The Role of Composite Information Systems The Citibank Corporate Finance and Strategies Analysts Case - WP # CIS-90-12

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The Role of Composite Information Systems

The Citibank Corporate Finance and

Strategies Analysts Case

Dana Pressman

May 1990 WP # CIS-90-12The Role of Composite Information Systems

The Citibank

Corporate Finance and Strategies Analysts Case

Dana R Pressman

Bachelor of Science Thesis in Economics

Massachusetts Institute of Technology

Cambridge, MA 02139

Abstract

This thesis will analyze the use of Composite Information Systems (CIS) within the

context of commercial financial analysis. As part of the Composite Information

Systems/Tool Kit (CIS/TK) research project at the MIT International Financial Services

Research Center, this case study will explain the benefits and difficulties of applying the

theoretical technology to corporate reality.

Information is a basic and yet often misunderstood asset. Most modern economic

theory assumes perfect information, yet modern economic society only realizes imperfect

information. With the proliferation of international markets and firms, information can no

longer be ignored or taken for granted; the loss of efficiency and knowledge will certainly

hamper the competitive firm. CIS is the first step towards bridging today's technology

with today's world and tomorrow's dreams.

The CIS/TK research project is a prototype solution to real problems faced by

individuals and corporations who need the flexibility and robustness of data integration.

This paper will document the purpose, function, and progress of the CIS/TK and further

relate that to the needs of Citibank's Corporate Financial Strategies & Analysis(CFSA)

Group. Both cases represent different resource needs and requirements, yet both call for the

use of a system which can easily connect the many data sources which are often used in a

company to solve a single question. Connect and connection are ambiguous terms in that they

conjure up visions of physical bridges. Yet in this context there is not only 'physical

connectivity' but 'logical connectivity' as well. Even if it is technically feasible to have

complete data integration, it is not necessarily always desirable.

This study has found that CIS/TK type integration is appropriate and feasible in

the case of Citibank's Corporate Financial Strategies & Analysis(CFSA) Group if certain

improvements and enhancements are added to the system. The study has found paths for

CIS/TK to follow as well as the benefits to the CFSA which CIS/TK can contribute.

Keywords and Phrases: Composite Inforamtion Systems, physical connectivity, logical

connectivity

Acknowledgements: I would like to thank David Lipfert, Steve Ellis, Lydia Magliozzi,

Judy Taylor, Robin Miller, and the other individuals I spoke with at Citibank. My

gratitude, of course, extends to Stuart Madnick and the other members of the CIS/TK team.

I would especially like to recognize Bertrand Regaldies .Table of Contents

I The Purpose of Integration............................................................................ 5

1.1 How to Integrate............................................................................. 5

1.1.1 Physical Integration.......................................................... 6

1.1.2 Logical Integration............................................................ 6

1.2 The System e CIS/TK ..................................................................... 6

II Citibank's CFSA ..................................................................................... 9

2.1 Group Description............................................................................. 9

2.2 Connectivity...................................................................................... 10

2.2.1 Physical Connectivity ........................................................ 10

2.2.2 Logical Connectivity......................................................... 10

2.2.3 Inform ation Sources............................................................ 15

2.3 Financial Services Industry .............................................................. 16

2.3.1 Inform ation Uses................................................................ 17

2.3.2 Inform ation Problem s........................................................ 17

2.3.3 Logical Connectivity......................................................... 18

2.4 Utilities Industry............................................................................. 18

2.4.1 Inform ation U ses................................................................ 18

2.4.2 Inform ation Problem s........................................................ 20

2.4.3 Logical Connectivity......................................................... 22

2.5 M edia Departm ent........................................................................... 22

2.5.1 Inform ation Uses................................................................ 22

2.5.2 Inform ation Problem s........................................................ 23

2.5.3 Logical Connectivity......................................................... 232.6 Petroleum, Metals and Minerals Department................................... 24

2.6.1 Inform ation Uses.............................................................. 24

2.6.2 Information Problem s........................................................ 25

2.6.3 Logical Connectivity.......................................................... 25

III General Overview of Needs and Enhancements............................................ 27

3.1 Im plem entation of CIS/TK............................................................... 28

IV Conclusion.........................................................................................................29

V Bibliography................................................................................................ 30

Appendix...............................................................................................................31

List of Figures

(1) CIS/TK Architecture................................................................................... 8

(2) CFSA Organization Chart.......................................................................... 11

(3) Comparison of LIFO and FIFO Inventory Calculations................................. 12

(4) Flowchart of FSI Analyses........................................................................... 18

(5) Flow chart of Utilities Analyses................................................................... 21I The Purpose of Integration

Computers in corporations have been a long time friend of the information hungry

executive. For those who want to pass along information there are word processing and

electronic mail applications. For mathematicians there are spreadsheet and analysis

software. For engineers CAD/CAM programs which allow electronic design and

manufacturing are the answer. Then there is the large database. In any database, linear,

relational, or remote, a large information base is stored in such a form so that any desired

piece of that base can be accessed painlessly. A phone book is a simple example of a large

easily accessible database, the user can access it by either referring to the paper version

which resides in almost every home, or by asking the phone operator to search her

electronic version.

The key word in databases is 'painlessly'. Since every database has its own

particular purpose, every database will have its own 'painless' query procedure. Some

require the user to learn a second language - such as Structured Query Language (SQL).

Others merely require the user to use menus and search words to obtain the desired

information. Local databases are used in a particular setting to hold anything from a

mailing list to a payroll. Remote sources on the other hand tend to offer widespread data,

such as financial statistics of American corporations. Often times two data sources contain

different and unrelated information and therefore are invariably kept separate; there is no

need to integrate.

However, what happens when the answer to your question is not found in any one

source? For example, the Career Services office at the MIT Sloan School of Management

offers many services to help graduates find their way into the corporate world. A student is

interested in getting a large overview of the company with which they wish to work.

Career Development Office has access to four distinct databases. Two of which are local,

the other two are remote dial-up only utilities. They have their own recruiting schedule

database which represents the visit dates of the companies and the students wanting to find

a job opportunity. The alumni database is also helpful in locating former MIT graduates

who are currently employed by a company in which a graduating student is interested. The

Finsbury's Dataline database provides financial information on companies which are mainly

based in Europe. The I.P. Sharp represents similar although not analogous information on

mostly American companies. Often the two remote databases share information on account of

the proliferation of international corporations and markets. The combination of the four

sources help to present to the student the most complete information at the touch of a few

keys. Therefore, if a student is interested in working for General Motors, the CIS/TK system

would output all the visit dates of General Motors and some basic financial information on

the present and past status of the company. The student can then access the alumni and get

a better feel for the company. This extra edge can make the difference between employment

and unemployment.

1.1 How to Integrate

There are two basic issues regarding the interlocking of the above databases:

'Physical Connectivity' and 'Logical Connectivity'. Physical Connectivity represents the

actual hardware connections, making the computers talk to one another and understand each

others language. Logical Connectivity asks the question if two databases should actually

converse with one another considering their different purposes.1.1.1 Physical Integration

Since each database is established by different people with different views there

are many issues which stem from the problem of no standard interface. Each database has

its own set of control commands. The physical connections must consider the following

attributes: different platforms, operation systems, database access protocols, and file

formats. For example, the escape symbol maybe represented differently in two systems.

Pressing the ESC key in one database can have the same purpose as the 'p' key in another.

It is relatively easy for a human to change 'vocabulary' as long as he knows the words. A

computer however, does not have the innate adjustment capabilities that humans do.

1.1.2 Logical Integration

The semantics of the data stored in a certain field of a database is often not

equivalent to the data stored in an analogous field of another. Here are some examples:

e Data Location - where can I find the data? Where is it located within the

database? What protocol must I follow to maneuver to the correct location?

" Attribute Naming - is CompName or CompCo the name of the company?

e Data Formatting and Scaling - is sales in thousands of Dollars or millions of

Yen?

" Inter-Database Instance Identification - is MIT equivalent to Massachusetts

Institute of Technology? How many different instances of a company can it check

and should it check?

e Levels of Granularity- Is the data for General Electric eclectic or must I look

at NBC and Kidder Peabody as well? Often companies are not simply one

organization. Although NBC is considered a singular company, it is owned by

General Electric. The question becomes to decide upon the appropriate company with

or without its parent company. In order to get aggregate and complete data on

General Electric it might be necessary to figure in the assets and debts of its other

companies.

e Concept Inferencing - the database does not specify average annual salary,

can it be inferred from several known attributes?

There are many issues which can easily be determined by the human eye and mind,

but the question remains: is it desirable and feasible to program and teach a computer to

perform a complicated repetitive task as in the above example? In each case a thorough

analysis must be completed in order to insure that all the effects, benefits and difficulties, of

the project are well understood. It is costly and inefficient if problems 'pop up' during the

implementation of a system which are unanticipated.

1.2 The System * CISITK

The CIS/TK system architecture is broken down into three distinct levels of

integration.

e Application Query Processor. This processor controls the user interface. It

translates the query information that the user gives into the language which can be7

understood by the system. After the query is executed, the Application Model

Processor reports the results of the query to the user in an appropriate form.

* Global Query Processor (GQP). As the second link in the pipeline, the GQP

determines which databases should be accessed to retrieve the desired attributes. It

discerns the nature of the particular variable and sends the required information to

the appropriate database controller. When the databases return the information,

the GQP assembles the results in order to completely realize the user's question.

* Local Query Processors (LQP). There are as many LQPs as there are

separate databases in the system. The LQP acts as an operator given the task of

finding the attribute specified by the GQP. The syntax, structure, and semantics of

the particular database are all incorporated in the individual LQPs so that an

executable query is passed to the remote or even local database. When it receives

the results it passes that information back to the GQP.

Figure 1 shows a graphical view of the CIS/TK System Architecture.Application

APPLICATION Model - mApplication

MODEL Manager Model Processor

Global

. Schema Joined

Query Table

GLOBAL

SCHEMA

Local Query

Processor I

Figure 1II Citibank's CFSA

In June 1989, David Godes recorded his findings of three case studies in his graduate

management thesis (WP # CIS-89-02). This thesis will be the second stage of the study of

the CFSA as requested by Citibank. Many changes have been made in the information

technology there since Godes' review was performed. An assessment of the modifications

that have occurred is necessary to insure that the needs and constraints of the Financial

Analysts are met. The project is a particularly complicated one in that connectivity has not

been proven to be the correct solution necessary to the situation at CFSA. It is often difficult

to understand the possible uses of a new system as the Associates have been taught to think

in terms of the technology which is available to them.

2.1 Group Description

The CFSA has two basic functions:

1) To identify new market opportunities - companies which need cash to

restructure or buy back some of its own stock, or to sent up a line of credit.

2) To evaluate current opportunities faithfully - using such variables as expected

value, expected environment, and the risk profile.

There are two basic types of analysis which are performed at the CFSA:

1) The annual review of all current accounts.

Purpose - to understand the current position of all presently

maintained company accounts. Is the current strategy profitable or should a

different type of credit be issued?

Method - the compilation and assessment of company financial

statements. Often the final statistics are compared to a control group of

corporate peers. The prqcess is done with Lotus 1-2-3 Macro-based templates

and often imported into Microsoft Word forms. The procedure is rather

repetitive as demonstrated by the use of macros and forms. The actual

process depends on the type of company being analyzed. For some

departments the analysis is based almost purely on numbers while other

departments require that more abstract variables, like expected market

conditions, be taken into account. The analysts or associates had no

complaints about the quality of their reviews. The bankers who use the

reviews and analysis use them as reference and background information.

Additionally, each associate had different reactions to the suggestion of

using an alternative system like CIS/TK.

2) Credit analysis of all incoming debt accounts.

Purpose - to decide on the most appropriate portfolio of debt

instruments for each incoming company. What amount of debt should be

issued, for what duration, and at what interest rate will give Citibank the

highest profit and lowest risk?

Method - in this case there is no uniform procedure. Each Associate

must determine which data and technique to use. Often, creativity takes a

large role in determining the final method of analysis.The CFSA uses many disparate data sources, many of them providing overlapping

functions. The CFSA is split up into five 'Specialized Industry Units' and three basic

'Regional Units'. Any Fortune 100 company which can be categorized under any of the

Specialized Industry Units is handled by that unit. Other companies are carried by the

appropriate Regional Unit. Each of the Specialized Industry Units has different methods of

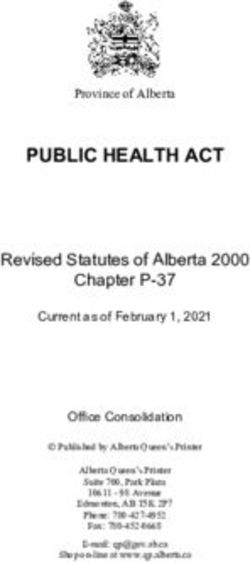

analysis based upon the type of information available. See figure 2 for an organizational

chart of CFSA. Each of four departments will studied in this thesis: Financial Services

Industry, Utilities, Media, and Petroleum, Metals and Minerals. The associates generally use

Lotus and internally created macro models to analyze and manipulate the data. Data is

downloaded from various databases or manually inserted into a general spreadsheet.

2.2 Connectivity

Since connectivity is an ambiguous term, I will again split the subject into two

separate areas: Physical and Logical. The entire CFSA has certain characteristics which

are necessarily functions of the individual units within the department.

2.2.1 Physical Connectivity

In most departments there already is a kind of physical connectivity. The bulk of

the databases, according to the Information Systems unit, is actually accessed through the

Lotus One Source service which provides a direct path to the 1-2-3 program. For the other

separate databases the Associates must either dial up or access the CD-ROM and then

navigate through that system separately. One of the major problems of giving all terminals

access to remote databases is the licensing problem. It is very expensive to provide constant

multiple access to databases which price their services based upon time used. This

particular problem can only be addressed by performing a cost-benefit analysis. Since the

dial-up services are not a major source of information, it is unlikely that constant access by

all the terminals is necessary or warranted. Any other problems are solvable, however, and

are similar to the ones discussed in the analysis of CIS/TK.

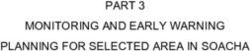

2.2.2 Logical Connectivity

Logically this is a very complicated system and not as readily integrated as the

CIS/TK. Much of the semantics of the various sources is capricious and complicated. For

example, the value of a company's inventory depends on the accounting procedures of the

particular firm. A company may chose to use a First-In-First-Out method or a Last-In-First-

Out method. See figure 3 for an example. Often a particular protocol is known intrinsically

by the user.ICorporate Finance Strategies &Analysis

Organization Chart CFSA

November 1989 J. YoungWood

Econoist

P. Cawfr

Spedellied hiduety Wilts Regional Mits

NCD

FSI PM4 East Central West

C. Faveukes* J. Mart S.Barow' 8. Knez oek'$ C. KesslerJ Newbery* H. Chistersen*

J. MacIonakd S.Sdoch

S.Abbasi L Magliozzi J. Mug no* H.Lim8 Applebaum J. Bruce

J. While* E. Bunker K. Starncic R. Rei R.Mier J. Harris R. Herenton

J. Bari

G Hil

R.Calant D. Gupla J. Zavakos V.Fur T. Peter H. Hobart K.FI

G. Craft K. Hamid J. Reed

S.Hurlim R.Racker

8. Alius 0. Know

M.4ise M.Neg

H

0. Presw

R."man D.Soo

C.Thieme

J. Von Feld

aMmumme I

Regional Wils Regional Wilts

nD

IM

New York NEMA Central Souetwst S Ws

M.Cannea' K. Weinstein S.Lefevre S.WlsW A Muller*

M.Hil C. Crke*

L.Marra J. Coons S.Hipmmn K.Claire J. Karp

M.Harrigen P.O'Connel M.Gales K. Fark R. Lewis

R. Lonna B.Simson

A.Huang W. Wong R. Snell D.Taylor

R.Sdyord J. Mc e Jr. R. Trimble M. Wadchom

R. Mueler

-EMmmmFirst, lets set up the available inventory.

A firm purchas es three television sets to sell:

Date ID Cost

December 1989 TV1 $200

February 1990 TV2 $250

March 1990 TV3 $270

Total Cost of Goods available to sell: $720

Then, a television set is sold for $500.

Financial Practices example:

Financial Statement FIFO LIFO

Sales $500 $500

Cost of Goods Sold $200 $270

Gross margin on Sales $300 $230

Ending Inventory $520 $450

Figure 3After accessing the same database variables many times and using that

information in their models, the Associates learn the meaning of the numbers. It takes a

while for new Associates to completely understand the system. They usually learn through

manuals and Business Solutions training classes which teach them the basics of each of the

systems and how to navigate through them. The finer details as to the meaning of a

particular ratio, for example, is taught in reference to the company itself. Although a

computer could also 'know' these meanings it would be extremely useful for the Associates to

be able to program the formulas and 'meanings' that the system uses. One associate

explained that he would want to be able to track the source of each of the data variables

and change them if he felt that they were inappropriate. This way if the meaning changes

or another variable is used the system is flexible enough to allow insertion and modification

of built-in definitions.

One example is that there is often discrepancies between data sources in the case of

cash flow statistics. The associate said that she always compares information retrieved

from Compustat with data found in the Company's Annual Reports. If there is a difference

she replaces the Compustat data with the Annual Report statistics. Information received

directly from clients proves to be a stable comprehensive source of data.

Another example would be the meaning of those cash flow statistics. It is difficult

to know whether or not the number reported includes working capital changes. The cash

flow from operations and working capital turnover ratio are ratios which give insights to

measures of liquidity at particular times. Both ratios are significant and sometimes

combined to give measurements of sales, inventories, and monetary constraints at particular

times. It is for this reason that the statistics are different from one source to another. To be

able to choose the 'correct' statistic takes a knowledge of the company as well as common

sense.

Another problem is that the data is not necessarily meant to be used in parallel

with other data. Often data is provided for a specific type of analysis and calls for a more

mental integration than a physical one. An example would be in the Petroleum, Minerals,

and Metals department the Associates must combine the validity of current contracts with

the possibility of future contracts. The present contracts can be shown as income and future

value of income, where as the potential for future contracts depends on the richness of the

mines and ores which the company owns. Many of the Associates perform manual searches

on textual information which does not call for outright mathematical manipulations. For

example, there are Stock Analyst Reports from other firms such as Kidder Peabody Inc., and

Drexel Burnham Lambert, reported in trade journals which are kept on-line in the library.

These forecasting reports include both textual and numerical information. An associate will

use textual analyses and forecasting data in order to get a feel for the company. When an

associate is first assigned to an analysis, he must gain a sense of the background and current

state of the firm. If the company is unknown to the Associate the first step in the process

will be to check on-line textual sources. A useful function for the system would be the ability

to 'read' through Global Reports or other on-line text based databases and choose the

appropriate selections.

The analyses which are performed are not always integrated. A cash flow analysis

would not be concerned with a bond or stock valuation. Different data is used and no

integration is necessary. However, the possibility of combining the results of the different

analyses into one comprehensive evaluation was never mentioned. A CIS/TK system might

be used to weigh different variables and give a general state for a company. Instead of

performing all the necessary analysis for new accounts, a 'comprehensive' would reveal if

additional interest should be shown in the company.

Many of the Associates whom I talked with were surprisingly suspicious about any

further use of computer technology. They either did not think that more integration was

beneficial nor that the forthcoming data would be trustworthy. They felt that their mental

techniques could not easily be translated into code; computers did not seem to be the answerto the large amount of repetition which they must perform. The repetition is not necessarily

one of an exact nature. Although the mechanical processes of finding data, entering into a

spreadsheet, running macros, and writing reports may seem to be the same, the thought

processes are different for different analyses because each firm has different characteristics.

Even though an Associate may perform a resource evaluation on many companies, the

evaluations may not involve the same calculations. An Associate must understand the

numbers and know the value of a particular attribute.

For example, a changing ratio of minerals in a particular mine will offer different

results depending on the analysis chosen to determine the value of that mine. At one point

in time a mine may contain different minerals; as the minerals are mined and more digging

reveals more of the mine that 'status' changes. The mineral which is being mined decreases

in mass, assuming no more is found, and therefore the contents of the mine change. If one

mineral is more valuable than another, a ratio which compares the amounts of the minerals

in the mine less than one would be negative. Conversely, a ratio of less than one which is

dependent on the less valuable mineral would be positive. Although it is the same ratio,

one mineral relative to another, the differing values of the minerals determine the value of

the ratio. Since the values of minerals are changing, the Associate must analyze the

appropriate numbers. The future value of a mine is very important as it determines the

amount of future profit.

Each of the data sources has different characteristics. Some are thorough while

others have more integrity. Compustat is particularly thorough, although the Associates

often check over the reported statistics to insure sensibility. DayText on the other hand

does not include all possible data, however, it is trustworthy. The Associate learns which

to use through experience and that knowledge is passed from mouth to mouth. The computer

does not have the experience or intelligence to identify statistics which are impossible for a

particular company.

Although integrity constraints can always be followed Associates' knowledge is

difficult if not impossible to categorize into rules. An Associate, however, will be able to

realize when any particular number is outrageous and basically impossible. After all, the

information was put into the database by a human in the first place and therefore open to

human error. There are integrity constraints that a human can enforce which may be very

difficult to put into rules so that the computer can enforce them. For example, an associate

will know that the value of an insurance firm is dependent on their investments and

conversely a cellular telephone company depends more on research and development as well

as marketing. A high value of assets then, is an ambiguous term whose value depends upon

the industry and time. Consequently, the human checkpoint is very integral to an effective

analysis. If the system could give a history of data statistics used, it would be useful so

that Associates would understand the history behind a particular result.

Since ratios are often combinations of many varied statistics the company must use a

formula in order to get a useful result. The statistics may or may not come from different

sources which have different levels of trustworthiness. In this case a data tagging feature

would be most useful so that associates can assess the 'correctness' of the final results. The

Associates stressed the costs of making mistakes and hence their innate mistrust of 'black

boxes' which spit out untraceable numbers.

Different calculations by different databases may yield different values for similar

fields. This is a result of the differences between the values of actual fields in disparate

data sources. If one database uses depreciated numbers and another uses nominal statistics

then the combined or compared statistics will be confusing if not meaningless. The Associate

can choose which one to use, and will understand the meaning of that calculation. By

personally placing the appropriate data into the macro, the associate is assured that the

meaning of the resulting ratios and statistics is the one that he wanted. But how can a

program be taught to understand the differences between the values when the definition of

those statistics is difficult to create? In some cases depreciation is included and in some it isnot. It is basically a decision left to the individual company's discretion. The answer may

be the integration of the data sources and the human sources. By getting human responses to

intermediate statistics and determining the actual value of those statistics, the system and

the Associate can understand the value of the final results.

2.2.3 Information Sources

The CFSA has a separate Business Solutions department which controls the computer

hardware and software used by each of the other departments. Most often the other

departments also have an internal person who is their computer specialist. This person may

be responsible for creating Lotus 1-2-3 macros, for example, as well as being an important

resource to the other members of the department. The Business Solutions department is

responsible for the maintenance of all current resources, training of all new staff on available

technology, support and training for all software upgrades, and research and implementation

of any appropriate new technology. The department is small and rather occupied. They

spend at least 70% of their time involved in everything necessary to keep up with the

current software and hardware platform. When new developments are considered the most

important attributes are ease of implementation and ease of maintenance. Cost-effectiveness

is in particular measured. Measurements are in terms of immediate costs, costs of support and

learning curve opposite expected return on investment(ROI). ROI is based upon the analysts

reports of time savings and quality improvement. A cost benefit analysis must be performed

before any new system is implemented.

The following databases and sources are used by the CFSA:

- Lotus One Source - an integrated data product provided by Lotus which

allows the Associate to obtain data from many databases. The service is

implemented on a Compact Disk which is downloaded weekly onto the network.

The information is therefore available to the Associates at their desks. All of the

data easily downloads into a Lotus 1-2-3 spreadsheet. Since all of the models are

implemented in Lotus 1-2-3 this is a rather useful product which is used by many of

the departments.

* Compustat - part of One Source which provides financial statements for the

Industrial, Utilities, and Line of Business business segments. This is one of the most

heavily and consistently used database. The information is gives is particularly

useful and connects smoothly with the models through Lotus 1-2-3.

- Daily Stocks - part of One Source which provides a time series of stock

quotes of stocks and warrants. Volume, stock dividends and splits are also included

* Bond Database - part of One Source which provides information about

government and corporate bonds as reported daily.

- Daytext - part of One Source which provides textual information about

private companies.

- IBES - part of One Source which stands for International Brokers Estimate

System. Provides earnings estimates for over 3,400 companies based the opinions of

over 2,500 securities analysts.

e Alcar - Is a stand alone application which provides modeling and

forecasting tools to be used with downloaded data(from Compustat). The program

generates cash flow and valuation ratios. The forecasting tool is a knowledge-based

system which asks for interaction with the Associates. Not many of the Associatesuse it because of lack of trust or general dissatisfaction with the provided analyses.

Often they export the data into their own Lotus 1-2-3 spreadsheet models.

Library with a well respected librarian- many of the Associates mentioned the

Librarian as a wonderful source of information. She is able to find the most useful

data on hard to find companies. This was particularly useful in finding new market

opportunities. Associates could just stop by the library and leave with a small

collection of articles, statistics and expectations.

- Quotron - An on-line database which provides almost real-time stock data.

The database resides on one workstation which Associates must access individually.

It is rarely used because One Source has Daily Stocks which is updated weekly.

However, Quotron provides more up to date information, for when it is useful.

- Bests Insurance Blue Books - Provides all the available information on

insurance companies. It is used solely by the Financial Services Industry and is

currently available to the Associates only in paper form(the Associates have to

enter the data manually). By the time this paper is published the department

should have started receiving the information in Compact Disk form.

- Global Reports - An on-line database which provides textual and minimal

statistical data about companies. It is accessible from a stand alone workstation

which Associates must learn how to navigate.

- Department of Commerce - One associate reported this as a source for the

Utilities industry. It was used as an example of rarely used but nevertheless useful

data sources outside the databases available on the floor. The information is

received over the phone but may be backed up by paper documents sent to the

associate.

*Company Stock Holders Reports - a good easily obtainable source of

information for cash flow, asset, and general financial statement information. It is

useful to compare the information found here to that provided by Compustat and to

determine the source of any differential.

9 Other internal information provided by the company - if the company is a

client of Citibank it will usually supply all necessary data directly to the

Associates. Again it provides a way of double checking all statistics and

understanding the exact value of all discrepancies.

Different departments make use of different combinations of the above information

sources depending on the industry. There may be other sources of information which are

infrequently used such as Lexus, Nexus, Reuters, and Dialog or hard to document(word of

mouth for example).2.3 Financial Services Industry

The Financial Services Industry Department is responsible mainly for insurance

companies. As part of the yearly report the Associate must perform peer reviews and create

a forecast based on historical information. The peer reviews compare the company under

review to 'peers' or other companies which are involved in a comparable industry. Of course

it is always difficult to find a good sample of strictly comparable companies, but those

numbers allow the Associate to understand if a sudden rise in premiums is a company

phenomenon or industry wide. It will also show if a company is below average in growth

rate. The forecast will also take into account general expectations such as business cycles,

political trends and other industry wide variables.

2.3.1 Information Uses

This particular department is peculiar in that all Statuatory Statements on

insurance companies is available at this time to Citibank only in paper form. The

department is working on receiving the information on Compact Disk so that the data can be

merely downloaded rather entered. All the information is listed in tables called industry

blue books. The Associates must spend about 20% of their time manually inputing this

information into a Lotus 1-2-3 spreadsheet.

The Associates must also manually input the test ratios for compliance. The

department undergoes a crunch review period annually in which all forecasting, NAIC ratios

and relevant ratios are determined. The Statuatory Statements reveal all current assets and

investments. The models and macros which perform the number crunching calculations are

implemented in Lotus 1-2-3.

. When an Associate is asked to perform an analysis of an unknown company the

process is as outlined in figure 4. The process depends mainly on whether or not Citibank

already has the statuatory statements for the company to be analyzed. If not, the Associate

is responsible for calling either the California or Alabama Regulatory Agencies which

supply all available statuary statements. Once received the process is basically similar in

either situation. Then the information is inputted into each of the four models and the

appropriate macros are run. The report mostly consists of written analysis although the

macros and results are often included for the Bankers' comprehension.

2.3.2 Information Problems

It is the data inputting which makes the crunch period invariably tense and tedious. The

department is currently trying to obtain the necessary data in a magnetic form so that the

relevant numbers will no longer have to be entered manually. Once this step is eliminated

the Associates feel that their jobs will be concentrated and intellectual rather than

mechanical although at that point double checking downloaded data will also be

important. This is basically the only problem which the Associates recognized. Once

solved, the process will be manageable. The department is also working on a database

which will hold all historical and current data on all companies which the associates work

with or analyze. The database is set to be working July, 1990. In this particular industry

there is little need for further integration of data, since the necessary information can only

be gotten from one source, the Statuatory Statements.Get a Statuatory

Retrieve Statuatory

Statement from

Statement and past

California or Alabam

analyses from files

Regulatory Agency

Input appropriate Enter any new data

statistics into the 4 into models and

models review history

'Ode

Compile all models

and perform

analysis

Time: Send final report

Time:

1.5 - 2 Weeks (textual and about 1 Week

numerical) to banker

Figure 4One important problem that the Associates expressed was that of timing. Since they

do not have all available data on hand for every company it takes quite a long time to

analyze a company whose statements they must get from one of the regulatory agencies.

Once the Compact Disk arrives, however, this problem should be solved.

Once the data becomes available on Compact Disk the FSI might consider including

data from other industries in their analyses. For example, the level of research and

development funds which a pharmaceutical company allocates might effect the claims

which Insurance companies encounter. If connections can be made then integration becomes

not only feasible but highly desirable. Although the Associates did not mention such a use,

it might be because they are not in a position to be moving ahead to new procedures and

methods while they are still trying to make the current ones efficient.

2.3.3 Logical Connectivity

In the Financial Services Industry department there is no need for current logical

connectivity since the Associates' duties would not be simplified by the additional data

availability. However, the incorporation of other industry's data into the forecasting

system may be a perfect use of the CIS/TK system. Until new methods are incorporated

though a CIS/TK type of system would not benefit this department.

2.4 Utilities Industry

Similarly to the Financial Services Industry department, the Utilities Industry must

also perform peer studies, yearly reviews and company forecasting. However, this

department is more automated. There is very little manual data processing, although

'double-checking' is an important keyword in the department since mistakes carry a high

price. Compustat downloaded into Lotus 1-2-3 leaves many manipulations to be disrupted

and chances for the data to be copied incorrectly. There are many chances for malfunction.

First, Compustat may have incorrect data, and secondly, there have been cases where

columns of data have been switched by the downloaded procedure. By checking numbers

which seem marginally improbable the Associates may prevent many priceless mistakes.

2.4.1 Information Uses

The Utilities department mainly uses the Bond Database although they also make

use of Global Reports, Daytext, and company suppled data. The Library is another primary

source of information, particularly the Librarian, Teresa.

When creating the annual reports the process includes the downloading of

information into Lotus 1-2-3, running the macros, and checking the results against expected

cash flow statistics. Any additional information needed for the annual reports can be gotten

directly from the customers who freely send Citibank their Annual Reports on paper.

Peer analysis may be more difficult since not all relevant peers will be customers of

Citibank. As part of the Annual Review the Associates are required to perform similar

reviews on comparable companies. In the utility industry, however, much of the information

is confidential and is received directly from the customer. A more intense search for data

about companies which are not customers must be embarked upon in order to make a complete

peer review. A much used source of information is the Librarian; she gives routes to follow

and sources for the Associates to check when they can not find any information in their on-

linedatabases. Industry reports as well as advertising materials provide some useful

information to use as comparison data.

For new prospects the process is not at all mechanical. Each Associate has their own

sources and methods of compiling the appropriate data. If a company catches the eye of an

Associate in a news report or in a merger or acquisition announcement an Associate most

probably will find as much information about a company in order to make an appropriate

analysis. Again, the librarian often provides a first stop on the route to success. One

Associate said that

she used the Chamber of Commerce as a reliable source of unbiased information. Any legal

method of acquisition is acceptable, and this is the detective part of the Associate position.

The route to follow when assigned a company is as follows and outlined in figure 5:

1) Check the company's Annual Report as found in the internal Investment Library.

Any other public documents which are available about the company are compiled as well.

Companies will send out public information.

2) Use the on-line global Reports database. It includes articles and news reports

about individual companies. Although it often includes statistical data as well, it is not a

particularly up to date source.

3) Find any information about the company in Regulatory Journals found in the

internal Library.

4) Use the company's equity reports from the Compustat database for further

forecasting ability.

5) Using Lotus 1-2-3 compile statistics, run the models, create the report in Microsoft

Word and include any relevant model and spreadsheet data.

2.4.2 Information Problems

For annual reviews the process is generally simple and uncomplicated. However, there

are problems which may arise. For example, not all statistics found in the Annual Reports

are deemed valuable since the information may be up to a year old. The numbers are not

always as current as is necessary. Finding that current information is easier than finding a

needle in a haystack, the only problem may be where to find the appropriate haystack.

Daily Stocks, another source of information, although current, does not always have all of

the necessary figures. Since the company is a client, the information can be found with

enough phone calls but as with the FSI speed is often a limiting factor.

Another problem is that companies are not always distinct entities. Rather they are

made up of many other companies that have different departmental entities which may or

may not work as corporate individuals. For example, Long Island Lighting Company also

operates, or is trying to operate, a nuclear reactor, Shoreham. However the data and

specifically the costs of Shoreham may not be included in LILCO's statistics, since it may be

considered its own company. This is a simple example, however, many times it is more

complicated. There are parent companies which do not actually produce anything and

companies which own companies which report their data in an oversimplified manner, such

that the atomic data is difficult to isolate.Associate is assigned

an analysis.

r..

Retrieve the

company's Annual

Report and other

public documents

Retrieve any

available

information from

Global Reports

Retrieve any

available

information from

Regulatory Journals

Retrieve financial

statements from thE

Compustat database

Compile all models

and perform

analysis

Send final report

(textual and

numerical) to bankez

Figure 5Statistics found in Annual Reports and common databases may have different values

for companies which are often different than what is needed. Associates must determine

the varaibles represented in the ratios and add or subtract complications as necessary. The

problem the Associates are faced with is to find which data entry is the one which they

are actually looking for. Which has the value that they believe it does?

Since the macros and models were created by one person inside the department there

is no formal training on how to use the system or the models. Systems support people are not

enough since they are not entirely familiar with the particular system. When there is a

problem, there is a problem, as different people in the department have different levels of

competency with the models.

One possible solution would be to have a formal training session or manual. Another

possibility would be an on-line help session which would allow users to access a library of

responses or pose new questions which can then be answered by anyone on the system who

knows. The answers and original questions can then be stored for future reference. If a

CIS/TK system were set up, training and appropriate help functions would be a great benefit

to all the users.

2.4.3 Logical Connectivity

In general, the department is fairly well connected to their most widely used sources

found in Lotus One Source. The appropriate processes have been successfully automated and

integrated. Although the individual Associates must go to separate workstations to access

remote databases such as Quotron, they did not seem to feel that it would be a tremendous

advantage to have that type of information available at their desktops. The Associate I

talked with felt that the present level of models and macros was appropriate and effective.

A CIS/TK system would seem to benefit the department although by today's standards it

does not seem to be a need.

2.5 Media Department

This is the youngest of all the departments at CFSA, basically it is responsible for

companies which pursue the technology market. Their first customer was a cellular phone

manufacturer. One interesting facet of the companies dealt with is that they are mainly

private companies and therefore do not have publicly traded stock. Information is harder to

obtain and often presents a great challenge to the Associates. This department is very

important as all of its clients tend to prefer equity to stock. Analyses must be thorough and

sensitive to the market since products' status is volatile and sometimes, hard to predict.

2.5.1 Information Uses

For annual reviews the Associates most often rely on the internal data which has

been collected on the company by the Associates as well as financial statements released by

the company. There is only one database which is concerned with private companies,

Daytext which is found as part of One Source. Global Reports, an on-line news service, also

offers some valuable information. Most of the internal analysis are highly based on

assumptions which the Associates make. The forecasts are therefore very sensitive to hard-

to-isolate variables such as market trends.Because of the nature of the companies which fall under the jurisdiction of the

Media department, Associates are forced to search everywhere and anywhere for signs of

new prospects. They may find their initial buzzword on the front page of an industry

magazine or on the tip of a colleagues tongue. Any interview by a CEO for example that

includes any kind of predictive information about an industry or a company is useful.

Industry newsletters as well as internal rumor sheets are continually read to catch the sign

of a possible customer. The first step is to visit the librarian to dig up any newspaper or

magazine articles on the desired company. DayText and Global Reports offer other good

places to get an initial feeling as to the potential of a company. Sometimes research may

include getting a superior to call an equivalent officer or friend in the company in question to

find information which is not publicly disclosed. Although this method is not always

successful, it can yield results.

The Alcar application available on the network is used as a valuation analysis tool

although it is not really appropriate for the companies which are basically manufacturers.

The knowledge-based system asks specialized questions which are not always applicable.

This program originally provided great hope to the associates since it was the first

forecasting tool kit. However, it has proven less than a miracle to most of the departments

as it does not seem to meet their needs.

2.5.2 Information Problems

The main problems with the annual reports is that information is scarce. Although

clients usually provide financial statements freely, it is difficult to find an unbiased source

of information. Compustat only offers information about publicly owned companies. Peer

studies are particularly hard to make as often times there is no appropriate peer. For

example, how can a company which only manufactures cellular phones be compared with a

company which manufactures phones, pagers, and other radio-wave devices?

The industry is fast paced and certainly not static. Mergers and acquisitions are

commonplace and add to the complexity of any analysis. Most of the companies are

entrepreneurial and eccentric compared to more conservative industries. Equity is easy to

find and therefore the speed and quality of the proposals are important factors. In these

respects the Media industry is completely different than the other basic industries and

different analyses must be done.

The risk and exposure analysis is done manually as the information is changing

daily and is not documented in any available electronic form. The acquisitions and

divestitures which are so prevalent in the industry deem it necessary to take the upmost

care in selecting appropriate data.

One problem which may effect the accuracy of an analysis is the market. It seems

that the Media market is particularly volatile and difficult to forecast. Therefore, the

dynamics of the market is a hard to develop variable which effects the Media market.

2.5.3 Logical Connectivity

The Media Department uses the local area network for Alcar, DayText, and

occasional glances at Compustat. CIS/TK system would need to have a utility which allows

users to enter information into their own dynamic database since much of the important

data, especially for annual reports, is information which has been previously entered into

various analysis routines. So far the department is only a year old and therefore has a

limited resource. They are working on creating a department database which copies the

extensive Compustat database. Unfortunately, it is impossible to create such a databaseovernight and can only be made worthwhile if it can be dynamically created and

maintained. It would have to be more complicated than Compustat in order to effectively

track all acquisitions, mergers, and divestitures.

If Global Reports, a text-based news service, which is available only at a stand

alone workstation, could also be implemented into the CIS/TK system then the Media

Department would make use of such a system. When Associates first spy a company prospect

in a newspaper or industry newsletter, they could use the system to bring up the names of

any recent articles or expectation information currently available. After reading the

material, the Associates can then decide whether or not they are actually interested in the

company and get ideas from the articles as to where to find additional information. The

system could then open a record for the new company so that the Associate could record all

found information, even if it were only to be used in the future or as part of a peer review.

2.6 Petroleum, Metals and Minerals Department

The Petroleum, Metals and Minerals Department is like each of the other

departments, quite individual. There is a high cost for analytical mistakes, and therefore

the Associates are very wary as to the source of their functional data. Consequently, any

computer systems are suspect to low trust values. The mysterious 'black box' holds many

suspicions because of the lack of control the associates feel they have. Much of the

historical information is not quantitative since the profits of the firms are not measured in

amount of goods produced but instead the number of contacts held and fulfilled. Firms rely

on contracts of varying length for their income. Many of the contracts are Government

contracts, and the ability of the firm not just to produce, but to be able to get contracts and

fulfill them is of the upmost importance. Even though the firm may be showing great

profits presently, the associate must take into consideration the future potential of the firm

relative to other firms in the industry against which they will be competing. Therefore,

the contracts, reserves, potential, and methods of the firms must be analyzed to get a

complete picture of the firm.

2.6.1 Information Uses

Much of the information gathered about each of the firm clients is difficult to

quantify. For examples, engineers are required to go to the mines and ores to make a forecast

as to the potential of the firm. Without enough of a reserve or potential of mines a PMM

company will be unable to compete against its peers. Another important factor are the

states of the contracts on which the company is currently fulfilling as well as the ones

which they are working on acquiring.

Annual Reports are extensions of the financial statements which the companies

provide. The Associates include the Citibank financial information and forecast based upon

those values. Alcar is used quite frequently for its forecasting capabilities. The debt

instruments are extremely complicated and the rules for those products are constantly

changing based on the variables of the company such as contracts, ability to meet contracts,

ability to make future contracts, and the ability to fulfill future contracts. If a company has

failed to meet a current contract, for example, it will have trouble trying to secure a future

contract even if it has proof of a large supply. Trust is an important factor between

companies which deal in contracts. It is difficult to quantify trust since it may not be uniform

across all relationships. Certain firms may have had a better relationship with the firm

under analysis and it is difficult to obtain that information. Because of the complications it

is very difficult to use Alcar and its rigid tools for forecasting.There are three or four tables which Compustat provides for comparative studies.

However, the Associates felt that they must constantly double check the statistics and the

calculated fields. These comparisons are most often used for the oil companies whose

product is rather uniform. The metal and mineral companies tend to be more conglomerated,

selling a variety of products. The PMM Associates also use the Global Report news service

and the Bond Database which is part of One Source.

2.6.2 Information Problems

Most of the problems stem from the physical nature of the data which is required to

do the analyses. The data on the actual mines of the company, for example are not kept in

any public database. It must be retrieved by the engineers which Citibank sends out. It is

historically kept on file and manually analyzed. Another problem is the value of the

individual statistics. For example, does the equity value of the company in a particular

database represent the book value or the current value for the equity.

Another major obstacle is the diversification of the metals and minerals companies.

Some companies make aluminum and sell it raw, but some are more vertically integrated and

also may make their own frames, pots, and pans. It is very difficult to make a peer study

with this type of assortment among the companies.

Another problem that the Associate mentioned which is an issue for all of the

departments which use different data sources is the different definitions used among them.

For example, does an operating income include depreciation? The answer depends upon the

accounting procedures of the firm. In general, the Associates seem to not trust the computer

sources very much and would require some sort of assurance that the data given is what the

Associate is looking for. Any magical results which the computer could 'punch out' would be

open to skepticism since the Associate I spoke with felt that the computer would not be able

to have the sophistication to understand the data correctly. Since the price of a bad

analysis is so high the Associates felt more assured and comfortable to double check all

numbers that could be checked. It is unknown whether this is just a temporary mistrust or if

the sophistication of technology would alleviate the misgivings the associates felt.

2.6.3 Logical Connectivity

One facet of this industry which differs from the others is the use of data collected

on-site. A computer at this time can not make that trip and record and analyze the visual

information which the engineers do. The findings of the reports are less quantitative and

more qualitative. Although the Associate may create integer type data variables this

translation is the analyzing part of the job.

This is another group which would benefit from the addition of Global Reports to

the system. The Bond database is also used and therefore a limited about of integration

would be useful. Another additional capability which would be an advantage for CIS/TK is

the ability for the user to create his own database and mapping procedures. If the

Associates were able to kept all historical information about a company in the system

further annual reports would be somewhat simplified. Although these particular analyses

call for qualitative analysis, the actual procedure could be simplified by the system. For

example, the 'PMM Database' would have a certain amount of text fields to store the

engineer's reports directly and then would have quantitative fields which the Associates

would be responsible for entering. The system could then save the deduced values and use

them for current reports, peer reviews, and future reports as well.

The immediate need for a system is nebulous for two reasons: the qualitative nature

of much of the data, and the mistrust of the Associates of data compiled by the computer by

hidden formulas and conversion mechanisms. However, it is probable that if a system wereYou can also read