Spectr um Investor - Spectrum Investment Advisors

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

As of 9/30/2020

Q 4 20 20 Spectr um Investor ®

Quar ter ly Newsletter New slet t er Su m m ar y:

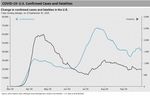

U.S. COVID-19 cases cont inue t o rise

Jon at h an M ar sh all Jam es M ar sh all Growth stocks boosted by tech

Chief Investment Officer Chairman/Founder Value stocks lifted by reopening

US stocks tur ned in a second consecutive quar ter of dr am atic gains, S&P 500 earnings recovery est imat ed by year-end 2021 (Factset)

continuing a histor ic stock m ar ket r ecover y that few pr edicted in the Interest rates lower for longer

depths of the M ar ch 2020 dow ntur n. Despite a str etch of volatility that US Election on the horizon

dam pened m om entum in Septem ber , the S&P 500 and Dow Jones Visit our website at www.spectruminvestor.com

Industr ial Aver age gained 8.9% and 8.2% r espectively over the past thr ee See important disclosures on Page 6

m onths, w hich capped the best tw o quar ter per for m ance since 2009. Our ADV Part 2A-2B & privacy notice can be found on our website.

Both indexes ar e up m or e than 28% since the end of M ar ch 2020 (WSJ,

10/1/20, r etur n includes dividends).

vaccinations available on a lim ited basis as ear ly as Decem ber , w ith m or e

M ar k et s. The char t below show s the S&P 500 is slightly above w her e it w idespr ead availability thr oughout 2021.

star ted this year , up 5.57% for 2020 as of 9/30. In com par ison, the

3. M or e st i m u l u s. It is w idely believed that w e need, and w ill get, m or e

tech-heavy Nasdaq Com posite has gained 25% to 9/30, car r ied pr im ar ily

gover nm ent stim ulus in the neighbor hood of $2 tr illion. The question is

by five lar ge cap tech stocks.

w hen and can it be effectively tar geted to ar eas of need.

I n vest or opt i m i sm . In spite of ongoing challenges w ith COVID-19 and

4. Upsi de su r pr i ses. M any aspects of the r ecover y have bounced back

uncer tainty over the upcom ing U.S. election, investor s gr ew m or e

faster than expected. In m ar kets for exam ple, although S&P 500 cor por ate

optim istic about the stock m ar ket over the sum m er. W hy?

ear nings w er e negative in the second quar ter , 84% of com panies beat

1. Th e Feder al Reser ve. The Fed w as able to stabilize m ar kets in M ar ch, expectations. In the last five m onths, the U.S. unem ploym ent r ate

pr oviding confidence they could do the sam e in the event of a potential dr opped fr om 14.2% in Apr il to 7.9% in Septem ber. It took 35 m onths to

second shock . They have also been clear that inter est r ates w ill r em ain go fr om 10% to 7.9% unem ploym ent follow ing the financial cr isis.

low er for longer. The Fed is now w illing to toler ate per iods of inflation

Accor ding to M or ningstar 's Chief U.S. M ar ket Str ategist Dave Seker a,

above its 2% tar get to com pensate for per iods like the cur r ent one, w hen

m ar kets w ill need the follow ing to continue upw ar d m om entum : an

inflation is r unning below its goal of 2%.

uncontested election, stim ulus appr oval, and a successful vaccination

2. I n n ovat i on ver su s COVI D-19. Significant gains w er e m ade in testing, r ollout in the fir st half of 2021. At cur r ent valuations, doubts or

tr eatm ent, and pr ogr ess tow ar d vaccination over the last six m onths. disappointm ents in these key ar eas w ould be headw inds and a set up for

Accor ding to Scott Gottlieb, for m er FDA com m issioner , w e could see potential cor r ections.Spectr um Investor ® Quar ter ly Newsletter

Qu ar t er ly Econ om ic Updat e Con t in u ed

Un even r ecover y: All ar eas of the m ar kets have im pr oved since billion left over , w hich m ay be utilized in the stim ulus package. Voter

M ar ch, but at m uch differ ent speeds. Social distancing continues to be tur nout in 2016 w as only 57%, w hich m eans an incr ease in voter tur nout

the pr im ar y factor. M or e tim e at hom e has cr eated a boom for tech could be pivotal. Eighty per cent of voter s say the economy is the num ber

fir m s that help keep us connected and enter tained. On the other side, one factor in deter m ining how they w ill vote.

the lim ited r eopening of the economy has m eant a lim ited r ecover y for

Candidate Joe Biden's tax plan w ould r oll back som e of Pr esident Tr um p's

sector s like tr avel and ener gy. M ost tech fir m s can be found in gr ow th

cor por ate tax cuts fr om 21% to 28%, w hich in theor y m ight tr im the

(r ed) w hile m ost tr avel and ener gy stocks fall in the value categor y

value of stocks 5% or so. The tax incr eases ar e com ing at a tim e w hen

(pur ple).

m any fir m s have car r y-for w ar d losses that could r un for year s, w hich

The char t on the could lim it the im pact of incr eased taxes (Fidelity Funds M onitor, 9/20).

r ight show s the For those ear ning m or e than $400,000, candidate Biden plans to r estor e

im pact this has the top per sonal tax br acket fr om 37% to 39.6%. Ther e is also a possible

had on stock incr ease in capital gains tax fr om 20% to 39.6%, w hich could cr eate som e

per for m ance w ith pr essur e on the m ar kets at year -end (Forecasts & Strategies, M ar k

gr ow th leading the Skousen, 9/20). For m or e on the election see page 5.

w ay and value not

Dr . Dav i d Kel l y, Chief Global M ar ket Str ategist at JPM or gan, said not to

quite back into

take too m uch of a bet dur ing the pr esidential election. The m ost

positive ter r itor y.

im por tant im pact for the election is to get a decisive victor y that can be

In August, Apple settled w ithin 48 hour s vs. a dr aw n out outcom e causing uncer tainty.

becam e the fir st Should w e get a sw eep either w ay, it w ill likely r esult in a m ajor stim ulus

publicly tr aded package w hich, long-ter m , could be inflationar y. Regar ding a tax

com pany to r each incr ease, Dr. Kelly believes any tax incr ease w ould not happen in 2021,

a m ar ket cap of $2 but r ather in 2022. Our national debt has incr eased by $4.2 tr illion, so

tr illion. It is the lar gest publicly tr aded com pany in the w or ld, and eventually taxes w ill need to incr ease to pay for it, but only w hen our

w or th m or e than all 2000 com panies com bined fr om the Russell 2000 economy r ecover s. Incr easing taxes too soon or too m uch can be

sm all cap index. Together , Apple, M icr osoft, Am azon, Facebook, and detr im ental to our economy.

Google m ake up m or e than 22% of the m ar ket cap w eighted S&P 500

Dr. Kelly sum m ar izes the COVID-19 economy as a slum p, a bounce, a

index. This has helped boost the r etur n of the S&P 500 (gr een) in spite

cr aw l and a sur ge, once w e have a vaccine. He stated that citizens w ho

of the equally w eighted aver age r etur n of the 500 com panies actually

becom e infected w ith cor onavir us fr om ages 70-79 have a 5% m or tality

being dow n -4.75%.

r ate if they ar e m ale and 2% if they ar e fem ale; the pr im ar y r eason

In another sign of the tim es, Exxon has been r em oved fr om the 30-stock Pr esident Tr um p w as taken to the Walter Reed M edical Center after

Dow Jones Industr ial Aver age and r eplaced by Salesfor ce, a cloud-based contr acting COVID-19. Daily new cases of COVID-19 ar e r ising once again

softw ar e com pany. Exxon had been a m em ber of the Dow since 1928. in the U.S., par tially due to r ising case counts in the M idw est. How ever ,

the char t below show s w e r em ain below the peak levels in late July.

St ay di ver si f i ed. If w e str uggle w ith COVID-19 for a pr olonged per iod,

w e m ay see gr ow th continue to lead. How ever , at cur r ent

valuations, a solid r eopening w ith the help of vaccinations w ould

likely see value stocks (ener gy, tr avel, financials and m ater ials)

begin to outper for m . Tech valuations ar e high at the m om ent

w ith a for w ar d pr ice to ear nings r atio of 34, but they ar e still

below the bubble levels of the 1990s (FW D P/E r atio: 53) w ith m uch

better balance sheets and cash flow gener ation. Technology has

r epr esented the m ost consistent ar ea of r elative str ength for the

S&P 500, not just year -to-date, but for the past decade (Jeff

Buchbinder , Equity Str ategist & Por tfolio M anager at LPL

Financial, 9/28/20).

Nat i on al debt . The elephant in the r oom . The Congr essional

Budget Office (CBO) thinks the feder al debt w ill soar fr om 79% of

Gr oss Dom estic Pr oduct (GDP) last year to 189% of GDP in 2049,

com par ed w ith its for ecast of 144% a year ago, due to

pandem ic-r elated bor r ow ing and Congr ess's incr ease in

descr etionar y spending. Inter est r ates ar e pr ojected to stay low ,

allow ing gover nm ent debt to continue to gr ow , w hich w ill likely

r esult in w eaker pr oductivity and w eaker US investm ent. The

Eur opean Centr al Bank cut its shor t-ter m inter est r ate to below zer o in In sum m ar y, expect volatility ahead, w ith the election ar ound the cor ner.

2014, w ith the Bank of Japan doing the sam e thing in 2016, and they ar e We suggest the aver age investor stay the cour se, pr im ar ily due to the Fed

still str uggling to get inflation back to 2%. Inflation that is chr onically outlook of low er for longer inter est r ates. As they say in the investm ent

too low r em ains a per plexing challenge to centr al banks, w hich have an business, "Don't fight the Fed." For m or e on the m ar kets, visit our

easier tim e fighting inflation w hen it's too high. w ebsite at w w w.spect r u m i n vest or .com and click on Resour ces to access

w eekly and m onthly econom ic updates fr om m ar ket str ategists.

Updat es on t h e El ect i on - Wash i n gt on t o Wal l St r eet . It is unlikely

stim ulus w ill be passed befor e the election. PPP funding has $130Spectr um Investor ® Quar ter ly Newsletter

S& P 500 I n dex at I n f l ect i on Poi n t s: The char t below illustr ates the per for m ance histor y of the S&P 500 fr om 1996 to 9/30/20. As of 3/23/20,

the S&P had dr opped 30%, but r ecover ed, dow n 8% as of 6/30/20. The S&P finished up 5.6% as of 9/30/20. As of 2/19/20, the 10-year Tr easur y

w as 1.6% and is now dow n to 0.7% as of 9/30/20, w hich com par es to the dividend yield of the S&P 500 of 1.8%. The cur r ent yield on stocks is

higher than the yield on bonds, w hich favor s stocks (see char t inset).

An n u al Ret u r n s an d I n t r a-Year Decl i n es: The char t below illustr ates the year -end r etur n of the S&P 500 Index vs. the intr a-year declines for

the past 40 year s. As of Septem ber 30, 2020, the S&P w as up 4% as investor s battle betw een the opposing im pacts of the cor onavir us pandem ic

and unpr ecedented stim ulus. Accor ding to JPM , the stock m ar ket histor ically finished up dur ing 75% of calendar year s. This char t can help a

long-ter m investor under stand the volatility of the m ar ket, and w hy, in m ost cases, w e believe the best thing to do is stay the cour se.Spectr um Investor ® Quar ter ly Newsletter

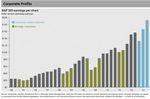

Cor por at e Pr of i t s: In addition to inter est r ates and the Feder al Reser ve, a key indicator of the m ar ket is ear nings. Accor ding to FactSet

(10/2/20), the ear nings on the S&P 500 as of 2020 ar e pr ojected to decline 18%. How ever , as the light blue bar s illustr ate, the ear nings

pr ojection for the S&P 500 for 2021 is up 25.7%, w hich favor s stocks.

Gover n m en t Con t r ol , t h e Econ om y an d t h e St ock M ar k et : Th e aver age r et u r n of t h e S& P 500 since 1947 is 12.9%, w ith a Republican pr esident

and a Republic-contr olled Congr ess (11% of the tim e). W ith a Dem ocr atic pr esident and a Dem ocr atic-contr olled Congr ess, (27% of the tim e) the

aver age r etur n of the S&P 500 since 1947 is 9.8%. A divided gover nm ent aver aged a r etur n of 7.8% (62% of the tim e). GDP gr ow t h since 1947

aver aged 2.8% (11% of the tim e), w ith a Republican pr esident and a Republican-contr olled Congr ess. GDP gr ow th aver aged 4.0% (27% of the tim e)

w ith a Dem ocr atic pr esident and Dem ocr atic-contr olled Congr ess. In a divided gover nm ent, the GDP gr ow th aver aged 2.8% (62% of the tim e).Spectr um Investor ® Quar ter ly Newsletter

In Ot h er Wor ds that ther e w ill be volatility no m atter w ho is elected and being

pr epar ed for it, is half the battle. W hether it is an election year or not,

Presidential Elections and the Markets you should alw ays have a long-ter m investm ent str ategy w hen it com es

to planning for your r etir em ent. Stick to the things you can contr ol,

An gie Fr an zon e | Newsletter Editor such as how diver sified you ar e. W hat dr ives your investm ent

decisions should be per sonal consider ations like how long you have to

As I sit dow n to w r ite this ar ticle I am joined by my tw o 9-year -old invest befor e you r etir e, your investm ent goals and your r isk toler ance,

daughter s, cur r ently attending vir tual school and continually r egar dless of w ho the next pr esident w ill be.

inter r upting m e to r equest a snack, give m e a play by play of ever y

If you take anything aw ay fr om this ar ticle, let it be this:

backgr ound conver sation happening on the Zoom call and to let m e

know that som eone keeps putting their m outh over the cam er a and it's - Expect volatility and pr epar e for it w ith a plan

distr acting. Gee, w hat's it like to be distr acted... Is ther e an in-per son - Don't let election pr edictions dr ive your investm ent decisions

m ute button I can pr ess? - Stick to your long-ter m investm ent str ategy and stay invested

The year 2020 has been challenging to say the least and em otions ar e If you ar e concer ned about your investm ents, be pr oactive and talk to

r unning high, thr ow a pr esidential election in the m ix and it can feel an advisor at Spectr um w ho can help. M aking a plan and diver sifying

alm ost too over w helm ing to handle. The key is not to let a pandem ic or your por tfolio can help keep you fr om r eacting to ever y new headline

a loom ing election affect your investm ent decisions. You ar e investing that pops up on your scr een. Just think, the less tim e spent on

for the long-ter m , so stay focused on your financial goals, investm ent w or r ying about your r etir em ent plan, the m or e tim e you have to lear n

tim e-fr am e and r isk toler ance. how to do "new m ath" instead of star ing blankly at your childr en w hen

they ask for help. Ser iously though, M ath star ts in 10 m inutes and I've

Fam ed investor Benjam in Gr aham has been cr edited w ith saying, "In the

got to get back to class.

shor t-r un, the m ar ket is a voting m achine. In the long-r un, it's a

w eighing m achine." W hat this m eans is that in the shor t-ter m , m ar kets Stay safe and be w ell.

r eact to new s, such as the election of a new pr esident, but in the

long-ter m they follow the fundam entals of investing. M ar kets don't like

uncer tainty and it doesn't get m uch m or e uncer tain than w ho the next

pr esident w ill be, but the volatility caused by this uncer tainty is often Sp ect r u m I n v est o r ® U p d at e

shor t-lived.

Accor ding to Har tfor d Funds' 2020 Election Sur vey, 45% of investor s

M or n in gst ar Cat egor y Aver ages 3r d Qt r 1 Year 3 Year

said they plan to m ake changes to their investm ents because of the

election. If w e look back in histor y, how ever , m aking changes solely Intermediate-Core Bond 0.94% 6.65% 4.88%

based on an election m ay not be in your best inter est. Since 1950 ther e Allocation 50%-70% Equity 4.85% 6.26% 5.70%

have been 17 pr esidential elections. As the char t below illustr ates, 10 of Large Cap Value 4.88% -4.41% 2.61%

them did not see an im m ediate negative stock m ar ket r esponse Large Cap Blend 8.06% 10.70% 9.54%

follow ing the election. In five cases, the S&P 500 declined by an aver age Large Cap Growth 11.54% 32.21% 18.22%

of 5% w ithin 17 days follow ing the election, w ith four of them

Mid Cap Value 4.34% -10.31% -1.16%

r ecover ing the loss w ithin a m onth and the other r ecover ing w ithin six

m onths. The r em aining tw o elections (2000 and 2008) saw m ajor Mid Cap Blend 6.32% -0.51% 3.40%

declines unr elated to the pr esidential election; the r eason for those Mid Cap Growth 10.10% 24.22% 14.60%

declines being the tech bubble bur st of the ear ly 2000s and the financial Small Cap Value 2.99% -14.21% -5.49%

cr isis of 2008-2009. Small Cap Blend 4.17% -6.57% -0.86%

Small Cap Growth 8.21% 18.72% 11.11%

Foreign Large Cap Blend 5.77% 2.09% 0.41%

Real Estate 2.20% 14.22% 1.13%

Natural Resources 8.85% 1.42% -1.73%

Sou r ce: M or n in gst ar , 3 yr r et u r n is an n u alized. M or n in gst ar classif ies cat egor ies

by u n der lyin g h oldin gs an d t h en calcu lat es t h e aver age per f or m an ce of t h e

cat egor y. Past per f or m an ce is n ot an in dicat ion of f u t u r e r esu lt s. Ret u r n s in

Blu e = Best , Ret u r n s in Red = Wor st . Please see Ben ch m ar k Disclosu r es on pg. 6.

DOW: 27,781 10 Yr T-Not e: 0.68%

NASDAQ: 11,092 In f lat ion Rat e: 1.4% (9/ 20)

S&P 500: 3,363 Un em ploym en t Rat e: 7.9%

Data as of 09/30/20 unless otherwise noted. The Dow Jones Industrial Average is comprised of

30 stocks that are major factors in their industries and widely held by individuals and

institutional investors. The S&P 500 Index is a capitalization weighted index of 500 stocks

designed to measure performance of the broad domestic economy through changes in the

aggregate market value of 500 stocks representing all major industries. The NASDAQ Composite

Index measures all NASDAQ domestic and non-U.S. based common stocks listed on The NASDAQ

W hile past per for m ance is not an indication of futur e r esults, Stock Market. Barrel of Oil: West Texas Intermediate. Inflation Rate: CPI. The market value, the

last sale price multiplied by total shares outstanding, is calculated throughout the trading day,

h i st or i cal l y speak i n g, r egar dl ess of w h et h er a Repu bl i can or and is related to the total value of the Index. Indices cannot be invested into directly.

Dem ocr at w on t h e el ect i on , US st ock s h ave t r en ded u p. As Dr. David To determine which investment(s) may be appropriate for you, consult your financial advisor prior to

investing. All performance referenced is historical and is no guarantee of future results. All indices are

Kelly, Chief Global Str ategist at JPM or gan stated, "Please don't let how unmanaged and cannot be invested into directly.

you feel about politics dictate how you feel about investing." Know ingSpectr um Investor ® Quar ter ly Newsletter

Bu dget

Spect r u m Wealt h M an agem en t Did you cr eate a budget for 2020? If so, how m uch has that changed?

Year End Checklist People ar e spending less on tr avel and enter tainm ent, but m ay also have

r educed incom e. In som e cases, they?ve substituted line item s on their

® budget, such as r eplacing a vacation w ith a hom e r enovation. Wor king

Br ian Wh it e, CFP | Wealth Manager fr om hom e w ipes out any com m uting costs, but Inter net access needs to

Rem em ber M ad Libs? You know , that gam e w her e you give a r andom be upgr aded. W her e do w e go fr om her e? To begin, don?t thr ow out the

ver b, noun, adver b or adjective, then inser t it into a sentence? Let?s tr y idea of m aintaining a budget. A budget is a basic tenet of financial

it: The year 2020 is going to go dow n in histor y as one of the m ost planning, especially for those in r etir em ent. By having a flexible budget

[inser t adjective] year s in histor y. in place, you?r e m uch m or e likely to be able to r each your financial goals.

Individuals acr oss the globe ar e r eady to m ove on to 2021, and w ith One of the m ost im por tant par ts of a budget belongs to health car e costs.

good r eason. Befor e w e star t thinking about those New Year 's This tim e of year can be im por tant to individuals w ho need to update

r esolutions and tr avel plans, consider a few ar eas of your per sonal their em ployee benefits options. Retir ed individuals ar e r enew ing their

finances that need to be r eview ed befor e year -end. M edicar e Supplem ent or Advantage plans. M any of us w ill be m aking

choices about health insur ance cover age as w ell as the differ ent options

Requ i r ed M i n i m u m Di st r i bu t i on s for putting aside m oney for health car e costs.

To begin, w e?r e going to give you som ething you DON?T need to do. The Accor ding to a Pr iceWater houseCooper s Health Resear ch Institute (HRI)

CARES act, w hich w as signed into law on M ar ch 27, suspended sur vey, 5% of Am er ican consum er s used a vir tual health visit for the fir st

Requir ed M inim um Distr ibutions (RM Ds) for IRAs and r etir em ent plans tim e this year. Of those user s, 88% said they w ould use it for futur e

for 2020. Pr ior to the CARES act, individuals had to annually take out a visits. This ?Telehealth? is a low er -cost alter native for health car e and is

cer tain per centage of their IRA accounts after tur ning 72. For the 2020 saving individuals m oney w hile pr oviding a safer alter native to

year , this r equir em ent has been suspended. Also, any inher ited or tr aditional office visits. A r eduction in health car e costs for 2020 could

beneficiar y r etir em ent accounts fall under the sam e law s. As of the m ean that ther e ar e additional funds in a Flexible Spending Account

publication date of this new sletter , ther e?s no indication that this (FSA) that need to be spent or they w ill be lost. If you have a Health

tem por ar y suspension w ill continue into 2021. Savings Account (HSA), you?r e not r equir ed to spend the balance of the

account in a calendar year. Be sur e to check your spending levels to

This is good new s for those individuals w ho do not need the additional

m ake sur e you?r e not in danger of losing funds OR have been able to

taxable incom e for this year. For anyone w ho did their tax planning

m axim ize your savings.

based on the distr ibution fr om their IRA, they should consider a Roth

IRA conver sion for that am ount. Conver ting investm ents to a Roth IRA Benchma r k Disclosur es: M or ningsta r Categor y Aver a ges: M orningstar classifies

still gener ates taxable incom e, but it allow s those investm ents to gr ow mutual funds into peer groups based on their holdings. The Category Average

calculates the average return of mutual funds that fall within the category during the

tax-fr ee. Those individuals w ho ar e hoping to pass on their IRA given time period. The following indexes and their definitions provide an approximate

accounts to futur e gener ations should look to a Roth IRA as their description of the type of investments held by mutual funds in each respective

account of choice. M orningstar Category. One cannot invest directly in an index or category average.

I nter mediate-Ter m Bonds: Ba r clays US Agg Bond I ndex?M easures the

performance of investment grade, US dollar-denominated, fixed-rate taxable bond

Tax Pl an n i n g/Ch ar i t abl e Gi v i n g

market, including Treasuries, government-related and corporate securities, M BS, ABS

and CM BS. Allocation 50%-70% Equity?These funds invest in both stocks and bonds

The next ar ea w e should be thinking about is taxes. The stock m ar ket and maintain a relatively higher position in stocks. These funds typically have

r oller coaster w e?ve been on has given m any m utual fund m anager s 50%-70% of assets in equities and the remainder in fixed income and cash. La r ge Ca p

oppor tunities to har vest losses. Ther e m ay also be gains, depending on Va lue: S&P 500 Va lue I ndex?M easures the performance of value stocks of the S&P

500 index by dividing into growth and value segments by using three factors: sales

the ar ea of the m ar ket the investm ent w as in. Inter est r ates ar e at growth, the ratio of earnings change to price and momentum. La r ge Ca p Blend: S&P

all-tim e low s, so fixed incom e investm ents m ay not be paying as m uch 500 I ndex?A market capitalization-weighted index composed of the 500 most widely

held stocks whose assets and/or revenue are based in the US. La r ge Ca p Gr owth:

in inter est. We still have thr ee m onths to go, w ith an election in the

S&P 500 Gr owth I ndex?M easures the performance of growth stocks drawn from the

m iddle. Capital gains, dividends and inter est incom e could cer tainly be S&P 500 index by dividing it into growth and value segments by using three factors:

less than 2019, so it m ay be a good year to consider taking m or e capital sales growth, the ratio of earnings change to price and momentum. M id Ca p

Va lue/M id Ca p Gr owth: S&P M idCa p 400 I ndex?A market cap weighted index that

gains. All decisions r egar ding the tax im plications of your investm ents covers the complete market cap for the S&P 400 Index. All S&P 400 index stocks are

should be m ade in consultation w ith your independent tax advisor or represented in both and/or each Growth and Value index. M id Ca p Blend: S&P

estate planning attor ney. Spectr um is not a tax advisor or estate M idCa p 400 I ndex?M easures the performance of mid-sized US companies, reflecting

the distinctive risk and return characteristics of this market segment. Sma ll Ca p

planner. Va lue: Russell 2000 Va lue I ndex?M easures the performance of small-cap value

segment of Russell 2000 companies with lower price-to-book ratios and lower

In the Septem ber 2019 new sletter , w e talked about differ ent w ays to forecasted growth values. Sma ll Ca p Blend: Russell 2000 I ndex?M easures the

give to char itable or ganizations. Be sur e to visit our w ebsite at performance of the small-cap segment of the US equity universe. It includes

approximately 2000 of the smallest securities based on a combination of their market

w w w.spectr um investor.com , under r esour ces, to r eview the cap and current index membership. For eign La r ge Ca p Blend: M SCI EAFE NR

infor m ation in that new sletter. As w e talked about ear lier , the RM D I ndex?This Europe, Australasia, and Far East index is a

has been suspended for 2020. W hile you?r e not r equir ed to w ithdr aw market-capitalization-weighted index of 21 non-US, developed country indexes. Sma ll

Ca p Gr owth: Russell 2000 Gr owth I ndex?M easures the performance of small-cap

funds fr om your IRA or r etir em ent account, you?r e still able to. The growth segment of Russell 2000 companies with higher price-to-value ratios and

Qualified Char itable Distr ibution (QCD) allow s individuals to gift assets higher forecasted growth values. Rea l Estate: DJ US Select REI T I ndex?M easures

to a char itable or ganization dir ectly fr om their IRA. The QCD is still the performance of publicly traded real estate trusts (REITs) and REIT-like securities

to serve as proxy for direct real estate investment. Natur a l Resour ces: S&P Nor th

available in 2020, but ther e m ay be better options for this year. Amer ica n Natur a l Resour ces I ndex? M easures the performance of US traded

Consider a gift of appr eciated stock (if available) at year -end. securities classified by the Global Industry Classification Standard (GICS) as energy

and materials excluding the chemicals industry and steel but including energy

companies, forestry services, producers of pulp and paper and plantations. Past

IRS Indexed Limits for 2020: performance is no guarantee of future results. This report is for informational

401(k), 403(b), 457 Plan Deferral Limit is $19,500. purposes only and should not be construed as a recommendation or solicitation to

Catch-up Contribution limit is $6,500. Source: www.irs.gov buy or sell any security, policy or investment. PE Ratio is the measure of the share

price relative to the annual net income earned by the firm per share.You can also read