Asian Equities Asset Allocation - Q4 October to December 2020 - Marlborough Fund Managers

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Q4 October to December 2020

Asian Equities Asset Allocation

For Professional Clients Only. Not for distribution to or to be relied upon by retail clients. Information contained in this

document does not constitute an advertisement and must not be passed on to third parties or otherwise made public.

COVID Update

With rolling lockdowns now scouring Western economies and every news article devoted to it, we would like

to highlight just a few points by way of update:

• The UK is absolutely not representative of the course or impact of the virus globally. With poorly recorded

cases, deaths and recoveries, its statistical prowess is now a laughing-stock and should be disregarded

when attempting to compare with global stats.

• The mortality rate has stabilised for countries with good access to good healthcare at under 2%.

• Countries which controlled the virus early show slightly higher cumulative mortality rates, probably because

less was understood about how to treat the disease in Q1.

• Across all of Asia, despite having pioneered knowledge discovery about the disease, the total cumulative

number of officially recorded COVID deaths represent fewer than 5 single days’ normal mortality.

• Over 250 vaccines are now under development globally, increasing the chances of a credible, scalable one

being found soon – maybe even, as politicians are suggesting, by year end.

Asian Asset Allocation Summary

Asian countries continued to see economic recovery their exposure to smartphones is more pronounced

throughout the summer from their lows in Q1, with than to PC’s or Work from Home (WFH) equipment

the strongest reported numbers coming from Taiwan than Taiwan’s. Hong Kong continues to suffer from

(beneficiary of the tech boom) and China. It is notable, a perfect storm, as a second wave of COVID-19

however, that with the exception of Taiwan, the exacerbated tensions surrounding the introduction

countries whose data normally corroborate China’s of a draconian new Security Law. Elsewhere, there

official data (Korea, Vietnam and Hong Kong) all are some signs of economic fade, after initial pent-

remained in contractionary mode. Global trade up demand was fulfilled and evidence of corporate

remains weak, but for each of Vietnam and Korea, COVID-fatigue is growing everywhere.

Manufacturing PMI Services

Source: Marlborough Fund Managers

Disclaimer: The stocks and ideas mentioned in this report should not be construed as a recommendation to buy or sell

anything. This document is intended only as an illustration of the investment themes likely to prevail in Asia over the coming

months and is based on our views at the time of writing. Opinions expressed are subject to change without notice and do

not take into account the particular investment objectives, financial situations or needs of individual investors.

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 1Along with their economies, Asian stock markets indeed all of us), however, it seems prudent to remain

appear to be pausing at present, with earnings underweight until then, adding only to the most

revisions running into resistance, but we only expect egregiously oversold stocks.

a temporary pause. Uncertainty surrounding the

India, as ever, stands apart from the rest of Asia.

US election, timing of potential vaccines and Brexit

Its handling of COVID has been erratic and

are uppermost. The world is waiting for the results

capricious, with astonishingly harsh lockdowns

of the US election and in China, the 5th Plenum

imposed at just hours’ notice and self-created

of the Communist Party is about to meet, setting

shortages of food driving inflation. However, Prime

its agenda for the next five years. The 14th 5 Year

Minister Modi’s style is to create reform via a string

Plan (145YP) is to promote the concept of “Dual

of sudden and unexpected hardships and this time

Circulation”, which will tip the balance of economic

appears no different, as he uses the pandemic to

drivers to the domestic economy, whilst seeing the

push through a series of farm bills which will reform

external economy as a linked, but separate and

the country’s supply chain and possibly pave the

lesser entity. Investors should pay particular attention

way for modern retail to take hold. If successful, the

to the speeches on China Standards 2035 as well.

moves could improve profitability for the country’s

Diplomatically, China herself appears beset by dark

businesses substantially.

clouds on every front at present (albeit that many are

of her own making), but the economy has returned Looking forward into 2021, we believe that we will

to normality far faster than anyone expected. see a world with COVID under control – either

Whether these levels of activity can be sustained through the availability of vaccines, or better

through the coming winter as many international treatments, or just that we all learn to live with it –

trade partners deal with rolling waves of COVID will and with that backdrop, we anticipate a continued

have to be seen, but the coming quarter promises recovery in the global economy.

a raft of high profile Initial Public Offerings (IPO’s)

Market valuations are high on average, but

in all China’s many and proliferating stock markets.

dramatically polarised internally, with concentrated

Of these, the highest profile will be the Ant Financial

leadership. Companies all across the world are

twin listings, which are set to value the company

cutting capex and costs now, so we expect those

at US$250bn at the start of trading and it is a

which survive to do so with better margins and for

near certainty that patriotic investors will push that

this tighter capacity to squeeze prices upwards off

valuation to exceed JP Morgan’s $290bn market cap

ultra-low bases in 2020.

and take the number one slot in global financials.

So, with the inexorable rise of Chinese stock markets By year end, China’s new 5 year plan will be clear;

within the region set to continue, what next for the the US election winner will be known and Brexit will

rest of the region? either have a deal or not (we think some kind of deal

is most likely). With so many vaccines in development,

In ASEAN, economies are also recovering, albeit

it also looks likely that the fear of COVID may recede,

somewhat more tentatively than China. ASEAN needs

leaving the world free to look ahead. That scenario

tourism and an improvement in oil, gas and palm

looks likely to generate a strong rotation away from

oil prices to sustain its recovery. We believe that

tech (although we do feel that demand for back-up

it will get all three of these, but possibly not until

WFH infrastructure will be retained) and North Asian

2021. Unless there is a credible, globally available,

markets, back towards the tourist destinations, leisure

affordable vaccine developed and circulated before

and services which are suffering so badly now. The

the October start of ASEAN’s 2020 tourist peak

end of 2020’s horrors may be in sight, but before we

season, which we think highly unlikely, it looks as

get to this happy recovery, a bumpy winter lies ahead.

if at least Q4 2020 will be lost. However, in the

rush to China and the tech-heavy markets of the

North, investors seem to have forgotten that ASEAN

has a huge and (with the exception of Thailand

and Singapore), very youthful population (>625m

people, with an average age of just 28). Many of the

countries are home to 50-100m+ people and have

sufficient domestic demand to sustain their own

growth. The region, along with Japan and Korea,

is pushing hard to get the giant RCEP trade treaty

signed before year end and if this can be achieved,

it will catalyse trade between nations accountable

for 45% of the world’s population, creating around

a third of global GDP and 40% of global trade. 2021

should prove a much better year for ASEAN (and

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 2Regional Market Valuations

Source: Bloomberg

Marlborough Asset Allocation Preference

MORE BULLISH PREFERENCE LESS BULLISH

5 4 3 2 1

India Taiwan China

Indonesia Philippines Malaysia

Korea Singapore Thailand

Source: Marlborough Fund Managers.

Regional Fund Flows

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 3Performance Across Asia

Source: MSCI, Morgn Stanley Research. Past performance is no guarantee of future results.

In the second section of our extracts from our quarterly asset allocation reports, we have chosen to highlight

Korea, where we might be seeing the start of a new cycle emerging now.

Korean Economics

S. Korean Economic Indicators

The Korean economy appears to be improving a little quarantine for 14 days after arrival. We do expect

from the lows seen in April to May, but remains weak tourism to return to Korea, but international visitors

on most measures. Trade remains tough, with so look unlikely to arrive in any numbers before Spring.

many trading partners under rolling lockdowns, but is

There has been better news this year from the

unequivocally better than it was; industrial production

shipyards, where Qatar has placed the largest order

and fixed capital formation appear to be softening

for LNG tankers in history, placing an order so large

again and consumer confidence is continuing to

that it will be split between China and Korea and will

reflect the recent rise in unemployment. Despite this

fill the capacity of all the Korean yards together. On

and the undoubtedly poor consumer sentiment,

top of this Mozambique has also signed a massive

Quarter on Quarter Personal consumption data show

order for more LNG tankers to satisfy Asia’s demand

that private sector reaction to the current crisis maybe

for greener fuel than coal over the coming decade.

looks closer to the short, sharp shock to sentiment

Our discussions with the Korean shipyards have shown

seen in the GFC, rather than the protracted shock of

that they anticipate finalising the paperwork in Q4 this

2003-5 post SARS. Korean industry is showing some

year and then expect to start hiring additional staff

signs of rebounding, albeit not yet healthy.

en masse from Q1 2021, with the principal additional

Domestic tourism is restarting, but remains manpower requirement coming in 2022. So, whilst

exceptionally nascent and there are still practically exceptionally good news for Korea, there is still a

no international arrivals, because all visitors must hiatus to fill between now and then.

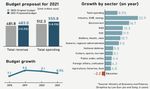

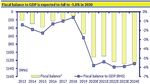

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 4Fiscal Balance Budget

Source: Ministry of Economy and Finance Source: Ministry of Economy and Finance

Faced with this sector-wide weakness, President Moon’s dramatically this year and contrary to current financial

government has renewed its efforts to stimulate the law in Korea, the fund will provide guaranteed

economy. The newly announced budget for 2021 minimum returns and will cover any losses up to 35%

has been set at W555trn, up 8.5% from the original made investing in the fund, encouraging investors in

2020 budget of W512trn, which was up 9% on the the stocks now to sell and buy the guaranteed version

previous year and later increased to W546trn by three instead. In addition to the New Deal Fund, there will

supplementary budgets. The new budget will be funded also be a New Deal Infrastructure Fund, which will

by W90trillion of debt, extending new expected fiscal primarily invest in infrastructure related to big data,

deficit for 2020-21 to between 5.5 and 6% of GDP. digitalization, and green energy. Investors into this

fund will have tax incentive of having to pay lower

Almost every sector of the economy will receive

dividend tax of 9% rather than the original 14% and

enhanced spending (even including reunification

lastly, there will be a Private Sector New Deal Fund.

efforts), but the most recent stimulus – the New Deal

– may prove the most controversial. “The New Deal” The KRX simultaneously announced the launch of five

will pour W160trn into three areas: the Digital New new indices in the BBIG space, promoting these high

Deal - new industries in the BBIG sectors (Batteries, flying “new deal” beneficiaries. The main new index

Bio, Internet and Gaming); the Green Economy; and called “K-New Deal Index” is an equally weighted

further personal income support. index comprised of just 12 stocks under the four

categories in BBIG, which are LG Chem, Samsung SDI,

As it does so, this package will create a new

SK Innovation for battery, Samsung Biologics, Celltrion,

investment fund to channel monies into a limited

SK Biopharm for bio, Naver, Kakao, Douzone Bizon,

number of beneficiary stocks, chosen by the

NCSoft, Netmarble and Pearl Abyss.

government, which will champion the BBIG sectors

(Battery, Bio, Internet and Games). Financing is Stock in the basket have fallen heavily since the

expected to be financed by the State (W3trn), the announcement as retail investors switch horses and

State Banks (W4trn from KDB and EXIM Bank), private institutional investors worry about private investment

financial institutions and private investors (W13trn in funds being crowded out by this move and businesses

total from the private sector). These industries are with no obvious New Deal aspect losing access to

expected to create 1.9m new jobs in the coming capital. The deal also hopes to divert capital from

five years. The fund is exceptionally controversial, money market funds as well, by promising returns in

as the stocks suggested have already appreciated excess of both cash and government bonds.

Total Budget Performance

Source: Ministry of Economy and Finance Source: Bloomberg

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 5South Korea CPI YoY

Source: Bloomberg

In keeping with the ultra-loose fiscal conditions, the Semiconductors lead that export data, with chips for

Bank of Korea continues to keep rates low. Inflation Huawei a key element within the list. Huawei accounts

has shown a slight upward shift in response to rising for some 10% of Hynix’ revenue and the company

food prices in August, partly due to a low base effect is a top ten customer for Samsung Electronics. It is

and partly as Mid-Autumn festival approaches, but clearly intended that this new regime should force

remains in highly manageable territory at present. US companies to switch from Korean chips to those

made by Micron (which in many cases is not possible),

We do not expect the BoK to take action on this,

but despite Apple’s purchases from Korea, the US

however. The Won has been appreciating sharply

has become a small market for semiconductors

against the USD, making key exports of items like

for Korean makers, taking just $4.2bn of Korea’s

semiconductors, which are typically sold in USD, less

semiconductor exports against China’s $22.4bn. The

profitable, but the exchange rate against the Rmb

two companies halted their sales to Huawei on 15th

– by far the most important trading partner now –

September, with Samsung and LG also cutting sales

remains stable.

of panels. Samsung was quick to sign a US$6bn

Prior to the COVID pandemic, President Trump’s policy order with Verizon for 5G equipment in its place

to reduce the trade deficit with S Korea appeared to be and another with Qualcomm and the company

gradually having some effect, with the US increasing also stands to gain from the increasing antagonism

its exports to Korea, rather than seeing a major cut in India towards China, but this is likely to cause

in Korean exports to the US. However, the policy has increasing friction between the US and Korea over the

also had the perhaps unintended consequence of coming months. At this stage, it is hoped that the US

increasing the trade between the US’ closest ally in the will relax its attitude towards China, or at least to its

Pacific arena with China, whose trade with Korea now allies’ relations with China, post the election, but there

amounts to double that between the US and the RoK. is no certainty of this.

Exchange Rates US Trade Deficit with South Korea

Source: Bloomberg Source: US Bureau of Statistics

ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 6Trading Partners Source: Bloomberg In the corporate world, recent earnings from Korean The Korean economy appears to have passed its nadir companies have remained mixed. However, the majority and we are optimistic that 2021 should see strong of companies did report Q2 earnings slightly better growth as the impact of all the stimulus packages than analysts’ expectations and, in what might be a start to hit just as the natural cycle in LNG tankers also glimmer of hope for industrial activity in the country, the improves. Q4 2020 may be too early to jump onto that whole utility sector saw better revenue than expected. trend, but it feels as if the worst has passed in Korea. Risk warnings Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting funds. Our funds invest for the long-term and may not be appropriate for investors who plan to take money out within five years. Tax treatment depends on individual circumstances and may change in the future. The fund will be exposed to stock markets. Stock market prices can move irrationally and be affected unpredictably by diverse factors, including political and economic events. The fund will invest in shares in emerging markets which can be more volatile than more developed markets. Changes in exchange rates may affect the value of your investment. In certain market conditions some assets in the fund may be less liquid and therefore more difficult to sell at their true value or in a timely manner. Regulatory Information This material is for distribution to professional clients only and should not be distributed to or relied upon by any other persons. It’s provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. The Key Investor Information Documents and the Prospectuses for all funds are available, in English, free of charge and can be obtained directly using the contact details in this document. They can also be downloaded from www.marlboroughfunds.com. An investor must always read these before investing. Information taken from trade and other sources is believed to be reliable, although we don’t represent this as accurate or complete and it shouldn’t be relied upon as such. Calls may be recorded for training and monitoring purposes. Issued by Marlborough Fund Managers Ltd, authorised and regulated by the Financial Conduct Authority (reference number 141660). Registered office: Marlborough House, 59 Chorley New Road, Bolton, BL1 4QP. Registered in England No. 02061177. Marlborough House, 59 Chorley New Road, Bolton, BL1 4QP Intermediary Support: 0808 145 2502 Email: enquiries@marlboroughfunds.com Website: www.marlboroughfunds.com ASIAN EQUITIES ASSET ALLOCATION Q4 SEPTEMBER TO DECEMBER 2020 7

You can also read