2019 FNZ TAX USER GUIDE - Rede Advisers

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2019

FNZ TAX USER

GUIDE

11. CONTENTS

2. INTRODUCTION 5

3. GENERAL INFORMATION REGARDING YOUR INVESTMENTS 6

3.1 Taxation of financial arrangements 6

3.1.1 Resident Withholding Tax on interest income 6

3.1.2 Tax reports prepared on a cash basis 6

3.2 Portfolio Investment Entities (PIEs) 6

3.2.1 Prescribed Investor Rate – Unlisted PIEs6

3.2.2 Unlisted PIE distributions 7

3.2.3 Fully imputed listed PIE distributions 7

3.3 Taxation of dividend income 7

3.3.1 New Zealand dividend income 8

3.3.2 Overseas dividend income 8

3.4 Foreign Investment Fund rules 8

3.4.1 De minimis exemption from the FIF rules 8

3.5 Foreign tax credits 9

3.6 Tax residency 9

3.7 Rebates, Fees, and Charges 9

4. COMPLETING YOUR TAX RETURN10

4.1 How to complete your tax return 11

4.1.1 IR3 – Individual Tax Return 11

4.1.2 IR4 – Company Tax Return 13

4.1.3 IR6 – Trust Tax Return 15

5. RESIDENT WITHHOLDING TAX DEDUCTED BY FNZ17

5.1 Interest Income 17

5.2 Dividend income 17

5.2.1 New Zealand dividend income 17

5.2.2 Overseas dividend income 17

6. FIXED INTEREST INVESTMENTS AND THE FINANCIAL ARRANGEMENTS RULES19

6.1 Cash Basis Person and method 19

6.1.1 Beneficiary or trustee of a trust 19

6.1.1.1 Trustee of an estate 19

6.1.1.2 Beneficiary of a bare trust 20

6.1.1.3 Trustee of a trust (other than a bare trust or estate) 20

6.1.1.4 Beneficiary of a trust (other than a bare trust) 21

6.1.2 Deferral threshold 21

6.1.3 Base Price Adjustment 21

6.1.4 Ceasing to be or becoming a cash basis person 22

6.2 Accrual methods 22

6.2.1 IFRS taxpayers 22

6.2.2 Foreign denominated financial arrangements 23

6.2.3 Certain bonds sold before first coupon date 23

6.2.4 Base Price Adjustment 23

6.2.5 Election to apply an accrual method 23

6.3 Worked examples 23

6.3.1 Simple accrued interest at balance date - accrual method 23

6.3.2 Accrued interest on purchase, premium paid or discount received -

accrual method 24

6.3.3 Accrued interest on purchase, premium paid or discount received-

cash basis person 25

6.3.4 Differences between accrual basis and cash basis 28

2 | 2019 FNZ TAX USER GUIDE6.4 Overseas Fixed Interest Investments 28

7. PORTFOLIO INVESTMENTS ENTITIES29

7.1 Unlisted PIEs 29

7.1.1 PIE tax crystallisation events 29

7.1.2 Crystallisation ratio 29

7.1.3 PIE taxable income / (loss) 30

7.1.4 Attributable taxable income / (loss) 30

7.1.5 Gross PIE tax payable / (rebate) 30

7.1.6 Net PIE tax payable / (rebated) 31

7.1.7 PIE tax and incorrect PIRs 31

7.2 Listed PIEs 31

7.2.1 Fully imputed PIE distributions 31

7.2.2 Unimputed PIE distributions 31

8. REALISED GAINS ON EQUITY INVESTMENTS32

8.1 New Zealand and certain Australian listed equities 32

8.2 Overseas equities subject to the FIF rules 32

9. FOREIGN EQUITY AND FOREIGN MANAGED FUNDS INVESTMENTS33

9.1 Foreign Investment Funds defined 33

9.2 Exemptions from the FIF Regime 33

9.3 Australian listed share exemption 33

9.4 Determining if the FIF rules apply to you 34

9.4.1 De minimis exemption 34

9.5 Portfolio FIFs 34

10. FOREIGN INVESTMENTS FUND (FIF) INCOME35

10.1 Calculation methods for FIF income (used by FNZ) 35

10.2 Fair Dividend Rate - the default method 35

10.2.1 Exclusions from applying the FDR method 36

10.2.2 Fair Dividend Rate (FDR) method calculation 36

10.3 Comparative Value (CV) method calculation 38

10.4 Comparative Value - The Compulsory Method 38

10.5 Comparative Value - The Optional Method 38

10.6 Other Calculation Methods (not used by FNZ) 39

10.7 Currency conversion rules for FIF taxation methods 39

10.8 Foreign tax credits 39

10.9 Share re-organisations 39

10.10 Impact of unsettled FIF trades as of 31 March on the tax report 40

10.11 General 40

11. R

EBATES, FEES AND CHARGES41

11.1 Fund Rebate Income 41

11.1.1 Fund Rebate Income taxed through PIE crystallisation 41

11.1.2 Untaxed Fund Rebate Income 41

11.2 Ongoing Fees 41

11.3 Collection Charges 41

12. RECONCILIATION OF FNZ TAX REPORT TO OTHER FNZ REPORTS42

13. QUESTIONS AND ANSWERS43

14. APPENDIX/TECHNICAL DEFINITIONS44

14.1 General definitions 44

14.2 Tax credit definitions 45

14.3 Classification of transaction types 46

34 | 2019 FNZ TAX USER GUIDE

2. INTRODUCTION

Welcome to the 2019 FNZ Tax User Guide. This investments in your tax return. They may also affect the

User Guide is produced by FNZ Custodians Limited treatment of the FNZ held investments.

(FNZ) in its capacity as an integrated financial services

provider in relation to your investments. It has been Should you or your tax adviser have any questions

prepared for New Zealand tax residents and FNZ regarding your FNZ Tax Report or the User Guide,

trusts that you find the contents of this User Guide please contact your financial adviser in the first

informative and helpful in understanding your New instance. Please note that while FNZ can provide

Zealand tax obligations and, should you be required information on your investments held in its custody, and

to, completing your New Zealand tax return. how FNZ has chosen to process any transaction, FNZ

does not provide tax advice.

The User Guide contains general information on the

various aspects of New Zealand tax legislation that Please also note the income figures expressed in this

may be relevant to your personal circumstances. report are not your portfolio performance. To obtain

The majority of the information that you should need your portfolio performance please contact your financial

to complete your tax return is in the next two sections. adviser. There may also be differences between how

certain transactions are displayed in your tax report

Your FNZ Tax Report collates information on the compared to other reports, due to how tax legislation

interest, dividend, and distributions received and applies to your investments and certain transactions.

processed by FNZ for you during the year ended Please see section 12 of the long form FNZ Tax User

31 March 2019 (“the 2019 income year”). An Guide for more details.

amalgamated tax statement such as your FNZ Tax

Report makes filing your income tax return much As FNZ and your adviser may not have complete

simpler. We recommend that you provide your FNZ knowledge of your specific circumstances, we strongly

Tax Report and this User Guide to your tax adviser. recommend that you seek independent tax advice from

a professional tax adviser to ensure you meet your New

Should you have other investments that are not held Zealand tax obligations.

in custody with FNZ or investments that have not

been held in FNZ’s custody for the entire income year, Yours sincerely

you may also need to include the income from those

Charlie Trotter

Managing Director - NZ

FNZ Limited

Disclaimer

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the

interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are subject to change over

time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek

professional tax advice where required. Whilst every effort has been made to ensure the accuracy of this User Guide and your tax reports,

to the maximum extent permitted by law no liability is accepted by FNZ for any errors or omissions.

53. GENERAL INFORMATION REGARDING

YOUR INVESTMENTS

This section contains general information regarding such as accrued interest, premiums and discounts

your investments which may be relevant to you when on purchase and disposal of certain fixed interest

preparing your 2019 tax return. We recommend you investments will be required to be factored into any

read this section in its entirety before completing your ‘spreading method’ calculation. Your tax report does

tax return. not contain any accrual calculations.

Section 6 of the long form Tax User Guide contains

3.1 Taxation of financial arrangements the tests to determine if you qualify to be a cash basis

3.1.1 Resident Withholding Tax on interest income person. It also includes detailed worked examples

which may be helpful to you in calculating your accrual

Your Resident Withholding Tax (“RWT”) rate as at

interest income should you be required to apply accrual

31 March 2019 which was supplied by you or your

reporting.

adviser is shown at the top of the first page of your

tax report.

3.2 Portfolio Investment Entities (PIEs)

If the RWT rate supplied was incorrect during the 3.2.1 Prescribed Investor Rate – Unlisted PIEs

2019 income year, you may have underpaid or

overpaid RWT on your interest income. Practically, Your Prescribed Investor Rate (“PIR”) at 31 March 2019

any under or overpayment is calculated by filing a which was supplied by you or your adviser is shown at

tax return. As RWT is a refundable tax credit, any the top of the first page of your tax report.

overpayment is generally refundable.

Individual and joint investors should not be required to

We recommend that you seek advice from your include unlisted PIE income in their tax return if they

tax adviser to quantify any tax liability or refund. elected the correct PIR or a PIR that was too high

throughout the 2019 income year. This is on the basis

3.1.2 Tax reports prepared on a cash basis that PIE tax is generally a final tax.

Your tax report has been prepared on a cash basis Please note that PIE tax is not a final tax for:

for tax purposes. As the cash basis method may not

be appropriate for you, we recommend you discuss • individuals and joint investors who had unlisted

your circumstances with your tax adviser to ensure PIE income crystallised at an incorrect PIR that was

you meet your New Zealand tax obligations. too low;

• trusts, unless the highest available PIR was elected

As an example, if you hold the investments as part

at all times during the income year; and

of a business activity or through a trust or company

and are preparing financial statements, or you do not • any entity that had unlisted PIE income crystallised

meet the criteria to be a cash basis person, you may at a 0% PIR during the income year.

be required to account for interest income using an

Electing the correct PIR is beneficial in that the

accrual method.

maximum PIR is typically lower than the corresponding

Accrual tax reporting is a complex area of tax law. marginal tax rate. That is, in some situations, you will

If you qualify for accrual tax reporting, you will be pay more income tax if you are required to include your

required to use a ‘spreading method’ to determine PIE income in your tax return and be taxed at your

the income to include in your tax return. Factors marginal rate, as opposed to the applicable PIE tax that

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

6 | 2019 FNZ TAX USER GUIDEwould have been paid if you elected the correct PIR. If you wish to take advantage of the imputation or FDP

If the PIR that applied to your unlisted PIE income credits received from your listed PIE investments, you

was less than you were entitled to use, you may need should include the gross fully imputed PIE distribution

to include some of your unlisted PIE income in your and any tax credits in your tax return.

tax return. The amount of income you are required to

For completeness, investors other than individuals

return is generally the amount that was taxed at the

and trusts are generally required to treat the imputed

lower PIR. You should be allowed to claim a credit

portion of distributions from listed PIEs as taxable.

for any PIE tax paid on your behalf that relates to the

PIE income included in your tax return. Amounts showing in your tax report as “Excluded

Listed PIE distributions” do not have to be included in

If your PIE investments incurred a loss during the

your tax return.

2019 income year, you should not be required to

include this loss in your tax return unless you had

a 0% PIR or you elected a PIR that was too low. 3.3 Taxation of dividend income

A ‘dividend’ is a broad concept under New Zealand

Please note that there are specific rules on how

tax legislation and generally includes all situations

new residents of New Zealand set their PIR. Please

where a company provides a ‘transfer of value’ to a

contact your tax adviser or visit www.ird.govt.nz

shareholder. This ‘transfer of value’ can occasionally

for more details.

include non‑cash items such as the distribution of

We recommend that you seek advice from your tax shares or other non-cash assets by the company to its

adviser to determine if you are required to include shareholders. FNZ interprets the dividend rules as part

any unlisted PIE allocated amounts in your tax return. of discharging its role as custodian and encourages

We also recommend advice is sought around whether clients to seek their own tax advice on the application

certain PIE income is required to be included for any of the dividend rules where necessary.

other purposes (for example the Working for Families

package) as the rules around these areas have

recently changed.

3.2.2 Unlisted PIE distributions

Such amounts are considered as excluded income

in terms of the Income Tax Act and therefore, clients

are never required to include them in their tax returns.

FNZ however reports these distributions for information

purposes and so that the total distributions reported

in the tax report is consistent with other reports issued

by FNZ.

3.2.3 Fully imputed listed PIE distributions

Distributions received from listed PIEs are generally

not taxable when received by individuals and trusts.

However, individuals on a marginal tax rate of less than

28%, and trusts that have beneficiaries on a marginal tax

rate of less than 28%, may benefit from electing to treat

the imputed portion of distributions from listed PIEs as

taxable. This is on the basis that the excess imputation

and/or FDP credits can be offset against other taxable

income (potentially resulting in a tax refund).

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

73.3.1 New Zealand dividend income 3.4.1 De minimis exemption from the FIF rules

Prima facie, all New Zealand sourced dividend income Individuals and certain trusts can choose not to apply

is subject to RWT at 33%. However, no RWT is the FIF rules if the total cost of their FIF investments

required to be deducted by FNZ if you had a valid RWT did not exceed $50,000 at any time during the income

certificate of exemption and this was provided to FNZ. year. This is known as the ‘de minimis’ exemption.

Companies, and other trusts, must apply the FIF rules

If the company paying the dividend has attached regardless of the cost of their FIF investments.

imputation credits to the dividend, FNZ will allocate

you your share of these imputation credits. Where Additionally, where you do not exceed the $50,000

applicable, FNZ has offset eligible tax credits against threshold you can elect to calculate your income

your tax liability to reduce the RWT withheld. using the FIF rules. If you do elect to do this you are

required to calculate your income using the FIF rules

You should consider whether dividend or associated for four years.

credits should be included in your tax return.

Your de minimis election as at 31 March 2019 which

3.3.2 Overseas dividend income was supplied by you or your adviser is shown at the

Prima facie, FNZ is required to deduct RWT at 33% top of the first page of your tax report.

on dividend income paid to investors from an overseas

If you have elected to be subject to the FIF rules, we

resident entity. However, no RWT is required to be

have included FIF calculations in your tax report for

deducted if:

your investments held in custody with FNZ. If you

• the overseas entity is a FIF and the investor has, have elected not to be subject to the FIF rules, no FIF

at the time the distribution is paid, elected to be calculations have been included in your tax report.

subject to the FIF rules (outlined in further detail

below); or If you have other FIF investments not held in custody

with FNZ or that your adviser is not aware of, we

• if you had a valid RWT certificate of exemption recommend that you consider the impact of these

and this was provided to FNZ. on your FNZ de minimis election. If your de minimis

If you have not elected to be subject to the FIF rules, election is incorrect, we recommend you contact

RWT is generally deducted from all overseas dividend your adviser immediately to have your de minimis

income. Please note that the amount of RWT withheld election amended.

from dividends you receive is based on the information As the FIF rules are complex, we recommend that

available at the time (being your FIF election and if the you seek advice from your tax adviser to determine if

overseas entity is a FIF or is exempt from FIF). you are subject to the FIF rules, and if so, which FIF

calculation method is most beneficial for you.

3.4 Foreign Investment Fund rules

Note where FIF instruments have been transferred out

The Foreign Investment Fund (“FIF”) regime contains

of custody, the FIF schedules may need to be modified

rules specifically designed to tax certain overseas

for transactions that occurred outside of FNZ custody

investments. A FIF is broadly defined to include a right

as well as your actual closing FIF holdings when

(i.e. a share) in a foreign company (i.e. a company

preparing your tax return. We suggest you refer to the

that is not resident in New Zealand). However, there

appendix for more information regarding our treatment

are some exemptions for certain Australian ASX listed

of transfers.

companies and Australian unit trusts. A FIF interest

also includes rights in certain foreign superannuation

schemes and life insurance policies. While you do not

hold such investments through FNZ, holding such an

interest may impact on your ability to apply the de

minimis exemption (see across).

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

8 | 2019 FNZ TAX USER GUIDE3.5 Foreign tax credits their New Zealand tax obligations.

Foreign tax may be withheld from overseas interest FNZ prepares different tax reports for residents of

or dividend income derived by you. The rate of New Zealand and non-residents. If you were non-

withholding tax will depend on the law of the foreign resident in New Zealand at any stage during the 2019

jurisdiction. In many circumstances, you may be able tax year, you will receive the non-resident report in

to claim a credit against your New Zealand tax liability respect of the entire year. We note that the manner in

for the foreign tax that has been withheld. which information is reported to you and the amount

of withholding tax deducted from your interest and

However, there are complicated rules around the

dividend income is based on your tax residency.

amount of the foreign tax credit which is allowed as

a credit in your tax return. In general, it is limited to The tax rules that apply if your residency changes

your New Zealand tax liability on the investments that during the year are complex and the information in

gave rise to the foreign tax credit. For example, if your your tax report should be carefully considered when

taxable income on your USA FIF investments is nil, completing your tax return. We would particularly

you will be unable to claim any credits for USA tax recommend that you seek tax advice on how to use

paid for these investments. In addition, if you have the information in your tax report and what adjustments

New Zealand losses available, these must be offset may be required to the information shown (for example

against taxable income before foreign tax credits part year calculations).

can be claimed. If these losses exceed your taxable

income, foreign tax credits may be forfeited. Please notify your adviser if your recorded residency

status is not currently correct or if it was not correct

Further, certain Double Tax Agreements (“DTA”) during the previous year.

between New Zealand and foreign jurisdictions

may limit the amount of the foreign tax credit. Some 3.7 Rebates, Fees, and Charges

countries require certain steps be taken before a

lower tax rate under the DTA can be applied. However, On the Summary of Investment Income page, FNZ

New Zealand tax rules generally limit foreign tax credits separately displays a subtotal for rebates that have

to the rate under the DTA. For example, if the DTA been taxed through a PIE crystallisation and a subtotal

rate is 15% and the amount withheld in the foreign for untaxed rebates. Unlisted PIE rebates are generally

jurisdiction is based on a 30% rate, you may be limited taxed in your unlisted PIE proxy tax calculations (as

to a tax credit at the 15% rate even though the actual shown in the relevant section of your tax report). A

tax withheld is at 30%. separate schedule of untaxed rebates from PIE funds

and other issuers is provided in the tax report and

Inland Revenue released a publication in November these are generally taxable. For the purposes of the

2018 titled “A guide to foreign investment funds following section ‘How to complete your tax return’,

and the fair dividend rate (IR461)” which provides FNZ has assumed that these rebates are taxable.

information on the eligibility to claim the benefit of

foreign tax credits. Fees and charges may be deductible for tax purposes.

For the purposes of the section How to complete your

As the rules around foreign tax credits are complex, tax return, FNZ assumes that fees and charges are

we recommend that you seek advice from your tax deductible, including any GST paid. If investors have

adviser to determine if you are eligible to claim a claimed GST input credits for any GST paid in respect

foreign tax credit. of any fees and charges in their GST returns, the

deductible amount needs to be reduced by the GST

3.6 Tax residency already claimed.

As noted, this User Guide has been prepared to We recommend that you seek advice from your tax

assist tax residents of New Zealand to understand adviser to determine if the rebates you received are

taxable and if the fees and charges you incurred are

deductible for tax purposes.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

94. COMPLETING YOUR TAX RETURN

The section below is a guideline on how to use the The information used to generate your tax report

information contained in your tax report to populate comes from a number of sources, including user

your tax return. On the summary pages of the tax input, domestic, and international sources. Accordingly

report a numbered ‘Item’ has been inserted which FNZ cannot guarantee the accuracy of this information.

relates to an ‘Item’ in the ‘How to complete your tax We note that FNZ attempts to process all transactions

return’ section. in line with the relevant New Zealand tax requirements.

However there may be rare cases where certain

Your tax report should be retained for tax purposes.

complicated foreign corporate transactions (for

Together with information from other sources, the

example some restructures, demergers, spinouts

summaries at the front of the report will assist in the

or takeovers) result in amounts displayed in the tax

production of your tax return. However, the summaries

report that may require further analysis on a case-

are not designed to be the sole source of information,

by-case basis. Accordingly clients should review the

particularly if you have other investments that are not

tax treatment of all transactions and seek advice as

held in custody with FNZ.

required. -FNZ does not provide tax advice.

Only income and distributions received while your

The tax report details the various amounts of tax

investments are held in FNZ custody are included

deducted from the income of investments held in

within your tax report. Where investments are transferred

custody with FNZ. We note that the rules around

into custody part way through an income year, FNZ

claiming any tax credits are complicated and vary

will only report income and distributions from the date

depending on your specific circumstances and the

that the investments are transferred into FNZ custody.

nature of the investments you have held. The ability

All amounts in the tax report summary pages are to claim tax credits that are included in your tax report

reported in New Zealand dollars. The exchange rates may also be impacted by the investments you hold, or

used are at the close of business on the day the gains and/or losses derived from investments not held

distribution is paid. In some cases, this rate could in custody with FNZ. As such, we recommend you

differ from the actual rate used in the cash seek professional advice if you intend to claim any tax

management conversion. credits displayed in your FNZ tax report as part of your

tax return.

The following section should be used as a guide only.

The income that is required to be included in your tax

return will depend on your personal circumstances. As

such, we strongly recommend you seek professional

advice before filing your New Zealand tax return.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

10 | 2019 FNZ TAX USER GUIDE4.1 How to complete your tax return

4.1.1 IR3 – Individual Tax Return

Please ensure that you have read the entire contents of section 3 (General information regarding your investments)

before continuing.

IR3 Box 13A - Total Interest RWT

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - NZ Resident Withholding Tax 2

Overseas Interest Income - NZ Resident Withholding Tax 9

Total RWT

13A $ , , .

IR3 Box 13B - Total Gross Interest

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - Gross Income 1

Total gross interest

13B $ , , .

IR3 Box 14 - Total Dividend Imputation Credits

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - NZ Imputation Credits 4

Overseas Dividend Income (Exempt from FIF Rules) - NZ Imputation Credits 11

Overseas Dividend Income (Subject to FIF Rules) - NZ Imputation Credits 15

Do you elect to treat fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - NZ Imputation Credits If yes, 29

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allocated Imputation Credits If yes, 27

Total dividend imputation credits

14 $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR3 Box 14A - Total dividend resident withholding tax and payments for foreign dividends

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Foreign Withholding Payment Credits 5

New Zealand Dividend Income - NZ Resident Withholding Tax 6

Overseas Dividend Income (Exempt from FIF Rules) - 12

Foreign Withholding Payment Credits

Overseas Dividend Income (Exempt from FIF Rules) - 14

NZ Resident Witholding Tax

Overseas Dividend Income (Subject to FIF Rules) - 16

Foreign Withholding Payment Credits

Overseas Dividend Income (Subject to FIF Rules) - 18

NZ Resident Withholding Tax

Do you elect to treat fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - Foreign Withholding Payment Credits If yes, 30

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allocated DWP Credits If yes, 25

Unlisted PIE Income (PIR 0% for Period) - Allocated RWT Credits If yes, 26

Total dividend RWT and payments for foreign dividends

14A $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

11IR3 Box 14B - Total Gross Dividends

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Gross Income 3

Do you elect to treat the fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - Gross Income If yes, 28

Total gross dividends

14B $ , , .

IR3 Box 17A - Total Overseas Tax Paid

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Foreign Withholding Tax 8

Overseas Dividend Income (Exempt from FIF Rules) - Foreign Withholding Tax 13

Overseas Dividend Income (Subject to FIF Rules) - Foreign Withholding Tax 17

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allocated Foreign Tax Credits If yes, 24

Total overseas tax paid

17A $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR3 Box 17B - Total Overseas Income

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Gross Income 7

Overseas Dividend Income (Exempt from FIF Rules) - Gross Income 10

Comparative Value (The Compulsory Method) - Total Comparative Value 33

Foreign Investment Fund (FIF) Income

Choose the lower of the Total Fair Dividend Rate 31 or 32

and the Total Comparative Value (the Optional Method)

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - PIE Taxable Investment Income If yes, 23

Total overseas income

17B $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR3 Box 24 - Total Other Income

FNZ Tax Report Item NZ Tax Return

Determine which of your management fee rebates are taxable:

Fund Rebate Income - Untaxed Fund Rebate Income 19

Total other income

24 $ , , .

IR3 Box 26 - Total Expenses Claimed

FNZ Tax Report Item NZ Tax Return

Determine which of your fees and charges are deductible including the GST portion:

Fees and Charges - Total Fees and Charges 20

Total other expenses

26 $ , , .

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

12 | 2019 FNZ TAX USER GUIDE4.1.2 IR4 – Company Tax Return

Please ensure that you have read the entire contents of section 3 (General information regarding your investments)

before continuing.

IR4 Box 13A - Total Interest RWT and/or NRWT

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - NZ Resident Withholding Tax 2

Overseas Interest Income - NZ Resident Withholding Tax 9

Total RWT and/or NRWT

13A $ , , .

IR4 Box 13B - Total Gross Interest

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - Gross Income 1

Total gross interest—if a loss put a minus sign in the last box

13B $ , , .

IR4 Box 14 - Total Dividend Imputation Credits

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - NZ Imputation Credits 4

Overseas Dividend Income (Exempt from FIF Rules) - NZ Imputation Credits 11

Overseas Dividend Income (Subject to FIF Rules) - NZ Imputation Credits 15

Listed PIE Distributions - NZ Imputation Credits 29

Unlisted PIE Income (PIR 0% for Period) - Allocated Imputation Credits 27

Total dividend imputation credits

14 $ , , .

Dividends and associated credits do not need to be included in your IR4 Income Tax return if you were liable to pay Foreign

Dividend Withholding Payment tax during the year on the dividends.

IR4 Box 14A - Total dividend RWT and FDP credits

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Foreign Withholding Payment Credits 5

New Zealand Dividend Income - NZ Resident Withholding Tax 6

Overseas Dividend Income (Exempt from FIF Rules) - 12

Foreign Withholding Payment Credits

Overseas Dividend Income (Exempt from FIF Rules) - 14

NZ Resident Witholding Tax

Overseas Dividend Income (Subject to FIF Rules) - 16

Foreign Withholding Payment Credits

Overseas Dividend Income (Subject to FIF Rules) - 18

NZ Resident Withholding Tax

Listed PIE Distributions - Foreign Withholding Payment Credits 30

Unlisted PIE Income (PIR 0% for Period) - Allocated DWP Credits 25

Unlisted PIE Income (PIR 0% for Period) - Allocated RWT Credits 26

Total dividend RWT and FDP credits

14A $ , , .

Dividends and associated credits do not need to be included in your IR4 Income Tax return if you were liable to pay Foreign

Dividend Withholding Payment tax during the year on the dividends.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

13IR4 Box 14B - Total Gross Dividends

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Gross Income 3

Listed PIE Distributions - Gross Income 28

Total gross dividends

14B $ , , .

IR4 Box 18A - Total Overseas Tax Paid

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Foreign Withholding Tax 8

Overseas Dividend Income (Exempt from FIF Rules) - Foreign Withholding Tax 13

Overseas Dividend Income (Subject to FIF Rules) - Foreign Withholding Tax 17

Unlisted PIE Income (PIR 0% for Period) - Allocated Foreign Tax Credits 24

Total overseas tax paid

18A $ , , .

Dividends and associated credits do not need to be included in your IR4 Income Tax return if you were liable to pay Foreign Dividend

Withholding Payment tax during the year on the dividends.

IR4 Box 18B - Total Overseas Income

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Gross Income 7

Overseas Dividend Income (Exempt from FIF Rules) - Gross Income 10

Comparative Value (The Compulsory Method) - Total Comparative Value 33

Total Fair Dividend Rate - FIF Income 31

Unlisted PIE Income (PIR 0% for Period) - PIE Taxable Investment Income 23

Total overseas income—if a loss put a minus sign in the last box

18B $ , , .

IR4 Box 21B - Total Other Income

FNZ Tax Report Item NZ Tax Return

Determine which of your management fee rebates are taxable:

Fund Rebate Income - Untaxed Fund Rebate Income 19

Determine which of your fees and charges are deductible (including the GST portion):

Fees and Charges - Total Fees and Charges 20

Total other income—if a loss put a minus sign in the last box

21B $ , , .

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

14 | 2019 FNZ TAX USER GUIDE4.1.3 IR6 – Trust Tax Return

Please ensure that you have read the entire contents of section 3 (General information regarding your investments)

before continuing.

IR6 Box 9A - Total Interest RWT

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - Allowable NZ Resident Withholding Tax 2

Overseas Interest Income - Allowable NZ Resident Withholding Tax 9

Total RWT

9A $ , , .

IR6 Box 9B - Total Gross Interest

FNZ Tax Report Item NZ Tax Return

New Zealand Interest Income - Gross Income 1

Total gross interest—if a loss put a minus sign in the last box

9B $ , , .

IR6 Box 10 - Total Dividend Imputation Credits

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - NZ Imputation Credits 4

Overseas Dividend Income (Exempt from FIF Rules) - NZ Imputation Credits 11

Overseas Dividend Income (Subject to FIF Rules) - NZ Imputation Credits 15

Do you elect to treat fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - NZ Imputation Credits If yes, 29

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allocated Imputation Credits If yes, 27

Total dividend imputation credits

10 $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR6 Box 10A - Total Dividend RWT and Payment for Foreign Dividends

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Foreign Withholding Payment Credits 5

New Zealand Dividend Income - NZ Resident Withholding Tax 6

Overseas Dividend Income (Exempt from FIF Rules) - 12

Foreign Withholding Payment Credits

Overseas Dividend Income (Exempt from FIF Rules) - 14

NZ Resident Witholding Tax

Overseas Dividend Income (Subject to FIF Rules) - 16

Foreign Withholding Payment Credits

Overseas Dividend Income (Subject to FIF Rules) - 18

NZ Resident Withholding Tax

Do you elect to treat fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - Foreign Withholding Payment Credits If yes, 30

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allocated DWP Credits If yes, 25

Unlisted PIE Income (PIR 0% for Period) - Allocated RWT Credits If yes, 26

Total dividend RWT and payment for foreign dividends

10A $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

15IR6 Box 10B - Total Gross Dividends

FNZ Tax Report Item NZ Tax Return

New Zealand Dividend Income - Gross Income 3

Do you elect to treat the fully imputed portion of listed PIE distributions as taxable?

Listed PIE Distributions - Gross Income If yes, 28

Total gross dividends

10B $ , , .

IR6 Box 13A - Total Overseas Tax Paid

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Allowable Foreign Withholding Tax 8

Overseas Dividend Income (Exempt from FIF Rules) - Allowable Foreign Withholding Tax 13

Overseas Dividend Income (Subject to FIF Rules) - Allowable Foreign Withholding Tax 17

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - Allowable Allocated Foreign Tax Credits If yes, 24

Total overseas tax paid

13A $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR6 Box 13B - Total Overseas Income

FNZ Tax Report Item NZ Tax Return

Overseas Interest Income - Gross Income 7

Overseas Dividend Income (Exempt from FIF Rules) - Gross Income 10

Comparative Value (The Compulsory Method) - Total Comparative Value 33

Foreign Investment Fund (FIF) Income

Choose the lower of the Total Fair Dividend Rate 31 or 32

and the Total Comparative Value (the Optional Method)

Have you had PIE income taxed at 0% during the year?

Unlisted PIE Income (PIR 0% for Period) - PIE Taxable Investment Income If yes, 23

Total overseas income—if a loss, put a minus sign in the last box

13B $ , , .

Please ensure you were eligible for each PIR used during the year as this may affect your calculation for this section.

IR6 Box 16B - Total Other Income

FNZ Tax Report Item NZ Tax Return

Determine which of your management fee rebates are taxable:

Fund Rebate Income - Untaxed Fund Rebate Income 19

Total other income—if a loss, put a minus sign in the last box

16B $ , , .

IR6 Box 19 - Total Expenses Claimed

FNZ Tax Report Item NZ Tax Return

Determine which of your fees and charges are deductible including the GST portion:

Fees and Charges - Total Fees and Charges 20

Total expenses claimed

19 $ , , .

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

16 | 2019 FNZ TAX USER GUIDE5. RESIDENT WITHHOLDING TAX DEDUCTED

BY FNZ

Broadly speaking, as a nominee for tax purposes, FNZ 5.2 Dividend income

is required to deduct RWT on dividend and interest

5.2.1 New Zealand dividend income

income paid to New Zealand resident investors on the

Wrap Platform (Wrap). Prima facie, all New Zealand sourced dividend income

is subject to RWT at 33% (less credit for any eligible tax

5.1 Interest income credits which may be attached). However, no RWT is

required to be deducted by FNZ if you had a valid RWT

FNZ has deducted RWT on interest income derived certificate of exemption and this was provided to FNZ.

by investors based on their elected RWT rate in Wrap

at the time of the distribution. If you did not provide Where applicable, FNZ has offset eligible tax credits

FNZ or your adviser with a valid IRD number, FNZ against your tax liability to reduce the RWT withheld.

has withheld RWT on interest income at the highest

5.2.2 Overseas dividend income

RWT rate.

Prima facie, FNZ is required to deduct RWT at 33%

If you provided a valid IRD number and did not provide on dividend income paid to investors from an overseas

FNZ or your adviser with a RWT rate election, RWT has resident entity. However, no RWT is required to be

been withheld on interest at the applicable default tax deducted if the overseas entity is a FIF and the investor

rate depending on your entity type. has, at the time the distribution is paid, elected to be

Where applicable, FNZ has offset eligible tax credits subject to the FIF rules. Please note that the FIF rules

against any tax liability to reduce the RWT required to are discussed in further detail in section 9 and 10

be withheld by FNZ. No RWT is deducted on interest of this guide.

income if you elected a 0% RWT rate and provided If you have not elected to be subject to the FIF rules,

a valid RWT certificate of exemption to FNZ. RWT is generally deducted from all overseas dividend

The amount of RWT deducted by FNZ is determined income derived by you unless you provided FNZ with

based on the information available at the time of the a valid RWT certificate of exemption.

distribution. If an incorrect amount of RWT has been Where the investor changes their election to become

withheld, you should contact your adviser immediately. subject to the FIF rules during the tax year, all

As RWT is a refundable tax credit, any overpayment distributions received from FIF investments from that

can generally be refunded by filing a tax return, or by point forward will no longer have RWT deducted at

filing an IR 454 (for those entities that are not required 33%. Investors may wish to claim a credit in their

to file a tax return). Please note that a company’s tax return for any RWT that has been deducted on

income tax refund is generally limited to the balance distributions from FIF investments at times when the

in its imputation credit account (“ICA”) at the end of investor was not subject to the FIF rules.

the income year.

If you are unsure how this affects you, we recommend

that you seek advice from your tax adviser.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

17Where the investor changes their election in Wrap to The amount of RWT deducted by FNZ is determined

no longer be subject to the FIF rules during the income based on the information available at the time of the

year, all distributions received from FIF investments distribution. If you believe an incorrect amount of RWT

from that point forward will be subject to RWT at 33%. has been withheld, you should contact your adviser

Please note that these investors may be required to file immediately. As RWT is generally a refundable tax

a tax return to ensure tax is paid on distributions from credit, any overpayment can be refunded by filing a

FIF investments (that were not subject to RWT) while tax return or by filing an IR 454 (for those entities that

the investor was subject to the FIF rules. are not required to file a tax return). Please note that a

company’s income tax refund is generally limited to the

Where applicable, FNZ has offset foreign tax paid to balance in its ICA at the end of the income year.

reduce the RWT withheld. No RWT shall be deducted

on dividend income if the investor has elected a 0% If you are unsure how this affects you, we recommend

RWT rate and a valid RWT certificate of exemption has that you seek advice from your tax adviser.

been provided to FNZ.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

18 | 2019 FNZ TAX USER GUIDE6. FIXED INTEREST INVESTMENTS

AND THE FINANCIAL ARRANGEMENTS RULES

Generally, you must calculate income and expenditure 6.1 Cash Basis Person and method

from your financial arrangements using the “financial

The cash basis rules exist to provide compliance

arrangement rules” (commonly known as the accrual

concessions to persons who hold financial arrangements

rules). Broadly, a financial arrangement is a debt or of a less than substantive value. The cash basis rules

debt like instrument (for example, bonds, and fixed also allow non individuals such as companies and

interest investments). If you are a “cash basis person”, trusts to apply the cash basis rules where certain

income is calculated on an interest paid/received basis. criteria are met. Investors are required to determine

If you are not a cash basis person, income must be their eligibility to use the cash basis method every

calculated each year using an accrual rather than cash income year.

method. Please note that all interest income is reported

The following flowchart summarises an investor’s ability

in the tax report on a cash basis (that is, reported when

to be a cash basis person. The section following the

the payment is received by FNZ). Depending on your

flowchart outlines some specific rules to use when

individual circumstances, the cash basis method may applying the flowchart.

not be appropriate for tax purposes.

6.1.1 Beneficiary or trustee of a trust

In addition to reporting your interest receipts in your

If you are a beneficiary or trustee of a trust, you may

tax return, you may be required to make adjustments

be required to either include or exclude the value of

for any accrued interest and/or discounts or premiums

the financial arrangements held by the trust when

included in the purchase price of any fixed interest

determining if you, in your personal capacity, are

securities that you have acquired. Similarly, adjustments a cash basis person. Similarly, this treatment may

may be required for any accrued interest and premiums be required for financial arrangement income and

or discounts that are included in the sale proceeds expenditure derived by the trust. These requirements

where securities are sold before maturity date. are considered in further detail below.

Information contained in the Direct Bond Trade Report

6.1.1.1 Trustee of an estate

within your tax report will assist you in determining

these adjustments. If you are the trustee of an estate, you may be a cash

basis person if at the time of the deceased’s death

You should note that depending on your circumstances, the deceased person was a cash basis person and

any losses or credit impairments resulting from deposits the cash basis thresholds (outlined in the flowchart

made with finance companies may be a capital loss above) are met. If these criteria are met, you may be

and, as such, may not be deductible for tax purposes. treated as a cash basis person for the income year of

However, an investor’s business that includes holding the deceased’s death and the four subsequent income

or dealing in financial arrangements of the type giving years provided the cash basis test is met each income

rise to the loss may be able to claim a tax deduction year.

for the loss provided certain requirements are met. You If you fail to meet the cash basis test, you must apply

are encouraged to seek professional tax advice before an accrual method, and are not permitted to use the

claiming a tax deduction for such losses. cash basis method in any subsequent income years.

This is irrespective of whether or not the deceased’s

Accrual tax reporting is a complex area of law. We

estate meets the cash basis test in future income years.

have included this information to help assist you to

determine how the accrual rules apply to you.

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

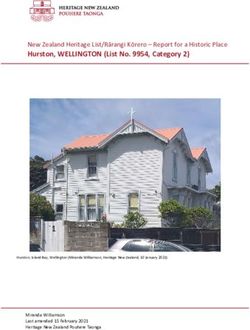

19Is your financial arrangement income and expenditure

$100,000 or less?* NO

YES

Is the value of all your financial arrangements

YES $1,000,000 or less?*

NO

Is your accrual financial arrangement income greater

than your cash basis financial arrangement income

by greater than $40,000?* (See Deferral threshold YES

section below).

NO

Has the Commissioner of Inland Revenue excluded The investor must use an

you from applying the cash basis method? accrual method.

YES

NO

The investor may apply the cash basis method to their

financial arrangements. Please note that a cash basis

person may elect to apply an accrual method.

*If you are a beneficiary or a trustee of a trust, please read the Beneficiary or trustee sections below.

6.1.1.2 Beneficiary of a bare trust • the value of the arrangement, if it produces trustee

income or beneficiary income under the trust rules;

If you are a beneficiary of a bare trust, you must

calculate your share of the trust’s financial arrangements • the income under the arrangement that is trustee

and the income and expenditure from the trust’s income or beneficiary income under the trust rules;

financial arrangements. In effect, you (as beneficiary)

• the value of the financial arrangement, if

are treated as being a party to the arrangement.

expenditure is incurred under it; and

The result of these calculations is included when • the expenditure incurred under the arrangement.

determining if you, in your personal capacity, meet

the cash basis test. These exclusions ensure that you (as an investor who

is a trustee of a trust) do not count the trust’s financial

6.1.1.3 Trustee of a trust (other than a bare arrangements when determining if you are, in your

trust or estate) personal capacity, a cash basis person.

If you are a trustee of a trust (other than a bare trust

or estate), the following trust amounts are excluded

when applying the tests to your personal position:

The information contained in the FNZ Tax User Guide is of a general nature only. The User Guide is based on tax legislation and the interpretation of that legislation at the time the guide is prepared. Both tax legislation and its interpretation are

subject to change over time. Tax legislation and its application to your specific circumstances can be complex. As such, you are strongly encouraged to seek professional tax advice where required. Whilst every effort has been made to ensure

the accuracy of this User Guide and your tax reports, to the maximum extent permitted by law, no liability is accepted by FNZ for any errors or omissions. Property of FNZ, not for onward distribution.

20 | 2019 FNZ TAX USER GUIDEYou can also read