How we will mobilise five essential healthcare sectors to address healthcare inequity

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Strategic Direction 2022 - 2026

STRATEGIC DIRECTION 2022 – 2026

How we will mobilise five

essential healthcare sectors to

address healthcare inequity

DECEMBER 2021

The world’s most vulnerable people need better access to

healthcare. In many areas of healthcare, just a few large firms

hold the key to making this possible, whether through their

market presence, dominance of manufacturing and distribution

or via innovation and intellectual property rights. The Access to

Medicine Foundation has developed a tried-and-tested model

for incentivising such companies to do more to reach people

in low- and middle-income countries. Over the next five years,

the Foundation will expand this model to cover a total of five

healthcare sectors: Big Pharma, generic medicine manufactur-

ers, vaccine manufacturers, diagnostics companies and medical

gas companies. Moving the big players in each of these sectors

would transform many millions of lives. This Strategic Direction

for 2022-2026 describes a six-part approach for expanding this

model and mobilising a diverse range of essential healthcare

companies to achieve global equity in access to healthcare.

1Strategic Direction 2022 - 2026

TH E PL AN I N B RI E F

The next five years: driving deeper and

broader access

The world’s most vulnerable people need better access to healthcare. The chronic ine-

qualities in access are more glaring than ever in the wake of the coronavirus pandemic

with acute issues of access to medicines, vaccines and other essential health products

such as medical oxygen. Over the next five years, the Access to Medicine Foundation

intends to save more lives by expanding its tried-and-tested model of incentivising com-

panies to help more people living in low- and middle-income countries. We will build

on our strengths as we begin to work with a wider range of firms across more sectors

to elicit systematic improvements in access to innovative medicines, vaccines, generic

treatments, diagnostics and medical gases. In broadening and deepening our work,

we will focus on the largest players that dominate their respective markets, whether

through control of supply and distribution or via innovation and intellectual property

rights. This approach has been shown to work in the case of Big Pharma – as demon-

strated by the success of the Access to Medicine Index – and we believe it can be equally

effective in other parts of the healthcare supply chain. In this strategy, we set out how

we will expand our model to cover a total of five healthcare sectors.

To meet the scale of our ambition, we will engage more companies and mobilise data,

rankings, analyses and a network of powerful allies – including investors, policymakers in

governments and global health organisations – to drive the uptake of best practices. It

is only by addressing the continuum of care that the world can truly help the two billion

people who still lack access to the medicines and healthcare products they need.

BY 2026: FOU R STR ATEG IC OUTCO M ES

We will work to enable four shifts in the industry that improve healthcare in low- and

middle-income countries:

1 A critical mass of companies is brought to the table

A diverse range of essential healthcare companies, in addition to Big Pharma,

address access as a core priority, including suppliers of generic and branded m

edicines,

vaccines, diagnostics, devices and medical oxygen. Access-related objectives that

include vulnerable populations are becoming embedded in commercial strategies and

company actions are being tracked by the Foundation.

2 Access to medicine is expanding along the continuum of care

Gaps in care provision start to close rapidly as best-practice access strategies

accelerate across low- and middle-income countries, and there is a portfolio of new

products in the pipeline. Increasing numbers of people can rely on a steady, sufficient,

timely and equitable supply of essential healthcare products.

3 Driving access at scale to help achieve universal health coverage

Healthcare companies improve local availability of products and relieve pressure

on health services through supply chain, product licensing and technology transfer pro-

grammes. Companies also improve affordability by matching prices to local economies

and people’s ability to pay.

4 The public, investors and policymakers are empowered to drive change

Investors and policymakers stimulate companies to step up action on access

through conditional funding and regulatory measures, leveraging the Foundation’s

tracking mechanisms to push for behavioural and strategic change within boardrooms.

They are supported by an informed and engaged public.

2Strategic Direction 2022 - 2026

WHY NOW, WHY US?

The challenge for this next decade

The need for equitable access to medicine has never been more important or more

urgent. The challenge for the global community this decade must be to close what is

an unacceptable gap between the “haves” and the “have-nots” so that the most vul-

nerable people, including millions of women, girls and children, are not left at the

back of the line. This applies just as much to life-saving products against non-com-

municable diseases, such as cancer and diabetes, as to interventions against infec-

tious diseases. With the world striving to achieve the Sustainable Development Goals

(SDGs) by 2030, there is no time to lose.

The COVID-19 pandemic, which has already destroyed so many lives and liveli-

hoods, has been a stark reminder of the damage caused when billions of people liv-

ing in low- and middle-income countries are relegated to the end of the queue for

vaccines and treatments, and how inequity undermines global health security. The

crisis also highlights the key role that just a few companies play in the development,

manufacture and distribution of essential health products. Actions by these compa-

nies and the enabling conditions set by governments to facilitate access make the

ultimate difference for patients.

Why transformation of the healthcare ecosystem is needed

Global health has seen important advances in recent decades and many leading

pharmaceutical companies have made progress in improving access to medicine

since the Foundation started benchmarking their performance in 2008. Yet the fact

remains that billions of people still cannot access the medicines that they need, and

essential healthcare services are out of reach for half the world’s population. The

people on the frontline of this crisis are the 83% of humanity who live in low- and 83% of all people alive today live in the 106 coun-

middle-income countries. tries covered by the research of the Access to

Medicine Foundation

Too many medicines and other essential healthcare products – both old and

new – remain unaffordable and unavailable. The skewed incentives driving industry

investment patterns mean that innovations routinely fail to reach the people who

need them most. A lack of lucrative markets in low- and middle-income countries

too often leads healthcare companies and their investors to ignore access in these

countries. This has resulted in much of the industry overlooking essential areas of

medicine, such as the hunt for new life-saving antibiotics and cures for crippling

tropical diseases.

There is a pressing need to marshal resources more efficiently and to motivate

more companies to step up. Although this is a daunting task, we know what needs

to change – and we have proved we can move the dial by encouraging companies

to do more. The Foundation has demonstrated the power of data, collaboration and

persuasion to trigger action by the pharmaceutical industry over many years and

ensure expanded access to products.

We plan to exploit our mechanisms of action to move Big Pharma more systemat-

ically and rapidly, while expanding our work to encompass more manufacturers of

healthcare products in four additional sectors: generic medicines, vaccines, diagnos-

tics and medical gases. This will enable us to be a catalyst to transform the health-

care ecosystem for the better. The Foundation’s solutions-oriented approach and

its unique ability to convene all stakeholders to address the pressing issues will be

needed more than ever in the wake of the COVID-19 pandemic as the global health

community prepares for future challenges.

3Strategic Direction 2022 - 2026

FIVE ESSE NTIAL H E ALTHCARE SECTO RS

Motivating the pivotal players

The next five years offer a major opportunity for the Foundation to continue to

drive change within Big Pharma, while expanding its proven tactics to other cru-

cial players in the global healthcare supply chain, thereby covering more essen-

tial health products. This will involve making the case for far-reaching change not

only to companies but also to policymakers and investors. Governments, multilat-

eral organisations and the financial backers of healthcare businesses all have a cru-

cial role to play in shifting access policies. Healthcare is not only about medicines

and vaccines; a wider group of companies is also critical in providing patients with

a continuum of care. In many cases these firms hold the key to increasing access

to scientific innovation in low- and middle-income countries and the Foundation’s

established system of incentivising better access standards can be applied equally

across these supportive products.

Two clear examples here are medical gases – including medical oxygen – and

diagnostics: sectors where there are a handful of large players with pivotal roles in

bringing solutions to health systems. Indeed, it is a common feature of all the sec-

tors where the Foundation currently operates and where it plans to step up activ-

ities that a relatively small number of companies control the market, whether

through dominance of manufacturing and distribution or via innovation and intellec-

tual property rights. Moving these big players therefore holds the key to improving

the scale of access globally and delivering on the SDGs.

This approach of focusing on the largest companies has already worked in the

case of the large research-based pharmaceutical companies covered by the Access

to Medicine Index. We believe this strategy can also prove highly effective in moti-

vating pivotal suppliers of other essential health products.

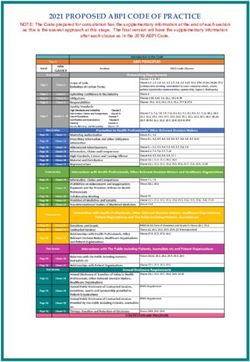

FIGURE 1 The five overlapping groups of essential healthcare industries

The Foundation’s model works best when the ecosystem that is being incentivised consists primarily of a small group of players that have

effective control of the market for specific products, either via their ability to innovate, their holding of patents or through market dominance.

There are five groups here that are important in high-burden disease areas: Big Pharma, generic medicine manufacturers, vaccine manufactur-

ers, diagnostics companies and medical gas companies. In all cases, there are a few dominant players that can have a big impact on healthcare in

low- and-middle-income countries.

Vaccine manufacturers

Big Pharma • $ 33 bn market

• $ 760 bn market • 5 manufacturers produce 60% of global volume

• 80% is covered in • 4 large manufacturers control 90% of global vaccine value

the Access to

Medicine Index

Big Pharma Medical

Vaccine

manufacturers gas

companies Medical gas companies

• $ 15 bn market

• Biggest 3 companies cover 69%

of the industrial gas market, incl.

medical oxygen

Generic medicine

manufacturers Generic medicine manufacturers

• $ 386 bn market

Diagnostics companies • Represent 60-80% of all medicine volume in

Diagnostics

• $ 83 bn global in-vitro diagnostics market companies key markets worldwide

• $ 43 bn point-of-care diagnostics market • Few major global players alongside many

• Highly fragmented market regional & local manufacturers

• Many small players alongside a few large

companies Note: circle size provides an indication of the comparative market value per sector. Values are approximations.

4Strategic Direction 2022 - 2026

B IG PHARMA

Continuing to drive Big Pharma’s uptake of scalable solutions

As innovators and producers of medicines, pharmaceutical Finally, pharmaceutical executives need to embrace access

companies have a clear societal duty to improve health. They in low- and middle-income countries as a core part of busi-

must ensure availability of their products to all people. ness strategies. It is no longer acceptable to park the access

The Foundation’s analysis shows that there has been a issue in a separate silo labelled “philanthropy” or “corporate

steady improvement over time, with eight of the top 20 social responsibility” where it does not receive daily board-

research-based pharmaceutical companies now developing level attention or investment.

systematic access planning approaches to make future med- Addressing all of these points will involve a structural

icines and vaccines accessible in poor countries at launch. rethink by some pharmaceutical companies. However, this

Nonetheless, fewer than half of all late-stage R&D pro- shift may not be as wrenching as some in the industry fear,

jects are currently supported by an access plan and products since it is aligned with the thinking of many of the pharma-

already on the market are largely overlooked when it comes ceutical industry’s biggest investors. As concerns over envi-

to efforts to improve access. ronmental, social and governance (ESG) issues grow across all

Big Pharma still needs to do much more in four key areas, industry sectors, more and more investors are actively push-

all of which will be a focus of the Foundation’s work over the ing for pharmaceutical companies to demonstrate a truly sus-

medium term. tainable profile.

Firstly, companies must increase and sustain R&D invest- In the 21st century, the key to that sustainability for Big

ment in the areas of greatest need, addressing priorities Pharma will lie in meeting societal demands for improved

such as innovation for poverty-related diseases, the hunt healthcare. From the investor perspective, this goal is vital for

for replacement antibiotics or child-friendly formulations of the long-term commercial success and viability of companies,

existing medicines. Investors and other stakeholders must on the grounds of good citizenship, attracting and retaining

push management teams to invest in more sustainable busi- talented staff and commercial self-interest as emerging mar-

ness models where financial returns are driven not by chasing kets become ever more important.

higher margins, but by delivering more effective treatments

to the largest number of patients. Governments, too, need RO LE I N ACCESS

to rethink and reform policies in public financing of research, Here are the three key areas where Big Pharma companies play a role in

ensuring access to medicine:

product regulation and international trade to encourage

investment in priority areas and ensure broad access. Increase and sustain R&D investment

Secondly, companies must expand the availability of new • Engage in R&D for set global health priorities

and existing products to more populations, especially the • Ensure that, upon launch, the products they develop reach those global

most neglected and vulnerable groups in the world’s low-in- populations that are most in need

come countries. Just 13% of essential products that must be

Expand the availability of new and existing products to more populations

administered by a healthcare practitioner – such as injectable • Register products widely in low- and middle-income countries

treatments for cancer and new medicines for mental health • Ensure supply security and sustained local availibility of marketed

conditions – are currently offered through access strategies products

in low-income countries, according to the latest Foundation • Support healthcare systems in developing countries and help to lay the

foundations for universal health coverage (UHC)

findings. This rises to 26% in the case of self-administered

products – mainly pills – which is still an unacceptably low Embrace access in low- and middle-income countries as a core part of

figure. business strategies

Thirdly, companies should be doing much more to support • Ensure continuous supply of essential health products

healthcare systems in low- and middle-income countries • Address shortages and stockouts

• Improve local availability and strengthen supply chains

and help to lay the foundations for universal health cover-

age (UHC). This requires pharmaceutical companies to take

a pragmatic and flexible view on pricing, bearing in mind the

range of payers for their products – from government-run

health systems to patients paying out of pocket. Access strat-

egies with the biggest impact on UHC will be those that

aim to make products affordable for all patients across the

income pyramid. And Big Pharma has a role in ensuring that

its actions align with local, national and international players

in infrastructure, supply chains and capacity building.

5Strategic Direction 2022 - 2026

G E N E RIC M E D ICI N E MAN U FACTU RE RS

Ensuring generic medicine manufacturers supply for the world

The world’s generic medicine manufacturers possess the strategies for low- and middle-income country markets and

adaptive R&D capability and large-scale manufacturing capac- deliver on licensing opportunities is therefore crucial to future

ity to supply billions of much-needed medicines to poorer global health across multiple fronts.

countries. In recent years, many of these manufacturers – Generic medicine manufacturers can reach many more

including those based in low- and middle-income countries underserved populations with both off-patent products and

such as India, China, Brazil and South Africa – have strength- innovative, high-priority medicines in several ways. One route,

ened their capabilities. Some have even developed propri- for example, is by ensuring earlier product launches in low-

etary technologies, thereby fortifying their global portfolio and middle-income countries for medicines covered by licens-

and footprint. Yet generic treatments, from medicines used ing agreements – a vital first step in facilitating sustaina-

to control hypertension and diabetes to biosimilars used to ble access to treatments. At the same time, generic medicine

fight cancers, are not always available or accessible to every- manufacturers need to commit to registering their in-licensed

one who needs them, due to issues of inadequate or insecure products as rapidly as possible in countries where the burden

supply, insufficient manufacturing in low- and middle-income of disease is high.

country markets, unaffordability, lack of compatibility with

local environments and substandard quality. Security of supply is another challenge, particularly when

Just as the world depends heavily on a small number of demand increases due to unforeseen circumstances, as was

Big Pharma companies for developing innovative medicines the case with the COVID-19 pandemic. To help achieve global

in key areas, the industry’s deep supply chain is also increas- health security and prevent shortages of existing manufac-

ingly dominated by large generic medicine manufacturers, both tured products, while at the same time ramping up global sup-

of finished medicines and vaccines and of bulk active pharma- ply of new or urgently needed products, manufacturers need

ceutical ingredients (API). As a result, such companies are well to consider several elements.

placed to participate in delivering on global health priorities. In the manufacture of APIs, for example, trade and foreign

Due to generic medicine companies’ strong position in low- policy feuds between sovereign states and border closures

and middle-income country markets, they can push for adap- when supplies of particular ingredients are tight, often cre-

tive R&D for products where treatments are already on the ate a fragile supply situation. This vulnerability to raw material

market but where there are clear gaps in access and supply, shortages is exacerbated by the fact that most APIs are pro-

such as for child-friendly formulations and new regimens for duced in just two countries: China and India.

infectious diseases. The vulnerable position of low- and middle-income coun-

The interplay between R&D-based pharmaceutical compa- tries, including those in sub-Saharan Africa, is increased sub-

nies and generic medicine manufacturers is critical to solving stantially by the fact that these countries typically have little

such problems – and constructive relations between the two if any on-the-ground pharmaceutical manufacturing capacity.

in areas such as technology transfer and the licensing of intel- This leaves local populations at the mercy of sometimes unreli-

lectual property rights can be one of the strongest drivers to able shipments from other nations. Building up manufacturing

delivering truly equitable access and improve local availability. capacity and improving local availability of finished products in

poorer countries must be made a priority in future if the world

Generic medicine manufacturers are responsible today is to improve the security of supply. Creating a more broad-

for supplying more than 80% of all essential medicines. based and resilient manufacturing base will also help individual

Importantly, as licensees they produce a wide range of companies to mitigate shortages and stockouts.

life-saving treatments for major killers, making them a vital Failure to address the innate fragility of the supply chain

conduit for new products into low- and middle-income coun- risks causing more problems and will lead to more cost spikes

tries. HIV/AIDS shows what is possible. In this case a global in future – and the hardest hit patients will be those in the

commitment to universal access to antiretroviral therapy, world’s poorest and least profitable markets.

delivered via generic medicine suppliers, has turned the The complementary efforts of the Foundation and vari-

tide of infection over the past decade and saved millions of ous patent pools to expand the use and impact of non-ex-

lives. But HIV/AIDS is just one disease, and similar efforts are clusive voluntary licensing is a prime example of what can be

needed in other areas such as tuberculosis and other infec- achieved. Since 2012, such deals have led to more than 30

tious diseases – including those which could become future million patient-years of treatment for people with serious

pandemics – as well as non-communicable diseases that are diseases such as HIV/AIDS, hepatitis C and tuberculosis.

a growing burden on health in poorer countries. Ensuring At present there is no comprehensive platform to track the

that generic medicine manufacturers optimise their access progress of the generics industry or identify key opportunities

6Strategic Direction 2022 - 2026

for companies to be more responsive to global health chal- RO LE I N ACCESS

lenges, although the Foundation has made a start through its There are three key areas where generic medicine manufacturers play a

role in ensuring access to medicine:

pioneering work in addressing the role of generic medicine

manufacturers in the Antimicrobial Resistance Benchmark.

Invest in R&D for global health priorities (where applicable)

The current gap in information about the role of the gener- • Invest in R&D where applicable and engage in partnerships to adapt pri-

ics industry in access to medicine creates a significant oppor- ority products for low- and middle-income country settings and vulnera-

tunity for the Foundation in monitoring the registration of ble populations

new products, tracking the speed of their availability in vari-

Engage in partnerships for needed products

ous markets, and scrutinising how manufacturers work with

• Engage in non-exclusive voluntary licences (VL)

different global organisations in priority areas. • Deliver to and prioritise underserved populations

• Register in-licensed products widely in low- and middle-income countries

• Expand sustained access for vulnerable populations* and ensure continu-

ous local availability of affordable products

Improve supply security and ensure product quality

• Ensure continuous supply

• Increase local manufacturing

• Address shortages and stockouts

• Strengthen supply chain

• Ensure Good Manufacturing Practice (GMP) standards are applied

* Vulnerable populations include displaced individuals, women & girls, children, people

living at the base of the income pyramid.

7Strategic Direction 2022 - 2026

VACCI N E MAN U FACTU RE RS

Enabling greater vaccine access

Vaccination is one of the most powerful and cost-effective occurrences seen in health systems worldwide, alongside

health interventions available. Vaccines currently prevent 2-3 antibiotic shortages.

million deaths every year from diseases including diphtheria, Local manufacturers should be encouraged to invest in

tetanus, pertussis, influenza and measles. As such, they are their production plants and build resilience so that they are

among our strongest tools for preventing epidemics and pan- better equipped to respond to rises in demand, including in

demics. Yet despite tremendous progress, far too many peo- times of crisis. Advance market commitments from pooled

ple around the world – including nearly 20 million infants each procurement agencies and clear prioritisation from global

year – have insufficient access to vaccines, and preventable immunisation campaigns can give them a financial incentive

diseases still cost millions of lives each year. Low- and mid- to take these steps.

dle-income countries represent a disproportionate burden Finally, local manufacturers can engage in capacity building

of vaccine-preventable disease and often have lower vaccine initiatives in partnership with local organisations to improve

coverage than high-income countries. Despite their broad the supply chain infrastructure. Such initiatives could include

social and economic benefits, vaccines face extensive access technical support or improved cold storage management.

issues including inadequate supply, specifically to low- and Since the COVID-19 pandemic began, the importance and

middle-income countries, as well as gaps in R&D and limited responsibilities of local vaccine manufacturers in ensuring

corporate involvement in the vaccine space. supply and access has received increased recognition from

The need for vaccines has never been greater. Over the the global health community. While it is paramount that these

past 10 to 15 years, a succession of serious infectious disease companies’ efforts are supported and sustained, monitoring

outbreaks has occurred, including Ebola, Zika and COVID- and evaluation of their activities should also be a priority for

19, with the latter expecting to cause USD 28 trillion worth global health stakeholders.

of damage by 2025. Vaccine manufacturers have a critical

role to play in ensuring that immunisation reaches people liv- RO LE I N ACCESS

ing in low- and middle-income countries. The world relies on There are three key areas where vaccine manufacturers play a role in

the industry to ramp up global supply and provide vaccines at ensuring access to medicine:

scale when they are needed.

Invest in R&D for global health priorities

Many vaccines currently on the market are not necessarily

• Invest in adapting priority products to suit the needs of low- and mid-

tailored to address the specific needs of low- and middle-in- dle-income countries

come country markets, resulting in limited access and inad- • Engage in R&D for identified and future gaps in infectious diseases,

equate coverage of populations against vaccine-preventable including epidemics and pandemics

diseases. For example, many vaccines require cold storage,

Deliver to and prioritise underserved populations

which is often unavailable in remote areas in low- and mid-

• Engage in licensing or manufacturing partnerships with major vaccine

dle-income countries. Local manufacturers, when equipped innovators (including Big Pharma and biotechnology companies)

to do so, can contribute to the development of vaccines that • Engage where available with other local vaccine manufacturers to

take such requirements into account. enhance local/regional availability

A more fundamental problem is the absence of vaccines • Partner with international organisations to enable broad access and

delivery of vaccines to low- and middle-income countries

for a number of critical diseases that are predominantly

• Ensure underserved populations are included in vaccine access

prevalent in poorer countries, including Lassa fever, chikun-

gunya and Nipah virus. New funding or collaboration mod- Improve supply security

els are needed to share the financial risks of developing vac- • Strengthen supply chains

cines against such diseases, with local manufacturers having • Address shortages and stockouts

an important role to play in partnering with large R&D-based

vaccine manufacturers, research institutions and biotech

companies to co-develop and deliver products. Local vaccine

manufacturers with the required manufacturing capacity can

bridge the gaps in access by collaborating to deliver to mar-

kets and populations that are commonly left behind.

Supply security is vital for vaccine access in low- and mid-

dle-income countries, in particular for children in many

African countries where local availability is limited. Shortages

and stockouts of vaccines are among the most frequent

8Strategic Direction 2022 - 2026

D IAG NOSTICS CO M PAN I ES

Unlocking the potential of diagnostics for all

Diagnostics and monitoring devices are an essential element markets and through the creation of sustainable supply

of the health system and a critical part of the continuum of chains. This can be done by companies setting up partner-

care. Whether performed on blood, tissue or other patient ships with regional stakeholders that already have a footprint

samples, diagnostic tests are a vital source of information for in key markets and by entering technology transfer agree-

disease management and patient care. They help determine ments with established manufacturers. Diagnostics compa-

the disease from which the patient suffers and which treat- nies can also support capacity building initiatives, for example,

ment should be prescribed, and can be used to monitor the for setting up equipment, training maintenance experts, and

progress of treatment. building up the skills needed to use diagnostics and devices in

In developed markets, they are now an integral part of local markets.

decision-making at every step along the care pathway, and Finally, the Foundation has identified a clear trend for more

their importance is increasing all the time as healthcare companies and global organisations to partner together in

becomes more and more personalised. Yet in low- and mid- order to bring diagnostics and treatments together in a single

dle-income countries, diagnosis remains one of the weak- care package – but so far this is concentrated on only a few

est links in the care cascade, resulting in unnecessary suffer- diseases in a few countries, thus benefiting only a small num-

ing and deaths. This has been highlighted during the COVID- ber of patients.

19 pandemic, with high-income countries having testing rates Despite the fragmented nature of the diagnostics sector

for SARS-CoV-2 10 times higher than low- and middle-income overall, there is a concentration of the biggest companies in

countries. several key therapeutic areas, which provides an opportunity

The diagnostics sector remains highly fragmented and to use the Foundation’s tried-and-tested model of incentivisa-

there is a lack of joined-up strategy for realising the potential tion. In the medium term, we intend to engage a few big play-

of diagnostic testing in lower-income countries. This results ers to deliver the maximum impact.

in gaps in the supply of and in access to testing and monitor-

ing devices across multiple therapeutic areas, including infec- RO LE I N ACCESS

tious diseases, maternal and neonatal health conditions and There are four key areas where diagnostics companies play a role in ensur-

ing access to medicine:

pregnancy, and prevalent NCDs such as diabetes and cardio-

vascular disease. Significant challenges exist in realising this R&D

promise, as R&D priorities remain skewed to wealthier mar- • Invest in R&D to address identified global priority gaps

kets, laboratory capacity is a frequent bottleneck, and deliv- • Invest in R&D to translate existing diagnostic and monitoring technolo-

ery obstacles persist even for relatively simple diagnostic kits. gies to meet specific low- and middle-income country needs

• Plan for access early in development to ensure broad access to popula-

Looking at R&D, in addition to new diagnostics for prior-

tions in need at launch

ity diseases, there is also an urgent need for technologies

that are better suited to lower-income countries – whether Manufacturing and Quality

through more robust and easy-to-use design, or via less reli- • Produce high quality diagnostics and devices

ance on central laboratory systems and fixed utilities (elec- • Ensure local availability by securing manufacturing capacity to multiple

global sites

tricity, internet, gas, etc). Partnerships can incentivise global

companies to foster this kind of adaptive R&D ecosystem. Deliver to and prioritise underserved populations

Such partnerships can be forged with local manufacturers, • Ensure diagnostics are available at scale for health systems and differ-

which have better visibility of the market and the needs of ent payers*

patients. • Prioritise access to underserved and vulnerable populations often left

behind

Diagnostics also need to be affordable for every payer,

from a supranational donor, such as the Global Fund or Diagnostic capacity building

UNICEF, to public health systems, to patients paying out-of- • Build local capacity by ensuring healthcare professionals have training on

pocket for self-test and monitoring devices. Beyond pricing proper usage and administration

strategies for the actual diagnostic device or test, companies • Provide support for maintenance and upgrades

need to factor in all the elements that will be required to per- *Different payers refer to reimbursed systems, patients paying out of pocket, etc.

form the test, such as reagent liquids or assay tips/cups, and

maintenance costs.

Additionally, there is a need to increase the availability of

diagnostics in low- and middle-income countries by increas-

ing the on-the-ground presence of suppliers in underserved

9Strategic Direction 2022 - 2026

M E D ICAL GAS CO M PAN I ES

Tackling the crisis in medical oxygen supply

The COVID-19 pandemic has highlighted a chronic crisis in RO LE I N ACCESS

medical oxygen supply that should have been tackled long There are four key areas where medical gas companies play a role in ensur-

ing access to medicine:

ago and now needs to be addressed as a matter of urgency.

Many low- and middle-income countries have faced horrific

Prioritise and invest in access in low- and middle-income countries

shortages, resulting in unnecessary patient deaths and huge • Establish a clear access strategy and implement access KPIs

bills for families forced to purchase costly cylinders on the pri- • Ensure delivery of medical oxygen to a broad array of countries and

vate market for unwell relatives. across different regions and provinces

• Delivery of required additional materials (e.g. cylinders) or strategic

Clearly, an integrated solution is necessary to address the

sourcing of necessary additional equipment to ensure appropriate use

problem of medical oxygen supply, not only to help deal with

upon delivery

the COVID-19 pandemic but to save millions of lives in the • Create more capacity for liquid medical oxygen vs. for industrial use

long term. Oxygen is vital for treating other deadly conditions,

including pneumonia, which claims the life of a child every 39 Engage rapidly during emergencies (e.g. in pandemics)

• Engage with multilateral organisations to expand access (e.g. the

seconds. It is also a common requirement during complica-

ACT-A Oxygen Emergency Taskforce) to sign formal Memorandums of

tions in childbirth. Essential efforts to reduce gaps in this area

Understanding (MOU) and agreements

are needed to progress toward universal health coverage and • Engage in bilateral agreements to expand access during emergencies

reach the various targets of the SDGs. • Provide transparent information on MOUs and the stipulations of bilat-

In most of Europe and North America, medical oxygen is eral agreements

• Deliver on existing commitments

delivered by tanker, stored in large vessels, and eventually

piped directly to bedsides. But many poor countries lack this

Engage in sustainable access approaches for health systems

infrastructure and rely instead on cylinders, which increases • Develop long-term contracts for liquid oxygen

the price per volume used. • Include ongoing service and maintenance support within such contracts

There are several challenges to improving access to med- • Demonstrate approaches to enable affordability for and within different

hospital and care settings within specific countries (e.g. a private hospi-

ical oxygen in low- and middle-income countries, includ-

tal in Rio vs. a public hospital in a rural/remote area or resource-deprived

ing market concentration, with the biggest three compa-

area)

nies responsible for 69% of the global industrial gas market.

Historically, the industry has not prioritised public health, as Strengthen sustainable supply

medical oxygen represents only a small proportion of its over- • Improve delivery mechanisms and delivery speed, including last mile

delivery

all business. Access is also hampered by a fragmented sup-

• Capacity building in collaboration with local partners and governments in

ply chain, involving complicated logistics and distribution net-

low- and middle-income countries to ensure continuity and appropriate

works, which can make supplies unaffordable. use/maintenance/forecasting techniques

The leading manufacturers of medical gases have a vital

role to play in providing sustainable supplies to health cen-

tres globally, and therefore have a duty to invest in capacity

to ensure improved access. They must prioritise and invest in

low- and middle-income countries, be proactive in finding new

ways of increasing supply and reducing the cost in poorer

countries when an emergency strikes, and engage in long-

term sustainable access approaches for health systems. So

far, the disjointed approach by the industry is reminiscent of

the position pharmaceutical companies were in several years

back, underscoring the potential for change.

Fixing the problem requires leadership from the companies

that dominate the industry. The medical oxygen supply chain

involves many distributors, but six manufacturers – including

the three market leaders – dominate the market, making it

ripe for the application of the Foundation’s system of encour-

agement that it has used for more than 15 years in the phar-

maceutical sector. This work has already started, in partner-

ship with the Every Breath Counts Coalition and others, but

there is more to be done.

10Strategic Direction 2022 - 2026

HOW WE WO RK

A unique catalyst for action

The Foundation is in a unique posi-

tion to act as a catalyst for this much-

needed change by ensuring that more

MISSION Stimulate and guide essential healthcare companies to bring their

companies play their part and raise their products to people in low- and middle-income countries

game on access. We do this by work-

ing alongside other stakeholders on

systemic access challenges, signalling Identify critical issues

Build consensus on the role of industry in access

where gaps exist, highlighting patterns

of corporate behaviour that work, and

driving solutions. Our independence and Perform in-depth analysis of data and CONVENING POWER

Multistakeholder dialogue

long-running specialisation in industry provide original insights

practices also allows us to track objec-

tively the progress made by companies.

To trigger radical transforma- OUTPUT RESEARCH REPORTS

Illustrating opportunities for each company to

tive change inside companies, the do more, accompanying best practices

Foundation now uses a combination of

direct influence

data, research insights, rankings and DRIVE ACTION

report cards, while leveraging a network

GLOBAL HEALTH GOVERNMENTS INVESTORS THE PUBLIC

of influential stakeholders, including ORGANISATIONS • policy briefings • collaborative engagement • Inform the public

investors, policymakers in governments • policy & practice • recommendations on access issues through media

• stimulate collaboration • information sharing & education

and the public. with industry

The Foundation’s leadership has an

indirect influence indirect influence

open line to many boardrooms. In addi-

tion, we carry out direct change-mak- global media

ing activities with companies, from reg-

ular interactions with top executives

to town hall meetings for hundreds of

employees. All these activities – and the

INDUSTRY

Improve buy-in and endorsement

media attention we engender as the of access at CEO/Board level

go-to independent expert source on CONVENING POWER

Multistakeholder convening

access to medicine – help to motivate Empower internal

Best practice sharing

Independently fostering partnerships access teams

and empower company access teams by

showcasing concrete examples of what

works and what does not.

Independent third-party evalua-

tion confirms that our work has made

a significant contribution to advancing

the pharmaceutical industry’s engage-

ment with access issues. At the same OUTCOME Companies make progress on their access to

medicine policies and practices

time, the Access to Medicine Index has

evolved into the primary benchmark in

the space. By providing a tool for learn-

ing and discussion, the Foundation helps IMPACT More people in low-and middle income countries

have access to healthcare products

companies understand the scope of

their own activities and how to put best

practices to use, while spurring healthy

competition between firms to do better.

11Strategic Direction 2022 - 2026

M OD E L I N ACTI ON

How we put our model for change into practice

To trigger radical transformative NGOs, g

overnments and investment findings and policy advice, enabling

change inside pharmaceutical circles. All our reports are online and evidence-based decision-making.

companies, the Foundation com- open-access, including the detailed Governments play a central role in

bines data, research insights, rank- company comparisons and validated setting the global health agenda and

ings and report cards, while lever- best practices, and have been down- prioritising disease areas, sustaina-

aging diverse networks of influen- loaded more than 100,ooo times. ble procurement decisions, and spe-

tial stakeholders. cific policy developments. By work-

ing closely on disseminating our

Here, a series of snapshots of B U I LD CO N S E N SUS O N findings, the Foundation supports

our current research and engage- U RG E NT PR I O R ITI ES governments in moving the needle

ment work demonstrates how Since 2008, the Foundation has further and faster on key access

the teams working at the Access systematically built consensus on issues. In 2020, the UK government

to Medicine Foundation put this what we can expect from pharma used the methodology and results

model for change into practice. companies on access to medicine. of the AMR Benchmark to inform

We consult 150+ experts and stake- the criteria for selecting compa-

holders to ensure a diverse range SU PPO RTI N G TH E G LO BAL nies and to set expectations for

of viewpoints and technical exper- H E ALTH AG E N DA the pilot of its first-ever Antibiotic

tise. In balancing these views, we For the global health community, Subscription Model. In 2021, the

have defined the priority actions we bring 15+ years’ experience of Norwegian government drew on

for pharma companies, what ‘good’ engaging pharma companies with the results of the 2021 Access to

looks like and how to get there, specific access issues and achieving Medicine Index in identifying its four

in governance and compliance, R&D a sustained level of industry respon- principles for urgent pharma action

and product delivery. siveness. Our research incentivises to combat COVID-19.

and tracks how pharma companies

TOC_Action fig Investors

respond to global health priorities,

Access to Medicine Foundation

such as in the WHO’s Model List

CHILDREN AND THE ‘BIG THREE’ EPIDEMICS

Ending the burden of 2021 ACCESS TO MEDICINE INDEX – OVERALL RANKING 18

HIV, malaria and TB

in children

1

2

GlaxoSmithKline plc

Novartis AG

4.23

4.18

Access to Medicine Foundation

of Essential Medicines. We assess

102 116

3 Johnson & Johnson 3.76

2021 ACCESS TO MEDICINE INDEX – OVERALL RANKING

JUNE 2020 4 Pfizer Inc 3.65

whether companies are taking

5 Sanofi

1 GlaxoSmithKline plc 4.23 3.47

6 2

TakedaNovartis AG

Pharmaceutical Co, Ltd 4.18 3.31

3 Johnson & Johnson 3.76

7 AstraZeneca plc 3.30

84

Children in low- and middle-income countries still remain on the frontline 4 Pfizer Inc 3.65

of the ‘big three’ infectious diseases. Despite great advances over the years, 8 Merck KGaA (Merck) 3.09

5 Sanofi 3.47

13

AIDS, malaria and TB continue to account for over half a million child deaths

each year, mostly in children under the age of five. This series of articles 9 Roche Holding

6 Takeda AG

Pharmaceutical Co, Ltd 3.31 3.07

action in areas where priorities are

assesses the current situation for each of the three epidemics. It stresses the

urgent need for a diverse range of new treatments that are suitable for chil- 10 Novo AstraZeneca

7 Nordisk A/Splc 3.30 2.96

dren, especially with the growing threat of drug resistance, with recommen-

8 Merck KGaA (Merck) 3.09

dations for governments, regulators, the pharmaceutical industry and others. 11 Eisai Co, Ltd 2.87

66

9 Roche Holding AG 3.07

11

12 Boehringer Ingelheim GmbH 2.84

10 Novo Nordisk A/S 2.96

60

13 Bayer

11 AG

Eisai Co, Ltd 2.87 2.63

54

14 12 Boehringer

Astellas Pharma Ingelheim

Inc GmbH 2.84 2.33

yet to be set, such as non-commu-

13 Bayer AG 2.63

14 Gilead Sciences Inc 2.33

14 Astellas Pharma Inc 2.33

15 Merck & Co, Inc (MSD) 1.88

14 Gilead Sciences Inc 2.33

8

16 Daiichi Sankyo

15 Merck Co,

& Co, IncLtd

(MSD) 1.88 1.80

17 16 Daiichi

AbbVie Inc Sankyo Co, Ltd 1.80 1.73

17 AbbVie Inc 1.73

18 Eli Lilly & Co 1.59

nicable diseases incl. heart diseases

18 Eli Lilly & Co 1.59

6

19 Bristol Myers Squibb Co 1.55

19 Bristol Myers Squibb Co 1.55

00 11 2 2 3 3 4 45 5

5

●

● Governance of Access

Governance of Access ● Research

● Research & Development

& Development ● Product Delivery

● Product Delivery

2021 R AN KI NG ANALYSIS

2021 R AN KI NG ANALYSIS

and cancer. Through strategic brief-

GSK retains the No. 1 position, yet only slightly LE AD E RS PE R TECH N I C AL AR E A

GSK retains the

ahead No. 1 position,

of Novartis. yetare

The leaders only slightly

followed by LE AD E RS PE R TECH N I C AL AR E A

ahead ofJohnson & Johnson,

Novartis. Pfizer and

The leaders areSanofi. The two

followed by Governance of Access

2015 2016 2017 2018 2019 2020

leading companies are in close competition, both GSK and Takeda lead, followed closely by Novartis.

2021 Antimicrobial Benchmark – SMEs and the antibiotic market Johnson & Johnson, Pfizer and Sanofi. The two Governance of Access

providing evidence that additional patients were All three demonstrate strong responsible business

I N CEN T I V E S leading companies areaccess

reached through in close competition,

strategies both

such as equita- GSK and

practices Takeda

either lead,stringent

by enforcing followed closely by Novartis.

compliance

Why do we need to ‘to fix the market’ for antibiotics?

providingble

evidence that

pricing and additional

voluntary patients

licensing were

initiatives. GSK’s All three

processes demonstrate

across strong

their operations or by responsible

setting via- business

ings, collaborative activities, com-

reached performance in R&Dstrategies

is a significant factor

as in its blepractices

staff incentives.

Most SMEs have not yet brought products to market, and new antibiotics generally

generate low revenues. As a consequence, SMEs have little room for error when it through access such equita- either by enforcing stringent compliance

comes to commercialisation once research grants have expired. They are expected retention of the top spot. It has access plans cov-

to navigate financial “valleys of death” – which starts when funding for early-stage ble pricing and voluntary licensing initiatives. GSK’s processes across their operations or by setting via-

research runs out and only ends if investors or Big Pharma start to show interest.*

ering the largest proportion of late-stage projects Research & Development

performance in Novartis

(20/25). R&D is closes

a significant

in on the factor in its

No. 1 position ble

GSK staff

leads incentives.

with the largest pipeline comprised of

No. of signatories Signatories’ AUM (USD tn)

At minimum, this forces SMEs to pause development while they hunt for financing.

At worst, it means that promising and urgently needed candidates for new medi-

cines, diagnostics and vaccines disappear when SMEs go bankrupt. retentionthrough

of theitstop spot. It has

performance accessDelivery,

in Product plans andcov- projects that target well-established treatment pri-

A promising drug is not enough ering thestands outproportion

largest for being the only company to projects

of late-stage apply orities, and has &

Research a structured process to develop

Development

For example, in 2021, the Swiss biotech company Juvabis was forced to reduce its equitable access strategies in at least one low-in- access plans for all projects. Novartis and Johnson

(20/25). Novartis closes in on the No. 1 position GSK leads with the largest pipeline comprised of

mittees and working groups, we

workforce to four employees due to financing constraints.17 This is despite its can-

didate antibiotic EBL-1003 demonstrating safety and tolerability in Phase I clini-

come country for all products assessed. Pfizer & Johnson follow, scoring well in all areas.

cal trials and promising preclinical activity against drug-resistant pathogens, in par- through its performance

is newly in the top 5, in Product

and Delivery,

leads when it comesand projects that target well-established treatment pri-

ticular Acinetobacter baumannii, a critical priority pathogen for antibacterial R&D

according to the WHO, and Mycobacterium abscessus. To get to this stage, Juvabis stands out for beingaccess

to addressing the only company to apply

to self-administered prod- orities,

Product and has

Delivery a structured process to develop

equitableucts acrossstrategies

different regions

in atand socio-economic Novartis leads, targeting

for allmultiple countries and

had received extensive support from the European Gram-Negative Anti-Bacterial

Engine consortium (ENABLE) and the National Institutes of Health (NIH) for access least one low-in- access plans projects. Novartis and Johnson

pre-clinical development and completion of Phase I clinical trials. groups, also demonstrating increases in patient patient populations across the income pyramid

To provide a buffer against bankruptcy – and encourage more companies to come country for all products assessed. Pfizer & Johnson follow, scoring well in all areas.

join the field – the economic and policy environment for antibiotic R&D must be

reach. Near the bottom of the ranking, Astellas, with equitable pricing strategies and responsible IP

reformed. This means developing the right mix of incentives to support R&D, and is newly in the top

AbbVie 5, andSankyo

and Daiichi leadsare

when it comes

the only compa- management. GSK is second, and both companies

to reward the market entry and the sustained availability of new products, through

to addressing access

do notto self-administered prod- Product

theirDelivery

M O B I LI S E TH E POWE R O F

nies that have an access-to-medicine strat- leverage know-how and resources to address

help maximise the impact of global

new financing, reimbursement and regulatory tools. Currently, the majority of R&D

incentives are ‘push’ incentives: financial and technical grants available to support egy different

ucts across with a business rationale.

regions andBristol Myers Squibb

socio-economic local access barriers

Novartis leads,through theirmultiple

targeting capacity build-

countries and

drug development. These typically support the riskier early phases of development,

which account for roughly 20% of the total costs required to bring a project to the takes the bottom rank with limited evidence of ing initiatives.

groups, also demonstrating increases in patient patient populations across the income pyramid

access initiatives across the areas measured.

reach. Near the bottom of the ranking, Astellas, with equitable pricing strategies and responsible IP

How are companies plugging the funding gap?

This chart totals the support that SMEs have raised via various push and pull incentives by

AbbVie and Daiichi Sankyo are the only compa- management. GSK is second, and both companies

24 SMEs active in late-stage antibacterial and antifungal R&D.**

PF

PU S H I N CEN T I V E S R& D VA LLE Y O F D E AT H PU LL I N CEN T I V E S

nies that do not have an access-to-medicine strat- leverage their know-how and resources to address 7

Financial and technical grants avail- Here is where much of the Cash payments or contracts that reward com-

I NVESTO RS

able to support drug development. funding received at the earlier panies for bringing a product to the market.

health organisations, e.g., in 2021, to

Example: CARB-X stages of development runs out. Example: NHS UK Subscription Reimbursement

Model

egy with a business rationale. Bristol Myers Squibb local access barriers through their capacity build-

USD 2,000

2,000,000,000

mn

takes the bottom rank with limited evidence of ing initiatives.

1,500

1,500,000,000

access initiatives across the areas measured.

1,000

1,000,000,000

CO M PA N Y PA R T N E RS H I P S

500

500,000,000 I N V E S TO RS

0

G OV E R N M E N T S A N D

FO U N DAT I O N S

7

establish a guide for good practice 150+ institutional investors, with

Discovery Preclinical Phase I Phase II Phase III Market Post-market

Approval Approval

The discovery phase of research As a project begins to move through To help drive a project beyond the CO M M E RCI A L VA LLE Y O F D E AT H

is considered the most risky, with the pipeline, venture capitalists gap and into market, SMEs mainly Funding for SMEs tend to dry

many investigative leads leading to and angel investors then select rely on partnerships with more out for a second time once the

failure. At this stage, SMEs are often SMEs to fund. Funders mostly resourced and experienced pharma- approved antibiotic hits the market.

dependent on funding, or push bank on projects with a promising ceutical companies. SMEs then rely on sales revenues

incentives, from governments and return-on-investment. and on any royalties and milestones

philanthropic organisations. from deals with other companies.

*E.g., Pfizer recently acquired Amplyx Pharmaceuticals Inc., securing ownership of ** These companies are developing 28 late-stage projects, and were identified by the

Amplyx’s lead novel compound, Fosmanogepix (APX-001), under development for the WHO and Antimicrobial Resistance Benchmark. Only companies with access and/or

treatment of invasive fungal infections as well as their early-stage pipeline of potential stewardship plans in place were included, see Appendix I.

antiviral and antifungal therapies.

8

in stewardship and access planning USD 25 trillion in AUM, use our

AG E N DA-S E T TI N G (SAP), to help curb antimicrobial research to trigger change in the

R ES E ARCH R E PO RTS resistance. pharma industry. Investors are

Our research uncovers where pro- strongest when they pool their

gress is being made, where gaps influence and speak with one

remain, and which companies per- voice to a company. Through 200+

form best. Our insights are drawn engagements per research cycle,

from a unique combination of e.g., workshops and research

sources, from companies, public launches, we inform investor teams

sources, and expert organisa- on specific opportunities for each

tions. With our thematic reports, company to improve access. The

we bring emerging or hidden Index Investor Statement is the

issues into the forefront, such as 4th largest ESG investor initiative

the f ragility of antibiotic supply I N FO R M G OVE R N M E NT and the only one focused on health.

chains. These reports are proven D ECI S I O N - MAKI N G

agenda-setters and have practical We equip global health leaders

recommendations for companies, with the most relevant research

12You can also read