Eclipse 500/550 2018 Q3 Market Update - AEROCOR, LLC Better Results From Better Data 747-777-9505

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2018 Eclipse 500/550

Q3 Market Update

July 1st, 2018

Thus far in 2018 the Eclipse market has been shaped by competing forces. An overall healthy economy has provided strong

support to the entire light jet market (including the Eclipse), while difficulties specific to the Eclipse have continued to create

FUD (Fear / Uncertainty / Doubt). These competing forces have resulted in an overall flat market, with inventory levels and

transaction volumes effectively unchanged. As of this writing, 32 aircraft are publicly listed for sale; unchanged from 1 year

ago. A total of 18 aircraft traded hands in the first half of 2018 (with 2/3’s brokered by AEROCOR), nearly identical to the 17.33

average from the previous three years.

Changes in support continue, with the recent announcement by Pratt & Whitney that it is transferring the ESP program (for the

PW-610 engine) to Aviall. This change may elevate short term uncertainty, though it is not unprecedented (ESP for the JT15D

engine was transferred to Vector Aerospace in 2015, and continues under that brand today.) Another “market wide” change for

2018 was the introduction of new tax regulations. Specifically, 100% expensing of pre-owned aircraft is now available,

increasing the incentive for buyers to move “up market,” however, the 1031 tax exchange no longer applies to aircraft. This

2nd change may impact the timing of many aircraft transactions, as sellers seeking to offset gains from one sale must now

purchase a replacement aircraft before the end of the year (the previous 1031 exchange rules allowed owners to span across

different years). This could increase activity in Q3, as sellers seeking to complete an exchange will need ample time to

complete two transactions. Owners considering a sale in 2018 are encouraged to contact AEROCOR before the end of Q3 so

as to take advantage of this potential shift in timing. While these tax changes may provide incentive for owners to take action

soon, they are certainly not the only considerations, as another focal point may also begin to impact liquidity: ADS-B

compliance (which requires all aircraft to be equipped with ADS-B equipment no later than January 1st, 2020).

Earlier this year an, ADS-B solution was introduced for IFMS v2.0 and v2.5 aircraft, meaning that a path to ADS-B compliance

is now available for all Eclipse aircraft versions. While this removes an important piece of uncertainty, it may soon give rise to

another: capacity. As of this writing, roughly 24% of the active fleet has been outfitted with ADS-B equipment, leaving well over

200 aircraft in need of an update. With 78 weeks remaining until the ADS-B mandate goes into effect, equipping the entire fleet

before the deadline will require the completion of, on average, nearly 2.8 installations per week. This may heavily stress (or

eventually exceed) shop capacity, potentially impacting values for non-upgraded aircraft as the 2020 deadline draws closer.

While all Eclipses are subject to similar “macro” conditions, to better understand the value of any one particular aircraft, it is

necessary to divide the market into like-kind “segments.” These segments are as follows:

Avio 1.0 - Avio 1.3 (Legacy aircraft)

The legacy aircraft market has remained consistent, with sale prices largely unchanged in at least 3 years. Legacy aircraft are

typically put to frequent use by enthusiastic owners, however, buyers are typically budget limited, and improperly priced aircraft

often remain on market indefinitely. There are currently only three legacy aircraft for sale, and all three are v1.0 aircraft.

Avio 1.5 - Avio 1.7 (Garmin aircraft)

After a reduction in prices in 2017, transaction volumes within this segment rebounded, and values have held relatively stable

in 2018. The segment remains slightly oversupplied, though one aircraft (listed by AEROCOR) is currently under contract to be

sold, and two others are priced irrationally, suggesting the “practical supply” within this segment is low. Buyers have shown a

preference for updated aircraft (i.e. those equipped with Garmin 625 GPS units and/or Glass Windshields), and while sellers

are unlikely to realize much of a financial return from these improvements, they may yield a strong improvement in liquidity.

IFMS v2.0

Only 5 aircraft traded hands in the first half of the year, which is slightly below average, and not entirely surprising given the

extremely high number of transactions which took place towards the end of 2017. New listings have continued to come to

market at an average (or slightly above average) pace, allowing inventory levels to return to the same level as July 1st of last

year (now 12 aircraft on market). Values have remained flat thus far in 2018, however, downward pressure could develop if

supply levels continue to grow.

IFMS v2.5 - v2.8 (Plus)

Consistent transaction volumes have helped to support consistent sale prices, which is an improvement over years past. This

year witnessed both the first and second “secondary market” 550 sale (both sold by AEROCOR), suggesting values of “upper

end" aircraft have now moved to meet demand. Supply remains nearly identical to a year ago, which currently stands at

roughly 10% of the segment. Further value trends are expected to follow changes in supply.

AEROCOR, LLC • Better Results From Better Data • 747-777-95052018 Eclipse 500/550

Q3 Market Update

"IFMS 2.7

. & v2.8

"IFMS 2.5

"IFMS 2.0

"

"

Avio 1.7

Avio 1.5

" Avio 1.3

" Avidyne

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Eclipse 500/550 Eclipse 500/550

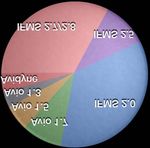

Current Fleet Configuration 12 Month Pre-Owned “For Sale” Inventory Trend

(includes all aircraft in the active fleet) (does not include “off-market” aircraft)

January 1st, 2018 Market Snapshot (Eclipse 500)

= For Sale

14% 12% 11% 10%

= Not for Sale

Avidyne - Avio 1.3 Avio 1.5 - 1.7 IFMS 2.0 IFMS 2.5 - 2.8

Average Days on Market 251 289 124 185

Low Ask $649,000 $595,000 $749,000 $1,199,000

Average Ask $682,333 $778,332 $974,250 $1,333,375

Eclipse 500

48 Month Adjusted Sale Prices Trend

$1.800m

NOT SHOWN

$1.580m "

"

Eclipse 550 (Call)

Avio 1.3 (Call)

" Avio 1.0 (Call)

$1.360m

$1.140m "IFMS 2.7 / 2.8

"IFMS 2.5

$0.920m

"IFMS 2.0

$0.700m

"Avio 1.7

"Avio 1.5

2014 2015 2016 2017 2018

an

(Sale prices adjusted for engine program enrollment, average total time, common options, etc. Dashed

lines represent regions where no direct market data exists.)

AEROCOR, LLC • Better Results From Better Data • 747-777-9505AEROCOR is the world’s largest broker of pre-owned Eclipse aircraft,

offering brokerage and buyer assistance services aimed at helping buyers

through the process of acquiring a turbine aircraft. Contact our offices at

747-777-9505 to learn more.

For More Information Contact:

Justin Beitler

(747)200-6004

justin@AEROCOR.comYou can also read