All Weather Equity (AWE) - IIFL

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

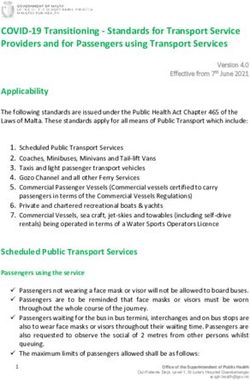

All Weather Equity (AWE)

What is All Weather Equity (AWE)

Make up to Without equity

Truly All Weather

50% return downside risk

*AWE gives 50% **Your Capital is ***Over last 10 years,

absolute return if protected in case Nifty AWE has given 50%

Nifty gives 7.5% falls after 3 Years return more than 90%

absolute return over 3 times

years

What you buy: Market Linked Debenture

issued by Edelweiss Finvest Pvt Ltd (EFPL), 100% subsidiary of Edelweiss Group

*50% absolute return is payable on the face value (1,00,000/- per Debenture) and not on the Issue Price, thus absolute return on investment may be lesser

**Capital is defined as the Face Value of the debenture, i.e. 1,00,000/- per debenture. Capital protection as well as returns are subject to the credit risk of Issuer.

***Based on backtested data from 21-Jul-08 till 20-Jul-18 assuming daily investment, covering 1827 observations. Backtesting is not indicative of future returns.

- This is not an offer document and does not constitute an offer for subscription 2AWE – Return Scenarios

Scenario 1 – Market Rallies Scenario 2 – Market Tanks

Nifty Level Nifty Return AWE Return Nifty Level Nifty Return AWE Return

17,515 50% 50%

**11,677 Start

Level

0% 0%

14,012 20% 50%

10,509 -10% 0%

~6.7x of Nifty Return

*Capital Protected

12,553 7.5% ***50%

9,341 -20% 0%

12,261 5.0% 33.3%

5,838 -50% 0%

11,969 2.5% 16.7%

**11,677 Entry 0.0% 0.0% 2,919 -75% 0%

Level

* Capital is defined as the Face Value of the debenture, i.e. 1,00,000/- per debenture

** Entry level will be the avg of Nifty close on 30-Aug-18 & 27-Sep-18. Nifty closed at 11677 on 30-Aug-18. Entry level may vary and will be fixed post 27-Sep-18.

***50% absolute return is payable on the face value (1,00,000/- per Debenture) and not on the Issue Price, thus absolute return on investment may be lesser 3

- All the above returns are Pre-Tax, Post-cost.90% times AWE has delivered 50% return

Nifty 50 3 Year Rolling Returns

80% 90% of the times AWE has

given Max Return 0f 50%

60%

Source: NSE Nifty Closing Prices

40%

Backtesting Results

20%

0%

-20%

2012 2013 2014 2015 2016 2017 2018

Nifty Performance AWE Perfomance

3 Year Rolling Return (abs.) Nifty 50 AWE

Total Observations 1827 1827

Average Return 32% 47%

Nifty Return Scenarios % Times Avg. Return Avg. Return

Below 0% 4% -3% 0%

0% to 7.5% 6% 5% 32%

7.5% to 50% 70% 25% 50%

Above 50% 20% 66% 50%

• Based on backtested data from 21-Jul-08 till 20-Jul-18 assuming daily investment, covering 1827 observations 4

• Backtesting is not indicative of future returnsAT P/E of 20X or More Nifty Delivers only 11% Returns

*Current Nifty P/E – 23-24X and historically Nifty 50 has delivered only ~11% absolute at P/E>20X where as AWE

would deliver 39% returns

Do note that this is for back testing and not returns.

NIFTY Avg. 3 Yr. AWE 3 Yr. Avg.

Analysis Condition

Returns Returns

Source: NSE Closing Prices

Nifty P/E > 20 11% 39%

Valuations

Different

Entry at

Nifty P/E 15-20 31% 50%

Nifty P/ERisk Factors

1 Credit Risk

✓ Repayment of principal as well as the returns

are subject to the credit risk of the Issuer

✓ In the event the Issuer is insolvent or goes

bankrupt, the investor may stand to lose the

entire invested capital.

2 Liquidity Risk

✓ MLDs are issued for a fixed tenor with no

interim exit options for the investor built in.

✓ While the MLDs are listed, there is no

assurance that liquidity will be available on

the same if there are no active buyers and

sellers.

3 Interest Rate Risk

✓ Rise and fall in the interest rates influence

the valuation of the investment, thus

resulting in loss during the tenor of the

investment.

• For detailed information about the risks mentioned above and other risks, please refer to the offer document. 6

• Investors should consult their financial advisors and read the offer document before investing.Why Should You Invest

• Upcoming General Elections 2019

Domestic Risks • High Market Valuations

• Slipping Fiscal Deficit

• Rising Interest Rates & Crude Oil

Foreign Risks • Trade wars

• Investors with large cap investments

Who should • Sell existing holdings and lock in profits

invest • Invest into AWE to keep profits safe and still

participate into equity market upside

7Key Terms

OFFERING All Weather Equity

PRODUCT TYPE Market Linked Debenture

ISSUER Edelweiss Finvest Pvt Ltd – (EFPL), 100% subsidiary of Edelweiss Group

CREDIT RATING CRISIL/ICRA PP-MLD-AA

SECURED Yes, with 1x collateral placed with SBI Trustee

LISTING Listed on BSE WDM Segment

FACE VALUE PER DEBENTURE INR 100,000/- per debenture

CAPITAL GUARANTEE 100% Capital (*Face Value) is protected at maturity

TENOR ~41 Months – 03-Mar-2022

Average of Official Closing Level of Nifty 50 on 30-Aug-2018 and Subsequent

ENTRY LEVEL

Month F&O Expiry on NSE

Average of Official Closing Level of Nifty 50 on NSE F&O Expiry from 31st to 36th

EXIT LEVEL

Month

*Face Value is 100000/- Per Debenture.

8

This is not an offer document. Please see the offer document for exact details.Disclaimer

This document has been prepared by (“Edelweiss”) and is strictly confidential and is intended for the use by recipient only and may not be circulated,

redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Edelweiss. Receipt and review of

this document constitutes your agreement not to circulate, redistribute, retransmit or disclose to others the contents, opinions, conclusion, or information

contained herein.

In the preparation of the material contained in this document, Edelweiss has used information that is publicly available, including information developed in-

house. Information gathered & material used in this document is believed to be from reliable sources and is given in good faith. Edelweiss however does not

warrant the accuracy, reasonableness and/or completeness of any information. For data reference to any third party in this material no such party will assume

any liability for the same.

Edelweiss and/or any affiliate of Edelweiss does not in any way through this material solicit any offer for purchase, sale of any financial products or any financial

instrument dealt in this material. All recipients of this material should before dealing and or transacting in any of the products referred to in this material make

their own investigation and seek appropriate professional advice. The investments discussed in this material may not be suitable for all investors. This document

does not disclose all the risks and other significant issues related to an investment in the financial instruments / products discussed herein. Any person

subscribing to any product/financial instruments should do so on the basis of and after verifying the legal, accounting and tax implications attached to such

product/financial instrument. Edelweiss does not in any manner advise on the tax implications on such debentures.

Edelweiss (including its affiliates) and any of its officers, directors, personnel and employees, shall not be liable for any loss, damage of any nature, including but

not limited to direct, indirect, punitive, special, exemplary, and consequential, as also any loss of profit in any way arising from the use of this material in any

manner. The recipient alone shall be fully responsible/are liable for any decision taken on the basis of this material.

Financial products and instruments are subject to credit risk of the Issuer, and yields may also fluctuate depending on various factors affecting debt markets.

Please note that past performance of financial products and instruments does not necessarily indicate the future prospects and performance thereof. By their

nature, certain risk disclosures are only estimates and could be materially different from what actually occurs in the future. As a result, actual future gains or

losses could materially differ from those that have been estimated. Any data on past performance, modeling or back-testing contained herein is no indication as

to future performance.

Edelweiss (including its affiliates) or its officers, directors, personnel and employees, including persons involved in the preparation or issuance of this material

may; (a) from time to time, have long or short positions in, and buy or sell the securities mentioned herein or (b) be engaged in any other transaction involving

such securities and earn brokerage or other compensation in the financial instruments/products discussed herein or act as advisor or lender/borrower in respect

of such securities/financial instruments/products or have other potential conflict of interest with respect to any recommendation and related information and

opinions. The said persons may have acted upon and/or in a manner contradictory with the information contained here. The information contained in this

document is of the date hereof and is subject to change.

9You can also read