Population growth hits 13 -year low; Baby boom Regional Aussie tourism hotspots - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | June 18, 2020

Population growth hits 13½-year low; Baby boom

Regional Aussie tourism hotspots

Population; Tourism

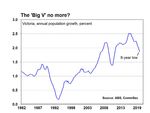

Population: Australia’s population increased by 349,833 people over the year to December 2019 to

25,522,169 people. Overall, Australia’s annual population growth rate eased from 1.43 to 1.39 per cent –

the slowest pace in 13½ years.

Baby boom: There were 305,800 Aussie babies born in the year to December - a 2-year high.

Annual population growth by state and territory: Victoria (1.87 per cent annual growth rate – slowest in 8

years), followed by Queensland (1.57 per cent – slowest pace in 3 years), Western Australia (1.28 per cent

– fastest rate in 5½ years), NSW (1.13 per cent – slowest pace in 7½ years), the ACT (0.99 per cent –

slowest pace in 14 years), Tasmania (0.97 per cent), South Australia (0.90 per cent) and the Northern

Territory (-0.38 per cent).

Domestic tourism hotspots: Outside of the major capital cities, the NSW North Coast, Gold Coast,

Sunshine Coast, Tropical North Queensland, NSW South Coast, Hunter Valley and Australia’s South West

regions were amongst the biggest recipients of interstate and intrastate tourism spending in 2018/19.

The demographic data on jobs provides insights on the job market, wages and prices, and ultimately on interest rates. Tourism data is

important for airlines, hotels, shops and transport operators. The Chinese data is important for exporters, especially rural producers,

consumer goods, mining and energy companies.

What does it all mean?

Aussie population growth was easing even before the COVID-19 outbreak reached our shores and international

and state borders were shut. Annual population growth hit a 13½-year low of 1.39 per cent in December 2019.

Population growth rates eased across most states and territories in 2019, led lower by major cities on Australia’s

East Coast. Canberra’s population growth rate at 0.99 per cent was the weakest annual pace in 14 years. And

annual growth rates have fallen to near 8-year lows in Victoria and NSW. Queensland’s annual population growth

rate of 1.57 per cent was the slowest in 3 years.

That said, the resurgence in iron ore mining activity is luring more Aussies and overseas migrants to Western

Australia - posting the strongest annual population growth rate in 5½ years.

Ryan Felsman, Senior Economist

Twitter: @CommSec

IMPORTANT INFORMATION AND DISCLAIMER FOR RETAIL CLIENTS

The Economic Insights Series provides general market-related commentary on Australian macroeconomic themes that have been selected for coverage by the

Commonwealth Securities Limited (CommSec) Chief Economist. Economic Insights are not intended to be investment research reports.

This report has been prepared without taking into account your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a recommendation and/or

investment advice. Before acting on the information in this report, you should consider the appropriateness and suitability of the information, having regard to your own objectives, financial situation and needs and, if necessary, seek

appropriate professional of financial advice.

CommSec believes that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made based on information available at the time of its compilation, but no representation or warranty is

made as to the accuracy, reliability or completeness of any statements made in this report. Any opinions, conclusions or recommendations set forth in this report are subject to change without notice and may differ or be contrary to the

opinions, conclusions or recommendations expressed by any other member of the Commonwealth Bank of Australia group of companies.

CommSec is under no obligation to, and does not, update or keep current the information contained in this report. Neither Commonwealth Bank of Australia nor any of its affiliates or subsidiaries accepts liability for loss or damage arising out

of the use of all or any part of this report. All material presented in this report, unless specifically indicated otherwise, is under copyright of CommSec.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399, a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124. This report is not

directed to, nor intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to

law or regulation or that would subject any entity within the Commonwealth Bank group of companies to any registration or licensing requirement within such jurisdiction.Economic Insights. Population growth hits 13½-year low; Baby boom

Perhaps the economic lockdown in the March quarter,

2020 may see a continuation of the mini baby boom?

There were already 305,800 babies born in the year

to December - a 2-year high!

With the Federal Government yesterday confirming

that Australia’s international borders will likely remain

shut until at least 2021 due to virus restrictions,

Aussies holidaying at home could provide a vital

lifeline for Aussie tourism businesses.

In fact, a record 11.3 million overseas trips were taken

by Aussie residents in 2019, up by 247,500 from

2018, according to the ABS, Austrade and Tourism

Research Australia (TRA) data. So which states had

the most outbound tourists? Unsurprisingly, NSW (34

per cent), Victoria (28 per cent) and Queensland (18

per cent) dominated the proportion of short-term

residents returning from overseas journeys in 2019.

And when holidaying, visiting friends and family, or travelling overseas for business, Aussies spent a gargantuan

$66.6 billion in other countries. So could this potentially offset the $45.4 billion in lost annual international tourism

income? Well, yes. Prior to the COVID-19 outbreak, Aussies undertook 117.4 million overnight trips, spending

$80.7 billion (interstate $45 billion/intrastate $35.7 billion) last year. And while some interstate borders remain

closed, it’s worth noting that intrastate travel (trips within a

traveller’s state of residence) accounted for around two

thirds of all trips in 2019, according to TRA data.

Australia’s state tourism satellite accounts were released

by Austrade a couple of weeks ago. The accounts

revealed that in financial year 2018/19, growth in Gross

Value Added terms (GVA – excludes taxes paid and takes

into account subsidies) was highest for Western Australia

(up 13.6 per cent), followed by Tasmania (up 11.1 per

cent), Victoria (up 10.8 per cent), Northern Territory (up 9.5

per cent), South Australia (up 8.3 per cent), Queensland

(up 3.3 per cent) and NSW (up 2.3 per cent). But GVA fell

in the ACT by 6.7 per cent. Across all states and territories,

domestic overnight visitors account for 57 per cent of total

GVA, followed by day trip visitors (13 per cent) and

international visitors (30 per cent).

So which Aussie regions could benefit from a lift in

interstate or intrastate visitors? Outside of the major capital

cities, the NSW North Coast, Gold Coast, Sunshine Coast,

Tropical North Queensland, NSW South Coast, Hunter

Valley and Australia’s South West regions were amongst

the biggest recipients of interstate and intrastate tourism

expenditure in 2018/19.

What do the figures show?

Population Statistics – December quarter

Australia’s population increased by 349,833 people

over the year to December 2019 to 25,522,169 people.

Overall, Australia’s annual population growth rate eased

from 1.43 to 1.39 per cent – the slowest pace in 13½

years. Natural increase contributed 39.8 per cent to the

annual lift in population with 60.2 per cent from migration.

Over the year to December, population growth was

strongest in Victoria (1.87 per cent), followed by

Queensland (1.57 per cent), Western Australia (1.28 per

cent), NSW (1.13 per cent), the ACT (0.99 per cent),

Tasmania (0.97 per cent), South Australia (0.90 per cent)

and the Northern Territory (-0.38 per cent).

June 18, 2020 2Economic Insights. Population growth hits 13½-year low; Baby boom

By state and territory, the ACT population growth rate at 0.99

per cent was the weakest annual pace in 14 years. Victoria’s

population growth rate hit 8-year lows at 1.87 per cent.

NSW’s annual population growth rate of 1.13 per cent was

the slowest pace in 7½ years. Tasmania’s annual population

growth rate of 0.97 per cent was the slowest rate in 2½ years.

And Queensland’s annual population growth rate of 1.57 per

cent is the slowest in 3 years.

Western Australian annual population growth of 1.28 per cent

was the highest in 5½-years. Annual population growth in

South Australia (up 0.90 per cent) is just below 5-year highs.

Northern Territory lost 900 residents in 2019.

Australia’s population grew by 70,234 people in the

December quarter or 0.3 per cent after growing by 94,382 people in the September quarter.

A net total of 210,600 people (3½-year low) migrated to Australia over year to December, down from

220,400 people in the year to September. Migration growth is down from the peak of 315,700 migrants in the year

to December 2008.

There were 305,800 babies born in the year to December - a 2-year high - up from 304,400 births over the year

to September.

And there were 166,700 deaths in the past year, up by 1,100 on the year to September.

Natural increase (births less deaths) for the year to December was 139,200 to be down by 5.2 per cent.

State Tourism Satellite Accounts – 2018/19

Australia’s state tourism satellite accounts were released by Austrade a couple of weeks ago and revealed that in

financial year 2018/19 total tourism consumption was $152 billion, up 6.2 per cent on 2017/18. Almost three

quarters of consumption came from domestic tourism, with growth in the domestic sector outpacing international

tourism growth in 2018/19.

And growth in Gross Value Added terms (GVA – excludes taxes paid and takes into account subsidies) was

highest for Western Australia (up 13.6 per cent), followed by Tasmania (up 11.1 per cent), Victoria (up 10.8 per

cent), Northern Territory (up 9.5 per cent), South Australia (up 8.3 per cent), Queensland (up 3.3 per cent) and

NSW (up 2.3 per cent). But GVA fell for the ACT by 6.7 per cent. Across all states and territories, domestic

overnight visitors account for 57 per cent of total GVA, followed by day trip visitors (13 per cent) and international

visitors (30 per cent).

What is the importance of the economic data?

Demographic Statistics are issued by the Bureau of Statistics each quarter. The figures include estimates of

births, deaths, in-bound and out-bound migration movements and estimates of population change by State.

The Australian Bureau of Statistics, Austrade and Tourism Research Australia releases data on overseas

arrivals and departures, produced monthly, quarterly and annually and are indicators of the health of the tourism

sector. The figures are also useful in understanding spending trends and tracking migrant numbers – an indicator

with widespread implications for employment, housing and spending.

What are the implications of today’s decision?

Our population growth has long been one of the strongest amongst OECD countries. But Australia’s population

boom is at an end due to the virus-enforced closure of our

international borders.

The Government has recently announced that it expects

net overseas migration – a key driver of population growth

– to fall by around 30 per cent in 2019/20 and about 85 per

cent in 2021/22. CBA Group economists forecast annual

population growth to fall to 0.7 per cent over the period –

the slowest pace on record. Of course, this will have a

significant impact on the labour and housing markets.

Analysis of tourism data shows that we all have a part to

play supporting our regional economies. By holidaying

locally we can help Aussies in the accommodation,

hospitality, travel and retail sectors get back to work.

Ryan Felsman, Senior Economist, CommSec

Twitter: @CommSec

June 18, 2020 3You can also read