Release of BEPS discussion draft: Preventing the Artificial Avoidance of PE Status

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

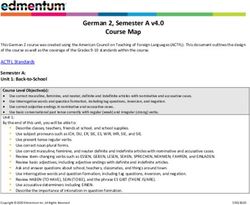

Tax Policy Bulletin

Tax Insights from International Tax Services & Transfer Pricing

Release of BEPS discussion draft:

Preventing the Artificial Avoidance

of PE Status

3 November 2014

In brief

Fundamental changes to the existing Permanent Establishment (PE) rules, with a potentially wide

impact on many structures currently in use by MNCs are proposed in the OECD discussion draft on BEPS

Action Step 7 (Preventing the Artificial Avoidance of PE Status) published on 31 October 2014. Although

one of the shortest papers so far released, the various options proposed in the draft, which include

widening the dependent agent provisions and narrowing both the independent agent exemptions and the

specific activity (e.g., warehouses, etc.) exemptions, go beyond the PE areas identified for review under

Action 7 in the original BEPS Action Plan. It seems clear that the broad reach of many of the options

reflects the concerns raised in the BEPS Report on the Digital Economy regarding the ability of

companies to market products and services in a host country without a meaningful physical presence.

There are five separate areas in which the OECD is proposing change:

Commissionaire arrangements and similar strategies

A variety of issues relating to the specific activity exemptions, including the operation of the

“preparatory or auxiliary” test and the ability of companies to fragment activities

Rules to counter the splitting up of contracts

Specific insurance sector PE proposals

PE profit attribution issues

Unlike some of the earlier OECD papers that have been released, the general approach of the PE

discussion draft is to offer alternative approaches to deal with the issues identified. The overall tone of

the paper is a little more cautious than earlier papers (where typically no such alternative approaches

were canvassed), perhaps reflecting not only the inherent difficulties in many of the proposals but also

the inevitably charged and ultimately political nature of many of the proposals. As is noted in the paper,

the proposals in the discussion draft do not represent the consensus views of the OECD but are intended

to facilitate analysis and comment by stakeholders. Nonetheless, a trait of all the proposals is clearly to

reduce the existing PE threshold.

www.pwc.comTax Policy Bulletin

In detail independent agent exemption (Art 5 relationship between that person

(6) of the OECD Model). These and the enterprise, are on the

The first two areas of the discussion options are based on the OECD’s view account and risk of the enterprise”.

draft will, in particular, be of material that “in many cases commissionaire

relevance to a wide body of taxpayers The discussion draft explains that

structures were put in place primarily the intention behind the substitute

and will introduce real risks of in order to erode the taxable base of

collateral impact. The third and fourth wording proposed is to refer to

the state where sales took place”.

areas are aimed at particular sectors. contracts that are on the account

The final area identifies some of the The policy underlying all of these and risk of the foreign enterprise

difficulties with attributing an alternatives is that where the activities by virtue of the legal (not

appropriate amount of profit to PEs that an intermediary exercises in a economic) relationship between

which would be created as a result of country are intended to result in the that person and the intermediary

these changes. regular conclusion of contracts to be or agent – e.g. a relationship

performed by a foreign enterprise, created by an agency contract, a

Commissionaire arrangements that enterprise should be considered

commissionaire contract, a

Commissionaire arrangements are to have a sufficient taxable nexus in

explained in the discussion draft as partnership agreement, etc.

that country unless the intermediary

arrangements through which a person is performing these activities in the The requirement of “independence” in

sells products in a given state in its course of an independent business. the independent agent exemption is

own name but on behalf of a foreign That result is delivered by all four also strengthened by the requirement

enterprise that is the owner of these drafting alternatives that are included that the agent must act for “various

products. Through such an in the discussion draft. persons” and in the ordinary course of

arrangement, a foreign enterprise is that business and also must not act

able to sell its products in a state The four alternatives each present

exclusively or almost exclusively on

without creating a PE to which such different permutations of approaches

behalf of one enterprise or associated

sales may be attributed for tax to two key problems with the current

enterprises. This restrictive version of

purposes. The person doing the selling drafting of the dependent agent rule.

the independent agent exemption is

(the commissionaire) in the state also included in all of the four

The first perceived problem is the

concerned would typically be taxed on alternatives discussed above.

wording “concludes contracts”. On

the remuneration it receives for its

services (often a commission) rather this point, two alternatives are Comment: The overall approach of

than on the profits derived from such suggested. The first is to replace lowering the dependent agent

sales. this wording by a test of whether threshold below the “concluding

the agent concerned “engages with contracts” test is likely to appreciably

These arrangements have been a specific persons in a way that widen the scope of the rule and

concern to a number of tax authorities results in the conclusion of introduce greater subjectivity into the

for a number of years and certainly determination of whether a PE exists

contracts”. The second alternative

before the BEPS project. This in any particular case. In particular,

is similar except that it addresses

explains why the “commissionaire” the current drafting would seem to go

issue has now become one of the situations where contracts may not

far beyond the “commissionaire”

higher profile issues within BEPS and be formally concluded. This is

model and potentially impact a wide

why Action 7 of the BEPS plan achieved by the introduction of the range of arrangements for making

required a policy re-evaluation of the words “concludes contracts or who direct sales or providing sales support.

existing PE rules in relation to such negotiates the material elements of This seems likely to include limited

commissionaire arrangements and contracts”. risk distributor and other principal

similar strategies. structures. Equally, the narrowing of

The second perceived problem

the independent agent exemption will

Four alternative options are put concerns the wording in the

also expand the scope of the

forward to amend the dependent existing dependent agent test of dependent agent rule. The

agent PE rules (Art 5 (5) of the OECD “contracts in the name of the independent agent options would in

Model) in order to deal with these enterprise”. It is proposed that this addition eliminate a long standing

arrangements and in addition these would be changed to “contracts principle that an agent can be

alternatives also tighten up the

which, by virtue of the legal independent even if it acts exclusively

2 pwcTax Policy Bulletin

for one party or one or more affiliated for the delivery of goods (i.e. a the scope of the exemption for

enterprises if appropriate criteria are warehouse) in which a significant collecting information for the

met. In addition to expanding the number of employees work for the enterprise by disguising what is in

coverage of the dependent agent rule, main purpose of delivering goods reality the collection of

the proposal would mean that an that the enterprise sells online. information for other enterprises

office used by an agent that falls by repackaging the information

That leads to the option for the

outside the independent agent collected into reports prepared for

general removal of the exemption these enterprises.

definition could be viewed as an office

at the disposal of the principal. for the use of facilities for the

delivery of goods or merchandise Finally, the fourth option, which is

Specific activity exemptions belonging to the enterprise. independent of the above options,

The reference to “specific activity” However, the discussion draft itself is concerned with the

exemptions is a reference to the list of seems reluctant to endorse this fragmentation of activities between

exceptions in Art 5 (4) of the OECD approach, noting that, even if a PE related parties. The discussion

Model, according to which a PE is is created by facilities used to draft notes that the Commentary to

deemed not to exist where a place of deliver goods or merchandise the OECD Model already addresses

business is used solely for activities

belonging to the enterprise, the the fragmentation of activities in

that are listed in that paragraph. The

resulting measure of attributable clarifying that a (single) enterprise

discussion draft examines four aspects

profit may not be particularly “cannot fragment a cohesive

of the Art 5 (4) rules, in each case

providing options to counter aspects significant and tax authorities operating business into several

that the Working Group sees as might be led into attributing too small operations in order to argue

potentially giving rise to the artificial much income to this activity if they that each is merely engaged in

avoidance of the PE threshold. The do not give the issue close preparatory or auxiliary activity”.

main targets are warehouses, consideration, leading to litigation The discussion draft seeks to go

purchasing offices, and offices used and inconsistent application of tax beyond this “given the ease with

for the gathering of information. The treaties. which subsidiaries may be

second and third options proceed on established”. This leads to two

the basis the first option, below, is not The third option addresses the PE

alternative options.

implemented and they therefore exemption for the maintenance of

target particular exemptions on which a fixed place of business solely for – Under the first, the anti-

the OECD has BEPS concerns. the purpose of purchasing goods or fragmentation rule denying a

merchandise or collecting PE exemption is extended to

The first option is to make all of

information for the enterprise. cases where complementary

the activities currently listed in the

There are in turn two alternative business activities are carried

provision as subject to the approaches proposed for this rule– on by associated enterprises ,

requirement of being “preparatory

regardless of residency, at the

or auxiliary”. This would mean – the first, to delete the entire

same location, or by the same

that it would not, for example, be provision;

enterprise or by associated

sufficient for facilities to be used – the second, to retain the enterprises at different

solely to deliver goods or exemption for collecting locations. For the rule to

merchandise belonging to the information but delete the apply a group of associated

enterprise (notwithstanding the exemption for purchasing enterprises must have at least

current drafting of the provision) goods or merchandise. one fixed place of business

unless in each case the activity that satisfies the PE threshold

concerned also could meet the The alternative options are based

on the view in the discussion draft and the activities concerned

proposed overriding “preparatory

that there is, at a policy level, must be “complementary

or auxiliary” test. functions that are part of a

insufficient justification for the

The second option is based on the exemption for purchasing goods cohesive business operation”.

observation in the discussion draft or merchandise and also there

– The second option is similar

that it is difficult to justify the are concerns that some

enterprises have sought to extend to the first except that it also

exemption for facilities used solely

3 pwcTax Policy Bulletin

applies where none of the designed to cover a period of less than in the PE rules. It is very likely that

places to which it refers 12 months) to a different company in this would in practice lead to a

constitutes a PE but the order to avoid the existence of a PE. materially increased uncertainty as to

combination of the activities the application of the PE definition

Here, two alternative options are put rules as a whole. The discussion draft

at the same place or at forward to deal with what is described explains that the anti-abuse rule

different places go beyond as abuse of the Art 5 (3) test. would apply only to tax-motivated

what is preparatory or

Under the first approach, there cases and not where there are

auxiliary. legitimate business purposes for the

would be an “automatic” rule to

Comment: The options are likely to involvement of associated enterprises,

take account of activities

create additional sources of but this distinction is likely to prove

performed by associated highly contentious in practice.

controversy and may have unintended

enterprises in arriving at an

consequences in some areas. If the

aggregate period of time for the Specific insurance sector PE

option to remove the exemption for

purposes of the 12 month rule. proposals

the delivery of goods is adopted, the

OECD Model Commentary will need One of the more surprising areas on

The second approach involves the

to make clear when storage/display which proposals have been developed

application of the treaty general (because it has nothing to do with the

ends and when delivery (which creates

anti-abuse rule (i.e. the “Principal specific PE issues identified in the

a PE) starts, in order to bring

Purpose Test” rule), developed original BEPS Action Plan) is the

certainty. With regard to the anti-

fragmentation options, the approach under the Action 6 work on treaty inclusion of options to deal with

of combining activity not just of a abuse, in relation to which there is insurance agents, even though they do

given legal entity but also of related proposed the addition in the OECD not conclude contracts for their

parties to assert a PE is created may Commentary of a new example to principal. There are two alternatives

lead to material increase in highlight the availability of that presented to achieve this goal. The

uncertainty and subjectivity as regards rule to counter this instance of first proposal, which seems to have

what is to count as a “cohesive been modeled on the UN Model, is

perceived PE abuse.

operating business” and would also that insurance companies would be

give source countries an ability to Comment: Careful consideration of deemed to have a PE in a state where

pierce or ignore the separate legal the first alternative will be necessary either they collect premiums through

personality of substantive legal as, in the absence of any further an agent established in that state or

entities. qualification, a range of different where they insure risks situated in

activities within a single MNC group that territory through such an agent.

Rules to counter the splitting up might be aggregated where there is If the agent is an independent agent,

of contracts arguably no abuse of the sort that is the rule would not apply. The

The options to counter the splitting up envisaged (e.g. specialist technicians discussion draft explains that the

of contracts are of relevance to the visiting a site to conduct feasibility provision suggested is already found

specific 12 month PE rule for studies in advance of a local in many treaties with some variations

construction sites in Art 5(3) of the subsidiary acting as contractor). This and it can be seen as merely extending

OECD Model (though it is noted in the could be a particular challenge for an the scope of the agency PE rule where

discussion draft that the splitting up MNC group that is diversified and premiums are collected or risks

of contracts is also a concern with the decentralised as they may be unaware insured through a person other than

application of service PE provisions, of all the activities of the MNC group. an independent agent even if

such as the alternative provision The second alternative seems much insurance contracts are not concluded

found in the OECD Model less welcome given that the by that person. Under the second

Commentary and in Art 5 of the UN implication is that, notwithstanding alternative, no specific rule would be

Model). the suggestion of inserting a specific added and the position of insurance

example in the Commentary, tax enterprises would be dealt with

The OECD’s concern is that authorities may be encouraged to through the more general changes

construction contracts may be make much more active and regular proposed to Art 5(5) and 5 (6) (as

artificially divided or split up with the use of the treaty Principle Purpose discussed in relation to

intention of allocating the resulting Test (PPT) and therefore further commissionaire arrangements above).

split contracts (each of which being undermine any residual certainty left

4 pwcTax Policy Bulletin

Comment: In connection with the (interest deductions), Action 8 international standards on the

first alternative on insurance agents, (intangibles) and Action 9 (risks and allocation of taxing rights on cross

there is no explanation in the capital) will all need to be considered border income.

discussion draft on why, in the in this regard and that the work on

absence of these sector-specific special risk and capital in particular might However, with its lowering of the PE

provisions, there would be “artificial involve a reconsideration of some threshold and narrowing of available

avoidance of the PE threshold in aspects of the existing rules and exemptions, it is inevitable that the

relation to insurance activities”. The guidance on attribution. proposed PE changes will lead to a

obvious question is what rationale (or material shift towards source-based

criterion) supports the development Comment: Perhaps the biggest taxing rights.

of special rules for the insurance omission of the PE discussion draft is

any substantive discussion on the Another important consequence of the

sector and no other sector? In proposals is likely to be a material

relation to the second alternative, critical question of what the expanded

scope of the PE definition will mean in increase in uncertainty given the

though brought forward as a specific greater use of subjective tests in what

rule to address the insurance sector, it terms of the attribution of profits to

the “new” PEs created. The discussion is proposed, coupled with the already

does in fact make no distinction problematic (because vague and in

between an insurance enterprise and draft seems to proceed largely on the

basis of an expectation of an increase many cases uncertain) attribution

any other enterprise and thereby rules. This means that if the options

seems to undermine the need for any in profits to such PEs over existing

transfer pricing arrangements but the in the discussion draft are largely

special rule as is proposed by the first adopted the existing strained dispute

alternative. In any event, this precise reasoning (for example, by

reference to the terms – or an resolution system will come under

proposed extension of the PE increasing pressure.

definition would not apply where the amendment to the terms – of the PE

insurance contracts concerned are re- attribution rules) is not included. In consequence, alternative means of

insurance contracts. Given the proposed changes to the PE preventing and resolving disputes and

definition and the (presumed) audits should be given a high priority,

PE profit attribution issues intention to attribute profits to at least for example in the expansion of

The discussion of profit attribution to some of these newly-created PEs, it advance ruling processes, etc. These

PEs is very short even though it is seems likely that significant changes could include both the initial

recognized in the discussion draft that to the treatment of risk may be determination of the existence of a PE,

the issue is of key importance in proposed by the work on risk and as well as the allocation of profits to

determining what changes should be capital under point 9 of the BEPS that PE.

made to the definition of the PE test. Action Plan.

It is noted that the preliminary work Enhanced dispute resolution options

done so far indicates that no

The takeaway such as administrative appeals,

substantial changes are needed to the The discussion draft states that the mediation and arbitration should also

existing attribution rules (in Art 7 of OECD’s actions to address BEPS are be developed. Without such changes,

the OECD Model) though clearly some intended to restore, not change, there is a real prospect of a dramatic

changes are contemplated by the source and residence taxation rights increase in the incidence of PE audits

BEPS PE work. However, it is and the actions proposed are not and disputes with potentially double

stressed that the work on Action 4 directly aimed at changing the existing taxation and years of uncertainty as

the outcome.

5 pwcTax Policy Bulletin Let’s talk If you’d like to discuss these issues further please call your usual PwC contact or one of the following: Richard Collier, London Ulf Andreson, Frankfurt Jerome Monsenego, Stockholm +44 207 212 3395 +49 69 9585-3551 +46 10 2133483 richard.collier@uk.pwc.com ulf.andresen@de.pwc.com jerome.monsenego@se.pwc.com Mike Gaffney, New York Steve Nauheim, Washington David Ernick, Washington +1 (646) 471 7135 +1 (202) 414 1524 +1 (202) 414 1491 mike.gaffney@us.pwc.com stephen.a.nauheim@us.pwc.com david.ernick@us.pwc.com David Swenson, Washington Alex Voloshko, Boston Alenka Turnsek, London +1 (202) 414 4650 +1 (617) 530-4512 +44 20 7213 5045 david.swenson@us.pwc.com alex.voloshko@us.pwc.com alenka.turnsek@uk.pwc.com Phil Greenfield, London +44 207 212 6047 philip.greenfield@uk.pwc.com © 2014 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved. PwC refers to the United States member firm, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. SOLICITATION This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. 6 pwc

You can also read