EMPLOYMENT & SMALL BUSINESS - MORPC

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

EMPLOYMENT & SMALL BUSINESS Summary Central Ohio experienced growth in employment that rivaled the national average in the years following the Great Recession. Strong growth overall, however, was not evenly felt across the region. Wages for employment, for instance, diverge widely across industry sectors, which meant that for some, the expense of working was not sufficiently offset by the earnings. This was especially challenging for working parents, with the high cost of childcare added to already distressed budgets. Overall, Central Ohioans were recovering their personal finances, which translated as more spending and contributions to the economic engines that drive employment growth. Small businesses, however, were struggling to compete with large national or global chains and a growing e-commerce market. Key Issues The COVID-19 pandemic initiated a historic economic collapse, including a rapid 14% employment decline in a single month. A recovery is in progress but is only partial. The industry sectors hit hardest by the pandemic shutdowns were primarily those with the lowest average wages. This created financial peril for un- and underemployed Central Ohioans, especially those with already low earnings. At the nexus of small business and supports for workers, the pandemic impact on childcare centers has the potential to create greater workforce challenges as childcare access and affordability are compromised. The COVID-19 shutdowns prompted a jarring collapse in consumer confidence. This, paired with reduced consumer spending, has implications on overall growth of the economy. Decreased consumer spending and weak confidence across the board created threats to an already weak small business environment. Small business closures, still a threat, will leave an indelible mark on both the region’s economy and communities. Central Ohio COVID19 Policy Briefs | Employment & Small Business 1

RECOVERY FROM HISTORIC EMPLOYMENT COLLAPSE

Central Ohio employment grew by 23% between December 2009 and February 2020 – totaling 214,400 jobs, nearly

one-third greater than the national average. This above-average growth was driven by key sectors including construction,

finance and insurance, and healthcare.

Employment in the Columbus metro suffered a historic decline during the March and April 2020 lockdown. The

employment collapse brought the region a total loss of 160,300 jobs (14.2%) (Figure 1). Leading this loss was leisure

and hospitality – arts, entertainment, recreation, hotels, restaurants, and other food services. This sector lost nearly

half its employment over that two-month span. In the Columbus MSA, leisure and hospitality accounted for 10% of total

employment in February 2020, but its loss represented more than one-third of the total employment decline (Figure 2).

Although growth in succeeding months has been significant, employment as of January 2021 remained 47,000 (4.2%)

below its February 2020 peak. While Central Ohio jobs have recovered faster than the country as a whole – U.S.

employment in January 2021 remained 6.5% below February 2020 – it will still be many months before job totals return

to their pre-pandemic levels.

Figure 1. Total Employment Figure 2. Employment Gain, Loss, & Net Change

Columbus MSA & US Columbus MSA & US

2010-2020, Monthly Apr 2020-Jan 2021, Comparison

Nationally, no primary sector has recovered all of the jobs lost last March and April. Locally, the Regionomics®

seasonally adjusted employment estimates show three sectors above their year-ago levels: construction, manufacturing,

and transportation and utilities. January financial activities employment is equal to its February 2020 level. However,

employment in the leisure and hospitality sector remains 26,000 (23%) lower than before the pandemic – a net loss

comparable to the national average.

The Regionomics 2021 Columbus Economic Forecast predicts a year-over-year gain of 26,800 jobs (2.6%). That would

be the largest gain since 2012, but it will leave December 2021 employment well below its February 2020 peak. This is

consistent with national forecasts. The quarterly surveys of economists by the Federal Reserve Bank of Philadelphia and

the National Association for Business Economics (NABE) both expect strengthening U.S. employment growth over the

year, but neither panel expects a full employment recovery this year. Among the economists in the NABE survey, 65% do

not expect this to occur until 2023 or later.

A related concern is the effect of long-term unemployment on workforce readiness and workers themselves. As discussed

in a recent Harvard Business Review article,1 the long-term unemployed lose skills and the contacts who could help them

regain employment, and suffer a range of psychological impacts. While no local statistics measuring unemployment

duration exist, the number of people nationwide unemployed for more than 27 weeks has quadrupled from its year-ago

level to more than 4 million. The share of all unemployed who have been without work for 27 weeks or more is now 41.5%,

more than double the share from before the pandemic. This impact has fallen disproportionally on women: the percentage

of women who are in the labor force is at its lowest level since 1987. Rather than the hoped for "V-shaped" recovery the

disparities in long-term unemployment point to the reality of a "K-shaped" recovery, with many in the region experiencing

more lasting economic struggles.

Some of the job dislocations from the pandemic will be permanent. Two-thirds of the economists in the NABE panel expect

up to 5% of jobs to disappear permanently, while one-quarter expect the impact to be even larger – up to 15%. There will

be a need for significant investment in retraining to address this dislocation and return these workers to the labor force.

Central Ohio COVID19 Policy Briefs | Employment & Small Business 2FINANCIAL PERIL FOR UN- & UNDEREMPLOYED

Pandemic-related job losses have

Figure 3. Net Employment Change by Industry

disproportionately impacted workers in lower-

(Average Annual Wage)

wage industry sectors, particularly leisure Columbus MSA

and hospitality (the arts, recreation, hotels, Feb 2020-Jan 2021, Comparison

and restaurants), and retail trade. Of the

47,100 net jobs lost through January 2021

in the Columbus MSA, 25,900 are in leisure

and 4,900 are in wholesale and retail. These

sectors account for two-thirds of the total

jobs lost. Wages in leisure and hospitality in

particular are the lowest of any sector – an

average of $21,463 in the Columbus MSA in

2019. Low-wage industry sectors also include

administrative support and waste services

(temporary staffing is included in this sector),

and other services. These are the most “at-

risk industry sectors”, and have suffered a

combined net loss of 34,000, 72% of all jobs

lost (Figure 3).

Low-income workers are more vulnerable

to the impacts of job loss. A 2019 Federal

Reserve study found that nearly 40% of

households nationwide were not equipped to

handle a sudden $400 expense – let alone

sudden unemployment. Housing is a particular

vulnerability. Among households earning less

than $75,000 annually, 46% in 2019 met the U.S. Department of Housing and Urban Development definition for “housing

cost burdened” – paying 30% or more of their income in housing costs. One in five households earning less than

$75,000 a year in the Columbus MSA paid 50% or more of their income in rent or mortgages.2,3

In Central Ohio, low-wage workers in at-risk industry sectors live in high concentrations in many of the region’s rural

county seats, in parts of Appalachia where ecotourism is a dominant industry (e.g., Perry and Hocking Counties), and in

areas of Franklin County with higher concentrations of Black and brown residents (Figure 4). These communities will be

places to note. High-income workers have more or less rebounded employment since the start of the pandemic, but

middle-income workers (10% down since January 2020), and especially low-income workers (29% down since January

2020) are still struggling to recover (Figure 5).

Augmented unemployment benefits have provided a lifeline for struggling households, but enhanced supports are only

temporary and may fall short of meeting all household expenses. Discussed in greater detail in the Social Sector brief,

survey data from the U.S. Census Bureau suggests that one out of every three adults in Ohio are having a somewhat

or very difficult time keeping up with usual household expenses. These Ohioans are more likely to have experienced

loss of employment as a major factor contributing to their difficulty keeping up with bills. They are more reliant on state-

run assistance programs (e.g., Supplemental Nutritional Assistance Program), and they are more likely paying bills by

borrowing money from friends and family, using credit cards or loans, using savings, or selling assets.

New claims for unemployment surged in April 2020, tapering off throughout the rest of the year, but remaining at higher

rates than before the pandemic. More recently, Ohio’s unemployment claims system has become the target of significant

fraud. Initial claims more than tripled during the week ended February 6, 2021, to a level rivaling that during the worst

of the job loss in April 2020. The need to subject all claims to greater scrutiny increases system costs and could lead to

delays in the payment of legitimate claimants’ benefits, which would put extra strain on households’ budgets (Figure 6).

Central Ohio COVID19 Policy Briefs | Employment & Small Business 3Figure 4. Home Locations of Workers Figure 5. Employment by Income

in Most At-Risk Industry Sectors Columbus MSA

Central Ohio Census Tracts, 2017 Jan 2020-Feb 2021, Daily

Figure 6. Unemployment Claims

Columbus MSA

Mar 2020-Mar 2021, Weekly

Central Ohio COVID19 Policy Briefs | Employment & Small Business 4CHILDCARE ACCESS & AFFORDABILITY

Affordability of childcare poses a difficult challenge for families. The Massachusetts Institute of Technology’s Living

Wage Calculator estimates the unsubsidized annual cost of childcare at $9,714 per year per child.4 These costs are

sometimes subsidized for lower-income households, but childcare costs can be a substantial burden even for

households with moderate income.

A related problem is the benefits cliff: the fact that the childcare subsidy disappears at a certain household income level

that is often well below what is needed to afford the unsubsidized cost. This can cause a worker facing the loss of the

childcare benefit to make the economically rational decision to forgo a promotion or additional work hours. Childcare

access and affordability would remove a key barrier to entry into the labor force and help to stabilize household finances

for many Central Ohio families.

Childcare access is also challenging due to supply limitations—childcare centers are a business model that operates on

tight margins. The cost of operating a childcare facility and the ability of clients to pay, including their access to subsidies,

lead to different service levels, which manifests an inequity in quality of early learning experiences. Slots in accredited,

highly rated early childhood education centers, as rated by Ohio’s Step Up to Quality program, are both expensive and in

high demand. These inequities were already present before the pandemic, but the increased costs and revenue losses

created by COVID-19 are expected to intensify these disparities.

One year after the pandemic shutdowns began, 6% of unemployed workers nationally reported that their primary reason

for not working was caring for children who were not in school or daycare.5 Locally, the number of children authorized for

childcare subsidies has remained consistently lower than 2019 numbers since the pandemic shutdowns began in March

2020 (Figure 7). Neither the national nor local data tell a complete story about the reasons why families have some

workers focused on childcare responsibilities in lieu of work. For some families, there is a likely connection to childcare

centers scaling back enrollment or closing entirely, or families’ concerns about health or inability to find work.

Childcare centers’ financial stability relies on full enrollment, which has been prohibited during the pandemic. The initial

stay-at-home order closed all centers in the spring, which was a large blow to financial viability. Some workers who were

allowed to work from home provided their own childcare, and others relied on informal arrangements.

Estimates of the impact of these stresses on the number and employment of childcare centers in the Columbus MSA are

not yet available, but a survey of local centers in March 2020 by Action for Children paints a dire picture.6 One in six

childcare centers remained closed at that time, as a result of sustained low enrollment and increased costs for personal

protective equipment (PPE) and cleaning. At the time, 30% of still-open providers anticipated closing within three months

without immediate support, and half of providers reported closing within 6 months (Figure 8). The loss of even a fraction

of these at-risk providers, especially those rated as high-quality, will create limitations on the number of available slots

that will continue after the pandemic. Furthermore, 49% of respondents in the Action for Children survey had already or

planned to increase tuition. With the already high cost of childcare, this places additional strain on Central Ohio families,

especially those with lower incomes.

Figure 7. Subsidized Childcare Figure 8. Childcare Center Survey

Central Ohio Counties*, 2019-2020, Monthly Columbus MSA, March 2020

Central Ohio COVID19 Policy Briefs | Employment & Small Business 5COLLAPSE IN CONSUMER

CONFIDENCE

Strong consumer confidence is essential for strong, sustained

growth in the economy. Consumer spending comprises

70% of gross domestic product (GDP), if consumers

lack confidence, they will not spend, and GDP growth will

be severely limited. The University of Michigan’s Consumer

Sentiment Index, which had been at 20-year highs before the

pandemic, fell to levels rivaling those immediately following the

2007-2009 recession as the pandemic took hold (Figure 9).

Although the reopening of the economy and the emergence of

therapies and vaccines has had a positive impact on the index, it

remains depressed.

The lack of confidence is evident in the personal savings

rate, which rose to historic highs, spiking to 33.7% during the

lockdown. By the fall of 2020, as consumer spending began

to slowly increase and overseas production and logistics

Figure 9. Consumer Sentiment

challenges subsided, the savings rate fell to the mid-teens, United States

a rate that still rivaled levels last seen in the early 1970s. In Jan 2010-Jan 2021, Monthly

January 2021, the rate again increased to 20.5% as economic

stimulus payments were hitting households’ bank accounts

(Figure 10). These savings represent amounts that households

are not devoting to consumption, which negatively impacts GDP

growth. Consumer confidence must improve before the savings

rate can return to pre-pandemic levels.

Discussed in more detail in the Economic and Community

Development brief, data obtained from Opportunity Insights’

Economic Tracker shows a clear divergence in consumer

spending by income.7 Lower income households are keeping up

with normal spending patterns, for the most part, as their budgets

tend to have fewer discretionary items that can be eliminated;

they are also less likely to be working from home, which makes it

difficult to eliminate some consumer spending needs. Middle- and

high-income households saw the greatest spending reductions,

suggesting that these earners are enjoying increased personal

savings, while making fewer contributions to GDP growth. Figure 10. Personal Savings Rate

United States

The economy and public health are linked in unprecedented Jan 2010-Jan 2021, Monthly

ways, and the course of the virus and vaccinations is critically

important to the return of confidence. The flow of positive news

about the declining virus positivity rate, the increasing number of

vaccinations, and the responsible reopening of sports and

entertainment venues to a limited number of patrons will have a

positive impact. However, there is an unknown number of

individuals who are hesitant to return to these venues. Perhaps

being vaccinated will reduce their concerns and thus making

vaccinations widely and easily available will help restore

confidence. Pent up demand for travel and tourism (discussed in

the Transportation brief) will also have positive effects on GDP

growth. The successful return of these economic engines will be

contingent on the publicizing of and adherence to public health

guidelines, which will reduce the positivity rate and keep the

economy reopening.

Central Ohio COVID19 Policy Briefs | Employment & Small Business

6THREATS TO AN ALREADY WEAK SMALL

BUSINESS ENVIRONMENT

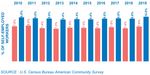

Central Ohio’s rate of self-employment, and concentration and growth of small businesses has been far below average for

years (Figure 11). Among the 100 largest MSAs in the U.S., Columbus in 2019 ranked 82nd in the percentage of workers

who are self-employed. Other statistics are available less regularly, but the rankings are stable. Columbus ranked 86th in

the share of all businesses that are small (fewer than 20 employees) in 2015 and 74th in the small business birthrate that

year.

Statistics on the loss of small businesses resulting from the economic stresses of the pandemic are not yet available, but

evidence suggests that a large number of small businesses are failing, or near failure. Discussed further in the Economic

and Community Development brief, these challenges are felt more acutely by businesses owned by people of color. A

national survey of small businesses suggests that “the share of firms that experienced financial challenges in the prior 12

months rose from 66% to 80% between 2019 and 2020.” 8 Furthermore, 90% of firms surveyed used some form of

emergency financial relief, predominately from the Paycheck Protection Program (PPP). Of the 64% of small businesses

that said they would apply for more financial support if available, 39% said their business would not survive unless

business returned to pre-pandemic levels, or more relief became available.

The new emergency relief package, however, offers much less aid to small businesses than previous rounds -- $50

billion of the $1.9 trillion plan, or only 2%. Of that total, $29 billion is targeted to aid hard-hit restaurants and bars, and

$1.25 billion is designated for live-event operators.8 Still, the economic stimulus provided to households will benefit

surviving businesses as confidence improves.

A March 2021 survey conducted by the U.S. Census Bureau of existing small businesses suggests that some Columbus

metro firms are still operating below capacity and anticipating a long, slow recovery. Although the extent is unknown,

by March 2021, some small businesses had already shuttered their operations, and would therefore be excluded from the

Census survey. Thirty percent of area small businesses are still operating within a 50% reduction of capacity, and an

estimated 40% of small businesses expect the “return to normal” will take at least 6 months. Still, some are anticipating a

ramp up of operations, by increasing staffing (40%), increasing marketing (30%), or making a capital expenditure (20%) in

the next 6 months. The size of firms and the nature of business matters, but this is unclear in these data.

Local businesses add unique elements to the community. Further, locally owned, locally serving businesses trap

spending that flows from chains to distant headquarters, so the spillover benefits of local businesses are greater. Civic

Economics has found that locally owned retailers trap an average of $0.48 of every sales dollar for at least one additional

round of spending, compared to $0.14 for the typical chain. The Columbus economy’s low concentration of small, local

businesses already has negative impacts on the economic impact of consumer spending, and the loss of these

businesses reduces the impact further.

Figure 11. Self-Employment

Columbus MSA & US

2010-2019, Annual

Central Ohio COVID19 Policy Briefs | Employment & Small Business 7Local governments can provide aid to these businesses to the extent possible by aggressively promoting the benefits of

shopping locally and shopping small, and by reviewing their own bidding and bid selection processes. In some cases,

government bid preparation requirements are complex, lengthy, and may shut out small firms. Some governments in the

region explicitly award points to bidders within their own jurisdiction, but given the regional benefit of keeping spending

local, all governments within the region should consider establishing preferences for local bidders and ensure that bidding

requirements are as straightforward as possible.

The same preferences for local purchasing can be adopted by private employers, particularly large anchor institutions.

Trade associations and chambers of commerce could work with these companies to find local suppliers that could

effectively meet the needs for goods and services that are currently being met by suppliers based outside of the area.

The region’s civic technology community is connecting volunteers and local businesses. Can’t Stop Columbus has created

initiatives that help local businesses launch sites for e-commerce, and help residents find local restaurant options9 or other

small business retailers.10 There has been a significant shift to online shopping in recent years – a trend that has

accelerated during the pandemic. This trend threatens to leave behind businesses that do not have an online presence. In

addition to promoting buying locally, local governments should consider supplying resources and funding to assist small

businesses, perhaps via the civic technology volunteer community, to develop e-commerce options.

REFERENCES

1. SHARONE, O. (2021, MARCH 18). A CRISIS OF LONG-TERM UNEMPLOYMENT IS LOOMING IN THE U.S. HARVARD

BUSINESS REVIEW. https://hbr.org/2021/03/a-crisis-of-long-term-unemployment-is-looming-in-the-u-s

2. U.S. CENSUS BUREAU: 1-YEAR AMERICAN COMMUNITY SURVEY. (2019). HOUSEHOLD INCOME BY GROSS RENT

AS A PERCENTAGE OF HOUSEHOLD INCOME IN THE PAST 12 MONTHS (TABLE B25074) [DATA SET]. RETRIEVED

FROM https://data.census.gov

3. U.S. CENSUS BUREAU: 1-YEAR AMERICAN COMMUNITY SURVEY. (2019). HOUSEHOLD INCOME BY SELECTED

MONTHLY OWNER COSTS AS A PERCENTAGE OF HOUSEHOLD INCOME IN THE PAST 12 MONTHS (TABLE

B25075) [DATA SET]. RETRIEVED FROM https://data.census.gov

4. GLASMEIER, A. (2021). LIVING WAGE CALCULATOR [DATA TOOL]. MASSACHUSETTS INSITITUTE OF

TECHNOLOGY. RETRIEVED FROM https://livingwage.mit.edu/metros/18140

5. CENSUS HOUSEHOLD PULSE SURVEY (2021, MARCH 17 – MARCH 29). TABLE 3. EDUCATIONAL ATTAINMENT FOR

ADULTS NOT WORKING AT TIME OF SURVEY, BY MAIN REASON FOR NOT WORKING AND SOURCE USED TO

MEET SPENDING NEEDS [DATA SET]. RETRIEVED FROM

https://www.census.gov/data/tables/2021/demo/hhp/hhp27.html

6. ACTION FOR CHILDREN. (2021). OPEN DOES NOT MEAN OKAY: CHILD CARE AFTER A YEAR OF PANDEMIC.

COLUMBUS, OH: AUTHOR. RETREIVED FROM https://www.actionforchildren.org/open-does-not-mean-okay/

7. CHETTY, R., FRIEDMAN, J., HENDREN, N., AND STEPNER, M. (2021). ECONOMIC TRACKER [DATA TOOL].

OPPORTUNITY INSIGHTS. RETRIEVED FROM https://tracktherecovery.org/

8. FEDERAL RESERVE BANKS. (2021). SMALL BUSINESS CREDIT SURVEY: 2021 REPORT ON EMPLOYER FIRMS.

RETRIEVED FROM https://www.fedsmallbusiness.org/medialibrary/FedSmallBusiness/files/2021/2021-sbcs-employer-firms-

report

9. GANDEL, S. (2021, MARCH 18). BIDEN STIMULUS PLAN OFFERS LESS HELP FOR SMALL BUSINESSES. CBS NEWS.

https://www.cbsnews.com/news/american-rescue-plan-small-business-stimulus/?intcid=CNM-00-10abd1h

10. SUPPORT COLUMBUS EATS. RETRIEVED FROM https://www.supportcolumbuseats.com/

11. SHOP SMALL COLLECTIVE. RETRIEVED FROM http://www.shopsmall.co/

Funders

Columbus City Council

The Columbus Foundation

The Robert Wood Johnson Foundation

Central Ohio COVID19 Policy Briefs | Employment & Small Business 8You can also read