Economic Impact Study Hurricanes v Sharks Super 12 Rugby Game - 19 March 2004 Yarrow Stadium, New Plymouth

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economic Impact Study

Hurricanes v Sharks Super 12 Rugby Game

19 March 2004

Yarrow Stadium, New Plymouth

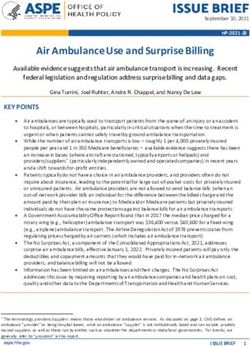

May 20041. Executive Summary

Venture Taranaki in partnership with the Taranaki Rugby Football Union (TRFU) have undertaken this

research initiative to evaluate the impact the recent Hurricanes v Sharks Super 12 rugby game (the game)

had on the Taranaki economy.

The Hurricanes region encompasses the lower half of New Zealand's North Island from Hicks Bay in the

north to Island Bay in the south. The opposing South African team (Sharks) do not have a large New

Zealand based supportive following; it is assumed this was an influential factor that impacted the number of

out-of-region spectators attending the game.

The total expenditure (in dollars) by event organisers, teams and spectators (within-region and out-of-region)

for the game came to an estimated $830,000. This comprises money that was spent by TRFU, event

organisers, spectators etc. (known as direct expenditure) and flow-on (or subsequent expenditure)

generated throughout the Taranaki economy before, during and after the game. The direct expenditure is

estimated at $560,000, while the flow-on output is estimated at $270,000.

Impact Expenditure Net Household FTE Employment* Value Added

Income (GRP)

Direct $560,000 $120,000 6.80 $240,000

Flow-on $270,000 $40,000 1.44 $110,000

Total $830,000 $160,000 8.23 $350,000

NOTE: impact figures rounded to two significant figures. *Figures do not sum to totals due to rounding

consistency.

Value added, or GRP, measures the total value of output producted within the Taranaki economy as a result

of the game. For example, consider a hotdog sold at the game for $1.60. Of this only $0.20 is added to the

Taranaki economy by the transaction. The remaining $1.40 is attributed to the region where the hotdog was

manufactured, freighted from etc. In this case, the game generated $350,000. The majority of this,

$240,000 was resultant from direct expenditure while $110,000 was from flow-on expenditure.

An equivalent of 8.23 full time jobs were created as a result of money spent by TRFU, event organisers and

spectators etc. In addition an estimated $160,000 of disposable income (i.e. after tax and savings) was

injected into local households in the form of wages/ salaries as a result of the game.

Page 2 of 17Over 300 spectators were surveyed to gain expenditure patterns and thoughts on the game. The greatest

benefit comes from out-of-region spectators as it can be assumed their expenditure may not have occurred

in the region if the game had not been on. A portion of Taranaki spectator expenditure was also included in

analysis as the event may have led them to spend more in the region that they otherwise would have. In

addition to economic information the survey identified a number of other key points, including:

• Saturday at 7.35 pm is the most favored time for future games at Yarrow Stadium.

• The majority of spectators attended the game with family.

• Sponsorship recall for Genesis Energy was high (84.8%) among Taranaki respondents.

• Newspapers and Magazine publications were the most effective form of advertising.

• The majority of respondents reported current ticketing methods are meeting their needs.

• The majority of out-of-region spectators originated from the Wellington and Manawatu-Wanganui

regions.

• Visitors stayed on average 1.74 nights when in Taranaki for the game. Almost half stayed in hotel/

motel accommodation.

Page 3 of 17Contents

1. Executive Summary ..................................................................................................................... 2

2. Introduction .................................................................................................................................. 5

3. Objectives .................................................................................................................................... 6

4. Expenditure.................................................................................................................................. 6

5. Economic Impact ......................................................................................................................... 7

6. Analysis

6.1 Accommodation...................................................................................................... 8

6.2 Advertising Effectiveness ....................................................................................... 8

6.3 Spectator Group Type ............................................................................................ 9

6.4 Purchasing Tickets ................................................................................................. 9

6.5 Sponsorship ........................................................................................................... 10

6.6 Preferred Time and Day of Future Games ............................................................. 10

6.7 Out-of-Region General Comments on Taranaki ..................................................... 11

7. Demographics

7.1 With-Region Respondents...................................................................................... 12

7.2 Out-of-Region Respondents................................................................................... 12

8. Conclusions ................................................................................................................................. 13

APPENDIX

A. Glossary ............................................................................................................................... 14

B. Methodology ......................................................................................................................... 14

C. Sources of Bias and Error..................................................................................................... 15

D. Model Review and Sector Descriptions (Dr Warren Hughes, Waikato University)................ 15

Page 4 of 172. Introduction

As Taranaki seeks to attract and retain events to the region, it is becoming more and more desirable to

evaluate the success of initiatives. It is increasingly common to measure the success of events by economic

contribution to the local economy. Venture Taranaki in partnership with the TRFU have undertaken this

research to determine the impact the Hurricanes v Sharks Super 12 game had on the Taranaki economy.

th

An estimated 12,500 people attended the Hurricanes v Sharks Super 12 game held on Friday 19 March at

New Plymouth’s Yarrow Stadium. Of these, 1,288 (10.3%) were estimated to be from outside of the

Taranaki region.

From a database of spectators, provided by TRFU, 572 surveys were distributed to Taranaki (468) and out-

of-region (104) spectators to measure expenditure. Estimates of other expenditure groups (e.g. teams/

management) were provided to Venture Taranaki by the TRFU. The total expenditure by spectators, game

organisers and teams was collated and used as input data into a 114-sector economic impact model of the

Taranaki Region. The information provided in this report summarises the economic impact of the event and

also provides feedback, gained through the spectator survey, to the TRFU on various game/park/ticketing/

demographic issues.

The economic impact of the game on the Taranaki economy is measured across the following variables:

1. Total sales expenditure or output in dollars.

2. Net Household Income (after tax and savings) generated in dollars.

3. Full-time Equivalent Employment (FTE) generated in persons.

4. Value Added, also known as Gross Regional Product (GRP) (salaries, profits and taxes) generated in

dollars.

While Total Expenditure measures the gross dollar impact of the event, economically the best measure is

Value Added (or GRP). Value Added measures the total value of goods and services created within the

Taranaki economy as a result of the game.

In addition to the economic benefits listed above, it is important to recognise the intangible benefits the game

generated for Taranaki that can not economically be measured. Two of the more significant intangible

benefits the Hurricanes v Sharks game generated included the international live broadcast via the Sky

network and the general positive feeling reported by visitors to the region.

Page 5 of 173. Objective

The key objective was to measure the financial economic impact the annual Hurricanes Super 12 game had

on the Taranaki economy.

Sub-objectives include:

• To measure out-of-region spectator expenditure.

• To measure the extra expenditure within Taranaki the game creates (i.e. how much Taranaki

residents spend as a result of the game).

• To identify where out-of-region spectators are coming from.

• To identify how spectators are finding out about the game.

• To measure how many spectators can identify the Taranaki Rugby primary sponsor (Genesis

Energy).

• To find out how people would like to purchase tickets in the future.

• To find out the types of groups attending games.

• To identify the preferred time and day of future games.

• To gain general feedback from out-of-region visitors on their trip to Taranaki.

4. Expenditure

Across the industries an estimated $562,922 was spent by TRFU, event organisers and spectators etc.

Estimates were collected via spectator survey and TRFU. See appendix section B for further information on

survey methodology and data collection methods. The table below details expenditure by industry.

Industry Sector Expenditure

Printing and services to printing $1,850

Electricity transmission $2,000

Non building construction $1,100

Retail trade $107,355

Accommodation $101,042

Bars, clubs, cafes and restaurants $168,669

Road freight transport $600

Road Pax (road passenger transport) $83,582

Communication services $150

Vehicle and equipment hire $560

Technical services $2,275

Advertising and marketing services $3,600

Employment, security and investigative services $10,000

Pest control and cleaning services $2,000

Medical, dental and other health services $350

Other sport and recreational services (tickets) $76,310

Personal and other community services $1,500

Total $562,922

Page 6 of 175. Economic Impact

The expenditure by organisers, teams and spectators (within-region and out-of-region) for the Hurricanes v

Sharks Super 12 game totaled an estimated $830,000. This is money that was spent both at the game and

in preparation for the game. The direct impact is estimated at $560,000, while the flow-on impact is

estimated at $270,000. One example of the difference between direct and flow-on impacts is renting a hotel

room; the direct impact would result from the client hiring the room, while the flow-on impact results from the

hotel purchasing electricity, gas, food and other commodities to supply the client.

Four key economic measures help asses the impact of an event on the region. These include total direct

expenditure (as above), net household income, full time equivalent (FTE) employment and value added

(also known as Gross Regional Product, GRP).

Impact Expenditure Net Household FTE Employment* Value Added

Income (GRP)

Direct $560,000 $120,000 6.80 $240,000

Flow-on $270,000 $40,000 1.44 $110,000

Total $830,000 $160,000 8.23 $350,000

NOTE: impact figures rounded to two significant figures. *Figures do not sum to total due to rounding

consistency.

All together an estimated $830,000 changed hands in Taranaki as a result of the Hurricanes v Sharks Super

12 Game. This expenditure was allocated across the relevant industry sectors and entered into the

economic impact model (see appendix section D for detailed description of the model) to determine

alternative impact measures.

Approximately 8.23 FTE jobs were created as a result of money spent by TRFU, event organisers and

spectators etc. for the Hurricanes v Sharks game in Taranaki. An estimated $160,000 of disposable income

(i.e. after tax and savings) was injected into local households in the form of wages/ salaries as a result of the

game.

Value added, or GRP, measures the value of output producted by the Taranaki economy as a result of the

game. For example, consider a hotdog sold at the game for $1.60. Of this only $0.20 is added to the

Taranaki economy by the transaction. The remaining $1.40 is attributed to the region where the hotdog was

manufactured, freighted from etc. It is estimated that $350,000 in regional output was created in the

Taranaki economy as a result of the game. The majority of this, $240,000 was resultant from direct

expenditure while $110,000 was resultant from flow-on expenditure.

Page 7 of 176. Analysis

6.1 Accommodation

Almost half (46.8%) of out-of-region spectators stayed in hotel/ motel accommodation while visiting Taranaki

for the game. Conversely, 31.9% stayed privately with friends/ family. On average, out-of-region spectators

spent 1.74 nights and $66.70 (per person) on accommodation while visiting the region.

Accommodation Form

25

20

Frequency

15

10

5

0

Hotel/ Motel Privately Hostel Holiday Park

6.2 Advertising Effectiveness

58.9% of Taranaki respondents reported they found out about the game via newspaper/ magazine

publications. Following this, radio and work of mouth mediums were most effective. The ‘other’ mediums

commonly included banners/ billboards around New Plymouth/ Taranaki and Super 12 information (e.g.

calendars).

Advertising Effectiveness

150

100

Frequency

50

0

Newspaper/ Radio Word of Other Internet Flyer

Magizine Mouth

Page 8 of 17The majority (27.7%) of out-of-region respondents also reported they found out about the game through

newspaper/ magazine advertising. Collectively 44.7% found out through word-of-mouth or the internet.

19.1% found game information through other means (generally ‘other’ included super 12 information).

6.3 Spectator Group Types

The majority of Taranaki spectators were family groups. Just less than one quarter of respondents went with

friends while 4.8% went to the game with work colleagues. Comparatively, 57.4% of out-of-region attendees

accompanied family to the game while 36.2% went with friends.

Taranaki Spectator Group Type

200

150

Frequency

100

50

0

Family Friends Work colleagues

NOTE: Respondents that reporting attending the game with friends and family were classified as family

groups. It is assumed that groups of this nature would be representative of family behavior.

6.4 Purchasing Tickets

Overall the response to current ticketing options was positive, with 78.5% of respondents either making no

comment or confirming the options available were satisfactory.

“I made a A number of respondents commented that they did not like the additional booking fee charged for

special trip purchasing tickets through New Zealand Post, as one respondent wrote “New Zealand Post is okay [for

to New purchasing tickets], but no booking fee”. Another issue raised was the inability for individuals to select seats,

Plymouth “I would like to be able to pick my seats from the Post Office”. A number of respondents also requested the

to pick up option of being able to purchase tickets directly from the TRFU with no booking fee.

my tickets”

Of the comments made by respondents, over one-third was with reference to tickets being available through

Service Stations. Some coastal respondents recommended rural business outlets sell tickets (e.g. Taranaki

Farmers) in order to save a trip to town.

Of the out-of-region respondents, over eighty percent either made no comment on how they would like to

purchase tickets in the future, or commented that the current methods were meeting their needs. A number

Page 9 of 17of individuals commented that they preferred the internet option available through Red Tickets. The issues

around the booking fee and seat selection were also raised.

6.5 Sponsorship

The significant majority of Taranaki respondents (84.8%) were able to identify Genesis Energy as the

primary sponsor of Taranaki Rugby. This is a strong response and indicates the effectiveness of marketing

initiatives to date.

Yarrows and TSB Bank were alternative sponsors mentioned by the remainder of Taranaki respondents.

4.8% of respondents were not able to answer the question.

6.6 Preferred Time and Day of Future Games

40.3% of Taranaki respondents indicated Saturday at 7.35 pm was the preferred time of future games.

Saturday at 2.35 pm (25.2%) and Friday at 7.35 pm (23.6%) was also favored by respondents.

Preferred Day and Time of Future Games

Day

Friday Saturday Sunday Total

Time 2.35 pm 0 65 9 74

5.35 pm 3 15 1 19

7.35 pm 61 104 0 165

Total 64 184 10 258

Page 10 of 176.7 Out-of-Region General Comments on Taranaki

“Excellent stadium,

friendly people,

“The stadium GREAT place”

is fantastic,

and with the Overall comments from visitors to the region were very positive. Issues commonly raised were

mountain in the new stadium renovations and the friendliness of the Taranaki people.

the

background

it is A number of respondents commented that additional signs would be beneficial. In particular,

awesome” roading signs indicating state highway three /state highway one and a sign to the CBD area in

New Plymouth. It was also suggested that out-of-town spectators (who pre-purchase tickets)

receive a map of New Plymouth and the stadium facility with their tickets.

Comments in relation to the game were also frequently made by respondents. One international visitor had

this to say “Hosting matches in the provinces is something that NZ does well and something Europe does

badly. I can not recommend enough the importance of the ‘peoples game’ being offered to the people,

including smaller provinces. I extended my stay in Taranaki for almost a week to see the game”.

A number of out-of-region spectators commented that Friday night games made it difficult to attend “Have it

on Saturday night, less time off work and school”.

Ticket prices were also commented on by both national and regional spectators. A

“Tickets

number of respondents suggested offering package deals, “ticket package deal to

were at a

include ticket, accommodation and a meal” and “Make it more family friendly – each

higher cost

child with an adult to receive a game pack (e.g. poster, flag, chips, small drink for

than other

$5.00 on terraces)”.

grounds”

One respondent expressed concern regarding ticket prices and food restrictions in the park “I was told on

arrival I could not take my own food in. I don’t think you can have such high admission costs and not allow

families to take food in. Either lower the price of admission and not food allowed in or vice versa. I think

currently the price is out of a lot of peoples range. It can cost over $100 for a family to watch our Super 12

team – this is why people are watching on TV”.

Page 11 of 177. Demographics

7.1 Within-Region Respondents

40.0% of respondents were male between the age of 40 and 65 years. This is likely to be due to the fact

that respondents were selected from the database based on the order of purchasing tickets, rather than

quota sampling based on demographics. It is also likely to be influenced by the nature of the event, and the

older population base in Taranaki.

‘Professional’ was the most frequent respondent occupation (36.4%), followed by ‘Labourers’ (19.4%) and

‘Farmers’(19.0%).

55.2% of within-region respondents were located in the New Plymouth Urban Area. Stratford and South

Taranaki Districts reported greater rural than urban spectators.

Location of Respondents

Urban or Rural Total

Urban Rural

New Plymouth District 149 49 198

Stratford District 6 12 18

South Taranaki District 17 37 54

Total 172 98 270

7.2 Out-of-Region Respondents

Again, the majority of respondents (34.0%) were males between the age of 40 and 65 years. ‘Professional’

was the most commonly identified occupation type (57.4%) followed by Labour related occupations (19.1%).

Most respondents originated from the Wellington and Manawatu-Wanganui Regions. Combined these

regions account for 85.1% of out-of-region respondents.

Origin of Spectators

25

20

Frequency

15

10

5

0

Au

W

W

So

M

H

N

aw

ot

an

el

ai

ck

ut

lin

ka

in

a

ke

hl

la

w

gt

to

an

N

n

's

at

on

d

Z

d

Ba

u-

W

y

an

ang

ui

Page 12 of 178. Conclusions

• The Hurricanes v Sharks Super 12 game held in Taranaki generated an estimated $830,000 of

expenditure. Of this, $560,000 was direct expenditure and $270,000 resulted from flow-on expenditure.

• An estimated $350,000 was generated in additional output as a result of the game.

• An equivalent of 8.23 full time equivalent jobs were created as a result of money spent by event

organisers and spectators.

• Around $160,000 (after tax and savings) was injected into local households in the form of wages/

salaries as a result of the game.

• Advertising in Newspapers and Magazine publications was the most effective form of advertising the

New Plymouth Hurricanes Super 12 game.

• Most spectators attend the game with family members as opposed to friends or work colleagues.

• Current ticketing methods are meeting the needs of spectators. However, due to the displacement of

the Taranaki population, there may be value in making tickets available through service stations.

• The Taranaki Rugby sponsor (Genesis Energy) was well recognised by over eighty percent of Taranaki

spectators.

• Saturday at 7.35 pm was the most favored time for future games.

• The majority of out-of-region spectators originated from the Wellington and Manawatu-Wanganui

regions.

• Visitors stayed on average 1.74 nights when in Taranaki for the game. Almost half stayed in hotel/

motel accommodation.

• Overall New Plymouth was received very well by out-of-region spectators visiting the region. In

particular, they were impressed with the improved stadium facilities and the friendliness of the Taranaki

people.

Page 13 of 17APPENDIX

A. Glossary

FTE Employment Full-time equivalent employment. A person working 30 or more hours per

week is regarded as a full-time employee by Statistics NZ (1 FTE). Two part-

time workers working up to 30 hours per week equate to one FTE. About 24%

of the NZ workforce works part-time.

Net Household Income Household income from wages and salaries after income tax (PAYE),

superannuation and other saving. This measures the amount of purchasing

power available to Taranaki residents as a result of the game.

Value Added, GDP or GRP GDP or gross domestic product also known as Value Added, is the value of

output produced within NZ by domestic and foreign Business Units. GRP or

gross regional product is the value of output produced regionally, e.g. in the

Taranaki economy. For example, consider a $40,000 utility vehicle to be sold

from a Taranaki dealership of which $10,000 is the dealer’s gross profit margin.

Only $10,000 is added to the Taranaki GRP by this transaction. The other

$30,000 accrues to the region where the utility was made and the freight etc.

cost to out-of-region firms transporting the vehicle to Taranaki.

Input/Output Model A model showing all economic inputs required to produce a given output level

of a good or service. For example, all labour, electricity and other inputs

required to process one tonne of milk solids into dairy products. Some inputs

(e.g. turbine generators) may need to be imported from outside the region or

from overseas. A 114-sector Input/Output Model for the 2003 year was the

basis for estimating the economic impacts reported for the Taranaki economy.

B. Methodology

Data Collection

The contact details (name and postal address) of spectators were provided to Venture Taranaki by TRFU.

The list comprised 5,710 ticket sales1 through Red Tickets either via phone, internet, by visiting a NZ Post

Shop, or a Books & More Store. Of these, 5,154 were from the Taranaki region and 586 (or 10.3%) were

from other areas in New Zealand.

2

572 economic surveys were distributed to spectators (104 to out-of-region and 468 to within-region

spectators). Out-of-region and with-region populations received different survey forms, this is to take into

account the fact that Taranaki based expenditure is different to that of out-of-region spectator expenditure

(i.e. accommodation).

1

Individuals on the list purchased more than one ticket. Only individuals that detailed their name and address were

included on the final selection list.

2

104 individuals purchased the 586 known out-of-region tickets. As this falls below the desired sample size, all

individuals were surveyed.

Page 14 of 17A response rate of 45.2% for out-of-region surveys and 57.7% for within-region surveys was achieved.

Based on a combined spectator population of 12,500, we can be 95% confident to +/- 5.9% that within-

3

region results are representative of the entire population and 95% to +/- 14.0% that out-of-region results are

representative of the entire population.

Data Analysis

Total out of town attendee expenditure was included in analysis while portion of within region expenditure

was included. The proportion included was based on the percentage chance that attendees would have

gone out of the region had the game not been on (i.e. if a respondent reports a 30% change they would

have gone out of the region if the game had not been on, then 30% of that respondents expenditure went

forward to be included in analysis).

C. Sources of Bias and Error

It is virtually impossible to conduct any research without a bias influence of some form. In this case, there

are a number of sources of bias and potential error that interpreters of the report should be aware of.

• Only a sample of those individuals that pre-purchased tickets was surveyed. Spectators that did not

purchase tickets to the game in advance, or did not disclose their contact details when pre-

purchasing tickets were not included on the database selection list. It is assumed that individuals on

the selection list are representative of the entire population.

• Due to the limited number of out-of-region attendees available to be surveyed, we can be confident

results are representative of the entire population to between 81 and 100%.

• Due to the detailed nature of questions asked, estimates and averages reported by respondents may

not be precisely reflective of true expenditure.

• Some attendees will not be willing to participate in the survey.

• It is likely that attendees that had a more significant financial relationship (i.e. stayed a number of

nights in the region) to report are more likely to complete the survey than those with a less significant

relationship to report.

• Although the best strategies were implemented to construct the survey form, the questions asked or

not asked can influence whether a respondent will complete the survey form.

D. Model Review (Dr Warren Hughes, Waikato University Department of Economics)

The model used in this report was constructed from data originating with Statistics NZ over the 1995/96

year. This data was then updated to 2003 productivity levels and prices and calibrated with NZ’s GDP. The

NZ and regional economies were categorised into 114 sectors.

3

This confidence interval is above the desired 10.0%; however is unavoidable due to the limited national level database.

Page 15 of 17The model for the Taranaki Region was used to document four economic impacts:

• Total sales, expenditure or output in dollars.

• Net household income after tax, superannuation and other saving in dollars.

• Value Added for the region in dollars.

• Employment in full-time equivalent persons (FTEs).

Although total sales, expenditure or output best measures the dollar value of total economic activity in a

region, it can be inflated by the value of large imports of products or services (e.g. a turbine for a co-

generation plant) into a region like Taranaki from say Australia or the UK. While such sales figures measure

total transaction value, the Value Added measure quantifies the economic value in dollars created within a

region (or NZ) by the local workforce after allowing for any necessary imports of raw materials and other

goods and services from outside that region (or NZ). This is the measure of the addition to gross regional

product (GRP) and ultimately to NZ’s GDP, and best reflects the true gain to the economy of interest.

Net Household Income is the best measure of available household purchasing power. Strong growth or

impact for this measure signals improved prospects for the Wholesale and Retail Trade sectors, Ancillary

Construction (e.g. house additions or renovations) and similar sectors. In percentage terms, this impact

shows almost the same value as FTE employment. Hence, growth or level of FTE approximates growth or

level of Net Household Income.

A wealthy region or country may show acceptable outcomes for the three dollar measures above but may

lack the industrial capacity to support good job growth in the region. Employment is therefore an important

attribute of regional prosperity and this means economic development within the region is required to expand

opportunities for a regional workforce. Such employment is measured in full-time equivalents (FTEs) since

about 24% of regional workforces are currently part-time employees.

Activities in the 114 Sectors of the Taranaki Economy

1 Other Horticulture 58 Furniture

2 Apple & Pears 59 Other Manufacturing

3 Kiwifruit 60 Electricity Generation

4 Other Fruit 61 Electricity Transmission

5 Mixed Cropping 62 Electricity Supply

6 Sheep & Beef Farming 63 Gas Supply

7 Dairy Farming 64 Water Supply

8 Other Farming 65 Residential Building

9 Services to Agriculture 66 Non-Residential Building

10 Forestry 67 Non-Building Construction

11 Services to Forestry 68 Ancillary Construction Services

12 Logging 69 Wholesale Trade

13 Fishing 70 Retail Trade

14 Coal Mining 71 Accommodation

15 Services to Mining 72 Restaurants, Cafes, Bars & Clubs

16 Other Mining & Quarrying 73 Road Freight

Page 16 of 1717 Oil & Gas Extraction 74 Road Passenger

18 Oil & Gas Exploration 75 Water & Rail Services

19 Meat Processing 76 Air Services, Transport & Storage

20 Poultry Processing 77 Communication Services

21 Bacon Ham & Smallgoods 78 Finance & Superannuation

22 Dairy Manufacturing 79 Insurance

23 Fruit & Veg, Oil & Cereal Processing 80 Services to Finance & Insurance

24 Bakery & Confectionary 81 Property Services

25 Seafood Processing 82 Owner Occupied Housing

26 Other Food Manufacturing 83 Vehicle & Equipment Hiring

27 Soft Drink, Cordial, Water 84 Scientific Research

28 Beer, Wine & Tobacco 85 Technical Services

29 Textile Manufacturing 86 Computer Services

30 Clothing Manufacturing 87 Legal Services

31 Footwear 88 Accounting Services

32 Other Leather Products 89 Advertising & Marketing Services

33 Sawmilling & Timber Dressing 90 Business, Admin. & Mngt. Services

34 Other Wood Products 91 Employment & Security Services

35 Paper & Paper Products 92 Pest & Cleaning Services

36 Printing & Services 93 Other Business Services

37 Publishing & Recorded Media 94 Central Government

38 Petroleum Refining 95 Defence

39 Petroleum & Coal Products 96 Fire & Police

40 Fertilisers 97 Local Government

41 Other Industrial Chemicals 98 Pre-School Education

42 Medicinal, Detergents & Cosmetics 99 Primary & Secondary Education

43 Other Chemical Products 100 Post School Education

44 Rubber Manufacturing 101 Other Education

45 Plastic Products 102 Hospitals

46 Glass & Ceramics 103 Medical & Dental

47 Other Non-metallic, Mineral Products 104 Veterinary Services

48 Basic Metal Manufacturing 105 Child Care

49 Structural, Sheet & Fab Metal Prod 106 Aged Accommodation

50 Motor Vehicles 107 Other Community Services

51 Ship Building 108 Movies, Radio & TV

52 Other Transport Equipment 109 Libraries, Museums & Arts

53 Photographic & Scientific Equipment 110 Horse & Dog Racing

54 Electrical & Appliance Manufacturing 111 Gaming

55 Agricultural Equipment 112 Other Sport & Recreation

56 Other Industrial Machinery 113 Personal & Community Services

57 Prefabricated Buildings 114 Waste, Sewer & Drainage

Page 17 of 17You can also read