Investor Presentation - $50M EQUITY RAISING - Comvita

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Important notice

Disclaimer and Important Notice

This presentation has been prepared by Comvita Limited (New Zealand company number 194391, (NZX:CVT)) (Company) and is dated 28 May 2020. This presentation has been prepared to provide

information in relation to the placement (Placement) and accelerated entitlement offer (Entitlement Offer) of new shares in the Company (New Shares) under clause 19 of Schedule 1 of the Financial

Markets Conduct Act 2013 (FMCA).

Information

This presentation contains summary information about the Company and its activities which is current as at the date of this presentation. The information in this presentation remains subject to

change without notice.

The information in this presentation is of a general nature and does not purport to be complete nor does it contain all the information which a prospective investor may require in evaluating a

possible investment in the Company or that would be required in a product disclosure statement under the FMCA. No information set out in this presentation will form the basis of any contract

(with the exception of the paragraph labelled “Acceptance” in this Disclaimer and Importance Notice). The historical information in this presentation is, or is based upon, information that has been

released to NZX Limited (NZX). This presentation should be read in conjunction with the Company’s annual report, market releases and other periodic and continuous disclosure announcements,

which are available at www.nzx.com/companies/CVT or https://www.comvita.co.nz/investor.

Not an offer

This presentation is not a prospectus or product disclosure statement or other offering document under New Zealand law or any other law (and will not be lodged with the Registrar of Financial

Service Providers). This presentation is for information purposes only and is not an invitation or offer of securities for subscription, purchase or sale in any jurisdiction.

Any decision to acquire New Shares should be made on the basis of the separate offer document to be lodged with NZX (Offer Document). Any Eligible Shareholder who wishes to participate in the

offer should review the Offer Document and apply in accordance with the instructions set out in the Offer Document and Entitlement and Acceptance Form accompanying the Offer Document or as

otherwise communicated to the shareholder. This presentation and the Offer Document do not constitute an offer, advertisement or invitation in any place in which, or to any person to whom, it

would not be lawful to make such an offer, advertisement or invitation. This presentation does not and will not form any part of any contract for the acquisition of New Shares.

Not financial product advice

This presentation is for information purposes only and is not financial or investment advice or a recommendation to acquire the Company’s securities, and has been prepared without taking into

account the objectives, financial situation or needs of prospective investors. Before making an investment decision, prospective investors should consider the appropriateness of the information

having regard to their own objectives, financial situation and needs and consult a financial adviser, solicitor, accountant or other professional adviser if necessary.

Investment risk

An investment in the Company’s securities is subject to investment and other known and unknown risks, some of which are beyond the control of the Company. The Company does not guarantee

any particular rate of return or its performance.

Past performance

Any past performance information given in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance. No

representations or warranties are made as to the accuracy or completeness of such information.

Future performance

This presentation includes certain “forward-looking statements” about the Company and the environment in which the Company operates, such as indications of, and guidance on, future earnings

and financial position and performance. Forward-looking information is inherently uncertain and subject to contingencies, known and unknown risks and uncertainties and other factors, many of

which are outside of the Company’s control, and may involve significant elements of subjective judgement and assumptions as to future events which may or may not be correct. A number of

important factors could cause actual results or performance to differ materially from the forward-looking statements. No assurance can be given that actual outcomes or performance will not

materially differ from the forward-looking statements. The forward-looking statements are based on information available to the Company as at the date of this presentation. Except as required by

law or regulation (including the NZX Listing Rules), the Company undertakes no obligation to provide any additional or updated information whether as a result of new information, future events or

results or otherwise.

2Important notice (continued)

Non-GAAP / IFRS financial information

Certain financial information included in this presentation is non-GAAP / non-IFRS financial information. This non-GAAP / non-IFRS financial information is not audited, and caution should be

exercised as other companies may calculate these measures differently. The non-GAAP / non-IFRS financial information includes pro forma financial information to which certain adjustments have

been made.

The Company’s financial information has been prepared in accordance with Generally Accepted Accounting Practice and is available at www.nzx.com/companies/CVT or

https://www.comvita.co.nz/investor. It complies with the New Zealand Equivalents to International Financial Reporting Standards (NZ IFRS) and other applicable Financial Reporting Standards, as

appropriate for profit oriented entities. The Company’s financial statements also comply with International Financial Reporting Standards (IFRS).

Distribution of presentation

This presentation must not be distributed in any jurisdiction to the extent that its distribution in that jurisdiction is restricted or prohibited by law or would constitute a breach by the Company of any

law. The distribution of this presentation in other jurisdictions outside New Zealand may be restricted by law, and persons into whose possession this presentation comes should observe any such

restrictions. Any failure to comply with such restrictions may violate applicable securities laws. See the “Foreign Selling Restrictions” section of this presentation. None of the Company, any person

named in this presentation or any of their affiliates accept or will have any liability to any person in relation to the distribution or possession of this presentation from or in any jurisdiction.

Not for distribution or release in the United States

This presentation is not for distribution or release in the United States. This presentation does not constitute an offer to sell, or the solicitation of an offer to buy, any securities in the United States.

The Entitlements and the New Shares have not been, and will not be, registered under the US Securities Act of 1933, as amended, or the securities laws of any state or other jurisdiction of the United

States, and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

Currency

All currency amounts in this presentation are in NZ dollars unless stated otherwise.

Disclaimer

To the maximum extent permitted by law, each of the Company, Craigs Investment Partners Limited and Forsyth Barr Group Limited (together, the Underwriters), Craigs Investment Partners Limited

and Forsyth Barr Limited (together, the Joint Lead Managers) and their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and advisers (together, the

Specified Persons) disclaim all liability and responsibility (whether in tort (including negligence) or otherwise) for any direct or indirect loss or damage which may be suffered by any person through

use of or reliance on anything contained in, or omitted from, this presentation.

None of the Underwriters, the Joint Lead Managers or any of their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and advisers have authorised,

permitted or caused the issue, submission, dispatch or provision of this presentation and none of them makes or purports to make any statement in this presentation and there is no statement in

this presentation which is based on any statement by any of them.

The Specified Persons make no representation or warranty, express or implied, as to the currency, accuracy, reliability or completeness of information in this presentation and, with regard to the

Underwriters, the Joint Lead Managers and their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and advisers, take no responsibility for any part of this

presentation, the Placement or the Entitlement Offer.

The Underwriters, the Joint Lead Managers and their respective affiliates, related bodies corporate, directors, officers, partners, employees, agents and advisers make no recommendations as to

whether you or your related parties should participate in the Placement or Entitlement Offer nor do they make any representations or warranties to you concerning the Placement or Entitlement

Offer, and you represent, warrant and agree that you have not relied on any statements made by the Underwriters, the Joint Lead Managers or their respective affiliates, related bodies corporate,

directors, officers, partners, employees, agents and advisers in relation to the Placement and Entitlement Offer and you further expressly disclaim that you are in a fiduciary relationship with any of

them.

Determination of eligibility of investors for the purposes of the Entitlement Offer is made by reference to a number of matters, including legal regimes and the discretion of the Underwriters and the

Joint Lead Managers. The Company, the Underwriters and the Joint Lead Managers disclaim all liability in respect of the exercise of that discretion to the maximum extent permitted by law.

The Company reserves the right to withdraw, or vary the timetable for the Placement and / or the Entitlement Offer without notice, subject to the NZX Listing Rules.

3Ta b l e o f

contents

• Executive Summary

• Trading Update

• Strategic Review & Business Transformation

• Offer Summary

• Key Risks

• Appendix: Foreign Selling Restrictions

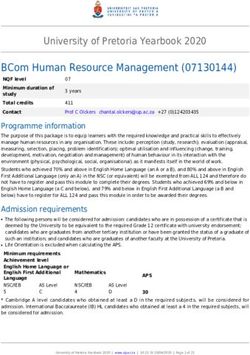

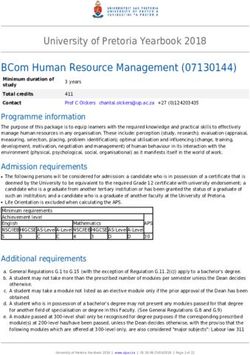

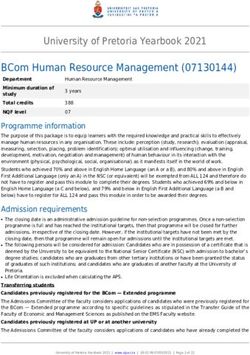

4Executive summary

• Strong trading performance year to date across most major markets with sales +7% 1 ahead of this time 12 months ago on a

like-for-like basis

• Like-for-like January to April revenue +28%1 with $ gross profit +61%1 (2HFY20 revenue expected to be +9%1 relative to

2HFY19)

CURRENT TRADING • Gross margin of 49% April YTD, an improvement of 1000 bp (10ppts) relative to FY19 YTD of 39%

• FY20 Underlying EBITDA guidance2 of approximately $17-19m

• Positive operating cash flow with net debt forecast to reduce by approximately $30m in the 6 months to June 2020 prior to

any capital raise, with $15m reduction achieved April YTD. Inventory reduced from $116m to $105m since December 2019

• Strong honey harvest season with 84% increased volume and quantity of UMF TM3 10+ up 185%

• Three point plan to stabilise performance, transform the organisation and build long term resilience and growth underway

• Focus the business on the right products, the right markets and the right channels

• Moving from a supply-focussed to a consumer-focussed organisation and undertaking relentless simplification

STRATEGIC REVIEW &

BUSINESS • Emphasizing business fundamentals, cashflow and inventory management

TRANSFORMATION • New harvest model aims to reduce volatility – harvesting business to breakeven during poor Mānuka honey harvest but

still retaining upside from good Mānuka honey harvests

• $15m business transformation programme on track (both COGS and fixed cost out) generating operating leverage and

reducing the revenue required to achieve breakeven NPAT from $16.2m to $13.5m per month

• Approximately $50m capital raise to re-set the capital structure, build resilience and enable a focus on profitable growth

• Equity raise comprises a $20m placement and an approximately $30m pro-rata accelerated non-renounceable entitlement

offer (‘Offer’). The Offer is fully underwritten by Craigs Investment Partners Limited4 and Forsyth Barr Group Limited

• All the Independent directors5 and the CEO will be supporting the offer with a minimum combined participation of $0.5m

EQUITY RAISE &

CAPITAL STRUCTURE • Following the equity raise, forecast net debt as at 30 June 2020 is expected to reduce to approximately $17m (~0.9x net

bank debt to expected FY20 Underlying EBITDA2)

• Comvita continues to be well supported by its debt provider and post capital raise has secured new debt facilities and

terms to 1 July 2022

• Comvita is targeting a long-term net bank debt level below 1.5x Underlying EBITDA2

1. Adjusts FY19 financial results to include the China Joint Venture as if the acquisition of the remaining 49% shares that Comv ita did not previously own was completed at the start of the financial year

2. Underlying EBITDA is earnings before interest tax depreciation and amortisation and excludes any non-operating and non-recurring items (of the same nature as disclosed in Comvita’s 1H20 results released on 27/2/2020). FY20

Underlying EBITDA is based on a post-IFRS-16 basis and therefore excludes lease cost from EBITDA and is a non-GAAP measure. We monitor this as a key performance indicator and believe it assists investors in assessing the

performance of the core operations of our business. FY20 Underlying EBITDA is assumed to be at the mid point of the $17 -19m range (i.e. $18m)

3. Unique Mānuka Factor

4. Neil Craig is a Director and Shareholder of Craigs Investment Partners Limited (the Underwriter) and a Director and Shareholder of Comvita Limited (the Issuer) 5

5. The independent Directors are Brett Hewlett, Lucas Bunt, Neil Craig, Sarah Kennedy, Paul Reid and Robert MajorComvita at a glance

• Natural health products company, with a focus on Mānuka honey and Propolis as

core ingredients of our products

• Long standing pioneering history, established in 1974, Co-Founder Alan Bougen

actively involved in the business as our Ambassador

• Global market leader with the #1 global brand of Mānuka honey

• Wholly owned subsidiaries in China, North America, UK, Hong Kong, Japan, S. Korea,

Australia, New Zealand enabling global execution & differentiation from competitors

at point of sale

• Vertically Integrated to capture full margin - All Comvita UMFTM Mānuka honey is

traceable ‘from the hive to the shelf’. Integrated system captures plantation, apiary, CVT to provide image of propolis

R&D, and processing data to produce UMFTM Mānuka honey of the highest quality

• Mānuka honey and Propolis products account for over 85% of sales

• Intellectual property in bee genetics , Mānuka cultivars and medical efficacy to

protect and extend leadership position

• Aiming to be Carbon Neutral by 2030. Top 10 biggest photovoltaic installation in NZ

Year to date

sales by

geography1

1) Revenue for FY20 to the end of April

2) Cross border e-commerce 6

6 6Tra d i n g u p d a t e

• Positive trading environment as consumers choose natural products that strengthen immunity, with YTD

revenue up 7% on a like-for-like1 basis and YTD gross margin up 1000bps (10 ppts) from 39%1 to 49%

• Like-for-like1 January to April revenue +28% with $ gross profit +61%. Four consecutive profitable months

with good cashflows and net debt reduction since Dec 19 of $15M. Inventory reduction of $11M

• Like-for-like1 2HFY20 revenue expected to be +9% relative to 2HFY19

• Most major markets are performing well with double digit top and bottom line growth in North America,

China, Rest of Asia and Europe. Elevated COVID-19 related sales estimated to be approximately $6-8m

largely offset by Australia and New Zealand down due to temporary closure of duty free and some retail

partners and Daigou channel not operating effectively. Hong Kong has seen sales impacted by social

unrest

• At a product level, strong performance of propolis and fresh olive leaf extract as consumers seek products

that help support immunity and high quality Comvita UMF TM Mānuka honey. Digital channel performing

well – April YTD revenue +40% PCP and gross margin materially higher than other channels

• Very strong honey harvest season with volume increased 84% and quantity of UMF TM 10+ up 185%. This

is envisaged to provide an approximate $5m cash flow benefit in FY21, with the associated margin benefit

spread across FY21 and FY22

1. Adjusts FY19 financial results to include the China Joint Venture as if the acquisition of the remaining 49% shares that Comv ita did not previously own was completed at the start of the financial year 8FY20 guidance

• Based on the business performance in the year to date and the current

trading environment, we expect the full year reported results to be:

• Record FY20 revenue of approximately $195-$199m (+14% FY19)

• FY20 Underlying EBITDA of approximately $17-19m1

• Inventory expected to reduce from $132m in FY19 to approximately

$105m in FY20

• Net Debt guidance of a reduction from $93m in December 2019 to

approximately ~$65m pre capital raise and approximately ~$17m post

capital raise as at 30 June 2020. Cash generation expected to continue to

support debt paydown in FY21

• Post capital raise $80m bank facility agreed

• Extended to 1 July 2022

• $20m term loan, $20m term revolver and $40m working capital

• FY21 business focus on mid single digit revenue growth (with incremental

revenue expected to deliver a ~20% EBITDA margin) alongside relentless

simplification and transformation delivering underlying earnings growth

partially offset by re-investment in marketing

• Marketing investment targeted in North America and China to support

our long term growth objectives.

1. Underlying EBITDA is earnings before interest tax depreciation and amortisation and excludes any non-operating and non-recurring items (of

the same nature as disclosed in Comvita’s 1H20 results released on 27/2/2020). FY20 Underlying EBITDA is based on a post-IFRS-16 basis

and therefore excludes lease cost from EBITDA and is a non-GAAP measure. We monitor this as a key performance indicator and believe it

assists investors in assessing the performance of the core operations of our business 9S TA B I L I S E P E R F O R M A N C E T R A N S F O R M O R G A N I S AT I O N BUILD LONG TERM RESILIENCE AND GROWTH

Arotahi – Our focus

Subsidiaries

Right Products

Right Markets

Vertical Integration

IMPROVED QUALITY

Consumer

Transformation / Risk reduction

$ investment in brand,

IP and science

Route to Market

= Long term profitable growth

11S ta b i l i s e p e r fo r m a n c e

• Winning in New Zealand and Australia

• NZ is our home and we must win at home. Its important that we show our

leadership in our home market

• Build distribution and brand loyalty

• Lift digital engagement and advocacy

• Getting fundamentals right

• Focus on Mānuka and Propolis products

• Joined up business planning

• Demand planning

• Cashflow

• Inventory

• Relentless simplification and focus on core

• 30% SKU reduction targeted over the next year

• Rationalising operating businesses

• Reviewing underperforming assets

12

12Tra n sfo r m e d o r ga n i s a t i o n

• Consumer centric organisation

• Focus on consumer knowhow and brand loyalty

• Penetration and Frequency of use

• Lifetime loyalty

• Clear roles defined for in-market sales & marketing and support centre

functions

• Launching new harvest model in FY21

• Designed to breakeven in a poor Mānuka honey harvest but retain upside from

good harvests

• Significantly reduce risk of future poor harvest seasons

• Continue to leverage our plantation and Mānuka IP

• New flat leadership structure

• Science at the heart

• Consumer and customer focused

• Transformation is the new norm

13

13Tra n sfo r m e d o r ga n i s a t i o n

• 3 year $15m transformation plan on track

• 300+ bps (3 ppts) improvement in gross margin targeted in FY21

• Underlying fixed cost reduction of $3.0m targeted in FY21

• Headcount reductions

• Generating long term operating leverage and enabling investment into China and

North America growth markets

• Simplified organisation

• Targeting lowest headcount level since 2011 by the end of FY21 (excluding China)

• Clear roles and responsibilities

14

14L o n g te r m r e s i l i e n c e a n d g ro w t h

• Focused growth in North America and China

• Total Addressable Market of US$1.78Bn1

• Marketing investment to drive penetration and consumption

• Digital first strategy

• Building Torontos

• Extending the Toronto model to one major city in China and one in the US

• Optimise distribution, marketing activation and digital communication to drive

household penetration with new users and consumption from existing users

• Run activity over 4-8 months with revenue per capita providing the benchmark

for progressive roll out to the next group of cities and larger geographies

• Leveraging competitive advantage

• Market leading position in China

• Technical know how and capability

• Science to support efficacy

• Quality leadership

• IP in Mānuka

• Role as category guardian

• Official sponsor of New Zealand Pavilion at World Expo Dubai

1. Source: Kantar World Panel and Statista

15L o n g te r m r e s i l i e n c e a n d g ro w t h

• Revenue required to achieve break-even NPAT reduced from $16.2m

to $13.5m per month

• Earn before we spend philosophy

• Long term business planning

• Reset of capital structure

• Support growth agenda

• Consumers and markets sole focus FY21

• Reduce leverage and increase resilience

• Deliver value to our shareholders and team

• Mānuka category 9.4% CAGR revenue growth to 20251

• Targeting 20% EBITDA margin by 2025

• Continue to invest for long term benefit

• Fix structure and ways of working that hold us back

• Build confidence with shareholders through open communication and delivery

of results

1. Source: average of Grandview Research, Cole Market Research and Hashtap Research 16EQUITY RAISING

Equity raising details

• Approximately $50 million fully underwritten equity raising, comprising:

• A $20 million institutional placement (“Placement”) to new and existing institutional investors

OFFER SIZE AND

• 1 for 4.15 pro-rata accelerated non-renounceable entitlement offer (“ANREO”) to raise approximately $30 million

STRUCTURE

• Approximately 20 million new ordinary Comvita shares (New Shares) will be issued under the equity raising

• All the Independent directors and the CEO will be supporting the offer with a minimum combined participation of $0.5 million

• $2.50 per New Share (the Offer Price), representing:

OFFER PRICE • 27% discount to TERP1 of $3.43

• 34% discount to the last closing price of $3.81 on 27 May 2020

INSTITUTIONAL • Eligible institutional shareholders will be invited to take up their entitlements in an accelerated Institutional Entitlement Offer

ENTITLEMENT OFFER • The Entitlement Offer is non-renounceable and any entitlements not taken up will lapse

• Eligible retail shareholders will be sent offer materials and invited to take up their entitlements in a Retail Entitlement Offer

• Eligible retail shareholders may also apply for additional new shares in excess of their entitlement, at the Offer Price, up to a maximum

RETAIL ENTITLEMENT of 100% over their pro-rata entitlement

OFFER • The rights will not be quoted on NZX and there will be no shortfall bookbuild for those entitlements not taken up by eligible retail

shareholders or the entitlements of ineligible retail shareholders (the Entitlement Offer is non-renounceable and any entitlements not

taken up will lapse)

RANKING • New Shares will rank equally with existing fully paid ordinary shares from date of issue

RECORD DATE • Entitlement Offer is open to existing eligible Comvita shareholders on the register as at 5.00pm NZT on 29 May 2020

• The equity raising is fully underwritten by Craigs Investment Partners Limited2 and Forsyth Barr Group Limited on customary terms for

UNDERWRITING

an offer of this nature

1. Theoretical Ex Rights Price at which Comvita’s ordinary shares would trade immediately after the ex -rights date for the Entitlement Offer. TERP is calculated with reference to Comvita’s closing

share price of NZ$3.81 on Wednesday 27 May 2020 and includes all new shares issued under the Equity Raising. TERP is a theore tical calculation only and the actual price at which Comvita’s

ordinary shares will trade immediately after the ex-rights date for the Entitlement Offer will depend on many factors and may not be equal to TERP

2. Neil Craig is a Director and Shareholder of Craigs Investment Partners Limited (the Underwriter) and a Director and Shareholder of Comvita Limited (the Issuer)

18Pro forma capital structure

• Comvita is broadly targeting a net bank debt level below 1.5x Underlying EBITDA1

• Subject to business performance, Comvita intends to resume dividends in accordance with its policy 2 in respect of the FY21 dividend

payable following year end

Sources & Uses of Funding

Sources NZ$m Uses NZ$m

New equity 50.0 Paydown of existing debt 48.2

Transaction costs and financing fees 1.8

Total Sources 50.0 Total Uses 50.0

Pro Forma Capitalisation

Net bank debt guidance (as at 30 June 2020) Pro forma net bank debt guidance (as at 30 June 2020)

Multiple of FY20F Multiple of FY20F

Limit Drawn Limit Drawn

Underlying EBITDA Underlying EBITDA

(NZ$m) (NZ$m) (NZ$m) (NZ$m)

(per guidance)1 (per guidance)1

Bank debt 100 ~73 ~4.0x 80.0 25 1.4 x

Cash on balance sheet 8 0.5x 8 0.5x

Net bank debt 100 ~65 ~3.6x 80.0 17 0.9 x

1. Underlying EBITDA is earnings before interest tax depreciation and amortisation and excludes any non -operating and non-recurring items (of the same nature as disclosed in Comvita’s 1H20 results released on

27/2/2020). FY20 Underlying EBITDA is based on a post-IFRS-16 basis and therefore excludes lease cost from EBITDA and is a non-GAAP measure. We monitor this as a key performance indicator and believe it

assists investors in assessing the performance of the core operations of our business. FY20 Underlying EBITDA is assumed to b e at the mid point of the $17-19m range (i.e. $18m)

2. Comvita’s dividend policy is to distribute dividends based on a payout ratio to a range of 25-35% of after tax operating earnings

19Equity raising timetable

Event Date

Announcement of equity raising and trading halt pre market open Thursday 28th May

Record date for the Entitlement Offer Friday 29th May

Institutional Entitlement Offer and Placement

Institutional Entitlement Offer and Placement opens Thursday 28th May

Institutional Entitlement Offer and Placement closes Thursday 28th May

Trading halt lifted and shares recommence trading on NZX on an ‘ex-entitlement’ basis Friday 29th May

Settlement on NZX, allotment and commencement of trading of new shares Wednesday, 3rd June

Retail Entitlement Offer

Retail Entitlement Offer opens Wednesday, 3rd June

Offer Document dispatched to Eligible Retail Shareholders Wednesday, 3rd June

Retail Entitlement Offer closes Friday, 12th June

Settlement on NZX, allotment and commencement of trading of new shares Friday, 19th June

These dates are subject to change and are indicative only. Comvita reserves the right to amend these timetables, subject to applicable laws and the Listing Rules.

20KEY RISKS

Key risks relating to the equity raise

This section outlines the key risks associated with the equity raising. These risks could have an effect on the performance of the Comvita share price as

well as the financial performance and earnings of Comvita. While this section sets out the key risks identified by Comvita in relation to the equity raising,

it does not (and does not purport to) outline all risks associated with an investment in Comvita shares, the future operating or financial performance of

Comvita, the equity raising or general market or industry risks. Some risks may be unknown and other risks, currently believed to be immaterial, could

turn out to be material.

In light of the COVID-19 pandemic, extra caution should be taken when assessing the risks associated with the investment. The rapidly changing COVID-

19 situation is bringing unprecedented challenges to global financial markets, and the economy as a whole. Capital markets have seen equity securities

suffer from spikes in volatility and significant price decline.

Before deciding whether to invest in Comvita shares, you must make your own assessment of the risks associated with an investment in Comvita and

consider whether such an investment is suitable for you having regard to all publicly available information (including this presentation and other

information available on the NZX website), your personal circumstances and following consultation with a financial or other professional adviser

Demand for Comvita’s Some of the recent increase in demand for Comvita’s products has been driven by an increase for health and wellness

products products as a result of COVID-19. There is a risk that this demand may not be sustained. There is also a risk that if

there is a prolonged recession consumers may reduce consumption of premium products.

Comvita considers that any drop off in demand would likely be low and the general trend of higher demand for health

and wellness products will continue. Likewise Comvita believes that there may be elevated demand for premium

quality Comvita Mānuka honey products. However if there was a sustained drop in demand for Comvita’s products or

Mānuka honey more generally, this would impact negatively on Comvita’s revenue, earnings and capital

requirements

Market access restrictions The outbreak of COVID-19 initially caused some disruption to global supply chains. Whilst Comvita was able to

manage the resulting logistical issues, there is risk that a second wave of a COVID-19 outbreak or other negative

factors may cause further disruptions which could impact Comvita’s sales in offshore markets

Comvita operates a diversified market strategy and operates a permanent establishment business model with

inventory held in market to mitigate this risk

22Key risks relating to the equity raise

Honey harvest and supply Comvita holds a strong supply of inventory to assist to meet expected sales over the next 12-24 months, has

strong relationships with suppliers and is progressing its own plantation strategy.

There remains a risk that meteorological or other factors outside of Comvita’s control may reduce supply of, or

materially increase the cost of, Mānuka honey and negatively impact Comvita’s ability to meet demand and or

reduce profitability and or negatively impact cash flow

Capital sufficiency Comvita has undertaken a capital sufficiency modelling exercise through to 30 June 2021 to assist in

determining the size of the equity raise. Comvita believes that a successful equity raise together with cost

saving initiatives and new bank facilities will provide Comvita sufficient capital to meet its requirements to

support its operations and respond to a potential downturn in the current trading environment.

The model is based on what Comvita considers to be a conservative set of assumptions however, there remains

the risk that negative impacts from global economic conditions or meteorological factors far exceed expected

levels, and cost-out assumptions cannot be met, or sales growth and increases in profitability takes longer than

expected. In the event of this scenario materialising, Comvita may have insufficient liquidity to meet capital and

operational requirements. Comvita would re-assess balance sheet strength and may seek to access additional

equity or debt funding which could have an adverse effect on Comvita and/or it’s earnings

In the event that the equity raise does not proceed, Comvita has sourced from its bank an alternative financing

package that will extend the bank facilities until July 2021. However this alternative financing package is more

restrictive and expensive through higher interest costs than the financing package that will be in place following

a successful equity raise

Operational and execution risk Comvita is undertaking a significant business and operational transformation including changing underlying

operations, reducing head count, divesting non core operations and focusing on core products

There is risk that this transformation does not go to plan (either failing to deliver the anticipated benefits or

delaying the timing of their impact) or has unintended consequences which negatively impact Comvita’s

earnings or capital requirements

23APPENDIX: FOREIGN SELLING RESTRICTIONS

Foreign selling restrictions

This document does not constitute an offer of New Shares of Comvita in any jurisdiction in which it would be unlawful. In particular, this document may not be distributed to any person,

and the New Shares may not be offered or sold, in any country outside New Zealand except to the extent permitted below..

Australia

This document and the offer of New Shares are only made available in Australia to persons to whom an offer of securities can be made without disclosure in accordance with applicable

exemptions in sections 708(8) (sophisticated investors) or 708(11) (professional investors) of the Australian Corporations Act 2001 (Cth) (the “Corporations Act”). This document is not a

prospectus, product disclosure statement or any other formal “disclosure document” for the purposes of Australian law and is not required to, and does not, contain all the information

which would be required in a "disclosure document" under Australian law. This document has not been and will not be lodged or registered with the Australian Securities & Investments

Commission or the Australian Securities Exchange and the Company is not subject to the continuous disclosure requirements that apply in Australia.

Prospective investors should not construe anything in this document as legal, business or tax advice nor as financial product advice for the purposes of Chapter 7 of the Corporations Act.

Investors in Australia should be aware that the offer of New Shares for resale in Australia within 12 months of their issue may, under section 707(3) of the Corporations Act, require

disclosure to investors under Part 6D.2 if none of the exemptions in section 708 of the Corporations Act apply to the re-sale.

Hong Kong

WARNING: This document has not been, and will not be, registered as a prospectus under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32) of Hong Kong, nor

has it been authorised by the Securities and Futures Commission in Hong Kong pursuant to the Securities and Futures Ordinance (Cap. 571) of the Laws of Hong Kong (the "SFO"). No action

has been taken in Hong Kong to authorise or register this document or to permit the distribution of this document or any documents issued in connection with it. Accordingly, the New

Shares have not been and will not be offered or sold in Hong Kong other than to "professional investors" (as defined in the SFO and any rules made under that ordinance).

No advertisement, invitation or document relating to the New Shares has been or will be issued, or has been or will be in the possession of any person for the purpose of issue, in Hong

Kong or elsewhere that is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong

Kong) other than with respect to the New Shares that are or are intended to be disposed of only to persons outside Hong Kong or only to professional investors (as defined in the SFO and

any rules made under that ordinance). No person allotted New Shares may sell, or offer to sell, such securities in circumstances that amount to an offer to the public in Hong Kong within six

months following the date of issue of such securities.

The contents of this document have not been reviewed by any Hong Kong regulatory authority. You are advised to exercise caution in relation to the offer. If you are in doubt about any of

the contents of this document, you should obtain independent professional advice.

Korea

The Company is not making any representation with respect to the eligibility of any recipients of this document to acquire the New Shares under the laws of Korea, including, without

limitation, the Foreign Exchange Transaction Act and regulations thereunder. The New Shares have not been, and will not be, registered under the Financial Investment Services and Capital

Markets Act of Korea (“FSCMA”) and therefore may not be offered or sold (directly or indirectly) in Korea or to any resident of Korea or to any persons for re-offering or resale in Korea or to

any resident of Korea (as defined under the Foreign Exchange Transaction Act of Korea and its enforcement decree), except as permitted under the applicable laws and regulations of Korea.

Accordingly, the New Shares may not be offered or sold in Korea other than to "accredited investors" (as defined in the FSCMA).

25You can also read