Prediction of Stock Exchange Share Price using ANN and PSO

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Prediction of Stock Exchange Share Price using ANN and PSO

Atanu Pal (11111012) Diptarka Chakraborty (11111016)

palatanu@iitk.ac.in diptarka@iitk.ac.in

Abstract: will give better estimation on share market

Stock Exchange Share Price is very hard to predict

return than that given by already existing

since there are no significant rules to estimate or system.

predict that. Stock price prediction is one of the

emerging field of research and many methods like Artificial Neural Network:

technical analysis, statistical analysis, time series

analysis etc are used for this purpose. Artificial Artificial neural networks (ANN) have been

Neural Network is a popular technique for the stock developed as generalizations of

price prediction. Here we use Multilayer Feed- mathematical models of biological nervous

forward network as a network model for predicting systems. A first wave of interest in neural

stock price and to train this network model we are networks (also known as connectionist

going to use Particle Swarm Optimization. models or parallel distributed processing)

emerged after the introduction of simplified

Introduction: neurons by McCulloch and Pitts (1943). The

basic processing elements of neural

The stock market is one of the most popular networks are called artificial neurons, or

investing places because of its expected simply neurons or nodes. In a simplified

high profit. So, people always want to know mathematical model of the neuron, the

expectation of return on investment in effects of the synapses are represented by

share market before investing money. In connection weights that modulate the

effect of the associated input signals, and

recent years, most of the researchers have

the nonlinear characteristic exhibited by

been concentrating their research work on neurons is represented by a transfer

the future prediction of share market return function. The neuron impulse is then

by using Artificial Neural Network. All the computed as the weighted sum of the input

researchers use different learning algorithm signals, transformed by the transfer

to train their system and to determine function.

different parameters of their system and The learning capability of an artificial

neuron is achieved by adjusting the weights

the learning algorithms include minimizing

in accordance to the chosen learning

least-square based objective function or algorithm. There are several learning

using gradient descent learning algorithm. algorithm (e.g. Hebbian Learning Rule,

Our motivation is also design this problem Perceptron Learning Rule, Backpropagation

using Artificial Neural Network, but we Learning Rule) known for such weight

want to apply Particle Swarm Optimization adjustment and now-a-days Genetic

Algorithm (GA), Particle Swarm

to update different parameters of the

Optimization (PSO) are also be used for

system. As Particle Swarm Optimization

adjustment of weight of ANN.

method optimizes a problem by iteratively

trying to improve a candidate solution, so it

may possible that if we apply it for this Particle Swarm Optimization:

problem to update different parameters of

Particle swarm optimization (PSO) is a

Artificial Neural Network, then our system

population based stochastic optimizationtechnique developed by Dr. Eberhart and 4. Terminate on some condition

Dr. Kennedy in 1995, inspired by social

5. Go to step 2

behavior of bird flocking or fish schooling.

The system is initialized with a population 6. Update each particle in each

of random solutions and searches for generation using

optima by updating generations. In PSO, the

potential solutions, called particles, fly v[i] = v[i] + * rand() * (pbest[i] -

through the problem space by following the present[i]) + * rand() * (gbest[i] -

current optimum particles. Each particle present[i])

keeps track of its coordinates in the and

problem space which are associated with

the best solution (fitness) it has achieved so present[i] = persent[i] + v[i]

far. (The fitness value is also stored.) This

where c1 and c2 are learning factors

value is called pbest. Another "best" value

(weights)

that is tracked by the particle swarm

optimizer is the best value, obtained so far Inertia Weight

by any particle in the neighbors of the

particle. This location is called lbest. When a d is the dimension, c1 and c2 are positive

particle takes all the population as its constants, rand1 and rand2 are random

topological neighbors, the best value is a numbers, and w is the inertia weight

global best and is called gbest. The particle

vidnew wi vidold c1 rand1 ( pid xid ) c2 rand2 ( pgd xid )

swarm optimization concept consists of, at

each time step, changing the velocity of xidnew xidold vidnew

(accelerating) each particle toward its

Velocity can be limited to Vmax

pbest and lbest locations (local version of

PSO). Acceleration is weighted by a random Multilayer Feed-forward Neural

term, with separate random numbers being

Network:

generated for acceleration

towards pbest and lbest locations. The basic architecture consists of three

types of neuron layers: input, hidden, and

PSO Algorithm: output layers. In feed-forward networks,

the signal flow is from input to output units,

1. Initialize population in hyperspace

strictly in a feed-forward direction. The data

processing can extend over multiple (layers

2. Evaluate fitness of individual

of) units, but no feedback connections are

particles

present.

3. Modify velocities based on previous

best and global (or neighborhood)

best positionsavailable closing price for the stock was

used.

Here we use data for trading days only and

also we ignore the data for certain trading

days for which some of the element of the

data (like stock volume) is missing.

Model Analysis:

There are two main phase

i. Training phase

ii. Prediction phase or testing phase

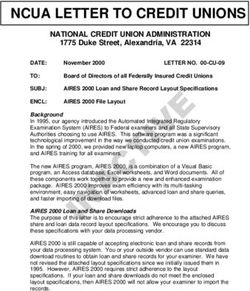

Fig 1: An example of Multilayer Feed-forward

The first phase training phase also can be

Neural Network

divided into two parts, building ANN model

and weight updation phase.

We use only one hidden layer but the

number of nodes in the hidden layer will be Multilayer Feed-forward Neural Network

selected later during the time of training Model:

and testing. We’ll run the training and We have used Multilayer Feed-forward

testing for different number of nodes in Neural Network to model the stock price

hidden layer and choose the number that prediction problem. Here we are predicting

will give the best result. closing price of a stock on the next day.

Thus input variables that are considered to

Preprocessing:

affect the stock exchange market are

Before using the data for analyzing,

preprocessing of data is needed. The 1. Last-day opening Stock Price

problem arises when there is no trading 2. Last-day high Value of Stock Price

data or partial trading data corresponding 3. Last-day low Value of Stock Price

certain days. Heinkel and Kraus [6] stated 4. Last-day stock Volume

that there are three possible ways dealing 5. Last-day closing price

with days having no trading, viz. ignore the

days with no trading and use data for Thus input layer of our neural network

trading days, assign a zero value for the model consists of five input nodes.

days which have no trading, build a linear

model which can be used to estimate the The output layer consists of only one node

data value for the day with no trading. In that gives the predicted Closing Stock Price.

most of times, weekly closing price refers to

each Friday’s closing prices. In the event of We have used only one hidden layer and we

Friday being a holiday, the most recently have found the number of nodes in the

hidden layer after trying out 5-15 numbersof nodes, and the best result we have found rate of the month August ,i.e, from 01-08-

for the number of nodes in the hidden layer 2011 to 31-08-2011 and match it with the

equal to 10. closing data of that period.

We have used sigmoid function Error is calculated using the following

(f(x)=( ) as activation function. formula

)

Relative Absolute Error (%) =

Weight Updation using PSO: | |

× 100

Here we have used Particle Swarm

Optimization to update the weight of our The table given below is showing the

Neural Network model. percentage relative error in prediction for

that period

The optimal PSO parameters have been

determined by varying the inertia weight Date Actual Predicted Error(%)

( ), maximum velocity ( ), social and 8/1/2011 25.27 24.13 3.96

cognitive coefficient ( and ) and the 8/2/2011 26.80 26.68 0.00

swarm size and the values of the 8/3/2011 26.92 26.50 0.00

8/4/2011 25.94 26.60 0.00

parameters for which we have found the

8/5/2011 25.68 25.41 0.00

best result in our training set are as follows:

8/8/2011 24.48 24.79 0.00

Inertia weight=0.3 8/9/2011 25.58 24.20 3.91

8/10/2011 24.20 24.58 0.00

Maximum velocity=2.0 8/11/2011 25.19 24.69 0.00

8/12/2011 25.10 26.46 3.98

=0.15 8/15/2011 26.51 27.71 0.00

8/16/2011 27.35 27.83 0.00

=0.8

8/17/2011 27.25 27.87 0.00

Swarm size=100 8/18/2011 24.67 28.07 12.16

8/19/2011 24.05 25.85 4.16

8/22/2011 24.98 27.54 8.01

Data Set Used: 8/23/2011 25.72 28.71 7.78

8/24/2011 26.90 28.32 3.72

Historical Stock Price data (from 01.01.11 to 8/25/2011 27.57 28.75 0.00

31.08.11) of Microsoft Corporation (MSFT) 8/26/2011 27.25 28.38 0.00

collected from http://in.finance.yahoo.com 8/29/2011 26.84 27.21 0.00

8/30/2011 26.23 28.62 7.62

Result: 8/31/2011 26.60 27.49 0.00

Here we have used data from 01-01-2011 to Table 1: Predicting price, Actual price and Error (%)

29-07-2011(total 146 data) for training of MSFT using ANN and PSO

purpose and then predict the stock close8/11/2011 25.19 27.479 7.99

8/12/2011 25.10 27.479 7.97

8/15/2011 26.51 27.478 0.00

8/16/2011 27.35 27.478 0.00

8/17/2011 27.25 27.478 0.00

8/18/2011 24.67 27.478 8.11

8/19/2011 24.05 27.479 12.47

8/22/2011 24.98 27.479 8.01

8/23/2011 25.72 27.478 3.89

8/24/2011 26.90 27.478 3.72

8/25/2011 27.57 27.478 0.00

8/26/2011 27.25 27.478 0.00

8/29/2011 26.84 27.478 0.00

8/30/2011 26.23 27.478 3.81

8/31/2011 26.60 27.478 0.00

Fig 2: graphical representation of Predicting and

Table 1: Predicting price, Actual price and Error (%)

Actual price of MSFT using ANN and PSO

of MSFT using ANN with Back-propagation

Algorithm

Comparison with Existing Model:

The table 2 is showing the relative

percentage error and figure 3 is showing

the graphical representation of predicted

and actual stock price of ANN based stock

price prediction system where Back-

propagation algorithm is used in weight

updation of ANN model with the same

MSFT dataset that we have used:

Date Actual Predicted Error(%)

8/1/2011 25.27 27.479 7.91 Fig 3: graphical representation of Predicting and

8/2/2011 26.80 27.479 0.00 Actual price of MSFT using ANN with Back-

8/3/2011 26.92 27.479 0.00 propagation Algorithm

8/4/2011 25.94 27.479 3.86

8/5/2011 25.68 27.479 3.89

8/8/2011 24.48 27.479 8.17

8/9/2011 25.58 27.479 3.91

8/10/2011 24.20 27.479 12.39From this comparison we can say that: inputs of ANN. If instead of these inputs,

different economical measures like General

Relative error (%) of our proposed

Index, Net Asset Value, P/E ratio, Earning

model is far better than that of

per Share, Share Volume will be used as

back-propagation algorithm based

inputs to ANN as proposed in [3] ,then our

ANN model

approach of weight updation using PSO may

Back-propagation based ANN model give better result but for this different

cannot capture the variations of parameter values of PSO need to be tuned.

stock market, but our proposed PSO

based ANN model can capture the

variations of stock market in a

better way relative to back-

References:

propagation based ANN model [1] Kunwar Singh Vaisla, Ashutosh

Kumar Bhatt, “An Analysis of the

Performance of Artificial Neural

Observation: Network Technique for Stock

Market Forecasting” on (IJCSE)

1. The output of the model is highly International Journal on Computer

dependent on the different Science and Engineering Vol. 02, No.

parameters of PSO. 06, 2010, 2104-2109

2. If input changes highly, then [2] Olivier Coupelon, “Neural Network

prediction of our model is not near Modeling for Stock Movement

to the actual value, i.e., error during Preiction-A State of the Art”

sudden fall or sudden rise of index [3] Khan, Alin, Hussain, “Price

value is much more. Prediction of Share Market using

ANN” on International Journal of

Conclusion and Future Work:

Computer Applications (0975 –

As researchers and investors strive to out- 8887) Volume 22– No.2, May 2011

perform the market, the use of neural [4] Mohammad Mohatram,

networks to forecast stock market prices “Forecasting of Stock Exchange

will be a continuing area of research. Here Share Price using Feed Forward

we have used only 146 data for training Artificial Neural Network”

purpose. Our model may give far better

[5] Egeli, Ozturan, Badur, “Stock Market

result if more data will be used during

training. Prediction Using Artificial Neural

Here we have used Last-day opening Stock Networks”

Price, Last-day high Value of Stock Price, [6] R. Heinkel, A Kraus, “Measuring

Last-day low Value of Stock Price, Last-day Event Impacts in Thinly Traded

stock Volume, Last-day closing price asStocks”on Journal of Financial and

Quantitative Analysis, March 1988

[7] Ajith Abraham, “Artificial Neural

Networks”

http://www.softcomputing.net/ann

_chapter.pdf

[8] “Swarm Intelligence” by Kennedy,

Eberhart, and Shi, Morgan

Kaufmann division of Academic

Press, 2001

[9] “Comparison of Particle Swarm

Optimization and Back-propagation

as Training Algorithms for Neural

Networks” by Venu G. Gudise and

Ganesh K. Venayagamoorthy,

Senior- Member; /IEEE

[10] http://www.engr.iupui.edu/~

eberhart/web/PSObook.html

[11] http://www.swarmintelligen

ce.orgYou can also read