Accountancy Plus - CyberSecurity: The Official Journal of CPA Ireland

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

March Issue 2020

Accountancy Plus

The Official Journal of CPA Ireland

CyberSecurity:

CPA Ireland Conferring Ceremony 2019

The 1 Trillion

Dollar Industry,

Rois Ni ThuamaTop Accounting Talent

TRUST THEIR FUTURE TO

BARDEN, SO SHOULD YOU.

The experts in accounting

& tax recruitment.

Barden is where accounting the objective advice you need to

professionals go before they start plan your professional future.

looking for a job. We’re here to help Get in touch with our expert team,

you achieve your ambitions and realise because the future doesn’t just

your potential. We’ll provide you with happen. We make it happen.

Dublin: 01 9103268 Cork: 021 242 7245 e: hello@barden.ie1

Editorial President’s Message

PRESIDENT’S MESSAGE

Accountancy Plus Welcome to the March 2020

March 2020 edition of Accountancy Plus.

2019 was an exciting year for CPA Ireland These agreements provide routes for

CPA Ireland which saw a number of significant qualified members of CPA Ireland to

initiatives and achievements. become a member of another body,

17 Harcourt Street, and to enjoy the benefits which each

Dublin 2, D02 W963 In the first year of the new brand, CPA organisation offers. CPA Ireland is

Ireland has remained true to the core planning to increase global alliances

T: 01 425 1000 brand values of being credible, forward further and are working on increasing

F: 01 425 1001 thinking, assured and open. During MRA’s with other countries.

the year, CPA Ireland ran both a digital

Unit 3, campaign and nationwide radio campaign In December 2019, I was delighted

The Old Gasworks, to further increase the brand awareness to formally admit the new conferees

Kilmorey Street, of CPA Ireland members and firms in the into membership. I challenged young

Newry, BT34 2DH SME market, and highlight the value that accountants to show leadership in the

CPA’s contribute to businesses in Ireland. fight against climate change and stated

T: +44 (0) 28 3025 2771 that members of the profession are

W: www.cpaireland.ie CPA Ireland was delighted to have been uniquely placed to exert positive influence

E: cpa@cpaireland.ie awarded a European Digitalisation Award on businesses to behave sustainably. I

for Services to Members by Accountancy would like to wish them every success in

Editor Europe in acknowledgment of the their future careers and look forward to

Patricia O’Neill innovative digital learning initiative through them becoming involved with the Institute

the new learning management system, on many levels.

Chief Executive Canvas. CPA Ireland was also shortlisted

Eamonn Siggins for an IITD National Training Award 2019 CPA Ireland is excited to host the first

in the Excellence in Digital Learning ever ‘Future of Accountancy’ event

Editorial Adviser

Category. In today’s digital world, the during the first half of 2020 which will

Róisín McEntee

online experience for members and see leading experts in the fields of digital

students is essential and Canvas provides transformation, human creativity and

Technical Adviser

learners with the building blocks needed strategic business advisory discussing

Alan Bailie

to enable members to maximise their the dramatic transformation the future

Advertising learning experience. holds for all of us both personally and

Ciara Durham professionally.

CPA Ireland was delighted with the

T: 086 852 3463

success of the online further learning As this is my last message as President

E: accountancyplus@gmail.com

courses in 2019 which are now all of CPA Ireland, I would like to thank CPA

available on Canvas. Canvas hosts courses members, students and staff for your

Published by

in FRS102, US GAAP, Governance in the ongoing support. I will pass over the office

Nine Rivers Media Ltd.

T: 01 667 5900 Charitable Sector, Certified Tax Adviser, of the President to John Devaney at the

E: gary@ninerivers.ie Data Analytics and Forensic Accounting all AGM and I wish John a very successful

of which are delivered through a variety of and enjoyable term.

Printed by learning channels. Throughout 2020, CPA

Ireland will be building on the success of .

Persona

the further learning courses through the

Distribution Canvas platform and through a digital first

Lettershop Services Ltd. initiative.

During 2019, CPA Ireland signed an MRA

Gearóid O’Driscoll

with CAI Sri Lanka and extended existing

President CPA Ireland

MRA’s with CPA Canada and CPA Australia.

Accountancy Plus March Issue 2020Contents

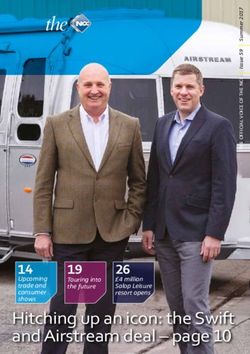

Pictured left to right Pauline

Hayden, Lyndsey Kavanagh,

Majella Regan (Liam Donnelly

Medal Winner), Gearóid O

Driscoll, President, CPA Ireland

and Eileen Hurley.

Institute Financial Reporting Taxation

President’s Message 01 Financial Reporting News 09 Tax News 23

Institute News 41 Highlights from Revenues

Law & Regulation Statement of Strategy

24

Information & 2020 - 2022

IBC

Disclaimer Law & Regulation News 10 Mairéad Hennessy

PAYE Modernisation:

CPA Profile Is Irish Employment Law

A year on 25

keeping up with the Gig

12 Sinead Sweeney

John Donoghue 07 Economy?

Derek McKay Ireland’s Corporate Tax

Deirdre McDonnell 08 System 27

Peter Reilly

Finance & Management

CPD

Finance & Management In Practice

14

News & Events 44 News

In Practice News 30

Leadership Insight

15 Recommendations for

Student Paul Healy

Reform of the UK Audit

31

Making the Agribusiness Market

Student News 48

Tick 18 Alan Bailie

Brendan McGowan

Opinion

Going, Going, Gone... IT

21

Cybersecurity 101: “An John McGrane

Working with Robots

Ounce of Prevention is 36

03 Lachlan Colquhoun

Worth a Pound of Cure”

Personal Development

Rois Ni Thuama

Tech: A friend or a foe?

38

EQ: Does it matter? Aynsley Damery

33

Ben Rawal03

Cybersecurity 101: “An Ounce of Prevention

Cybersecurity 101 by Rois Ni Thuama

OPINION

is Worth a Pound of Cure”

by Rois Ni Thuama

A Doctor of Law and subject matter expert in cyber governance and risk mitigation, Rois is Head of

Cyber Security governance for Red Sift one of Europe’s fastest-growing cybersecurity companies.

Working with key clients across a wide market spectrum including legal, finance, banking, and oil &

gas Rois writes and presents on significant cyber threats, trends, addressing and managing risks.

High profile data breaches have Not only will directors want to ensure increased spend. The fact that

brought Facebook, British Airways that they are protecting their firms’ directors have a legal obligation to

and Equifax into the media spotlight, digital assets, commercially sensitive their company to exercise reasonable

resulting in both media and information & personally identifiable care, skill and diligence clearly

consumer backlash and a good deal information (PII) amongst other informs their view and their appetite

of negative shareholder attention. things, but they will undoubtedly for sensible security measures.

want to protect themselves against What is meant by ‘sensible security

It is unsurprising then that the shareholder reaction and litigation. measures’ can be summed up

reputational damage and business with the old adage, an ounce of

disruption that followed these The operational impact, media prevention is worth a pound of cure.

incidents has created a sense of coverage and consumer backlash, So, it is entirely foreseeable that firms

urgency for board members to review together with record fines as a would rank protective cybersecurity

their cybersecurity policies, products result of breaches of the General products & services more highly than

and spending. Data Protection Regulation (GDPR), those services that offer remediation.

have doubtless contributed to the

Grow your

career with us

If you have the drive and motivation to

succeed, then all you need is the

opportunity to grow. At ifac we have

openings for a range of roles at all career

stages - from graduates to experienced

professionals.

Grow your career as part of a dynamic top

ten firm. We are currently recruiting for:

- Tax Senior, Dublin

- Senior Accountant, Enniscorthy

- Senior Accountant (Partner Fast-Track),

Trim

For more information and to see how you can become part of our team,

visit www.ifac.ie/about/careers

Accountancy Plus March Issue 202004

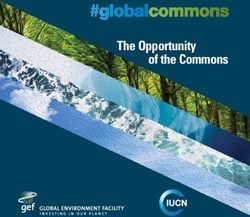

World’s Biggest Data Breaches & Hacks Jan 2020 Source: informationisbeautiful.com

Latest

Blank US

Brians Capital Coff ee Door Customs

8fit

Media

Club

Meets Dash Dubsmash Ge.tt Fotolog Houzz Ixigo OxyData Petflow Roll20 Suprema & Border

Whitepages YouNow

Games One Bagel 4,900,000 162,000,000

380,000,000

Protection

2019 Artsy Breed DataCamp Desjardins

Indian

Microsoft

44,000,000

Quest ShareThis Stronghold Toyota

WiFi

Canva Group

Facebook HauteLook Diagnostics Kingdoms Vardguiden

Ready 420,000,000

Jobseekers

Newegg

Finder

500px 275,000,000

Bulgarian

National

MBM Saks TicketFly Twitter

Revenue Coinmama Company MyFitnessPal and Lord T-Mobile 330,000,000 Vision

Animoto

2018 Agency

Chtrbox

EyeEm Google+ Healthcare.gov

150,000,000 Panerabread

&Taylor

Direct

Armor Blur LocalBlox Texas

ViewFines

Games BookMate Dixons Facebook

Marriott

Nametests Quora SKY voter Ticketmaster

Australian records

National Carphone High Hotels 120,000,000 NMBS 100,000,000 Brasil WordPress

University Grindr Tail 383,000,000 Urban

Careem CMS Facebook Hail TIO Massage

Amazon Chinese Mount Sing SVR Networks Wonga

2017

British Resume leak Dell GoPayNow.com Health Malaysian

medical Olympus MyHeritage Orbitz Health Tracking Zomato

Airways Cathay 202,000,000 South Imgur practitioners 188,000

Click2Gov East Swedish Uber Viacom

Amazon

Pacific Firebase Transport 57,000,000 Waterly

Airways

Hong Kong Malaysian Mutelle

RootsWeb

Snapchat

Registration Linux telcos & Agency

Disqus Generale

Bell CEX & Electoral

Office

Instagram Ubuntu

Forums

MVNOs de la Police Turkish Yahoo

2016 Cellebrite DaFont Equifax Quest Syrian

Three

citizenship

database Weebly

143,000,000 Diagnostics Red Cross Government

Interpark LinkedIn Mail.ru Minecraft PayAsUGym Blood

Service

The expectation within the This short paragraph reveals two c. learning to rely on their internal

cybersecurity industry is that the things: cyber and information security

current trend for spending on experts.

1. A willingness to spend significant

cybersecurity products and services

sums to protect assets and client’s

will continue to increase and is It is worth pointing out that

privacy.

expected to exceed $1 trillion reasonably priced cybersecurity

cumulatively over the five-year period 2. An error. The headline in bold products which address significant

from 2017 to 2021. To put that into refers to the ‘threat of cyber cyber threats would not merit such

context, the aggregate spend globally security’ which is obviously not attention from the board. These ‘no-

for cyber security in 2004 was $3.5 right. The author(s) must have brainer’ solutions should be signed off

billion. intended to refer to cyber threats. without conversation on the advice

In all likelihood it should have read of the firms cyber and information

In 2018, JP Morgan CEO Jamie ‘Cyber threats may very well be the security experts. Not every cyber

Dimon wrote in the 2018 Annual biggest threat to the U.S. financial matter merits a lengthy inquiry and

Report that the firm spends nearly system’. trusting your experts saves your firm

US$600 million a year to protect their money and time.

business. That’s a single business with There are a number of reasons why

all of this information should matter 2. Errors -

a cyber security budget that 14 years

to accountants. Often, these appear in

previously would have represented

cybersecurity literature. JP Morgan

a 1/7th of the total global spend. If

1. Increased oversight - is a sophisticated, innovative

you’re not wide-eyed reading that, go

As cybersecurity budgets balloon, firm. They are undoubtedly a

back and read it again.

this will be required. Some global leader in terms of their

cybersecurity products are so cybersecurity posture. However,

But there’s more, take a look at an

expensive that a compelling despite this level of sophistication,

excerpt from the annual report.

business case will need to be this report to their shareholders

made at board level and will merit contains a glaring error, as

The threat of cyber a discussion. Accountants familiar discussed above. Cybersecurity

security may very well be with good governance principles isn’t the threat, it’s the solution.

the biggest threat to the specifically the ‘four-eyes’ principle Just keep this in mind, if something

U.S. financial system. will desire a robust business doesn’t make sense to you, it might

justification for a material spend. not be you.

I have written in previous

No one in a business should have 3. Career advancement -

letters about the enormous carte blanche to sign off huge By 2022 the EU will not be able

effort and resources we sums. To that end, it is imperative to fill 355,000 jobs in the cyber

dedicate to protect ourselves that accountants, auditors, CFO’s, security sector. For anyone wanting

and our clients - we spend etc. are able to participate in the a career change or accelerated

nearly $600 million a year conversation by: career advancement, they

on these efforts and have

a. understanding the business case, should consider some additional

more than 3,000 employees cybersecurity training to gain a

deployed to this mission in b. being able to sensibly interrogate better understanding of essential

some way. that business case,

products and policies.

Accountancy Plus March Issue 202005

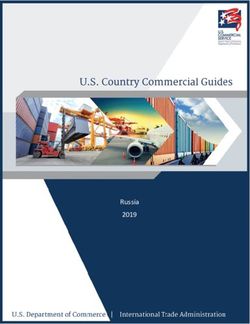

Understanding the business

Crime againgst Crime using Crimes in the

case Crime Types machines/ machines/ machine/

Cybersecurity 101 by Rois Ni Thuama

OPINION

integrity-related Computer related Content related

It’s frequently said in cyber that the

offence informs the defence. Indeed, Opportunities Harmful/Trespass Acquisition/(Theft/ Onscenity/Violence

Deception)

it’s a sensible rule to live by. But to

deploy it, you must first understand Cyber-Assisted • Phreaking • Frauds • Trading sexual materials

Crimes • Chipping • Pyramid Schemes • Stalking

what the offences are (i.e. threats), Traditional crime • Harassment (personal)

and then determine which offences/ using computers.

threats are the most significant. In More opportunites

for traditional crime

order to do that, you will need to

have at least a passing familiarity with Cyber Enabled • Cracking/Hacking • Multiple large-scale • Online sex trade

Crimes • Viruses frauds • Camgirl sites

the cyber threat landscape which Hybrid cybercrime • Hactivism • 419 type fraud • General

organises the offences in a clear way. New opportunities • Trade secret theft • Hate speech

for traditional crime • ID Theft • Organised paedophile

For this, an excellent starting point (e.g. organisation rings (child abuse)

across boundaries)

was provided by Prof. Wall, Head

Cyber-Dependent • Spams (list • Intellectual Property • Cyber sex

of Law School at Leeds University, crimes construction and Piracy distrubution • Cyber-pimping

a leading cybersecurity academic. True Cybercrime content) • Online Gambling • Online grooming

His matrix distils cybercrimes into New opportunities • Denial of service • E-auction scams • Organised Bomb talk /

their component parts so that every for new types of • Information • Phishing, smishing, Drug talk / Targeted hate

crime (Sui Generis) Warfare vishing speech

cybercrime fits into a set description.

• Parasitic • Social network media

By knowing where the threat sits, you Computing crimes

are more easily able to determine the

solution.

We’re already seeing legal cases Let’s take phishing/business email

where human resources have been compromise (BEC) as an example.

Cyber threat landscape put under exceptional strain, leading The IC on both sides have warned

For example, certain cybercrimes do to suffering with post-traumatic stress businesses that phishing emails/BEC

not need a technical or expensive disorder (PTSD) because they have are a significant cyber threat. The

solution. Firms can protect their been expected to do the work of AI. FBI refers to it as the US$26 billion

reputation from damaging social scam. The NCSC have warned about

media comments (i.e. hate speech or When we assess the entire picture, phishing and even put the legal

defamatory remarks) by ensuring that the first question to ask is: which of sector in the UK on express notice

employment contracts have carefully these represents a significant cyber that this is the most significant cyber

crafted provisions that encourage threat? threat facing law firms. Bad actors

compliance to a well-formed cyber use phishing emails as their starting

governance policy. The key is not to This is typically where vendors will point for 70% of data breaches and

deploy expensive technical solutions explain that their solution solves the 90% of targeted cyberattacks. It

simply because the crime occurs on most significant cyber threat. Now follows that if you fix phishing, you

a computer. The answer might be a although that may be true, more can remove the starting point for 70%

written process, policy or carefully often than not it’s mere puff. This of data breaches and 90% of targeted

crafted provision in a contract. leads to the second question, that cyberattacks, therefore reducing

must be asked: who is your source the overall chances of these events

Conversely, don’t rely on policies for that claim? happening.

when the problem is ‘in the machine’.

It is vital not to turn staff into filters If independent, trusted experts within This leads neatly to the third question:

and firewalls. No amount of training the Intelligence Communities (IC) is there an industry standard fix?

will assist staff in crunching through have warned from both perspectives

metadata, that is computational work that something is a significant cyber For BEC/phishing attacks, there

and should be done by, you guessed threat, that should be enough is. The solution to BEC is DMARC.

it, computers. There are a number guidance for reasonable directors to DMARC is the global industry

of downsides to expecting human move to the third question. Sensible, standard protocol recommended by

resources to do computational work, independent sources for cyber threat Email Service Providers (ESPs) and

including: assessments include National Cyber government agencies. The protocol

Security Centre (NCSC), Federal helps your computer to verify that the

i. burnout Bureau of Investigations (FBI), Internet email you send from your business

ii. decreased productivity Crime Complaint Centre (IC3) email address is authentic, protecting

and the Department of Homeland both your brand and your clients.

iii. increased stress levels

Security. There are other bodies, but This is why the IC in the US and

iv. failure this is a good starting point. Britain have repeatedly emphasized

v. employment tribunals

Accountancy Plus March Issue 202006

the importance of deploying the Cyber risks 3. Reputational damage - studies

DMARC protocol. For people new indicate that public companies

The major risks associated with

to cybersecurity, here’s a neat hack: suffer a loss of 7% off their share

cybersecurity failures are:

if you ever see something done at price on the initial news shock,

protocol level, its importance cannot further amplified by 15-20% on

1. Business operational - the scale of

be overstated. Protocols are the additional news flows. However,

the operational damage depends

fundamental building blocks of the the reality can be far worse than

on the threat and what steps

internet, it’s the digital equivalent of researchers initially evidenced.

your information security team

underpinning a house. Failing to fix For example, in 2016 a BEC attack

have taken to protect against it. It

at protocol level means you are on saw a French firm lose 20% off

might result in a total cessation of

shaky foundations. its share price in a single day. It

business capabilities for minutes,

started the day at €35 billion and,

hours, days or weeks.

To recap: despite the firms rapid response to

a ‘fake news’ article, had €7 billion

1. What’s the problem? 2. Litigation - includes fines, legal

wiped off its price. It is of course

costs and damages. By now

2. Will trusted independent sources not possible to measure the impact

everyone is familiar with the fine:

support the claim that it is a to a privately held firm, but we do

up to 4% of global annual turnover

problem? know that a combination of factors,

or €20 million, whichever is higher.

including the loss of earnings

3. Is there an industry standard Less well known perhaps is that

because of business disruption,

fix that is well known and GDPR contains a provision which

leads to a reported 60% of firms

understood? will give rise to claims from data

folding within 6 months of an

subjects affected by data breaches.

attack.

After answering yes to those three Some law firms have positioned

questions, the final question to themselves to respond quickly

ask is whether it is reasonable and Conclusion

to data breaches by optimising

proportionate to deploy a fix it? For keywords to drive web traffic to The decision-making process can be

example, if the fix costs X times the their website. somewhat nuanced but ultimately,

total value of the firm, the answer will, the process is more science than art.

of course, be no. If it’s less than the In the event of a data breach, these Businesses need to learn quickly that

cost of the Christmas party or what law firms, already highly ranked, dealing with known cyber threats,

the office spends on non-essentials will be returned for users on the which cybercriminals rely on, might

like plants or days away, the answer first page on a Google search not sound ground-breaking, but it is

will undoubtedly be yes. which will facilitate class actions, essential governance 101. If you’re

at speed. This will undoubtedly not fixing the known problems with

Now that we have a passing contribute to business disruption well-known solutions, your firm’s

understanding of the cyber threat as senior management turns their cyber security and risk posture is

landscape and the questions a attention and man hours away from immature, indefensible and imperils

reasonable director would ask; it production to damage limitation. the business and its staff.

remains to review the risks.

Rois Ni Thuama

Doctor of Law and subject matter

expert in cyber governance and risk

mitigation. Head of Cyber Security

governance for Red Sift.

Accountancy Plus March Issue 202007

Title: Chief Executive

Company: ifac

CPA Profile

John Donoghue

CPA PROFILE

Qualifications: FCPA

John Donoghue

Why did you decide to start out on and focused approach to work and journey smoother?

a career in accountancy? how I use my time. It also gave me

Commit. Don’t half do it. Set your

a broad understanding of business

I knew I wanted to be in business, and timetables, make your sacrifices,

principles and strategy, in addition to

when I looked at the people who led understand it’s a big commitment and

the core skills of accounting. I met

successful businesses, they tended to drive on. It will be worth it in the end.

great people along the way, and I

be from a finance background, so I

wouldn’t be where I am now without

felt accountancy was a good platform What do you think are the most

the qualification.

for building a successful career. It was pressing issues for accountants?

an easy decision to make.

What has been your biggest career Keeping up with the pace of

achievement? change in technology is a big issue

Why did you choose CPA Ireland

for accountants. In ifac we are

as your qualification route? Ifac has gone from strength to

embracing new technologies to

strength over the last few years.

I discussed the options with friends give our people more time to focus

We have consistently grown the

and colleagues to get a sense of on high value activi-ties. The need

practice at about 10% per year, and

what might be in-volved in gaining a for firms to have a multi-disciplinary

we have developed and grown our

professional accounting qualification, skillset is becoming more obvious

Tax, Advisory, Food and Agribusiness,

and then contacted the Institutes. with each passing day. Clients

Business Support Services and our

I liked the fact that CPA is an Irish need access to a wide range of

Financial Planning teams.

organisation, it felt more local, expertise to help them to optimise

and the people I talked with in the their businesses and achieve their

Our people are totally committed to

Institute were warm and welcoming. potential. Our profession is changing

helping our clients to achieve their

CPA felt like the right fit for me. fast. The ability to identify and

potential and build sound financial

understand client issues/problems

futures. We are training, retaining and

Please provide a brief history of or opportunities and engage experts

recruiting fantastic people across

your career. when needed is the most important

the business. No single achievement

and valuable skill that accountants

I qualified in 2005, having trained stands out, we are working all the

bring to their clients. The numbers

in ifac’s Carlow office and an time to do more for our clients and

are important, advice around the

accounting firm in Kildare. I was teams across the country, and that

numbers is where we add value.

appointed Managing Partner of our philosophy is paying dividends as our

Tullamore office in August 2005. busi-ness continues to grow.

How do you unwind?

I held that role for almost seven

years before being appointed What or who inspires you most in I spend time with my wife Lorraine

ifac Commercial Manager. Our business? and daughters Aoife, Neasa and

Commercial Manager role is focused Tara. They keep me on my toes and

In business, Chuck Feeney set an

on helping our practice teams in put everything in perspective. I love

amazing example and inspired a new

thirty locations across Ireland to standup comedy; I read a lot and try

wave of Philanthropy and Warren

optimise their business processes to keep fit!

Buffett is inspiring for his success and

and business development. I was

for his extraordinary com-munication

appointed ifac Chief Executive in What traits do you admire most in

skills. There are also many inspiring

2015. The work goes on… others?

people in ifac, who have faced, or

are fac-ing challenging personal Generosity, which can be underrated

How do you find your CPA

situations, we do our very best to and sometimes overlooked. If you are

qualification has helped you in

support them. giving your time, expertise or financial

your role?

support to help other people, you are

The CPA qualification and my studies If you were advising someone making a positive differ-ence in the

in Griffith College have been of just starting out with their CPA world. And of course, honesty, it’s an

huge benefit to me. Studying for the qualification, what tip would you essential ingredient in building high

qualification gave me a disciplined give them that would make their trust, high impact relationships.

Accountancy Plus March Issue 202008

Title: Director of Education

Company: CPA Ireland

CPA Profile Qualifications: CPA, MoR

Deirdre McDonnell

Why did you start out on a career One of the projects I worked on What has been your biggest career

in accountancy? during that time in CPA Ireland was achievement?

the representation of our Institute

I wasn’t 100% sure of what I wanted to This is a tough question as I qualified as

on the FEE (European Federation

do when I finished secondary school. I a CPA accountant 30 years ago exactly

of Accountants, now Accountancy

was due to start an Arts degree at UCD, this year and there have been a number

Europe) Euro Working Group, where I

and my sister who was a trainee CPA of key moments where I have really felt

served on the FEE Committee for the

accountant at the time, secured me a that I have reached my potential.

development of the new Euro Currency.

summer job in her training firm, and I

Working with global companies during

really loved the work. At the time, PA Consulting, a global

my time in PA Consulting, finding

management consulting company was

I was surprised how much I loved the myself at boardroom tables with heads

advertising for ‘Euro Experts’ to work

routine of being in an office, part of a of business for companies turning over

with their Euro Changeover projects

team, independent and earning my own billions each year, and helping these

internationally. I applied and was

money, I was sold. companies make significant changes

accepted as I had experience that very

to their operations, is definitely a high

few people had in the development of

Why did you choose CPA Ireland point, but also working with some really

this new currency.

as your qualification? amazing SME clients, has been just as

I spent 3 very happy years at PA rewarding in different ways. Speaking

My sister was already training with a Consulting, working on Euro at conferences in Europe during my

CPA practice, and she recommended Changeover and Y2K projects, involvement with FEE also stands out as

CPA to me enthusiastically as she specialising in Business Continuity one of my significant career memories.

found the support and advice from Planning. I worked all over Europe and

the Institute staff to be really useful. However, today, as I work on the

the US with multinational companies

The CPA qualification has served me development of a new syllabus for CPA

including Philips CE, Vendome Luxury

very well, especially when I worked on Ireland to educate future fit finance

Group, Willis Plc, amazing experience

projects in the States later in my career. professionals in a rapidly changing

and I will remember it always.

CPA was immediately recognised in environment and see my team

the boardroom and clients were always When I was expecting my first child, transforming our examination system

happy to be dealing with the CPA I knew I couldn’t continue with the to become fully online, including online

designation. weekly international travel, and I set up invigilation, I realise that some of the

my own consulting firm. I wanted to biggest career achievements may still

get more freedom from the corporate be ahead of me.

Please provide a history of your

world, to spend more time with my

career.

family, so I made a decision to bring What do you think are the most

Having spent 3 years in practice with my skills from working with global pressing issues for accountants?

Gavin & Co, I moved into the advertising companies to SMEs in Ireland.

industry as financial controller of All There is no doubt in my mind that big

I worked on many projects over the data and the emerging very disruptive

Ireland Media, which was later bought

years with CPA Ireland in a consulting technologies that are enveloping

out by Carat, a global advertising group.

capacity. When the previous Director the profession, will challenge all

My 5 years in this role were hugely

of Education, Paul Heaney announced accountants and their role in adding

enjoyable, it was a very dynamic time

his retirement, I was approached to value. Unless we become comfortable

in the ad industry in Ireland. In the late

see if I would be interested in the role, with the advance of these technologies

80s early 90s, it was the steadiness

and following much consideration, I and understand the source and

of accounting with the glamour of

realised that my CPA qualification, my composition of the data, we will be

advertising.

understanding of the requirements of prisoners to the data analysts and our

I did however feel like I needed a the market in relation to newly qualified ability to make meaningful contribution

change, and when an opportunity accountants and the wonderful network will be threatened. Our syllabus review

came up to join CPA Ireland in 1996 of academic support surrounding the has demonstrated that while we must

as Director of Member Services, I role at CPA, I took it on and have not still be experts in our core accounting,

joined Eamonn Siggins and his team looked back. finance, tax and auditing disciplines,

at Ely Place and spent 5 great years we must also be data analysts, artificial

learning new skills and developing the intelligence specialists and pioneers

management and creative side of my of future developments such as

skillset. continuous audit and blockchain.

Accountancy Plus March Issue 202009

Snapshot of IAASA’s

Financial Reporting News

Financial Reporting News

FINANCIAL REPORTING

financial reporting

activities in 2019

IAASA has recently published

European Union (Qualifying accounting records (S281 to S286), summary information of its

share capital (S318 and S319), the financial reporting enforcement

Partnership, Accounts and activities undertaken during 2019.

statement on relevant audit information

Audit) Regulations 2019 (S325(1)(e)), circularisation of financial Source: www.iaasa.ie

statements (S338) and remuneration,

In November 2019, the European Union

appointment and removal or resignation

(Qualifying Partnership, Accounts and

of auditors (S381 to S385, S396 to S398

Audit) Regulations 2019 (S.I. 597/2019)

and S401 and S402). Sustainable Development

were signed into law. These regulations

The financial statements of a qualifying Goals Disclosure (SDGD)

change the accounting and auditing

rules for ‘qualifying partnerships’ for partnership are required to include Recommendations

financial years commencing on or a Partners Report which will include

The International Federation

after 1 January 2020. For accounting similar information to that required in a

of Accountants (IFAC) recently

periods commencing prior to this date Directors Report under the Companies

published a joint report calling for

the European Communities (Accounts) Act 2014. The duties, obligations or

improved reporting on the UN’s

Regulations 1993 continue to apply. discretion imposed on the directors

sustainable development goals

and/or secretary under Part 6

The meaning of a qualifying partnership in an attempt to hit goals set for

Companies Act 2014 are deemed to be

is set out in Regulation 5 of the 2019 2030.

imposed on, or granted to, members

Regulations which outlines two types of

of a qualifying partnership by virtue of The report includes

qualifying partnership. Firstly, the new

Regulation 8. recommendations the purpose

rules apply to a general partnership,

of which are to establish a best

formed under the Partnership Act A qualifying partnership can avail of

practice for corporate reporting

1890, all the members of which are audit exemption, however an audit will

on the SDG’s and enable more

themselves limited such that the be required where one partner, serves

effective and standardised

ultimate beneficial owners of the a notice in accordance with Section

reporting and transparency on

partnership enjoy the protection of 334(1) Companies Act 2014, stating

climate change, social and other

limited liability. that the partner does not wish that

environmental impacts.

audit exemption be availed of by the

In addition, the rules also apply to

qualifying partnership for the financial Source: www.ifac.org

limited partnerships (formed under the

year specified in the notice.

Limited Partnerships Act 1907) where

the general partner(s) effectively enjoy A qualifying partnership is required,

the protection of limited liability. The by the 2019 Regulations, to file an

regulation also contains provisions annual return with the Companies

which covers certain entities not Registration Office using form P1.

governed by the law of the state which Financial Statements, a Partners Report

are similar in nature to either of the and an Auditor’s Report will be required

above. to be annexed to the annual return.

The provisions in relation to Abridged

The Regulations apply Part 6

Financial Statements also apply where

Companies Act 2014 to a qualifying

the relevant size criteria are met.

partnership as if it were a company,

subject to any modifications necessary The 2019 Regulations also impose a

to take account of the fact that the reporting obligation on auditors to

qualifying partnership is unincorporated. the ODCE, similar to that required of

Part 6 of the 2014 Act is the section that statutory auditors in relation to the

deals with Financial Statements, Annual reporting of category 1 and 2 offences

Return and Audit and sets out provisions under Section 393 Companies Act

on, inter alia, the preparation of financial 2014. Regulation 42 sets out the

statements, disclosures including offences that can be committed by a

directors’ remuneration, audit, audit qualifying partnership. The offences,

exemption, annual returns, appointment which if committed, are required to be

and removal of statutory auditors and reported to the ODCE by an auditor of

offences. a qualifying partnership are set out in

Regulation 31.

Regulation 15 dis-applies a number of

Sections of Part 6 including provisions

relating to the keeping of adequate

Accountancy Plus March Issue 202010

International peer review finds Central Bank

is effectively regulating credit union sector

Law & Regulation News The Central Bank of Ireland recently published the “Peer

Review: Central Bank of Ireland’s Performance of its

Regulatory Functions in Relation to Credit Unions”. The

review, undertaken by an external and experienced team

AML update of regulatory experts from the International Credit Union

Regulators’ Network (ICURN) found that the Central

The European Union (Money Laundering and Terrorist Bank effectively performs its functions in the regulation

Financing) Regulations 2019 were signed by the and supervision of the credit union sector. It was also

Minister and became effective from 18th November highlighted in the review that significant improvements

2019. The regulations amend the Criminal Justice had been made since the previous review in 2015.

(Money Laundering and Terrorist Financing) Act 2010

Source: www.centralbank.ie

(the Act).

One of the key changes for accounting firms is the new

requirement to have in place “appropriate procedures” ESMA sets out its strategy on sustainable finance

for employees, or persons in a comparable position to The European Securities and Markets Authority (ESMA)

report a contravention of the Act internally within the published its Strategy on Sustainable Finance. The strategy

firm through a specific, independent and anonymous sets out how ESMA will place sustainability at the core of its

channel. These procedures should be proportionate to activities by embedding environmental, social and Governance

the size of the firm. (ESG) factors in its work.

The key priorities for ESMA highlighted in the strategy include:

Practitioners will need to consider how this can be

provided for within their firm. Firms should now update • completing the regulatory framework on transparency

their policies and procedures in this regard and provide obligations via the Disclosures Regulation. ESMA will

work with the EBA and EIOPA to produce joint technical

the appropriate training to staff.

standards;

The regulations require competent authorities, which • reporting on trends, risks and vulnerabilities (TRV) of

includes CPA Ireland, to apply a risk-based approach sustainable finance by including a dedicated chapter in its

to the exercise of its supervisory functions and to TRV Report, including indicators related to green bonds,

provide access to its employees and officers to relevant ESG investing, and emission allowance trading;

information on the domestic and international risks of • using the data at its disposal to analyse financial risks from

money laundering and terrorist financing which affect climate change, including potentially climate-related stress

its own sector. testing in different market segments;

• pursuing convergence of national supervisory practices

It also requires that competent authorities take on ESG factors with a focus on mitigating the risk of

measures to prevent a person convicted of a relevant greenwashing, preventing mis-selling practices, and

offence from performing a management function in or fostering transparency and reliability in the reporting of non-

being the beneficial owners of an accountancy firm. financial information;

• participating in the EU Platform on Sustainable Finance that

Practitioners operating within CPA firms and beneficial will develop and maintain the EU taxonomy and monitor

owners of such firms are now required to inform CPA capital flows to sustainable finance; and

Ireland if they are convicted of a relevant offence. • ensuring ESG guidelines are adhered to in the entities that

ESMA supervises directly, while being ready to accept any

A “relevant offence” means –

new supervisory mandates related to sustainable finance.

(a) an offence under this Act, ESMA’s work spans the investment chain from issuer to

investment funds, investment firms and retail investors. It has

(b) an offence specified in Schedule 1 to the Criminal already delivered on several objectives of the EU’s action plan

Justice Act 2011 , or on financing sustainable growth and will continue to assist the

EU institutions to achieve sustainable finance goals, including

(c) an offence under the law of a place (other than the by providing advice on areas where new Level 1 and Level 2

State), consisting of an act or omission that, if done or measures may be necessary.

omitted to be done in the State, would, under the law

To help deliver its strategy ESMA set up a Coordination

of the State, constitute an offence under subsections

Network on Sustainability in 2019. The network is composed

(a) or (b)

of experts from national competent authorities and ESMA

staff. It will be supported by a consultative working group of

Source: www.irishstatutebook.ie

stakeholders, which will be established in the coming months.

Source: www.esma.europa.eu

Accountancy Plus March Issue 2020CPD Requirements for the 2020 - 2022 Cycle

Members working in Practice:

The CPD requirement for the CPD cycle is 75 structured and 45 unstructured hours.

The minimum hours in any one year is 30 hours, of which 15 have to be structured.

By the end of 2022, you will need to make sure that you have completed

the full requirement of 75 structured and 45 unstructured hours.

If you are a practicing cert holder, a minimum of 40 out of your 75 structured hours

have to be completed in the core hours.

Members working in Industry:

The CPD requirement for the CPD cycle is 60 structured and 60 unstructured hours.

The minimum hours in any one year is 20 hours, of which 10 have to be structured.

By the end of 2022, you will need to make sure that you have completed

the full requirement of 60 structured and 60 unstructured hours.

If you have any queries on your CPD requirement,

please contact Niamh Sheehan on nsheehan@cpaireland.ie12

Is Irish employment law

keeping up with the gig

economy?

By Derek McKay

Much has been made about the protection of gig economy

workers but what should companies using self-employed

contractors be doing to protect themselves?

Since the emergence of the “gig penalise those involved in bogus • Their work cannot be sub-

economy” over a decade ago, there self-employment, where employers contracted to another individual.

has been a lot of debate about the are wrongly classifying workers as

• The person does not supply

evolution of work and how it will self-employed rather than direct

materials for the job or the

continue to change into the future. employees, thus avoiding or evading

necessary equipment to do the job

There is a clear reality that certain their obligations, including tax and

other than the small tools of the

types of jobs and roles are changing PRSI.

trade.

and with the introduction of new

In October 2019, the Oireachtas

technology platforms, such as Uber • They are not exposed to personal

Committee on Employment Affairs

and Deliveroo, we are seeing the financial risk in carrying out the

and Social Protection heard that

creation of roles that were never work.

bogus self-employment could be

there previously.

costing the Irish State €1 billion each • Does not assume any responsibility

Despite concerns that there would year in lost tax and PRSI2, which for investment and management in

be a surge in those working in the gig results in savings of up to 30% for the business.

economy, the numbers are relatively the employer and a loss to the Social

• They do not have the opportunity

low and have not shown signs of Insurance Fund. Trade Unions have

to profit from sound management

dramatic increases. In 2018, the also described the situation as a

in the scheduling of engagements

Workplace Relations Commission massive fraud being perpetrated

or in the performance of tasks

sponsored a report by the Economic against the State.

arising from the engagements.

and Social Research Institute that put

the figure at between 8 and 9%1.

Employed or self-employed… • The individual receives expense

or bogus self-employed? payments to cover subsistence

The informal structure of this type

As it stands there are only two and/or travel expenses.

of employment suits many people.

The general consensus is that those classifications of employment status • They are entitled to extra pay or

working in the gig economy do so – employed or self-employed. To time off for overtime.

out of choice rather than necessity. help provide some guidance and

clarity, the Revenue Commissioners And, the criteria set out by Revenue

The ability to choose when you

published its Code of Practice for on whether an individual is self-

want to work and for how long, suits

Determining Employment or Self- employed include:

some peoples’ lifestyles, especially

students or those looking to make Employment Status of Individuals. • The individual owns their business.

some additional income. But there The criteria set out to identify if an

individual is an employee includes: • They are exposed to financial

is a trade-off; with this flexibility

risk by having to bear the cost of

comes a lack of security and benefits • That the individual is under the correcting faulty or substandard

for employees. And for employers, control of another person who work carried out under the

there can be some unintended directs as to how, when and where contract.

consequences as well. the work is to be carried out.

• They assume responsibility for

One thing is for certain, employment • The individual receives a fixed investment and management in the

relationships will continue to evolve wage and works set hours or a enterprise.

and be challenged particularly given given number of hours per week or

the Government’s aim to heavily month. • The individual has the opportunity

1 “Measuring Contingent Employment in Ireland”, ESRI, August 2018.

2 “Bogus Self-Employment Presentation to the Social Welfare Committee”, Martin McMahon, October 2019.

Accountancy Plus March Issue 202013

to profit from sound management own tax deductions. The company contracts with any self-employed

in the scheduling and performance argues that the Commissioner’s contractors they may be working

Is Irish employment law keeping up with the gig economy? by Derek McKay

LAW & REGULATION

of engagements and tasks. reliance on a UK case (Weight with.

Watchers v Revenue and Customs

• Has control over what is done, how For example, an individual who is

Commissioners, 2011) was wrong

it is done, when and where it is working on the basis of commission

and that the Commissioner failed to

done and whether he or she does it may still be regarded as an employee,

follow Irish law in relation to mutuality

personally. even if they are not working from the

of obligation and also failed to give

employer’s premises – there is clearly

• Has the freedom to hire other proper consideration to the terms

a Mutual Obligation in this situation.

people, on his or her terms, to do and conditions of the contract with

the work which has been agreed to the driver. Or if the self-employed contractor

be undertaken. is required to use company branded

Mutuality of Obligation exists

materials or equipment in the process

• They can provide the same services where an employer is obliged to

of completing their work, they may

to more than one person or provide work for an employee

be considered employees – the

business at the same time. and the employee is obliged to

company is providing direction

perform or fulfil that work as would

• They provide the materials and on how the person should be

be considered normal employer/

equipment necessary for the job, completing their task.

employee relationship.

other than the small tools of the

trade. The Commissioners had argued that

Employers beware – if in

the contract required the driver to doubt, review contracts and

• Has a fixed place of business where

initiate an agreement in relation to get advice

materials and equipment can be

availability to work. When confirmed,

stored. The gig economy, contractors, self-

a roster was then drawn up based on

employed workers, agency workers

• They are responsible for costing this availability and it found that once

– all these categories of workers bring

and agreeing a price for the job. a driver was rostered for one or more

about questions for Companies about

shifts, there was then a contract of

• They are responsible for providing how they manage these workers and

“mutual obligation”.

their own insurance cover e.g. remain compliant.

public liability cover, etc. The High Court agreed, finding

Until such time as Irish legislation has

that the contracts operated by

• And, they control the hours of work caught up with the changing face

Domino’s Pizza included Mutuality

in fulfilling the job obligations. of work, our advice for employers is

of Obligation; once a driver was

assess their contracts and working

These guidelines are pretty rostered by the company, there

relationships with individuals through

straightforward and self-explanatory was a contract that retained mutual

the lens of being compliant with

and, if necessary, all easy to obligations.

both Revenue and the Employment

demonstrate. However, there are

Interestingly, in the UK, a trade Fora such as the Workplace Relations

circumstances where it isn’t always

union failed in its High Court bid Commission.

clean-cut. Our advice is Employer

to represent and lobby Deliveroo,

Beware.

the popular food delivery platform,

High Court rules delivery on behalf of its riders on pay and

drivers are employees conditions. The High Court case

came on the back of an appeal of a

In December 2019, the High Court decision by the Central Arbitration

ruled that delivery drivers for a Committee, which has previously

company in the Domino’s Pizza found that riders could not be

franchise are to be treated as recognised for collective bargaining

PAYE employees. The ruling came because they were not classed as

following an appeal by the pizza “workers”. Because riders could freely

company against the Tax Appeals pass jobs to other people to do on

Commissioner’s finding, which found their behalf, they couldn’t be classed

that its drivers working in 2010/11 Derek McKay

as employees.

under contracts “of” service were

taxable workers paying PAYE and Review and analyse Derek McKay is Managing Director at

national insurance. employment contracts Adare Human Resource Management.

Adare Human Resource Management

Karshan (Midlands) Ltd., t/a Domino’s While the Domino’s Pizza example is a team of expert-led Employment

Pizza had argued that the drivers is specific to the contracts operated Law, Industrial Relations and best

operated under contracts “for” by the company and their delivery practice Human Resource Management

services, were therefore self- drivers, employers should take note consultants.

employed and responsible for their of the findings and assess their own

For more information go to

www.adarehrm.ie

Accountancy Plus March Issue 202014

Finance & Assessment of the economic impacts arising

for Ireland from the potential future trading

Management relationship between the EU and UK.

News The Minister for Business, Enterprise and Innovation has published

a study commissioned by her Department, examining the

economic impact on Ireland of a potential EU-UK free trade

agreement.

Investors call for

The report, which was undertaken by Copenhagen Economics,

improved workforce reflects the trade provisions of the Revised Political Declaration

reporting for the Future Relationship between the EU and the UK. The

Political Declaration sets out the intent of both the EU and UK to

A new report issued by the

negotiate a comprehensive Free Trade Agreement to replace the

Financial Reporting Council’s

Financial Reporting Lab concludes current economic relationship. At this point, it represents the best

that reporting on workforce related indication of what a future EU-UK FTA will look like.

issues needs to improve both to Previous analysis published by the Department in 2018 found that

meet investor needs and to reflect the economic impact on Ireland of a worst-case Brexit scenario

modern-day workforces. - trading with the UK based on World Trade Organisation (WTO)

Workforce related matters such rules - would reduce Ireland’s projected annual growth rate and

as working conditions, changing result in GDP being approximately 7% lower in 2030 (i.e. the

contractual arrangements and economy would still grow albeit at a slower rate).

automation have all become areas

Taking the parameters of the revised Political Declaration, this

of increasing investor focus in

study points to a reduction in GDP of between 3.2% and 3.9%

recent years and the lab’s report

in 2030. Effectively this reduces the level of harm on the Irish

reveals overwhelming support for

economy by half.

clearer company disclosures.

While this latest study assesses the specific impact of moving to a

The report provides practical

guidance and examples on how new EU-UK FTA, in reality, the Government and firms have been

companies can provide improved engaged in intensive Brexit preparations which, taken together

information to investors. It with new opportunities under recent EU FTAs (e.g. South Korea,

encourages companies to think Canada, Mexico and Japan), have the potential to significantly

of the workforce as a strategic mitigate the impacts of the changed EU-UK relationship.

asset and explain how it is invested For further information and to read the report please visit

in, underpinned by data on the

composition, engagement, https://dbei.gov.ie/en/Publications/Assessment-economic-

retention and diversity of the impacts-Ireland-potential-future-trading-relationship-EU-UK.html

workforce.

Source www.dbei.gov.ie

Source: www.frc.org.uk

Accountancy Plus March Issue 202015

Paul has operated at an

executive level in commercial

Leadership Insight

Leadership Insight by Paul Healy

FINANCE & MANAGEMENT

environments for over 20

years. His broad areas of

expertise include: Education

by Paul Healy Chief Executive Skillnet Ireland

and Labour, Market

Policy, Human Resource

Development, Public Affairs

and Corporate Governance.

Please provide a brief history of our organisation substantially since To remain competitive, we must

your career. 2016, investing €140million in boost the other pillars of Ireland’s FDI

I spent the first 10 years of my career Ireland’s workforce during this period, proposition, particularly talent. The

in financial services, in sales and sales and delivering some of the most issue of small and medium enterprise

leadership positions. The experience innovative workforce development (SME) productivity is also a growing

of being a Financial Advisor at the initiatives ever seen in Ireland. priority area with several national

age of 22 was a positive one for and international reports expressing

me, setting the basis for sound Can you give some insight as concern around the productivity

commercial awareness, customer to what the catalyst was for this levels within our indigenous SMEs.

service and self-discipline. I went on change? Finally, to the most pressing issue

to manage a business for Bank of When you think about it, of our time; climate change and

Ireland, before switching to a career technological advances, globalisation, the implications for businesses and

in HR, a discipline I worked hard to climate action and an array of workers as Ireland transitions to a

master and served in a number of competitive forces are combining low carbon and environmentally

senior HR management positions to disrupt the workplace to an sustainable economy.

through my career. I also ran my own extent that is unprecedented in

For our businesses and workers to

business for a time and developed a history. Powered by AI, we are

adapt to this new world, and for

career in academia, all before taking seeing technology performing ever

our enterprise base to thrive and to

up my current position as Chief more complex tasks that were once

prosper, a major shift in the intensity

Executive of Skillnet Ireland. thought to be the sole domain of

of talent development and upskilling

humans. Some jobs are disappearing

You joined Skillnet Ireland as is now urgently needed. The work of

entirely, but new technologies are

Skillnet Ireland is deeply rooted in all

Chief Executive in 2016 and also unlocking enormous potential

of these challenges and they serve as

since this time, the structure of within businesses, bringing new

a catalyst for ongoing change in our

and messaging from Skillnet jobs, many of which never existed

organisation.

Ireland has changed. Were you previously. We are also seeing the

brought into Skillnet Ireland to very nature of employment itself What were the biggest

bring about this change or was being redefined, with the rise of the challenges in implementing

this something you instigated? gig economy, portfolio careers, virtual the changes and how did you

Probably a bit of both. Skillnet and remote working, and extended overcome these challenges?

Ireland is a unique organisation in so working lives.

A challenge for a comparatively

many ways. We sit neatly between small Government agency is to

Turning specifically to Ireland, there

industry and Government, leading a make your voice heard. In many

are multiple challenges now facing

partnership of 70 enterprise bodies, ways I am fortunate in this regard

businesses here, not least of which

providing talent development and because Skillnet Ireland has such a

are the complexities arising from

upskilling to 15,000 businesses and powerful story to tell. The agency has

Brexit. As our labour market continues

60,000 workers throughout the been recognised as an international

to tighten, businesses are confronted

country every year. What attracted best-practice model by the EU

with acute skills shortages in ICT,

me to the role was the immense Commission, the OECD and the ILO,

engineering, science, construction,

pent-up potential of a Government among others.

healthcare and financial services

agency that puts businesses in

among others.

control of the process, and one that Yet, that message hasn’t always cut

fosters a networked approach that Ireland’s foreign direct investment through to the domestic audience.

leverages Ireland’s open culture of (FDI) model has never been in For us, the job of good ‘storytelling’

collaboration. a position of greater challenge. is vital as each year we must

The trend over recent years is for successfully navigate an intensely

Working in deep collaboration with countries to reduce their headline competitive funding process.

our industry partners, including corporation tax rates.

CPA Ireland, we have developed

Accountancy Plus March Issue 2020You can also read