GENERAL REPORT - Osoyoos Credit Union

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

ANNUAL

2019

GENERAL

REPORT

Initially Delivered at Annual General Meeting

Wednesday, June 17, 2020

Committed to Community

Osoyoos Credit Union is the financial institution of choice

with competitive products, professional personal service and a community focus.

—1—OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT 2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

74 years behind us

— and still growing

I

N 2021, OSOYOOS CREDIT UNION will celebrate its

75th anniversary — and we’ll be doing pretty much

what we’ve been doing for the last 74 years.

We’re embracing our quest to be not only the

OCU celebrates opening

financial institution of choice for the Osoyoos

community but also a corporate and community leader.

The Osoyoos Credit Union has come a long way

from its humble beginnings in 1946 — when just

of Rock Creek branch

18 members turned out for its first annual general

meeting.

A

Now with more than 3,500 members throughout

FTER MONTHS OF WORK, Osoyoos Credit Union Before OCU arrived, people would often have to drive the South Okanagan and West Boundary, OCU is not

opened its second location to the public — 50 km to other nearby communities to get physical access to only the independent financial institution of choice in

east of Osoyoos in Rock Creek. banks and other financial institutions. Osoyoos but also a community leader.

As the credit union’s first-ever expansion That all changed with the the incorporation of the In 2019, we added a second location, setting up a co-

to another location, this was a big milestone West Boundary Community Services Co-operative operative in Rock Creek that provides banking services

many within the community are celebrating. Association in February 2019. Shortly thereafter, OCU to that community and other resources richly received

The newly constructed Riverside Centre is offering and the Rock Creek Farmers Institute purchased land by the Rock Creek community.

in- branch services two days a week — and a whole lot for the Co-op and planning and construction of the Over 74 years, we’ve dedicated ourselves to a

more. Riverside Centre was underway. consistent commitment to our members and people

“We’ve been able to engage the community as a There’s also room on the property for two additional before profits.

whole and go back to our co-operative roots,” says OCU buildings, including potential retail space for local

CEO Greg Sol.

The money invested in the Osoyoos Credit Union

commercial enterprises.

is returned to the community through member

The Riverside Centre boasts many features that are Staff at OCU Rock Creek will be able to help members

great for the local community, including space and patronage and dividends and through commitment to

with account services like opening accounts, lending,

shared resources for other community partners, high- investments, and savings products like Registered

many local organizations and charities.

speed fiber-optic Wi-Fi and an electric vehicle charging Retirement Savings Plans (RRSPs) and Tax- Free Savings We’ve continued to live up to our Together We’re

station. accounts (TFSAs) at this new location. Better mantra, our staff providing community service,

The branch fills a longstanding need in the Rock For additional convenience, a new ATM is available our organization committing financial resources,

Creek community — it’s been ninety years since the outside the building for people to access teller services time and energy to local causes and our combined

community has had financial services available locally. like deposits, withdrawals, balance inquiries and so on. membership, management and team working together

to build a better future for Osoyoos.

—2— —3—OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT 2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

TABLE OF CONTENTS CEO’s Report to the Membership

O

CEO’s Report to the Membership . . . . . . . . . . . . . . . . 4

Board of Directors . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 SOYOOS CREDIT UNION had a successful and To meet our high standard of professional and community

Business Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 productive year in 2019 — one in which our efforts service, we have empowered OCU employees to take action to

continued to be focused on fulfilling dreams for our ensure our core values are maintained.

Independent Auditor’s Report . . . . . . . . . . . . . . . . . . 8 members while ensuring we remain the heart of co- This includes providing each and every team member with the

Financial Position . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 operative finance in the region and creating enduring authority to make decisions commensurate with their jobs and

OCU in the Community . . . . . . . . . . . . . . . . . . . . . . . 12 legacies by maintaining core organizational values. skills and developing skill sets that ensure they provide sound

We don’t just talk about values; we live them every day. financial advice every time they interact with a member.

As we reflect on our future, how we interact with and advise We want our team members to be proud of the work they do,

The Annual Report is available on the Osoyoos committed to owning up to mistakes — and learning from them

our members today will set the stage for future years as those

Credit Union’s website at ocubc.com relationships strengthen and as our employees work with our — and maintaining a sense of responsibility for understanding and

members to create and achieve their financial goals. filling in knowledge gaps.

For further information, contact: I’m happy to report that OCU team members do take pride in the

Certainly, changing conditions in 2020 make that even more of a

work they perform. This pride is manifest in a collective capacity

Greg Sol, CEO priority for us. to complete tasks fully and accurately, ensuring positive personal

8312 Main Street Community is the heart of Osoyoos Credit Union, which is why presentation daily, and being responsible for their actions.

Osoyoos, BC V0H 1V0 we continue to invest locally in so many ways. Our team culture is built on collaboration. This allows the OCU

Ph. 250.495.6522 | Fax. 250.495.3363 In 2019, we continued our annual Community Giving fund, which team members to make unique choices — and respect the unique

includes a review of submissions in April and November, followed choices of others — knowing that standing together in this effort

Email. contact@ocubc.com creates great organizational strength.

by upwards of $50,000 in grant funding.

We encourage non-profit, service clubs and good causes of all It is this organizational strength and commitment to core values

kinds to review our program posted on our website. that will sustain OCU through this current difficult period. In fact, it

allows us to do more, to turn the challenges into opportunities to

Another way we supported our community was by remaining

improve our service and dedication to our membership, partners

a living wage employer. This is an initiative that ensures workers and others with whom we do business.

receive wages that provide the resources to help their families Thank you for your support and trust in us through 2019.

meet their basic needs. Together, we will build a brighter tomorrow, even as things are

We continue to encourage partner organizations, members and difficult. Together we truly are better.

other businesses in the community to provide similar programming Greg Sol

Osoyoos Credit Union and help their employees also build a healthy and vibrant lifestyle. Chief Executive Officer

is a Living Wage Employer

O OCU’s Board

SOYOOS CREDIT UNION is proud to announce

that we are certified as a Living Wage Employer!

A Living Wage Employer is an organization

of Directors

that provides a “living wage rate” to its

employees that reflects the “true costs of living

in a community and that parents can earn what they need

to support their families.” Pat Wycherley Leo Callarec Alan Bajkov Richard Douziech Kathryn Gudewill

As Living Wage Employers, we not only meet the

Osoyoos Credit Union is governed by a volunteer board of

requirements of providing a “living wage,” but we also

directors elected by membership. Directors are engaged in general

strive to do business with other social enterprises

and specific duties, including attending regular board meetings and

wherever possible to help reduce poverty in our more occasional committee meetings.

communities.

With an emphasis on the local economy, our directors strive to

In 2019, OCU paid out almost $1.55 million in employee represent those who elected them by meeting members’ needs

salaries and beniefts, income that for the most part was through the friendly and local resources an independent credit

invested back into the community. That was an increase of union can provide.

almost $150,000 from 2018. In 2019, OCU’s Directors received a combined $30,387 in

compensation.

Thomas Martin Zachary Poturica Diane Thomas Kevin Nelson

—4— —5—OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT 2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

Business Analysis Business Analysis

HIGHLIGHTS

A

LTHOUGH financial institutions loans all up significantly (7.55%) from the

provide information in table previous year.

format, the numbers do not In total, Loan Receivables had a net

always provide the full story of

an organization’s performance. carrying value of $84,869,589 in 2019, up

This business analysis is a supplement from $73,891,006 the previous year.

to the provided financial statements, Member Deposits

offering an improved view of Osoyoos

Credit Union’s performance in 2019 and Member Deposits increased to

additional explanation where warranted. $135,057,076 from $130,654,117 in 2018,

At the beginning of 2018, the credit the largest share of that increase coming

union adopted new or revised standards in Term Deposits. increasing more than

substantially different from those it $4.8 million to $47,207,546.

previously used. Demand Deposits account for

This new standard fundamentally alters $63,187,622 of total deposits, down from

the classification and measurement of

financial assets subsequent to initial $65,513,793 in 2018.

Beyond the Numbers Term Deposits

I

Registered plans are included in year for the lending department with all

recognition, including impairment and

Member Deposits – these include of the lenders exceeding their individual

incorporates a new hedge accounting Due by Mar. 31, 2020 824,500

F 2020 WILL BE REMEMBERED as lending targets for the year.

model. retirement savings plans, retirement

a year of continuous adaptation, Members are receiving a high level Due April 1 - Dec 31, 2020 3,249,430

For additional explanation of these income funds, educational savings plans,

2019 will be recalled as providing of service and quality advice from our

changes, please contact OCU staff to and tax free savings accounts. Due on or after January 1, 2021 15,049,852

opportunity to develop the skills lending team. The increase in lending

arrange for a personal consultation.

Osoyoos Credit Union management volume did not negatively impact our Accrued Interest 144,614

Member Equity delinquency in any way with delinquency

Financial Performance As a condition of membership, which is

and staff would need to maintain

rates remaining very low. Total 19,268,396

resiliency through the challenges to come.

required to use the services of the Credit Staff education continued to be a key

The Credit Union’s total assets The Bank of Canada rate remained

area of focus as staff completed various Portfolio Investments

Union, each member is required to hold a unchanged in 2019, however both deposit

increased to $146,352,155 in 2019, courses and topic-specific training in Commercial Bonds 31,371,266

up from $141,892,358 — or 3.04% certain amount of membership shares. and lending rates declined slightly.

addition to their required compliance

— from 2018. This increase is also an OCU paid out $36,581 in dividends on That resulted in a lot of uncertainty in courses. Accrued Interest 172,401

improvement from 2017, when assets Members’ shares. the market with forecasts of a possible

The movement towards having an Total 31,543,667

totalled $144,822,045 at year’s end. recession, in the near future.

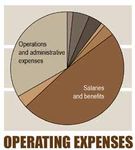

Operating Expenses Account Manager assigned to individual

Deposit growth proved to be rather Equity Instruments

Cash Position members has required staff to fill their

The Credit Union’s operating expenses challenging in a low-interest rate knowledge gaps in areas where they were

The Credit Union’s cash position environment, a situation we overcame by Central 1 Shares (Class A) 51,146

declined in 2019, falling to $5,245,911 in 2019 increased about $335,000 from less familiar.

2018. introducing a new investment option for We came into 2020 with a team of well- Central 1 Shares (Class E) 35

from $7,795,913 the previous year.

our members by providing access to Index educated, knowledgeable and caring staff Central 1 Shares (Class F) 528,923

Cash is defined as cash on hand, The largest increases were in operating Linked Term Deposits.

deposits with Central 1 Credit Union Ltd. and Administrative Expense (up $223,517) that take pride in their work and in the Stabilization Credit Union Shares 141

The new option gives members the relationships that they are building with

and balances held within investment and Employee Salaries and Benefits (up CUPP Services Ltd.

option of investing in the market while their members. 43,194

portfolios. $149,813). guaranteeing their principal investment. Cross training efforts with our teller Truvera Mortgage Investment 1,600,000

Member Loans In 2019, a substantial amount of time team were very successful with tellers

Net Income and effort was invested in growing the

West Boundary Community Services 1,000

Outstanding member loans increased now being able to perform many more

in 2019, with commercial and residential Net income for 2019 totaled $261,261, skills of our lenders and the results speak tasks on the front line to assist our Total 2,224,439

mortgages and commercial and consumer down from $323,003 in 2018. for themselves: it was a very successful members.

74

Number of Years

4,128

Number of Members

$135.1m

Member Deposits

$185,457

Amount Paid in Patronage

$146.5m

Osoyoos Credit Union

$261,261 Net Income

OCU has operated in Osoyoos in 2019 in 2019 and Dividends in 2019 Assets in 2019 in 2019

—6— —7—OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT 2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

Auditor’s Report Financial Position

To the Members of the Credit Union’s ability to continue as a and related disclosures made by

Osoyoos Credit Union

W

going concern, disclosing, as applicable, management.

Osoyoos Credit Union:

E HAVE AUDITED the

matters related to going concern nd using

the going concern basis of accounting unless

• Conclude on the appropriateness

of management’s use of the going Consolidated Statement of Financial Position

management either intends to liquidate the concern basis of accounting and,

financial statements of

Credit Union or to cease operations, or has based on the audit evidence obtained, As of December 31, 2019, with comparative information for 2018

Osoyoos Credit Union (the

“Credit Union”), which no realistic alternative but to do so. whether a material uncertainty exists

comprise the statement Those charged with governance are related to events or conditions that 2019 2018

of financial position as at December 31, responsible for overseeing the Credit may cast significant doubt on the Osoyoos Credit Union is

2019, and the statements of comprehensive Union’s financial reporting process. Credit Union’s ability to continue Assets incorporated under the Credit Union

income, changes in members’ equity and as a going concern. If we conclude Cash 5,245,911 7,795,913

Auditor’s Responsibilities for the that a material uncertainty exists,

Incorporation Act of British Columbia

cash flows for the year then ended, and Investments (Note 5) 53,071,502 56,679,940 and is a member of Central 1 Credit

Audit of the Financial Statements we are required to draw attention

notes to the financial statements, including Members’ loans receivable (Note 16) 84,869,589 73,891,006 Union Limited.

in our auditor’s report to the

a summary of significant accounting policies. Our objectives are to obtain reasonable Income taxes recoverable (Note 6) 9,606 -

related disclosures in the financial The Credit Union operates as

In our opinion, the accompanying assurance about whether the financial statements or, if such disclosures are Advances to related party 70,000 -

financial statements present fairly, in all statements as a whole are free from Property, plant and equipment (Note 7) 2,585,381 2,714,625

one operating segment in the

inadequate, to modify our opinion. loans and deposit taking industry

material respects, the financial position of material misstatement, whether due to Our conclusions are based on the audit Intangible assets (Note 8) 120,115 177,973

the Credit Union as at December 31, 2019, fraud or error, and to issue an auditor’s evidence obtained up to the date of Other assets (Note 9) 136.405 202,280 in British Columbia. Products and

and its financial performance and its cash report that includes our opinion. Reasonable our auditor’s report. However, future Investment property (Note 10) 423,646 430,621 services offered to its members

flows for the year then ended in accordance assurance is a high level of assurance, but events or conditions may cause the include deposit products,

with International Financial Reporting is not a guarantee that an audit conducted Credit Union to cease to continue as a 146,532,155 141,892,358

Standards. loan products and registered

in accordance with Canadian generally going concern.

accepted auditing standards will always Liabilities investment products.

Basis for Opinion • Evaluate the overall presentation,

detect a material misstatement when it structure and content of the financial

Member deposits (Note 12) 135,057,076 130,654,117 The consolidated financial

We conducted our audit in accordance exists. Misstatements can arise from fraud statements, including the disclosures, Income taxes payable (Note 6) - 50,007 statements of the Credit Union as

with Canadian generally accepted auditing or error and are considered material if, and whether the financial statements Other liabilities 508,285 329,990 at and for the year ended Dec. 31,

standards. Our responsibilities under those individually or in the aggregate, they could represent the underlying transactions Derivative financial instruments (Note 11) 32,350 -

standards are further described in the

2019, comprise the Credit Union

reasonably be expected to influence the and events in a manner that achieves Deferred tax liabilities (Note 6) 76,258 55,977

Auditor’s Responsibilities for the Audit of economic decisions of users taken on the and its wholly owned subsidiary

fair presentation. Patronage dividends payable (Note 13) 106,135 187,017

the Financial Statements section of our basis of these financial statements. We communicate with those charged Member shares (Note 13) 1,238,516 1,346,591 OCU Wealth Management Services

report. We are independent of the Credit As part of an audit in accordance with with governance regarding, among other Ltd. Together, these entities are

Union in accordance with the ethical Canadian generally accepted auditing matters, the planned scope and timing of 137,018,620 132,623,699 referred to as the Credit Union.

requirements that are relevant to our audit standards, we exercise professional the audit and significant audit findings,

of the financial statements in Canada, Commitments (Note 17) The Credit Union adopted

judgment and maintain professional including any significant deficiencies in

and we have fulfilled our other ethical skepticism throughout the audit. We also: amendments to the following

internal control that we identify during

responsibilities in accordance with these • Identify and assess the risks of material our audit. Members’ equity

standards, effective Jan. 1, 2017.

requirements. We believe that the audit misstatement of the financial statements, Member shares (Note 13) 224,743 238,277 Adoption of these amendments

evidence we have obtained is sufficient whether due to fraud or error, design had no effect on the Credit Union’s

and appropriate to provide a basis for our Retained earnings 9,288,792 9,030,382

and perform audit procedures responsive consolidated financial statements.

opinion. to those risks, and obtain audit evidence 9,513,535 9,268,659

that is sufficient and appropriate to

• IFRS 10 Consolidated financial

Responsibilities of Management provide a basis for our opinion. The risk Chartered Professional Accountants 146,532,155 141,892,358 statements;

and Those Charged with of not detecting a material misstatement March 4, 2020 • IFRS 11 Joint arrangements;

Governance for the Financial resulting from fraud is higher than for • IFRS 12 Disclosure of interests

one resulting from error, as fraud may Approved on behalf of the board in other entities;

Statements involve collusion, forgery, intentional

Management is responsible for the omissions, misrepresentations, or the • IAS 1 Presentation of financial

preparation and fair presentation of override of internal control. statements;

the financial statements in accordance • Obtain an understanding of internal • IAS 16 Property, plant and

with International Financial Reporting control relevant to the audit in order equipment;

Standards, and for such internal control to design audit procedures that are

as management determines is necessary appropriate in the circumstances, but not • IAS 27 Separate financial

to enable the preparation of financial for the purpose of expressing an opinion Pat Wycherley Thomas Martin statements;

statements that are free from material on the effectiveness of the Credit Union’s Director Director • IAS 38 Intangible assets.

misstatement, whether due to fraud or internal control.

error. • Evaluate the appropriateness of

In preparing the financial statements, accounting policies used and the

management is responsible for assessing reasonableness of accounting estimates

—8— —9—OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT 2019 ANNUAL GENERAL REPORT OSOYOOS CREDIT UNION

Financial Position Financial Position

Statement of Comprehensive Income Statement of Cash Flows

For the year ended December 31, 2019 For the year ended December 31, 2019

2019 2018

2019 2018

Cash provided by (used for) the following activities

Interest revenue Operating activities

Interest on member loans 3,078,911 2,856,280 Interest received from members’ loans 3,118,972 2,627,746

Interest on investments and deposits 1,812,203 1,599,828 Interest and dividends received from investments 1,868,028 1,791,908

Fees, commissions and miscellaneous income received 404,512 373,167

4,891,114 4,456,108 Cash paid to suppliers and employees (2,709,483) (2,404,062)

Interest paid on deposits (1,294,417) (1,236,035)

Interest expense

Patronage and dividends paid (185,457) (168,124)

Interest on member deposits 1,691,288 1,547,711 Income taxes recovered (paid) (126,107) 27,650

Net interest income 3,199,826 2,908,397 1,076,048 1,012,250

Impairment losses on member loans (Note 16) 4,319 22,983 Financing activities

Financial margin 3,195,507 2,885,414 Net change in member deposits 4,180,141 (3,630,410)

Capital Management Other income 461,215 416,016

Net change in member shares (121,610) (109,979) Credit facilities

In managing its capital, the Credit 4,058,531 (3,740,389) The Credit Union has available

Union’s primary objective is to ensure 3,656,722 3,301,430 to it, through Central 1, a $750,000

it maintains adequate liquidity to Investing activities CAD and $250,000 USD demand

Operating expenses Net change in members’ loans receivable (11,018,644) 2,006,368 operating line of credit secured by a

meet its financial obligations, make

Amortization of intangible assets (Note 8) 61,740 67,236 Advances to related party (70,000) - demand debenture and the general

necessary capital purchases and

Deposit insurance 149,759 114,030 Purchases of investments - (127,886) assignment of book debts.

support ongoing business. Proceeds on disposal of investments 3,430,032 -

The Credit Union monitors and Depreciation of property, plant and equipment (Notes 7 and 10) 123,474 115,754 The outstanding balance at

Purchases of property, plant and equipment (20,969) (119,802) December 31, 2019 was nil.

assesses its financial performance Director and committee expense 41,700 27,175 Purchases of intangible assets (5,000) (17,520)

to ensure it is meeting its objectives. Distribution to members (Note 13) 103,284 182,875

(7,684,581) 1,741,160 The Credit Union had the following

The Financial Institutions Act Employee salaries and benefits 1,568,730 1,418,917 member deposits at end of year:

(British Columbia) requires the Occupancy and equipment 114,023 124,588 Decrease in cash resources (2,550,002) (986,979)

Credit Union to maintain, at all Cash resources, beginning of year 7,795,913 8,782,892 Demand Deposits

Operating and administrative expense (Note 14) 1,079,451 855,934 2019 2018

times, a capital base which is

Cash resources, end of year 5,245,911 7,795,913

adequate in relation to the business 3,242,161 2,906,509 63,187,622 65,513,793

carried on. Term Deposits

The level of capital required is

based on a prescribed percentage

Operating income

Other expense

414,561 394,921

Statement of Changes in Members’ Equity 2019 2018

47,207,546 42,382,348

of the total value of risk weighted Loss on disposal of property, plant and equipment - (48,832) For the year ended December 31, 2019

Registered Plans

assets, each asset of the Credit Loss arising from decrease in fair value of derivative financial instrument (32,350) - Accumulated

Union being assigned a risk factor

other

Member Retained comprehensive

2019 2018

Impairment loss on property, plant and equipment and intangible assets (34,175) -

based on the probability that a loss shares earnings loss Total equity 23,878,938 22,197,160

may be incurred on the ultimate Income before income taxes 348,036 346,089 Dormant Accounts

Balance December 31, 2017 207,740 8,554,661 (311,115) 8,451,286

realization of that asset. 2019 2018

Provision for (recovery of) income taxes (Note 6) Comprehensive income - 323,003 - 323,003

The Credit Union considers its Distribution to members - (4,142) - (4,142) 29,851 28,515

capital to include membership Current 66,494 67,347

Net issuance of member shares 30,537 - - 30,537 Non-equity Shares

shares (member shares and Deferred 20,281 (44,261)

Impact of initial application of IFRS 9 - 156,860 311,115 467,975 2019 2018

investment shares), and undivided 86,775 23,086 32,524 34,524

earnings. Balance December 31, 2018 238,277 9,030,382 - 9,268,659

Comprehensive income - 261,261 - 261,261 Accrued Interest

There have been no changes in Net income 261,261 323,003

what the Credit Union considers to Distribution to members - (2,851) - (2,851) 2019 2018

Other comprehensive income for the year - -

be capital since the previous period. Net issuance of member shares (13,534) - - (13,534) 720,595 497,777

Total comprehensive income for the year 261,261 323,003

Balance December 31, 2019 224,743 9,288,792 - 9,513,535

— 10 — — 11 —OSOYOOS CREDIT UNION 2019 ANNUAL GENERAL REPORT

Highlighting OCU’s team

2019 proved yet again community activities

• In May, some of our staff participated in

‘together we’re better’

the Hike for Hospice to support Desert

Valley Hospice.

• In June, we rounded up 30 riders to

participate in the Big Bike Ride for Heart

O

and Stroke Foundation. Collectively, we

raised more than $2,200.

• In July, we sponsored a Hole in One

SOYOOS CREDIT UNION community can make such a difference Prize at the Osoyoos Rotary Golf

STAFF are proud to be a part and we are proud to do so. Tournament. We also handed out

of an amazing community. freshly popped popcorn and gave

We work among the Our Staff Volunteer Program everyone a chance to win a wine basket

friendliest, most considerate We took community support to the next with two bottles from Adega on 45th

level and implemented a Staff Volunteer Estate Winery!

and generous people.

Program in 2019. • In August, we organized a barbecue

With fresh fruits brought in to us during Fundraiser for one of our own staff

the summer, wine throughout the year Staff were encouraged to volunteer member, Russell Comerford, who was

and baked goods brought in from across in our community and schedule time raising money for the Ride to Conquer

the border, we are truly blessed to be off from work or take time off in lieu if a Cancer in honour of his mother. We

thought of and appreciated so often. volunteer opportunity was on a day off to raised $1,800 in five hours thanks to

a maximum of seven hours over the year. our hungry supporters! Russell rode

Our members think so much of us and 200 km in two days — and came to

every day we think so much of them — Our OCU team was able to share their work the following Tuesday.

and the community in which we live and knowledge, skills and time with the • We spent August 1 at Area 27 Racetrack

work. following organizations: to support and bring awareness to

Community is one of the four core • Desert Valley Hospice Society-Hike ONSN Child & Youth Development

values that we strive to live by at work for Hospice; Center.

with the people we help and at home • In September at the Rock Creek Fair, we

• Heart & Stroke Foundation-Big Bike participated as a sponsor and had our

with our family and friends every day. Ride; event tent set up to highlight our new

We want to thank everyone in our • Osoyoos Secondary School Drama location at the Riverside Centre in Rock

community for supporting their credit Club; Creek.

union with personal and business banking • In mid October our Board of Directors

needs. That allowed us in turn to support • South Okanagan Association for hosted a barbecue for our community

our community with our Community Integrated Community Living; to celebrate our International Credit

Giving Fund, Staff Volunteer Program and • Osoyoos Secondary School Union Day and the impact the credit

unions have to the community.

complimentary use of our OCU Event Breakfast Club;

• Later in October, we celebrated our

Trailer. • Osoyoos Elementary School Junior sixth annual Trick or Treat Main Street

Together, we’re better! Curling; with our Toy Story Theme. We captured

more than 175 moments for about 200

Community Giving Fund • Osoyoos & District Arts Council; children and parents-dressed up for the

In 2019, we decided that we wanted • Osoyoos Rotary Club; event! Everyone received a copy for

to meet the community members who • Ride to Conquer Cancer-BBQ their memory book.

• In November, to celebrate our

make Osoyoos and our nearby districts so Fundraiser and Oliver Twist Car Customer Appreciation Day, our staff

great — from Rock Creek to the east and Show Fundraiser; and rolled up our sleeves and baked goodies

Princeton to the west. • Junior Achievements BC-Financial for our members to enjoy with their

We decided as a team that we Literacy Programs presented to coffee and hot chocolate before the

wanted to meet the people who make Osoyoos Secondary School, Osoyoos Christmas Light Up show on Main St.

a difference in our community when Elementary School, Greenwood • In late December, we sponsored the

they are the successful recipients of our last hockey game of the year for the

Elementary and Midway-Boundary Osoyoos Coyotes! We brought bam-

Community Giving Fund. Secondary School. bam sticks to give away, threw in $150

We wanted to learn more about their in loonies during the Loonie Scramble

purpose and the impact they make in our Our OCU Event trailer and provided the fans a chance to win

community. With the complimentary rental the prize at Toss a Puck onto the ice.

We all took turns to go out to the And to top off the event, everyone

equipment including a barbecue, two full attending had a chance to win a New

organizations and meet their volunteers propane tanks, popcorn machine, three Year Celebration basket loaded with

and presented their gift from our tables and tent, our OCU Event Trailer goodies!

Community Giving Fund. was out in the community to help with 17

A collective $50,000 we give back to our events in 2019.

— 12 —You can also read