IRAs Are Top Tool for Retirement Savings - Dolan Financial Services

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Focus on Financial FItness

Linden Financial Group

108 Main Street • Amesbury • MA • 01913

978-388-3468 • 978-388-3468

plan@lindenfinancialgroup.com • LindenFinancialGroup.com

IRAs Are Top Tool for Retirement Savings

Individual retirement accounts are the largest pool of U.S. retirement assets, which totaled $33.1 trillion at the

end of the third quarter of 2020.

Source: Investment Company Institute, 2020

Page 1 of 4

See disclaimer on final page

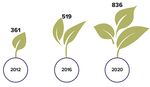

May 2021Growing Interest in Socially Responsible Investing

U.S. assets invested in socially responsible strategies 800 different investment funds that incorporate ESG

topped $17.1 trillion at the start of 2020, up 42% from factors, and the field is expanding rapidly.2

two years earlier. Sustainable, responsible, and impact

(SRI) investments now account for nearly one-third of Number of ESG Investment Funds

all professionally managed U.S. assets.1 This upward

trend suggests that many people want their investment

dollars to pursue a financial return and make a positive

impact on the world.

There is also wider recognition that good corporate

citizenship can benefit the bottom line. A favorable

public image might increase sales and brand value,

and conservation efforts can help reduce costs,

improving profit margins. Some harmful business

practices are now viewed as reputational or financial

risks that could damage a company's longer-term

prospects.

ESG Explained Source: US SIF Foundation, 2020

SRI strategies incorporate environmental, social, and

governance (ESG) considerations into investment

decisions in a variety of ways. ESG data for publicly Many SRI funds are broad based and diversified,

traded companies is often provided alongside some are actively managed, and others track a

traditional financial data by investment research and particular index with its own collection of SRI stocks.

rating services. Some examples of prominent ESG ESG criteria can vary greatly from one SRI fund to

issues include climate change, sustainable natural another. Specialty funds, however, may focus on a

resources, labor and equal employment opportunity, narrower theme such as clean energy; they can be

human rights, executive pay, and board diversity. more volatile and carry additional risks that may not be

suitable for all investors.

A simple exclusionary approach (also called negative

screening) allows investors to steer clear of companies Socially responsible investing may allow you to further

and industries that profit from products or activities both your own economic interests and a cause that

they don't wish to finance. These choices can vary matters to you. Moreover, recent research suggests

widely depending on the individual investor's ethics, you shouldn't have to accept subpar returns in order to

philosophies, and religious beliefs, but alcohol, support your beliefs.3

tobacco, gambling, and weapons are some typical As with any portfolio, it's important to pay attention to

exclusions. the composition and level of risk and to monitor

Similarly, positive screening can help investors identify investment performance. Be prepared to make

companies with stronger ESG track records and/or adjustments if any of your holdings don't continue to

policies and practices that they support. Impact meet your financial needs and reflect your values.

investing is a less common strategy that directly The return and principal value of SRI stocks and funds

targets specific environmental or social problems in fluctuate with changes in market conditions. Shares,

order to achieve measurable outcomes. when sold, may be worth more or less than their

There are also a variety of integrative approaches that original cost. There is no guarantee that an SRI fund

combine robust ESG data with traditional financial will achieve its objectives. Diversification does not

analysis. These tend to be proactive and guarantee a profit or protect against investment loss.

comprehensive, so they are less likely to avoid entire Investment funds are sold by prospectus. Please

industries. Instead, analysts and portfolio managers consider the investment objectives, risks, charges, and

may compare industry peers to determine which expenses carefully before investing. The prospectus,

companies have taken bigger steps to meet which contains this and other information about the

environmental and social challenges, potentially investment company, can be obtained from your

gaining a competitive advantage. financial professional. Be sure to read the prospectus

carefully before deciding whether to invest.

Investment Opportunities

The range of investment vehicles used in SRI 1-2) US SIF Foundation, 2020

strategies includes stocks, mutual funds, 3) The Wall Street Journal, March 16, 2020

exchange-traded funds (ETFs), and, to a lesser extent,

fixed-income assets. Altogether, there are more than

Page 2 of 4, see disclaimer on final pageHome-Sweet-Home Equity

Buying a home is a long-term commitment, so it's not Borrow on Equity

surprising that older Americans are much more likely If you stay in your home and want money for a specific

than younger people to own their homes "free and purpose, such as remodeling the kitchen or fixing the

clear" (see chart). If you have paid off your mortgage roof, you might take out a home-equity loan. If instead

or anticipate doing so by the time you retire, you'll need to access funds over several years, such

congratulations! Owning your home outright can help as to pay for college or medical expenses, you may

provide financial flexibility and stability during your prefer a home-equity line of credit (HELOC).

retirement years.

Home-equity financing typically has favorable interest

Even if you still make mortgage payments, the equity rates because your home secures the loan. However,

in your home is a valuable asset. And current low you are taking on another monthly payment, and the

interest rates might give you an opportunity to pay off lender can foreclose on your home if you fail to repay

your home more quickly. Here are some ideas to the loan. In addition, you may have to pay closing

consider. costs and other fees to obtain the loan. Interest on

Enjoy Lower Expenses home-equity loans and HELOCs is typically tax

deductible if the proceeds are used to buy, build, or

If you are happy with your home and don't need to tap

substantially improve your main home, but is not tax

the equity, living free of a monthly mortgage could

deductible if the proceeds are used for other

make a big difference in stretching your retirement

expenses.

dollars. It's almost as if you had saved enough extra to

provide a monthly income equal to your mortgage. You Refinance

still have to pay property taxes and homeowners With mortgage rates near historic lows, you might

insurance, but these expenses are typically smaller consider refinancing your home at a lower interest

than a mortgage payment. rate. Refinancing may allow you to take some of the

Consider Downsizing equity out as part of the loan, but of course that

increases the amount you borrow. While a refi loan

If you sell your home and purchase another one

may have a lower interest rate than a home-equity

outright with cash to spare, the additional funds could

loan or HELOC, it might have higher costs that could

boost your savings and provide additional income. On

take some time to recoup. And a new loan comes with

the other hand, if you take out a new mortgage, you

a new amortization schedule, so even with lower rates,

may set yourself back financially. Keep in mind that

a larger portion of your payment may be applied to

condominiums, retirement communities, and other

interest in the early years of the loan. Refinancing

planned communities typically have monthly

might be a wise move if the lower rate enables you to

homeowners association dues. On the plus side, these

pay off a new mortgage faster than your current

dues generally pay for maintenance services and

mortgage.

amenities that could make retirement more enjoyable.

Paying Off the Mortgage

The percentage of homeowners with a primary regular mortgage declines steadily with age.

Source: 2019 American Housing Survey, U.S. Census Bureau, 2020

Page 3 of 4, see disclaimer on final pageNew Changes to College Financial Aid and Education Tax Benefits

In late December 2020, Congress passed the as the student aid index, or SAI, in an attempt to more

Consolidated Appropriations Act, 2021, another relief accurately reflect what this number represents: a

package in response to the pandemic. The bill yardstick for aid eligibility rather than a guarantee of

included several provisions related to education, what families will pay (families often pay more than

including $22.7 billion for colleges and universities. their EFC amount).

Here are some key highlights.

Expanded Lifetime Learning credit. The bill

Simplified FAFSA. The bill accomplishes the increased the income limits necessary to qualify for the

long-held bipartisan objective of simplifying the Free Lifetime Learning credit, an education tax credit worth

Application for Federal Student Aid, or FAFSA, starting up to $2,000 per year for courses taken throughout

with the 2023-2024 school year. For example, the one's lifetime to acquire or improve job skills. Starting

legislation significantly reduces the number of overall in 2021, a full credit will be available to single filers

questions (including eliminating questions about drug with a modified adjusted gross income (MAGI) below

convictions and Selective Service status); makes the $80,000 and joint filers with a MAGI below $160,000

income protection allowance more favorable for (the credit phases out for single filers with incomes

parents and students, which will allow more income to between $80,000 and $90,000 and joint filers with

be shielded from the formula; increases the income incomes between $160,000 and $180,000). These are

threshold (from $50,000 to $60,000) to qualify for the the same income limits used for the American

simplified needs test, an expedited formula in the Opportunity credit. To accommodate an expanded

FAFSA that doesn't count family assets; and widens Lifetime Learning credit, Congress repealed the

the net of students eligible for a Pell Grant. deduction for qualified college tuition and fees for 2021

and beyond.

However, the FAFSA will no longer divide a parent's

assessment by the number of children in college at the Employer help with student loan repayment. The

same time. This change has the potential to bill extended a provision allowing employers to pay up

significantly reduce the amount of financial aid offered to $5,250 of employees' student loans on a tax-free

to middle- and high-income families who have multiple basis for another five years. This provision, included in

children in college at the same time. the Consolidated Aid, Relief, and Economic Security

(CARES) Act, would have expired at the end of 2020.

Goodbye EFC terminology. In the future, the

expected family contribution (EFC) will be referred to

Securities and Advisory Services offered through Commonwealth Financial Network® , member FINRA/SIPC, a Registered Investment

Adviser. Fixed insurance products and services offered through CES Insurance Agency.

Commonwealth does not provide legal or tax advice. Please consult with a legal or tax professional regarding your individual situation.

This informational e-mail is an advertisement. To opt out of receiving future messages, follow the Unsubscribe instructions below

Page 4 of 4

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2021You can also read