Arizona Metals Corp. Corporate Presentation

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Arizona Metals Corp. *

October 2019

Corporate Presentation March 2019

*Name change from Croesus Gold Corp subject to shareholder approval at upcoming Special MeetingArizona Metals Corp.

Forward-Looking Statement

Statements contained in this presentation that are not gold will be sustained or will improve; that general business two mineral projects; the nature of mineral exploration and

historical facts are “forward-looking information” or “forward- and economic conditions will not change in a materially mining and the uncertain commercial viability of certain

looking statements” (collectively, “Forward-Looking adverse manner and that all necessary governmental mineral deposits; the Company’s lack of operating revenues;

Information”) within the meaning of applicable Canadian approvals for the planned exploration on the Kay Mine Project governmental regulations and the ability to obtain necessary

securities legislation and the United States Private Securities and Sugarloaf Peak projects will be obtained in a timely licenses and permits; risks related to mineral properties being

Litigation Reform Act of 1995. Forward Looking Information manner and on acceptable terms; the continuity of the price of subject to prior unregistered agreements, transfers or claims

includes, but is not limited to, disclosure regarding possible gold and other metals, that the Company’s existing patented and other defects in title; impacts to patented and unpatented

events, conditions or financial performance that is based on and unpatented land has not been altered by any designation land by designation under U.S. Federal Statute or other laws,

assumptions about future economic conditions and courses of under U.S. Federal statute or other laws and economic and currency fluctuations; changes in environmental laws and

action; the timing and costs of future exploration and testing political conditions and operations. regulations and changes in the application of standards

activities on the Company’s properties; success of exploration pursuant to existing laws and regulations which may increase

activities; time lines for technical reports; planned exploration Forward-Looking Information involves known and unknown costs of doing business and restrict operations; risks related to

and development of properties and the results thereof; and risks, uncertainties and other factors which may cause the dependence on key personnel; and estimates used in financial

planned expenditures and budgets and the execution thereof. actual results, performance or achievements of the Company statements proving to be incorrect. Although the Company has

Statements concerning historical mineral resource estimates to be materially different from any future results, performance attempted to identify important factors that could affect the

may also be deemed to constitute forward looking information or achievements expressed or implied by the Forward-Looking Company and may cause actual actions, events or results to

to the extent that they involve estimates of the mineralization Information. Such risks and other factors include, among differ materially from those described in Forward-Looking

that will be encountered if the property is developed. In certain others, obtaining financing on commercially reasonable terms, Information, there may be other factors that cause actions,

cases, Forward-Looking Information can be identified by the operations and contractual obligations; changes in exploration events or results not to be as anticipated, estimated or

use of words and phrases such as “plans”, “expects” or “does programs based upon results of exploration; future prices of intended. There can be no assurance that Forward-Looking

not expect”, “is expected”, budget”, “scheduled”, “suggest”, metals; availability of third party contractors; availability of Information will prove to be accurate, as actual results and

“optimize”, “estimates”, “forecasts”, “intends”, “anticipates”, equipment; failure of equipment to operate as anticipated; future events could differ materially from those anticipated in

“potential” or “does not anticipate”, believes”, “anomalous” or accidents, effects of weather and other natural phenomena such statements. Accordingly, readers should not place undue

variations of such words and phrases or statements that and other risks associated with the mineral exploration reliance on Forward-Looking Information. Except as required

certain actions, events or results “may”, “could”, “would”, industry; environmental risks, including environmental matters by law, the Company does not assume any obligation to

“might” or “will be taken”, “occur” or “be achieved”. In making under U.S. federal and Arizona rules and regulations; impact release publicly any revisions to Forward-Looking Information

the forward-looking statements in this presentation, the of environmental remediation requirements and the terms of contained in this presentation to reflect events or

Company has applied several material assumptions, including, existing and potential consent decrees on the Company’s circumstances after the date hereof or to reflect the

but not limited to, that the current testing and other objectives planned exploration on the Kay Mine Project and Sugarloaf occurrence of unanticipated events.

concerning the Kay Mine Project and Sugarloaf Peak project Peak project; certainty of mineral title; community relations;

can be achieved and that its other corporate activities will delays in obtaining governmental approvals or financing;

proceed as expected; that the current price and demand for fluctuations in mineral prices; the Company’s dependence on

2Arizona Metals Corp.

Investment Highlights

Kay Mine Project, Yavapai County, Arizona

• 100%-owned, comprising 70 patented acres and 1,260 acres of BLM claims

• High grade VMS deposit with underground exploration from 1951 to 1979

• Historic resource estimate of 6Mt at 5.8% CuEq (2.2% Cu, 3.03% Zn, 2.81 g/t Au,

55 g/t Ag), or 742Mlb copper equivalent

• Open at depth and only 25% of known strike tested

Sugarloaf Peak Project, La Paz County Arizona

• 100%-owned, comprising 222 BLM claims covering 4,410 acres

• Historic resource estimate of 1.5Moz gold at 0.5g/t Au

• Heap-leach, open-pit target open for expansion in all directions

• Starts at surface, oxidized, flat-lying, and tabular

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101

guidelines. Significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the

historic resource can be verified and upgraded to be compliant with current NI 43-101 standards. The Company’s QP has not yet

undertaken sufficient work to classify the historic estimate as a current resource and the Company is not treating the historic estimate as

a current resource

3Arizona Metals Corp.

Leadership Team

Marc Pais, President and CEO, Director Paul Reid MBA, Executive Chairman

• B.Sc. Geological Engineering (Mineral Exploration) from Queen’s • 15 years of experience in financing mineral exploration, development

University and production assets

• Founder and former President of Telegraph Gold (listed as Castle • Founder and former Chairman of Telegraph Gold (listed as Castle

Mountain Mining, later acquired by Equinox Gold) Mountain Mining, later acquired by Equinox Gold)

• Seven years experience as a Mining Analyst, with a focus on precious • An Investment Banking professional with extensive experience in

metals development companies raising capital, going-public transactions and advisory services

Sung Min (Eric) Myung, Chief Financial Officer Colin Sutherland, Director

• Senior Financial Analyst at Marrelli Support Services Inc. • CPA with 20 years operational and financial experience

• Previously worked at public accounting firms for 7 years • Most recently served as President of McEwen Mining (NYSE:MUX)

• Canadian Professional Accountant designation (TSX:MUX)

• Master of Accounting degree from University of Waterloo • Served as CEO and Managing Director of Archipelago Resources Plc,

where he grew production to 200,000 ounces per year

Conor Dooley, Corporate Secretary, Director • Held senior financial and executive roles with Timmins Gold, Capital

• Partner at WeirFoulds LLC in Toronto Gold, Nayarit Gold, and Aurico Gold

• Advises clients in securities regulatory matters and capital markets

transactions Rick Vernon, Director

• LLB from Dalhousie University • 30 years experience as mining finance professional

• Previously Managing Director, Head of Investment Banking at PI

Dr. Mark Hannington, Technical Advisor Financial Corp.

• 35 years of experience as a research geologist, specializing on • Previously Managing Director, Head of Investment Banking at Stonecap

volcanogenic massive sulfide deposits and the metallogeny of modern Securities Inc.

and ancient volcanic belts • BSc in Geological Sciences from Queen’s University

• Currently a Professor of Economic Geology at the University of Ottawa • MBA from University of Southern California

• Previously worked as a senior scientist in mineral resources at the

Geological Survey of Canada for 15 years David Smith CPG, Vice President of Exploration

• BSc in Geology from Queen’s University • 30 years of global precious metals exploration experience, including co-

• MSc and PhD from the University of Toronto discovery of ~1M oz Au eq Solidaridad/La Sabila deposit, Mexico

• Core expertise is managing mineral projects from acquisition to

exploration, resource modeling, and project development

• MSc from University of Oregon

• MBA from Pinchot University/Presidio Graduate School

4Arizona Metals Corp.

Capital Structure

Shares Outstanding (basic) 49.5M

Options 7.1M

Warrants 6.8M

Shares Outstanding (FD) 63.4M

Cash at September 30, 2019 $2.5M

Ownership by Management and Insiders 15.1M (31%)

Ownership

Management

and Insiders

31%

Retail and

Institutional

Investors

55%

Riverside

Resources

14%

5Arizona Metals Corp.

History of the Kay Mine

• Prior to 1900: Kay Mine was discovered and mined on a small scale from the inclined No. 1 shaft, produced 635 tonnes

• 1918 to 1929: Kay Copper Company – deepened the No. 1 Shaft to 457 m (1,500 ft), sunk the No. 4 shaft to 366 m (1,200 ft),

installed the No. 3 Shaft, and developed several thousand feet of underground workings on 11 levels, discovering the ore

bodies above the 600 Level but produced no ore. The company drilled at least 89 underground drill holes. The Kay Copper

Company failed in the late 1920s and the project was dormant until 1949, apparently from a combination of low metals prices

and litigation

• 1949 to 1956: Various Mid-Century Operators – in 1949 Black Canyon Copper Corporation, opened the underground workings

to the 500 Level and shipped about 907 tonnes (1,000 short tons) of ore. In 1949, Black Canyon Copper sub-leased the project

to Shattuck-Denn Mining Company and New Jersey Zinc Company until 1952. These companies dewatered and rehabilitated

the No. 4 Shaft at least to the 1000 Level, and performed surface and underground exploration, including resampling and

underground diamond drilling of at least 14 holes. They shipped 1,425 tonnes of ore(1,571 short tons). In 1955-1956, the

project was leased to Republic Metals Company, which shipped 414 tonnes (456 short tons) of ore from above the 350 Level. A

cave-in destroyed pumping operations, and the mine was allowed to flood

• 1972 to 1984: Exxon Minerals – the project was acquired by Exxon Minerals Company in 1972, which completed geologic

mapping; “mine mapping”; relogging drill core and cuttings; petrographic studies; assaying 610 m (2,000 ft) of unassayed drill

core; stream sediment and soil geochemistry surveys; reviewing historical assay data and incorporating into mine maps and

cross sections; and geophysical surveys. Exxon drilled 23 core/rotary exploration holes totaling 8,094 m (26,554 ft), 14 of which

were in the immediate vicinity of the Kay Mine and which total 6,807 m (22,333 ft)

• 1990 to 2015: Post-Exxon Multiple Owners – the five patented claims changed hands a number of times between 1990 and

2015, without exploration work. In 1990 Exxon sold the five patented claims to Rayrock Mines, which in turn sold them to

American Copper and Nickel Company in 1995. Ownership changed a number of times until 2015, but no exploration work

completed

• 2017 to 2018: Silver Spruce Resources – in March, 2017, Silver Spruce Resources Inc. acquired five patented mining claims

and then staked 14 unpatented Kay Mine mining claims in April, 2017. Silver Spruce took 39 samples on the project but did no

other exploration work

• 2018 to present: Arizona Metals USA Corp – on September 26, 2018, Arizona Metals USA Corp signed a letter of intent to

acquire the five patented and 14 unpatented Kay Mine claims from Silver Spruce Resources. To date, Arizona Metals Corp has

performed initial geologic and geophysical exploration on the project and staked 50 additional unpatented mining claims

6Arizona Metals Corp.

Project Locations

• Kay Mine – located 45 miles

north of Phoenix, Arizona

• High-grade VMS deposit

with historic resource

estimate of 742Mlb copper

at 5.8% CuEq

• Sugarloaf Peak – located 130

miles west of Phoenix, Arizona

• Heap-leach, open-pit target

Source: Fellows, 1982 (Exxon Minerals) and Dausinger 1983 (Westworld Resources)

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101

guidelines. Significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the

historic resource can be verified and upgraded to be compliant with current NI 43-101 standards. The Company’s QP has not yet

undertaken sufficient work to classify the historic estimate as a current resource and the Company is not treating the historic estimate as

a current resource

7Arizona Metals Corp.

Kay Mine Project Overview – surrounded by high-grade historic past

producing VMS mines

United Verde: Produced 30Mt at 4.8% copper produced by Phelps

Dodge

Extension: Blind discovery underground that produced 3.5 Mt at 10.2%

Cu, 1.3 g/t Au, 58 g/t Ag

1884 - 1975

Iron King Mine: Produced 5.1Mt at 4.2g/t Au, 127 g/t Ag,

Old Dick Mine: Produced 1.35Mt at 3.5%

7.3% Zn, 2.5% Pb, and 0.2% Cu

Cu, 12% Zn, 0.7g/t Au and 11g/t Ag

1903 - 1969

1947 - 1966

Bruce Mine: Produced 822kt Blue Bell Mine: Produced 1.1Mt at 3% Cu, 2g/t Au, and

at 3.3% Cu, 9.0% Zn 51g/t Ag

1968-1977 1903 - 1959

Kay Mine

(Arizona Metals Corp.)

9Arizona Metals Corp.

Kay Mine Project Overview 390500 391000 391500 392000 392500 393000 393500 394000 394500

Ü

3771000

3771000

.

!

• Located 45 miles north of Phoenix in

3770500

3770500

the Yavapai County, Arizona .

! .

!

.

!

Shaft No 3

¸

3770000

3770000

• Kay deposit host stratigraphy has .

!

been traced over 5,600 feet at

3769500

3769500

.

!

Shaft No 1

.

!

!!

.

.

!

. .

!!

.

¸ .

! .

!

Shaft No 4

surface with only 25% (1,400 feet of .

! .

!

¸

.

!

.

!

strike) drill tested .!

!. No 2

3769000

3769000

Shaft

¸

.

!

.

!

3768500

3768500

• Mineralization consists of two Legend

Recently Staked BLM Claims

steeply dipping massive sulfide Kay Mine Patented Claim Boundary

3768000

3768000

KayMine Unpatented Claim Boundary

bodies ¸ Mine Shaft

.

! Drill Collars

3767500

3767500

Mineralized Orebodies

Projected to Surface

• In 1982, it was estimated the Kay .

! .

! 200 - 350 Levels

500 - 800 Levels

3767000

3767000

Mine hosted 6Mt at 5.8% CuEq (2% 1000 - 1200 Levels

1350 - 1500 Levels

CuEq cut-off grade) 2100 Level

3766500

3766500

Datum: WGS 84 UTM Zone 12N

0 250 500 1,000

Meters

Source: Fellows, 1982 (Exxon Minerals) 390500 391000 391500 392000 392500 393000 393500 394000 394500

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101

guidelines. Significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the

historic resource can be verified and upgraded to be compliant with current NI 43-101 standards. The Company’s QP has not yet

undertaken sufficient work to classify the historic estimate as a current resource and the Company is not treating the historic estimate as

a current resource

10Arizona Metals Corp.

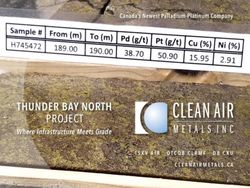

Kay Mine Historic Resource Estimate

Kay Mine

Tonnes (Mt) 5.8

Cu Grade (%) 2.20%

Zn grade (%) 3.03%

Silver Grade (g/t) 55

Gold grade (g/t) 2.81

Kay Deposit Value by Metal

Silver, 7%

Zinc, 22%

Copper, 39%

Gold, 31%

Source: Fellows, 1982

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be 11

compliant with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the

Company is not treating the historic estimate as a current resourceArizona Metals Corp.

Historic Grade Estimates

Source: Estimates by Arizona Metals Corp. Data from Exxon Minerals 1972-1982

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

12Arizona Metals Corp.

Historic Kay Mine Project Overview

Source: Estimates by Arizona Metals Corp. Data from Exxon Minerals 1972-1982

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

13Arizona Metals Corp.

Proposed Kay Mine Project Phase 1 Drill Program of 5,000 m in 12 holes

392400 392500 392600 392700 392800 392900 393000 393100

¯

0

58

58 0

66 0

66 0

58

0

58 0

58 0

0

58

3769500

3769500

0

58

0

68

67 0

0

59

60 0

580

58 0

58

Shaft No 1

0

58 0

58 0

58 0

58 0

580

0

58

580

0

58

0

0

66

58

58

0

580

0

58

3769400

3769400

0

58

630

Pad 1

580

64

58 0

0

64

580

0

64 0

T8N

65

0

580

R2E

590

A B

Pad 3

58 0

590

0

65

0

64

58 0

590

59

3769300

3769300

0

600

64 59 0

0

Pad 2

58 0

58 0

59 0

590

58 0

59 0

0

63

59

0 C D

0

58

0

65

590

590

58 0

620

59

3769200

3769200

0

640

580

620

E F

0 0

65 58

Mineralized Orebodies K

Legend L

610

Projected to Surface

65 0

63

Proposed Drilling 58

200 - 350 Levels

0

0

580

Proposed Drill Pads

3769100

3769100

500 - 800 Levels

580

65 0

580

590

Kay Mine Property Boundary 1000 - 1200 Levels

M G

58

0

!

. Historic Drill Collars 1350 - 1500 Levels N

62

0

580

59 0

59

H

0

0 50 100 200 Datum: WGS 84 UTM Zone 12N 2100 Level

Meters 59

630

0

59

0

392400 392500 392600 392700 392800 392900 393000 393100 O

P

I

J

R

Q

S T

Looking NE

14Arizona Metals Corp.

March 2019 helicopter VTEM survey defined a number of targets west of Kay Mine

390500 391000 391500 392000 392500 393000 393500

3770500

3770500

¯

( KA-2

! ( KA-5

!

K-17

(

!

9 8 7 6 5 4 3 2 1 46 ¸Shaft No 3

3770000

3770000

K-1

(

!

10 11 12 13 14 15 16 17 18 47 K-5

KA-9 K-12 K-3!

(K-4 KA-6_E

3769500

3769500

(

!

Old Workings (Gossan Zone) K-13

!

(

( K-8

! (

!

(K-10A !

!

K-9 ¸ Shaft

(

! (

!

No 1

( K-7

!

( K-2 KV-3

K-6

¸Shaft No 4

K-10

(

! (

! (

!

27 26 25 24 23 22 21 20 19 48 KV-2 K-16

(

! !!

( ( K-14

3769000

3769000

Shaft No 2

¸ KA-7

(

!

KV-1

(

!

28 29 30 31 32 33 34 35 36 49

3768500

3768500

45 44 43 42 41 40 39 38 37 50

0 250 500 1,000

Meters

390500 391000 391500 392000 392500 393000 393500

Source: Arizona Metals Corp, March 2019

15Arizona Metals Corp.

Maxwell Plate Modelling of VTEM Identified 4 Untested Conductors

16Arizona Metals Corp.

• 3 drill holes proposed to test the Central Conductor (MX2) and 6 for the Western Conductor (MX1)

17Arizona Metals Corp.

Kay Mine Depth Potential Compared to VMS Deposits in Production

• Kay Mine is higher grade and only a fraction of the depth compared to operating copper mines

– Lalor Lake (Hudbay Minerals), LaRonde (Agnico Eagle) and Kidd Creek (Glencore)

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101

guidelines. Significant data compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the

historic resource can be verified and upgraded to be compliant with current NI 43-101 standards. The Company’s QP has not yet

undertaken sufficient work to classify the historic estimate as a current resource and the Company is not treating the historic estimate as

a current resource

18Arizona Metals Corp.

Kay Mine CuEq Grade Comparables

Copper Grade Average Grade

6.0% 5.8%

4.9%

5.0%

Copper Equivalent Grade (%)

4.3%

4.0% 3.8%

3.2%

3.0%

3.0% Average: 2.8%

2.0%

1.0% 0.7%

0.0%

Nevada Copper Aquila Kutcho Constantine Adventus Atico Kay Mine

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

Source: Company reports 19Arizona Metals Corp.

Kay Mine EV/Resource (cents/lb) compared to Underground Peers

16.0

14.8

14.0

EV/Resource CuEq (cents/lb)

12.0

10.0

8.4

8.0

6.0 5.6

Average: 4.8 cents/lb

4.0

2.6 2.7

2.0 2.1

0.9

0.0

Arizona Metals Kutcho Constantine Nevada Copper Aquila Atico Adventus

*

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

Source: Company reports 20Arizona Metals Corp.

High Grade Copper-Gold VMS deposits are scarce and trade at a premium valuation

Arizona Metals Corp

Company

Symbol TSXV:AMC

Share Price $0.20

Market Capitalization (M) $10

Cash (M) $2.5

Earn-In Payments O/S (M) $0

Enterprise Value (M) $7.5

Project Name Kay Mine

Location Arizona

Ownership 100%

Royalties None

14,000m combined surface

Total Historic Drilling (Kay Mine)

and U/G

Cut-off Grade (CuEq) 2.0%

Total Attributable Resource* 5.8Mt at 5.8% CuEq

Contained CuEq (Mlbs) 742

EV/lb CuEq $0.01

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

21Arizona Metals Corp.

Sugarloaf Peak Deposit Provides Additional Optionality to Shareholders –

Historic Resource Estimate of 1.5Moz gold at 0.5g/t

746000 747000 748000 749000

± • Coincident magnetic low

3726000

Target C-5

!

(

!!

CS-4

!

(

!!

CS-5

and IP chargeability

SGL-11-01

!

(

!!

WW-10

!

(

! !

WW-3

SGL-11-05

!

(

! !

CS-3

!.

!

ASP-04 SGL-11-04

!

(

!

SGL-11-04 anomalies extend 2 km to

!

!

(

!!

SGR-12-07

WW-7 !

(

!

!

. ASP-03

CS-6

! ASP-02 ! !

(

! ! (

!

CS-10 !

! !

!

(

!!

!

.

! SGR-12-08

!

(

!

the NW of historic resource

!

SGR-12-19

!

(

!

!

SGL-11-03!

.

!

SLP-09-004

!

(

!

SGL-11-02 !

!

(

!(

! ! ASP-01

!

!

(

!

Target C-3

!

!

WW-1

!

(

!!

SWR-13 SWR-12

!

(

! !

SGR-12-09

SWR-7

!

(

!

(Target C-5) and 1.5km to

SLP-09-002 !

SWR-11 SWR-10 !

(

!

(

! SLP-09-003 !

!

WW-8!

!

(

! !(

!

SLP-09-001

! ! (

! !

SGL-11-06 SWR-9

!

(

! !(

! !

!

(

! SWR-8 !

(

! !

!

1.5Moz

( SWR-1 historic

!

WW-4 !

(

! WW-9 !(

! Target C-1 !

!

!

! !

SWR-3

SGR-12-18 !

(

! !

!

(

! SWR-2 !

(

! SGR-12-12 ! WW-6

Target C-4 !

resource

3725000

!

!

(

!

!

SGR-12-11 CS-7 !

!( !

(

!

(

! !

the SE

! !

!

SGR-12-17

!

(

!! !(

! !

(

! ! ! SWR-6

SGR-12-10

!(

!

!

(

!

SWR-4 !

SLP-09-005 WW-5

!

!

Central Zone Exploration Targets WW-2 (

! !(

! CS-12

! !

!

!

(

!

!

(

! !

Legend SGR-12-13 !

(

!

!

!

SWR-5

Central Zone exploration targets

Drillholes

!

(

!

!

CS-9

• Previous holes include:

Grade*Thickness (ppm*m) Target C-2

! 0-5 CS-8

!

! !

(

!

66m of 0.54 g/t

!

•

6 - 15

! 16 - 30

! 31 - 45

SWR-16

! 46 - 69

Alteration

Silicic

Au contours

> 500 ppb Au

!

(

!

!

CS-1

!

(

!!

SGR-12-15

!

(

! !

! • 88m of 0.78 g/t

Argillic and sericitic

> 200 ppb Au SGR-12-14

Propylitic

!

125m of 0.4 g/t (EOH)

CS-11

GO !

(

!

•

!

Riverside Claims Cable OD

MA

NF !CS-11A

3724000

Third Party Placer Claims Pipeline AU

LT

?

Third Party Lode Claims Roads

100m of 0.42 g/t Au

0 250 500

Datum: NAD83, UTM Zone 11N

m

!

(

! !

SGR-12-16

•

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a Gcurrent

OO

DM

AN resource and the Company is not

FAU

treating the historic estimate as a current resource LT

?

Source: Dausinger, 1983 (Westworld Resources), and Choice Gold 2011-2012 22Arizona Metals Corp.

Sugarloaf – Long Sections

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

23Arizona Metals Corp.

Sugarloaf – Deposit Open Laterally and at Depth

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

24Arizona Metals Corp.

Mining Friendly Jurisdiction

Permitting Water Infrastructure

• Permitting underway – • Groundwater most likely • Adjacent to Interstate Highway 10

drill permit for 10,000m source for mining

program expected Q4’19 operations (similar to • Easy access to roads, rail, natural

Copperstone) gas, and electricity

• Located 15 miles from

past-producing • Drill holes on and near • 8 km west of the town of

Copperstone Mine the project (2.6 km) Quartzsite

encountered

• Both Copperstone and groundwater

Sugarloaf are on BLM

claims in La Paz County • Possible other sources

include Bouse Canal

• Copperstone open pit (20km) and Colorado

gold mine operated from River (15km)

1987-1993 (Produced

over 500koz)

25Arizona Metals Corp.

Sugarloaf Open-Pit, Heap-Leach Company Comparables

Average

Shares Total Ounces EV /

Share Market Cap Enterprise Total Grade

Company Symbol Deposit Location

Price (M) Value (M) Tonnes Resource

O/S (M) (g/t Au) (MozAu)

($/oz)

North

Corvus Gold KOR-T Nevada 112 $2.57 $289 $282 70 0.63 1.4 $201

Bullfrog

Northern Vertex NEE-V Moss Arizona 245 $0.32 $78 $82 18 0.84 0.5 $172

Revival Gold RVG-V Beartrack Idaho 52 $0.71 $37 $48 27 1.50 1.3 $37

Caballo

Candelaria CAND-V Mexico 114 $0.25 $28 $19 40 0.48 0.6 $31

Blanco

Gold

TriMetals Mining TMI-T Nevada 247 $0.07 $17 $18 35 0.61 0.7 $26

Springs

West Kirkland WKM-V Hasbrouk Nevada 409 $0.08 $31 $30 117 0.33 1.2 $25

Almaden

AMM-T Ixtaca Mexico 112 $0.89 $99 $83 173 0.82 4.6 $18

Minerals

Average - - - - - - - 68 0.74 1.5 $73

Arizona Metals AMC-V Sugarloaf Arizona 50 $0.20 $10 $7 93 0.50 1.5 $5

Source: Company Reports; $ in millions ex. Share Price

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

26Arizona Metals Corp.

Summary

• Two 100% owned projects in mining-friendly Arizona

• Excellent infrastructure at both projects-road, power and water access

• Kay Mine is a high-grade VMS target with historic resource estimate of

6Mt at 5.8% CuEq*

• Sugarloaf is a near-surface, open-pit target with a 1.5Moz gold historic

resource estimate*

• Kay Mine valuation of $0.01/lb CuEq compared to high-grade VMS peers

at an average of $0.05/lb

• Sugarloaf valuation of $5/oz compared to heap leach peers at an

average of $73/oz

* The historical estimates for the Kay Mine and Sugarloaf Peak Projects predate and are unclassified and not compliant with NI 43-101 guidelines. Significant data

compilation, re-drilling, re-sampling and data verification may be required by a Qualified Person before the historic resource can be verified and upgraded to be compliant

with current NI 43-101 standards. The Company’s QP has not yet undertaken sufficient work to classify the historic estimate as a current resource and the Company is not

treating the historic estimate as a current resource

27Arizona Metals Corp.

Contact

Marc Pais President & CEO

416.565.7689

mpais@arizonametalscorp.com

Paul Reid Chairman

416.845.9311

preid@arizonametalscorp.com

Website

http://www.arizonametalscorp.com/

Twitter

https://twitter.com/ArizonaCorp

28You can also read