Federal Reserve and US Mint Take Action to Address Coin Shortages - ARTAZN

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

VOLUME 18 – NO 7 / JULY 2020

Federal Reserve and Taking

US Mint Take Action to Down the

Counterfeiters

Address Coin Shortages Law enforcement authorities from

Consequently, retailers have been forced Italy, Belgium and France, supported

to limit or even refuse to give out change. by Europol, have dismantled an

Kroger Co, a supermarket chain with nearly organised crime network involved

3,000 stores, is one example, temporarily in euro counterfeiting, arresting 44

refusing to give coins out as change. suspects and freezing assets worth

Customers can either round up their bills €8 million in Italy. It is understood

to the nearest dollar and give the excess to be the largest euro counterfeiting

charity or get their change stored on loyalty network to be disrupted in the history

cards. Retailers around the country are of the euro.

taking similar measures, putting up posters The criminal network is believed to have

asking customers for exact change or produced and distributed more than 3

payment by card. million counterfeit banknotes with a total

The Fed is responsible for coin distribution face value of over €233 million over the

and one of its first actions in June, when years, which represent one quarter of

Nowhere is the mismatch between the problem became apparent, was to all counterfeit euro banknotes detected

public and media perceptions that implement quotas based on historic in circulation since the introduction of

COVID-19 is hastening the demise of order volumes by denomination and the the currency.

cash on the one hand, and yet evidence depository institution endpoint to protect According to Europol, the mastermind

that demand is surging in many its coin inventories. As a result, banks and behind the criminal organisation has

countries on the other, more apparent other distributors of coins have received been involved in currency counterfeiting

than in the US, which has had to take less than what they ordered or even less for more than 20 years. He had not

action to remedy a shortage of coins than their usual allotments. only established the whole network in

describe by the Federal Reserve as a charge of the production of counterfeit

Another action is that the United States

‘significant issue’. euros and other currencies, but also

Mint has upped coin production. Circulating

The Chairman of the Federal Reserve, coin production has decreased in recent organised their dissemination on the

Jerome Powell, told the House Financial years, down from 16 billion in 2016 to 11.9 European market.

Committee in Congress that ‘with the partial billion in 2019. And because of COVID-19

closure of the economy, the flow of coins restrictions for Mint workers, the first half of

through the economy has gotten… It’s kind this year has been particularly slow. In the

of stopped.’ second half, however, the US Mint expects

In April 2020 there were $47.8 billion worth to produce up to 1.6 billion coins per

of coins in circulation in the US, up from month for the rest of the year, adding up to

$47.4 billion a year earlier, showing that this projected total of 14.2 billion coins for 2020.

issue is not a shortage of coins themselves, The Mint has also issued a statement to

but their circulation. With banks and shops the public, asking for its help in paying at

closed, people have not been paying with shops with exact change and returning

cash, whilst the Fed’s system of producing spare change to circulation by depositing it

and distributing coins has been disrupted, at banks.

meaning that banks have been holding

Continued on page 6 >

fewer coins. Continued on page 16 >

www.currency-news.comWhat is the Future for Cash?

There can be no doubt that the future For cash

for cash will be different from what it There are, however, also reasons why the

would have been had the world not use of cash may stabilise or even increase:

experienced COVID-19. 1. During the pandemic, and even if a

We consider the implications at a time vaccine is developed in the next six

when there is still so much that is not months, there is going to be a recession

known about the virus, or stated another and high unemployment, even in those

way, there is still much to learn. countries with the highest GDP. Cash

That aside, it is possible that the effects has been proven to be the best way to

of the pandemic will reduce the usage of manage household and other personal

Inside this Issue cash even after it itself is (we hope) a distant

memory. The evidence for this, as noted our

budgets in a crisis, and many will adopt it

out of necessity.

1 Federal Reserve and supplement ‘Protecting Cash, Safeguarding 2.It is probable that cash will be shown

US Mint Take Action to the Public Against COVID-19 – Part 3’, is either not to be a hygiene risk for

Address Coin Shortages as follows. COVID-19 or to offer less risk than the

Against cash use of plastic cards.

1 Taking Down the 3. The current focus globally is defending

1. Cash use fell in lockdowns because

Counterfeiters and improving the rights of minority

even habitual cash users were forced in

2 What is the Future for some cases to adopt alternative payment groups, the socially deprived and those

on low incomes. A large number of

Cash? methods – they may not return to the

same level of cash usage. For example, these people use cash for their daily

3 Year of Growth and people have had to shop online for basics transactions – governments will not wish

Innnovation for Bank such as food to be delivered or collected, to institute policies against them.

Indonesia and for items normally available in shops 4.A high percentage of commerce takes

selling non-essential items that have place in informal markets in under-

3 Busy Year for not been allowed to open. Payments in developed and developing countries.

Central Bank of Turkey virtually all cases have been digital. It is Cash is essential in these circumstances

3 Bank of Botswana expected that many people will continue – as they recover and grow, so will cash

Prepares for the Future to shop like this, even after shopping (until digital becomes more acceptable).

returns to normal.

Likely scenarios

4 News in Brief 2.Hygiene – the perception that cash could Taking these factors into account, there are

5 New Notes and cause contamination has led people and a considerable number of logical scenarios

organisations to direct payment to cards

Tenders in the Region regarding the future of cash. The most

and mobile phones. It will be a major likely are:

5 Argentina Runs out of task to reverse this perception and new

Cash will remain as a widely used form of

Capacity behaviour.

payment, not least because the poorest

3. Contactless payments substituting for

5 CMB Moves Forward as cash may have formed new habits.

people in rich countries, and most people

Strategic Company Contactless card limits being increased

in poorer countries currently depend on

cash. This is unlikely to change in the near

6 People in the News by c. 50% will remain, increasing the future, so cash will remain in use globally,

opportunity and inclination to pay with but especially in low GDP countries, as a

7 Cash and COVID-19 – them. major form of payment for at least 10-15

Expert Views from the 4.Access to cash will be reduced as bank years.

Frontline (Part 3) branches and ATMs decline in number. It may decline globally afterwards but it

10 Making the Change – 5. The correlation between cash is too soon to predict the rate of decline,

Artazn Gears up for Coins transactions and GDP is high. The not least because it will vary from country

of the Future economic impact of the pandemic is likely to country and the impact of digital

to reduce GDP. currencies, including those of central

12 Not All Plastic is Bad – Just 6.Contactless/digital payments will banks, is too soon to predict.

Ask the Issuers of Polymer continue to be highly promoted for both Digital payments will continue to increase

Banknotes convenience and safety from infection. their market share. Cash will continue

13 Security Shouldn’t be 7. As cash usage declines the cost of to decline as a form of payment. It will

decline to as low as 10% of transactions

Breezed Over providing cash will increase – access to

cash will decline forcing a move to other in the most developed countries within 10

14 Oman’s new 50 Rial – forms of payment. years, but will continue to be the prime

Celebration Matched to 8.Legislation may be required to ensure

form of payment in the least developed

Innovation cash remains available, but government

countries for at least 15 years.

Governments may have to subsidise or

15 Note and Coin News funding may also be required.

fund the use of cash where its use has

declined below commercially viable levels.

2 CURRENCY NEWS | COMMENTYear of Growth and Innovation for Bank of

Bank Indonesia Botswana

According to Bank Indonesia's recently- Cash in circulation increased by 51%, from Prepares for the

Future

released Annual Report, its new Command Rp 2 22,769,920 million to Rp 335,745,187

Centre for Rupiah Currency Management million during the year. Perum Peruri

became operational in 2019 and delivered 11,558 million banknotes and 999

successfully co-ordinated cash services million coins. Bank Indonesia spend 45% The Bank of Botswana’s 2019 annual

when an earthquake struck Palu, NTB, and more on currency planning, procurement report looks to the future of payments in

when there were floods in Java Island on and printing compared with 2018, Rp two main areas in addition to reporting on

1 January 2020. Christmas 2019 also saw 4,483,509 million. cash in circulation (CIC).

the annual issue of banknotes increase by The Bank conducts two surveys each Banknote and coin usage continues to

14.9% compared with the previous year, year of households and traders/MSMEs grow strongly. In 2019 banknote volumes

reaching Rp 112.5 trillion. across 82 cities/regencies and five areas increased by 18% and coins by 6%. The

Again, the Command Centre played its role of the Bank’s cash custodians. 2019 saw P200 remains the largest circulation note

in managing this significant increase. survey results that significantly exceeded by volume, representing 31% of issued

targets set for both large and small notes. The volume of P10 notes increased

denomination notes. by 41%, significantly more than any other

denomination. The old series of coins

were demonetised at the end of the year,

resulting in coins in circulation to fall 47.6%

Busy Year for

as old coins were returned.

In January 2019, the Electronic Payment

Central Bank of Turkey Services (EPS) Regulation, statutory

instrument No 2, came into force. This

establishes the legal framework for the

The value and volume of banknotes issued Firstly, the number of Decentralised Cash licencing and oversight of EPS Providers,

by the Central Bank of the Republic of Management Depots (MONY) increased including money and value transfer

Turkey (CBRT) increased by 16% and by 13 to 21. These are in addition to its 21 service operations. It brings mobile money

11.7% respectively in 2019 to a value of TY branches, 16 banknote depots in provinces operations under the jurisdiction of the

153.4 billion and 2.139 billion notes. that don’t have branches, and two cash Bank, an important move given the growth

The average each year over the last five centres. CBRT organised collections of in mobile payments in the region.

years has been a 12.8% increase in value TRY 559.3 billion and payments of TRY

580.4 billion. The Annual Report gave a comprehensive

and an 8.6% increase in volume. Every overview of digital payments and reviewed

denomination saw double digit volume Secondly it established 11 new what is happening with Central Bank

increases apart from the TY 10 and TY 20 Consignment Coin Depots (CCDs) to Digital Currencies (CBDCs) around the

denominations (see charts 1 and 2 below). enhance coin cash management. These world. It laid out the operator, regulator,

The annual average value of banknotes were organised through a protocol with the overseer and catalyst for change functions

in circulation as a percentage of GDP Post and Telegraph Organisation. There are of the Bank across payments, a summary

decreased from 4% in 2009 to 3.4% now 12 in total which handled 36% of the of selected fintech products and their

in 2019. country-based coin transaction volumes. advantages and disadvantages, some of

Banknote printing expenses increased by CBRT has a serial number tracking project the regulatory concerns relevant to fintech

6% to TY 44.4 million due to an increase inwhich developed analytics and dashboards and a detailed summary of the uptake of

the number of notes printed and exchange using sample datasets based on its BPS CBDCs around the world.

rate movements. 2000 high speed sorter data. It has also Although cash will remain a core payment

CBRT re-organised a number of elements continued work on its new series banknote method, this review summarised the

of its cash management system during design project. CBRT has a virtual museum situation and the Bank’s role in managing

the year. for banknotes, including production the changing payment environment.

processes, and this was renewed during

Chart

Chart

1: Value

1: Value

andand

Number

Numberof Banknotes

of Banknotes

in in Chart

Chart

2: Number

2: Number

of Banknotes

of Banknotes in Circulation

in Circulation

by by

the year.

Circulation

Circulation Denomination (Million

Denomination (Million

Banknotes)

Banknotes)

ValueValue

of Banknotes

of Banknotes

in Circulation

in Circulation

(TRY(TRY

Billion)

Billion) (left axis)

(left axis) 200 200

TL TL 100 100

TL TL 50 TL

50 TL

Number

Number of Banknotes

of Banknotes in Circulation

in Circulation (Million)

(Million) (right(right

axis)axis) 20 TL

20 TL 10 TL

10 TL 5 TL5 TL

180 180 2,4002,400 900 900

160 160 2,2002,200 800 800

140 140 2,0002,000 700 700

120 120 600 600

1,8001,800

100 100 500 500

1,6001,600

80 80 400 400

1,4001,400

60 60 300 300

40 40 1,2001,200 200 200

20 20 1,0001,000 100 100

0 0 800 800 0 0

2010

2010

2011

2011

2012

2012

2013

2013

2014

2014

2015

2015

2016

2016

2017

2017

2018

2018

2019

2019

2009

2009

2010

2010

2011

2011

2012

2012

2013

2013

2014

2014

2015

2015

2016

2016

2017

2017

2018

2018

2019

2019

Chart 1: Value and number of banknotes in circulation (Source: CBRT). Chart 2: Number of banknotes in circulation by denomination (million banknotes)

Source:

Source:

CBRTCBRT Source:

Source:

CBRT

CBRT

(Source: CBRT).

CENTRAL BANK NEWS | VOLUME 18 – NO 7 | JULY 2020 3News in Brief

Bulgaria and Croatia Enter Goebel Breaks Ground on The senior secured noteholders will take

Euro Waiting Room New Production Hall full control of Travelex, the company said.

The restructuring came after the company

Bulgaria and Croatia have been accepted Goebel Capital, manufacturer of high failed to secure a buyer, having put itself

into the ERM-2 mechanism, a mandatory security printing presses, recently held a up for sale after its parent Finablr was

stage and so-called ‘waiting room’ for ground-breaking ceremony for the new brought to the brink of insolvency by an

joining the euro, heralding the currency production hall it is building in Eschenbach apparent fraud.

bloc's first expansion in a half decade. in Switzerland, attended by representatives

from local politics and business. The deal will see the company divided into

The two eastern European nations must two parts. New Travelex will include the

spend at least two years in ERM-2 and The company’s technology is based on wholesale and outsourcing business, as

fulfil a number of further criteria relating to web-fed printing. According to Managing well as some international retail businesses.

economic policy and convergence before Director Manuel Vogel, sheet-fed printing Warehouse Travelex will comprise of some

starting the practical preparations to join the is far less efficient and takes much longer of the company’s retail businesses in UK,

euro, a process that takes roughly another than Goebel’s technology. In addition, Europe and North America.

year, making 2023 the earliest year for he claims, the Goebel Capital machines

their membership. are more suitable for the production of The company’s revenue fell 36% to £112

polymer banknotes. million in the first quarter of 2020, mainly

The decision ‘represents an important due to a cyber attack at the start of the year

milestone in Bulgaria and Croatia’s efforts Goebel Capital is headquartered in Baar which forced it to take all its systems offline

to join the euro area’, the European in Switzerland with a production and for several weeks. Subsequently it has been

Commission said. service facility in Darmstadt in Germany. badly hit by the impact of COVID-19 on

Both countries will sit on the ECB’s Production at the new facility is due to global travel and forex demand, particularly

Supervisory Board from October with full start in September. In addition to banknote at international airports where it has a

voting rights. presses, the company also manufactures strong presence.

web presses for visas and stamps. The first

As part of ERM-2, the ECB has set the

central rate of the Bulgarian lev at 1.95583

machine to be produced at the new site is G4S Lays off Quarter of

against the euro and the Croatian kuna’s

for the Chinese post office.

Cash Workforce in UK

central rate at 7.53450.

Sound of Intaglio Now G4S is planning to make as many as 1,150

The last EU member to adopt the euro was

Lithuania, in 2015. Bulgaria joined the EU

Available at POS workers in its UK and Ireland operations

redundant as it scales back its struggling

in 2007 and Croatia in 2013. When they Sound of Intaglio® – the authentication cash handling business, with the job losses

adopt the euro, the number of eurozone technology that uses image processing to representing more than a quarter of its

countries will rise to 21. validate authentication banknotes that, to 4,000-strong workforce in cash solutions.

date, has been used exclusively for forensic

The overall business had revenues of £1.1

New Currency Centre for intelligence and examination – is now also

billion in 2019, before the sale of part of the

Algeria? available for banknote authentication at the

point of sale (POS). operation to Brink’s in February. However, in

In the recent ceremony to launch Algeria’s March, shortly before the UK’s coronavirus

The technology allows detection of genuine lockdown, the UK cash business reported a

new 2,000 dinar note and 200 dinar coin

intaglio print through the analysis of 2D loss of £91 million for 2019.

(see page 15), the country’s Minister for

images using state-of-the-art wavelet

Finance, Aymen Benabderrahmane, is It has been struggling amid a decline in

transform (see CN August 2019). It

reported to have referred to the granting cash transactions in the UK as people

has been integrated into the Document

of land intended for the realisation of a increasingly switch to card payments in

Analysis and Classification System (DACS),

modern industrial centre to include a new stores and online. The decline in cash

a stand-alone laboratory device for

printing facility, a national sorting centre for usage during the coronavirus outbreak

analysis, description and classification of

banknotes and an educational and training has added further to the pressures on

banknote counterfeits.

institute for banknote production. the company.

Sound of Intaglio is a joint development

Algeria’s state-owned printworks, Hotel des

Monnaies, is the only banknote production

between KBA-NotaSys and the Institute DLR Raises Funds for

facility in the world to use web technology.

Industrial IT of Technische Hochschule

Ostwestfalen-Lippe, and is being

Turnaround

Its current banknote production line, which De La Rue has successfully raised £100

commercialised through Coverno, a joint

can produce up to 1.7 billion notes a year, million through the issuing of almost 91

venture between the two companies.

was supplied by Goebel and installed million shares, sold at £1.10 each, meeting

in 2004.

Lifeline for Struggling its target for the fundraising first announced

It is understood that a greenfield site for

the new premises has been purchased,

Travelex last month.

The troubled foreign exchange provider According to CEO Clive Vacher, the equity

but that any progress has been put on raise will provide the company with the

hold pending the appointment of a new Travelex has been thrown a lifeline after an

announcement that its debt holders will financial and operational flexibility to ensure

governor. Benabderahmane Ayman was the success of its Turnaround Plan. ‘With

appointed governor last year, but lasted inject £84 million pounds of fresh liquidity

as part of a debt restructuring to help this capital, we will be able to strengthen

less than six months before moving to the our balance sheet, reduce our costs and

post of Finance Minister. the currency service provider ride out the

coronavirus crisis. invest in the exciting growth opportunities

we see in authentication, polymer banknote

production and security features. I firmly

believe this will drive improved returns

and create long-term value for our

shareholders,’ he said.

4 CURRENCY NEWS | NEWS IN BRIEFNew Notes and Argentina

Tenders in the Region Runs out of

The Central Bank of the Bahamas has

Capacity

announced the results of its tender According to local reports, the

for the reprinting of the Bahamas $10, Argentinean government is having

which was awarded to Crane Currency to import banknotes for the first

– making it its first banknote printing time in five years, as the domestic

contract with the central bank. supplier (Casa de Moneda

While the award is for a reprint, the $10 Argentina, or CAMOAR) can’t keep

The Bahamian $50, printed on Durasafe and

will undergo an upgrade in security with incorporating MOTION RAPID thread.

pace with soaring demand due to

the addition of a RAPID® Detect 4mm a combination of the pandemic

micro-optic security thread and a revamped Guatemala and Costa Rica and inflation, currently running at

colour scheme. According to Crane, this over 40%.

In Central America, meanwhile, the Bank

follows the Bank’s evaluation and positive of Guatemala has recently tendered The nominal value of bills and coins in

public response to the RAPID security for all its denominations in preparation circulation jumped 80% this month,

thread used in the new Bahamas $50 for the increased demand expected and the number of notes issued has

banknote issued in October 2019 (which due to COVID-19. The winners were increased by 30%. CAMOAR, which

was the first such thread to be integrated Giesecke+Devrient, Oberthur Fiduciaire and has two printing facilities, is currently

into Landqart’s Durasafe® substrate). Orell Füssli. operating at full capacity. It already has

The current series of Bahamas banknotes supply agreements with the printworks

And in Costa Rica, the central bank has

is known as CRISP Evolution (CRISP being of Chile and Brazil, but both options are

unveiled details of the new 2,000, 5,000

the acronym for Counterfeit-Resistant considered too expensive and hence it

and 20,000 colones notes, which are being

Integrated Security Product) that began with is holding an international tender for 250

printed on Guardian® by Oberthur Fiduciaire

the new $10 in 2016. The final banknote million 500 peso notes.

and which will shortly go into circulation.

in the series, the Bahamas $100 (the The problems of capacity have been

The country is in the process of converting

country’s highest denomination) is reported compounded by the shelving of a new

all its notes to polymer, and, whilst the new

to be in an advanced stage of design and high denomination 5,000 peso note

notes will maintain the colour, characters

is expected upon issue in 2021 to contain due to controversy over one of the

and size of the current paper notes, there

a micro-optic MOTION SURFACE® stripe, personalities portrayed in the design,

will be some changes to the design, notably

also applied to Durasafe in another first for with the government focusing instead

in the form of a window with a holographic

a feature-substrate pairing. on issuing more 200, 500 and 1,000

element, along with a SPARK® Live feature.

peso notes. If the 5,000 peso had been

The Bank has also announced that, issued, according to reports, CAMOAR

following a tender issued earlier this year would have been able to easily supply

for 25 million 1,000 and 65 million 10,000 the country with enough banknotes.

colones notes, the contract has been

awarded to Orell Füssli.

CMB Moves Forward as Strategic Company

As reported in the last issue of Currency In its 2019 annual report, CMB announced This result reflects the progress CMB has

News, the future of the Casa da Moeda a 39% increase in gross profit to R$469 made to become more efficient and win

Brasil (CMB) is clearer as the President million. 2019 saw record passport new business. The annual report said that

removes it from the privatisation list. Its production, 2.99 million units, and strong CMB is investing in a new technology

operational performance in 2019 showed growth in banknote and coin volumes. arm, recognising the continued move to

significant improvement, although CMB’s President told a local newspaper digital documents, and continues to seek

remaining in loss, but with a clear last year that CMB would make a loss of export markets.

strategic direction. R$200 million in 2019. In fact, the loss was In a related development, and a further

In November 2019 a Provisional Measure significantly less, just under R$90 million. boost to CMB, the Central Bank of Brazil

(MP) for the privatisation was announced In 2016 CMB lost a major revenue source, has announced that it will issue a new

in Brazil’s Congress. The MP sought the Brazilian national cold beverage tax high denomination R$200 later this year.

to revoke the CMB’s exclusive right to stamp system (SICOBE), and it has not yet Some 450 million of the new notes are to

produce banknotes, coins and passports. returned to profit overall as a result. be printed.

It expired in April and, according to the

constitution, cannot be renewed during Volumes (millions) Coins Banknotes Passports

the next legislative year. In May, President

2014 400 1028 2.27

Jair Bolsonaro announced that he would

be removing CMB from the 15 companies 2015 658 954 2.29

on the government’s privatisation list, 2016 648 1062 2.26

as he considers it to be a strategic

2017 769 1116 2.55

national company.

2018 727 1668 2.88

2019 881 1764 2.99

REGIONAL NEWS | VOLUME 18 – NO 7 | JULY 2020 5Coin Shortages

(Continued)

People in the News

Portugal’s former finance minister, Mário Efthimios Matsoukis –

In this statement, it noted that in 2019 Centeno, is likely to become the country’s Entrepreneur, Security Printer,

it contributed 17% of newly-minted next central bank governor, replacing Role Model

circulating coins to the supply chain, Carlos Costa, who has stepped down after

with the remainder coming from third- serving two five-year terms.

party coin processors and retail activity.

Hence the need for the public to help in

improving the coin supply issue. Malawi’s newly elected President has

dismissed Dalitso Kabambe, Governor of

‘For millions of Americans, cash is

the Reserve Bank of Malawi, and replaced

the only form of payment and cash

him with Wilson Banda, its former General

transactions rely on coins to make

Manager for Economic Services who has

change. We ask that the American

also worked at the World Bank.

public start spending their coins,

depositing them, or exchanging them

for currency at financial institutions or Kyrylo Shevchenko has been appointed

taking them to a coin redemption kiosk. the new Governor of the National Bank Efthimios Matsoukis.

The coin supply problem can be solved of Ukraine. He replaces Yakiv Smolii,

with each of us doing our part,’ it said. who resigned in early July citing political Efthimios Matsoukis, Managing Director

Meanwhile earlier this month, the pressure. of Veridos Matsoukis Security Printing in

Federal Reserve set up the US Coin Athens, passed away on 21 June after a

Task Force – a time-limited, limited- serious illness. He came from a long line

The Governor of Danmarks Nationalbank,

scope convention of industry leaders to of printers, entering the family business

Hugo Frey Jensen, has resigned after 36

‘work together to identify, implement, A Matsoukis in 1972, which had been

years at the Bank. He will depart when his

and promote actions to reduce founded by his grandfather in 1891. Printing

successor has been found.

the consequence and duration of and entrepreneurship were in his blood.

COVID-19 related disruptions to normal In 1969, A Matsoukis began its cooperation

coin circulation’. The Bank of Israel has set up a committee with Giesecke+Devrient, initially working

In addition to the Federal Reserve and to search for a new Director General, after on the new Greek passport and later

US Mint, task force members represent the incumbent, Hezi Kalo, announced his producing passports worldwide,

all major participants in the coin supply plan to step down from the position this becoming one of the few G+D contract

chain, including representatives from September, following 12 years at the Bank. manufacturers. In 2007 the cooperation

armoured carriers, the American was formalised in the joint venture Giesecke

Bankers Association, the Independent The Reserve Bank of New Zealand is & Devrient Matsoukis SA; in 2015, G+D

Community Bankers Association, the setting up a new payments services transferred its shares in the company

National Association of Federal Credit department, which will be led by Steve to Veridos.

Unions, coin aggregator representatives Gordon, currently Head of Currency, ‘We are losing not only a trusted business

and the retail trade industry. Property and Security. Ian Woolford will partner but a friend’, said Andreas

It has already convened and will take over as Head of Money and Cash. Räschmeier, CEO of Veridos. ‘Efthimios

complete a first set of recommendations He has held a variety of roles at the RBNZ Matsoukis combined business sense with

shortly, at which point it will share its over the last three decades, most recently wisdom, entrepreneurship with empathy.

progress and evaluate the benefits of heading the financial policy team in the His leadership was exceptional, and we will

continuing the task force. analysis department. miss him very much’.

In addition, coin industry partners are ‘Two major strategic projects – the Payment Efthimios liked to share his vast knowledge

encouraged to use social media to Systems Replacement, and the Future of and expertise and to move things forward.

promote the circulation of coin, using Cash – have resulted in new responsibilities Consequently, he was active in the Greek

the hashtag #getcoinmoving. and considerable advancements in thinking Printing Federation which he led ‘into

and future direction for physical and Europe’, fostering cooperation with Intergraf

‘The coin circulation issue is national

electronic payments’, Assistant Governor and with fellow security printers in Europe.

in scale. While the task force will be

Christian Hawkesby said. ‘The Future As a member and Chairman of Intergraf’s

focused on identifying actionable

of Cash project is designed to explore Committee of Experts, where he was best

steps that supply chain partners can

and encourage conversations about how known by the banknote community, he

take to address the issue, it is clear

the role of cash is changing. Woolford shaped the Intergraf Conference and led it

that it will take all of our collective

will be responsible for establishing a new from a relatively modest event in 2003 to its

efforts to get coin moving again’, the

policy function, focusing on expanding the present size and importance.

Fed commented.

Future of Cash project and work on digital ‘Efthimios was more than respected, he

currencies, as well as the central bank’s was loved by the community as an elder

existing currency functions.’ statesman’, said Beatrice Klose, Intergraf’s

Secretary General. ‘He loved sharing his

Peter Huber has retired as Mint expertise and experience, and he had

Director of the State Mints of Baden- a great sense of humour. If you needed

Württemberg. He has been succeeded by advice, Efthimios was there for you. He will

Benjamin Hechler. be sorely missed’.

6 CURRENCY NEWS | PEOPLE IN THE NEWSCash and COVID-19 –

Expert Views from the Frontline (Part 3)

In the April issue of Currency News™, we initiated a new feature called Expert Views from the Frontline, in which we asked a

selection of ‘on the ground’ experts, who are dealing with various aspects of cash on a daily basis, about how COVID-19 is

impacting their operations and is likely to impact the future of cash.

That selection represented a cross-section of producers, issues and influencers, which we followed up in May with a further cross-

section, albeit with a more geographically diverse focus, including views from Latin America, Africa and Australia.

This month we continue the theme, with an emphasis on companies and organisations involved in cash handling and management.

Excluding Cash Can Exclude Merchants Will Rethink

Americans and Expect Alternative

Brad Moody, EVP Operations, Lowers & Ways of Dealing with Cash

Associates Vik Devjee, Vice President, CIMA

Q: How important is cash or otherwise in the current situation? Cash Handling America

A: The figures speak for themselves. Q: How important is cash or otherwise in the

Payments and receipts trended together for much of the last 30 current situation

years, from the 1980s through the early 2000s. Cash payments were A: Cash has never been more important in times

consistently slightly higher than other forms of payments, leading of crisis like the one we are currently living. The

to an increase in cash in circulation. In the mid-2000s, the Federal underbanked or unbanked population that depends

Reserve’s payment and receipt volumes diverged, causing the value on cash need to be addressed with even more

of currency in circulation to spike. In 2018, the Fed paid out 2.1 vigor today than before.

million more notes more than it received, for a value of $100 billion Lockdowns, access to banks, etc. pose huge risks

additional currency in circulation. This indicates cash as the preferred on this segment to access cash. As unemployment

method of payments. increases due to business closures and furloughs,

Domestic cash in circulation increased 5.6% over the past 40 years, consumers become more diligent on living within

and the differentiation doubles when comparing to the US currency in their means and budgeting daily. Access to cash

circulation internationally. and its use become critically important in times

The value of currency in circulation per US resident has grown from like this.

$861 in 1978 $1,477 in 2018, using 1993 dollars, almost doubling. Q: What your customers are saying and doing?

Debit card usage still dominates the payments preference averaging A: Our community of partners and retailers tell us

41% of all payments, where cash and credit also maintain a 22% and that certain retail segments are experiencing record

30% payment preference respectfully. Digital/other payments are high revenue levels. Grocery and health related

less than 5% year over year. business are seeing never before growth numbers.

Q: How do you think this will change payments? Cash is certainly being scrutinised at every level

A: The spending habits of the population where cash is used for from handling at point-of-sale to back office

general merchandise, gifts, and food and personal care equate to operations. All retailers are exploring better ways to

64% of all cash usage. The main age demographic for the usage handle and deal with cash.

of cash for amounts under $20 is led by 19-25 year old’s. There is Regardless of research on cash being safe, there is

no recent data to show information as of 2020, but with contactless still a negative perception on the use of and handling

payment options and retailers that continue to offer digital payment of cash in the retail and banking segments at the

solutions such as Venmo, it is expected to make a nominal change. moment. Service providers need to address these

The population still maintains a sense of satisfaction from feeling concerns with real solutions, not spend their time

the currency in their hands and having the physical notes available trying to convince them otherwise.

on demand from an ATM or retail banking center. This is a culture Q: What do you see as the future for cash post-

behavior that could take decades to shift. COVID?

Q: What will be the impact on payments in the future? A: I feel that cash will come back to pre-COVID

A: Retailers still need to provide a payment option for the unbanked levels inevitably. However, I have no doubt that

and underbanked. These items represent around 10% of the merchants who accept cash will rethink and

population which primarily consists of cash payments. 32% of the expect alternative ways of dealing with cash. I see

unbanked are paid in cash. Retailers must continue to accept cash greater adoption of technology that automates the

as a form of payment in order to deliver the goods and services consumer-facing process of cash payments at self

purchased. Digital payments create a separation in the population serve kiosks or at point of sale.

that buy goods and services and continue to contribute to the I also see better ways of managing cash in back

economy. Contactless payment options have a greater risk to office cash rooms through the use of technology and

retailers in the form of cyber breaches and excessive transaction fees more optimized cash in transit (CIT) processes.

that are significant to profitability.

COVID-19 | VOLUME 18 – NO 7 | JULY 2020 7Cash at a Crossroads – NAC Cash is the Go-To Solution

Weighs In in Case of a Disaster

Bruce Renard, Executive Director, Luis Oro, Head of Innovation &

|National ATM Council Productivity, Prosegur

Q: How is the pandemic affecting your members, Q: How important is cash or otherwise in

the ATM community? the current situation?

A: The National ATM Council, Inc has been proud to play A: Maintaining the right to use cash is more

a prominent role in seeking to preserve and further the important than ever. In a crisis, and this is a big one,

interests of cash as a safe and secure payment option for you want to keep options open and never renounce

consumers in the US. To this end, we have supported the something that has proved to work. Central banks

nation’s thousands of ATM deployers with information and around the world have been very clear about

guidance throughout the pandemic concerning safe cash the relevance of keeping cash circulating in the

handling ‘best practices’ and available federal/state/local domestic economies.

financial relief. Contrary to that, cash has been attacked using

This has been a most challenging time for all our ATM heroes unfounded sanitary arguments. Subsequently,

who have continued to ensure an uninterrupted supply of authorities have recognised that touching a plastic

convenient cash at the hundreds of thousands of essential PIN pad is more dangerous than paying with cash,

retail locations continuing in operation during the pandemic. but the damage has already been done.

At the same time, ATM companies have been hurting, with It is important to realise that pushing consumers

entrepreneurial retail ATM routes down by approximately to use debit and credit cards or other new digital

50% on average from all the retail locations that have been alternative payment methods is creating an additional

shut down during this health crisis. For those locations problem to people that are already suffering a lot.

remaining open, our NAC members have seen significant Those most vulnerable are in a greater risk if cash is

transaction volume upticks, reflecting withdrawal of the not available.

many governmental assistance funds (PPP/SBA funds; For small retailers, fighting for their survival, cash just

unemployment benefits) distributed in recent months. costs them the time to take it to the bank. On the

Q: What measures are you taking to actively promote cash? other hand, card payments charge them fixed plus

A: NAC has taken a lead role in debunking ‘fake news’ variable fees, taking a toll on their revenues. Even

about cash safety in the wake of the pandemic and in more, these costs are higher when we talk about new

communicating the fact that cash is physically as safe or digital payments.

safer than other payment mechanisms. NAC informed the Finally, resiliency is more critical than ever. Experience

WHO regarding the science showing that porous US paper is showing that we can’t predict the next thing that

currency is a dramatically lower transmitter of viruses/ will go wrong. Electronic means of payment are

bacteria to human hands than those nonporous surfaces subject to collapse while cash is the go-to solution in

associated with other payment methods such as charge case of a disaster.

cards and mobile phones – leading to the WHO walking Q: What action you are likely to mitigate the current

back its earlier attributed public statements casting doubt effects and to secure the future of your business?

on cash safety.

A: It is difficult to predict the depth of the financial

NAC has also helped form the Consumer Choice in crisis in general and the specific impact in the cash

Payments Coalition – a unique assembly of leading business cycle. Cost efficiency is a must and we are taking

and consumer organizations dedicated to maintaining cash important steps in that direction. Sanitary concerns

acceptance and vitality in America. will most probably lead to a world where self service

The CCPC is dedicated to enacting federal legislation that solutions take an important role. We are aggressively

requires cash acceptance as a universal payment option developing the portfolio of cash payment front

for consumers at brick and mortar venues throughout the office solutions as part of our Prosegur Smart

US. The CCPC has also issued material public statements Cash solutions.

regarding cash safety, seeking to restore public confidence in Q: How do you think this will change the industry?

using cash, notwithstanding the pandemic. Having a unified

A: The challenges our customers are facing might

voice representing powerful national consumer and business

be the trigger to radical changes in the cash cycle.

organizations will make a real difference in the court of public

Among other projects, ATM and even branch

opinion on this issue.

network utilities are crystalising.

NAC and CCPC members are continuing efforts to add to

Q: What do you see as the future for cash post-

the 43 Members of Congress now co-sponsoring HR-2650,

COVID?

the Payment Choice Act of 2019. This is a strong pro-cash

choice measure with broad bipartisan support in the House A: The pandemic has shown us that there is public

and poised to be taken up promptly once Congress returns demand for the freedom to use cash. While some

to business. governments were wrongly pushing for cashless

payments at the beginning of the crisis, people were

Efforts are also underway for a bipartisan companion bill to

taking cash home as a precautionary measure, as

be introduced in the Senate, that will further ensure a speedy

the ECB or the Federal Reserve stated.

enactment by Congress. Signature of such a measure to

preserve the ongoing vitality of US currency as a universal As the sanitary situation improves, cash payments

payment option for consumers is also expected from are recovering their share. Hopefully governments will

the President. realise it is critical to maintain the freedom to use cash

and, if needed, take action to defend it.

8 CURRENCY NEWS | COVID-19Perceptions, Innovations & Cash Relying on a Time Proven

in the Next Normal Commodity

Paul Race, Vice President, Strategic Thomas Savare, Chairman,

Marketing, International Business, Glory Oberthur Fiduciaire

Q: What is your view on the current negative Q: How important is cash or otherwise in the

perceptions of cash? current situation?

A: Bad news travels fast. And in the case of the WHO’s A: Banknotes are proving to be vital; if governments

supposed statement about COVID-19 and cash, arguably and central banks have used quantitative easing

faster than the virus itself. The impact of global coverage as a key means of response, then humans have

of the mis-quote continues to have a dramatic impact responded by relying on that much maligned but

on our industry. Consumers have moved from the tacit absolutely essential, time proven commodity – the

understanding that ‘cash is dirty’ to the widespread belief that banknote. While individuals may in some countries

‘cash is dangerous’. reduce their usage of banknotes as a payment

In many ways this shift is understandable – we all want to mechanism, they certainly are using them as a store

minimise our risk in the face of the virus. of value; an insurance policy – just as we all have for

hundreds of years.

There is, however, a broader societal concern. For many

people around the world, even in developed economies, cash Q: What is the impact on your business and

is their only payment option and for many more it remains a what action are you taking to secure the future of

strong preference, often for budgeting reasons. Until we can your business?

reverse the impact of the virus on employment numbers and A: Our business is in a strong place; in all our

economies, the number of people relying on cash to manage locations (France, Holland, Bulgaria) we have

their household finances is likely to increase significantly. put robust protocols in place to protect, first and

Q: Albert Einstein famously said that ‘in the midst of every foremost our employees, but also our suppliers and

crisis, lies great opportunity’. Do you see this as the case, and therefore ultimately our customers. The systems

if so how? we put in place in the ‘good times’ have stood up

to the pressure and I am pleased to say that we

A: Glory recently launched our ‘Contactless Cash Payment’

have a record order book – a reflection, I think of

campaign demonstrating how cash recycling technology at

the confidence customers have in our processes

the point of sale enables physical distancing between cashier

and procedures.

and customer – ensuring retailers can continue serving the

widest possible customer base and arguably providing an Q: How do you think this will change the industry?

even safer transaction process than those involving card A: I am not sure this event will act as a particular

readers, particularly when a PIN is required. catalyst for change in our industry: I think it has been

While cash continues to be an extremely cost-effective way evident for some time who will survive and who will

for retailers to receive payment from customers, there remains not survive in the long term and I don’t see COVID

significant inefficiency in the overall cash cycle. A recent report changing this dynamic.

from Deloitte quantified the global cost of this at $23.5 billion On the other hand, I do think central banks will seek

annually, with 70% of that number associated with ATMs and more reassurance that the banknotes they issue are

transportation. For banks and retailers there is a continued not vehicles for transmission of disease. Certainly, we

mismatch between the cash they have versus the cash they have been very pleased with the reaction to the launch

need and every movement of cash costs money. of Bioguard Enhance™, which does enable central

Around the world Glory is enabling retailers and banks to banks to reduce this risk by issuing banknotes with

change the way cash moves. The next evolution of the cash biocidal properties; we believe these properties will

cycle – Cash 4.0 – enables them to reduce costs and offer be as common a feature on banknotes as intaglio or

new services to their customers, including free and convenient watermarks within a few years.

access to cash at a lower cost than traditional ATMs. Equally, I believe that central banks will pay more

Integrating mobile phone applications into the cash cycle is the attention to the environmental footprint of the banknote

next step in its evolution. Through our investment in socash supply chain and I am so very proud of the role our

in Asia we’re connecting retailers who have excess cash company is playing in leading this dialogue and debate

with consumers who need to access cash. And through our across the industry.

acquisition of Cash Payment Systems, consumers can now Q: What do you see as the future for cash, post-

pay for online purchases, utility bills and more using cash in COVID?

retail outlets as well as withdrawing / depositing cash to their A: I remain very positive: too many people for too

bank account all at the point of sale using their mobile phone. many years have predicted the end of cash. All I can

Q: What do you see as the future for cash post-COVID? say is that we see no sign of it at the moment.

A: While the mainstream press headlines continue to forecast Of course, we need to be on guard and fight for our

the imminent demise of cash, the news may not be as bad as position but let’s not forget that the human being

it seems. loves the intimacy and freedom which cash provides.

Inevitably we will see a ‘less-cash’ future but while we The freedom to use cash is a fundamental human

collectively continue to innovate, finding new ways to increase right, a protection against the might and overreach

the efficiency of the cash cycle and reduce cost for all involved of government and state as well as information

in the process, there is very much a place for cash in the ‘next technology giants.

normal’ post-COVID. It’s about ‘need’ for some, and ‘choice’ We humans will continue to use banknotes; we at

for many others. Oberthur Fiduciaire will continue to provide them.

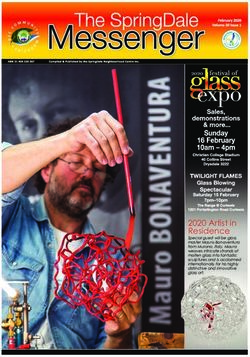

COVID-19 | VOLUME 18 – NO 7 | JULY 2020 9Making the Change – Artazn

Gears up for Coins of the Future

The pioneer in plated coins – Jarden Q: What were those ownership changes, Q: What was the logic behind the change of

Zinc Products – which has been and where does Artazn stand now? name from Jarden Zinc to Artazn, and what

supplying coins blanks since the 1980s A: We go back to 1885 as part of the does it mean?

– has recently been renamed as Artazn Ball Brothers’ canning jars, where zinc A: There were two main driving forces.

LLC and rebranded as ARTAZN™. The was used for the lids. They had two One was that we needed to maintain our

company has announced the first different facilities at the time, which were zinc heritage – hence the ‘zn’ at the end

major contract for its new ZincSecure® consolidated here in Tennessee 50 years of the name. The other is to leverage the

technology, which it sees as the ago. Fast forward to 1993, Ball Corporation term ‘artisan’ to reflect that what we do is

industry’s solution to replacing high spun off four operating businesses which all about craftsmanship. We have over 300

cost banknotes with secure, cost- became known as Alltrista. The two billion coins in circulation and these are all

effective zinc-based coins. And it has gentlemen that were the guiding force took made to very tight specifications, dealing

been challenged recently to ramp up the the business from a $300 million company in microns. For example, we have had an

supply of blanks for US coins, following to a $10 billion company under the name impeccable quality record as a supplier

the pandemic-induced shortages in Jarden Corporation. to the US Mint for nearly 40 years with

the country. 25 years as a sole source. That does not

At the time virtually all of Jarden was

comprised of consumer-oriented products. happen by accident.

In 2016 the company was bought out by So the idea of craftsmanship – quality,

Newell Rubbermaid to become Newell integrity, and trust – and our heritage in

Brands. Newell divested a number of the zinc, were really the basis for our name.

Jarden businesses, and a deal was then Q: You have recently obtained a contract for

structured to create what is now Jadex ZincSecure for new coins in Ukraine. Is this

Inc, with Artazn being one of four business the first contract for the technology? And if

under that platform. Jadex in its entirety is so, what were the challenges in persuading

about a $650 million company. the National Bank of Ukraine to go with

Q: And now for some words on what Artzan this option?

actually does. A: The NBU was already a customer for

A: We are the leading manufacturer zinc-based commemorative coins, but

of zinc strip in North America, with in- then wanted to convert some of its notes

house capabilities for melting, alloying, to coins to save money and provide

casting, rolling, slitting, blanking and greater security. A particular benefit of

plating operations. We use different alloy ZincSecure, aside from the cost savings,

compositions to create properties for a wide is in its unique electromagnetic signature

Tom Wennogle. range of applications, including coinage. (EMS) that provides a distinctive signal and

In that market, we are the world’s leading greater security.

Currency News™ spoke to Artazn’s

manufacturer of plated coin blanks with So security is a key benefit of ZincSecure

President, Tom Wennogle, about these

more than 300 billion coin blanks made and so is its lower cost compared to

developments, and what – in such

and released into circulation in more than solid alloys and banknotes. Both were

uncertain times – he sees as the future for

20 countries. important considerations.

Artazn and the coin industry.

Our core offering is zinc, but we also supply But another benefit is artistic. Zinc is a

Q: Can you describe your background and

steel-based coinage that we can do in any softer material and more ductile, meaning

why you joined Artazn?

finish and plating technology, be it mono-, that you can achieve a greater relief and

A: I have been the president for Artazn for 12 bi- or multi-ply. In fact, we were the first therefore, from an aesthetic point of view,

years now, but in the business world for 45 company to develop and offer plated coins better results. What the NBU was able to

years, primarily in metals and the stainless- back in the 1980s. do with the face of their new coins (the

steel Industry. When somebody suggested 5 and 10 hryvnia) is stunning. They did

In addition to that, we now offer a security

that Jarden Zinc, as it was then, was looking their homework, tested public opinion

component in the form of ZincSecure,

for some new leadership, I applied and really and based on positive results decided to

which is a plated zinc-based alloy coin

fell in love with East Tennessee, which is use ZincSecure.

blank. We developed technology to anneal

where the company is located.

the blank without melting the zinc core. We Q: Do you have any other partnerships

There was nothing to fix here – it was a believe that ZincSecure could fundamentally within the industry regarding licencing

great business, but just needed a little bit of change the industry, by offering a high- and production?

a cultural change. It was a manufacturing security plated product not afforded by A: In the past, we have had very successful

and engineering-oriented company but plated steel and offering increased savings partnerships with a number of industry

needed more of a strategic outlook, which on currency conversion from notes to coins. leaders. Today we are developing other

has been my emphasis. We have gone

partnerships to promote zinc-based

through a number of ownership changes,

coinage products. It is apparent in the

but despite that we have had tremendous

industry that the market for steel-based

growth, expanded our international coinage

products is crowded and very competitive.

capacity, and have rebuilt most of the zinc

strip production equipment that has been

around for almost 50 years.

10 CURRENCY NEWS | ON THE RECORDThe technology we have developed has A: We are following all of the CDC (Center Director Ryder of the US Mint has gone

clear benefits in which other organizations for Disease Control and Prevention) on record stating that he does not see a

have expressed interest. We would like guidelines because our associates and our day where the penny would be eliminated,

to expand the number of producers who customers are paramount. We want to keep but he does offer the idea of programs to

could offer zinc-based coin blanks. them safe and healthy. increase circulation. It does not necessarily

Q: How important do you view security in We have been deemed an essential bode well for us in terms of manufacturing,

coins versus other attributes such as cost? business, so we need to continue our but it is probably one of the more effective

How do your products (ZincSecure and production operations. The nature of means to be more efficient with existing

others) compare with the competition? our automated operations allows for the circulating coinage.

A: As far as we are concerned, the security appropriate social distancing in most cases So as a taxpayer I get it, but in reality I

of ZincSecure is unparalleled to other plated and, where there is a potential for more think that the logistical challenges are very

coin options. That is our strongest pitch, the condensed areas, we have re-engineered difficult to overcome. But we never take

security side of it, whether it be in vending, those spaces to enable social spacing. anything for granted, and we are always

coin counting, or sorting equipment. Our HR policies are highly geared towards looking for the next ‘big thing’, which is

protecting our employees, including the where ZincSecure comes in.

A significant security advantage of this zinc-

based coinage product is the EMS that it rotation of office employees. We have Q: What do you see as the future for coins?

provides. The availability of a wide range of effectively reduced our physical attendance A: I know that we are challenged, but I see

ZincSecure alloy compositions, each with a in our offices by about 60%. a continued demand. I think that countries

different EMS, gives customers a variety of Q: Have you seen a change in demand at their heart recognise the need for

choices with much greater accuracy. following the arrival of COVID-19? currency and the ability to make change in

Additional to the security features are the A: Recently, yes, we have. Our US Mint a cash transaction.

economic benefits of ZincSecure, which operations are basically full and are going We will see more consumption and use

we believe offers mints and central banks seven days a week on those lines. It is in developing countries, where coinage is

considerable savings over banknotes and now common news that there is a coin still a very big part of their economy. I think

solid alloys. shortage in the United States. The US Mint that there is a sense of pride and security

We have a very cost competitive and highly and the federal government are responding in it. In the US I certainly see the challenge

secure product with ZincSecure. aggressively to get their inventories back up continuing, and I think that it will take some

to where they want. As people go back into work on the part of the industry to raise

Q: What do you see as the main issues

retail, they are going to use cash and are awareness here.

facing circulating coins at the moment?

going to need change for that as well. I am hoping too that our new zinc-based

A: There are a number of challenges,

It is worth pointing out as well that the material helps coins move forward over the

including electronic payments, but I also

current coin shortages, which are a direct next decade or so.

think it’s generational, with younger people

result of the pandemic and the disruption Q; And the future for Artazn?

willing to walk around without cash in

it has caused to the normal flow of

their pocket. And while the concept of an A: It is really bright. We have worked very

coins, show just how important coins are

electronic or cashless society has its merits hard at diversifying. We also have a terrific

for transactions.

conceptually, it just takes one computer ownership structure that is very supportive

crash or security breach and people rush Q: One scenario for the future of coins and interested in seeing us grow, and

back to cash. is greatly reduced demand due to more we are exploring many different products

efficient recirculation policies and the associated with zinc. Obviously, our pride

I think that we as an industry have to

removal of low denominations. Do you and joy is ZincSecure, so we are really

continue to promote the security of the

agree that this could be the case and, if so, excited for the future.

coin, the need for coinage and currency,

what steps are you taking as a company to

and not get overrun by the big money that What gives me faith in our future is that we

prepare for and mitigate against it?

is in credit cards and mobile apps. have a terrific workforce, great technical

A: The US is slightly different to other minds and engineering resources. I do

However, there is definitely a place for

countries that have eliminated lower not think we have ever been as ready to

coins, they are secure and accepted

denomination coins. By comparison, our meet the demands of the future as we are

everywhere, unlike some digital payment

economy is much larger. There is also a right now.

options. I think that young people are very

fairly large percentage of the population

security conscious. They understand the

that is unbanked, so coins are crucial

vulnerability of cyber security and they also

for them. I think that around 68% of

understand the value of having cash in

Americans surveyed said that they support

an emergency.

the penny. Changing the composition of

Q: What steps have you taken to make your our coins is a very politically cumbersome

business COVID-19 resilient and if demand task as Congress would have to approve

has increased, have you managed to meet any changes.

it and if so how?

ON THE RECORD | VOLUME 18 – NO 7 | JULY 2020 11You can also read