BANCO SANTANDER, S.A - MORTGAGE COVERED BONDS INVESTORS PRESENTATION "Cédulas hipotecarias (CH)"

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

H1 2020 BANCO SANTANDER, S.A. MORTGAGE COVERED BONDS INVESTORS PRESENTATION Here to help you prosper “Cédulas hipotecarias (CH)”

Important information

Non-IFRS and alternative performance measures

In addition to the financial information prepared in accordance with International Financial Reporting Standards (“IFRS”) and derived from our financial statements, this presentation contains certain

financial measures that constitute alternative performance measures (“APMs”) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority

(ESMA) on 5 October 2015 (ESMA/2015/1415en) and other non-IFRS measures (“Non-IFRS Measures”). The financial measures contained in this presentation that qualify as APMs and non-IFRS measures

have been calculated using the financial information from Santander Group but are not defined or detailed in the applicable financial reporting framework and have neither been audited nor reviewed by

our auditors. We use these APMs and non-IFRS measures when planning, monitoring and evaluating our performance. We consider these APMs and non-IFRS measures to be useful metrics for

management and investors to facilitate operating performance comparisons from period to period, as these measures exclude items outside the ordinary course performance of our business, which are

grouped in the “management adjustment” line and are further detailed in Section 3.2. of the Economic and Financial Review in our Directors’ Report included in our Annual Report on Form 20-F for the year

ended 31 December 2019. While we believe that these APMs and non-IFRS measures are useful in evaluating our business, this information should be considered as supplemental in nature and is not

meant as a substitute of IFRS measures. In addition, other companies, including companies in our industry, may calculate or use such measures differently, which reduces their usefulness as comparative

measures. For further details of the APMs and Non-IFRS Measures used, including its definition or a reconciliation between any applicable management indicators and the financial data presented in the

consolidated financial statements prepared under IFRS, please see the 2019 Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission on 6 March 2020, as well as the section

“Alternative performance measures” of the annex to the Banco Santander, S.A. (“Santander”) Q2 2020 Financial Report, published as Inside Information on 29 July 2020. These documents are available on

Santander’s website (www.santander.com). Underlying measures, which are included in this presentation, are non-IFRS measures.

The businesses included in each of our geographic segments and the accounting principles under which their results are presented here may differ from the included businesses and local applicable

accounting principles of our public subsidiaries in such geographies. Accordingly, the results of operations and trends shown for our geographic segments may differ materially from those of such

subsidiaries.

Forward-looking statements

Santander cautions that this presentation contains statements that constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-

looking statements may be identified by words such as “expect”, “project”, “anticipate”, “should”, “intend”, “probability”, “risk”, “VaR”, “RoRAC”, “RoRWA”, “TNAV”, “target”, “goal”, “objective”, “estimate”,

“future” and similar expressions. These forward-looking statements are found in various places throughout this presentation and include, without limitation, statements concerning our future business

development and economic performance and our shareholder remuneration policy. While these forward-looking statements represent our judgment and future expectations concerning the development

of our business, a number of risks, uncertainties and other important factors could cause actual developments and results to differ materially from our expectations. The following important factors, in

addition to those discussed elsewhere in this presentation, could affect our future results and could cause outcomes to differ materially from those anticipated in any forward-looking statement: (1)

general economic or industry conditions in areas in which we have significant business activities or investments, including a worsening of the economic environment, increasing in the volatility of the

capital markets, inflation or deflation, changes in demographics, consumer spending, investment or saving habits, and the effects of the COVID-19 pandemic in the global economy; (2) exposure to various

types of market risks, principally including interest rate risk, foreign exchange rate risk, equity price risk and risks associated with the replacement of benchmark indices; (3) potential losses associated with

prepayment of our loan and investment portfolio, declines in the value of collateral securing our loan portfolio, and counterparty risk; (4) political stability in Spain, the UK, other European countries, Latin

America and the US; (5) changes in laws, regulations or taxes, including changes in regulatory capital and liquidity requirements, including as a result of the UK exiting the European Union and increased

regulation in light of the global financial crisis; (6) our ability to integrate successfully our acquisitions and the challenges inherent in diverting management’s focus and resources from other strategic

opportunities and from operational matters while we integrate these acquisitions; and (7) changes in our ability to access liquidity and funding on acceptable terms, including as a result of changes in our

credit spreads or a downgrade in our credit ratings or those of our more significant subsidiaries. Numerous factors could affect the future results of Santander and could result in those results deviating

materially from those anticipated in the forward-looking statements. Other unknown or unpredictable factors could cause actual results to differ materially from those in the forward-looking statements.

2Important information

Forward-looking statements speak only as of the date of this presentation and are based on the knowledge, information available and views taken on such date; such knowledge, information and views

may change at any time. Santander does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

No offer

The information contained in this presentation is subject to, and must be read in conjunction with, all other publicly available information, including, where relevant any fuller disclosure document

published by Santander. Any person at any time acquiring securities must do so only on the basis of such person’s own judgment as to the merits or the suitability of the securities for its purpose and only

on such information as is contained in such public information having taken all such professional or other advice as it considers necessary or appropriate in the circumstances and not in reliance on the

information contained in this presentation. No investment activity should be undertaken on the basis of the information contained in this presentation. In making this presentation available Santander gives

no advice and makes no recommendation to buy, sell or otherwise deal in shares in Santander or in any other securities or investments whatsoever.

Neither this presentation nor any of the information contained therein constitutes an offer to sell or the solicitation of an offer to buy any securities. No offering of securities shall be made in the United

States except pursuant to registration under the U.S. Securities Act of 1933, as amended, or an exemption therefrom. Nothing contained in this presentation is intended to constitute an invitation or

inducement to engage in investment activity for the purposes of the prohibition on financial promotion in the U.K. Financial Services and Markets Act 2000.

Historical performance is not indicative of future results

Statements as to historical performance or financial accretion are not intended to mean that future performance, share price or future earnings (including earnings per share) for any period will necessarily

match or exceed those of any prior period. Nothing in this presentation should be construed as a profit forecast.

Third Party Information

In particular, regarding the data provided by third parties, neither Santander, nor any of its administrators, directors or employees, either explicitly or implicitly, guarantees that these contents are exact,

accurate, comprehensive or complete, nor are they obliged to keep them updated, nor to correct them in the case that any deficiency, error or omission were to be detected. Moreover, in reproducing these

contents in by any means, Santander may introduce any changes it deems suitable, may omit partially or completely any of the elements of this presentation, and in case of any deviation between such a

version and this one, Santander assumes no liability for any discrepancy.

3Index

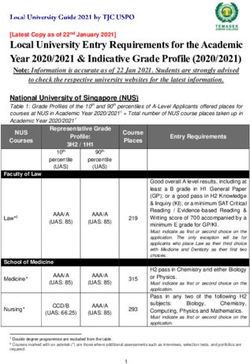

1 2 3 4 5

Spanish Santander Santander Mortgage Appendix

macroeconomic Business Spain – Main Covered

environment Model & figures Bonds

Strategy

4Spanish macroeconomic environment

Stock of loans increased boosted by the state-guaranteed programmes

Total loans (EUR bn)

1,178 1,193 Demand for loans up boosted by the state-guaranteed

1,159 1,155 1,159

1.8 programmes, mainly in SMEs and corporates.

YoY -0.7

(%) -1.7 -1.5 Housing loans also impacted by measures following

-4.4 regulatory and supervisory recommendations, that, in

many cases, were materialised through moratorium on

payments of credit obligations.

Jun-19 Sep-19 Dec-19 Mar-20 May-20

Total deposits (EUR bn)

1,104 1,093 1,111 1,125 1,169

8.5 In savings, demand deposits increased, both in households

YoY 5.1 4.8

(%) 5.3 4.2 and companies, in order to protect themselves from the

consequences related to the COVID-19 crisis.

Jun-19 Sep-19 Dec-19 Mar-20 May-20

Source: Bank of Spain. 5

Loans to Other Resident sectorsSpanish macroeconomic environment: Credit quality

The NPL ratio in Spain continued its downward trend in Q1’20. Expected to

increase from Q2 onwards related to the intensity of the crisis…

Spain Mortgage NPL ratio (%) European Banks Total NPL ratio by

country (%) – Q1’20

7.0%

7.0%

6.0% 6.0%

5.0% 5.0%

4.0% 4.0%

3.0% 3.0%

2.0%

2.0%

1.0%

1.0%

0.0%

0.0%

Mar-08

Mar-11

Mar-12

Mar-13

Mar-14

Mar-17

Mar-18

Mar-19

Mar-20

Mar-09

Mar-10

Mar-15

Mar-16

Sep-10

Sep-11

Sep-12

Sep-13

Sep-16

Sep-17

Sep-18

Sep-19

Sep-09

Sep-14

Sep-15

Sep'08

… although payment holidays (for mortgages and consumer loans) and government

guaranteed loans can affect the timing

6

Source: Bank of Spain and EBA Risk Dashboard.Spanish macroeconomic environment: Credit quality

Housing market impacted by lockdown measures and, for the coming quarters, by

the economic effects on employment and payment capacity of households

Housing starts (thousand units) Total housing sales (thousand units)

* Cumulative 12 months May-20 vs May-19: -13.8% Finished * Cumulative 12 months

101 106 houses:

583 570

92 93 2014: 31 491 532 548

78 81

2015: 30 458

364 366 402

64

2016: 26 349

50 301

44

34 35

2017: 36

2018: 41

2019: 57

May-20: 56

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Q1'20*

(thousands)

Source: Ministry of Development

Source: Ministry of Development

Housing: Prices (price index per m2 in real terms) Price heterogeneity (% YoY in nominal terms)

Base 100: Q3’07 “peak” 10%

110

100 Q1’20 / Q1’19: Total Large cities Other towns

100 -0.4% 5%

(real terms)

90

0%

80

70 Q1’20: 68 -5%

60

-10%

50

Q1'04

Q1'06

Q1'09

Q1'11

Q1'12

Q1'14

Q1'17

Q1'19

Q1'02

Q1'03

Q1'05

Q1'07

Q1'08

Q1'10

Q1'13

Q1'15

Q1'16

Q1'18

Q1'20

-15%

Jun-08 Jun-09 Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Jun-20

Source: Ministry of Development and Bank of Spain (appraisal methodology)

Source: Tinsa (appraisals)

7Index

1 2 3 4 5

Spanish Santander Santander Mortgage Appendix

macroeconomic Business Spain – Main Covered

environment Model & figures Bonds

Strategy

8Santander Business Model & Strategy

We delivered strong net operating income performance (+2% in constant euros),

though profit affected by COVID-19 related provisions

% change

EUR mn H1'20 H1'19 Euros Constant

Euros

Net interest income 16,202 17,636 -8 0 Resilient customer revenue

even with lower business activity

Net fee income 5,136 5,863 -12 -4

Other income 1,180 937 26 26 Strong performance in CIB in the quarter

Total income 22,518 24,436 -8 0

Operating expenses -10,653 -11,587 -8 -2 Accelerating the reduction in our cost base

Net operating income 11,865 12,849 -8 2

Loan-loss provisions1 -7,027 -4,313 63 78 LLPs impacted by COVID-19 charges

Other results -997 -957 4 12

Underlying PBT 3,841 7,579 -49 -44

Impairments arising from the deterioration

Net capital gains and provisions -12,706 -814 - - of the macroeconomic scenario

Attributable profit -10,798 3,231 - - related to COVID-19

Underlying attributable profit 2 1,908 4,045 -53 -48

(1) Provisions overlay in Q1 was included in the net capital gains and provisions line but has now been allocated by country in this line (LLPs). 9

(2) Excluding net capital gains and provisionsSantander Business Model & Strategy

Our focus on increasing customer loyalty via unique personal banking

relationships...

Total customers Loyal customers Loyal / Active

146 mn (+3%) 21.5 mn (+4%) customers

Individuals (mn) Companies (k)

+4% +4% 29.9% 30.7%

145 146 146 19.7 1,741 1,804

141 142 144 18.9

139

136 138 Jun-19 Jun-20

Increased or broadly stable loyalty

Jun-18 Sep Dec Mar-19 Jun Sep Dec Mar-20 Jun Jun-19 Jun-20 Jun-19 Jun-20

ratio in

all 3 regions

Note: Year-on-year changes 10Santander Business Model & Strategy

… together with an acceleration in digital adoption…

39.9 mn (+15% YoY) Steady growth in our digital customers: +3.1 mn in H1’20

Digital customers1 vs. +2.0 mn in H2’19

Strong engagement and digital sales:

47% in Q2’20 +27% YoY +23% YoY

(44% in H1’20 and 36% in 2019)

Digital sales2 as % of total sales # Accesses3 # Transactions4

(online & mobile) (monetary & voluntary)

Digital customers: Strong mobile customer growth:

4.6 mn 6.1 mn

32.2 mn (+22% YoY) +5.8 mn YoY

5.1 mn 14.5 mn Mobile customers +3.0 mn YTD

(1) Every physical or legal person, that, being part of a commercial bank, has logged in its personal area of internet banking or mobile phone or both in the last 30 days

(2) Percentage of new contracts executed through digital channels during the period 11

(3) Private accesses. Logins of bank’s customers on Santander internet banking or apps. ATM accesses by mobile are not included

(4) Customer interaction through mobile or internet banking which resulted in a change of balance. ATM transactions are not includedSantander Business Model & Strategy

…and doing business in a more responsible and sustainable way…

Culture Sustainability

Engagement Women

86% of employees 40% Group Board >EUR 20 bn EUR 1 bn EUR 1 bn

Leader mobilised in Green finance Santander first Santander second

proud to work for Santander

(+1 pp vs 2018)

23% Group leadership (2019-Q1’20)

green bond green bond

(+2 pp vs. 2018) issuance (Oct-19) issuance (June-20)

Communities Dow Jones index2 Financial inclusion

1.6 mn 69 k 2.0 mn EUR 277 mn

people helped through our scholarships granted people financially credit to microentrepreneurs3

community programmes empowered (+73% vs. 2018)

Note: figures as of 2019 and changes on a YoY basis (2019 vs. 2018) 12

(1) Dow Jones Sustainability index 2019

(2) Microentrepreneurs are already included in the people financially empowered metricSantander Business Model & Strategy

… improves operational excellence by helping to deliver resilient top line

performance and increased cost savings

Resilient revenue despite COVID crisis… …with one of the best cost-to-income among peers1

Total income, constant EUR mn Cost-to-income, H1’20

Peer 1 46%

47%

22.5 22.5 8 pp

Peer 2 49%

better than

peer avg.

Peer 3 52%

Peer 4 54%

Peer 5 54%

H1'19 H1'20

Peer 6 55%

Peer 7 63%

Peer 8 63%

Peer 9 65%

(1) Peers included are: BBVA, BNP Paribas, Citibank, Credit Agricole, HSBC, ING, Itaú, Scotiabank and Unicredit. Santander calculations 13Santander Business Model & Strategy

Our geographic and business diversification, coupled with our subsidiaries

model…

Loan portfolio by country Loan portfolio by business

Breakdown of total gross loans excluding reverse repos, % of operating areas ex. SGP Breakdown of total gross loans excluding reverse repos, Jun-20

Jun-20

Argentina; 1%

Chile; 4% Other S. Am.; 1% Other individuals; 10%

Brazil; 7%

Spain; 23%

Mexico; 3%

CIB; 13%

Home

mortgages;

US; 11% 35%

SCF; 11% Corporates;

Other Europe; 5%

13%1

Poland; 3%

Portugal; 4%

UK; 27% SMEs; 12% Consumer;

17%

Total gross loans excluding reverse repos: EUR 909 bn

RWAs as of Jun-20: EUR 567 bn 87% of loan portfolio is Retail, 13% Wholesale

(1) Corporates and institutions 14Santander Business Model & Strategy

… is resilient throughout the cycle

Resilient profit generation throughout the cycle PPP/Loans well above most European peers1

Group pre-provision profit, EUR bn %, Jun-20

Peer 1 3.4

2.8

26.2

25.5 25.6

23.9 24.4 23.6 23.7

23.0 22.6 22.8

19.9

Peer 2 2.3

17.7

14.8

Peer 3 1.9

11.4

Peer 4 1.8

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Peer 5 1.7

Peer 6 1.3

(1) European peers include: BBVA, BNP Paribas, Credit Agricole, HSBC, ING and Unicredit. Santander calculations using publically available data. 15Santander Business Model & Strategy

Credit quality supported by mitigation measures and volume increases…

Loan-loss provisions Credit quality ratios

Jun-19 Mar-20 Jun-20

EUR bn

Cost of credit 0.98% 1.17%1 1.26%

+78%

YoY

NPL ratio 3.51% 3.25% 3.26%

Coverage ratio 68% 71% 72%

(1) Considering annualised YTD provisions and loan portfolio

average of the period: 1.62% in Q1’20, 1.46% in H1’20

Percentage change in constant euros

16Santander Business Model & Strategy

…with cost of credit estimation of 140-150 bps at year-end reiterated

Credit quality ratios NPL ratios by country

% % Q2 2019 Q2 2020

Spain 7.02 6.55

4.08%

3.93% SCF 2.24 2.52

UK 1.13 1.08

3.73%

3.62% Poland 4.21 4.57

NPL ratio 3.51% 3.47% Portugal 5.00 4.43

3.32% US 2.32 1.49

3.25% 3.26%

Mexico 2.21 2.50

Brazil 5.27 5.07

Chile 4.52 4.99

1

2016 2017 2018 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Argentina 3.79 3.15

Cost of credit ratios by country

% Q2 2019 Q2 2020

1.18% 1.17% 1.26% Spain 0.41 0.68

1.07% 1.00% 0.97% 0.98% 1.00% 1.00% SCF 0.36 0.78

Cost of credit

UK 0.06 0.23

Poland 0.66 0.96

Portugal 0.03 0.30

USA 3.09 3.30

1 Mexico 2.61 2.95

2016 2017 2018 Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Brazil 3.84 4.67

(1) Acquisition of Banco Popular in 2017 Chile 1.10 1.46 17

Argentina 4.33 5.67Santander Business Model & Strategy

Well-funded, diversified, prudent and highly liquid balance sheet (large % contribution from

customer deposits), actively reinforcing already strong LCR ratios following COVID -19 crisis

Liquidity Balance Sheet

EUR bn, Jun-20 1,234 1,234 Liquidity Coverage Net Stable Funding

Ratio (LCR) Ratio (NSFR)

1

Jun-20 Dec-19 Mar-20

Loans and Customer

advances to deposits Spain2 193% 143% 105%

847

customers 935

SCF 297% 248% 111%

UK2 149% 145% 124%

50

Securitisations and others

Portugal 172% 134% 106%

180 M/LT debt issuances

Financial assets 210

34 ST Funding Poland 188% 149% 130%

Fixed assets & other 89 123 Equity and other liabilities

US 133% 133% 116%

Assets Liabilities

HQLAs3 Mexico 169% 133% 121%

Brazil 169% 122% 109%

EUR bn, Jun-20 HQLAs Level 1 212.3

Chile 161% 143% 109%

HQLAs Level 2 12.3

Argentina 214% 196% 180%

Level 2A 6.4

Group 175% 147% 111%

Level 2B 5.9

Note: Liquidity balance sheet for management purposes (net of trading derivatives and interbank balances)

(1) Provisional data 18

(2) Spain: Parent bank, UK: Ring-fenced bank

(3) 12 month average, provisional dataSantander Business Model & Strategy

Stock of issuances shows diversification across instruments and entities

Debt outstanding by type Debt outstanding by issuer entity

EUR bn and %, Jun-20 EUR bn and %, Jun-20

Preference shares; Other;

Sub debt; 9.2; 5%

US; 8.6; 5% 7.8; 4%

12.4; 7%

Brazil; 3.1; 2%

Chile; 9.3; 5%

Senior non- Senior; SCF;

preferred; 62.4; 35% 22.0; 12%

San S.A.; 78.9;

43.6; 24%

44%

UK; 50.4;

Covered bonds;

28%

52.5; 29%

Note: preference shares also includes other AT1 instruments. 19Santander Business Model & Strategy

Conservative and decentralised liquidity and funding model

EUR 26 bn1 issued in public markets in H1’20 Very manageable maturity profile

EUR bn, Jun-20 EUR bn, Jun-20

12.3 49.6

1.5

San S.A. 1.6 3.3

9.1 7.9 7.4

7.0

5.6 SCF 2.2 4.4 5.9 2.5 3.9 3.1

0.8 3.6 3.4 2020 2021 2022 2023 2024 2025+

3.5 0.5 12.2 14.5

2.5 1.3 8.2

3.2 3.1 UK 6.2

2.9 6.4

1.3 1.3

2 2020 2021 2022 2023 2024 2025+

Spain UK SCF USA Other

Brazil 1.1 1.2 0.8 0.0 0.0 0.0

Other public market issuances includes a USD 1.75 bn

2020 2021 2022 2023 2024 2025+

issuance in Mexico, and other issuances in Brazil,

Chile and Poland

USA 0.1 0.5 1.1 2.3 0.9

3.6

2020

2020 2021

2021 2022

2022 2023

2023 2024

2024 2025+

2025+

20

(1) Data include public issuances from all units with period-average exchange rates. Excludes securitisations (2) Includes Banco Santander S.A. and Santander International Products PLC

Note: preference shares also includes other AT1 instruments.Index

1 2 3 4 5

Spanish Santander Santander Mortgage Appendix

macroeconomic Business Spain – Main Covered

environment Model & figures Bonds

Strategy

21Santander Spain

Santander remains committed to maintaining its leadership by supporting individual

customers, SMEs and Corporates, especially to overcome the COVID-19 crisis

KEY DATA H1’20 YoY Var. STRATEGIC PRIORITIES

Customer loans1 EUR 203.8 bn +1.4%

Customer funds2 EUR 311.8 bn -1.7% Contribute to the economic recovery supporting our self-

employed, SMEs and Corporates

Underlying att. Profit EUR 251 mn -63.9%

Underlying RoTE 3.2% -6.1 pp

Keep on growing SMEs, Corporates and Wealth segments with

strong focus on high value-added products

Efficiency ratio 54.9% -22 bps

Increase customer revenue and continue costoptimisation

Loans market share3 18.0% +35 bps

Deposits market share 3 18.6% -28 bps

Accelerate the Bank´s digital transformation towards a data

Loyal customers 2.5 mn +3.1%

driven company

Digital customers 5.1 mn +9.7%

Focus on reducing doubtful assets and leverage our capital

Branches 3,222 -24.1%

efficient model

Employees 27,261 -11.1%

(1) Excluding reverse repos.

(2) Excluding repos.

22

(3) Spain market share includes: SAN Spain (public criteria) + Openbank + Hub Madrid + SC Spain. Other Resident sectors in Deposits.

Loans market share as of May-20 and YoY variation vs. Jun-19. Deposits market share as of Mar-20 and YoY variation vs. Mar-19Santander Spain

Spain

KEY DATA H1'20 % H1'19 P&L* Q2'20 % Q1'20 H1'20 % H1'19

Loyal / active customers (%) 33 +2 pp NII 931 0.6 1,856 -8.0

Net fee income 535 -16.8 1,178 -5.5

Digital customers (mn) 5.1 +10%

Total income 1,562 -12.7 3,350 -9.6

NPL ratio (%) 6.55 -47 bps Operating expenses -896 -5.1 -1,841 -10.0

Cost of credit (%) 0.68 +27 bps Net operating income 665 -21.2 1,509 -9.1

LLPs -313 -50.3 -941 100.1

Efficiency ratio (%) 54.9 -22 bps

PBT 237 112.0 350 -62.6

RoTE (%) 3.2 -6.1 pp Underlying att. profit 161 79.1 251 -63.9

(*) EUR mn

VOLUMES1

Loans & Advances Customer Deposits High activity in SMEs and Corporates boosted by loans with ICO

to Customers (EUR bn) (EUR bn)

guarantee, reaching 27% market share and more than EUR 11 bn

201

191 192

204 +1% 251 248 -1% loans growth in the quarter

YoY 240 YoY

235

Profit impacted by lower non-customer revenue and higher LLPs,

partially offset by cost reduction efforts. QoQ recovery in NII

NPL ratio improved 47 bps YoY (with a high level of corporate

Jun-19 Dec-19 Mar-20 Jun-20

Jun-19 Dec-19 Mar-20 Jun-20

loans granted) and coverage ratio rose to 43.3%

Note: Underlying RoTE 23

(1) Loans and advances excluding reverse repos. Customer deposits excluding reposIndex

1 2 3 4 5

Spanish Santander Santander Mortgage Appendix

macroeconomic Business Spain – Main Covered

environment Model & figures Bonds

Strategy

24Mortgage covered bonds (Banco Santander, S.A.)

Banco Santander S.A. ratings

Moody's S&P Fitch

Direction

Date last Direction Direction Date last

Rating Rating Date last change Rating last

change last change last change change

change

Covered Bonds Aa1 03/12/2019 ↑ - - - AA 04/12/2019 ↑

Senior Debt (P)A2 17/04/2018 ↑ A 06/04/2018 ↑ A 17/07/2018 ↑

Senior Non-preferred Baa1 27/09/2017 ↑ A- 06/04/2018 ↑ A- 09/02/2017 Initial

Subordinated (P)Baa2 04/03/2014 ↑ BBB+ 06/04/2018 ↑ BBB 27/03/2020 ↓

AT1 Ba1 20/04/2017 ↑ - - - BB+ 27/03/2020 ↑

Short Term Debt P-1 17/04/2018 ↑ A-1 06/04/2018 ↑ F2 11/06/2012 ↓

25Mortgage covered bonds (Banco Santander, S.A.)

Mortgage Covered Bonds are direct obligations of Banco Santander, S.A.

collateralised by its mortgage portfolio

✓ Banco Santander S.A.’s mortgage portfolio is a low risk profile business, focused on residential

and first home financing…

✓ …well diversified by geography and maturity with an adequate LTV

✓ Mortgage covered bonds (CH) show a high level of over-collateralisation…

✓ …and have a three notch rating uplift in Banco Santander S.A.: rated Aa1 by Moody’s and AA

by Fitch

✓ CH represent ~29% of total wholesale issuances at Santander Group as of June-20. Santander

is one of the top issuers in Spain

Santander is a relevant player in the Spanish mortgage business (market share ~20%1), a key

commercial product in our customer-focused business model

1. Estimation. Last data available of Spanish mortgage covered bonds outstanding is for 2018 (EUR 213,253 mn). Please see appendix. 26Mortgage covered bonds (Banco Santander, S.A): Main figures

Collateral description 2 Mortgage covered bonds

1 (cover pool – 100% mortgage loans) description

EUR million EUR million

82,240 Outstanding

58,342

24,913

In the market

Retained 20,786

Total cover pool Eligible Portfolio

June 2020 June 2020 June 2020

⚫ Average loan size (€ thousand) 102

⚫ Number of loans (thousands) 809

Collateralisation 330%

⚫ Loan seasoning (years) 7.2 rate1

⚫ Remaining loan maturity (years) 15.1

⚫ Average cover pool LTV (%) 72

Maximum issuance capacity: EUR 46,673 mn

⚫ Eligible pool LTV (%) 46 (80% eligible cover pool portfolio)

⚫ Eligible portfolio NPL ratio (%) 2.9

⚫ Interest rate type 16% fixed; 84% FRN

(1) Only as a percentage of mortgage covered bonds (CH) in markets. Considering 100% CH, 180% 27Mortgage covered bonds (Banco Santander, S.A): Description of collateral (1/4)

Low risk portfolio focused on residential and first home financing…

Cover pool portfolio: EUR 82 bn

June 2020

Segments Guarantees

Developer 4%

activities1 Second home2

25% Other

Other 30% 1%

business

activities

75% Residential3

Households 66%

99%

First home2

(1) Developer mortgage product 28

(2) Estimate from mortgages to individuals

(3) Finished and under construction buildings for residential purposesMortgage covered bonds (Banco Santander S.A.): 1) Description of collateral (2/4)

... concentrated in urban areas with lower unemployment rates …

%

June 2020 Regions1 Back-

Murcia Asturias book

Castile-La Mancha, Extremadura Madrid 26.89

Canary Islands

Andalusia 17.95

Madrid

Catalonia 16.63

Valencian Community 6.89

Andalusia

Galicia 4.77

62% Canary Islands 4.40

38% Castile and Leon 4.08

Balearic Islands Basque Country 3.66

Balearic Islands 3.19

Catalonia

Valencian Community Castile La Mancha 2.53

Aragon 2.05

Galicia

Castile and León

Murcia 1.82

Cantabria Aragon, Navarre,

Basque Country

La Rioja Asturias 1.34

Extremadura 1.33

Regions with unemployment rates < Spain’s average Cantabria 1.31

Regions with unemployment rates > Spain’s average Navarre 0.78

La Rioja 0.37

(1) Andalusia includes Ceuta and Melilla

29Mortgage covered bonds (Banco Santander S.A.): 1) Description of collateral (3/4)

… where just 33% has a residual life under 10 years…

Residual life by buckets Loan seasoning

54,901

53%

13,396 16%

12% 11% 9%

6,148 3,031

1,365 1,425 1,974

0-1Y 1-2Y 2-3Y 3-4Y 4-5Y 5 - 10 Y 10+ Y Up to ≥ 12 - ≤ 24 ≥ 24 - ≤ 36 ≥ 36 - ≤ 60 ≥ 60 months

12months months months months

30Mortgage covered bonds (Banco Santander S.A.): 1) Description of collateral (4/4)

... and with an adequate loan-to-value

Cover pool portfolio Eligible portfolio1

June 2020 June 2020

LTV (weighted ave.) = 72% LTV (weighted ave.) = 46%

Outstanding by LTV interval (%) 100 Outstanding by LTV interval (%) 100 100

Cumulative (%) 83 Cumulative (%)

77

61

41

33 36

28 29

23 22 17 23

10 12

10 12 -

0-20% 20-40% 40-60% 60-80% >80% 0-20% 20-40% 40-60% 60-80% >80%

(1) Total cover pool portfolio excluding high LTV loans (residential >80% and commercial >60%, without additional guarantees); loans w/o appraised value and non-euro loans; 31

100% developer loans; and othersMortgage covered bonds - 2) Description of bonds

Average maturity of 6 years due to low issuance activity in recent years

Distribution by maturity Maturity profile

EUR million, June 2020 EUR million, June 2020

2020;

1,290

2021;

7,800

6,850

>2026;

17,634

2022;

7,700 4,000 10,784

6,500

1,425

1,000 1,011

- 3,700

- 2,000 2,239 2,475

1,290 1,300 1,125

2023;

2026; 2024; 1,125

2020 2021 2022 2023 2024 2025 2026 >2026

3,900 2025; In the market Retained

3,000

3,250

Average maturity: 6 years 100% issued in euros

32Index

1 2 3 4 5

Spanish Santander Santander Mortgage Appendix

macroeconomic Business Spain – Main Covered

environment Model & figures Bonds

Strategy

33Appendix – Spanish CH market: Volumes

Spain. Covered bonds outstanding (EUR mn) Spain. Covered bonds issuance (EUR mn)

34Appendix – Spanish CH market: Volumes

Spain. Covered bonds outstanding (EUR mn)

35Appendix – Spanish CH market: Volumes

Spain. Covered bonds issuance (EUR mn)

36Thank You. Our purpose is to help people and businesses prosper. Our culture is based on believing that everything we do should be:

You can also read