Restaurant Payments DIGITIZING - PYMNTS.com

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

DIGITIZING

Restaurant Payments

REPORT

MARCH 2021

FEATURE STORY – PAGE 10

How Machine Learning,

Contactless Payments NEWS AND TRENDS – PAGE 14

Are Helping Piada 71 percent of consumers want restaurants

to continue offering contactless payments,

Italian Street Food Meet ordering methods and menus, even after the

pandemic ends

Shifting Ordering Needs DEEP DIVE – PAGE 20

Restaurants seek to meet diners’ needs and

relieve concerns with self-serve kiosks, QR

code menus and mobile apps04 What’s Inside

A look at how the ongoing pandemic has accelerated

the uses of digital ordering and payments at

restaurants and how eateries can help keep pace with

these changes

10

Feature Story

An interview with Matt Harding, senior vice president

of culinary and menu innovation for Piada Italian

Street Food, and Jason Profitt, the restaurant’s

director of technology, on how the Italian fast casual

chain is keeping pace with changing digital ordering

and payment trends

14 News & Trends

Recent headlines from the space, including why digital

restaurant payments may be opening up QR codes’

path to ubiquity and why 59 percent of consumers plan

to continue using mobile third-party delivery apps for

restaurant orders even after the pandemic has eased

20 Deep Dive

An in-depth examination of how restaurants are

adopting digital ordering, menu browsing and payments

technologies to provide swifter and safer on-site dining

and takeout experiences

25 About

Information on PYMNTS.com and American Express

Acknowledgment

The Digitizing Restaurant Payments Report is done in

collaboration with American Express, and PYMNTS

is grateful for the company’s support and insight.

PYMNTS.com retains full editorial control over the

following findings, methodology and data analysis.W H A T ’ S I N S I D E

he global health crisis rap- online. The monthly average spend for dining

idly accelerated the volume of in person is $205.

diners ordering takeout and deliv-

Developing convenient and seamless digital

ery online and through mobile

payment and ordering capabilities is becoming

apps from their favorite eater-

critical for restaurants of all types, especially

ies rather than risking exposure in person at

as consumers appear to have no plans to

sit-down restaurants. Consumers spent $486

return to their pre-pandemic ordering and

billion on food eaten at home in 2020, and 89

payment behaviors. Another recent PYMNTS

percent of those orders originated from dig-

study found that 87 percent of the consum-

ital channels, according to recent PYMNTS

ers who have moved to online ordering from

data. This includes websites as well as both

restaurants plan to continue ordering online

restaurant-branded and third-party aggregator

once the crisis has passed, indicating digital

mobile apps, such as DoorDash and Uber Eats.

channels may be well on their way to becom-

Enabling digital payments and orders — both ing the primary ways for restaurants to engage

online and in person at restaurant locations — customers and grow their revenues.

is becoming a key factor that will help attract

These developments could provide a key boost

customers who are choosing between restau-

for restaurants, especially as takeout and deliv-

rants. This is especially the case for millennial

ery become more critical to their business

and Generation Z diners, with 61 percent of

operations. One recent report found that 89

these consumers stating that digital pay-

percent of small, independent restaurant own-

ment options were critical when making such

ers are dependent upon takeout orders to stay

decisions, according to one recent study.

afloat, and this dependence is prompting orga-

Fifty-seven percent agreed digital ordering

nizations to roll out initiatives to meet these

capabilities were essential, up from 46 per-

needs. Restaurant technology and back-end

cent in 2019. Consumers in these generations

software provider Resy is working with card

are also spending more when they order digi-

network American Express, for example, on a

tally, as recent PYMNTS data found that bridge

promotion called #TakeoutTuesday, which is

millennials — those between 32 and 41 years

intended to keep operations moving on what is

of age — spend an average of about $279 per

typically the slowest day for eateries.

month ordering from table-service restaurants

© 2021 PYMNTS.com All Rights Reserved | 5W H A T ’ S I N S I D E

Ensuring that restaurants have access to the percent of diners stating they would continue

digital tools they need to process takeout and to use mobile delivery apps after the crisis has

delivery orders is equally key. Those restau- passed. Restaurants will need to be sure they

rants will need to carefully consider how to can offer these online payment and ordering

go about integrating these tools and how to options to keep these diners satisfied and to

ensure their own brands can stand out from a grow customer loyalty as consumers become

more crowded pack. more familiar with these tools.

AROUND THE DIGITAL RESTAURANT Eateries appear ready to take on this challenge.

PAYMENT WORLD Restaurants surveyed in one recent study

One recent study found that 53 percent of con- stated they expect 62 percent of their 2021

sumers now consider takeout and delivery to revenues to come from takeout and delivery

be “essential” to their current lifestyles, with orders, and they are adjusting their daily oper-

digital channels playing an integral role. Use of ations accordingly. Restaurants are expressing

both curbside pickup and mobile delivery apps more interest not only in consumer-facing

is ramping up, with 46 percent of individuals digital tools but also in technologies that can

now ordering takeout through these methods. smoothly support these features. Ninety per-

Consumers are also expected to cling to cent of eateries have either already invested or

their smartphones in the future, too, with 59 plan to invest in kitchen automation technology,

6 | © 2021 PYMNTS.com All Rights ReservedW H A T ’ S I N S I D E

for example, allowing them to more efficiently

Industry

fulfill orders as well as collect consumer data

on order and payment preferences. This would

help them successfully compete.

Consumers do not appear ready to go back to

INSIGHT

pre-pandemic dining behaviors, with another

What ordering and payments technologies are proving

report revealing that in-person dining com-

important in helping restaurants serve diners during

fort levels are fluctuating. Comfort levels were the pandemic? What should restaurants keep in mind

at 44 percent at the end of January and rose as they work to adapt their services?

to 51 percent at the end of February, yet only “The pandemic placed an unprecedented burden on

44 percent of consumers stated they would restaurants to find ways to sustain their business …

feel safe dining at restaurants in early March, This included the increased adoption of mobile and

indicating increased wariness. Off-premises web-based ordering for delivery and takeout and [the]

orders have not waned, however. The study adoption of QR codes to safely pull up menus and order-

ing information. Customers quickly adapted to these

found that 80 percent of restaurant traffic now

new trends, and we do not expect a [reversion] back to

takes place outside restaurant locations, such

ordering behavior[s] prior to the pandemic. While we are

as from orders placed via phone calls, through entering a more positive chapter with increasing vacci-

mobile apps or online. This indicates that dig- nation rates, restaurant owners should still continue to

ital ordering channels will continue to play a digitize their operations. Customers are still very aware of

key role in the restaurant industry in the near sanitary and touchless practices, and both will continue

future as consumer trust toward sit-down din- to be important factors in their dining decisions. For this,

restaurant owners should allow and embrace the way

ing slowly returns.

their customers want to pay, including contactless and

For more on these stories and other digi- QR [code] payments. We also expect to see increased

tal restaurant payments headlines, read the adoption amongst restaurant owners in technology that

report’s News and Trends section (p. 14). allows them to automate their kitchen operations for a

more efficient back of house, and the expanded use of

PIADA ITALIAN STREET FOOD ON kiosks and menu-based QR codes to streamline the din-

KEEPING PACE WITH CHANGING ing experience to increase sales volume.”

PAYMENT, ORDERING TRENDS

Restaurants have long employed varied CURTIS WILSON

menu items to appeal to different consumers’ Vice president and general manager of restaurant,

tastes, and the same can be said of offer- travel and entertainment, global merchant and

ing the right variety of ordering channels and network services

American Express

© 2021 PYMNTS.com All Rights Reserved | 7W H A T ’ S I N S I D E

payment options to help attract customers. DEEP DIVE: HOW THE PANDEMIC PUT

Diners have grown familiar with digital order- ORDERING, PAYMENTS TECHNOLOGY

ON THE MENU

ing after a year of opting to eat at home to

avoid pandemic-related risks, and they are Restaurants have had to redesign their order-

now expecting more options than ever when ing and payments services to keep serving

interacting with their chosen eateries. In this customers safely during the global health crisis,

month’s Feature Story (p. 10), Matt Harding, and digital solutions are playing a key role in

senior vice president of culinary and menu those transformations. Venues have adopted

innovation for Italian fast casual restaurant a variety of technologies, including on-site

chain Piada Italian Street Food, and Jason equipment and mobile tools that enable diners

Profitt, the eatery’s director of technology, to place orders remotely and skip face-to-face

discuss how the pandemic has impacted con- interactions. This month’s Deep Dive (p. 20)

sumers’ ordering and payment wants and examines restaurants’ key technological adop-

needs as well as how the company is using a tions as they work to provide swift, socially

holistic all-in-one system and machine learn- distant purchasing and transaction experi-

ing to help foster more seamless experiences. ences. It also examines how consumers of

various generations are engaging differently

with these revamped ordering methods.

8 | © 2021 PYMNTS.com All Rights ReservedW H A T ’ S I N S I D E

89%

FIVE

Portion of the $486 billion

in food eaten at home

that consumers ordered

through websites and

mobile apps in 2020 FAST

FACTS

$279 87%

Average amount bridge Share of consumers who

millennials spend each have shifted to ordering

month ordering online from online and plan to continue

table-service restaurants using such services once

the pandemic ends

92% 56%

Portion of top-performing Share of restaurants where

restaurants that offer customers began using

mobile order-ahead apps mobile order-ahead apps

more often that experienced

revenue growth during the

pandemic

©©2021

2021PYMNTS.com

PYMNTS.comAll

AllRights

RightsReserved

Reserved|| 9How Machine Learning,

Contactless Payments Are

Helping Piada Italian Street Food

Meet Shifting Ordering Needs

Restaurants must be creative in how they work Leaning on an all-in-one platform that funnels

to stand out — both in what they offer on their orders to one interface can help restaurants

menus as well as which channels they support process them seamlessly, said Matt Harding,

for food orders. Consumers are flocking even senior vice president of culinary and menu inno-

more to online and mobile tools to find their vation at Italian fast casual restaurant chain

meals in the wake of the pandemic, meaning Piada Italian Street Food. Harding recently

eateries must work swiftly to ensure they can spoke with PYMNTS along with Piada’s direc-

support orders from various platforms to stay tor of technology, Jason Profitt, to explain how

competitive. the chain’s digital ordering features, including

© 2021 PYMNTS.com All Rights Reserved | 11F E A T U R E S T O R Y

its website, branded mobile app and loyalty millennials or younger consumers, Harding

and rewards program, are all collectively man- explained. The closures of brick-and-mortar

aged through Piada One, a holistic system the locations largely made digital ordering a

company developed in-house. Piada, which necessity for all generations, and that digital

has 38 locations in six states, is also looking to convenience is now changing what consum-

integrate new technologies, such as machine ers expect from all channels as in-person

learning (ML), to help analyze collected data dining recovers. This is the impetus behind

and use it for more personalized customer Piada’s examination of contactless payments,

experiences. Profitt said.

“To the ML part of it, that is something that “There are instances where somebody has that

we are going to be pretty heavily investing in little mini panic when they get to the checkout

[during] 2021,” Profitt said. “Now that we have and [go], ‘Oh man, I forgot my wallet,’ but they

everything under our own ecosystem, we have [have] their phone,” he said. “[Those are] really

a lot more of an ability to really leverage the the guests that we are looking [to target] for

data that we already have and act on it in a way [contactless]. … We look at it to be a bit of a

that is going to be more [like] operating with a convenience factor.”

scalpel versus with a chainsaw. … We see that

Piada aims to roll out contactless payments

as something that is going to be a big win for

support later this year, Profitt continued.

us in 2021.”

Restaurants must research which touchless

Effectively applying tools like ML means payment methods will best suit their existing

tracking how consumers are currently order- models as well as which of these tools are

ing or paying as trends keep changing as the currently capturing diners’ interest. Solutions

health crisis continues. This is something that like QR codes are experiencing a resurgence,

is especially crucial currently, as diners are though consumers tend to use them for very

experimenting with a larger variety of contact- particular interactions with their chosen eater-

less payment and ordering tools that are being ies, according to Harding.

introduced to meet demand.

“I think everybody really thought that QR codes

PAYMENTS A LA CARTE were the MySpace of the payment technol-

ogy platform,” Harding said. “But they have

Consumers are utilizing a growing number of

really come back strong in terms of payment

channels to order food, with convenience most

[and] even in terms of menus. How many

often the factor driving the choice. Mobile

ordering is no longer the purview of tech-savvy

12 | © 2021 PYMNTS.com All Rights ReservedF E A T U R E S T O R Y

restaurants do you go to and they have a QR a little fluid and you have to make sure that you

code and [say], ‘Hey, this is our menu.’” have your base work done.”

The eatery’s sister restaurant, Lindey’s, The ability to pivot swiftly to meet these shift-

recently implemented QR codes for orders, he ing needs and frictionlessly fulfill orders is

added, and 25 percent of guests are now using more critical than ever, as digital’s conve-

them when it comes time to pay. QR codes do nience is now both expected and necessary.

not align as well with the fast casual dining Restaurants will have to work quickly and

model implemented by Piada, Harding admit- intelligently to ensure they can stay on top of

ted, where other touchless payment solutions these trends.

like tap and pay or mobile-enabled payments

can help keep lines moving at the necessary

speeds. Tracking consumer payment behav-

iors is only the first step restaurants must take

“ Everybody really

to help drive engagement, however.

thought that QR codes

PLAYING THE LONG GAME

Implementing the ordering tools and payment were the MySpace

technologies to which consumers are now

flocking will be critical to keeping those diners of the payment

invested, but eateries should not assume these

preferences are set in stone, Harding warned. technology. But they

“Consumer wants and preferences are actually

still changing, and you cannot apply previous

have really come back

situations to what the guest is going through

now,” he said. “I think everybody believes that strong in terms of

the guest is going to return very slowly to kind

of a blend of digital and in-person. … The big- payment [and] even in

gest opportunity is to have the technology “

piece, the operational piece, the guest service terms of menus.

piece, … and we all kind of think we know where

that’s going to [be]. … But I think you have to be

© 2021 PYMNTS.com All Rights Reserved | 13N E W S & T R E N D S

Contactless and digital Industry experts argue that digital menus’ pop-

ularity is now pushing QR codes, which were

ordering technologies initially slow to catch on in the U.S., into the

DIGITAL MENUS, CONTACTLESS mainstream. Recent reports indicate that QR

ORDERING PROPEL QR CODES INTO

THE SPOTLIGHT codes, or at least contactless payments, may

well continue to thrive past the pandemic, with

The pandemic has brought digital technologies

one study finding that 40 percent of consum-

into restaurants and accelerated their adop-

ers want to use touchless tools after the crisis

tion by consumers outside of their doors. One

ends. This could have intriguing implications

November 2020 study found that 45 percent

for the future of on-site dining, and restaurants

of consumers now prefer to review menus

should think twice about rolling back digi-

digitally and then pay via their phones rather

tal offerings as consumers begin to venture

than interact with wait staff, for example. Many

back out.

believe this trend will continue in the coming

months, and QR codes are expected to lead

the way.

© 2021 PYMNTS.com All Rights Reserved | 15N E W S & T R E N D S

CONSUMERS EXPRESS PREFERENCE

FOR PANDEMIC-DRIVEN RESTAURANT

71%

INNOVATIONS

Diners are becoming more comfortable using

emerging touchless technologies, and a recent

study indicates that contactless payments

are very likely to play a key role in the restau-

rant industry as time goes on. The report of consumers

found that 71 percent of consumers want their

favored eateries to continue offering contact-

less payments, ordering or digital menus once

want restaurants

the pandemic is over.

to continue

Consumers are also expected to continue to

turn to takeout and delivery over in-person

dining throughout 2021, with 91 percent say-

offering

ing that they want to see restaurants’ offerings

in these areas continue — especially when it contactless

comes to picking up alcohol or meal kits. This

indicates that diners are adjusting quickly to payments.

the way the ongoing pandemic has impacted

typical interactions with restaurants and, more

notably, that they do not expect eateries to

return to pre-pandemic business models.

relax, but one recent study found that con-

Dining and customer sumers still cannot make up their minds about

comfort returning to sit-down restaurants. The report

CONSUMERS CLING TO DIGITAL tracked consumers’ comfort with both indoor

ORDERING AS MANY REMAIN WARY OF and outdoor dining over the first few months

IN-PERSON DINING

of 2021, finding that while 51 percent of diners

Eateries in various states are tentatively stated they would be comfortable returning to

reopening their brick-and-mortar doors to con- restaurants in the last weeks of February 2021,

sumers as spring arrives and capacity limits only 44 percent said the same by early March.

16 | © 2021 PYMNTS.com All Rights ReservedN E W S & T R E N D S

Diners may still be hesitant to visit their favor- REMOTE WORKERS MORE LIKELY TO

ite restaurants in person, but digital orders for ORDER TAKEOUT, DELIVERY THAN

OTHER WORKERS

takeout and delivery remain strong. About 80

percent of restaurant traffic is still occurring Ordering meals to be eaten at home is also

off-site, the study found. more popular with certain consumer demo-

graphics, according to a recent study. Younger

CURBSIDE PICKUP TAKES THE LEAD consumers are much more likely to have

OVER DELIVERY ordered takeout or delivery than older gener-

Takeout and delivery purchases are actually ations, with 59 percent of individuals between

becoming a dietary staple for many individuals, the ages of 18 and 24 claiming they had done

one study showed, with 53 percent of consum- so throughout the pandemic. Consumers who

ers stating these meals were “essential” to how work from home are also more likely to spring

they currently live. Forty-six percent of diners for takeout than those who do not work, and

are now ordering food for takeout or curbside they also make these orders more frequently.

pickup, according to another study, and 34 per- Forty-six percent of diners who were able to

cent are making delivery orders via third-party work remotely and ordered takeout stated they

delivery services, such as DoorDash. Curbside do so at least one to two times weekly,Eater-

pickup’s slight lead may be partly due to con- ies expect 62 percent of 2021 revenue to come

sumers’ distaste for the service and delivery from takeout and delivery orderswhereas 38

fees that come tacked onto mobile orders: 73 percent of those who could not work from

percent of customers state that delivery is too home said the same.

expensive once all the costs are added to the

This shows that digital ordering solutions

order price.

for off-premises dining have not yet become

The former study also found that 59 percent of fully accessible to all consumer groups look-

consumers plan to continue ordering through ing to take advantage of restaurants’ off-site

delivery apps once the crisis has subsided, indi- offerings. Expanding this access could help

cating that consumers’ new mobile purchasing increase restaurants’ revenues and engage

behaviors are here to stay. Determining how to a larger crop of potential customers. Some

stand out on these mobile apps therefore rep- restaurants also are participating in promo-

resents a crucial challenge for restaurants. tional campaigns that encourage customers to

order takeout on what are typically slow sales

days, and these eateries may seek to boost

© 2021 PYMNTS.com All Rights Reserved | 17N E W S & T R E N D S

orders by advertising relevant promotions allowing access to digital menus via QR codes

offered by the card brands they accept. or through URLs to help meet this expectation,

while 61 percent are currently offering con-

Tech innovations and tactless payments in their brick-and-mortar

emerging challenges locations.

RESTAURANTS INVEST IN AUTOMATION Ninety percent of restaurants also stated they

TO HELP FUEL RISE IN TAKEOUT, have either made investments or plan to invest

DELIVERY ORDERS

in kitchen automation technology to speed up

Contactless payments and other digital tools order fulfillment. Implementing automation

may be gaining ubiquity to help support safe on the back end can help eateries more easily

and convenient in-person dining, yet eateries accept and push out orders as well as further

surveyed in one recent report expect the bulk utilize consumer data, such as preferred orders

of their 2021 revenue — 62 percent — to come or payment preferences, for more personal-

from takeout and delivery orders. About half ized customer experiences. Doing so can help

of the restaurants surveyed plan to continue

18 | © 2021 PYMNTS.com All Rights ReservedN E W S & T R E N D S

eateries compete more successfully by engag-

ing consumers and fostering greater loyalty.

PIZZA QSRs LOOK TO MOBILE TO JUMP-

START SLUGGISH SALES

Pizza giants Domino’s and Pizza Hut appear

to be tailoring their customer engagement

strategies to suit consumers’ rising prefer-

ence for digital ordering. Domino’s is looking

to increase its takeout orders for the coming

year, according to recent statements from CEO

Ritch Allison. This follows declining same-store

sales at the chain’s locations for Q4 2020 — a

decline its competitor Pizza Hut shared.

Focusing on optimizing takeout and deliv-

ery can help shore up those losses, but these

quick-service restaurants (QSRs) are fac- over the past year to keep customers invested

ing increased competition. A fall 2020 study and engaged during the pandemic. This

found 27 percent of eateries partnered with includes offering an extension of its mobile

third-party delivery apps such as DoorDash order-ahead services to web users, allowing

to enhance their delivery capabilities, while consumers who may not be ready to sign up for

17 percent developed their own delivery solu- their app to access the same benefits online.

tions in-house. Gaining a competitive edge on

mobile will likely be a top priority and challenge Consumers can also select the option for curb-

for restaurants as the year continues. side pickup when ordering on their phones,

further intertwining these online tools. The

SONIC MAKES MOVES TO BOOST omnichannel crossover of digital payment

CROSS-CHANNEL ENGAGEMENT

offerings can help provide consumers with a

Fast food chain Sonic is also aiming to enhance more connected dining experience by meet-

its online payment capabilities as digital order- ing them where they are and can help fast

ing increasingly becomes the norm among food chains better compete with other brands

consumers. The QSR announced multiple that offer the same mobile or curbside pickup

changes and upgrades to its online offerings features.

© 2021 PYMNTS.com All Rights Reserved | 19D E E P D I V E D E E P D I V E

How Ordering, Payment

Technologies Help Restaurants

Serve Up Safer Experiences

The global health crisis sent restaurants This Deep Dive examines that journey, detailing

scrambling as many business models were how restaurants have turned to technologies

overturned. Gathering diners in the same like self-serve kiosks, QR code-accessible

enclosed spaces where they would be shar- digital menus and mobile order-ahead and pay-

ing air suddenly became dangerous when the ment apps to help meet contactless demands.

airborne virus arrived in the U.S. and quickly

spread. Consumers, employees and restaurant SOCIALLY DISTANT SERVICE

managers became and remain keenly aware of Restaurants have been deploying various

these risks, even as some local governments technologies to offer quick, contactless order-

permit on-site dining to reopen. Continuing ing that can help meet the health and safety

to serve customers during the pandemic has needs of consumers who place orders on-site,

therefore required establishments to upgrade whether for takeaway or sit-down meals. Some

their setups and offer swift, socially distant venues have introduced self-serve kiosks

ordering and payment experiences for both where diners can order, often without need-

pickup and dine-in services to lower contagion ing to interact with wait staff. An October 2020

risks and make diners feel more comfortable. survey of 2,081 U.S. adults found that 44 per-

These considerations have also been key when cent of respondents would like to use kiosks

it comes to payments experiences, as con- at their favorite dining establishments during

sumers want to use their preferred payment their next visits, while even more consum-

methods across all channels. Restaurants ers wanted to use these machines at QSRs.

must therefore be payment-agnostic and sup- Seventy-one percent of diners said they would

port transactions that leverage consumers' rather use self-service kiosks at QSRs than

preferred credit or debit cards, cards on file, engage with staff members during at least

payments made via QR codes and contact- some visits. This may indicate that consumers

less wallets. are most desirous of automated experiences

21 | © 2021 PYMNTS.com All Rights Reserved © 2021 PYMNTS.com All Rights Reserved | 21D E E P D I V E D E E P D I V E

at venues where they are already primed to with shared physical objects. Many full-service

expect minimal interaction with staff. eateries have since deployed alternatives to

physical menus, with 54 percent of casual

Many of the surveyed consumers were also

dining, 48 percent of family dining and 50 per-

eager to use their phones to browse menus,

cent of fine dining establishments saying they

order and pay instead of engaging with wait-

had launched QR code menus, according to a

staff. Forty-five percent of respondents

survey of 6,000 restaurant owners and oper-

expressed interest in such mobile offerings,

ators that was conducted in November 2020

and these purchasing habits may prove to

and December 2020.

be long-lasting, with 40 percent of that seg-

ment saying they would like to keep using Venues are also sensitive to how consumers

these methods even after the crisis ends. want to pay for these orders, and 40 percent

Restaurants must take special note of this of restaurant operators said that they had

trend as consumers become more discerning adopted contactless or mobile payments after

in regard to their chosen payment methods. March 2020. Customers appear responsive

Catering to diners who prefer to pay using to these offerings, as a separate 2020 survey

cards with incremental fees as well as those found that 43 percent of consumer respon-

who have turned to mobile wallets, for exam- dents would like to use contactless payments

ple, will be important for eateries. at checkout. Other diners wanted to avoid

going inside entirely, with 40 percent prefer-

VIRTUAL BROWSING AND PAYMENT ring to place mobile orders while remaining in

Restaurants have doubled down on virtual their cars outside the eateries and 38 percent

menus during the past year and have taken favoring curbside pickup options. Solutions

approaches such as posting QR codes that like these can all help restaurants satisfy din-

visitors can scan with their phones to pull ers’ cravings while minimizing the chances of

up meal options. This move can enable cus- viral exposure.

tomers to view menus before entering the

locations so they can get in and out more REMOTE ORDER AND DELIVERY

quickly. Touch-free options like these may also Many customers prefer to avoid tableside

have been at least partially inspired by fears service during the pandemic, and pickup and

that spread early last year over the possibil- delivery have seen striking growth as a result.

ity of the virus being transmitted via contact Online ordering and delivery accounted for 39

22 | © 2021 PYMNTS.com All Rights Reserved © 2021 PYMNTS.com All Rights Reserved | 22D E E P D I V E

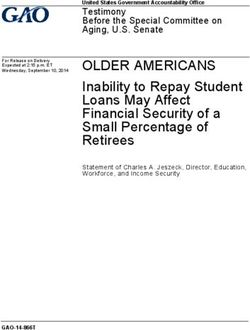

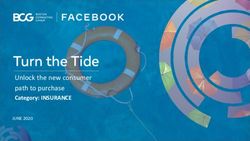

Figure I: Features that distinguish top, middle and Top

bottom performers Middle

Bottom

Ability to pick up orders

without standing in line Ability to pick up orders at the drive-thru

88.9% 8900000000

56.5% 5700000000

70.8% 7100000000

33.1% 3300000000

41.8% 4200000000 16.3% 1600000000

Ability to pay in-store with

Ability to order using a mobile app contactless cards

91.7% 9200000000

46.3% 4600000000

69.7% 7000000000

23.6% 2400000000

30.6% 3100000000 26.5% 2700000000

Loyalty or rewards program Ability to pay online

91.7% 9200000000

57.4% 5700000000

65.1% 6500000000

22.2% 2200000000

21.4% 2100000000 7.1% 0700000000

Ability to order using self-service kiosks

Ability to pay with digital wallets at the restaurant

82.4% 8200000000

32.4% 3200000000

56.0% 5600000000

22.2% 2200000000

23.5% 2400000000 14.3% 1400000000

Ability to pick up orders curbside Ability to pay with QR codes

90.7% 9100000000

27.8% 2800000000

52.8% 5300000000

16.9% 1700000000

23.5% 2400000000 12.2% 1200000000

Ability to order online Ability to pay with card on file

88.9% 4700000000

30.6% 3100000000

48.2% 3200000000

10.2% 1000000000

9.2% 2000000000 6.1% 0600000000

percent of restaurant franchises’ sales in 2020 A December 2020 PYMNTS survey of 490

and just 20 percent in 2019. Franchisees have restaurants also found that while 60 percent

taken note, and 69 percent planned to invest in had taken revenue hits during the pandemic,

mobile ordering in 2021 — a far cry from the 25 digital tools could help soften the blow or

percent that had intended to do the same for even increase revenue. Ninety-two percent of

2020, reflecting just how significantly the pan- restaurants deemed “top performers” gave

demic has changed industry outlooks. customers mobile order-ahead options, for

© 2021 PYMNTS.com All Rights Reserved | 23D E E P D I V E

example. Similarly, 56 percent of eateries where boomers. These younger diners were also

customers began using mobile order-ahead particularly likely to use third-party delivery

offerings more often said their revenues grew services to get their meals, with 63 percent of

during the pandemic. Top-performing restau- Gen Z and 60 percent of millennial consumers

rants are also ahead of the curve in offering using such options during the past six months,

more opportunities for consumers to pay along with only 19 percent of baby boomers.

using their preferred methods. More than 30

Health concerns have made serving custom-

percent of these eateries enable consumers to

ers challenging, leading many restaurants to

pay using cards on file, for example, whereas

turn to ordering and payment technologies to

just 10 percent and 6 percent of middle- and

help them meet demands for both safety and

bottom-performing restaurants say the same,

convenience to deliver rapid, compelling ser-

respectively.

vices. Diners who become accustomed to the

Offerings enabling digital ordering for pickup speed and seamlessness of ordering apps

or delivery are especially likely to appeal and other tools are likely to want to keep using

to younger generations. A December 2020 them well after the pandemic has ended, mak-

survey of 1,000 adults found that 90 percent of ing it all the more important for restaurants to

Generation Z and 85 percent of millennial con- develop strong digital strategies now.

sumers had ordered food delivery witvhin the

past six months, as did just 58 percent of baby

24 | © 2021 PYMNTS.com All Rights ReservedABOUT

PYMNTS.com is where the best minds and the best content meet on the

web to learn about “What’s Next” in payments and commerce. Our interac-

tive platform is reinventing the way companies in payments share relevant

information about the initiatives that make news and shape the future of

this dynamic sector. Our data and analytics team includes economists,

data scientists and industry analysts who work with companies to mea-

sure and quantify the innovations at the cutting edge of this new world.

American Express is a globally integrated payments company, provid-

ing customers with access to products, insights and experiences that

enrich lives and build business success. Learn more at americanexpress.

com, and connect with us on Facebook, Instagram, LinkedIn, Twitter,

and YouTube.

Key links to products, services and corporate responsibility information:

charge and credit cards, B2B supplier center, business credit cards, travel

services, gift cards, prepaid cards, merchant services, Accertify, InAuth,

corporate card, business travel, and corporate responsibility.

We are interested in your feedback on this report. If you have questions,

comments or would like to subscribe to this report, please email us at

feedback@pymnts.com.

© 2021 PYMNTS.com All Rights Reserved | 25DISCLAIMER

The Digitizing Restaurant Payments Report may be updated periodically. While reasonable efforts are made to keep

the content accurate and up to date, PYMNTS.COM: MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND,

EXPRESS OR IMPLIED, REGARDING THE CORRECTNESS, ACCURACY, COMPLETENESS, ADEQUACY, OR RELIABILITY

OF OR THE USE OF OR RESULTS THAT MAY BE GENERATED FROM THE USE OF THE INFORMATION OR THAT THE

CONTENT WILL SATISFY YOUR REQUIREMENTS OR EXPECTATIONS. THE CONTENT IS PROVIDED “AS IS” AND ON AN

“AS AVAILABLE” BASIS. YOU EXPRESSLY AGREE THAT YOUR USE OF THE CONTENT IS AT YOUR SOLE RISK. PYMNTS.

COM SHALL HAVE NO LIABILITY FOR ANY INTERRUPTIONS IN THE CONTENT THAT IS PROVIDED AND DISCLAIMS

ALL WARRANTIES WITH REGARD TO THE CONTENT, INCLUDING THE IMPLIED WARRANTIES OF MERCHANTABILITY

AND FITNESS FOR A PARTICULAR PURPOSE, AND NON-INFRINGEMENT AND TITLE. SOME JURISDICTIONS

DO NOT ALLOW THE EXCLUSION OF CERTAIN WARRANTIES, AND, IN SUCH CASES, THE STATED EXCLUSIONS

DO NOT APPLY. PYMNTS.COM RESERVES THE RIGHT AND SHOULD NOT BE LIABLE SHOULD IT EXERCISE ITS

RIGHT TO MODIFY, INTERRUPT, OR DISCONTINUE THE AVAILABILITY OF THE CONTENT OR ANY COMPONENT

OF IT WITH OR WITHOUT NOTICE.

PYMNTS.COM SHALL NOT BE LIABLE FOR ANY DAMAGES WHATSOEVER, AND, IN PARTICULAR, SHALL NOT BE LIABLE

FOR ANY SPECIAL, INDIRECT, CONSEQUENTIAL, OR INCIDENTAL DAMAGES, OR DAMAGES FOR LOST PROFITS, LOSS

OF REVENUE, OR LOSS OF USE, ARISING OUT OF OR RELATED TO THE CONTENT, WHETHER SUCH DAMAGES ARISE IN

CONTRACT, NEGLIGENCE, TORT, UNDER STATUTE, IN EQUITY, AT LAW, OR OTHERWISE, EVEN IF PYMNTS.COM HAS

BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES.

SOME JURISDICTIONS DO NOT ALLOW FOR THE LIMITATION OR EXCLUSION OF LIABILITY FOR

INCIDENTAL OR CONSEQUENTIAL DAMAGES, AND IN SUCH CASES SOME OF THE ABOVE LIMITATIONS

DO NOT APPLY. THE ABOVE DISCLAIMERS AND LIMITATION`S ARE PROVIDED BY PYMNTS.COM AND ITS

PARENTS, AFFILIATED AND RELATED COMPANIES, CONTRACTORS, AND SPONSORS, AND EACH OF ITS

RESPECTIVE DIRECTORS, OFFICERS, MEMBERS, EMPLOYEES, AGENTS, CONTENT COMPONENT PROVIDERS,

LICENSORS, AND ADVISERS.

Components of the content original to and the compilation produced by PYMNTS.COM is the property of

PYMNTS.COM and cannot be reproduced without its prior written permission.

26 | © 2021 PYMNTS.com All Rights ReservedYou can also read