COVID-19 Update for Employers & Employees - Paul O ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

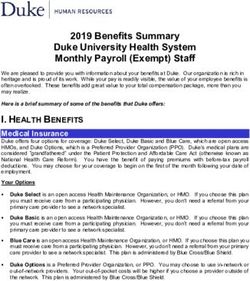

COVID-19 Update for Employers & Employees

General Guidance for Employers & Employees

The DEASP has published COVID-19 Information for Employers and Employees to include a range of

income supports for those affected by COVID-19.

COVID-19 Illness Related Absence

With regard to employees who are self-isolating on the instruction of a doctor or HSE, or are

diagnosed with COVID-19, and are confined to their own home or a medical facility, they should

apply for Illness Benefit for COVID-19 absences.

There are no PRSI qualifying conditions to be satisfied and it is payable from the first day of the

claim. The rate of payment increased from €305 per week to €350 on 24th March. It will be paid for

a maximum of 2 weeks where a person is self-isolating and for up to a maximum of 10 weeks if a

person has been diagnosed with COVID-19 (Coronavirus).

DEASP COVID-19 Payments relating to Lay-off & Short-time Working

With regard to those employees who have temporarily been laid off or placed on short-time working

hours as a result of the COVID-19 pandemic, the 2 options available from the DEASP are as follows:

Employees can claim the COVID-19 Pandemic Unemployment Payment (PUP) directly from

the DEASP. In this instance, Revenue advise that employers should enter a cessation date for

the employee on the Payroll Submission. This is an emergency payment of €350 per week

and will be payable for the duration of the crisis. An employee can apply for COVID-19 PUP if

he:

o is aged between 18 and 66 years old, and

o lives in the Republic of Ireland, and

o has lost his job, been temporarily laid off or asked to stay at home due to the COVID-

19 pandemic and is not getting any money from his employer.

Self-employed individuals who have ceased due to the pandemic can also avail of the

payment.

Any person claiming for an adult dependant and one or more dependent children should

claim a Jobseeker's Payment instead of the COVID-19 PUP as the additional amounts due for

dependants will bring the overall total in excess of €350.

While Revenue advise that an employer should enter a cessation date in the Payroll

Submission, this leave date is purely for administrative purposes and should not, by itself, be

regarded as the termination of the employee's contract of employment.

W | www.paulodonovan.ie | T | Ireland (021) 4321799| With regard to cross border workers (i.e. those commuting across the border to work and

returning home on a daily or weekly basis), they should claim unemployment benefits from

the country where they are resident. A cross border worker who had been working in

Northern Ireland but who lives in Ireland can make a claim for COVID-19 PUP. A cross border

worker who had been working in Ireland but who lives in Northern Ireland can make a claim

for Universal Credit.

With regard to those employees who have been placed on short-time working

arrangements, employees can claim Short-time Work Support directly from the DEASP. This

scheme provides payment for employees whose hours have been reduced and they are

working 3 days or less per week and meet the qualifying conditions. For example, where an

employee's working week has been reduced from 5 days to 3 days, the employee may

receive €81.20 for the days the employee is not working (2/5ths of €203) - assuming the

employee qualifies for the maximum personal rate.

Revenue Temporary Wage Subsidy Scheme

As an alternative to directing employees to claim COVID-19 PUP, Short-time Work Support or Illness

Benefit from the DEASP, employers can choose to retain the employee on the payroll and operate

the Temporary Wage Subsidy Scheme (TWSS).

The TWSS is effective from 26th March and replaces the Employer COVID Refund Scheme. Some key

points relating to the operation of the TWSS are as follows:

The TWSS is a refundable tax-free payment which employers can pay employees through

payroll. The scheme is expected to last 12 weeks from 26th March and employers should

keep employees on the payroll.

The TWSS is open to employers who self-declare to Revenue that they have experienced

significant negative economic disruption due to COVID-19 and satisfy the eligibility criteria

It only applies to employees who were included on a Payroll Submission in the period

between 1st February 2020 and 15th March 2020 and the employee was on the payroll as of

29th February.

Employers are not obliged to pay employees an additional amount of money on top of the

TWSS amount, however employers are permitted to do so if they wish.

The TWSS amount, which is refunded by Revenue to the employer, is calculated as follows:

o Where the employee's average weekly net pay does not exceed €586, the TWSS is

calculated as 70% of the employee's average weekly net pay subject to a maximum

of €410 per week.

o Where the employee's average weekly net pay exceeds €586 but does not exceed

€960, the TWSS is €350 per week.

o The TWSS should not be operated in respect of any employee whose average weekly

net pay exceeds €960. Normal tax, USC and PRSI rules apply to any payments made

by the employer to such employees.

W | www.paulodonovan.ie | T | Ireland (021) 4321799| In phase 1 of the operation of the scheme, Revenue will refund the employer €410 in

respect of each qualifying employee regardless of the amount of subsidy paid by the

employer to the employee. This will have to be reconciled at a later date.

In phase 2 which is due to come into operation later in April, Revenue will refund the

employer the actual amount of the wage subsidy.

In general, refunds due to employers will be processed within 2 banking days.

There should be communication between the employer and employee to ensure that the

employee is aware that the employer is operating the TWSS, hence the employee should not

apply directly to the DEASP as this may result in a duplicate payment for the employee.

The TWSS can be operated in respect of directors where the qualifying conditions as met, as

directors are taxable under the PAYE system.

Where an employee has multiple jobs, the TWSS can be operated by multiple employers

subject to the qualifying conditions and rules as outlined above.

While the TWSS is taxable income, it will not be subject to PAYE. Instead the employee will

be liable for tax on the subsidy amount paid to them by way of review at the end of the year.

Operation of the TWSS for Crèche & childcare workers

There is some confusion regarding the operation of the TWSS for crèche and childcare workers. The

Department of Children and Youth Affairs (DCYA) are instructing crèches and childcare providers to

pay employees 100% of their pay, subject to a minimum payment of €350. However, where the

employee earns less than €350 per week, this does not comply with Revenue's guidance. Revenue

are advising that payments made by crèches and childcare providers will have to adhere to the

Revenue guidelines in order for them to receive a refund of the TWSS from Revenue. We understand

that the DYCA are reviewing their guidance.

Prohibition on Employee Claiming Redundancy due to Lay-off & Short-time Working

The Emergency Measures in the Public Interest (Covid-19) Act 2020 prevents employees from

claiming redundancy where they have been laid off or put on short-time during the emergency

period (13th March to 31st May but this end date can be extended) due to the effects of measures

required to be taken by their employer in order to comply with, or as a consequence of, Government

policy to prevent, limit, minimise or slow the spread of infection of COVID-19

While employees do not accrue annual leave while laid-off, they accrue a public holiday benefit in

respect of any public holiday arising during the first 13 weeks of layoff.

Benefit in Kind

Company Vehicles

Revenue issued updated guidance on the BIK provisions for company vehicles during the period of

COVID-19 restrictions as follows:

1. Employee continues working as normal

If the employee continues to undertake business travel as normal, then BIK should be

calculated in the usual manner (i.e. based on business kilometres).

W | www.paulodonovan.ie | T | Ireland (021) 4321799|2. Employer takes back possession of the vehicle

If the employer takes back possession of the vehicle and the employee has no access to the

vehicle, then BIK is not chargeable for this period.

3. Employer prohibits private use of the vehicle

If the employee retains the vehicle but the employer prohibits private use of the vehicle,

then no BIK is chargeable for the relevant period if the vehicle is not used for private use.

Records should be maintained by the employer to show that the employer prohibited the

use of the vehicle and that no private travel occurred e.g. photographic evidence of the

odometer at the commencement and cessation of the relevant period.

4. Employer allows private use of the vehicle

If the employee retains the vehicle and no or reduced business use occurs, and personal use

is limited, the amount of business kilometres travelled in January 2020 may be used for the

purpose of calculating BIK during the period of the COVID-19 restrictions. Appropriate

records should be kept verifying the business travel in January and amount of private use

such as photographic evidence of the odometer.

Small Benefit Exemption

For 2020, Revenue are waiving the requirement that only one voucher is proved to an employee in a

tax year where an employer wishes to accelerate part of an award to recognise the efforts of

frontline or key staff working during the period of the COVID-19 crisis. This concession only applies

to employees working during the COVID-19 crisis. All other conditions must be satisfied (i.e. an

employer is permitted to give a qualifying employee 2 or more vouchers during 2020, but the

aggregate total cannot exceed €500).

Payment of taxi fares

Where an employer pays for a taxi to transport an employee to or from work due to health and

safety concerns, BIK will not apply for the duration of the COVID-19 period only.

Reimbursements by an employer to an employee regarding holiday/flight cancellations or in

relation to costs of assisting employees returning to the State

Provided the employee is integral to the business and was required to return to deal with issues

related to the COVID-19 crisis by his or her employer, the costs incurred are reasonable and the

employee is not otherwise compensated (i.e. via an insurance policy or direct claim to the service

provider), a BIK will not arise. This may include costs related to family members who were on holiday

or due to go on holidays with the employee.

Working from Home

Revenue published an updated version of the e-Working and Tax. The Tax and Duty Manual (TDM)

confirms that an employer is permitted to pay an e-Worker a tax free payment of up to €3.20 per

working day where the qualifying conditions are met, which includes employees working from home

due to COVID-19. Where an employer does not pay €3.20 per day to an e-worker, the employee is

not entitled to claim a tax deduction for a round sum of €3.20 per day.

W | www.paulodonovan.ie | T | Ireland (021) 4321799|However, employees retain their right to claim tax relief in respect of actual vouched expenses

incurred wholly, exclusively and necessarily in the performance of the duties of their employment.

Employees need to retain receipts for expenses incurred such as light and heat for the tax year. This

amount should then be pro-rated to the portion of the year which the employee is working from

home. This pro-rated amount should be apportioned between private use and employment use. For

this purpose, Revenue accept that 10% of the pro-rated amount relates to employment use.

A taxable BIK will not arise where employers provide equipment such as laptops, printers, scanners

and office furniture in order for employees to set up a working space in their homes.

Compliance with Certain Reporting & Filing Obligations

In light of the ongoing COVID-19 pandemic, Revenue released guidance in relation to compliance

with the following obligations:

Share schemes filing obligations - filing deadline for all 2019 share scheme returns has been

extended from 31st March 2020 to 30th June 2020.

Cross-Border Workers Relief - days spent working from home in the State due to COVID-19

will not preclude an employee from being entitled to claim this relief.

Special Assignee Relief Programme (SARP) - The 90-day time limit for submitting the SARP

1A is extended to 150 days following the employee's arrival in the State.

Real-time foreign tax credit (FTC) for Restricted Stock Unit (RSU) cases - For those in receipt

of real-time foreign tax credits through payroll in 2019, the 31st March 2020 filling deadline

is extended until 31st October 2020.

PAYE Dispensation Applications - Revenue will not strictly enforce the 30-day notification

requirement for PAYE dispensations applicable to short term business travellers from

countries with which Ireland has a double taxation treaty who are going to spend in excess

of 60 workdays in the State in a tax year.

Foreign Employments - Operation of PAYE - Revenue will not seek to enforce Irish payroll

obligations for foreign employers in genuine cases where an employee was working abroad

for a foreign entity prior to COVID-19 but relocates temporarily to the State during the

COVID-19 period and performs duties for his or her foreign employer while in the State.

PAYE Exclusion Order - Irish Contract of Employment - The operation of a PAYE Exclusion

Orders for employees working abroad under an Irish contract of employment will not be

affected where the employee works more than 30 days in the State due to COVID-19.

Residence rules - Force Majeure circumstances - An individual is not regarded as being tax

resident in the State in respect of any day following the intended day of departure where

the individual is prevented from leaving the State due to extraordinary natural occurrences.

Where a departure from the State is prevented due to COVID-19, Revenue will consider this

as an extraordinary natural occurrence for the purpose of establishing an individual's tax

residence position.

If you have any queries please contact us on 021-4321799 or info@paulodonoavn.ie

W | www.paulodonovan.ie | T | Ireland (021) 4321799|You can also read