Consumer confidence hits 27-month high New residential home building hits 6 -year low - CommSec

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Economics | October 14, 2020

Consumer confidence hits 27-month high

New residential home building hits 6½-year low

Consumer Confidence; Home sales; Tourism; Dwelling starts; Economic forecasts

Consumer confidence: The Westpac-Melbourne Institute Index of Consumer Confidence rose by 11.9 per

cent in October, lifting from 93.8 in September to a 27-month high of 105 points. A reading above 100

points denotes optimism. The index is up 38.9 per cent after hitting 29-year lows of 75.6 points in April.

New detached home sales: In seasonally adjusted terms, private new detached home sales rose by 3.8 per

cent in September to be up 28.9 per cent over the quarter. In the seven months since COVID-19

restrictions came into effect in March, sales are 11.8 per cent higher than at the same time last year.

Preliminary overseas travel: In September, there were 49,800 estimated overseas departures and 16,700

estimated arrivals. Departures fell 18.2 per cent, but arrivals were up 8.3 per cent compared to August.

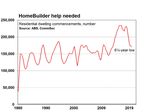

New dwelling starts: The number of dwelling starts fell by 5.6 per cent to 42,448 units in the June quarter.

There are currently 183,120 homes being built across Australia. In original terms, work started on 171,274

new dwellings over the 12 months to June – the lowest number in 6½ years.

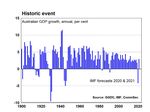

Global growth forecasts: The International Monetary Fund (IMF) expects the global economy to contract

by 4.4 per cent in 2020 before rebounding by 5.2 per cent in 2021. The Australian economy is tipped to

contract by 4.2 per cent in 2020 before expanding 3 per cent in 2021.

The consumer confidence figures have implications for retailers, and other consumer-focussed businesses. The home sales data has

implications for banks, retailers, developers, building and building material companies. The tourism data is useful in showing the impact

of travel restrictions on the economy. Building & building material companies are affected by dwelling starts including Boral, James

Hardie, Adelaide Brighton, Lend Lease, CIMIC, Dulux and Brickworks. Global economic forecasts are useful for exporters and companies

that trade across a range of countries.

What does it all mean?

Aussie consumer confidence has hit 27-month highs. Yes, you read it correctly – sentiment is currently at the

highest level since July 2018! And in further good news, confidence in virus-hit Melbourne (up 13.3 per cent to

102 points) is back at levels last seen in August 2019. And sentiment in COVID-19 ‘hotspot’ Sydney lifted by 13.6

per cent to an 18-month high of 108.5 points. But will it encourage more spending given home price weakness?

Westpac-Melbourne Institute’s survey of 1,200 consumers was largely conducted after the Federal Budget was

handed down and the Reserve Bank added a clear policy easing bias to its statement on October 6. Of course,

Ryan Felsman, Senior Economist

Twitter: @CommSec

IMPORTANT INFORMATION AND DISCLAIMER FOR RETAIL CLIENTS

The Economic Insights Series provides general market-related commentary on Australian macroeconomic themes that have been selected for coverage by the Commonwealth Securities Limited (CommSec) Chief

Economist. Economic Insights are not intended to be investment research reports.

This report has been prepared without taking into account your objectives, financial situation or needs. It is not to be construed as a solicitation or an offer to buy or sell any securities or financial instruments, or as a

recommendation and/or investment advice. Before acting on the information in this report, you should consider the appropriateness and suitability of the information, having regard to your own objectives, financial

situation and needs and, if necessary, seek appropriate professional of financial advice.

CommSec believes that the information in this report is correct and any opinions, conclusions or recommendations are reasonably held or made based on information available at the time of its compilation, but no

representation or warranty is made as to the accuracy, reliability or completeness of any statements made in this report. Any opinions, conclusions or recommendations set forth in this report are subject to change

without notice and may differ or be contrary to the opinions, conclusions or recommendations expressed by any other member of the Commonwealth Bank of Australia group of companies.

CommSec is under no obligation to, and does not, update or keep current the information contained in this report. Neither Commonwealth Bank of Australia nor any of its affiliates or subsidiaries accepts liability for

loss or damage arising out of the use of all or any part of this report. All material presented in this report, unless specifically indicated otherwise, is under copyright of CommSec.

This report is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399, a wholly owned but not guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124.

This report is not directed to, nor intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution,

publication, availability or use would be contrary to law or regulation or that would subject any entity within the Commonwealth Bank group of companies to any registration or licensing requirement within such

jurisdiction.Economic Insights: Consumer confidence hits 27-month high

the respondents liked what they heard from Federal Treasurer

Josh Frydenberg with Westpac reporting, “For this Budget we

saw a net positive balance of 9.5 per cent [average since 2010 is

-29 per cent] indicating that a clear majority of respondents

assessed that the Budget would ‘improve their finances’.”

And the growing prospect of even lower borrowing costs has

emboldened Aussie consumers, despite high unemployment,

elevated mortgage debt and virus-related home loan deferrals. In

fact, sentiment for mortgagors rose by 12.7 per cent to a 27-

month high of 108.7 points in October. And those that fully own

their home are even more chipper with confidence up 13.5 per

cent to 33-month highs of 105.4 points.

Home prices are broadly lifting outside of Sydney and Melbourne.

So it’s no surprise that consumer views on whether it’s a good ‘time to buy a dwelling’ surged by 10.6 per cent to

13-month highs of 122.2 points in October.

Better sentiment towards the housing market is timely, given the ongoing downturn in residential building

construction. While figures are a little dated, builders begun work on just 171,274 new dwellings over the year

ended June 30, 2020 – the lowest number since September 2013.

The decline in dwelling starts in the June quarter likely reflecting the impacts of COVID-19 restrictions, including

lockdowns. During the pandemic, some building and construction projects have been delayed or cancelled as

businesses consolidate their operations and conserve cash. In recent months, the Australian Industry Group and

Housing Industry Association have both highlighted the challenges for construction businesses with new and

existing projects being withdrawn or postponed, enquiries and new orders declining, and contracts cancelled. The

closure of Australia’s international borders has adversely affected demand for new residential projects.

The economic downturn and lower inbound migration will likely limit growth in residential building construction. But

supportive government policies, including the $688 million HomeBuilder package, additional state based grants in

Western and Tasmania, the NSW Government’s $1.1 billion social housing fund and first homebuyer assistance

schemes could still boost activity. And the rebound in home sales could support demand for new detached homes

– especially with Aussies re-considering inner city living in the wake of the health crisis.

What do the figures show?

Consumer confidence – October

The Westpac-Melbourne Institute Index of Consumer Confidence rose by 11.9 per cent in October, lifting

from 93.8 to a 27-month high of 105. A reading above 100 denotes optimism. The index is up 38.9 per cent after

hitting 29-year lows of 75.6 points in April.

The current conditions index rose by 7.3 per cent. And the expectations index rose by 15.1 per cent.

All five major components of the index rose in October:

According to Westpac, “For this Budget we saw a net positive balance of 9.5 per cent [average since 2010 is -29

per cent] indicating that a clear majority of respondents assessed that the Budget would ’improve their finances’.”

The survey was based on responses from 1,200 people and conducted in the week from October 5 to October

10, 2020.

October 14, 2020 2Economic Insights: Consumer confidence hits 27-month high

New home sales – September

In seasonally adjusted terms, private new detached home

sales rose by 3.8 per cent in September to be up 28.9 per

cent over the quarter. In the seven months since COVID-19

restrictions came into effect in March, sales are 11.8 per cent

higher than at the same time last year.

The Housing Industry Association reported, “New home sales

increased by 29.7 per cent in South Australia in September

compared to August, followed by Victoria and New South

Wales which increased by 16.7 per cent and 6.1 per cent

respectively. Sales in Queensland and Western Australia

both declined during the month by 4.2 per cent and 11.5 per

cent respectively.”

No data was published by the HIA for multi-unit sales.

Preliminary arrivals & departures (September)

According to the Bureau of Statistics, all overseas arrivals to Australia in September (provisional

estimates):

“16,700 estimated trips, 8,900 of these are Australian citizens

8.3 per cent increase compared to the previous month and a 99 per cent decrease compared to the

corresponding month of the previous year

7.2 per cent of all arrivals were New Zealand citizens, the largest group apart from Australian citizens

returning home

10.3 per cent of all arrivals were those arriving on temporary other visas.”

According to the Bureau of Statistics, all overseas departures from Australia in September (provisional

estimates):

“49,800 estimated trips, 11,700 of these are Australian citizens

18.2 per cent decrease compared to the previous month and a 97.2 per cent decrease compared to the

corresponding month of the previous year

18.2 per cent of all departures were Chinese citizens

19.7 per cent of all departures were those leaving on temporary other visas.”

Dwelling starts & work done – June quarter

The total number of dwelling starts fell by 5.6 per cent to 42,448 units in the June quarter after lifting by 5.1 per

cent in the March quarter and 4.2 per cent in the December quarter. Starts are down 8 per cent from a year ago.

House starts fell by 0.8 per cent to 25,691 dwellings in the June quarter to be down by 1.4 per cent from a year

ago.

Apartment starts fell by 12.4 per cent to 16,549 units in the June quarter to be down 15.8 from a year ago.

Work started on 171,274 new dwellings over the 12 months to June, down by 13 per cent on the year. Starts

fell from the record high of 234,440 dwellings in the year to June 2016.

Across Australia, starts in the June quarter fell in six states/territories: NSW (down 1.9 per cent); Victoria (down

10.4 per cent); Queensland (up 2.4 per cent); South Australia (down 12.6 per cent); Western Australia (down 21.9

per cent); Tasmania (down 9 per cent); Northern Territory (up 33.6 per cent); and the ACT (down 29.3 per cent).

In the year to June, dwelling starts were higher than the decade average in Tasmania (up 17.8 per cent) and the

ACT (up 3.5 per cent). Starts were below the decade average in:

NSW (down 7.4 per cent); Victoria (down 3.3 per cent);

Queensland (down 19 per cent); South Australia (down 0.4 per

cent); Western Australia (down 39.7 per cent); Northern Territory

(down 64.7 per cent) and Australia (down 11.5 per cent).

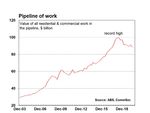

In the June quarter the value of residential and commercial

building work done fell by 3.8 per cent to be down 4.8 per cent on

a year ago. New residential work fell by 4.9 per cent, alterations &

additions were down 5.2 per cent and commercial building fell by

2.1 per cent.

The value of residential and commercial building work in the

pipeline stood at $88.5 billion at the end of June, down by 2.9 per

cent on a year ago and below the record-high of $99.7 billion at

the end of June 2018.

October 14, 2020 3Economic Insights: Consumer confidence hits 27-month high

Across Australia, 183,120 homes are currently being built,

down from a record 231,622 homes in March 2018.

In the June quarter, the value of residential and commercial

building work yet to be done (completed) stood at $66.5

billion, down 6.7 per cent on a year ago.

International Monetary Fund (IMF) World Economic Outlook

(WEO)

According to the IMF, “Global growth is projected at -4.4

percent in 2020, 0.8 percentage points above the June 2020

WEO Update forecast. The stronger projection for 2020

compared with the June 2020 WEO Update reflects the net

effect of two competing factors: the upward impetus from better-than-anticipated second quarter GDP outturns

(mostly in advanced economies) versus the downdraft from persistent social distancing and stalled reopenings in

the second half of the year.”

And, “Global growth is projected at 5.2 percent in 2021, 0.2 percentage points lower than in the June 2020 WEO

Update. The projected 2021 rebound following the deep 2020 downturn implies a small expected increase in

global GDP over 2020–21 of 0.6 percentage point relative to 2019.”

For Australia, the IMF is tipping GDP to contract by 4.2 per cent in 2020 (prior forecast: -4.5 per cent) before

expanding 3 per cent in 2021 (prior forecast: +4 per cent). However, “the projections do not reflect the October 6

Commonwealth budget, which was released after the cut-off date (September 28) for the October 2020 WEO.”

What is the importance of the economic data?

Westpac and the Melbourne Institute release the Index of Consumer Sentiment each month. The ANZ/Roy

Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute

consumer sentiment index but the former measure is a timelier assessment of consumer attitudes. Confident

consumers may be more inclined to spend, especially on major items.

The Housing Industry Association releases data on the sales of new homes each month. The HIA collects the

data each month from a sample of Australia's largest 100 homebuilders. The survey covers around 15 per cent of

the home building industry.

The Australian Bureau of Statistics releases data on overseas arrivals and departures, produced monthly and

is an indicator of the health of the tourism sector. The figures are also useful in understanding spending trends

and tracking migrant numbers – an indicator with widespread implications for employment, housing and spending.

New provisional monthly data has been provided since the COVID-19 crisis began.

The Australian Bureau of Statistics releases data on dwelling commencements (starts) each quarter. The

figures provide guidance on future construction activity. If construction begins on new houses or apartments, it

signifies work for building trades.

The International Monetary Fund provides forecasts for world economies each quarter: January, April, July and

October. The data is important for financial markets, trading companies and global-dependent businesses.

What are the implications for investors?

While many Aussies are avoiding holding hard cash or banknotes during the pandemic due to health concerns

(preferring to use their cards for payments) the Reserve Bank’s payments policy guru Tony Richards said today

that the Bank doesn’t see a strong case to introduce a digital currency anytime soon.

Policymakers remain fixated on getting Aussies back to work in

the aftermath of virus lockdowns. The IMF is forecasting Aussie

unemployment to remain elevated - averaging 6.9 per cent in

2020 and 7.7 per cent in 2021.

The Reserve Bank has said that it is ready to ease its policy

settings further. So all eyes will be on Reserve Bank Governor

Philip Lowe’s speech - “The Recovery from a Very Uneven

Recession” - at 9am AEDT tomorrow.

And of course, the much-anticipated labour force survey for

September is released just hours later. Commonwealth Bank

Group economists estimate that 20,000 jobs will be lost with the

jobless rate lifting to 7 per cent.

Ryan Felsman, Senior Economist, CommSec

Twitter: @CommSec

October 14, 2020 4You can also read