Branch closure impact assessment - Closing branch: Danske Bank Mallusk, 39 Mallusk Road, Newtownabbey BT36 4PP

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

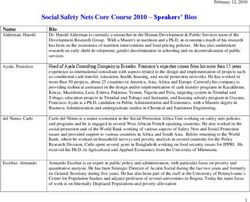

Branch closure impact assessment Closing branch: Danske Bank Mallusk, 39 Mallusk Road, Newtownabbey BT36 4PP Closure date: 22 October 2021 Information correct as at: 9 July 2021

Our Approach We regularly undertake strategic reviews of our business to determine how best to serve the evolving needs of our customers. While branches are still an important part of our offering, many customers are using them much less frequently, instead choosing to use digital channels, banking on the telephone and the Post Office (where Danske Bank customers can carry out banking services). A decline in transaction levels at Mallusk branch means that it is no longer economically sustainable, and we’ve made the difficult decision to close the branch on 22 October 2021. These decisions are made on a case-by-case basis following a thorough, strategic review and approval process, taking many factors into consideration – including branch usage and the availability of alternative ways to bank. We’ve invested over £3 million in our branch network and the transformation of several key branches over the past number of years, and we continue to invest in enhancing our digital and online offerings. This Impact Assessment sets out the steps we have taken to minimise the impact of our decision to close our Mallusk branch on our customers, in-line with our responsibilities under the Access to Banking Standard.

Our Decision for closing Mallusk Branch We regularly review the use by customers of our branches across Northern Ireland by monitoring the level of activity taking place including number of counter transactions. We also consider whether each branch location can remain economically sustainable. During the process we consider a range of factors including: • The level of transactions within a branch. Transactions in Mallusk branch have reduced by 38% from Jan 2017 - May 2021. • The customer profile of Mallusk branch (detailed on page 5). • Alternative ways to bank, including free to use ATMs in the local area. • Distance to nearest alternative bank branches and Post Office. • The number of employees affected. • The cost of running the premises. Access to Banking Standard The Access to Banking Standard, overseen by the Lending Standards Board (LSB), is designed to ensure that customers affected by branch closures receive sufficient communication and clarity on the reasons for the closure and adequate support in accessing alternative banking services. As part of the Access to Banking Standard, we publish this Impact Assessment on our website when we announce our decision to close, it is also available in hard copy at our Mallusk and Abbey Centre branches, and can be printed on request at any branch or made available through our customer contact centre. This Impact Assessment is also available in Braille, large print, on tape and on disc. Please ask a member of staff for more details. From 9 July, we will be reaching out to local public representatives and other community groups to share the news that Mallusk branch is closing and to provide contact details to address any questions, queries or investigate any support requirements. Two weeks before the closure, we will publish an updated version of our Impact Assessment (available on danskebank.co.uk/branchchanges), which will include any communication and feedback from stakeholders. How to contact us If you have been affected by our decision to close Mallusk branch, or if you would like to know what additional steps you can take to ensure you continue banking with us, please call our dedicated line on 0345 601 0089. For general banking enquiries, please call 0345 600 2882 (both lines are open Monday - Friday 8am - 6pm; Saturday and Sunday 9am - 5pm).

Mallusk branch information

39 Mallusk Road, Newtownabbey, BT36 4PP

Monday, Tuesday, Friday: 9.30am - 4.30pm (lunchtime closing 12.30pm -1.30pm)

Wednesday, Thursday: 10.00am - 4.30pm (lunchtime closing 12.30pm -1.30pm)

CUSTOMER PROFILE BRANCH FACILITIES

96%

PERSONAL

CUSTOMERS

Internal ATM (without deposit functionality) YES

External ATM NO

4%

BUSINESS

Internal ADM

Counter

NO

YES

CUSTOMERS Safety deposit YES

Fully accessible for customers.

AGE PROFILE OF

PERSONAL CUSTOMERS

AGEALTERNATIVE SERVICES

If you have any concerns, questions or require additional support with the closure

of Mallusk and the alternative services listed below, please don’t hesitate to talk

to the team in branch or over the phone in our customer contact centre.

ABBEY CENTRE Lunchtime closure: No Counter service: Yes

3.8 MILES AWAY (BY ROAD)

Saturday opening: No Internal ATM: Yes*

Abbey Centre, Longwood Road, (with deposit functionality)

BT37 9UH

Public transport: Bus

Internal ADM: Yes*

Public parking: Yes – shopping centre parking

Mon, Tues, Fri: 9.30am - 4.30pm is available. External ATM: Yes*

Wed & Thurs: 10.00am - 4.30pm (without deposit functionality)

Fully accessible * available during shopping

centre opening hours.

BALLYCLARE Lunchtime closure: Yes – Counter service: Yes

6.5 MILES AWAY (BY ROAD) daily from 12.30pm - 1.30pm Internal ATM: Yes

18 The Square, Ballyclare, Saturday opening: No (without deposit functionality)

BT39 9BB Internal ADM: No

Public transport: Bus

Mon, Tues, Fri: 9.30am - 4.30pm Public parking: Yes – on street parking available. External ATM: Yes

Wed & Thurs: 10.00am - 4.30pm Nearby public car park: Market Square. (without deposit functionality)

Fully accessible

CARRICKFERGUS Lunchtime closure: Yes – Counter service: Yes

8.7 MILES AWAY (BY ROAD) daily from 12.30pm - 1.30pm Internal ATM: No

21-23 High Street, Carrickfergus, Saturday opening: No

BT38 7AL

Internal ADM: No

Public transport: Bus External ATM: Yes

Mon, Tues, Fri: 9.30am - 4.30pm Public parking: Yes – on street parking available. (without deposit functionality)

Wed & Thurs: 10.00am - 4.30pm Nearby public car park: High Street Car Park.

Fully accessible

DONEGALL SQUARE WEST Lunchtime closure: No Counter service: Yes

9 MILES AWAY (BY ROAD)

Saturday opening: Yes Internal ATM: Yes

Donegall Square West, Belfast, (with deposit functionality)

BT1 6JS

Public transport: Bus

Internal ADM: Yes

Public parking: Yes – on street parking available.

Mon, Tues, Fri: 9.30am - 4.30pm Nearby car parks: Montgomery Street, Castle External ATM: Yes

Wed & Thurs: 10.00am - 4.30pm Court and The Tannery. (without deposit functionality)

Fully accessible

OTHER DANSKE BANK Information on all our branches can be found at

danskebank.co.uk/branchfinder

BRANCHES Your nearest alternative branch is at Abbey Centre.

NEARBY POST OFFICE® -NEARBY PAYPOINT

SERVICES

PayPoint offers in-store payment services for

customers – including bill payments and cash Spar - Mallusk

functions. 45 Mallusk Road, Newtownabbey,

Found on consumer.paypoint.com and searching BT36 4PS

BT36 4PP. Open Monday - Sunday 7.00am - 10.00pm

Centra Glenabbey Filling Station

1 Mayfield Link, Newtownabbey, 492 Antrim Road, Glengormley,

BT36 4GX BT36 5DB

Open Monday - Sunday 6.00am - 11.00pm Open Monday - Sunday 12.00am -11.45pm

NEAREST FREE TO USE OTHER LOCAL BANKS

CASH MACHINES Ulster Bank

2 Farmley Road, Glengormley,

Found at link.co.uk/consumers/locator

Newtownabbey, BT36 7QU

1.4 miles away (by road)

Musgrave Centra

2 Mayfield Link, Mallusk, BT36 4PP Santander

1-3 Farmley Road, Glengormley,

Tesco Newtownabbey, BT36 1QU

Unit 5, Mayfield Neighbourhood Centre, 1.4 miles away (by road)

Glengormley, BT36 7WU

Bank of Ireland

Spar

275-279 Antrim Road, Glengormley,

45 Mallusk Road, Newtownabbey, BT36 4PP Newtownabbey, BT36 7QN

7.8 miles away (by road)

BROADBAND AVAILABILITY WITHIN THE AREA OF MALLUSK BRANCH*

Highest available Highest available

Availability

download speed upload speed

Standard 4 7 Mbps N/A

Superfast 4 80 Mbps 20 Mbps

Ultrafast 8 N/A N/A

*Information found on checker.ofcom.org.uk and searching BT36 4PP.OTHER WAYS TO BANK WITH US

After Mallusk branch closes, you can complete day-to-day banking at any

Danske Bank branch in Northern Ireland. We do also have a number of

alternative ways to bank with us, without having to visit a branch.

eBanking (Personal customers)

eBanking lets you manage your accounts online and stay in control of your finances

24 hours a day. Through it, you can check your account balances, account transactions,

make transfers, view statements and more. Customers who have Savings accounts

with no cards are able to transfer money between accounts using eBanking and our

Mobile Banking App. Accessible on internet browsers on any device through

www.danskebank.co.uk, after you have registered for eBanking.

District (Business customers)

District is an online banking platform for business customers, where you can check

account balances, view transactions, make payments, view statements and more.

Mobile Banking App (Personal customers)

Manage your account and carry out a wide range of banking activities, all through our

App. Available through the App Store and Play Store.

Text and email alerts (Personal customers)

You can set up alerts to help you manage your accounts, through our Account Balance

Service and Overdraft Alerts service.

Account Balance Service lets you set up customised text and email alerts, which can be

set up to be sent daily or when a certain activity happens on your account – for example,

if your account goes above or below a certain balance, or when a payment enters or

leaves your account.

Overdraft Alerts help you stay on top of your account if you have an overdraft. If we have

your mobile number, we’ll text you when you go into an arranged or unarranged overdraft

so you can take any action needed.

For more information on both, including how to get set up, please visit

danskebank.co.uk/personal/ways-to-bank/alerts

Post Office

Complete day-to-day banking at any Post Office branch in the UK. You can:

• Withdraw cash using your Debit Mastercard.

• Deposit cash using your Debit Mastercard.

• Check your balance with your Debit Mastercard.

• Lodge cheques to your account (NI only). You will need a pre-printed envelope (available

at Danske Bank branches and the Post Office) and a bank giro credit with your account

details (sometimes these can be found at the back of your chequebook, or you can ask

us to send a bank giro credit book out to you for lodgements). Cheques are processed

the day we receive them.Contact Us Our customer contact centre has advisers that can help with any and all everyday banking queries. You can also organise appointments over the phone, and get further help that you might need with banking. Phone us on 0345 600 2882 (Monday - Friday: 8.00am - 6.00pm and Saturday and Sunday: 9.00am - 5.00pm). Cash machines You can use your Danske Bank Debit Mastercard to withdraw funds from cash machines. Most provide free withdrawals, but you will be given a warning before completing your transaction on fees that may be charged. You can view free to use cash machines at link.co.uk/consumers/locator At Danske Bank cash machines, withdrawals from Danske Debit Mastercards are free of charge, and you are also able to access your Danske Mastercard balance onscreen or request a mini statement of your account. Automated Deposit Service In recent years, we have made investments in our Automated Deposit Services in some of our branches across Northern Ireland. This includes our Automated Deposit Machines (ADMs) which take note and coin deposits, as well as our adaptions to ATMs inside and outside a number of branches, which can facilitate withdrawals and deposits using your Danske card. These aren’t available in all branches, but can be found at Abbey Centre**, Altnagelvin, Armagh, Ballymena, Banbridge*, Bloomfield**, Coleraine*, Cookstown, Donegall Square West, Downpatrick*, Dungannon*, Enniskillen, Forestside, Kennedy Centre**, Lisburn, Magherafelt, Newry, Newtownards, Omagh*, Portadown*, Shipquay Place. To get more information, please get in touch with your local branch or you can call our customer contact centre. *Deposit facility available outside branch 24/7 **Deposit facility available during shopping centre opening hours Account assistance If you need help accessing your account, we have a number of options that can help. These include: • A Carer’s account • Power of Attorney’s, Enduring Power of Attorney’s and Court Protection orders can also be registered on accounts • Mandates. We appreciate that there can be times when due to a temporary or permanent situation, you might require additional assistance or support from us. If you need further help or more information about your options, please get in touch with the team at Mallusk before closure, or you can contact us on 0345 601 0089 (line is open 8am - 6pm Monday - Friday and 9am - 5pm Saturday and Sunday). After closure, the team in Abbey Centre or any of our branches can help, or you can contact us on the phone. Get more information at: danskebank.co.uk/waystobank

Impact Assessment Update 08.10.2021 As part of our adherence to the Access to Banking Standard, we give a commitment to update customers and stakeholders on any feedback that has been provided since the branch closure announcement and issue of the initial Branch closure impact assessment, which has now been updated and is available online (at www.danskebank.co.uk/branchchanges) and hard copies will continue to be available for customers in our Mallusk and Abbey Centre branches up to and after the branch closure. We appreciate the closure date is fast approaching and you may want to speak to a member of staff to discuss your future banking arrangements. We also want to remind customers and stakeholders that even after the branch closes on 22 October at 12.30pm, there is still support and assistance available for any issues or concerns you might have, or any questions you might need to ask us. You can continue to contact us to address any of these queries or questions: • By phone: Using our dedicated phone line for these queries, 0345 601 0089 (line is open 8am-6pm Monday-Friday and 9am-5pm Saturday and Sunday); • In branch: You can use any Danske Bank branch, and speak to any of our colleagues who can assist you. Until closure, our Mallusk team will be on hand to help you and after that, your nearest branch will be Abbey Centre branch; • Online: Through our Secure Mail function on eBanking or through your Mobile Bank App. Customer engagement Twelve weeks before the closure date, we sent letters to impacted customers. In these letters, we detailed our decision to close the branch, included alternative ways to bank with us and shared alternative services (including the Post Office, other Danske Bank branches and free to use cash machines). From the morning of the announcement, we also displayed this decision to close in posters and countertop notices in Mallusk branch. We recognised the need for some of our customers registered to Mallusk who may require different forms of communications. Large print letters were created and sent to specific customers and proactive phone calls were made as required. Our branch staff used our data as well as their local knowledge to identify customers who may need additional support during the branch closure and an outreach programme was undertaken to speak with these customers either by phone or face-to-face in order to address any concerns and offer solutions to address their banking needs. Since the announcement, we’ve attempted to contact (by telephone) 131 Mallusk customers who have no card attached to their account, so we could explain the closure and alternative options available. To date, we have successfully contacted 64 customers. We have a further 141 Mallusk customers who we have identified as requiring additional support and proactive contact is being made as required to support customers and discuss banking alternatives. In Mallusk branch, we’ve been proactively engaging with customers both by phone and at the counter to discuss our online and mobile banking options, services offered by the Post Office, cash machine services, telephone banking and raising awareness of fraud and scams in order to help support our customers. You can find more information on our alternative ways to bank in this document, on page 8 and 9 and our staff will be happy to demonstrate our online banking should you need a little further support in this area. Hard copies of our Step by Step banking guide continue to be available for customers to take away in our Mallusk and Abbey Centre branches – these can be requested up to and after the closure and can also be posted to you if requested. Alongside that, in August we hosted a Ways to Bank webinar for any customer to attend and find out more about the alternative options to bank.

Community and stakeholder engagement On the day we announced the decision to close Mallusk branch, we also proactively contacted local stakeholders to let them know about the closure, share alternative services and provide an opportunity for them to discuss our decision with us. We contacted (by phone and/or email): Local MP – Paul Girvan Local MLAs – John Blair, Pam Cameron, Steve Aiken, Declan Kearney, Trevor Clarke Local Councillors – Matthew Magill, Philip Brett, Mark Cosgrove, Michael Goodman, Noreen McClellan, Julie McGrath Retail NI, Federation of Small Businesses NI, Consumer Council, Age NI, UK Finance NI, NI Chamber of Commerce. We informed the Post Office of the closure, so they were aware that their nearby branches may see more customers completing banking transactions there. We provided them with copies of the Impact Assessment for customers. Locally, Mallusk and Abbey Centre branch colleagues also proactively contacted and provided information and meetings with our branch manager to help with the transition. Customers that were contacted, and also invited to visit our Abbey Centre branch were: Henderson’s, Whitewell Metropolitan, Ashers, McAuley Metals. Community and stakeholder feedback Comment: We’re aware that the Financial Services Union (FSU) is calling for a pause to branch closures, and for the setting of a Banking Forum. Action: We retain a close working relationship with the Union and have met them since we announced the closure of Mallusk branch. Comment: Some political contacts expressed disappointment, but understood the rationale, at the closure of the branch. Action: We discussed the Post Office banking service, which was positively received as an alternative. The letter that had been issued to customers and the Mallusk Impact Assessment were also forwarded by email to all of the political stakeholders, for a further look at the data supporting the reasons for closure of the branch and alternative banking options available for their constituents. Customer feedback: We had no customer feedback or complaints from Mallusk customers. At a branch level, customers discussed alternatives with colleagues in branch and had access to our Impact Assessments for further information and data.

Definition of key terms

Term Definition

Access to Banking Standard The Access to Banking Standard, overseen by the LSB, is designed to ensure that

customers affected by branch closures receive sufficient communication and clarity

on the reasons for the closure and adequate support in accessing alternative banking

services.

Accessible (Pg 5 and 6) All our branches are fully accessible, with the majority having level access.

When level access is not provided, mobile ramps are available.

The majority have height-adjustable teller counters. All have automatic doors,

hearing loops, low level writing desks, ground floor meeting rooms and welcome

assistance dogs.

Automated Deposit Some of our branches have Automated Deposit Machines (ADMs) inside. They allow

Machine (ADM): customers to lodge notes and coins into their Danske Bank account with or without

their card.

ATM with deposit function Some of our branches have ATMs with additional functionality, where customers

can withdraw and also deposit money into their accounts using their Danske Bank

Mastercard.

Banking services / branch Range of banking services for Danske Bank customers include in-branch, self-service

facilities machines, on the phone, online, appointments, cash machines, counter service, self-

service machines and appointments available.

Customer contact centre Our customer contact centre helps service our customers over the phone, online

and through direct mails. Advisers there can complete many of the transactions that

would happen over the counter at branch and answer queries you may have.

Counter service/Counter Banking completed ‘over the counter’ with a teller – usually cash or cheque deposits

or withdrawals, or could be receiving change.

Customer profile Breakdown of Personal and Business customers who have an account at the branch.

Customers who actively use Customers who have used the branch at least 3 times in a six-month period (to

this branch account for Covid-19 impact, data was analysed for September 2019 – February

2020, and November 2020 – April 2021).

Demographic By ‘Demographic’ we mean the breakdown of customers by age range.

Increasingly digital world More and more services move online – including banking. For Danske Bank, our digital

world is focused on our personal eBanking and Mobile Banking App, and our District

services for business customers. As well as our customer contact centre, where

customers can complete banking online or over the phone.Term Definition

Miles away All mileage calculated using Google Maps and Apple Maps.

Other Danske Bank Alternative Danske Bank branches to the branch closing – addresses and

branches miles included.

Other local banks Alternative non-Danske Bank bank branches.

Nearest Closest services available.

Public transport For access to alternative Danske Bank branches, we’ve listed public transport where

it is available. To get the most up to date travel information, we’d advise you look at the

local provider. Translink operates coach, bus and train services throughout Northern

Ireland, and the most up-to-date routes can be found on their website (translink.co.uk).

Some routes may require more than one service from starting to final destination.

Self Service / Automated At some of our branches, we have self service equipment/Automatic Deposit

deposit service Machines (ADMs) where Danske customers can make note and coin lodgements

into their accounts. There are also some branches with ATMs which have a deposit

functionality too - meaning you can withdraw and deposit at some of those cash

machines.

Stakeholder A stakeholder is defined as an individual or group that has an interest in any decision

or activity of an organisation. For our branch closures, we consider the political

representatives of a local area as key stakeholders, as they and their constituents

are impacted directy.

Strategic review A strategic review is a structured process to identify a business’s progress

towards achieving its overall goals. This could be about improving the performance

of an existing area or making changes to the existing ways of working to improve

performance.

Traditional banking Banking solely in a branch, with no additional online banking.

Vulnerable customer The Financial Conduct Authority defines a vulnerable customer as someone who, due

to their personal circumstances, is especially susceptible to harm, particularly when

a firm is not acting with appropriate levels of care.This publication is also available in Braille, in large print, on tape and on disk. Speak to a member of staff for details. Danske Bank is a trading name of Northern Bank Limited which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority, Financial Services Register, reference number 122261. Registered in Northern Ireland R568. Registered Office: Donegall Square West Belfast BT1 6JS Northern Bank Limited is a member of the Danske Bank Group. danskebank.co.uk

You can also read