Making It Simple: Sanctions Compliance - REFERENCE & MASTER DATA INSTRUMENT & LEGAL ENTITY DATA - Bloomberg LP

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

REFERENCE & MASTER DATA Making It Simple: Sanctions Compliance. INSTRUMENT & LEGAL ENTITY DATA

MAKING IT SIMPLE: SANCTIONS Economic sanctions are penalties imposed by a nation or group of

COMPLIANCE – INSTRUMENT nations onto another nation or group of nations, including restrictions

& LEGAL ENTITY DATA

on financial transactions and trade barriers, and are designed to

deprive a target company of the use of its assets and to deny it

2 S

anctions Are Everywhere access to other financial systems, such as the benefits of trade,

2 Not All Sanctions Are Created Equal transactions and services.

4 E

xplicit versus Implicit Sanctions The introduction of new sanctions in PENALTIES FOR VIOLATING

response to the 2014 crisis in Ukraine SANCTION REGULATIONS

4 E

ntity versus Instrument Level has increased the complexity of Fines for violating sanction

Sanctions sanctions data for several reasons: regulations can be substantial.

For example, criminal penalties

•T

arget entities are more active in

for willful violations in the U.S.

the global economy and financial

can include economic fines and

markets than previously sanctioned

imprisonment. Moreover, being

companies.

singled out by the financial authorities

•T

he U.S., the European Union and can result in damage to a firm’s

other governments have imposed reputation, loss of revenue and

overlapping but often different destruction of shareholder value.

sanctions. The list of sanctioned

entities as well as the scope of BLOOMBERG IS HERE TO HELP

the sanctions can vary from one Bloomberg has made significant

jurisdiction to another. investments to deliver high-quality,

comprehensive sanction data that

• Sanction programs are becoming addresses the needs of the industry.

more targeted. Certain jurisdictions Bloomberg Sanction Data covers 10

– such as the U.S., the EU, Canada, different jurisdictions: U.S. Office

Switzerland, Australia and Japan – of Foreign Assets Control (OFAC),

differentiate between comprehensive EU, United Nations, Canada, U.K.,

and sectoral sanctions. Switzerland, Japan, Hong Kong,

•S

anctions programs capture both Singapore and Australia. A team

explicitly defined and implicitly of subject-matter experts monitors

related sanctioned companies. As a the different sanction programs and

result, understanding the ownership provides timely updates. Bloomberg’s

structure of these companies is legal entity data flags entities that

critical to ensuring full compliance. have been sanctioned by any of the

previously mentioned jurisdictions

•T

here is limited guidance on the new and indicates the type of sanction

sanctions, requiring market players that applies in each case. As a

to individually determine the scope response to specific sectoral sanction

of sanction programs on specific programs, which limit the ability of

entities and instruments. entities to access additional capital

In addition to the increasing in the financial markets, Bloomberg

complexity in sanctions, regulatory now offers a pre-trade compliance

scrutiny with regards to compliance solution comprised of instrument level

has become more severe. sanction data.SANCTIONS ARE EVERYWHERE

Many financial companies are global As an example, a Canadian broker-

in nature, and it is imperative for these dealer based in Toronto, with operations How can firms manage multiple

organizations to abide by sanction in New York, London, Frankfurt and sources and multiple pieces

rules in the jurisdictions where they do Tokyo, will need to manage multiple of legislation that can require

business. This is challenging because pieces of legislation that require legal and specialized knowledge

each jurisdiction has its own specific specialized legal knowledge about about sanctions and financial

laws and rules that determine which sanctions and the impact on its instruments?

entities or instruments are sanctioned. business. This is because not only will

The process is complicated by the they need to comply with Canadian Bloomberg provides an industry-wide

fact that while lists of sanctioned sanction regulation but also with the solution by monitoring sanctions in

companies for the various jurisdictions U.S. (OFAC), U.K., EU and Japanese 10 global jurisdictions. Whenever the

often overlap, they are not 100 percent specific rules. U.S. (OFAC), EU, U.N., Canada, U.K.,

the same. Understanding and Switzerland, Japan, Australia, Hong

correctly interpreting legal texts, in Kong or Singapore issues changes or

jurisdictions where sanctions are publishes new legal articles that will

written only in the local language, impact sanction data, our sanction

adds another layer of complexity. experts will ensure, often by working

with local counselors, that the

legislation is interpreted correctly and

consequently updated in our database.

NOT ALL SANCTIONS ARE CREATED EQUAL

Traditionally, sanctions programs have Distinguishing sectoral and

been comprehensive in nature. These comprehensive sanctions is critical to How can an organization know

sanctions generally prohibit all direct understand the type of relationship a with certainty which types of

or indirect imports/exports, trade firm can have with a given entity. sanctions apply to a potential

brokering, financing or facilitating counterparty or client?

For instance, a U.S. financial company

against most goods, technology

engaging in a swap deal with a new Bloomberg has worked with

and services. Transactions require a

Russian counterparty will need to local counselors and its internal

specific license or exemption from the

understand if sanctions apply to the compliance department to

OFAC before they can take place.

entity. If the counterparty appears on understand the various directives

However, the new sanctions a sanction list, further research will in the different sanction programs.

introduced in July 2014, known be required to determine whether the As a result, we are able to provide

as sectoral sanctions, apply only sanction is comprehensive or sectoral. details about the type of sanction

to specific activities with target The Compliance team will reject the that applies to each entity. In

companies, primarily, providing deal if comprehensive sanctions apply addition, for some jurisdictions,

medium- to long-term financing or but may approve it if the Russian we provide the lineage tracing the

engaging in business related to key company is sectoral sanctioned. type of sanction to the specific

sectors, such as energy and defense. applicable directive.

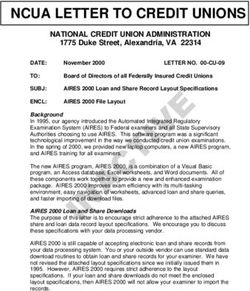

INSTRUMENT & LEGAL ENTITY DATA 2By combining detailed legal entity sanctions information with a legal entity’s corporate structure, the securities

they have issued and a sophisticated rules engine, Bloomberg is able to provide a complete sanctions solution

for the industry.

RUSSIAN FEDERATION

NPO URALVAGONZAVOD AO VTB BANK PJSC DENIZBANK A.S.

Explicitly Sanctioned

OFAC FULL SANCTIONED OFAC SECTORAL SANCTIONED NOT OFAC SANCTIONED

SDN List Directive 1

All securities will No OFAC sanctioned

be sanctioned securities

VTB-LEASING OJSC VTB BANK BELARUS CJSC VTB BANK OJSC

Implicitly Sanctioned Implicitly Sanctioned Implicitly Sanctioned

No Outstanding Issues

VTB-LEASING FINANCE Fixed Income

Implicitly Sanctioned Equities

Securities

RULE

Fixed Income ENGINE

Equities

Securities

RULE

ENGINE ISSUE OFAC

TICKER DATE MATURITY SANCTIONED?

EJ884551 Corp 10/29/2013 10/31/2016 N

ISSUE OFAC EJ301885 Corp 8/6/2012 Perpetual N

TICKER DATE MATURITY SANCTIONED?

EH549957 Corp 6/16/2009 6/7/2016 N

EH864455 Corp 6/16/2009 6/7/2015 N

EI075820 Corp 12/9/2009 11/30/2016 N

EI349860 Corp 8/10/2010 8/1/2017 N

EI351069 Corp 8/11/2010 8/2/2017 N

EK750289 Corp 12/4/2014 11/25/2021 Y

EK750469 Corp 12/30/2014 12/21/2021 Y

EK748599 Corp 8/15/2014 8/5/2022 Y

EK748737 Corp 12/30/2014 12/20/2022 Y

EK750812 Corp 12/30/2014 12/20/2022 Y

INSTRUMENT & LEGAL ENTITY DATA 3EXPLICIT VS. IMPLICIT SANCTIONS

Only a small fraction of all sanctioned As an example, a German large

companies are listed by official bank servicing thousands of How can a firm determine all

sources. These programs state that counterparties in Europe will need to related companies that should

majority-owned subsidiaries are also ensure that none of these companies be considered sanctioned and

in scope for these directives. It is is added to a European sanction list. perform the analysis necessary

essential for global market players to Furthermore, the Compliance team to determine if a security is or not

have in-depth understanding of an will also need to ensure that their impacted by sanctions?

entity’s corporate hierarchy to ensure counterparties are not controlled by

that the both explicitly and implicitly a company that is sanctioned by the Bloomberg flags both explicitly and

sanctioned entities are captured in a EU, since this might require them to implicitly sanctioned entities by going

firm’s compliance program. Mapping terminate the relationship. well beyond simply mapping sanction

the companies on an official sanction lists to entity records. We leverage

list to an entity database is part of the our extensive corporate hierarchy

process, but it is not enough. database to show a complete picture

of sanctioned companies, specific to

each jurisdiction. As a result of this

approach, firms can be confident

that they have the most up-to-date

sanctioned entities, even as corporate

structures continue to evolve.

ENTITY VS. INSTRUMENT LEVEL SANCTIONS

The introduction of sectoral sanctions For example, as part of the pre-trade

in 2014 was designed to restrict a compliance process, Compliance Satisfying the pre-trade

company’s access to new capital in officers need to evaluate trades that compliance requirement.

the financial markets. Compliance pose a risk to the institution. Trading

managers now need to understand a bond of a sectoral sanctioned To satisfy the pre-trade compliance

both the type of sanction program company represents a certain requirement with respect to sanctioned

levied against the company and challenge, since that instrument may securities, Bloomberg combines its

the potential instruments that are or may not be eligible for trading issue-to-issuer linkages, legal entity

restricted from trading or investment. depending on when it was issued sanction data and its market standard

and when it matures. instrument reference data to derive

While none of the governments that a comprehensive list of sanctioned

issue sanctions has published a list of instruments. Our sophisticated

sanctioned securities, it remains the rule engine is able to specify which

responsibility of each market player instruments are in scope with specific

to be compliant by interpreting the directives and scalable to both current

directives to understand whether a and upcoming listings.

security is sanctioned.

INSTRUMENT & LEGAL ENTITY DATA 4TAKE THE NEXT STEP

Bloomberg for Enterprise is ready to help your firm acquire highly accurate legal entity data suitable for use in a wide

variety of risk and compliance workflows. Contact one of our data professionals at eprise@bloomberg.net or visit

bloomberg.com/enterprise now.

BEIJING FRANKFURT LONDON NEW YORK SÃO PAULO SYDNEY

+86 10 6649 7500 +49 69 9204 1210 +44 20 7330 7500 +1 212 318 2000 +55 11 2395 9000 +61 2 9777 8600

DUBAI HONG KONG MUMBAI SAN FRANCISCO SINGAPORE TOKYO

+971 4 364 1000 +852 2977 6000 +91 22 6120 3600 +1 415 912 2960 +65 6212 1000 +81 3 3201 8900

bloomberg.com/enterprise

The data included in these materials are for illustrative purposes only. ©2016 Bloomberg L.P. All rights reserved. S655162310 0216 DIGYou can also read