Dairy Outlook: August 2021 - Penn State Extension

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Dairy Outlook: August 2021

Milk prices remain weak as feed costs are 15%

above the previous 12 month average, despite

recent commodity declines. Programs like Dairy

Margin Coverage offer potential relief to tight

margins.

*Predicted values based on Class III and Class IV futures

regression (Goodling, 2021).

Feed prices have taken a more dramatic position in the past

few months. Led by highs in corn and soybeans, 12 month

average feed costs for the U.S. are 9.4% higher and

Pennsylvania 15.6% higher than the previous 12 month

average (Table 1). In the last three months, feed costs have

come down slightly, but still remain at highs reached over a

Robert Goodling, Penn State

decade ago. Farms with adequate home raised feed

inventories are better positioned to address the resulting tight

Slow Milk Price Growth Meets Rapid Feed margins than those reliant on a larger quantity of purchased

Cost Expansion feed.

Summer prices have been challenging for Class III prices, but

very tumultuous when it comes to feed. Despite the short A Tale of 3 Risk Management Levels

lived spike in Class III in May, Class III and IV have been Low milk price and/or high feed commodity prices leads to

normalizing and slowly growing for all of 2021 (Figure 1). increased discussion around risk management strategies. There

Current futures suggest that Class III will potentially grow to have been various risk management strategies available to

$18/cwt by the end of the year, while Class IV looks stable producers over the years, and a popular current option is Dairy

around $16/cwt. Based on a regression of Class III and Class Margin Coverage (DMC) established in the 2018 Farm

IV, the predicted Pennsylvania all milk price will grow from Bill. The DMC is two and a half years into its program, and its

around $18.75/cwt to potentially $20/cwt for the second half utilization by producers has varied greatly by premium level

of 2021. chosen, percent production enrolled, etc. Given the current

Figure 1: Twenty-four month Actual and Predicted* Class margin environment, a comparison of three premium levels

III, Class IV, and Pennsylvania All Milk Price ($/cwt) offered illustrates an interesting picture. Let's take an example

dairy interested in covering 90% of its 5,000,0000 lbs. milk

eligible for DMC. How would this dairy's net indemnities

compare for 2019-2021 at three coverage levels: $4.00, $6.50,

and $9.50? Net indemnity means the total payouts less any

fees and premiums. Figure 2 shows what the annual net

indemnities per cwt were at each level as well as the monthly

Milk and Feed Cost Margin USDA calculates for payment

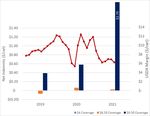

determination.Figure 2: USDA Dairy Margin Coverage Net Indemnities for

2019-2021 at $4, $6.50, and $9.50 premium levels

¹Based on corn, alfalfa hay, and soybean meal equivalents to

produce 75 lbs. of milk (Bailey & Ishler, 2007) ²The 3 year

average actual IOFC breakeven in Pennsylvania from

2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck, Ishler,

Goodling, 2018).

USDA Farm Service Agency, 2021. "Dairy Margin Coverage

Program".

Table 2: 12 month Pennsylvania and U.S. All Milk Price,

Feed Cost, Milk Margin ($/cwt for lactating cows)

It should be noted 2021 only contains the first six months and

the amount of milk covered and the amount of premium are

adjusted to reflect such. The minimum level of $4.00 has yet

to result in an indemnity payment since 2019, and with a

minimum $100 fee, there is hardly any impact on an annual

basis for the level of production. At $6.50 coverage, it has

been a mixed performance. In 2019, it did not trigger any

payments, but did have a $0.07/cwt cost. Two months

triggered payments in 2020, resulting in a net indemnity of

$0.06/cwt, and currently 2021 is tracking to be somewhere in

between. The top level coverage, $9.50, definitely has been a

positive since DMC was offered. It has resulted in a net

indemnity around $0.50/cwt in 2019 and 2020, and currently

is poised to return nearly $2.80/cwt if margins remain in their

sub $7.00 range for the remainder of 2021. Although this may

not offset all the rising costs producers are facing, having ¹Based on corn, alfalfa hay, and soybean meal equivalents to

these additional funds for those that elected higher levels of produce 75 lbs. of milk (Bailey & Ishler, 2007) ²The 3 year

coverage will help to lessen the impact on this year's financial average actual Milk Margin breakeven in Pennsylvania from

position. As with any risk management strategy, every 2015-2017 was $12.33 ± $2.29 ($/cwt) (Beck, Ishler, Goodling,

operation is unique, and so decisions should be based on that 2018).

operation's financial position, estimated production, and long

term objectives. Enrollment for DMC occurs in the fall prior Figure 3: Twelve month Pennsylvania Milk Income and

to the coverage year, so producers elected coverage for 2021 Income Over Feed Cost ($/milk cow/day)

back in October thru December 2020. No official data has

been announced for the 2022 enrollment period, but most

likely will occur in the October to December 2021 time frame.

Income Over Feed Cost, Margin, and All

Milk Price

Table 1: 12 month Pennsylvania and U.S. All Milk Income,

Feed Cost, Income over Feed Cost ($/milk cow/day)

Page 2 Dairy Outlook: August 2021To look at feed costs and estimated income over

feed costs at varying production levels by zip

code, check out the Penn State Extension Dairy

Team's DairyCents or DairyCents Pro apps

today.

Data sources for price data

• All Milk Price: Pennsylvania and U.S. All Milk Price

(USDA National Ag Statistics Service, 2021)

• Current Class III and Class IV Price 8/13/2021 and

²The 3 year average actual IOFC breakeven in Pennsylvania 8/16-8/19/2021 (USDA Ag Marketing Services, 2021)

from 2015-2017 was $9.00 ± $1.67 ($/milk cow/day) (Beck,

• Predicted Class III, Class IV Price (CME Group, 2021)

Ishler, Goodling, 2018).

• Alfalfa Hay: Pennsylvania and U.S. monthly Alfalfa Hay

Table 3: Twenty-four month Actual and Predicted* Class Price (USDA National Ag Statistics Service, 2021)

III, Class IV, and Pennsylvania All Milk Price ($/cwt) • Corn Grain: Pennsylvania and U.S. monthly Corn Grain

Price (USDA National Ag Statistics Service, 2021)

Aug-20 $19.77 $12.53 $18.10 • Soybean Meal: Feed Price List (Ishler, 2021) and average

Sep-20 $16.43 $12.75 $18.00 of Decatur, Illinois Rail and Truck Soybean Meal, High

Protein prices, National Feedstuffs (USDA Ag Marketing

Oct-20 $21.61 $13.47 $18.80 Services, 2021)

Nov-20 $23.34 $13.30 $20.20

References

Dec-20 $15.72 $13.36 $18.80

Bailey, K. and V. Ishler. " Dairy Risk-Management Education:

Jan-21 $16.04 $13.75 $17.30 Tracking Milk Prices and Feed Costs ". Penn State Extension.

Feb-21 $15.75 $13.19 $17.40 Accessed 9/20/2017.

Mar-21 $16.15 $14.18 $17.90 Beck, T.J., Ishler, V.A., & Goodling, R. C. 2018. "Dairy

Enterprise Crops to Cow to Cash Project," the Pennsylvania

Apr-21 $17.67 $15.42 $18.40 State University. Unpublished raw data.

May-21 $18.96 $16.16 $19.30 CME Group. " Class III Milk Futures Settlements ". Accessed

Jun-21 $17.21 $16.35 $19.10 8/13/2021.

Jul-21 $16.49 $16.00 $19.01 CME Group. " Class IV Milk Futures Settlements ". Accessed

8/13/2021.

Aug-21 $16.15 $15.75 $18.73

Ishler, V. " DairyCents Mobile App ". Penn State Extension.

Sep-21 $17.35 $15.93 $19.33 #App-1010.

Oct-21 $17.34 $16.04 $20.20 Ishler, V. " DairyCents Pro Mobile App ". Penn State

Nov-21 $17.66 $16.12 $20.37 Extension. #App-1009.

Dec-21 $17.63 $16.22 $20.42 Ishler, V. "Feed Price List". Personal Communication.

Accessed 8/13/2021.

Jan-22 $17.40 $16.34 $20.18

Microsoft 2016. " Forecast.ets function ", Office Help

Feb-22 $17.40 $16.53 $20.28 Website.

Mar-22 $17.42 $16.67 $20.37 USDA Ag Marketing Services, 2021. Milk Marketing Order

Apr-22 $17.48 $16.85 $19.78 Statistics. Accessed 8/13/2021.

May-22 $17.48 $16.89 $19.80 USDA Ag Marketing Services, 2021. " National Feedstuffs:

Soybean Meal, High Protein ". Summary of USDA AMS

Jun-22 $17.48 $16.93 $19.83 Grain Reports. Accessed 8/13/2021.

Jul-22 $17.52 $17.04 $20.02 USDA Economic Research Service, 2021. " Dairy Data ".

Commercial disappearance of milk in all products. Accessed

* Italicized predicted values based on Class III and Class IV 8/13/2021.

futures regression (Beck, Ishler, and Goodling 2018; Gould,

2019). USDA Economic Research Service, 2021. " Milk Production

". Accessed 8/13/2021.

Page 3 Dairy Outlook: August 2021USDA Farm Service Agency, 2021. " Dairy Margin Coverage

Program ". Accessed 8/19/2021.

USDA National Ag Statistics Service, 2021. Agricultural

Prices, Quick Stats version 2.0. Accessed 8/13/2021.

Authors

Robert C. Goodling, Jr.

Extension Associate, Dairy

rcg133@psu.edu

814-863-3663

David L. Swartz

Assistant Director, Animal Systems Programs

dls19@psu.edu

717-385-5380

Claudia Schmidt, Ph.D.

Assistant Professor of Marketing and Local/Regional Food Systems

cschmidt@psu.edu

814-863-8633

Virginia A. Ishler

Extension Dairy Specialist

vishler@psu.edu

Tim Beck

Extension Educator

tjb12@psu.edu

717-870-7702

Penn State College of Agricultural Sciences research and extension programs

are funded in part by Pennsylvania counties, the Commonwealth of

Pennsylvania, and the U.S. Department of Agriculture.

Where trade names appear, no discrimination is intended, and no endorsement

by Penn State Extension is implied.

This publication is available in alternative media on request.

Penn State is an equal opportunity, affirmative action employer, and is

committed to providing employment opportunities to all qualified applicants

without regard to race, color, religion, age, sex, sexual orientation, gender

identity, national origin, disability, or protected veteran status.

This article, including its text, graphics, and images ("Content"), is for

educational purposes only; it is not intended to be a substitute for veterinary

medical advice, diagnosis, or treatment. Always seek the advice of a licensed

doctor of veterinary medicine or other licensed or certified veterinary medical

professional with any questions you may have regarding a veterinary medical

condition or symptom.

© The Pennsylvania State University 2021

Code: ART-7255

Page 4 Dairy Outlook: August 2021You can also read