appropriate.

i) If the card is lost or stolen I agree to notify The Royal Bank of Scotland plc immediately by

telephone and the Purchasing Card Administrator as soon as possible thereafter.

j) I agree to retain all documentation relating to each transaction and to submit approved statements

within the timeframe stated.

k) You have been issued with a PIN number for business use for your card; you are responsible for

the safe keeping of the individual PIN Number. You must not divulge the PIN Number to

anyone. (Remove if Dept Card)

l) Monthly Credit Limit : £5,000

m) Single Transaction Limit £1,500

n) Cost Code for Government Purchasing Card: 5744 XXX XXXXX

Employees Signature………………………………………… Date……………

Card Administrators Signature……………….……………… Date…………..

To be retained by the Purchasing Card Administrator – copy to the Cardholder.PURCHASING CARD MONTHLY TRANSACTION LOG

Name ...................................................Department............................................ Phone..................................... Month ......................... Year……………………

Last Four Digits of Credit Card ..........0635....................

Order Date Invoice Gross

Order Description of Goods / Net Invoice

Ref No Supplier Name Approved by Goods Rec’d VAT Amount Invoice

Date Services Amount

Rec’d (√ ) Amount

2 x B&B Rooms for Jo Budget/Cost

Example ABC Hotels Bloggs 2-3/6/11 Centre

Controller

TOTAL

Cardholder’s Signature............................................................. Budget Holder’s Signature.............................................................. DATE

This form together with receipts must accompany The Royal Bank of Scotland plc Statement when returned to Payments OfficeYou can also read