SASKATOON RETAIL MARKET - Research & Forecast Report - Colliers International

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economic Overview Emerging Neighbourhoods Becoming Retail Hubs

Economic indicators for Saskatoon continue to point toward The prominence of the retail nodes within emerging

sustained stability. Saskatoon’s GDP is projected to be in the neighbourhoods has fueled development activity since 2014

range of $23.1B resulting in year-over-year GDP growth of and 2019 was no different.

1.68%; this rate is expected to outpace the provincial growth of

1.1%. (Source: SREDA) Over the past 6 years, the retail sector has grown by nearly

12.8% as a result of new inventory introduced throughout

Saskatoon is expected to continue growing at an annual rate the City. Much of this inventory has been developed within

of 2% with the current CMA population estimated at 328,245. emerging neighbourhoods such as Brighton, Kensington, The

The City remains one of the youngest in the country with Hamptons, and The Meadows.

Saskatoon’s median age at 35.8 years; 5.4 years younger than

the national median of 41.2. Retailers continue to show a preference for new inventory

within emerging neighbourhoods. As new developments

Despite a relatively flat employment market that isn’t continue to establish themselves as retail hubs within the

anticipated to create much in terms of new job growth, market, existing corridors are witnessing an increase in

unemployment is projected to remain stable and in line with the available space as well as a softening in lease rates as they

national average at 6%. compete with the new inventory.

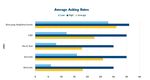

As a result of this shift, average asking rates softened within

existing retail corridors from $21.90 to $21.34 per square

Market Overview foot. In 2018, Colliers reported a 13% gap between advertised

The City’s retail market continued to grow as the sector and effective rents and in 2019 the gap has narrowed to 11%

expanded to 14.5M square feet. An additional 370,325 with most of this variance being accounted for by tenant

square feet of new inventory was introduced to the market. improvement allowances.

Year-over-year retail vacancy experienced a decline of 19

basis points to 4.61% with 385,817 square feet of absorption Asking rates within emerging neighbourhoods for new

inventory continue to hold steady starting at $28 per square

foot and escalating upwards to $36 per square foot.

Retail Sales Growth

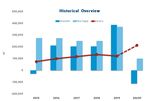

Historical Overview

Fig. 1 - Average Asking Rates; price PSF per area.

Fig. 2 - Historical Overview; Vacancy vs. Net Absorption and New Supply.

2 Research & Forecast Report | 2019 | Saskatoon Retail | Colliers InternationalThe Future of the Retail Landscape New Retail Tenants

In August of 2019, Colliers reported a study that examined

RETAILER LOCATION

how the spending habits of millennials would alter the retail

landscape. Restaurant and health & wellness spending were Pink Cadillac Hampton Village

two of the categories that witnessed a significant increase Tim Horton’s Hampton Village

in spending by millennials since the start of the century. Canadian Brewhouse Hampton Village

Restaurant spending has increased by 124% while health &

wellness rose by 111%. As a result of these spending habits, F45 Training Cory Commons

it is projected that more restaurant and fitness-related users Dollarama Cory Commons

will look to enter the market. The Keg Brighton Market Place

The report also stated that millennials spend 53% more on

A&W Brighton Market Place

restaurants than Canadians did in the same age cohort in

2000. This is a significant uptick highlighting millennials 7-11 Brighton Market Place

willingness to prioritize dining and socializing within their Motion Fitness Brighton Market Place

spending. As a result of a growing online shopping sector,

malls throughout Canada witnessed a decline in foot traffic Save-on Foods Brighton Market Place

and have begun to pivot their strategies to offer shoppers an Shoppers Drug Mart Brighton Market Place

experience including dining, entertainment, and the ability

Leopold’s Tavern Evergreen Square

to gather and socialize. A local example highlighting this

growing trend is the $80M re-development project currently Swan Pizza Evergreen Square

underway at Midtown Plaza. Influenced by millennials F45 Training Evergreen Square

shopping habits, Midtown strategically decided to redevelop Olive Garden Preston Crossing

the food court into a 42,000-square-foot hall. The modern

King of Donair University Heighs Square

space accommodates 16 vendors and aims to increase foot

traffic throughout the mall. Sobeys Liquour Lawson Heights

In regard to the trends within the health & wellness industry, Sobey’s Liquour University Heights Square

the Colliers report noted that spending within this industry is H&M Midtown Plaza

expected to hold steady and likely carry on with Generation

Z. As a result of these trends and long-term importance

Notable Retail Transactions

for health, it is anticipated that fitness related retailers will

explore opening locations in the coming years. LEASED LEASED

Brighton Hampton Heights

Motion Fitness The Canadian Brewhouse

Leased 40,000 SF Leased 7,000 SF

LEASED LEASED

Evergreen Square Confederation Park Suburban Centre

Leopold’s Tavern Anytime Fitness

Leased 3,200 SF Leased 7.000 SF

Research & Forecast Report | 2019 | Saskatoon Retail | Colliers International 3400+ offices in MARKET CONTACT:

Richard Jankowski

68 countries on Managing Director | Saskatchewan

+1 306 664 1644

richard.jankowski@colliers.com

6 continents Alvaro Campos

Market Intelligence Coordinator | Saskatchewan

United States: 145 +1 306 664 1241

alvaro.campos@colliers.com

Canada: 45

Latin America: 23 CONTRIBUTORS:

Asia Pacific: 86 Keith Webb | Vice President | Sales Associate

Maxwell Lee | Sales Associate

EMEA: 131 Tanis Macala | Marketing Coordinator

Colliers International | Saskatoon

728 Spadina Crescent East

$3.3B Saskatoon, SK | Canada

US* in annual +1 306 664 4433

revenue

2B

square feet

under management

17,000+

professionals

and staff

*Based on 2018 results

About Colliers International Group Inc.

Colliers International Group Inc. is an industry leading global real estate services company with more

than 17,000 skilled professionals operating in 68 countries. With an enterprising culture and significant

employee ownership, Colliers professionals provide a full range of services to real estate occupiers,

owners and investors worldwide. Services include strategic advice and execution for property sales,

leasing and finance; global corporate solutions; property, building and project management; workplace

solutions; appraisal, valuation and tax consulting; customized research; and thought leadership

consulting.

Colliers professionals think differently, share great ideas and offer thoughtful and innovative advice that

help clients accelerate their success. Colliers has been ranked among the top 100 outsourcing firms by

the International Association of Outsourcing Professionals’ Global Outsourcing for 11 consecutive years,

more than any other real estate services firm.

colliers.com

Copyright © 2020 Colliers International.

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to

ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult

their professional advisors prior to acting on any of the material contained in this report.You can also read