Australian Lamb and Sheep Meat Annual Review 2018 - Rural Bank

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

About the research About Rural Bank

The Australian Lamb and Sheep Meat Annual Review includes Rural Bank has been a wholly-owned subsidiary of Bendigo and

data and outlooks on factors affecting Australian and international Adelaide Bank Limited since 2010. It is the only Australian-owned

sheep markets, such as production, seasonal conditions, prices and and operated dedicated agribusiness bank, providing exceptional

demand. Significant effort has been taken to secure the most recent financial services, knowledge and leadership for Australian farmers

data available. to grow.

Where appropriate, Middle East and North African nations are About Ag Answers

referred to as the Middle East and North Africa (MENA).

Ag Answers is a specialist insights division of Rural Bank. Recognising

MENA includes: Algeria, Bahrain, Djibouti, Egypt, Gaza Strip, Iran, that good information is the key to making good business decisions,

Iraq, Israel, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Rural Bank provides research and analysis into commodities, farmland

Saudi Arabia, Syria, Tunisia, United Arab Emirates, West Bank values, farm business performance and topical agricultural issues to

and Yemen. enable farmers to make informed decisions.

This report is intended to provide general information on a particular subject or subjects and is not an exhaustive treatment of such subject(s).

The information herein is believed to be reliable and has been obtained from public sources believed to be reliable. Rural Bank Limited, ABN 74 083 938

416 AFSL / Australian Credit Licence 238042 makes no representation as to or accepts any responsibility for the accuracy or completeness of information

contained in this report. Any opinions, estimates and projections in this report do not necessarily reflect the opinions of Rural Bank and are subject to change

without notice. Rural Bank has no obligation to update, modify or amend this report or to otherwise notify a recipient thereof in the event that any opinion,

forecast or estimate set forth therein, changes or subsequently becomes inaccurate. This report is provided for informational purposes only. The information

contained in this report does not take into account your personal circumstances and should not be relied upon without consulting your legal, financial, tax or

other appropriate professional.

© Copyright Rural Bank Ltd ABN 74 083 938 416 and Bendigo and Adelaide Bank Ltd ABN 11 068 049 178 (RBL19085) (07/18)

2Summary

The Australian sheep industry continued its strong run in 2017 with stock when they would otherwise seek to increase flocks to take

a fifth consecutive year of growth in the average annual trade lamb advantage of historically high prices. This has seen slaughter rates

price, and fourth consecutive year of growth in the mutton price. trend higher, putting downwards pressure on sheep and lamb prices

Lamb production in 2017 was 1.3 per cent lower than 2016, the earlier in the year. However the strength of demand is such that

first year of decline after five consecutive years of growth. Growth prices only declined marginally under the weight of the extra supply.

in both production and prices for a sustained period is a remarkable Tightening supplies in June have seen prices trend higher, with lamb

combination, and highlights the growing strength of demand over entering record territory above 700c/kg.

that time. Given that domestic consumption of sheep meat has

The outlook for the industry remains very positive with global

remained steady, the growth in demand is almost exclusively from

demand set to continue to outpace supply, meaning increased

export markets, namely the US, China and Middle East.

opportunities for Australian sheep meat exports and sustained

The value of exports from the Australian sheep industry was $3.7 support for prices. The low Australian flock is a limiting factor

billion, equivalent to 7.4 per cent of Australia’s total agri-food exports. to supply, and producers will be looking for improved seasonal

Sheep industry exports grew by $622 million in 2017, accounting for conditions to allow for flock expansion.

10.5 per cent of the almost $6 billion growth of agri-food exports; a

This report provides analysis of historical trends of seasonal

significant contribution to the sector’s growth.

conditions, prices, production and demand, both domestically and

Positive sentiment has continued for sheep producers into 2018, but from a global perspective. It also investigates the outlook for the

has been tempered slightly by poor seasonal conditions which have Australian sheep industry and the likelihood of the current strength

forced some producers to buy in more feed or consider turning-off of the industry continuing.

3Seasonal conditions

Australian sheep producers have experienced mostly dry conditions South Wales, the Mallee and Wimmera in Victoria and parts of

in 2018. A good, albeit late, spring in 2017 provided most regions South Australia where some areas were ‘greener’ than average.

with a good feed base to get through summer. However, the early

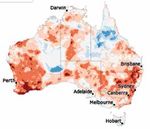

Drier than average conditions are expected to continue through

months of 2018 have been drier than average and have seen pasture

winter. The major sheep producing regions of New South Wales,

conditions deteriorate in most sheep producing regions, except

northern Victoria and South Australia are unfortunately among the

for western Victoria and Western Australia which are experiencing

areas with the least likelihood of receiving median rainfall. Conditions

favourable lambing conditions. Autumn largely failed to provide much

are also expected to be warmer than average for most of Australia

improvement in conditions, resulting in poor pasture conditions going

during winter.

into winter.

Both the El Niño – Southern Oscillation and the Indian Ocean Dipole

The extended period of dry conditions is reflected in soil moisture

are forecast to hold their neutral state during winter and therefore

estimates. Most major sheep producing regions had below average

have less influence on Australia’s climate, making local drivers more

root zone soil moisture during May. Soil moisture was average to

influential. The rainfall outlook for south eastern Australia is being

above average in south eastern South Australia, south west Victoria

influenced by below average pressure (warmer water) over the

and Tasmania.

Tasman Sea, which is expected to reduce the rainfall making its way

The effects of below average soil moisture are shown in the to Australia by weakening the westerlies. Longer range models are

normalised difference vegetation index (NDVI) where vegetation in beginning to suggest an El Niño may develop in spring, with La Niña

May was lower than the long term average for the month in many the least likely scenario later in the year.

sheep producing areas. The exception to this was in southern New

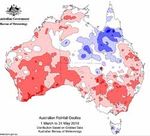

Recent rainfall deciles – Mar to May 2018 Chance of above median rainfall outlook – Jul to Sep

80

Rainfall Decile

Ranges 75

70

Chance of exceeding median rainfall (%)

Highest

on record 65

10 Very much above

60

average

8-9 Above average 55

50

4-7 Average

45

2-3 Below average

40

Very much

1

below average 35

lowest on

30

record

25

20

Source: Bureau of Meteorology, 2018 Source: Bureau of Meteorology, 2018

Relative root zone soil moisture – May 2018 Vegetation index anomaly – May 2018

Root zone 5.0

soil moisture 3.0

2.0

Highest 1% 1.5

Very much above 1.0

average 0.6

Above average 0.2

-0.2

Average

-0.6

-1.0

Below average

-1.5

Very much

below average -2.0

lowest on -3.0

record -5.0

No Data

Source: Bureau of Meteorology, 2018 Source: Bureau of Meteorology, 2018

4Australian production

Australian lamb slaughter fell 2.3 per cent in 2017, brought down by be tighter supplies during winter as most old season lambs will have

tighter supply in the first half of the year when seasonal conditions already been sold and new season lambs are expected slightly later.

allowed for greater stock retention for flock expansion. Slaughter in Winter and spring rainfall will be a major factor in determining lambing

the second half of 2017 was higher than 2016 as conditions began percentages and overall production for the year.

to deteriorate and forced some stock turn-off. The trend of increased

The Australian sheep flock recovered 4.2 per cent to 70.2 million in

slaughter has continued in early 2018 with year to date lamb

2017 after a dip in 2016. Producer intentions to continue expanding

slaughter trending 8.1 per cent higher than 2017 as dry conditions in

flocks to take advantage of strong returns for both sheep meat and

NSW and Victoria have prompted increased stock turn off.

wool were evident in early 2017, when seasonal conditions allowed

Mutton production also experienced a year in two parts, with tight for greater retention of stock for breeding and wool production.

supplies in early 2017 and a significant rise in slaughter in the However, despite price incentives to expand flocks, the dry seasonal

second half of the year leading to an annual increase of 10.9 per conditions later in the year and in early 2018 produced headwinds

cent. Mutton production has continued to grow in 2018 with year to for flock expansion. The increased slaughter observed in 2018 will

date production trending 14.8 per cent above 2017 as producers delay growth in the flock and subsequently limit production growth.

reluctantly continue to turn-off older stock. It is expected that producers will switch into flock expansion activities

when seasonal conditions improve.

Sheep and lamb slaughter in 2018 continues to exceed expectations

as a result of poor seasonal conditions, and indicates that there will

The Australian sheep flock was approximately 70.2 million after a 4.2 per cent increase in 2017

130 25

120

20

million head slaughtered

110

100

million head

15

90

80 10

70

5

60

50 0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Sheep flock (LHS) Lamb slaughter (RHS) Sheep slaughter (RHS) Data: Meat and Livestock Australia (MLA),

Australia Bureau of Statistics (ABS)

Australian lamb production for January to Australian lamb production for January to

April 2018 was 8 per cent higher than 2017 April 2018 was higher in Victoria and NSW

55 100

90

50

80

45 70

‘000 tonnes cwt

‘000 tonnes cwt

60

40 50

40

35

30

30 20

10

25 0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec VIC NSW SA WA TAS QLD

5yr ave 2016 2017 2018 Jan-Apr 2016 Jan-Apr 2017 Jan-Apr 2018

Data: MLA Data: MLA

5International production

World sheep meat production is expected to continue its upward with average annual lamb slaughter 20.6 per cent lower than the

trajectory in 2018 and reach 15 million tonnes for the first time. This early 2000s. This is largely due to a shift towards expansion of dairy

follows a 1.2 per cent increase in 2017. The growth in world production and beef production. New Zealand and Australia are the dominant

has been a long-term trend with a 29 per cent increase being exporters of sheep meat, each accounting for approximately 34

recorded since 2000, driven by increases in China and Africa of 70 per cent of global exports. Declining capacity for growth in sheep

and 63 per cent, respectively. meat exports from New Zealand has the potential to create more

opportunities for Australian exports to meet growing demand. This

The expected growth in production in 2018 is largely from China.

is particularly true in New Zealand’s key markets such as China and

China has been a major contributor to the long-term growth in world

Europe, where Australia has lower market share.

sheep meat production and produced 32 per cent of the world’s sheep

meat in 2017. Chinese production is almost exclusively consumed US sheep meat production continued its steady decline in 2017,

domestically, but has been unable to keep up with growing domestic falling a further 3.3 per cent; 12 per cent lower than 2010. USDA

demand since the late 2000s, creating an opportunity for sheep forecasts expect this trend to continue in 2018 with a small decline in

meat imports. In 2017, imports accounted for only 4.3 per cent of production of 0.7 per cent. While production has been trending lower,

consumption. US consumption has been increasing. As a result, the percentage of

consumption met by domestic production has declined from 52%

New Zealand lamb slaughter increased by 2.9 per cent in 2017 but is

in 2010 to 37% in 2017, increasing the dependence on imports to

trending 3.8 per cent lower in 2018. The New Zealand sheep industry

meet demand.

has been operating on a much smaller scale in the last nine years,

6New Zealand lamb slaughter is trending New Zealand lamb exports are trending

3.5 3.8 per cent below 2017 12.4 per cent lower in 2018

60

3.0 50

2.5

40

‘000 tonnes swt

million head

2.0

30

1.5

20

1.0

0.5 10

0 0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec China UK Germany Netherlands USA France

5yr ave 2016 2017 2018 Jan-Apr 2016 Jan-Apr 2017 Jan-Apr 2018

Data: Statistics New Zealand Data: Statistics New Zealand

Chinese sheep meat production to increase US sheep meat production to decrease

by 3.1 per cent in 2018, consumption to by 0.7 per cent in 2018, consumption

increase 2.9 per cent to increase 0.3 per cent

5.5 200

180

5.0 160

140

‘000 tonnes cwt

million tonnes

4.5 120

100

4.0 80

60

3.5 40

20

3.0 0

2012 2013 2014 2015 2016 2017 2018f 2012 2013 2014 2015 2016 2017 2018f

Production Consumption f= OECD forecast Production Consumption* f= USDA forecast

Data: OECD-FAO Data: United States Department of Agriculture (USDA)

* Consumption estimated based on production and trade data

7Demand and trade

The growing strength of demand from export markets continues There are also opportunities arising from declining exports from

to provide strong support for high sheep and lamb prices, despite New Zealand which holds a 55 per cent share of the Chinese sheep

domestic consumption remaining the largest market for Australian meat import market, but have experienced a 10 per cent decline in

sheep meat. Since 2010, domestic consumption of lamb has lamb export volume to China so far in 2018.

remained relatively steady, with the growth in production since then

Lamb export volumes to the US for the year to April are 5.2 per

going almost entirely to export markets. As a result, the share of

cent below 2017, following an eight per cent decline in 2017.

production exported increased from 40 per cent in 2010 to 51 per

The average lamb export price to the US is averaging 4.8 per cent

cent in 2017. Export demand is even more significant for mutton

lower than 2017, but still at historically high levels. Lower volumes and

markets with export volumes equivalent to 87 per cent of production

prices suggest some price resistance for lamb, with other proteins

in 2017, up from 78 per cent in 2010.

experiencing price declines in the US. Despite an easing in volumes,

Increased slaughter rates in 2018 have resulted in a five per cent demand fundamentals remain strong with lamb growing in popularity,

increase in the volume of lamb exported between January and particularly among millennials in the casual dining and fast food

April compared to 2017. Exports in March set a new record high for segments of the food service sector.

monthly volume, up 21 per cent from February to 26,288 tonnes. The

The Middle East and North Africa (MENA) region is also

price of exported lamb has averaged $8/kg this year, five per cent

demonstrating strong demand with a 20 per cent increase in lamb

higher than 2017, signalling that demand continues to exceed supply.

export value for the year to date, building upon a 16 per cent increase

The same can be said of mutton, with year to date export volumes up

in value recorded in 2017. This growth is coming from both higher

15 per cent on 2017 and average price up 3.5 per cent.

prices (+8.2 per cent) and higher volumes (+11.2 per cent). Mutton

China overtook the US as Australia’s top lamb export market by exports to MENA are trending lower in 2018 with volume down

volume in 2017, registering a 30 per cent increase in volume and 25 9.6 per cent and value down 7.7 per cent. This comes after growth in

per cent increase in average price, combining for a remarkable 63 per value of 14 per cent in 2017.

cent jump in export value to $265 million. Mutton exports also had

Lamb continues to increase in popularity in South Korea, albeit from a

a good year in China, returning to $206 million, just below the peak

very low base. This was observed in a 63 per cent increase in export

of 2014. Chinese sheep meat import demand can be volatile as it is

value in 2017. This trend has continued in early 2018 with year to date

dependent on the often variable domestic production which supplies

export value increasing by 18.6 per cent compared to the same time

approximately 95 per cent of consumption. Demand from China has

last year.

continued to strengthen in 2018 with the volume of lamb exports

trending 5.6 per cent higher than 2017 and average prices up 8.6 per All factors considered, the outlook for demand and trade is very

cent. Mutton exports have increased even further with volume up 43.5 positive with combinations of growing volumes and prices pointing to

per cent and price up 30.4 per cent. The value of mutton exports for very strong demand. The long term trend of declining production in

January to April is $67 million, already exceeding the value of exports New Zealand adds further optimism for the Australian sheep industry

for the first eight months of 2017. Australian exports to China have to capture an increased share of global demand.

the potential to continue growing from increasing import demand.

The volume of Australian lamb exports Lamb exports to China and MENA

28 are trending 5 per cent higher than 2017 are trending higher in 2018

25

26

24 20

22

‘000 tonnes swt

‘000 tonnes swt

20 15

18

10

16

14 5

12

10 0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec China MENA USA South Korea Japan

5yr ave 2016 2017 2018 Jan-Apr 2016 Jan-Apr 2017 Jan-Apr 2018

Data: Global Trade Information Service (GTIS) Data: GTIS

8Export markets - country detail

Destination YoY% 2017% Jan-Apr Jan-Apr YoY%

2015 2016 2017

Country Change Share 2017 2018 Change

LAMB EXPORTS (‘000 TONNES SWT)

World 250 260 264 2% 86 90 5%

China 38 47 62 30% 23% 21 22 6%

USA 58 59 54 -8% 21% 18 17 -5%

UAE 19 21 20 -7% 7% 7 7 -5%

Qatar 13 15 13 -14% 5% 4 4 -17%

South Korea 6 9 12 38% 5% 4 4 -4%

MUTTON EXPORTS (‘000 TONNES SWT)

World 161 142 162 15% 50 57 15%

China 36 31 47 53% 29% 10 15 43%

Malaysia 16 16 15 -7% 9% 3 6 72%

USA 14 10 14 41% 9% 7 5 -25%

Saudi Arabia 17 12 14 19% 9% 6 6 6%

Singapore 10 10 10 2% 6% 3 4 14%

LIVE SHEEP EXPORTS (‘000 HEAD)

World 1,960 1,870 1,950 4% 589 552 -6%

Kuwait 633 635 646 2% 33% 230 101 -56%

Qatar 387 561 640 14% 33% 189 164 -13%

Turkey 0 0 225 12% 154

UAE 250 191 114 -41% 6% 35 26 -28%

Oman 80 90 113 26% 6% 53 17 -68%

Destination YoY% 2017% Jan-Apr Jan-Apr YoY%

2015 2016 2017

Country Change Share 2017 2018 Change

LAMB EXPORTS (A$ MILLIONS)

World 1,774 1,799 2,114 18% 648 714 10%

USA 598 610 651 7% 31% 209 190 -9%

China 141 163 265 63% 13% 84 97 15%

UAE 138 153 163 7% 8% 58 56 -3%

South Korea 42 65 106 63% 5% 33 39 19%

Qatar 93 102 106 4% 5% 30 32 6%

MUTTON EXPORTS (A$ MILLIONS)

World 751 641 929 45% 277 329 19%

China 108 78 207 165% 22% 36 67 88%

USA 93 69 118 70% 13% 61 35 -42%

Malaysia 73 71 84 19% 9% 17 34 97%

Saudi Arabia 73 51 75 48% 8% 32 34 5%

Singapore 50 49 58 18% 6% 17 23 35%

LIVE SHEEP EXPORTS (A$ MILLIONS)

World 246 218 249 14% 76 79 4%

Qatar 47 60 83 39% 34% 24 21 -10%

Kuwait 76 69 82 19% 33% 29 13 -54%

Turkey 0 0 25 10% 17

Oman 9 11 16 55% 7% 8 2 -72%

UAE 28 20 14 -32% 6% 4 3 -24%

Data: GTIS

SWT = shipped weight

9Prices

Australian lamb prices had a fantastic run in 2017 with the Eastern Eastern states trade lamb indicator increased

States Trade Lamb Indicator (ESTLI) averaging 626c/kg, an 11 per

750

14 per cent from mid-April 2018

cent increase on 2016. This was the fifth consecutive year of growth in

the annual price, and a 50 per cent increase on the 2012 average. 700

Lamb prices steadily eased from January to March as more numbers 650

came onto the market due to deteriorating seasonal conditions, but

600

c/kg cwt

began to recover in late April. A tightening supply of lambs in recent

weeks has accelerated the recovery in prices and seen the ESTLI 550

reach a record high of 712c/kg. At a national level, indicators are all

averaging lower for the year to date, with restocker lambs showing the 500

largest drop (down15 per cent) after being in strong demand this time 450

last year. Merino lamb prices are only trending 1.9 per cent lower than

2017 with high wool prices providing a floor to demand. The only lamb 400

categories to record year on year increases in price are trade, heavy Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

and Merino lambs in Western Australia where seasonal conditions 5yr ave 2016 2017 2018

were more ideal than in eastern states earlier in the year. Data: MLA

Despite prices trending lower than 2017 levels, they have still been

quite resilient to pressure of increased slaughter. This resilience has

been supported by strong demand, particularly from export markets. Prices are averaging below 2017 levels for all

800

categories of Australian lamb

Domestic sheep prices are benefiting from the relatively low Australian

dollar in 2018. The dollar has averaged 77 US cents so far in 2018, 700

but has been steadily declining from a high of 81 cents in late January

Average price (c/kg cwt)

to a low of 74 cents in June. 600

500

The Australian dollar is relatively low from a historic perspective,

particularly compared to 2011 when lamb prices were at similar 400

levels to 2018. The ESTLI for year to date is only averaging 1.8 per 300

cent higher than the same period in 2011, however the ESTLI in US

200

dollars is 23.7 per cent lower. This is good news for Australian sheep

producers who are receiving historically high prices, while international 100

buyers are paying closer to the historic average. 0

Restocker Light Trade Heavy Merino

2016 YTD 2017 YTD 2018 YTD

Data: MLA

The Australian dollar has been trending lower

0.83 after a high of 81c in January

0.81

0.79

0.77

AUD/USD

0.75

0.73

0.71

0.69

0.67

0.65

Jan-16

Mar-16

May-16

Jul-16

Sep-16

Nov-16

Jan-17

Mar-17

May-17

Jul-17

Sep-17

Nov-17

Jan-18

Mar-18

May-18

Jul-18

Data: Reserve Bank of Australia

10Rural Bank modelling forecasts lamb prices to remain at existing high Over the longer term, Australian sheep and lamb prices are expected

levels through winter before easing through spring and into summer. to remain above long term averages as demand continues to outpace

Seasonal conditions in winter and spring will play a significant role supply. The outlook for continued growth in global sheep meat import

in the direction of prices within the model’s 68 per cent confidence demand means Australia will continue to have robust demand from

interval range, which averages between 592-711c/kg. It is expected major export markets of the US, China and the Middle East, as well

that prices will trend closer to the upper end of the range, particularly as emerging markets such as South Korea. Supply is expected to

with expectations that lamb supply over winter will be tight, given continue to struggle to match the growth in demand due to a low

that most old season lambs were sold earlier than usual and new Australian flock and the steadily declining industry in New Zealand.

season lambs are likely to be finished later than usual due to poor These factors all favour continued strength in sheep and lamb prices

seasonal conditions. This could mean a continuation of the upwards in Australia.

trend in prices observed since late April, before the usual easing of

prices in spring when new lambs come into markets. An improvement

in seasonal conditions from now to the end of the year would give

prices a further boost with producers looking to retain more lambs,

tightening supply, and restockers looking to compete with processors

in markets, strengthening demand.

Eastern States Trade Lamb Indicator

800

700

600

500

c/kg cwt

400

300

200

95% confidence interval

100

68% confidence interval

0

Jan -11

Jun -11

Nov -11

Apr -12

Sep -12

Feb -13

Jul -13

Dec -13

May -14

Oct -14

Mar -15

Aug -15

Jan -16

Jun -16

Nov -16

Apr -17

Sep -17

Feb -18

Jul -18

Dec -18

Data: MLA, Ag Answers forecast

Australian mutton prices are averaging Australian mutton prices increased by an exceptional 25.7 per

6.8 per cent below 2017 cent in 2017, the fourth consecutive year of growth in the average

550 annual price. The average price of 439c/kg was the highest on

record and 74 per cent higher than 2012.

500

Prices have remained high in 2018, but have trended below the

450 exceptional prices of 2017 since late March. The main cause of

prices being lower than this time last year has been the relatively

400

c/kg cwt

higher slaughter rates, however strong demand, particularly from

350 China, has continued to force prices upwards despite the added

supply. Mutton prices for the year to date are averaging lower in all

300

states except Western Australia where they are sitting 1.4 per cent

250 higher than 2017. The outlook for mutton prices remains positive

with demand strong and supply low from a historic perspective.

200 Producers will be looking to retain older sheep, which means an

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

improved seasonal outlook would allow producers to hold stock,

5yr ave 2016 2017 2018 tightening supply and boosting prices further.

Data: MLA

11Sheep and lamb prices – state detail

State Type Current Price June 2017 5 year average 80th percentile 20th percentile

21st June

EASTERN STATES TRADE LAMB INDICATOR (C/KG CWT)

ESTLI 712 625 555 616 498

SALEYARD INDICATORS (C/KG CWT)

Vic Restocker 0-18kg 647 705 552 638 475

Light 12-18kg 659 683 539 607 462

Trade 18-22kg 661 681 558 621 492

Heavy 22kg+ 660 659 560 616 504

Merino 16-22kg 620 649 493 567 411

Mutton 18-24kg 518 523 368 430 302

NSW Restocker 0-18kg 539 673 561 654 481

Light 12-18kg 630 645 526 603 446

Trade 18-22kg 651 654 557 617 504

Heavy 22kg+ 656 631 563 622 506

Merino 16-22kg 615 599 502 573 428

Mutton 18-24kg 498 501 362 418 302

SA Restocker 0-18kg 659 490 572 656 485

Light 12-18kg 644 559 517 589 452

Trade 18-22kg 612 568 530 579 488

Heavy 22kg+ 661 607 540 592 489

Merino 16-22kg 642 503 475 535 418

Mutton 18-24kg 398 458 326 381 276

WA Restocker 0-18kg 505 534 465 538 406

Light 12-18kg 608 592 499 572 450

Trade 18-22kg 641 652 516 607 455

Heavy 22kg+ 657 628 509 593 450

Merino 16-22kg 627 615 486 586 417

Mutton 18-24kg 415 423 304 381 236

Tas Restocker 0-18kg 627 688 560 644 483

Light 12-18kg 581 633 531 586 467

Trade 18-22kg 591 625 546 595 500

Heavy 22kg+ 543 616 535 576 492

Mutton 18-24kg 489 542 344 402 282

RETAIL PRICE ($/KG)

Aus Lamb 15.01 14.50 13.83 14.85 12.67

AUSTRALIAN DOLLAR

AUD/USD 0.74 0.76 0.80 0.90 0.75

Data: MLA, Reserve Bank of Australia

12Wool

Wool prices have been setting record highs for most of 2018 with While production is marginally higher in 2017/18, demand for Australian

the Eastern Market Indicator reaching a record high of 2,073c/kg wool is growing at a more rapid rate. The volume of Australian wool

in June, adding further confidence to Australian sheep producers. exports for the financial year to March are trending 5.5 per cent higher

The sustained rise in prices over the last 18 months has been observed than 2016/17. Demand has exceeded supply to the extent that the

to a greater extent for fine wool. The 18 micron price guide in the average export price has increased 15.7 per cent for the financial year

southern wool zone is averaging 16 per cent higher for the financial to date. Increases in both volume and price have led to a 22.5 per cent

year to date compared to 2016/17. Medium and broad wools have rise in the value of wool exports for the year to date, up to $2.9 billion.

also experienced significant rises in price recently with the southern

The outlook for wool prices remains favourable, with very low stocks

price guides for 21 and 28 micron wool averaging 34 per cent and

of wool in the global pipeline and demand for woollen garments

24 per cent higher in the 2017/18 financial year to date, respectively.

expected to continue growing as more people enter the Chinese

Production has been relatively steady in the last few years, after a long middle class and a widening range of products are manufactured with

term downwards trend. At the end of May, wool production for the wool. Economic indicators also favour high wool prices, with high global

financial year was 1.2% higher than 2016/17. Fewer sheep shorn and consumer confidence ratings, and a lower Australian dollar at around

lower average cuts per head are likely to see wool production decline 75 US cents.

in 2018/19.

The eastern market indicator hit a record Fine wool has experienced the best price

2,200

high of 2,027c/kg at the end of May 3,000

gains, recently joined by medium wool

2,000 2,500

1,800

2,000

c/kg clean

c/kg clean

1,600

1,500

1,400

1,000

1,200

500

1,000

800 0

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

16 16 16 16 17 17 17 17 18 18 18

2015/16 2016/17 2017/18 17 micron 21 micron 28 micron

Data: Australian Wool Exchange (AWEX) Data: AWEX

Australian wool production is 1.2 per cent The value of Australian wool exports is

higher than 2016/17 trending 18.9 per cent higher in 2017/18

45 2,500

40

2,000

35

‘000 tonnes greasy

1,500

A$ millions

30

25 1,000

20

500

15

10 0

China Italy India Czech Rest of

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Republic world

5yr ave 2015/16 2016/17 2017/18 2015/16 YTD 2016/17 YTD 2017/18 YTD

Data: Australian Wool Testers Authority Data: GTIS

13In the spotlight – live sheep exports

Live sheep exports are a significant part of the Australian sheep were to be processed locally, state sheep and lamb slaughter would

industry, contributing $249 million, or 7.6 per cent to the combined reach 5.4 million, a 46 per cent increase from 2017. This growth in

sheep industry export value of $3 billion. Australia exported 1.95 supply is not unprecedented, with a 47 per cent increase in slaughter

million live sheep in 2017, representing only 6.1 per cent of Australian recorded in 2013. This corresponded with a decline of 16 per cent in

sheep and lamb offtake for the year. The vast majority of Australia’s the annual weighted average trade lamb and mutton price. Current

live sheep exports leave from Western Australia with 1.7 million sheep bills put to parliament propose a phase out of the trade over five years,

exported in 2017. This accounted for 31 per cent of the state’s sheep meaning a gradual increase in slaughter requirement could occur.

and lamb offtake (slaughter plus live exports) for the year. As a result, History also provides an example of this with slaughter increasing

the outcomes of current proposals to phase out the live sheep export for five years between 2003 and 2008 by 35 per cent, and a

trade would be most strongly felt in Western Australia rather than other corresponding decline in the weighted average price of 21.7 per cent.

exporting states of South Australia and Victoria, where live exports There are many more factors to consider when assessing the effects

accounted for 5.3 and 0.1 per cent of these states’ respective offtake of a phasing out of live sheep exports, but applying these percentage

in 2017. declines to the 2017 weighted average price of 535c/kg would bring

the price down to 419-449c/kg, still above the 80th percentile level.

A loss of the live export trade would require approximately 1.7 million

sheep to find alternative markets in Western Australia. Assuming they

The number of live sheep exported per year from Australia has levelled out at

8 approximately two million after declining from a peak of 6.8 million in 2001

7

6

5

million head

4

3

2

1

0

2011

2010

2016

2000

2001

2003

2004

2005

2006

2007

2008

2009

2012

2013

2014

2015

2017

2002

Kuwait Qatar UAE Oman Jordan Saudi Arabia Bahrain Others

Data: GTIS

The majority of Australian live sheep Western Australia live sheep exports

exports came from WA in 2017 accounted for 31 per cent of the state’s

6 sheep and lamb offtake in 2017

QLD

5

NSW 0.0

0.2%

4

VIC

million head

0.7% 3

SA 2

WA

13.3%

85.8%

1

0

2011

2007

2017

2005

2008

2013

2015

2009

2012

2006

2010

2014

2004

2016

Sheep & lamb slaughter Sheep exported

Data: GTIS Data: GTIS, MLA

14Primary sources:

Australian Bureau of Statistics, 2018, Principal Agricultural Commodities 2016-17, accessed June 2018.

Australian Wool Exchange, 2018, Micron price guides, accessed June 2018.

Australian Wool Testers Authority, 2018, Key Test Data, accessed June 2018.

Bureau of Meteorology, 2018, Australian NDVI standardised anomaly map, accessed June 2018.

Bureau of Meteorology, 2018, Australian rainfall decile map, accessed June 2018.

Bureau of Meteorology, 2018, Australian rainfall outlook map, accessed June 2018.

Bureau of Meteorology, 2018, Australian relative soil moisture map, accessed June 2018.

Global Trade Information Service, 2018, Global Trade Atlas, accessed June 2018.

Meat and Livestock Australia, 2018, Statistics Database, accessed June 2018.

OECD-FAO, 2017, Agricultural Outlook 2017-2026, accessed June 2018.

Reserve Bank of Australia, 2018, Exchange Rates Historical Data, accessed June 2018.

Statistics New Zealand, 2018, Infoshare, accessed June 2018.

United States Department of Agriculture Economic Research Service, 2018, Livestock and Meat International Trade Data, accessed June 2018.

15For report enquiries: AG ANSWERS P 1300 796 101 E ag.answers@ruralbank.com.au For banking enquiries: RURAL BANK P 1300 660 115 W ruralbank.com.au ELDERS P 1300 618 367 E bankmarketing@elders.com.au

You can also read