Is the most transformative perspective the one you don't have? - Excellence in Integrated Reporting 2021

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Is the most

transformative

perspective the one

you don’t have?

Excellence in Integrated Reporting 2021Purpose of the 2021 EY Excellence in Integrated Reporting survey Virtual workshop

The purpose of the survey is to encourage and benchmark standards of excellence in the quality of The Excellence in Integrated Reporting workshop will

integrated reporting to investors and other stakeholders in South Africa’s listed company sector. be held as a virtual event this year, due to the social

distancing regulations in place. During the workshop

Over the years it became clear that financial Contact we will:

statements on their own did not tell the whole For more information on this survey, contact

story of a company’s performance. Companies Larissa Clark, IFRS Desk Leader, EY Africa at • Provide an overview of the 2021 EY Excellence in

therefore started reporting on their environmental larissa.clark@za.ey.com. Integrated Reporting survey results;

impacts, employee-related issues and corporate

social responsibility issues in a separate report Disclaimer • Discuss positive and negative trends in integrated

often referred to as a sustainability report, which The survey findings and rankings of the reporting;

accompanies the financial information distributed integrated reports have been independently

to shareholders. prepared by the three adjudicators with • Highlight examples of leading practice, to assist

affiliations to the University of Cape Town companies to prepare their next integrated report;

Since 2010, all companies listed on the (UCT), comprising Professors Alexandra Watson

Johannesburg Stock Exchange (JSE) have been (Emeritus Professor), Goolam Modack (College of • Reflect on how companies should deal with the on-

required to produce an integrated report in line Accounting) and Mark Graham (Graduate School going socio-economic effects of COVID-19 and the

with King III. This requirement has been carried of Business). Accordingly, the survey findings and recent unrest in SA in their integrated reports; and

forward to King IV, effective for financial years ranking of the integrated reports are the views of

commencing on or after 1 April 2017. In addition, the adjudicators. • Consider the requirements of the revised

the JSE requires application and disclosure of International Framework, published in 2021.

King IV in any report lodged with them after The other material has been prepared for general

1 October 2017. information purposes only and is not intended Date: Wednesday 29 September 2021 at 3pm with

to be relied on as accounting, tax or other a replay on Tuesday 5 October at 10am.

EY has been commissioning the Excellence in professional advice. Please refer to your advisors

Integrated Reporting survey for the last ten years for specific advice. Please contact eyreportingupdates@za.ey.com

in order to encourage excellence in the quality

of integrated reporting to investors and other For more information please visit: ey.com/en_za

stakeholders by South Africa’s top companies. Follow us on Twitter: @EY_Africa

B | Excellence in Integrated Reporting 2021Excellence in Integrated

Reporting 2020

ica

k Y Afr

ar , E

Cl ader

issa Le

Lar Desk

R S

IF

ica

Afr

EY

cer,

ita tive Offi

nS u

Aje f Exec

hie

C

Ltd

up

nk Gro

a

edb

e fric

a

e ions, N

oan r, EY A i t

ts isag Rela

n N eade ed V estor

phe L lfr

A d In v

Ste rance

Assu Hea

ss,

Busine

of

ool

te Sch

ua

rad

ham ssor, G n

ra rofe w

rk G P e To

Ma ciate of Cap

o

Ass ersity

v

Uni

Ltd

n Ore

a Ir

o erts

mb Rob ted

zarura cer, Ku g h

Lei Integra ica

a fi

ll M l Of cer, uth A

fr

hwe ncia ffi

Bot f Fina tive O of So

e u e

Chi xec mitte

ef E m

Chi ing Co

ort

C Rep 2021

| Excellence in Integrated Reportinge er

at th emb

n ducation ment; M

ley E e

la K utive anag

Nico of Exec ool of M k-tank

n ch in

Dea rdam S lobal th

e G

Rott Q, EY’s

of EY

d

E Lt

rie ficer, JS

Fou f

ve O

Leila Executi

ief

Ch

ts

arke

lobal M

G

r, EY

ecto

Jaggi ghts Dir

tam si

Gau lobal In

s

G

r

EYQ

ties

Ltd

inn e

W

Proper

20

ne

edefi

er, R

20

ok ffic

K lO

Leon Financia

f

Chie

D | Excellence in Integrated Reporting 2021Contents

Contents

02 Introduction 14 Top 10 companies

03 Leading with purpose – Reset for growth 17 Overall impressions at a glance

04 Reimagining a purpose-led growth 19 2021 Adjudicators’ observations and

strategy overall performance

06 Integrated reporting – time to refocus? 23 The mark plan at a glance

08 Towards international sustainability 24 The mark plan and adjudication process

standards

26 About the adjudicators

10 10 Years of integrated reporting in

South Africa

27 How can EY help?

12 2021 Rankings

1 | Excellence in Integrated Reporting 2021Introduction

2020 will always be remembered as the year that brought us opportunity to revisit their strategies, to create sustainable We are joined on this critical journey by the University of

the COVID-19 pandemic. Office based employees were turned and long-term value. We explore the five critical ingredients in Cape Town’s College of Accounting, as we track and evaluate

into Zoom and MS Teams experts overnight as gatherings formulating a purpose-led, long-term value strategy (page 4). the efforts by the Top 100 JSE listed companies to explain

were halted, international supply chains were disrupted, the value that they create over the short, medium and

This has not only been a year of unprecedented economic

and international travel was restricted. As the COVID-19 long-term. This survey is made possible by the continued

uncertainty due to the pandemic and the recent South African

pandemic spread to all corners of the world, our companies, involvement and dedicated efforts of Professors Alex Watson,

civil unrest; we have also seen unprecedented developments

industries and wider economy were severely impacted. It was Mark Graham and Goolam Modack, the panel of independent

on the reporting front. In April 2021, the Trustees of the

challenging for most companies to deal with the immediate adjudicators from the College of Accounting at the University

IFRS Foundation, the oversight body of the International

impact of the pandemic and remain resilient during this time. of Cape Town.

Accounting Standards Board (IASB), published a proposal to

2021 will be remembered as the year of the vaccine. As more amend the IFRS Foundation Constitution to accommodate It is our great pleasure to congratulate Redefine Properties

vaccines become available and vaccination rates in South the formation and operation of an International Sustainability for achieving first place in our 2021 awards. As you will read

Africa start to increase, we are optimistic that restrictions will Standards Board (ISSB). This will pave the way for a global further on in this report, the judges felt Redefine’s report

soon be lifted. In some parts of the world, people are slowly suite of sustainability standards under the banner of the is attractive, well laid out and easy to read. The strategic

returning to their offices, restrictions on travel are being lifted IASB. We have included an interview with James Luke, overview, the integrated stakeholder engagement and the

and sporting events are allowing spectators. IFRS Desk, EY Africa and member of the IASB Foundation’s use of capitals to explain the group’s value creation story are

Advisory Council, on these important developments and what examples of excellent disclosures that demonstrate integrated

2021 also brought South Africans other unique challenges

they mean for South African reporters. We have also asked thinking within the group. The section of the governance

as we saw widespread civil unrest and looting during July.

Alex Watson, Professor Emeritus, University of Cape Town, report that shows how the board considers material matters

The reactions to these events were as varied as the reasons

to share her perspective on the purpose of South African to ensure the achievement of the group’s strategic objectives

therefor. At the same time, it was a powerful reminder of the

integrated reports and whether our integrated reports are still and desired governance outcomes can be considered best

importance of building an inclusive economy and society. Ajen

fit for purpose. practice.

Sita, our Africa CEO, considers the importance of entities

having a clearly defined purpose and focussing on long-term This is the tenth year that we have commissioned the We also congratulate Nedbank Group and Kumba Iron

value creation (see page 3). Excellence in Integrated Reporting survey and awards. As we Ore on achieving second and third place respectively. Our

reflect on this important milestone, we have included some congratulations are extended to all the entities included in

Adversity, such as what South African companies have had

comments on the journey so far and the trends that we have the Top 10 for their outstanding reports. We commend the

to deal with over the past 2 years, creates an opportunity to

seen (see page 10). We believe that in times of unprecedented entities that achieved the rankings of “Excellent” and “Good”

revisit and reimagine our business strategies. As economies

economic uncertainty it is more important than ever to for their efforts and the examples they have set.

start to open up again and business can operate in a manner

encourage companies to report in a transparent and balanced

similar to that of the pre-pandemic era, it is important to For more details on how the companies were selected, the

way. EY is committed to continue the quest for excellence in

recognise that a growth strategy cannot be based on the mark plan and the adjudicators, please refer to page 23.

integrated reporting. We hope that companies will be both

same assumptions and principles as before. It will not be a

inspired and encouraged by those who have set the bar high

return to business as it once was. Businesses should use this

to improve the quality of their integrated reports.

2 | Excellence in Integrated Reporting 2021Embracing uncertainty

Leading with purpose – Reset for growth

As the business environment around the world evolved during the pandemic, so well as their positioning. An increasingly informed group of consumers, customers

have CEO priorities and the need for leaders to initiate a strategic reset. To put their and stakeholders know the type of organisations they want to associate with

businesses back on a growth trajectory, entities need to re-evaluate their purpose. and those are purpose-led businesses who reflect strong hopes, ambitions, and

There is an ongoing shift from the view that the primary purpose of companies is to aspirations.

enhance and protect value for shareholders, to the view that corporations should

understand and address the needs of their broader stakeholders and in doing so Adversity has created opportunity. Companies need to use this opportunity to

create long-term sustainable value. evaluate, re-set and implement their strategies in double quick time. We look

forward to working with the business community and other stakeholders to create

The shift to a focus on long-term value is an important one. It is a focus away long-term value.

“

from short-term profit-making to long-term value creation. But more than that it

is a focus on creating value for customers, employees, and society as a whole and

not simply maximising shareholder’s value. It recognises that there is a disconnect

between the traditional net asset value of an entity and the value that an entity

creates which includes the non-financial metrics, such as customer relationships, Purpose helps everyone who deals with the company to

intellectual capital, and competitive advantages. There is no doubt that progress understand what the organisation actually stands for

has been made but there is more work to do. Looking at our own 2021 Excellence

in Integrated Reporting survey showed us that 48 of the 100 companies reviewed

and against, who they are, their values as well as their

have made a serious attempt at producing an integrated report that focusses on positioning.

long-term value. The other 52 have not.

So, if we are to reset our strategy, what do companies need to consider?

Companies that thrive, do so because their leaders understand that investing in

a broader set of stakeholder considerations will have a considerable impact on

their ability to attract capital; their ability to attract top talent as well as drive the

sustainability of their businesses. This is a long-term value approach to building a Ajen Sita

growth strategy. The challenge is to move beyond the short-term financial reporting Chief Executive Officer, EY Africa

bias towards drivers of long-term value.

Long term value starts with a clear sense of purpose. The formulation of an entity’s

purpose is an aspirational or unique reason for existing. Where the purpose of

an entity is clearly defined, it will meaningfully inform business decisions and

commitments. Purpose helps everyone who deals with the company to understand

what the organisation actually stands for and against, who they are, their values as

3 | Excellence in Integrated Reporting 2021Reimagining a purpose-led growth strategy

Reimagining a purpose-led growth strategy

It has been more than a year since the COVID-19 pandemic Sustainability – Sustainability is one of the defining challenges Many studies show that the desire for technological

began. South Africa and many parts of the world are still of our lifetime. It is also the innovation opportunity of a acceleration is one of the most significant drivers of

feeling the impact of the various waves and the unprecedented generation. Entities are increasingly embracing the business transformation. If businesses are to successfully harness

economic lockdown. The recent civil unrest in Kwa-Zulu Natal case for sustainability. Becoming a purpose-driven business technology at speed, they need to upskill and reskill their

and Gauteng has brought further social and economic hardship may require difficult trade-offs as long-term investments are employees. Organisations will also need to create a culture of

to many communities. The consequences of these events will prioritised over short-term profit making. agility and a transformative mindset to be able to successfully

be felt for many years to come. adopt digital transformation.

Businesses that have refocussed their purpose have

At the same time, as vaccines become more freely available experienced some important payoffs. Purpose-driven Trade – Geopolitical tensions and the uncertainty that they

and vaccination rates increase, we are starting to contemplate businesses have employees who are more engaged, committed create are forcing businesses to re-evaluate their operating

life beyond COVID-19. In some parts of the world, economies and motivated. Research has shown that businesses that models. As trade flows and patterns are changing, businesses

and businesses are opening up, people are slowly returning to both define and act with purpose outperform their peers by will need to adapt their strategies to deal with ever changing

their offices and businesses as restrictions on gatherings and 5-7%. This also provides businesses with an opportunity to and unpredictable complexities. The optimisation of supply

international travel are being lifted. differentiate their products, as customers are four times more chains will be critical, not only to ensure resilience in times

likely to buy from businesses with a strong purpose. of instability, but also from an ethical point of view due to

Even in those countries and industries where economies pressures from stakeholders. As economies around the

are beginning to rebound, the pandemic has resulted in Trust – In the post-pandemic era, trust will be a licence to world re-open at different rates, businesses with flexible

an incredibly changed business environment. This is an operate. At a time that trust in governments and institutions trade strategies will be best placed to take advantage of the

opportunity to revisit and reimagine business strategies. But is at an all-time low, the importance of building trust in an opportunities to grow.

a growth strategy in the post-pandemic era cannot be built on increasingly virtual and connected world will be critical to

the same assumptions and principles that drove results in the create long-term value. People want to trust the organisations People – Any purpose-led long-term value strategy will only

pre-pandemic era. It will not be a return to business as it once they buy from, work for and invest in. be successful where people are put front and centre of

was. Businesses should use this opportunity to revisit their everything. Businesses need the right talent to conceptualise

strategies, to create sustainable and long-term value. Technology – The pandemic has given businesses that were and execute a purpose-led strategy – a scarce resource. The

well-positioned to work remotely and function independently most advanced innovations, or cutting-edge technologies, can

In order to create this long-term value, it is important that an of a physical space, a competitive advantage. It has also fail if they lose sight of human values. Leading businesses are

entity has a clear and shared understanding of its purpose. highlighted the fact that we are capable of being far more already reimagining how their people work and where they

This is the reason a business exists – the ‘why’. Its growth flexible and able to work remotely much more extensively work, establishing a new hybrid approach to working. This

strategy should formulate how the entity’s purpose will be than what we thought possible. The pandemic has catapulted will not only manage the transition to the post-pandemic era,

achieved. There are five key elements that will need to be us into the ‘digital first’ era overnight. But the technology but also enable these businesses to allow increasingly flexible

considered in formulating a purpose-led growth strategy. revolution is only just beginning. working arrangements for their employees in the future.

Source: EY – The CEO imperative – Rebound to more sustainable growth

4 | Excellence in Integrated Reporting 2021Reimagining a purpose-led growth strategy

A purpose-led strategy is the path to long-term value in the post-COVID environment. This is

a strategy built on sustainability, trust, technology, trade and putting people at the centre of

every decision an entity makes. Now is the time to re-evaluate your purpose and strategy and

take advantage of the opportunity to reimagine these to create long-term value.

“

In order to create this long-term value, it is important

that an entity has a clear and shared understanding of

its purpose.

Stephen Ntsoane

Stephen Ntsoane Larissa Clark

Assurance Leader, EY Africa IFRS Desk Leader, EY Africa

5 | Excellence in Integrated Reporting 2021Integrated reporting – time to refocus?

Integrated reporting – time to refocus?

Ten years after the introduction of integrated reporting in South Africa, as monetary amounts, generally prepared in terms of the well documented

are our integrated reports serving their purpose and continuing to lead, and widely applied International Financial Reporting Standards (IFRS)

or at least follow, global best practice in integrated reporting? This is a and their purpose is well understood. Financial statements may include

difficult question to answer at this point when the purpose of corporate climate related issues to the extent that they create risks that for

reporting is being reconsidered, globally. As we mark ten years of example impact discount rates used for impairment calculations,

integrated reporting in South Africa, it is a good time to reflect on what provision for carbon taxes etc. Reporting is then expanded to

the purpose of integrated reporting in South Africa is and whether we include those sustainability matters that have the potential

need to refocus our efforts. to create or diminish enterprise value in the future and that

investors may factor into investor and shareholder voting

South African companies rushed into integrated reporting in 2010, whilst decisions – the enterprise value approach. Reporting can

the adoption in the rest of the world has been slower, possibly allowing then be expanded even further to include the economic,

preparers to benefit from the learnings of early adopters and developments environmental, and social impacts that are not captured by

in reporting requirements. In South Africa the purpose and consistency enterprise value. That gives rise to sustainability reporting,

of application of the International Framework has varied between which is multi-stakeholder focused and relevant for

reporting entities – 30 of the 100 reports included in this survey state that assessing sustainable development impacts.

their integrated report is aimed at a variety of stakeholders, whereas 25

of the reports state that their report is primarily aimed at the providers ‘Enterprise value reporting’ is the focus of the newly

of capital1. Recent global developments have provided more clarity on formed (June 2021) Value Reporting Foundation, which

the purpose of different types of reports, and in particular, the distinction has been formed by combining the International Integrated

between reports that focus on enterprise value as opposed to those that Reporting Council (IIRC) and the American Sustainability

focus on the enterprise’s impact on sustainable development. Both issues Accounting Standards Board (SASB). Their emphasis is on

are topical, and relevant, but they are different. A report that tries to enterprise value reporting and how it is created, preserved,

combine both, without focusing on the distinction, runs the risk of not or eroded over time. Integrated reporting is a form of

successfully serving its purpose and, unfortunately, is not uncommon in enterprise value reporting, as is evident from the focus of

South Africa. the integrated report on ‘information available to providers

of financial capital to enable a more efficient and productive

The building block approach to corporate reporting, advocated by the allocation of capital’. Similarly, the focus of the new International

International Federation of Accountants (IFAC), is useful to consider when Sustainability Standards Board will also be on enterprise value2.

assessing whether a report is achieving its purpose. The starting block is the

financial statements which include amounts that are already represented

1

Read more about the results of the survey from page 19 to 22.

2

In April 2021, the Trustees of the IFRS Foundation, the oversight body of the International Accounting Standards Board (IASB), published a proposal to amend the IFRS Foundation

Constitution to accommodate the formation and operation of an International Sustainability Standards Board (ISSB). You can read more about their proposals on page 8.

6 | Excellence in Integrated Reporting 2021Integrated reporting – time to refocus?

Sustainability reporting is the practice of disclosing A sustainability report will include all material Applying this distinction to reporting on the current

the most significant economic, environmental, impacts, with only those that are material to Covid pandemic, the most relevant aspect in an

and social impacts, and therefore the contribution enterprise value creation being included in an integrated report is to report on how an organisation

by the entity to sustainability development goals. integrated report. Globally, most companies first has demonstrated its resilience and adaptability to

The Global Reporting Initiative (GRI) Standards are prepare a sustainability report and may progress unanticipated challenges as that is relevant to future

the most widely used standards for sustainability from there to integrated or enterprise value enterprise value creation potential. In contrast, a

reporting. Individual reporting metrics from the GRI reporting, making it easier to apply the double sustainability report will include disclosures on how

standards may be appropriate for use in reporting on materiality approach. The requirement for listed an entity has supported its various stakeholders in

issues that are relevant to enterprise value that are South African companies to prepare integrated Covid times, i.e. the outward impact of your current

not covered by IFRS. reports, while many had never prepared a activities.

sustainability report, has raised the risk of preparing

A challenge, that may be greater in South Africa an integrated report that does not include all If ever there is a time to focus on the direction and

than elsewhere, is applying, and demonstrating material impacts and are not supported by the content of external reports, it is now. Challenges

its application, of the double materiality concept, necessary detailed data collation and verification in the operating context caused by the Covid

promoted by the European Commission and the processes that would have been developed to pandemic, climate and other challenges, increased

GRI. This approach is key to demonstrating the prepare sustainability reports. financial capital provider needs for relevant

completeness of the reports and to ensure that and reliable sustainability information, together

published reports achieve their purpose. First, the The other aspect to consider is whether the reports with unprecedented progress in clarifying and

reporting entity needs to consult a broad group take the appropriate point of view, or direction, of harmonizing reporting requirements are all reasons

of stakeholders to identify all matters which are reporting. A sustainability report is outward looking to reconsider whether current external reporting

material to its most significant impacts on the as it reports on the company’s impact on the world, practices are fit for purpose. In the post-pandemic

economy, environment, and people. The second level whereas an integrated report should report on the era, entities are encouraged to reflect on the

of materiality is then to identify the subset of those extent to which its external environment has an purpose of their integrated reports and whether they

issues that are material to enterprise value creation. impact on its ability to create value in the future and are achieving its intended purpose.

is therefore more inward looking and future focused.

“

Applying this distinction to reporting on the current Covid pandemic, the most

relevant aspect in an integrated report is to report on how an organisation has

demonstrated its resilience and adaptability to unanticipated challenges as that is

relevant to future enterprise value creation potential. In contrast, a sustainability

report will include disclosures on how an entity has supported its various

stakeholders in Covid times, i.e. the outward impact of your current activities. Alex Watson

Independent non-

Alex Watson

executive director;

Professor Emeritus,

University of Cape Town

7 | Excellence in Integrated Reporting 2021Towards international sustainability standards

Towards international sustainability standards

• To build on the work of existing frameworks. The Trustees

One of the consequences of the COVID-19 pandemic is the be referred to as ‘IFRS Accounting Standards’. It would seem have identified that the new board would build upon

increasing focus that non-financial information is receiving. therefore that the concept of ‘IFRS standards’ will be made up the work of the Task Force on Climate-related Financial

Investors are seeing non-financial information as a core of both ‘IFRS Accounting Standards’ and ‘IFRS Sustainability Disclosures (TCFD), as well as work by the alliance of

element in investment decisions and there is an increased Standards’. I would encourage companies to follow the leading standard-setters in sustainability reporting focused

recognition that financial reporting alone does not provide developments and understand the final constitutional changes

on enterprise value.

investors and other stakeholders with a full picture of the value of the IFRS foundation and the new standards when the ISSB

of the company. The expectation gap between the information is created. • To make use of a buildings block approach. This approach

needs of investors and the non-financial information provided

would allow the ISSB to provide a global baseline of

seems to have widened. There is a growing appetite for The Trustees have announced their views on the strategic

standards for sustainability reporting and at the same time

a formal framework for measuring and communicating direction of the new sustainability standards board. What

enhance comparability and consistency of sustainability

intangible value, in particular environmental, societal and are they currently proposing?

reporting. In addition, this will allow for flexibility in

governance risks. There have been four fundamental choices that the Trustees

coordinating with other frameworks and local regulations,

have made relating to both the scope and approach for the

accommodating a wider range of reporting requirements.

In April 2021, the Trustees of the IFRS Foundation (the new sustainability standards board, namely:

Trustees), the oversight body of the International Accounting

Standards Board (IASB), published a proposal to amend the • To establish the audience to whom the sustainability What are the requirements that Trustees consider essential

IFRS Foundation Constitution to accommodate the formation information would be targeted. The current proposals aim for the success of a sustainability standards board?

and operation of an International Sustainability Standards to focus on the information needs of investors, lenders The IFRS foundation is an independent standard-setting

Board (ISSB). This will pave the way for a global suite of and creditors with an emphasis on enterprise value, body. Therefore, the Trustees have considered the following

sustainability standards under the banner of the IASB. therefore taking a capital market approach rather than requirements to make this proposed board a success:

a multi-stakeholder approach. While this may disappoint

We have asked James Luke, IFRS Desk, EY Africa and some stakeholders, the narrower scope makes this project • A sufficient level of global support from public authorities,

member of the IFRS Foundation’s Advisory Council about more manageable and is consistent with the concepts global regulators and market stakeholders in key markets;

these important developments and what they mean for South underlying current IFRS standards.

African reporters. • Collaboration with regional initiatives to achieve global

• To meet the information needs of investors on all consistency and reduce complexity in sustainability

What is the proposed name for the new sustainability environmental, social and governance matters. This is reporting;

standards that will be issued by the ISSB? a broad mandate and climate-related matters are being

Based on the documentation released by the Trustees, the regarded as a priority as there has been clear signalling • Adequate governance structures for the board;

proposed name for the standards issued by the ISSB is ‘IFRS from both regulators and the investor community that

sustainability standards’. The Trustees have proposed that climate risk is pervasive and of importance. • Appropriate level of technical expertise for Trustees,

the standards and IFRIC interpretations issued by the IASB members and staff;

8 | Excellence in Integrated Reporting 2021Towards international sustainability standards

• Capacity to obtain financial support and to achieve the

required level of separate funding; That being said, it is very clear from discussions held by the this assessment entities would probably consider whether

Trustees and the Advisory Council that there will be a link the information they are providing meets these stakeholder

• Development of a structure and culture that seeks to build between both boards. Generally, many issues will affect both needs, whether it would require expanding their processes and

effective synergies with financial reporting; and boards and they would need to work together on solving these systems that record and analyse their non-financial metrics,

issues and setting standards. We may find that as the boards and whether these disclosures explain how the non-financial

• Ensuring the current mission and resources of the progress with their work, the management commentary information supports and enhances the value that the

Foundation are not compromised. may become the vehicle that is best suited for sustainability company creates.

disclosures that will be published by reporting entities. While

Will the composition and governance structure of the ISSB this exposure draft is being driven by the IASB, we may find Overall, I think that South African companies do have an edge

be similar to the existing requirements of the IASB? subsequent exposure drafts being issued by both boards. over other jurisdictions and internationally South Africa has

I do think that this will be monitored by the Trustees. The been considered one of the leading countries with respect

concept of sustainability is far wider than that of financial It is clear that there are currently a large number of to integrated reporting. However, I do see the playing field

reporting and you may find that the skills required on the developments in the non-financial reporting space. What starting to change and our companies may have to be agile in

board may change from time to time. This could be addressed does all this mean for South African reporters? their reconsiderations when it comes to their reporting. There

by a rotation of board members or if need be by a change of Although South African companies have prepared is no reason why South African companies cannot set the

the size of the board. sustainability reports for many years, these reports have benchmark in terms of the proposed sustainable reporting.

largely focussed on sustainable development matters. In recent

Recently, the IASB issued an IFRS Practice Statement years much more attention has been given to governance

Exposure Draft on Management Commentary1. How will related matters, as a result of the spate of governance failures

the issuance of this revised practice statement impact the we have seen in public and private companies. An area that

development of the sustainability standards? South African companies will need to focus much more on in

The practise statement exposure draft proposes a separate the future is climate-related matters and how their operations

appendix detailing the requirements and guidance about are impacting the environment. This is in line with the

intangible resources and relationships, as well as ESG international demand from both regulators and investors for

matters. The board sees the management commentary as increased climate related disclosures from companies.

an appropriate location for reporting on ESG matters and

envisages the revised practice statement being applied in We have entered a transitional phase in terms of reporting

conjunction with the sustainability reporting requirements and where investors and regulators are demanding more non-

guidance. financial information from companies. These decisions will

include an assessment of the needs of their stakeholders. In

James Luke

IFRS Desk, EY Africa

1

IFRS Practice Statement Exposure Draft ED/2021/6 Management Commentary

9 | Excellence in Integrated Reporting 202110 Years of integrated reporting in South Africa

10 Years of integrated reporting in

South Africa

Past winners

20 20 20 19 20 18 20 17 20 16 20 15 20 14 20 13

Nedbank Nedbank Nedbank Kumba Iron Kumba Iron Liberty Royal Gold Fields

Group Ltd Group Ltd Group Ltd Ore Ltd Ore Ltd Holdings Ltd Bafokeng Ltd

Platinum Ltd

In 2012 the Top 10 were not ranked.

Truworths International Ltd Liberty Holdings Ltd and Absa

has been in the Top 10 for all 10 Group Ltd (previously called

years of Excellence in Integrated Barclays Africa Group Ltd) have

Reporting, whilst Sasol Ltd has K

umba Iron Ore Ltd, Nedbank both been in the Top 10 for 6

Kumba Iron Ore Ltd and Redefine

been in the Top 10 for 9 years. Group Ltd, Standard Bank Group years.

Properties Ltd have been in the

Top 3 for 5 consecutive years, whilst Ltd and Vodacom Group Ltd have

Nedbank Group Ltd has been in the been in the Top 10 for 8 years

Top 3 for 4 consecutive years. whilst Redefine Properties Ltd

has been in the Top 10 for 7 years.

10 | Excellence in Integrated Reporting 202110 Years of integrated reporting in South Africa

10 Years of integrated reporting in

South Africa

By Mark Graham, Associate Professor, Graduate School of Business, University of Cape Town

The journey so far Positive trends over the years Progress still to be made after 10 years

• “Integrated reporting is a journey” has become • Significant improvements in the quality of (the • Insufficient

explanation of the value the

the great cliché! better) integrated reports. business wishes to create for itself and others.

• Early reports were often a sustainability report • Improved connectivity of information, • No clear identification as to whether the

combined with the annual financial statements particularly for those with a clearly articulated integrated report focus on factors that are

and some management commentary. purpose. relevant to capital providers and enterprise

value or a broader audience.

• Diversity in structure and innovation in • Better use of infographics, navigation tools and

communication seen over the years. cross references. • Not enough emphasis on strategy and value

creation.

• Ongoing struggle to strike a balance between the • Improved articulation of business models and

traditional annual report and a more forward- operating context. • Not clear what is needed to achieve strategic

looking report that emphasises strategy and value objectives.

• Better differentiation of outputs and outcomes

creation.

and more robust data. • Poor evidence of integrated thinking.

• 50% of JSE listed (top 100) companies are still

• Innovation in layout and structure. • Trade-offs between capitals not given enough

NOT (really) getting it right.

prominence.

• Greater conciseness.

• Gap widening between reports ranked as

• Not enough explanation of how the business will

‘Excellent’ and those ranked as ‘Average’ and • Greater use of websites for detailed

use its various capitals (or resources) to create

‘Progress to be made’. remuneration, sustainability, and compliance

value.

information.

• South Africa’s top reports are comparable with the

• Balance not achieved – challenges, constraints,

best in the world. • Increased usage of the UN’s Sustainable

disappointments, and negative outcomes.

Development Goals.

• Lack of explanation of how governance

structures /processes will create/preserve

value.

• No description of the process that is followed to

ensure the integrity of the information.

11 | Excellence in Integrated Reporting 20212021 Rankings

2021 Rankings

Top 10 rankings

Redefine Nedbank Kumba

with Honours with Honours with Honours

Properties Group Ltd Iron Ore

Ltd Ltd

Vodacom Truworths

Anglo American Netcare Ltd

Group Ltd International

Platinum Ltd

Ltd

Absa Group Ltd Oceana Group Standard Bank

Ltd Group Ltd

“Honours” is awarded to those high quality integrated reports, which the adjudicators believe have come closest to complying with the requirements of the Framework.

12 | Excellence in Integrated Reporting 20212021 Rankings

Excellent* Good* Average* Progress to be made*

The adjudication process

ranks entities in the

following categories:

Absa Group Ltd Adcock Ingram Holdings Ltd BHP Group plc AECI Ltd

Excellent (which Anglo American Platinum Ltd African Rainbow Minerals Ltd Bid Corporation Ltd Anheuser-Busch InBev SA/NV

includes the top Aspen Pharmacare Holdings Ltd Anglo American plc British American Tobacco plc AVI Ltd

10 positions)

Discovery Ltd AngloGold Ashanti Ltd Capital & Counties Properties plc The Bidvest Group Ltd

DRDGOLD Ltd Barloworld Ltd Clicks Group Ltd Capitec Bank Holdings Ltd

Good

Exxaro Resources Ltd Coronation Fund Managers Ltd Dis-Chem Pharmacies Ltd Cartrack Holdings Ltd

Impala Platinum Holdings Ltd Glencore plc Distell Group Holdings Ltd Compagnie Financière Richemont SA

Kumba Iron Ore Ltd Gold Fields Ltd EPP NV Globe Trade Centre SA

Average Mondi plc Growthpoint Properties Ltd Equites Property Fund Ltd Irongate Group

Nedbank Group Ltd Harmony Gold Mining Company Ltd FirstRand Ltd Italtile Ltd

Netcare Ltd JSE Ltd Fortress REIT Ltd KAP Industrial Holdings Ltd

Oceana Group Ltd Liberty Holdings Ltd Hammerson plc Lighthouse Capital Ltd

Progress to be

Omnia Holdings Ltd Life Healthcare Group Holdings Ltd Investec plc MAS Real Estate Inc

made

Pan African Resources plc Massmart Holdings Ltd Mediclinic International plc NEPI Rockcastle plc

Pick n Pay Stores Ltd Mr Price Group Ltd Momentum Metropolitan Holdings Ltd Ninety One plc

Redefine Properties Ltd MTN Group Ltd Motus Holdings Ltd PSG Group Ltd

“Excellent” and “Good” Royal Bafokeng Platinum Ltd Northam Platinum Ltd MultiChoice Group Ltd Reinet Investments SCA

are awarded to entities Sappi Ltd Old Mutual Ltd Naspers Ltd South32 Ltd

that progressively

Sasol Ltd RCL Foods Ltd Pepkor Holdings Ltd Super Group Ltd

achieve a higher level of

Sibanye Stillwater Ltd Shoprite Holdings Ltd Prosus NV Textainer Group Holdings Ltd

adherence to the spirit of

integrated reporting. Standard Bank Group Ltd The Foschini Group Ltd PSG Konsult Ltd

Telkom SA SOC Ltd Tiger Brands Ltd Quilter plc

Truworths International Ltd Transaction Capital Ltd Rand Merchant Investment Holdings

Vodacom Group Ltd Woolworths Holdings Ltd Ltd

Remgro Ltd

Resilient REIT Ltd

Sanlam Ltd

Santam Ltd

Sirius Real Estate Ltd

Stenprop Ltd

The SPAR Group Ltd

Vivo Energy plc

Vukile Property Fund Ltd

13 | Excellence in Integrated Reporting 2021Top 10 companies

Top 10 companies

By Mark Graham, Associate Professor, Graduate School of Business, University of Cape Town

Redefine Properties Ltd Nedbank Group Ltd

Redefine’s report is attractive, well laid out and easy to Nedbank’s report has a clear emphasis on value creation

read. The strategic overview, the integrated stakeholder and strategy. It commences with a section that outlines

engagement and the use of capitals to explain the group’s the group’s approach to integrated thinking, the integrated

value creation story are examples of excellent disclosures reporting process and the way in which the report is

that demonstrate integrated thinking within the group. The structured. The report itself is structured in a sensible way

section of the governance report that shows how the board that makes it easy to follow the value creation narrative. The

considers material matters to ensure the achievement of the focus of the report is on the ability of the organisation to

group’s strategic objectives and desired governance outcomes create value for its stakeholders, with an appropriate suite

can be considered best practice. The detailed reporting on of supporting documents to provide additional compliance

trade-offs provides useful insight into the tough choices facing and other information. We particularly liked the governance

the group and the thinking that lies behind their decision section of the report and the way in which it focusses on

making. The report incorporates the Sustainable Development value creation and preservation together with clear cross

Goals (SDGs) in a meaningful manner and explains how the references to where more information can be found on any

group arrived at the specific SDGs that are relevant to the issue. The discussion on strategic trade-offs and the impact

group. We particularly liked the explanation of the materiality on capitals, outcomes and KPI’s is an excellent example of

determination process and the graphic that was used to showing how strategic decisions are made in an integrated

illustrate how the group’s material matters were crystallised. way. The report handles the impact of the COVID-19

The explanation of performance against the various strategic pandemic in a thoughtful manner, particularly in the context

objectives is comprehensive and balanced. Furthermore, there of framing risk, scenario planning and the outlook for the

is a useful explanation of why each performance measure future.

is important and each measure is clearly linked to other

elements within the report.

14 | Excellence in Integrated Reporting 2021Top 10 companies

Kumba Iron Ore Ltd Anglo American Platinum Ltd

Kumba’s report has an excellent strategic focus with the appropriate amount of strategic Amplats’ report commences with a useful explanation of its approach to reporting and the

detail being provided. The report makes use of iconography to guide the reader through the principles that are applied in drafting its integrated annual report. We particularly liked the

report, whilst the report itself presents a wealth of information in a balanced, transparent, explanation of how the reporting boundary is determined by working outwards from the

and interconnected manner. The narrative is crisp and concise with good use being made core legal entity to consider risks, opportunities and outcomes associated with entities or

of appendices to present more detailed information that may be of interest to readers. We stakeholders that have a significant effect on the group’s ability to create value. The sections

particularly liked the section that outlines the group’s ability to create value over time and the that outline the group’s strategy, business model and the markets within which it operates are

way in which this is clearly framed within the context of its capitals and inputs together with the particularly helpful in setting out the context for the group’s value creation story. Furthermore,

challenges that exist in securing the necessary inputs. The explanation of the group’s strategy the roadmap that shows how the group plans to deliver on its strategy within short, medium

is clear and attention is given to explicitly outlining the short, medium and long-term strategies. and long-term time horizons is useful. The group’s risks are clearly presented, appropriately

The identification of material issues and their implications for value creation, together with integrated with strategy and illustrated with a heat map that shows the likelihood and

the group’s strategic response provides useful insight into the group’s operating context. The consequence of each risk. The reporting is balanced and the explanation of the group’s trade-

group’s opportunities are clearly presented and the way in which they are linked to the capitals offs and the way in which they are managed is excellent. Informative infographics show the

is an indication of integrated thinking within the group. economic contribution that the group makes in both South Africa and Zimbabwe.

Vodacom Group Ltd Netcare Ltd

Vodacom’s report is easy to navigate and makes excellent use of icons to link sections and Netcare’s report contains a wealth of useful information and its sensible structure makes the

guide the reader. The report is crisp, concise, attractive and easy to read. It has a strong focus report easy to navigate. The section dealing with the COVID-19 pandemic is detailed, helpful

on both strategy and value creation. We particularly liked the one-page introduction to the and appropriate, given the sector in which the group operates. We particularly liked the strong

group’s strategy that shows the linkage between strategic objectives, historic performance focus on creating measurable value for each class of stakeholder. Material matters are linked

and medium-term goals, this provides a good introduction to the more comprehensive detail to stakeholder concerns and strategic pillars and clearly separated into immediate and ongoing

that follows. The disclosures, within the explanation of the group’s business model, of the priorities. The way in which strategy progress against each of the strategic pillars is reported

investments made in various resources and relationships to sustain value are useful. The and linked to remuneration is excellent. Good use is made of icons to distinguish between

sections that outline how the group is responding to its external operating environment and to positive, negative or neutral outcomes in both the current year and in the future. The linkage

stakeholder ‘hot topics’ are excellent. The report clearly shows how the group’s ability to deliver to the operating environment, the group’s response, and related risks with extensive cross

value depends on the contribution and activities of a range of stakeholders. In addition to referencing to where more detail can be found gives a clear insight into the agility and resilience

comprehensive disclosure of material stakeholder issues, an internal assessment of the quality of the organisation. The detail provided on each of the group’s capitals, especially relationship

of the relationship with each stakeholder group is also provided. The governance disclosures capital, is comprehensive and clearly explains how sustainable value will be created.

are enhanced by detailing the Board’s key focus areas and showing how these are linked to the

group’s risk and strategy.

15 | Excellence in Integrated Reporting 2021Top 10 companies

Truworths International Ltd Absa Group Ltd

Truworth’s report has a clear strategic focus with an emphasis on value creation both for itself Absa’s report commences with a detailed explanation of the materiality determination process.

and for other stakeholders, together with relevant information on how the value that is created The report focusses on value creation and contains an appropriate mix of forward-looking

is measured. We particularly liked the emphasis on providing information that is specific to information and performance disclosures. A wealth of useful, well contextualised and clearly

the group rather than mere generic or boilerplate disclosures. Furthermore, the report is easy explained data is provided within the report and we particularly liked the extensive use of cross

to navigate, avoids the use of jargon and is written using language that is clear and concise. referencing which makes the report easy to navigate. The detail provided in respect of the

Given the nature of the business, the separate identification of how the impacts of COVID-19 group’s stakeholders’ needs and expectations, that include both a strategic response to these

were managed is helpful. We particularly liked the detailed and integrated disclosure of each needs and expectations and performance measures for each stakeholder group, is excellent.

material issue that incorporates performance against objectives and targets, challenges The business model is comprehensive and the market drivers that are influencing the business

encountered, future objectives and plans, risks and opportunities as well as achieved and target model are clearly explained. The explanation of the group’s strategy is excellent and includes

key performance measures. The section that discloses how the group manages its various useful linkages to material matters, the capitals, key risks and mitigation actions as well as

stakeholder relationships is excellent. The governance section includes a useful and innovative performance against each strategic objective. The report includes a detailed explanation of the

table that unpacks board deliberations by separating key issues and routine matters by those strategic trade-offs facing the group and how these have been managed. Furthermore, the clear

that have been noted, considered, approved, authorised or resolved. identification of how the COVID-19 pandemic is impacting the group’s strategy is helpful.

Oceana Group Ltd Standard Bank Group Ltd

Oceana’s report includes a clear focus on the factors that are relevant to its future value Standard Bank’s report starts with an informative explanation of the group’s approach to

creation. The report achieves a high level of connectivity between material issues, strategic integrated thinking. The report is well laid out, with a structure that is easy to follow and

objectives, principal risks and the external environment context. We particularly liked the navigate. We particularly liked the way in which the report is focused on the group’s value

explanation of how various external issues are impacting on the group’s business model. The creation story and delivering on the group’s strategy with a suitable distinction between short,

explanation of how the group manages trade-offs to deliver long-term value is excellent and medium, and long-term strategies. The group’s five strategic value drivers provide a golden

sufficiently detailed to get a good sense of the effect of each trade-off on the various capitals thread to the narrative and help to integrate the business model, constraints, key trade-offs,

employed. The material risks are clearly presented within the report by using both inherent key priorities, oversight and strategic outcomes. The section that outlines the group’s approach

and residual risk heat maps to show the principal risks that will affect the group’s ability to to resource allocation, with its focus on balancing value outcomes, is excellent. The disclosures

create value. The group’s approach to the development of its strategy is detailed and the actual of financial outcomes and the way in which the financial statements are annotated clarifies the

strategies to achieve the various strategic objectives are comprehensively explained. The strategic progress that has been made in achieving client focus, employee engagement and

governance section is well laid out and achieves the objective of explaining how the various risk and conduct. There are extensive and useful disclosures of the group’s impacts in those

governance focus areas support the group’s strategy and contribute towards the group’s areas where it believes that it can best achieve the group’s purpose while still making a positive

governance outcomes. impact on society.

16 | Excellence in Integrated Reporting 2021Overall impressions at a glance

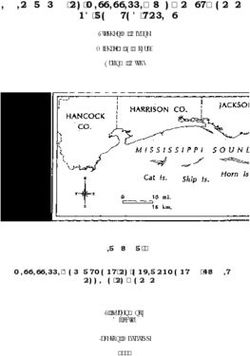

Overall impressions at a glance

Surveys

“Excellent” integrated 24 24

reports have a 2021

coherent value creation

narrative

3 Integrated reports

52 Excellent

awarded an “Honours”

consistent with 2020 Good

Average and Progress to be made

The quality of

“Excellent” and

“Good” integrated 22

reports continues to

improve

2020

Little improvement in

those integrated reports 29

ranked as “Average” or

“Progress to be made”

49

24 Companies ranked

as “Excellent”,

compared to 22 and

24 Companies

23 in 2020 and 2019

ranked as “Good”

respectively

compared to 29 23

in 2020 and 28 in

2019

2019

28

49

17 | Excellence in Integrated Reporting 2021Overall impressions at a glance

Governance disclosures integrated within Unclear distinction between short-,

the narrative on value creation medium- and long-term strategies

Remuneration disclosure being Insufficient linkage between key

linked to strategic progress and/ or performance indicators and the

other outcomes explanation of how the business is being

managed

Increased usage of the UN

Positive Negative Lack of focus on how current activities

Sustainable Development Goals

trends trends have impacted the future availability of

inputs

Generic explanations of the various trade-

Better integration of financial offs between the capitals

information with the value creation

narrative

Useful disclosure on the effects of Insufficient explanation of the value the business

the COVID-19 pandemic wishes to create for itself and others

18 | Excellence in Integrated Reporting 20212021 Adjudicators’ observations and overall performance

2021 Adjudicators’ observations and

overall performance

By Mark Graham, Associate Professor, Graduate School of Business, University of Cape Town

Companies included in the survey

Key observations

• Top 100 Johannesburg Stock Exchange (JSE) Limited listed companies

selected based on their market capitalisation as at 31 December 2020. • The

quality of “Excellent” and “Good” reports • Better

use of interactive tools to help navigate

continues to improve. within the report and to provide a link to

• Integrated report or annual report for year-ended on or before 31

additional information.

December 2020.

• Excellent reports have a clear strategic focus,

• Largest in survey: Prosus NV with a market capitalisation of R2.6 trillion. an emphasis on value creation and a high level • Improved

linkage of relevant UN Sustainable

of connectivity between the various elements Development Goals (SDGs) to strategy and

• Smallest in survey: Vukile Property Fund Ltd with a market capitalisation presented and consequently have a coherent outcomes.

of R7.6 billion.

value creation narrative.

• Increased

reporting on climate change and

• The 100 companies in the survey account for 97% of the market

capitalisation of the JSE at 31 December 2020. • Very little improvement in those reports ranked inclusion of Task-Force on Climate-related

as “Average” and “Progress to be made”. Financial Disclosures.

• Some

reports have early adopted the new 2021 • More

reports now including extracts of financial

Changes to the top 100 Framework. statements within their financial review and

• Eleven

companies that appeared in the 2020 survey are no longer using annotations to explain items within these

• Many

reports deal with COVID-19 pandemic financial statements.

regarded as being eligible as a result of falling out of the Top 100 due to

relative changes in market capitalisation or other corporate activity. issues in an integrated and sensible way.

• General

improvement in the disclosure of

• New / returning in 2021 survey: • More

reports now including an endorsement opportunities.

• Cartrack Holdings Ltd • Omnia Holdings Ltd signed by all directors.

• DRDGOLD Ltd • Pan African Resources plc • Increased reference being made to separate

• Irongate Group • Prosus NV • More companies are using a broad suite of sustainability reports.

reports to communicate compliance and

• Lighthouse Capital Ltd • Stenprop Ltd

sustainability information that previously would • Continued

improvements in the use of graphs/

• Ninety One plc • extainer Group Holdings

T

have been included in the integrated report. tables/infographics and icons to achieve

• Oceana Group Ltd Ltd

conciseness, integration, and more effective

communication.

19 | Excellence in Integrated Reporting 2021You can also read