Opinion: Retail Cities CEO Ray Gaul on the cashierless paradox in travel retail

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Opinion: Retail Cities CEO Ray Gaul on the

cashierless paradox in travel retail

INTERNATIONAL. Retail Cities is a global retail data and insights firm, primarily focused on fast growth

industries and markets. Its CEO and Co-Founder Ray Gaul looks at how the advantages held by travel retail as

an innovation leader could help the sector come to the fore in the new era of ‘cashierless’ retail.

Travel retail has always maintained some differences from general retail, in multiple dimensions, but with three

shopper mindset differences predominant. These differences will be important to remember as ‘cashierless’

retail solutions explode across travel hubs.

How can we make sure humans are at the centre of all interactions in retail

without forcing shoppers to interact with staff – does that mean new staff, new

training, different roles?Ray Gaul will build on the theme of this article with a presentation at the Virtual Travel

Retail Expo 2021

Key differences include:

Willingness to spend. Travel retailers know that consumers typically leave home with some extra cash to

spend, looking buy a gift to say things like, “What a great trip!”, “I missed you!”, “We value our business

partnership”, or “Thank you for hosting me.”

Grabbing attention. With assigned seating, waiting lounges, and other features, travel retailers know

they will have the consumer’s undivided attention for a fixed amount of time, even if just briefly. They

also know they can begin to interest consumers in advance of any scheduled trip.

Moments of need. Travel retailers know that consumers will forget to pack, lose something along the

way, or see something they simply must have along their journey.

Travel retail’s position as an innovation leader

The result of these differences is that travel retail has been a step ahead of general retail in innovation. Travel

retail has served as innovation leader in changing the process which consumers use to make retail purchase

decisions.

In general retailing, the purchase journey has had a linear construct – it was impractical and rare to do shopping

in any way other than the following sequence.

Step 1: Leave home and decide which store to enter.

Step 2: Take a closer look at some departments, categories and items. Visit other stores to make

comparisons and ultimate decision on where to buy.

Step 3: Go back to the store, purchase item(s) and transport these to home/office/other.The digital age has upended this linear construct, creating disruptive forms of retail in its wake. For example, start-up retailers using a beauty-in-a-box style solution can now ship goods directly to a consumer (Step 3); the consumer can then take a closer look at each item (Step 2); the consumer can then decide to visit stores to try different colors/styles/pack sizes (Step 1). The shopping landscape has changed forever, with travellers passing though airports already adopting digital methods to interact with retailers and food & beverage providers The digital age has enabled a million combinations to take place, in different sequences. These go by names such as showrooming, ‘norooming’, webrooming, ‘autorooming’, and more. Travel retail has often been there first – a true leader for the broader industry. The advantages of leadership Travel retail has been in a unique position to take advantage of these changes ahead of generalised retail for two reasons. Firstly, travel retail has never been bound by the same linear construct as general retail. Airlines have provided shop in advance, pick-up at destination services since the early days of intercontinental civilian flights. Secondly, airports, train stations, and ferry terminals are often at the heart of retail’s test and learns. These are places where governments, technology companies, and retailers come together to build future societies. As a

result, these are wonderful testing grounds for new ideas that require the combination of government, the technology sector and retail to come to life. Travel retail, as a result, has often been more beautiful, more entertaining, and more futuristic than general retail over the past two decades. Can this continue now after 18 months of austerity, restrictions on certain types of personal interactions between retail salespeople and travellers, and other challenges? Leadership lost? One exception to travel retail’s leadership has been in the contactless store segment of digital retail. Cashierless stores first began to reach scale as online-to-offline solutions. Led by Alibaba with Happy Hippo and startup online player T11 in China, contactless has been happening in Asia as early as 2014. This was followed by Amazon Go in the USA in 2016. It didn’t arrive in Europe until 2021 with the launch of Amazon Fresh in London earlier this year and Rewe’s Pick & Go store in Cologne, Germany in May. Cashierless is just now making its way, wholesale, into airport and train station retail. Hudson in the USA has recently partnered with Amazon to provide ‘Just Walk Out’ travel stores in North American travel hubs. Other travel retailers are fast followers. It will be moments, not more, before more travel retailers launch their own versions of cashierless retail solutions, particularly in the convenience sub-segment of travel retail. Combined with the pandemic’s push to create contactless and socially-distanced experiences for regulatory and sanitary reasons, retail zones in airports and tourist destinations might soon become ‘service from a distance’ environments. Travel retailers have neither the team structures, number of stores, nor the budgets to be true leaders in cashierless retail solutions. Tesco, Britain’s largest supermarket chain with an annual capital ecommerce budget exceeding US$1 billion, just launched its second cashierless store. Tesco will always have larger technology investments than leading duty free retailers such as Dufry, DFS, China Duty Free Group, Lotte and more. Does this mean that travel retail will lose some of its innovative edge as a source of future inspiration for the rest of retail as consumers make the switch to cashierless?

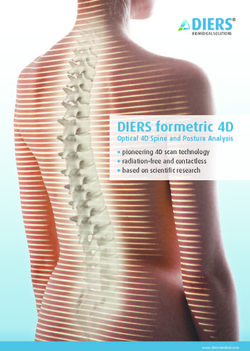

North American travel retailer Hudson has been quick out of the blocks to offer cashierless retail outlets in US

airports, using Amazon Just Walk Out technology

Humanity gained?

But wait just a moment. Businesspeople, tourists and adventurers often proclaim that what they love most about

their journeys is the chance to meet and interact with locals, retail being the frontline in such interactions. This

creates a paradox for retail designers, strategists, and workforces. How can we innovate to make travel retail

convenient and sanitary while delivering experiences that guarantee visitors will return and promote each

destination?

Despite the obvious scale disadvantages for travel retailers looking to build tech solutions, travel retailers retain

five big advantages over general retailers when moving to new digital solutions in retail, including cashierless

solutions.

1. Willingness to try something new. We said at the beginning that travel shoppers have budgeted to ‘buy

something extra’. They also have it in their heads that they will ‘try something new’. This makes the job

of shifting shoppers out of old habits to new habits much easier for a travel retailer.

2. Less of a hurry. Similarly, we said at the start that travel shoppers have moments where they know they

will need to sit and wait – on the airplane, at the check-in, waiting for a pick-up – these are great moments

to ask them to download, install, receive instructions. These opportunities just don’t appear for general

retailers.

3. Moments of need. Additionally, travel shoppers will be separated from the things they need because of

carelessness, forgetfulness, emergency or other reasons. Digital solutions may or may not be the right

solution for these moments of need but if they are the right fit they will make a lasting impression on theshopper.

4. Government partnership. Governments continue to invest in travel hubs and will need to do so with

more energy as we emerge from the pandemic. This gives travel retailers a unique voice and possible

platform for doing things with assistance rather than going it alone.

5. Technology hubs. Finally, and maybe most importantly, governments are encouraging IT and tech giants

to build tech hubs at the airports and train stations rather than outside of town or in a server farm in the

middle of nowhere. The proximity between travel retail and IT/tech incubators should not be overlooked.

In total, travel retailers will retain their advantages if they remember the human connections they enjoy – with

consumers, with government officials and with technology partners. Travel retailers can remain leaders in this

next phase of retail if they stay focused on using the retail technologies to solve different shopper needs than

those being used in general retailing.

Preparing for what comes next

We encourage all travel retailers, travel brands, and retail consultants to build a three-step vision for the future

of cashierless retail in travel hubs by answering these questions. Now is the right time to do this given the early

stage of cashierless development in travel.

1. How will we better understand shopper needs as a result of cashierless technology?

2. How can we make sure humans are at the centre of all interactions in retail without forcing shoppers to

interact with staff – does that mean new staff, new training, different roles?

3. How can we retake our natural position as leaders in innovation by partnering with governments and

technology providers in the right places at the right times?

Note: Readers can comment on this article via the Disqus platform below or via our LinkedIn page.

Building on the theme of this article, Ray Gaul will be speaking at October’s Virtual Travel Retail Expo 2021

with a presentation titled ‘The Contactless Paradox in Travel Retail’.

Contact:

Web: https://www.retailcities.com/

Email: ray.gaul@retailcities.comYou can also read