KINGFISHER AIRLINES: MANAGING MULTIPLE STAKEHOLDERS

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

IMB 353

ABHOY K OJHA

KINGFISHER AIRLINES:

MANAGING MULTIPLE STAKEHOLDERS

The entire airline industry in India came under close scrutiny after Kingfisher Airlines, already known to be in deep

trouble with a variety of stakeholders, cancelled about 35 flights, one day in November 2011. Many passengers had

harrowing experiences of being stranded at odd locations, making alternate arrangements to travel, and rescheduling

important engagements owing to the travel disruptions. Most of them, many very loyal customers of Kingfisher,

were distressed with the cancellations, and were even more distraught when other airlines raised fares. Many of

them contemplated switching their future travel programs to other airlines. Several others not directly affected by the

sudden events wondered whether they would ever book flights with Kingfisher Airlines in the future. Owing to the

furor these cancellations created, the Directorate General of Civil Aviation (DGCA) sought explanations from the

Kingfisher management. To prevent the crisis from affecting the whole airline industry, the Minister of Civil

Aviation had to step in to assure everyone that it was a crisis that would blow over, and even the Prime Minister was

forced to make a statement that the government would look for ways to help the airline deal with its existing

challenges.

On November 15, 2011, Vijay Mallya, Chairman and Sanjay Aggarwal, Chief Executive Office of Kingfisher

Airlines addressed a press conference at Mumbai’s Hyatt Regency to explain the sudden cancellation decisions of

the airline. They attempted to clarify that the cancellations were the result of a well-planned initiative and part of a

long-term restructuring process, although it might have come as a surprise to outsiders. The CEO suggested that they

had initially planned to cancel flights for a short period of time so they did not feel the need to notify the DGCA, but

when they realized their mistake they apologized for not keeping the DGCA in the loop. i Most analysts were

reluctant to accept the clarifications citing the fact that leave alone the DGCA, passengers and other external

stakeholders, even the crew, the ground-staff, and the ticketing executives of Kingfisher Airlines were taken by

surprise when the cancellations were announced. Further, the top executives tried to quell some of the rumors, such

as “the cancellations were due to over 100 pilots having submitted their resignation letters”. However, by that time,

it was well-known that Kingfisher employees, including pilots, had their salary payments delayed over the last few

months and dissatisfaction among them had been simmering, so the rumors of the resignations lingered for some

time.

After the damage control exercise at the press conference, Mallya and Aggarwal had to think through their strategy

to bring the airline back on track. They were aware that the airline had a very good reputation among its customers

(although the events that occurred may have hurt it) because of the high service quality standards it had established

and continued to maintain despite its other problems. However, they needed to assess whether the customers valued

all the differentiated services enough to pay higher prices to offset the costs associated with them, and whether the

focus on customers had allowed the airline to take its eyes off the needs of the other stakeholders. They now needed

to convincingly re-engage with all the stakeholders (customers, employees, suppliers, and larger society, including

government agencies, and finally owners) to assure them of the airline’s long-term viability to ensure their continued

support to revive the organization. There was a fear that even loyal customers might desert the airline for other

options that were quite abundant given the state of overcapacity in the industry, if Kingfisher Airlines acquired the

reputation of an unreliable airline owing to its ongoing problems. If that happened, it would be next to impossible to

pull Kingfisher Airlines out its existing crisis.

AIRLINE INDUSTRY IN INDIA

A 2009 Pricewaterhouse Coopers report called “Changing Dynamics: India’s Aerospace Industry” for the

Confederation of Indian Industries had described the Indian aviation sector, which included the airlines industry, as

Abhoy K Ojha prepared this case for class discussion. This case is not intended to serve as an endorsement, source of primary data, or to show

effective or inefficient handling of decision or business processes.

Copyright © 2012 by the Indian Institute of Management Bangalore. No part of the publication may be reproduced or transmitted in any form or

by any means – electronic, mechanical, photocopying, recording, or otherwise (including internet) – without the permission of Indian Institute of

Management Bangalore.Kingfisher Airlines: Managing Multiple Stakeholders Page 2 of 10

a high-growth segment of India’s economy. The domestic airlines industry had grown over five times in terms of

passenger volumes since its nascent stage in the mid-1990s. In 1997–1998, the domestic passengers were about 115

lakhs (1 lakh = 0.1 million) in number. In 2011, the Indian domestic market was already the ninth largest and the

fastest growing airlines market in the world. ii There were about 606.63 lakh domestic passengers during January to

December, 2011; relative to 520.21 lakhs in the same period, a year earlier indicating a year-on-year growth of

16.6%.

However, a report published in December 2011 based on the financial audit conducted by the DGCA indicated that

financial problems plagued all the airlines. It suggested the need for significant actions to remedy the situation. With

the exception of IndiGo, which was still unlisted, all the domestic airlines were in the red. In the very same quarter

in which the industry experienced the fastest growth, Jet Airways, the industry leader, suffered a loss of 714

crores, SpiceJet 240 crore, and Kingfisher 469 croreiii (1$ = about 47 in 2011). Air India, the government-

owned airline, was even worse off. According to the Chief Executive of Centre for Asia-Pacific Aviation, Kapil

Kaul:

The domestic airlines are projected to report a combined loss of $2.5 billion ( 1,250 crore) by

end of this fiscal (2011–12), with the state-run Air India alone accounting for $1.75–2 billion) and

other airlines to the tune of $600–700 million. iv

Although this paradoxical condition of the industry, in which growth in passenger volumes was very high, but most

airlines continued to make losses, had been known for some time; it was generally seen as an interim situation.

Analysts suggested that the airlines had invested in capacity for the long term and the market was yet to catch up,

and things would be ‘‘normal’’ once there was a match between capacity and passenger volumes.

Globally, the airline industry has been a very difficult business and some very famous airlines that looked invincible

at a time in the past were not in operation in 2011. There were very few airlines in the world that had been profitable

during the earlier decade, particularly in the last few years owing to the combination of the global downturn as well

as rise in fuel prices. However, it was still an industry that had seen new entrants trying their luck. It appeared that it

was easy for new airlines to enter the industry, but difficult for them to exit and even more difficult for most of them

to make a profit. Earlier, the upfront capital investments used to be very high and acted as a barrier to entry,

allowing incumbents some room to maneuver. With a downturn in the global airline industry and the availability of

the option to lease aircraft at attractive rates, the capital costs had come down dramatically making entry

significantly easier. Fixed costs including labor, airplanes and their maintenance and spares, services infrastructure,

airport equipment and handling services, and even fuel, to a large extent, formed a very high proportion of the

overall costs. However, there were few advantages for incumbents over the new entrants on these parameters

making entry into the industry easier than in the past.

The airline industry in India faced some unique challenges that made matters worse. Firstly, owing to government

regulations, there was a need for airlines to fly on financially unattractive routes. Hence, airlines were forced to

incur some losses they could otherwise have avoided if they were run on purely commercial grounds. During good

times, this may not have been a major problem as the profitable routes more than compensated for the losses, but in

bad times they were an avoidable burden.

In an interview, Nikos Kardassis, CEO of Jet Airways attributed the poor state of the industry to another three

factors: cut-throat fares, high fuel prices, and high taxes v. He argued that Air India was responsible for the cut-throat

fares that started the price competition which forced all the airlines to lower prices. It may have contributed to

growth in passenger volumes, but had hurt the finances of all the airlines. Air India was able to sustain the price

competition because it did not experience the same commercial pressures from its owners, the government. The

repeated government bailouts for Air India made it a challenge for private sector airlines, such as Jet Airways and

Kingfisher Airlines, to achieve commercial viability in a competitive market.

Owing to government restrictions on the petroleum industry, the airlines needed to buy aviation turbine fuel at very

high prices. Domestic oil companies maintained the high prices to offset losses on their other products whose prices

were controlled 1. Owing to the hangover from the past, the airlines were seen as catering to the rich. So, the airlines

market was perceived as a captive price-insensitive market without price controls in which prices could be

1

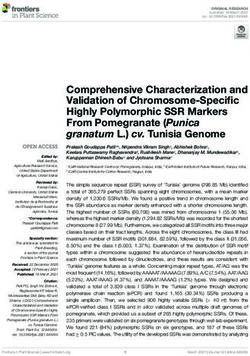

The government was considering the option of allowing airlines to import aviation fuel to ease this cost burden.Kingfisher Airlines: Managing Multiple Stakeholders Page 3 of 10 maintained at levels substantively higher than global prices. In addition, using similar logic, the national and state governments levied high taxes on aviation fuel as they needed to raise resources. These taxes were not viewed as unpopular as they did not affect the ‘‘common’’ citizen. As a result of these two factors, airlines in India were burdened with very high input costs. Further, in the short run, the costs of enhancing domestic airport infrastructure were being passed on to airlines, which only made matters worse. Exhibit 1 provides data on the performance of the domestic airlines on various parameters. A quick analysis of the data suggested that the low-cost airlines had performed significantly better than full-service airlines, despite having to work in the same operating environment in India. The growth in the airlines industry in India had been skewed with the rate of growth in the low-cost segment being significantly higher than in the full-service segment. Estimates suggested that about 75% of the domestic flyers opted for low-cost airlines, and Dinesh Keskar, President, Boeing India, estimated that the proportion would stabilize at 80% in the future. Experts believed that the low-cost airlines had about a 30% cost advantage per seat over a full-service airline which allowed them to lower prices to attract passengers without cutting into their margins. There are several factors which allowed the airlines that had adopted a low-cost model to keep their costs lower than the others. Firstly, the low-cost airlines had fleets with one base model of a standardized aircraft. Since these aircraft could fly on all the routes, the number of aircraft required was reduced. The maintenance schedules kept the number of aircraft out of service at a bare minimum. On the other hand, the full-service airlines had fleets which included propeller powered aircrafts for short distance routes, smaller jet powered aircraft for medium distance routes with low passenger volumes, and large jet powered aircraft for long distance routes with large passenger volumes. As a result, with the existing levels of activity, the number of aircraft out of service and hence adding to the cost was higher to full-service airlines. Further, costs in spare parts and maintenance for the low-cost model was also lower as only one model of an aircraft had to be supported relative to several different models from different manufacturers by the full-service providers. Secondly, significant cost advantages were gained from lower turnaround times at airports which allowed a low-cost airline to fly an average of 12–13 hours a day in comparison to about 8 hours flying time for a full-service airline. The quick turnaround time was largely attributed to not providing elaborate hot meals which reduced loading/unloading time, and also resulted in reduction in time taken to clean the aircraft between flights when meals were not served. Another reason for the quick turnaround was that the aircraft could be used for all the routes of the airline rather than some restricted routes for full-service airlines that flew different aircraft on different routes. The quick turnaround also reduced some airport charges that were based on the time an aircraft was at an airport. Several other factors also contributed to the low costs. Since the low-cost airlines did not offer hot meal services, they carried a lighter load of food and cutlery, etc., and also avoided a lot of heavy equipment required to keep the food warm. The lighter load reduced fuel consumption. Further, the low-cost airlines had more seats for the same model of the plane relative to the full-service airlines owing to which their fixed costs were spread over a larger number of passengers. vi Comparing different airlines on a typical aircraft, the low-cost airline could seat up to 190 passengers as compared to about 150 by a full-service airline. Finally, the pure low-cost model also required lower levels of staffing. The full-service airlines had about 50% more staff per plane compared to a low-cost airline. vii The difference in performance of full-service airlines and low-cost airlines could be seen in the contrasting performance of Kingfisher Airlines and IndiGo Airlines. In terms of market share, Kingfisher experienced a drop in November owing to sudden flight cancellations, but recovered in December when the busier routes were restored. There was no noticeable change in complaints, and its on-time performance was the best across airlines, and cancellations were lower than the previous two months. However, its seat factor dropped despite the flights being restored probably because passengers had not returned to the airline at the same rate owing to lingering doubts about potential cancellations. On the other hand, IndiGo maintained its market share, despite higher levels of complaints, and relatively low on-time performance (unlike the popular perception 2). However, on an average it had the lower levels of cancellations during the period. Most importantly, it improved its seat factor quite significantly. In other words, despite relatively better performance than IndiGo on complaints and on-time performance, Kingfisher’s 2 Amber Dubey, Director (Aerospace and Defence), KPMG was quoted as saying, “On-time performance is no longer a luxury, it is a necessity. On-time service, too, is said to have helped IndiGo become the second-biggest airline. People fly to be on time and for point-to-point travel. IndiGo seems to have got its fundamentals right." However, the data seems to suggest that IndiGo’s on-time performance was not as good as the perception.

Kingfisher Airlines: Managing Multiple Stakeholders Page 4 of 10

market share and seat factor were lower than IndiGo. A high seat factor was the critical element, particularly for

full-service airlines, in ensuring profitability. Ironically, IndiGo, a low-cost airline, fared better than others on this

parameter and achieved profitability, while poor seat factor led to losses for the major airlines, including Kingfisher.

On an average, Kingfisher’s operative expenses exceeded the operating revenues by about 20% while IndiGo’s

operating expenses were about 17% less than operating revenues. viii

Rishikesha T. Krishnan of the Indian Institute of Management Bangalore believes that there is no easy way out for

the industry particularly the full-service airlines such as Kingfisher Airlines. They will have to focus on operational

excellence to reduce costs and increase seat factor to ensure that they recover the costs and return to profitability.

According to him:

The survivors and winners will be the ones that are successful in embracing operational excellence

and differentiating to the extent that customers value. ix

However, lowering costs need not mean providing low quality. Rahul Bhatia, Managing Director, IndiGo was

quoted in Outlook Business saying: “To tell people today that low-cost is low-quality is for the birds”. x He believes

that high quality service can be provided at lower costs by understanding customer needs better and by reducing

costs incurred on services that were not appreciated by the customer.

KINGFISHER AIRLINES

Kingfisher Airlines was established in 2003. Its head office was located in Mumbai while its registered office was in

Bengaluru. It was owned by the Bengaluru-based United Breweries (UB) Group. It started commercial operations as

a full-service airline in 2005 with a fleet of four new Airbus A320-200s operating a flight from Mumbai to Delhi. In

2007, it acquired a 26% stake in Air Deccan, a low-cost airline launched in 2003 by Deccan Aviation which was

managed by Capt. G.R. Gopinath. Later, Kingfisher’s stake in Air Deccan was increased to 50% and the

organizations were merged. Air Deccan was renamed Kingfisher Red and remained largely a low-cost arm of

Kingfisher Airlines. Kingfisher Airlines started its international operations in September 2008 by connecting

Bengaluru with London. In 2011, Kingfisher Airlines served 63 domestic destinations and 8 international

destinations in 8 countries across Asia and Europe. xi In a very short span of time, Kingfisher Airlines established

itself as a high service-oriented airline and obtained several rewards for its services and also received more awards

for being India’s best airline.

It was predominantly a full-service airline with a limited service arm in the form of Kingfisher Red. It offered three

classes of travel on domestic routes and two classes of services on international routes. Within the country,

Kingfisher First, the premium class available on some domestic routes targeted business travelers by providing

luxurious seats, ample leg space, and personalized services that were comparable, if not better than any other airline

in the country. Kingfisher Class, the standard class, was available on most of the routes operated by the airline, and

targeted the regular traveler, provided smaller seats, less leg space and a lower level of service, but still comparable

or better than any other domestic airline. Both these classes of travel were provided by Kingfisher Airlines, which

started as and remained the full-service arm of Kingfisher Airlines. Kingfisher Red, the no-frills class, targeted the

price-conscious traveler and was offered by Kingfisher Red. Gradually, the routes on which this option was

available declined as many of the routes were assigned to Kingfisher Airlines to offer Kingfisher Class services.

Further, some limited services were added to Kingfisher Red, probably to differentiate the airline from other low-

cost airlines. On international routes, only Kingfisher First and Kingfisher Class options were available and services

in both classes were comparable to the best in the industry.

Despite its rapid expansion and its excellent service offerings to its customers, Kingfisher Airlines faced challenges

in making a profit. While all airlines, particularly the full-service providers suffered owing to the global trends and

some unique conditions in India, the crisis that Kingfisher experienced was worse than others, with the exception of

Air India. The airline had never made a profit since it started operations in 2005, which in itself was not a

significant issue as it often takes long for such a venture to break even. However, the problem was that there was no

sign that the airline was moving in the direction of financial viability. By September 2011, the accumulated losses

were 5960 crores (1 crore = 10 million).xii Its debt of about 8000 crores from about 13 different lenders had to beKingfisher Airlines: Managing Multiple Stakeholders Page 5 of 10

recast in November 2010 with them reducing interest rates and converting part of the interest burden into equity. 3

The same lenders refused to oblige again in November 2011 unless the promoters put in fresh owners equity. 4 The

cash strapped airline was in the danger of upsetting the rest of its stakeholders if it did not resolve the crisis soon.

The DGCA, in its December 2011 report, even suggested that the airline be asked to shut operations by revoking its

license because the financial problems could affect the safety of the airline. xiii In short, the financial problems had

the potential of hurting the future of the organization.

According to experts, a major reason for the inability of Kingfisher Airlines to become a successful organization

was that it had difficulties in providing a coherent model of operations that engaged with all the stakeholders

consistently. According to Tony Fernandes, CEO of AirAsia, South-East Asia’s largest low-cost airline:

They lack focus, haven’t stuck to one model (full carriers/low cost) before changing it and are

trying to do too many things at the same time. xiv

When Kingfisher Airlines was launched, it was a single class airline providing a reasonably high level of services

comparable to that provided by Kingfisher Class. Since the high paying business class passengers did not appreciate

the single class airline, it introduced Kingfisher First to attract them. This required the planes to be reconfigured to

support the two classes and allow for a full-service offering. Almost simultaneously, Air Deccan was renamed

Kingfisher Red and positioned as the low-cost arm of Kingfisher Airlines. However, since the services were better

than other low-cost airlines and also King Club benefits were common, many Kingfisher Class passengers moved to

Kingfisher Red when both flight options were available. Apparently, this led to the later move to exit the low-cost

space and focus only on the full-service offering, except for some few restricted routes. Multiple changes in strategy

had left all concerned confused and also the cost of transitions had used up more capital than a consistent philosophy

would have required.

Some analysts believed that given the crowding of players in the low-fare segment, Kingfisher’s move to operate a

full-service airline was the correct decision. Arguing that the cost difference between low-cost airlines and full-

service airlines was not very significant, Kingfisher would gain from its ability to charge higher prices for its

excellent services. xv Others thought that the decision to merge Kingfisher and Air Deccan (and change the name to

Kingfisher Red) was a mistake. It would have been advisable to keep the Air Deccan brand for the low-cost segment

and run it as a separate customer facing organization while merging the back ends to achieve economies of scale in

shared infrastructure and services. They argued that, based on the new brand positioning, there was little difference

between Kingfisher Airlines and Kingfisher Red as they looked the same and offered similar services without

leveraging the benefits of full service or low costs. They described the strategy as ‘‘stuck in the middle.’’xvi

Others criticized the focus on the top end of the market when the growth was in the no-frills end of the market. They

suggested that there was limited scope to grow based on only the top end of the market because the volumes would

continue to be low in the future. If Kingfisher created excess capacity at the top end, it would have to provide

discounts to improve the seat factor, but then would fail recover its costs of services. Omkar Goswami, Chairman,

CERG Advisory wrote:

Fancy seats, comely cabin crew and three course meals don’t work in India. To understand how

airlines work, (Vijay) Mallya needs to look at how IndiGo runs its business. But, he won’t.

Because he thinks in terms of ultra-luxurious experience, which can’t pay for itself.” xvii

Another article on Kingfisher suggested, “Kingfisher is known for its world-class service standards, but that has

come at a steep cost.” and meeting the high standards while controlling costs would be a big challenge. According to

the article, “A kitten used to badam milk will not drink skimmed milk.” xviii

MANAGING THE TRANSITION: KEEPING ALL STAKEHOLDERS ENGAGED

Any organization needs to keep five sets of stakeholders engaged in order for it to be a resilient organization that

remains in good health in the long run. The top managers of Kingfisher Airlines needed to focus on a recovery

3

Analysts believe that the government influenced public sector banks to provide relief to the airline.

4

The government is considering a proposal to increase the limit of foreign direct investment in airlines in India from 20% to 49% which might be

of help to Kingfisher.Kingfisher Airlines: Managing Multiple Stakeholders Page 6 of 10

program in order to (i) meet the expectations of its customers so that they continued to patronize its products and

services and also encourage others to do the same, (ii) keep it worthwhile for the suppliers of the necessary

resources to continue to do business with the organization, (iii) meet the aspiration of its employees so that they

were motivated to contribute to the organization and also help attract and retain the necessary talent for future

growth, and, (iv) comply with expectation of the society/community both in terms of legal compliance as well as a

good corporate citizen, and finally (v) satisfy the owners of the organization by providing them returns that meet

their expectations,

CUSTOMERS

Kingfisher Airlines was credited with transforming service levels offered in the airline business in India by focusing

on services such as good food, personal screens on domestic flights, and airline ushers who attended to customers as

they arrived at the airport. Its frequent flyer program called King Club provided advantages to customers that were

very well-appreciated. Its lounge facilities at various airports established new standards in services not seen in India

before. It had managed to create a very loyal customer base that would support it. However, when the airline

cancelled hundreds of flights in November 2011 and then extended the cancellations to mid-December, xix it shook

the confidence of this loyal group. According to the DGCA report, the airline did not operate 175 daily flights owing

to non-availability of aircraft during the winter schedule." xx As one loyal customer at an airport waiting for a

Kingfisher flight revealed his anxiety:

I mostly travel with Kingfisher, but after what happened in last few days, I am a bit worried. My

flight to Mumbai is delayed by 40 minutes, but I hope it will take off. I have a good experience

with the airline, but last minute cancellation shouldn’t happen as it causes a lot of inconvenience

to passengers. xxi

It was rumored that the airline was considering uninstalling its in-flight entertainment system, which at one time was

its unique selling point, as part of its cost-cutting drive. xxii Was Kingfisher prepared to take such drastic steps to

withdraw such well-appreciated services in order to save costs? Was it willing to test the loyalty of the only set of

stakeholders that was still relatively satisfied to meet the expectations of other stakeholders?

SUPPLIERS

Kingfisher was dependent on a host of resource suppliers to provide its services. It could not afford to not make it

worthwhile for them to continue their association with the airline. Any disengagement by one or more suppliers

would sink the airline. As Pratip Chauduri, Chairman, State Bank of India (SBI), a key provider of financial

resources to Kingfisher said:

Kingfisher is a valued company, but an airline would need fuel, fleet and finance to run the show.

Kingfisher should tell us how it plans to streamline its daily requirements. xxiii

SBI was the leader of the consortium of 13 banks that did not provide further financial support at the end of 2011 xxiv

because it did not make business sense for them unless the promoters infused fresh equity into the company. xxv

Kingfisher faced similar challenges with the companies that supplied fuel as the airline was not able to pay its bills.

Hindustan Petroleum Corporation Limited and Bharat Petroleum Corporation had both not faced payment issues. On

occasion, they had refused to supply fuel, or put the airline on cash and carry basis for supply, and even involved the

courts to resolve disputes.

The story with the suppliers of aircraft was no different. Kingfisher had been unable to pay the rentals on the aircraft

it had leased. In one instance, the airline had to return aircraft to GE Commercial Aviation Services on the directions

of the Karnataka High Court. In another instance, DVB Aviation Finance Asia Ltd. had filed a case in a UK court

owing to Kingfisher’s inability to pay its lease rentals. xxvi Fearing possible liquidation of the airline, some of the

leasing companies were seeking repossession of the aircraft that had been leased. xxvii

On similar lines, the Airport Authority of India (AAI) had pending dues of over 200 crore from Kingfisher. It was

reported that checks issued by Kingfisher Airlines had bounced xxviii and the airline was asked to operate on a cashKingfisher Airlines: Managing Multiple Stakeholders Page 7 of 10

basis after Kingfisher Airlines did not settle dues on a regular fortnightly basis and that their outstanding amounts

exceeded the security deposit and bank guarantees with AAI. xxix The Mumbai International Airport Limited had on

an earlier occasion put the airline on cash-and-carry mode and threatened to put Kingfisher on the same mode unless

it paid its dues. xxx Analysts believed that there were several other small lesser known suppliers that were

experiencing similar problems with that airline, but did not have the clout to restructure their relationship. However,

many were close to the stage of disengaging with Kingfisher to avoid getting deeper into the red themselves.

What could Kingfisher do to improve its relationship with its suppliers? Could it afford to displease them any

longer? Even if they continued dealing with Kingfisher because of lack of other options, would they walk the extra

mile for Kingfisher after they had nurtured other relationships?

EMPLOYEES

Kingfisher Airline had staff strength of 6,000 and spent about 58 crores a month on salaries in 2011. Kingfisher

Airlines had delayed salaries of its employees by a few days or weeks every month since July 2011. Once the

management had attributed the delay to a bank strike, but had resorted to delays in payment of salaries regularly

since then. It was also alleged that the taxes deducted from the salaries of employees had not been deposited with the

tax authorities. xxxi The salary delays had caused considerable stress among the employees as many had credit and

EMI payments commitments that they could not meet. However, even as their satisfaction and morale was at its

lowest, they had to face irate passengers because of the flight cancellations in November and December, 2011.

There were suggestions that several Kingfisher employees, including pilots, were looking for other jobs xxxii and over

100 Kingfisher pilots had submitted their resignations. xxxiii The DGCA report suggested that 24 pilots had left the

airline during November and December, 2011. xxxiv

What could Kingfisher Airlines do to improve the morale of is employees? Could it afford to have disgruntled

customers facing employees at the time when, given all the sense of unease about the airline, its services would be

scrutinized more closely by discerning customers? Would its actions influence the kind of talent it would attract and

impact the quality of service it could offer in the future?

COMMUNITY/SOCIETY

All organizations, including commercial organizations, function with the sanction of society. Society provides the

legal and normative framework within which an organization functions. There were times when governments were

expected to help organizations that were critical to society during times of crisis. In the past, several governments

across the world had provided a variety of special privileges to airlines to keep them viable.

Kingfisher Airlines had asked the government to help it survive by ensuring three-months of credit period from its

suppliers. The civil aviation minister was quoted as saying "There is no bailout scheme or plan by the government

for any of the private airlines before me." xxxv Despite these public assertions, there was a feeling that the government

might put pressure on the public sector banks to make special provisions for the airline, as was rumored to have

happened a year earlier. Hence, the All India Bank Employees Association demonstrated to oppose any bailout of

the airline.xxxvi In the prevailing economic context, there was very little acceptance for the idea of governments

supporting private enterprises, including private airlines. As Omkar Goswami put it:

The notion that airlines need to be ‘‘saved’’ comes from an era when these were often

government-owned and ‘‘flying the flag’’ was equated with nationalism. That’s passé. Like any

other business, airlines need to fend for themselves. Rahul Bajaj was right in asking whether the

government would consider bailing out Bajaj Auto if it went bankrupt. The answer is “no”. So too

for airlines.xxxvii

At the same time, several agencies of the government were unhappy with Kingfisher Airlines and were quite ready

to disengage with Kingfisher, which would eventually mean that the airlines would have to shut down at least its

domestic services. The DGCA was quite damning of the airline. It believed that about one-third of Kingfisher’s fleet

was grounded owing to lack of engines, components, and spare parts. They suggested that the airline was

cannibalizing components and parts from the grounded aircraft to keep the remaining aircraft flight worthy. They

were concerned about the safety implications for the passengers and others who might be affected. It even indicatedKingfisher Airlines: Managing Multiple Stakeholders Page 8 of 10

that withdrawing Kingfisher’s license to fly was an option. xxxviii The service tax department had frozen the bank

account of Kingfisher for non-payment of dues. xxxix

What could Kingfisher do to win back the support of the larger society and the government and its agencies so that

they would provide the flexibility and support needed by the airline to recover? Was lobbying with the government

still a viable option?

OWNERS

Shareholders are the owners and have a residual claim on the assets of a company. The share price reflects the

confidence they have on the future earnings of the company. Quite clearly, during the crisis, the shareholders had

lost a significant amount of confidence in the top management of the company to restore Kingfisher to its full value

creating potential. Kingfisher shares that had traded at about 48 per share in April 2011 traded close to 20 per

share in November 2011 when the cancellations were announced. The shares of Kingfisher’s holding company, UB

Group, that traded at about 315 per share earlier in the year was down to 82 per share. xl Analysts were very

critical of Kingfisher’s performance on critical financial parameters such as margins and cash flow. It was well-

known that the airlines’ costs were higher relative to its competition, and the ratio of interest expense to net sales

ratio was several times higher than others. Its debt to equity ratio was a matter of concern, and as the crisis had

revealed, Kingfisher quite clearly had a problem of poor cash flow. xli

What could the management of Kingfisher do to restore the confidence of its shareholders? Could it afford to keep

shareholder concerns on the back burner for some time and let share prices fall further while it addressed the

concerns of the other stakeholders? Could Kingfisher’s poor performance cause the shareholders of the UB Group to

also desert the entire group?

DECISION TIME

Mallya and Aggarwal were well aware of the challenges that Kingfisher Airlines faced. They were conversant with

the various analyses and sensitive to the criticisms of the airline, and also were attentive to the wide ranging advice

that was provided to them both publically and privately. They needed to chalk out a program that defined a sequence

of steps, with some contingency arrangements, to take the airline from the situation of crisis to a position in which

the company had met the threshold level of satisfaction of all stakeholders to ensure their continued engagement and

support. It could then proceed to take the company to new heights.

i

http://ibnlive.in.com/news/kingfisher-seeks-govt-help-more-flights-curtailed/201523-3.html

ii

Shobha John, Where’s the flight going? Sunday Times of India, Bangalore, November 20, 2011

iii

Shobha John, Where’s the flight going? Sunday Times of India, Bangalore, November 20, 2011

iv

http://articles.economictimes.indiatimes.com/2011-11-11/news/30387022_1_kingfisher-airlines-domestic-airline-industry-low-cost-airline

v

Cover Story, Business World, December 5, 2011

vi

Asha Rai and Saurabh Sinha, Earth bound, The Crest Edition, The Times of India, November 19, 2011.Kingfisher Airlines: Managing Multiple Stakeholders Page 9 of 10

vii

http://www.thehindubusinessline.com/industry-and-economy/logistics/article2633295.ece?ref=wl_industry-and-economy

viii

DGCA Data for 2009–10.

ix

Rishikesha T Krishnan, No easy way, Outlook Business, January 21, 2012

x

Sudipta Dey and Rahul Bhatia, Flying High, Outlook Business, December 10, 2011, page 71.

xi

http://en.wikipedia.org/wiki/Kingfisher_Airlines

xii

http://en.wikipedia.org/wiki/Kingfisher_Airlines

xiii

Saurabh Sinha, Kingfisher Airlines safety an issue: DGCA, TNN | January 5, 2012, 01.18AM IST

http://timesofindia.indiatimes.com/business/india-business/Kingfisher-Airlines-safety-an-issue-DGCA/articleshow/11368768.cms

xiv

Shobha John, Where’s the flight going? Sunday Times of India, Bangalore, November 20, 2011

xv

Ram Prasad Sahu, Kingfisher Airlines: Survival hinges on improving yields, rights offer Mumbai November 17, 2011, 0:36 IST

http://www.business-standard.com/india/news/kingfisher-airlines-survival-hingesimproving-yields-rights-offer/455732/

xvi

http://www.bangaloremirror.com/article/1/2011111920111119072223143c1ca422d/Mallya-found-running-a-lowcost-airline-brand-

embarrassing.html

xvii

Omkar Goswami, A Tricky Business, This, Business World, December 5, 2011, page 16.

xviii

Asha Rai and Saurabh Sinha, Earth bound, The Crest Edition, The Times of India, November 19, 2011.

xix

http://economictimes.indiatimes.com/news/news-by-industry/transportation/airlines-/-aviation/kingfisher-airlines-brings-good-time-for-air-

india/articleshow/10748551.cms

xx

Saurabh Sinha, Kingfisher Airlines safety an issue: DGCA, TNN | January 5, 2012, 01.18AM IST

http://timesofindia.indiatimes.com/business/india-business/Kingfisher-Airlines-safety-an-issue-DGCA/articleshow/11368768.cms

xxi

http://articles.economictimes.indiatimes.com/2011-11-12/news/30391209_1_kingfisher-airlines-international-routes-domestic-airline

xxii

http://www.livemint.com/2011/11/17001644/Inflight-entertainment-system.html?h=B

xxiii

http://www.financialexpress.com/news/kingfishers-request-for-fuel-on-credit-forwarded-to-pmo/876857/

xxiv

http://articles.economictimes.indiatimes.com/2011-11-14/news/30397516_1_kingfisher-plans-kingfisher-airlines-kfa

xxv

http://www.financialexpress.com/news/kingfishers-request-for-fuel-on-credit-forwarded-to-pmo/876857/

xxvi

http://en.wikipedia.org/wiki/Kingfisher_Airlines

xxvii

http://articles.economictimes.indiatimes.com/2011-11-11/news/30387108_1_kingfisher-airlines-plan-flights-a320

xxviii

Asha Rai and Saurabh Sinha, Earth bound, The Crest Edition, The Times of India, November 19, 2011.

xxix

http://en.wikipedia.org/wiki/Kingfisher_Airlines

xxx

http://www.moneycontrol.com/news/business/mial-asks-kingfisher-to-paydailysaturday_627840.html

xxxi

http://en.wikipedia.org/wiki/Kingfisher_Airlines

xxxii

http://www.hindustantimes.com/India-news/NewDelhi/Uncertainty-hounds-Kingfisher/Article1-770233.aspx

xxxiii

http://ibnlive.in.com/news/over-100-kingfisher-pilots-quit-sources/201111-7.html

xxxiv

Saurabh Sinha, Kingfisher Airlines safety an issue: DGCA, TNN | January 5, 2012, 01.18AM IST

http://timesofindia.indiatimes.com/business/india-business/Kingfisher-Airlines-safety-an-issue-DGCA/articleshow/11368768.cms

xxxv

http://www.hindustantimes.com/News-Feed/SectorsAviation/No-bailout-Mallya-will-suffer-if-he-mismanaged-government/Article1-

770517.aspx

xxxvi

http://economictimes.indiatimes.com/news/news-by-industry/transportation/airlines-/-aviation/aibea-employees-oppose-kingfisher-airlines-

bailout-urges-rbi-to-recover-loans/articleshow/10759266.cms

xxxvii

Omkar Goswami, A Tricky Business, This, Business World, December 5, 2011, page 16.

xxxviii

Saurabh Sinha, Kingfisher Airlines safety an issue: DGCA, TNN | January 5, 2012, 01.18AM IST

http://timesofindia.indiatimes.com/business/india-business/Kingfisher-Airlines-safety-an-issue-DGCA/articleshow/11368768.cms

xxxix

http://economictimes.indiatimes.com/news/news-by-industry/transportation/airlines-/-aviation/air-india-kingfisher-airlines-accounts-frozen-

by-service-tax-dept-for-non-payment-of-dues/articleshow/11040448.cms

xl

www.indiatoday.intoday.in/story/the-big-story/1/160559.html

xli

Jeff Glekin, Gloats about India's Icarus. Vijay Mallya misses the point, Wednesday, November 16, 2011 3:42PM IST

http://in.reuters.com/article/2011/11/16/idINIndia-60558820111116?type=economicNewsKingfisher Airlines: Managing Multiple Stakeholders Page 10 of 10

Exhibit 1

Domestic Market Share and Seat Factor of Airlines in India (October–December, 2011)

Airline Market Share Seat Factor Complaints/1000 On-time Performance Cancellation %

Oct Nov Dec Oct Nov Dec Oct Nov Dec Oct Nov Dec Oct Nov Dec

IndiGo 19.6 19.8 19.5 84.2 88.7 90.4 1.5 2.2 3.1 91.4 87.8 74.3 0.2 0.1 0.7

Jet Airways 17.6 17.6 18.3 70.8 76.0 78.7 1.7 1.6 1.5 92 91.4 83.4 0.9 0.5 1.5

Kingfisher 16.7 14.0 18.0 79.3 79.6 78.3 1.6 1.7 1.6 92.6 91.8 87.3 2.8 2.6 1.9

Air India 16.6 19.8 16.0 72.0 76.0 77.3 1.1 1.8 1.3 79.9 65.5 63.7 3 2.8 3.8

SpiceJet 16.1 15.5 14.4 78.0 76.9 82.0 1.7 1.5 1.7 89 90 80.3 0.4 0.4 0.6

Jet Lite 7.2 7.3 7.6 74.1 79.7 82.5 1.4 1.4 1.4 91.8 89.6 78.5 1.6 0.9 2.4

Go Air 6.2 6.2 6.1 76.1 79 77.0 4.5 4.1 3.9 94.3 83.4 80.5 0.2 0.3 1.9

Source: DGCA websiteYou can also read