MUNICH | HOTEL MARKET REPORT 2018 - MARKTBERICHT - Colliers International

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

MARKTBERICHT

MARKET REPORT 2018

MUNICH | HOTEL

2017 Q1-Q4

Hotel Market Munich 2017 Q1-Q4

Munich, the state capital of Bavaria and the third largest city

of Germany, recorded - after a restrained development in the HOTEL MARKET STRUCTURE BASED ON CLASSIFICATION 1

prior year - the strongest growth of the number of guest

arrivals and overnight stays in 2017 and takes the 1st place

in the nationwide ranking among the best performing cities.

The occupancy of rooms (OCC rooms) as well as the average

room rate (ARR) are listed in the TOP 3 of German cities and

effect the highest RevPAR of Germany.

Accommodation Supply

According to the Federal Statistical Office of Bavaria, 432

accommodation providers operated in Munich and provided

74,552 guest beds in 2017. Versus the prior year the number

of operating accommodation providers increased by 4.9 % as

well as the number of guest beds rose by 8.0 %.

Key facts hotel market | Development vs. pre-year

Accommodation providers operating… 432 + 4.9 %

Guest beds available ………………..………. 74,552 + 8.0 %

Arrivals………………………………….….…...…. 7.8 Mio. + 10.2 %

Overnight stays…………………….…………… 15.7 Mio. + 11.7 % DEVELOPMENT OF ACCOMMODATION SUPPLY 1

Duration of stay Ø……………………..……… 2 days 0%

Bedspace Occupancy……………….………… 59.9 % + 3.6 %

ACCOMMODATION PROVIDERS OPERATING

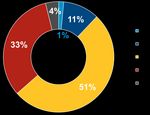

With 51 % the 3-star hotel classification forms the majority in

the structure of the hotel market in Munich, followed by the

4-star sector with a share of 33 %. Despite the rise of the

number of operating accommodation providers, the

GUEST BEDS AVAILABLE

percentage distribution almost remained the same - except

the 2-star sector with a growth of 29 %, up to a total share of

11 % in Munich‘s hotel market. This was effected by the

increasing popularity of budget hotel concepts.

The forecast of new hotel projects and developments in

Munich contains the following openings:

Currently, Munich’s highest hotel building, the Hotel Tower

with a height of 86 meters, is under construction and will be

1

completed in 2019, located in Munich‘s new city quarter All figures are written in the German way of writing → decimal mark of all figures:

comma in German = point in English - vice versa!

„Werksviertel“ next to the huge railway station „Ostbahnhof“.

The Hotel Tower will accommodate two different hotels: An

ADINA apart-hotel with 234 rooms operated by the Australian

group TFE and a hostel with 500 rooms operated by the

Austrian group Wombat‘s.

The first German NYX hotel with 225 rooms, a boutique brand

of Leonardo Group, schedules the opening in Munich in June

2018.Demand For Accommodation DEVELOPMENT OF DEMAND FOR ACCOMMODATION 1

Regarding the demand for accommodation, Munich achieved

new peak results in the number of guest arrivals and in the

number of overnight stays compared to the year before.

7.763.333 guest arrivals were recorded, a 7.3 % increase

versus the prior year, resulting in 15.663.728 overnight stays

in Munich in 2017, a growth of 11.7 % relative to the prior

year. The average duration of stay remains the same like in

2016: 2 days.

The permanent positive development of the numbers of guest

arrivals and overnight stays since 2009 continued in 2017. The

overnight stays rose by 58.1 % and the guest arrivals by 55.8

% versus the year 2009.

In 2017 the demand for accommodations of the guests from Overnight stays in mio. Guest arrivals in mio.

domestic grew by 9 %, up to 51 %, and from abroad up to 49

%, a remarkable increase of 14.6 % versus the prior year. DEMAND FOR ACCOMMODATION BASED ON ORIGIN 1

Munich‘s second mayor Josef Schmid gives a positive rating:

„Munich attracts lots of visitors from all over the world and

from domestic. Due to Munich’s hospitality along with its

cosmopolitan spirit and its unique sightseeing hotspots, the

city of Munich is considered as a popular travel destination.“

An almost identical allocation of the demand for

accommodation from domestic and from abroad is a rare

result in the TOP 7 cities in Germany and supports the

statement before.

Guests from Germany

Guests from abroad

Performance Hotel Market PERFORMANCE OF THE HOTEL MARKET 1

In 2017 Munich’s occupancy of rooms amounts to 76.2 %.

Despite a slight decline of 0.3 % versus the prior year, Munich

takes the 3rd place in the national ranking regarding the

occupancy of rooms. Munich’s average room rate (ARR)

achieved a significant peak result with EUR 111, compared to

the TOP 7 German cities, Munich takes the 2nd place in the

ARR rating - although a slight decrease of 3.5 % versus the

year 2016.

These results effect an average revenue per available room

(RevPAR) of EUR 84. Despite a decline of 4,5 % versus the prior

year. Munich takes the 1st place in the RevPAR ranking of

German cities in 2017! With a growth of 3.6 % the occupancy

of guest beds rose up to 59.9 %. Despite the positive

development of the hotel market the KPIs result in contrastive

values. A look at the occupancy of rooms (OCC) and at the

occupancy of guest beds show this contradiction, with the

conclusion that the data volume of STR Global contains more DEVELOPMENT OF THE BEDSPACE OCCUPANCY 1

and more budget and economy hotels, and here are different

data is measured.

Forecast

The Munich hotel market shows an excellent performance and

comparing the key indicators nationwide, despite slight

declines, Munich is listed among the TOP 3 of German cities.

Munich still attracts lots of visitors from all over the world.

This on-going fast rising upwards trend of the last years is also

expected in the future.

Due to this, Munich is considered as an extremely interesting

location for hotel Investments. Bedspace Occupancy

1 All figures are written in the German way of writing → decimal mark of all figures:

comma in German = point in English - vice versa!

Page 2 | Colliers International Hotel GmbH | Report Hotel Market 2017 Q1-Q4 Munich, GermanyOVERVIEW 2017 Q1-Q4

PERFORMANCE

Kennzahlen Deutschland Berlin Düsseldorf Frankfurt Hamburg Köln München Stuttgart

1

KPIs Germany Berlin Dusseldorf Frankfurt Hamburg Cologne Munich Stuttgart

Zimmerauslastung Ø

Occupancy Ø

71,5% 76,8% 69,4% 69,9% 81,6% 75,2% 76,2% 73,3%

Veränderung Vorjahr

Development YOY

0,8% -0,3% -0,1% 1,1% 0,7% 1,8% -0,3% 0,0%

Zimmerpreis Ø

95,00 € 93,00 € 112,00 € 98,00 € 101,00 € 104,00 € 111,00 € 103,00 €

Average room rate

Veränderung Vorjahr

Development YOY

1,3% 3,3% -2,6% 2,1% 4,1% 8,3% -3,5% 4,0%

Zimmerertrag Ø

RevPAR Ø

68,00 € 71,00 € 78,00 € 69,00 € 82,00 € 78,00 € 84,00 € 75,00 €

Veränderung Vorjahr

Development YOY

2,1% 1,4% -2,5% 4,5% 5,1% 11,4% -4,5% 2,7%

HOTEL MARKET

Kennzahlen Deutschland Berlin Düsseldorf Frankfurt Ham burg Köln München Stuttgart

Key Facts 1 Germ any Berlin Dusseldorf Frankfurt Ham burg Cologne Munich Stuttgart

Beherbergungs-

betriebe

51.916 795 220 280 382 280 432 170

Accom m odation

providers

Veränderung Vorjahr

-0,1% 0,8% -0,9% 3,3% 5,5% -1,8% 4,9% 1,2%

Developm ent YOY

Bettenangebot

3.000.474 142.754 27.017 51.815 63.263 32.544 74.552 21.071

Guest beds offered

Veränderung Vorjahr

2,1% 2,6% -1,9% 4,9% 6,4% 1,4% 8,0% 3,2%

Developm ent YOY

Gästeankünfte

178,2 Mio. 13,0 Mio. 2,9 Mio. 5,6 Mio. 6,8 Mio. 3,6 Mio. 7,8 Mio. 2,0 Mio.

Guest arrivals

Veränderung Vorjahr

3,9% 1,8% 6,4% 7,7% 3,3% 7,3% 10,2% 2,0%

Developm ent YOY

Übernachtungen

459,5 Mio. 31,2 Mio. 4,8 Mio. 9,5 Mio. 13,8 Mio. 6,2 Mio. 15,7 Mio. 3,8 Mio.

Overnight stays

Veränderung Vorjahr

2,7% 0,3% 4,6% 8,4% 3,7% 8,1% 11,7% 2,0%

Developm ent YOY

LOCATION

Kennzahlen Deutschland Berlin Düsseldorf Frankfurt Hamburg Köln München Stuttgart

1

Key Facts Germany Berlin Dusseldorf Frankfurt Hamburg Cologne Munich Stuttgart

Einwohner

2 82,7 Mio. 3,7 Mio. 640.000 736.000 1,8 Mio. 1,1 Mio. 1,5 Mio. 610.000

Population

Arbeitslosenquote

2 5,3% 8,4% 6,9% 5,6% 6,5% 8,1% 3,8% 4,3%

Unemployment rate

Sozialversicherungs-

pflichtig Beschäftigte

Employees subject to

31,4 Mio. 1,4 Mio. 398.524 551.231 932.219 538.112 821.971 396.516

social insurance 3

Verfügbares Einkommen

pro Kopf 22.671 € 19.095 € 21.207 € 22.130 € 24.000 € 21.336 € 23.658 € 23.540 €

Income per capita

Flughafenpassagiere

Airport passengers

234,7 Mio. 33,3 Mio. 24,6 Mio. 64,4 Mio. 17,5 Mio. 12,4 Mio. 44,5 Mio. 10,9 Mio.

1 All figures are written in the German way of writing → decimal mark of all figures: comma in German = point in English - vice versa!

2 im Dezember des Berichtsjahres / in December of reporting year

3 im Juni des Vorjahres / in June of pre-year

Page 3 | Colliers International Hotel GmbH | Report Hotel Market 2017 Q1-Q4 Munich, GermanyAccelarating success.

Colliers International

Global Key Facts 2017 Colliers International Hotel GmbH

400 The Colliers International Hotel GmbH, as a part of Colliers

International, provides a full range of real estate services for

offices in

the hotel sector. As a consultant for all topics regarding hotel

properties, the Colliers International Hotel GmbH has gained

lots of experience in the German hotel market for decades.

69 Colliers International Hotel offers services in Germany and in

countries on Europe with the focus on international hotel brands. Colliers

International Hotel GmbH advises hotel corporations,

investors, hotel operators as well as project developers on

6 their choice of location, business concept and brand strategy.

continents Together with associates, they liaise financing and equity-

partners. Moreover, Colliers International Hotel GmbH selects

the matching hotel properties to meet the investor’s needs.

€ 2.4 Colliers International Group Inc. (Nasdaq: CIGI) (TSX: CIG) is a

billion of revenue global leader in commercial real estate services, with over

15,000 professionals operating in more than 400 offices in 69

countries.

180

million sqm managed area

Colliers International Hotel GmbH

15,400 Budapester Strasse 50

professionals 10787 Berlin | Germany

Fon +49 30 5858178-10

Fax +49 30 5858178-99

Your contact:

Andreas Erben

Managing Partner

Head of Hotel | Germany

Fon +49 30 5858 178-10

www.colliers.de andreas.erben@colliers.com

Reference sources: Statistisches Landesamt, IHA Hotelmarkt Deutschland Report, www.hotel.de,

www.ahgz.de, www.hotelier.de, Verband der deutschen Verkehrsflughäfen www.adv.aero, www.muenchen.de

Picture copyright by Taxiarchos228 [FAL], from Wikimedia Commons

Copyright © 2018 Colliers International Hotel GmbH

This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any

kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reliability. Any interested party should undertake their own inquiries

as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties arising out of this document and excludes all

Page 4 |for

liability Colliers

loss International

and damages Hotelarising

GmbH there

| Report HotelThis

from. Market 2017 Q1-Q4isMunich,

publication Germany property of Colliers International and/or its licensor(s) © 2018. All rights reserved.

the copyrightedYou can also read