2023 THE FORGOTTEN LENDER: THE ROLE OF MULTILATERAL LENDERS IN SOVEREIGN DEBT AND DEFAULT

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

THE FORGOTTEN LENDER: THE ROLE OF MULTILATERAL LENDERS IN 2023 SOVEREIGN DEBT AND DEFAULT Documentos de Trabajo N.º 2301 María Bru Muñoz

THE FORGOTTEN LENDER: THE ROLE OF MULTILATERAL LENDERS IN SOVEREIGN DEBT AND DEFAULT

THE FORGOTTEN LENDER: THE ROLE OF MULTILATERAL LENDERS IN SOVEREIGN DEBT AND DEFAULT María Bru Muñoz (*) BANCO DE ESPAÑA (*) Banco de España, calle de Alcalá, 48, 28014, Madrid, Spain; e-mail address: maria.bru@bde.es. I would like to thank Hernán D. Seoane, Carlos Pérez Montes, Almuth Scholl, Marija Vukotic, Beatriz de Blas, Andrés Erosa, Emircan Yurdagul, and seminar participants at Universidad Carlos III de Madrid and Banco de España for valuable comments and suggestions. https://doi.org/10.53479/25026 Documentos de Trabajo. N.º 2301 January 2023

The Working Paper Series seeks to disseminate original research in economics and finance. All papers have been anonymously refereed. By publishing these papers, the Banco de España aims to contribute to economic analysis and, in particular, to knowledge of the Spanish economy and its international environment. The opinions and analyses in the Working Paper Series are the responsibility of the authors and, therefore, do not necessarily coincide with those of the Banco de España or the Eurosystem. The Banco de España disseminates its main reports and most of its publications via the Internet at the following website: http://www.bde.es. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. © BANCO DE ESPAÑA, Madrid, 2023 ISSN: 1579-8666 (on line)

Abstract The role of multilateral lenders in sovereign default has been traditionally overlooked by the literature. However, these creditors represent a significant share of lending to emerging markets and feature very distinct characteristics, such as lower interest rates and seniority. By including these creditors in a traditional DSGE model of sovereign default, I reproduce the high debt levels found in the data while maintaining default probabilities within realistic values. Additionally, I am able to analyze the role of multilateral debt in emerging economies. Multilateral loans complement private financing and reduce the incompleteness of international financial markets. Also, multilateral funding acts as an insurance mechanism in bad times, providing countries with some degree of consumption smoothing, opposite to the role of front-loading consumption fulfilled by private financing. Keywords: sovereign debt and default, IFIs, multilateral institutions, seniority, consumption smoothing, emerging markets. JEL classification: F34, F35, G15.

Resumen Tradicionalmente, la literatura sobre default soberano ha pasado por alto el papel de los prestamistas multilaterales. Sin embargo, estos acreedores suponen un porcentaje significativo de los préstamos a los países emergentes y presentan una serie de características que los hacen muy diferentes, como tasas de interés más bajas o ser acreedores preferentes, entre otras. Al incluir a estos prestamistas en un modelo de equilibrio general dinámico estocástico tradicional de default soberano, puedo reproducir los altos niveles de deuda encontrados en los datos y mantener las probabilidades de default dentro de valores realistas. Además, analizo el papel de la deuda multilateral en las economías emergentes. Los préstamos multilaterales complementan la financiación privada y reducen la falta de completitud de los mercados financieros internacionales. Asimismo, la financiación multilateral actúa como un mecanismo de seguro en tiempos difíciles, lo que brinda a los países un cierto grado de suavización del consumo, en contraposición al papel de anticipación del consumo que cumple el financiamiento privado. Palabras clave: deuda y default soberanos, instituciones financieras internacionales, instituciones multilaterales, orden de prelación de pago, suavización del consumo, mercados emergentes. Códigos JEL: F34, F35, G15.

1 Introduction

1 Introduction

The presence of heterogeneous lenders in sovereign borrowing and default, and partic-

The presence of heterogeneous lenders in sovereign borrowing and default, and partic-

ularly, the role of multilateral institutions, has been generally overlooked by sovereign

ularly, the role of multilateral institutions, has been generally overlooked by sovereign

default models. Nevertheless, official lenders,1 which comprise bilateral and multilateral

default models. Nevertheless, official lenders,1 which comprise bilateral and multilateral

creditors, are the main source of funding for developing economies. These lenders tend

creditors, are the main source of funding for developing economies. These lenders tend

to offer loans at lower interest rates and higher maturities than private lenders, which

to offer loans at lower interest rates and higher maturities than private lenders, which

are mainly banks and bondholders. In spite of the importance of official lenders in gen-

are mainly banks and bondholders. In spite of the importance of official lenders in gen-

eral, and multilateral lenders in particular, the sovereign default literature on non-private

eral, and multilateral lenders in particular, the sovereign default literature on non-private

creditors has primarily focused on the International Monetary Fund (IMF). This may be

creditors has primarily focused on the International Monetary Fund (IMF). This may be

related to the role of the IMF as a bailout agency, together with the conditionality as-

related to the role of the IMF as a bailout agency, together with the conditionality as-

sociated to its loans, and this predominance has occurred despite the relatively small

sociated to its loans, and this predominance has occurred despite the relatively small

share that IMF debt represents in total lending2 (see Table 1). In fact, most papers that

share that IMF debt represents in total lending2 (see Table 1). In fact, most papers that

approach non-private lending do so from the bailout perspective, not considering the

approach non-private lending do so from the bailout perspective, not considering the

overall effect that official financing has on borrowing and default. However, in developing

overall effect that official financing has on borrowing and default. However, in developing

countries, official loans —bilateral and multilateral— are used not only in severe crises,

countries, official loans —bilateral and multilateral— are used not only in severe crises,

but also as part of their regular funding.

but also as part of their regular funding.

Multilateral development banks (MDBs), which include the World Bank and other

Multilateral development banks (MDBs), which include the World Bank and other

regional development banks such as the European Investment Bank (EIB) or the Inter-

regional development banks such as the European Investment Bank (EIB) or the Inter-

American Development Bank (IADB), are a significant source of funding for developing

American Development Bank (IADB), are a significant source of funding for developing

economies. In general, these institutions aim at promoting economic development and

economies. In general, these institutions aim at promoting economic development and

social progress through the funding of projects in areas such as infrastructure, education,

social progress through the funding of projects in areas such as infrastructure, education,

health, etc., and also through budget support, mainly in low and middle-income coun-

health, etc., and also through budget support, mainly in low and middle-income coun-

tries.3

tries.3

Multilateral lenders feature very distinct characteristics: they generally impose no

Multilateral lenders feature very distinct characteristics: they generally impose no

conditionality; they keep financing countries after they default to private lenders, i.e.

1

Official financing, according to International Debt Statistics database (IDS) by the World Bank

they do not impose financial exclusion after a default to private lenders; they are the

are 1“loans from international organizations (multilateral loans) and loans from governments (bilateral

Official financing, according to International Debt Statistics database (IDS) by the World Bank

loans)”

are “loans

only2 senior from international

creditors organizations

together with the (multilateral

IMF; andloans) theyand loans

offer frominterest

lower governments (bilateral

rates. 4

Ad-

Considering as total lending the sum of total public and publicly guaranteed debt and use of IMF

loans)”

2 as defined in IDS.

credit

ditionally, multilateral

Considering lenders

as total lending theare

sumusually

of total repaid in full

public and afterguaranteed

publicly they experience

debt and ausedefault,

of IMF

3

creditAccording

as definedtoinIDS,

IDS. multilateral loans include “loans and credits from the World Bank, regional

being

3 this type

development

According to of

banks, default,

and

IDS, other indeed, an include

multilateral

multilateral loans infrequent event.

and intergovernmental

“loans Then, whatthe

agencies.

and credits from areWorld

the consequences

Excluded are loans

Bank, from

regional

funds administered

development banks, by another

and international organization

multilateral on behalf of a agencies.

and intergovernmental single donor government;

Excluded thesefrom

are loans are

of a cheap

classified

funds and senior

as loans

administered from flow of fundsorganization

governments.”

by an international on intereston rate spreads,

behalf debtdonor

of a single levelsgovernment;

and default prob-

these are

classified as loans from governments.”

abilities? How do private creditors react to the fact that multilateral creditors will be

2

repaid

7 first in case of default?

BANCO DE ESPAÑA DOCUMENTO DE TRABAJO N.º 2301 2

In order to analyze this issue, I develop a DSGE model of sovereign default with twoconditionality; they keep financing countries after they default to private lenders, i.e.

they do not impose financial exclusion after a default to private lenders; they are the

conditionality; they keep

only senior creditors financing

together countries

with the afterthey

IMF; and theyoffer

default to interest

lower private rates.

lenders,

4 i.e.

Ad-

they do not

ditionally, impose financial

multilateral lendersexclusion after

are usually a default

repaid in full to private

after they lenders; they

experience are the

a default,

only

beingsenior creditors

this type together

of default, withanthe

indeed, IMF; and

infrequent theyThen,

event. offer what

lower are

interest rates.4 Ad-

the consequences

ditionally, multilateral

of a cheap and lenders

senior flow are usually

of funds repaid

on interest rateinspreads,

full after they

debt experience

levels a default,

and default prob-

being this How

abilities? type of

do default,

private indeed, anreact

creditors infrequent

to theevent. Then,

fact that what are the

multilateral consequences

creditors will be

of a cheap

repaid firstand senior

in case of flow of funds on interest rate spreads, debt levels and default prob-

default?

abilities? How do private creditors react to the fact that multilateral creditors will be

repaid first in

In order to case of default?

analyze this issue, I develop a DSGE model of sovereign default with two

different lenders from which countries may borrow simultaneously: private lenders and

In order to

multilateral analyze this

institutions. issue,

The I developlender

multilateral a DSGE modelthe

features of sovereign defaultcharacter-

aforementioned with two

different lenders

istics, that from which

is, seniority, lowercountries may borrow

interest rates, simultaneously:

no conditionality, lack ofprivate lenders

financial and

exclusion

multilateral institutions.

after a private default andThe multilateralafter

full repayment lender features

a default to the aforementioned

multilateral character-

institutions them-

istics,

selves. that

To is,

theseniority,

best of mylower interest rates,

knowledge, no conditionality,

a lender that combineslack of characteristics

these financial exclusion

has

after a private

not been fully default and in

portrayed fullDSGE

repayment after default

sovereign a defaultmodels.

to multilateral

Some ofinstitutions them-

these attributes

selves. To included

have been the best in

of sovereign

my knowledge,

defaultamodels

lender that

that feature

combines

an these

officialcharacteristics has

lender that offers

not beenloans,

bailout fully typically

portrayedwith

in DSGE sovereignHowever,

conditionality. default models.

all theseSome of these

elements haveattributes

not been

have been together

portrayed included within

in sovereign default

a lender that models that creditor

is a regular feature an official

of the lender that offers

country.

bailout loans, typically with conditionality. However, all these elements have not been

portrayed together within

By introducing a lender lender

a multilateral that is with

a regular

the creditor of the country.

aforementioned characteristics, the

model is able to generate high levels of public debt, 50 percent in the benchmark model

By introducing

—similar to what is afound

multilateral lenderwith

in the data—, withvery

the reasonable

aforementioned characteristics,

levels of the

default, and with

model is able

a degree to generate

of patience that high levelsthan

is higher of public

many debt, 50 this

used in percent in the

strand benchmark

of the literaturemodel

and,

—similar

therefore, to whattoisthe

closer found in the data—,

microeconomic with very

evidence. reasonable levels

Furthermore, of default, and

the combination with

between

aseniority

degree of

andpatience

recoverythat is that

rates higher than many

I develop used

in this in this

model strand

gives rise toofathe literature

novel and,

private debt

therefore, closerwhich

price function, to theismicroeconomic

an important evidence.

difference Furthermore,

with respect the combination

to the between

existing literature

seniority and recovery

and a contribution to rates thatthanks

it. Also, I develop in this

to this modelI gives

setting, rise to

am able to disentangle

a novel private

the debt

role

price function, lending

of multilateral which isvis-à-vis

an important

privatedifference

financing,with respect

which to theimportant

is another existing literature

contribu-

and

tion aofcontribution

this article. toMultilateral

it. Also, thanks to acts

funding this setting, I am ablemechanism

as an insurance to disentangle the role

for countries

of

andmultilateral lending vis-à-vis private

fulfills a consumption-smoothing financing,

role which

—opposite is another

to the important

front-loading contribu-

use of private

tion4 Also,

funds—.of this

As article. Multilateral

a result,loans

multilateral multilateral funding

lending

tend to offer

acts as an complement

longer becomes

insurance

maturities,abut

mechanism

to private

I abstract from

for countries

financing.

this dimension in this

paper.

and fulfills a consumption-smoothing role —opposite to the front-loading use of private

1.14 Also,Facts

multilateral loans tend to offer longer maturities,

3 but I abstract from this dimension in this

paper.

In what follows, I will discuss the empirical facts that motivate the inclusion of a lender

8

BANCO DE ESPAÑA DOCUMENTO DE TRABAJO N.º 2301 3

with the aforementioned characteristics in a version of Arellano (2008) sovereign default

model.funds—. As a result, multilateral lending becomes a complement to private financing.

1.1 Facts

funds—. As a result, multilateral lending becomes a complement to private financing.

In what follows, I will discuss the empirical facts that motivate the inclusion of a lender

with the aforementioned characteristics in a version of Arellano (2008) sovereign default

1.1 Facts

model.

In what follows, I will discuss the empirical facts that motivate the inclusion of a lender

withFact

the 1:

aforementioned

Multilateralcharacteristics

lending is onein aofversion of Arellano

the main sources(2008) sovereign

of funding in default

devel-

model.

oping countries. Multilateral loans, which exclude IMF loans, represent a significant

share of total lending, while IMF loans, a typical focus in the literature, account for a

Fact

much 1: modest

more Multilateral

share.5lending is one

Multilateral of the

loans mainfor

account sources

almostof

a funding in devel-

third of total lend-

oping countries.

ing as shown Multilateral

in Table 1 and areloans, which exclude

approximately IMFasloans,

as high represent

bilateral a significant

lending, which is

share of total lending,

the remaining share of while

officialIMF loans,

debt. a typical

In this regard,focus

Horninetthe

al. literature, account6 for

(2021) underscore thata

much more

“During the modest share.5 Multilateral

1970s, multilateral loans

lending first account

overtook for almost

bilateral a third

lending and of

hastotal lend-

remained

ing as shown

dominant sinceinthen”

Table(Horn

1 andetare

al., approximately

2021, p. 11). as high as bilateral lending, which is

the remaining share of official debt. In this regard, Horn et al. (2021) underscore6 that

“During the 1970s, multilateral lending first overtook bilateral lending and has remained

Table 1: Debt by Creditor (%)

dominant since then” (Horn et al., 2021, p. 11).

Lender As Share of Total Debt As Share of GDP

and Use of IMF Credit

Private Debt Table 1: Debt by27.8

Creditor (%) 11.2

Official Debt 66.3 31.9

of which Multilateral Debt As Share of

Lender 32.4

Total Debt As Share 14.3of GDP

IMF Debt and Use of5.9 IMF Credit 2.6

Private Debt 27.8 11.2

Official Debt 66.3 31.9

Multilateral loans are also important in terms of GDP. Indeed multilateral funding

of which Multilateral Debt 32.4 14.3

IMF Debt

represents 5.9

on average 14 percent of GDP in developing 2.6share of GDP

countries, a higher

than bank loans and bonds altogether, which account for roughly 11 percent of GDP, and

wellMultilateral loansshare.

above the IMF are also important in terms of GDP. Indeed multilateral funding

represents on average 14 percent of GDP in developing countries, a higher share of GDP

thanFact

bank2:loans and bonds altogether,

Conditionality which account

is not present in most formultilateral

roughly 11 percent

loans.ofCondition-

GDP, and

5

In this paper I use data that comes mainly from Beers et al. (2020b) for default data, and World

well

ality above

Bank’s the IMFDebt

isInternational

an important share.

element of (IDS)

Statistics IMF loans, but Development

and World it is not necessarily

Indicatorsafor

widespread feature

other economic in-

dicators. Using the aforementioned databases, I create an unbalanced panel of 60 lower-middle and

of multilateral

upper-middle loans.

income Conditionality

countries with data onis defined

sovereignindebt

Babbandand Carruthers

default from 1970 (2008) as “making

to 2015. For more

details on the data used, please see Section A.3.

the65disbursement

Horn

In thisetpaper

al. (2021)of include

I use resources

data that toloans

IMFcomes national

as partgovernments

mainly of multilateral

from contingent

lending

Beers et al. and

(2020b) on the

fordata are performance

default scaled by the

data, and of

US

World

GDP rather

Bank’s than by each

Debtcountry’s GDP.

certainInternational

policies” (Babb Statistics (IDS) and2008,

and Carruthers, Worldp.Development

13) and in Indicators

Koeberlefor andother economic

Malesa in-

(2005)

dicators. Using the aforementioned databases, I create an unbalanced panel of 60 lower-middle and

upper-middle

as “the specific income setcountries with data

of conditions on sovereign

attached debtdisbursement

4to the and default fromof 1970 to 2015. For

policy-based more

lending

details on the data used, please see Section A.3.

6

or budget

Horn et support” (Koeberle

al. (2021) include and Malesa,

IMF loans as part of 2005, p. 6).lending

multilateral Before

and1980 multilateral

data are insti-

scaled by the US

GDP rather than by each country’s GDP.

tutions had almost no loans with conditionality. As explained in Babb and Carruthers

9

(2008),

BANCO DE ESPAÑA 4

before 1980 the World Bank and other

DOCUMENTO DE TRABAJO N.º 2301

multilateral institutions offered almost

only the so-called investment lending, which is typically not associated to conditionality.

After 1980 conditionality was part of some loans, but in a small share of the total mul-Fact 2: Conditionality is not present in most multilateral loans. Condition-

ality is an important element of IMF loans, but it is not necessarily a widespread feature

ality is an important element of IMF loans, but it is not necessarily a widespread feature

of multilateral loans. Conditionality is defined in Babb and Carruthers (2008) as “making

of multilateral loans. Conditionality is defined in Babb and Carruthers (2008) as “making

the disbursement of resources to national governments contingent on the performance of

the disbursement of resources to national governments contingent on the performance of

certain policies” (Babb and Carruthers, 2008, p. 13) and in Koeberle and Malesa (2005)

certain policies” (Babb and Carruthers, 2008, p. 13) and in Koeberle and Malesa (2005)

site“the

as specific

to private set of conditions

creditors. 7

Furthermore, attached to theA.4,

in Section disbursement of policy-based

I estimate financial exclusion lending

from

as “the specific set of conditions attached to the disbursement of policy-based lending

or budget support”

multilateral (Koeberle

lending when a defaultand toMalesa,

private2005, p. 6).

creditors Before

takes place1980

finding multilateral insti-

similar results.

or budget support” (Koeberle and Malesa, 2005, p. 6). Before 1980 multilateral insti-

tutions had almost no loans with conditionality. As explained in Babb and Carruthers

tutions had almost no loans with conditionality. As explained in Babb and Carruthers

(2008),

Factbefore 1980 the World

4: Multilateral creditorsBank areandsenior

other multilateral

lenders as they institutions

enjoy the offered almost

so-called

(2008), before 1980 the World Bank and other multilateral institutions offered almost

only the so-called

preferred creditorinvestment

status. lending,

As shown which is typically

empirically bynot associated

Schlegl et al. to conditionality.

(2019) multilat-

only the so-called investment lending, which is typically not associated to conditionality.

Afterinstitutions

eral 1980 conditionality

and the IMF was areparttheof only

somesenior

loans,creditors,

but in a givensmall their

sharepreferred

of the total mul-

creditor

After 1980 conditionality was part of some loans, but in a small share of the total mul-

tilateralAccording

status. lending. For instance

to Schlegl —and

et al. using

(2019) thethebasisWorld Bank

for their as an example—,

seniority is that it is Koeberle

acknowl-

tilateral lending. For instance —and using the World Bank as an example—, Koeberle

and Malesa

edged by the(2005) show that

main creditor only around

governments and 10-20 percentinstitutions

important of operations and 30 percent

in financial markets, of

and Malesa (2005) show that only around 10-20 percent of operations and 30 percent of

volumes

like from Similarly,

Moody’s. 1980 to 2003 in theand

Cordella World

PowellBank werehighlight

(2021) adjustment thatoperations,

the preferred which may

creditor

volumes from 1980 to 2003 in the World Bank were adjustment operations, which may

involve“is

status conditionality,

not stronglywhile

backed theinhighest share oflaw”(Cordella

international loans was still and thatPowell,

of investment

2021, p. lending.

2). In

involve conditionality, while the highest share of loans was still that of investment lending.

the same vein, Perraudin et al. (2016) highlight that the preferred creditor status is not

Fact 3: Multilateral

a contractual feature, but “a creditors keep lending

market practice to countries

attributable that arefaced

to the incentives in default

by dis-

Fact 3: Multilateral creditors keep lending to countries that are in default

with private

tressed sovereign creditors.

borrowers” The lack of financial

(Perraudin exclusion

et al., 2016, from

p. 9). multilateral

According financing et

to Perraudin after

al.

with private creditors. The lack of financial exclusion from multilateral financing after

defaulting

(2016), thetopreferred

private creditors is key, is

creditor status since

theitresult

casts ofdoubt on onetrying

countries of thetomain avoidassumptions

defaulting

defaulting to private creditors is key, since it casts doubt on one of the main assumptions

of sovereign

to multilateral default models: since

institutions financial

theseexclusion

keep funding(also called financial

countries whenautarky). As a mat-

private lenders do

of sovereign default models: financial exclusion (also called financial autarky). As a mat-

ter ofwhich

not, fact, quantitative sovereign

in turn is in line with thedefault

lack models assume

of financial that countries

exclusion repay their

after a default debts

to private

ter of fact, quantitative sovereign default models assume that countries repay their debts

in order to

lenders. avoid thetheir

Moreover, penalties thatcreditor

preferred a default involves,

status namely to

contributes output

the highlosses and standing

credit financial

in order to avoid the penalties that a default involves, namely output losses and financial

exclusion.

that Financial

multilateral exclusionenjoy,

institutions is usually

as it defined as the by

is also shown inability of obtaining

Perraudin financing

et al. (2016). 8 in

exclusion. Financial exclusion is usually defined as the inability of obtaining financing in

international markets. However, multilateral banks keep offering funds to countries after

international markets. However, multilateral banks keep offering funds to countries after

theyFact

default to private lenders.

5: Multilateral lenders tend to offer lower interest rates than private

they default to private lenders.

creditors. Multilateral lenders tend to offer better financial terms than private cred-

TheInempirical

itors. evidence

this regard, in this

Cordella andregard

Powellincludes

(2021)Levy Yeyatithat

highlight (2009) who shows financial

international that pri-

The empirical evidence in this regard includes Levy Yeyati (2009) who shows that pri-

vate lendingcan

institutions is negatively correlated

“lend limited amounts withatdefault,

close towhile official lending

the risk-free rate under is notmost

significantly

circum-

vate lending is negatively correlated with default, while official lending is not significantly

affected by it. Alsoand

stances”(Cordella Avellán

Powell, et 2021,

al. (2021)

p. 2).findIn empirical

particular,evidence supporting

as explained this lack

in Nelson (2020) of

affected by it. Also Avellán et al. (2021) find empirical evidence supporting this lack of

financial

“Due exclusion,

to the financialsince

backingtheyofshow

their how

member during fiscalgovernments,

country crises, whichthe include

MDBssovereign

are able

financial exclusion, since they show how during fiscal crises, which include sovereign

default,

to borrow multilateral

money in development

world capitalbanks marketsdo not decrease

at the lowesttheir funding

available to countries,

market oppo-

rates, gener-

default, multilateral development banks do not decrease their funding to countries, oppo-

ally the same rates at which developed country governments borrow funds inside their

site to private creditors.7 Furthermore, in Section A.4, I estimate financial exclusion from

own borders. The banks are able to relend this money to their borrowers at much lower

multilateral lending when a default to private creditors takes place finding similar results.

5

5

7

In Bru Muñoz (2022) I also find that official lenders do not impose financial exclusion to countries

thatFactare in 4: Multilateral

default creditors

to private lenders. are senior

Nevertheless, lenders

Flogstad as they

and Nordtveit enjoy

(2014) findthe so-called

the opposite for

concessional official lending.

preferred

8 creditor

Other authors, such status.

as Bolton As

and shown

Jeanne empirically

(2009) suggestby Schlegl

that et may

seniority al. (2019) multilat-

be related to how

difficult it is to renegotiate a given debt. They consider that countries may default on debt that is easier

eral 10 institutions

to renegotiate

BANCO DE ESPAÑA

and the IMF are the only senior creditors, given their preferred creditor

and repay debt that is harder to renegotiate, giving rise to some kind of de facto seniority.

DOCUMENTO DE TRABAJO N.º 2301

status. According to Schlegl et al. (2019) the basis for their seniority is that it is acknowl-

6

edged by the main creditor governments and important institutions in financial markets,multilateral lending when a default to private creditors takes place finding similar results.

Fact 4: Multilateral creditors are senior lenders as they enjoy the so-called

7

site to private

preferred creditors.

creditor Furthermore,

status. As shownin Section A.4, by

empirically I estimate

Schlegl financial exclusion

et al. (2019) from

multilat-

multilateral lending

eral institutions andwhen a default

the IMF to only

are the private creditors

senior takesgiven

creditors, placetheir

finding similarcreditor

preferred results.

site to private creditors.7 Furthermore, in Section A.4, I estimate financial exclusion from

status. According to Schlegl et al. (2019) the basis for their seniority is that it is acknowl-

multilateral lending when a default to private creditors takes place finding similar results.

Fact

edged by 4:

theMultilateral

main creditorcreditors

governmentsareand

senior lenders

important as they enjoy

institutions the so-called

in financial markets,

preferred

like Moody’s. creditor status.

Similarly, Cordella Asand shown

Powellempirically by Schlegl

(2021) highlight thatettheal.preferred

(2019) multilat-

creditor

Fact 4: Multilateral creditors are senior lenders as they enjoy the so-called

eral

statusinstitutions and thebacked

“is not strongly IMF are the only senior

in international creditors, given

law”(Cordella and their

Powell,preferred

2021, p.creditor

2). In

preferred creditor status. As shown empirically by Schlegl et al. (2019) multilat-

status.

the same According to Schlegl

vein, Perraudin et et

al. al. (2019)

(2016) the basis

highlight for the

that theirpreferred

senioritycreditor

is that itstatus

is acknowl-

is not

eral institutions and the IMF are the only senior creditors, given their preferred creditor

edged by the main

a contractual creditor

feature, but “agovernments

market practice and important

attributable institutions in financial

to the incentives facedmarkets,

by dis-

status. According to Schlegl et al. (2019) the basis for their seniority is that it is acknowl-

like Moody’s.

tressed sovereignSimilarly,

borrowers”Cordella and Powell

(Perraudin et al.,(2021)

2016, highlight that thetopreferred

p. 9). According Perraudincreditor

et al.

edged by the main creditor governments and important institutions in financial markets,

status

(2016),“isthenot stronglycreditor

preferred backed status

in international

is the resultlaw”(Cordella

of countriesand Powell,

trying 2021,defaulting

to avoid p. 2). In

like Moody’s. Similarly, Cordella and Powell (2021) highlight that the preferred creditor

the same vein, Perraudin

to multilateral institutionset since

al. (2016)

these highlight

keep funding that the preferred

countries creditor

when privatestatus is not

lenders do

status “is not strongly backed in international law”(Cordella and Powell, 2021, p. 2). In

anot,

contractual feature,

which in turn is inbut

line“awith

marketthe practice attributable

lack of financial to theafter

exclusion incentives

a defaultfaced by dis-

to private

the same vein, Perraudin et al. (2016) highlight that the preferred creditor status is not

tressed

lenders.sovereign

Moreover,borrowers” (Perraudin

their preferred et status

creditor al., 2016, p. 9). According

contributes to the highto Perraudin et al.

credit standing

a contractual feature, but “a market practice attributable to the incentives faced by dis-

(2016), the preferred

that multilateral creditorenjoy,

institutions statusasis itthe resultshown

is also of countries trying et

by Perraudin toal.

avoid defaulting

(2016). 8

tressed sovereign borrowers” (Perraudin et al., 2016, p. 9). According to Perraudin et al.

to multilateral institutions since these keep funding countries when private lenders do

(2016), the preferred creditor status is the result of countries trying to avoid defaulting

not,Fact

which5:inMultilateral

turn is in linelenders

with thetend lack of

to financial

offer lowerexclusion afterrates

interest a default

thantoprivate

private

to multilateral institutions since these keep funding countries when private lenders do

lenders.

creditors. Moreover, their preferred

Multilateral lenders tend creditor status

to offer contributes

better financialtoterms

the highthancredit standing

private cred-

not, which in turn is in line with the lack of financial exclusion after a default to 8private

that

itors.multilateral institutions

In this regard, Cordella enjoy,

and as it is also

Powell shown

(2021) by Perraudin

highlight et al. (2016).

that international financial

lenders. Moreover, their preferred creditor status contributes to the high credit standing

institutions can “lend limited amounts at close to the risk-free rate under most circum-

that multilateral institutions enjoy, as it is also shown by Perraudin et al. (2016).8

Fact 5: Multilateral

stances”(Cordella and Powell, lenders

2021,tendp. 2).toInoffer lower interest

particular, rates

as explained in than

Nelsonprivate

(2020)

creditors.

“Due to the Multilateral

financial backing lenders tend member

of their to offer better

countryfinancial terms the

governments, than private

MDBs arecred-

able

Fact 5: Multilateral lenders tend to offer lower interest rates than private

itors.

to borrow In this

moneyregard, Cordella

in world capitalandmarkets

Powell (2021)

at the highlight that international

lowest available market rates, financial

gener-

creditors. Multilateral lenders tend to offer better financial terms than private cred-

institutions

ally the same canrates

“lend at limited amounts atcountry

which developed close togovernments

the risk-freeborrow

rate under

fundsmost circum-

inside their

itors. In this regard, Cordella and Powell (2021) highlight that international financial

stances”(Cordella

own borders. The and banks Powell,

are able 2021, p. 2). this

to relend In particular, as explained

money to their borrowers in at

Nelson

much(2020)

lower

institutions can “lend limited amounts at close to the risk-free rate under most circum-

“Due

interest to rates

the financial

than thebacking

borrowersof their

would member country

generally havegovernments, the MDBsloans,

to pay for commercial are able if,

stances”(Cordella and Powell, 2021, p. 2). In particular, as explained in Nelson (2020)

to borrow

7

indeed,In Brusuchmoney

Muñoz

loans in

(2022)world

were alsocapital

I available tomarkets

find that at such,

thedolowest

official lenders

them. As not available

the impose

MDBs’ market

financial exclusion

non-concessional rates, gener-

to countries

lending

“Due

that aretointhe financial

default backing

to private lenders.of Nevertheless,

their member country

Flogstad and governments,

Nordtveit (2014)the findMDBs are able

the opposite for

ally

windows the same

concessional are rates at which

self-financing

official lending. anddeveloped

even generatecountrynet governments

income.”(Nelson, borrow2020,funds inside their

p. 7).

to borrow

8 money such

Other authors, in world

as Boltoncapital

and markets

Jeanne (2009)at the lowest

suggest thatavailable

seniority market rates, to

may be related gener-

how

own borders. The banks are able to relend this money to their borrowers at much lower

difficult it is to renegotiate a given debt. They consider that countries may default on debt that is easier

ally

to the same

renegotiate andrates

repayat debtwhich

that isdeveloped country governments

harder to renegotiate, borrow

giving rise to some kind funds inside

of de facto their

seniority.

Thus, the fact that multilateral lenders can offer relatively lower interest rates is

own7 Inborders. The banks are able to relend this money to their borrowers at much lower

Bru Muñoz (2022) I also find that official lenders do not impose financial exclusion to countries

linked to their ability to obtain funds at very 6 favorable rates, which in turn is related to

that are in default to private lenders. Nevertheless, Flogstad and Nordtveit (2014) find the opposite for

concessional

the87multilateralofficialinstitutions’

lending. preferred creditor status. In this regard, Cordella and Pow-

In Bruauthors,

Other Muñoz (2022)

such asI also findand

Bolton thatJeanne

official (2009)

lenderssuggest

do not that

impose financial

seniority mayexclusion to countries

be related to how

that are

difficult in

it isdefault

to to private

renegotiate a lenders.

given debt.Nevertheless,

They Flogstad

consider that and Nordtveit

countries

ell (2021) underscore for multilateral institutions that “IBRD and the four main regionalmay (2014)

default onfind the

debt opposite

that is for

easier

concessional

to renegotiateofficial

and repaylending. debt that is harder to renegotiate, giving rise to some kind of de facto seniority.

8

MDBs (ADB,

Other AfDB,

authors, suchEBRD andand

as Bolton IDB) maintain

Jeanne (2009)AAA ratings.

suggest Moody’s

that seniority may and beStandard

related to and

how

difficult it is to renegotiate a given debt. They consider that countries may default on debt that is easier

Poor’s

BANCO DE ESPAÑA 11 DOCUMENTO

both and

to renegotiate suggest

repaythese

DE TRABAJO N.º 2301

fiveisorganizations

debt that

6 enjoy giving

harder to renegotiate, preferred

rise tocreditor

some kindstatus”

9

of de facto(Cordella

seniority.

and Powell, 2021, p. 3). Therefore, the aforementioned high credit standing, linked to

6

the preferred creditor status, is a key part of the multilateral institutions’ business: it isThus, the fact that multilateral lenders can offer relatively lower interest rates is

linked to their ability to obtain funds at very favorable rates, which in turn is related to

the multilateral institutions’ preferred creditor status. In this regard, Cordella and Pow-

interest

ell (2021)rates than the

underscore forborrowers would

multilateral generally

institutions have

that to pay

“IBRD forthe

and commercial

four main loans, if,

regional

indeed,(ADB,

MDBs such loans

AfDB,were

EBRDavailable to them.

and IDB) As such,

maintain AAAthe MDBs’

ratings. non-concessional

Moody’s lending

and Standard and

windows

Poor’s are suggest

both self-financing and organizations

these five even generate enjoy

net income.”(Nelson, 2020,

preferred creditor p. 7).

status” 9

(Cordella

and Powell, 2021, p. 3). Therefore, the aforementioned high credit standing, linked to

the Thus, thecreditor

preferred fact that multilateral

status, is a key lenders can multilateral

part of the offer relatively lower interest

institutions’ rates

business: is

it is

alinked

factortothat

their ability

allows to obtain

them to raisefunds

fundsatatvery

low favorable rates,which

interest rates, whichpermits

in turnthem

is related to

in turn

theoffer

to multilateral

relativelyinstitutions’ preferred

cheaper financing creditor status. In this regard, Cordella and Pow-

to countries.

ell (2021) underscore for multilateral institutions that “IBRD and the four main regional

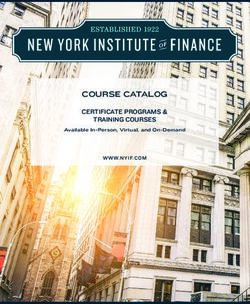

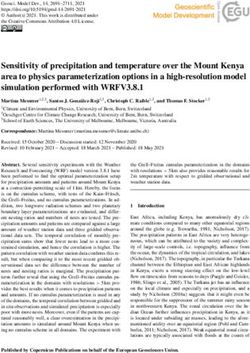

MDBs (ADB,Figure

AfDB,

Additionally, 1:EBRD

Probability

according toand ofand

IDB)

Dellas default

maintainand

Niepelt debtratings.

AAA

(2016) inthe

default by lender

Moody’s

low and

interest rateStandard and

that official

9

Poor’s both

offer suggest

(a) Probability

lenders these to

of default

is the result five

of organizations

each

the enjoy

(b)

creditor penalties

stronger preferred

Totalthat creditor

debt these

as % GDPstatus”

ofcreditors

in the (Cordella

can first year to

impose in

default to each of the lenders

and

By Powell,

Creditor

defaulting 2021,Probability

p. since

countries, 3). Therefore, the aforementioned

theseofpenalties

default reduce the probability high credit standing,

of default.10 linked to

Paris

the Club creditor status,6.0

preferred is a key part of the

Defaultmultilateral

with any lender institutions’ business: it is

49.7

IMF 1.1

aIBRD

factor

Fact that allows them

6: Default to 1.4

raise funds at

to multilateral low interest

lenders is anrates,

Def. with Paris Club

which permits

infrequent event. them

As ainresult

turn

74.7

toIDA 0.8 Def. with IMF 106.2

of offer relatively

these cheaper

very different and financing

specific to countries. default to multilateral lenders, repre-

characteristics,

Banks 2.9 Def. with IBRD 77.2

Bondsby the IBRD and the 3.5

sented International Development Association (IDA)11 in panel (a)

Def. with IDA 102.4

Note: The probability of default is computed by

of Additionally,

Figure

dividing according

the1,estimated

is a rare event. to

number Dellasto

Default

of default and Niepelt (2016)

multilateral

episodes the lowtends

institutions

Def. with Banks

interest rate that

to occur

50.3

official

in periods

with a specific

lenders offer lender

is the byresult

the number

of the of years withpenalties that these creditors can impose to

of high debt

positive debt as share

stock with of GDP,

that as stronger

lender. shown in panel (b)

For more of Figure 1. Therefore,

Def. to Bonds 50.2

countries

information

defaulting on this estimation,

countries, since please

these see Bru

penalties 60 10 80

default to multilateral

Muñoz (2022).

lenders when either reduce

GDP isthevery probability

0

low, of 40

or20totaldefault.

debt 100

% of GDPis very high.

9

The multilateral development banks (MDBs) listed above are the International Bank for Reconstruc-

tion and Development (IBRD), the Asian Development Bank (ADB), the African Development Bank

Fact 7:

Fact 6: Multilateral

Default to multilateral are lenders is full

an infrequent event. As a aresult

(AfDB), the European Bank forlenders

Reconstruction repaid in

and Development after they

(EBRD) experience

and the the Inter-American de-

Development

of theseAs veryBank (IDB).

different and The IBRD is one of the two branches of the World Bank that offer loans to

fault.

governments Perraudin al. specific

in developingetcountries.

characteristics,

(2016) highlight, in thedefault

severaltodefaults

multilateral lenders,

analyzed repre-

in Cruces

10 11 how countries

sented

and by the IBRD

An example

Trebesch of one ofand

(2013), these

thosethe International

penalties

to Development

is presented

multilateral by Lang et al.Association

development were (IDA)

(2021) who underscore

banks in panel (a)

never accompanied

that were in arrears to the World Bank or to the IMF were excluded from the Debt Service Suspension

of Figure

Initiative,

by 1, isinaindebt’s

which,

a decrease rare event.

the context

face of Default andtoalso,

the Covid-19

value multilateral

pandemic, institutions

the few provided

defaults tends

temporary

to the to occur

debt relief ininthe

Inter-American periods

means

Devel-

of a temporary suspension of debt service to official bilateral creditors.

of 11high

opmentIBRD debt

and as

Bank share

never

IDA of two

areinvolved

the GDP, debtaswrite-downs.

branches shown

of the in panel

World (b)that

Likewise,

Bank of Schlegl

Figure

offer 1. to

et

loans Therefore,

al. countries

(2019) underscore

governments in devel-

oping countries. These agencies are not the only multilateral lenders, but these are the only for which

default

that thetoIMF

disaggregated

multilateral

and

data on the

lenders

World

defaulted

when

Bank

debt

either GDPgranted

have only

is available

is etvery

in Beers

low, or

debt

al. (2020b),

total

write-downsdebt is

therefore I use

very high.

exceptionally

them in this

paper9 as a proxy for all defaults to multilateral lenders.

The multilateral development banks (MDBs) listed above are the International Bank for Reconstruc-

under the Multilateral Debt Relief Initiative from 2005, but, as highlighted by Cordella

tion and Development (IBRD), the Asian Development Bank (ADB), the African Development Bank

(AfDB),

and the European

Powell Bankalso

(2021), who for Reconstruction 7 Development

and

show similar findings, (EBRD)that

the countries and the the Inter-American

benefited from this

Development Bank (IDB). The IBRD is one of the two branches of the World Bank that offer loans to

program

governments didinnot have access

developing to international private financial markets.

countries.

10

An example of one of these penalties is presented by Lang et al. (2021) who underscore how countries

that were in arrears to the World Bank or to the IMF were excluded from the Debt Service Suspension

Initiative, which, in the context of the Covid-19 pandemic, provided temporary debt relief in the means

Fact 8: Multilateral funding is part of the regular funding of countries

of a temporary suspension of debt service to official bilateral creditors.

11

ratherIBRD and an

than IDAoccasional

are the two branches

bailout. of the World Bankinstitutions

Multilateral that offer loans

tendto to

governments in devel-

act as long-term

oping countries. These agencies are not the only multilateral lenders, but these are the only for which

disaggregated

lenders data on

that fund defaulted

either debtprojects

specific is available in Beers et

or provide al. (2020b),

budget therefore

support, whileI the

use IMF

them tends

in this

paper as a proxy for all defaults to multilateral lenders.

to act as a bailout agency. In this regard, as highlighted in Horn et al. (2021) “In 1944,

12

BANCO DE ESPAÑA DOCUMENTO DE TRABAJO N.º 2301 7

the IMF was founded with the aim of providing short-term official funds to countries

with temporary balance-of-payments problems, alongside with the World Bank that was

intended to provide long-term development and reconstruction funds” (Horn et al., 2021,Paris Club 6.0 Default with any lender 49.7

IMF 1.1

Def. with Paris Club 74.7

IBRD 1.4

IDA 0.8 Def. with IMF 106.2

Banks Figure 1: Probability

2.9 of default and debt in default by lender

Def. with IBRD 77.2

Bonds

(a) Probability of default to3.5

each creditor (b) Total debt as % of GDP in the first year in

Def. with IDA 102.4

Note: The probability of default is computed by default to each of the lenders

dividing the estimated

By Creditor number of default

Probability episodes

of default Def. with Banks 50.3

with a specific lender by the number of years with

Paris Club 6.0 Def. to Bonds 50.2

positive debt stock with that lender. For more Default with any lender 49.7

IMF

information on and

this “financial 1.1

estimation, rescue”

please see 12

Bru

development” loans. TheDef.first category

with Paris Club

0 20—closer

40 to60 the activity

% of GDP 74.7

80 100 of

IBRD(2022).

Muñoz 1.4

multilateral

IDA developments institutions—

0.8 tends to beDef.substantially

with IMF higher than the latter 106.2

Banks 2.9 Def. with IBRD 77.2

—closer

Fact to

7: the IMF role— from

Multilateral lenders the fifties, and except

are repaid in full in the years

after of the

they Great Financial

experience a de-

Bonds 3.5

Def. with IDA 102.4

Crisis The

Note:

fault. when they become

probability

As Perraudin very

of default

et al.

issimilar.

(2016)

computed by

highlight, in the several defaults analyzed in Cruces

dividing the estimated number of default episodes Def. with Banks 50.3

with a specific lender by the number of years with

and Trebesch (2013), those to multilateral development banks were never accompanied

Def. to Bonds 50.2

positive debt stock with that lender. For more

by aIndecrease

orderonto

information reproduce

inthis face the

estimation,

debt’s facts

please

value shown

andsee infew

Bruthe

also, thisdefaults

section, I 20include

0 to the

within

Inter-American

40 60

% of GDP

80

a Devel-

DSGE

100

Muñoz (2022).

sovereign

opment default

Bank never model

involveda multilateral lender that

debt write-downs. offersSchlegl

Likewise, loans with

et al. typically lower in-

(2019) underscore

13

terestthe

that rates

IMF (asand

longtheas World

privateBank debt have

is notonly very low), that imposes no conditionality

Fact 7: Multilateral lenders are repaidgrantedin full debtafterwrite-downs

they experienceexceptionally

a de-

and that isMultilateral

under senior. Also, thisRelief multilateral creditor does not but,penalize countries byafter they

fault. theAs Perraudin etDebt Initiative

al. (2016) highlight, from

in the2005,

several as highlighted

defaults analyzed inCordella

Cruces

default to private

and lenders andshow

continues

similaroffering funding to them that in the event of from

a default

and Powell

Trebesch (2021), whothose

(2013), also to multilateral findings,

developmentthe countries

banks were never benefited

accompanied this

to privatedid

program creditors.

not have However,

access if countries default

to international tofinancial

the multilateral institution, they

by a decrease in debt’s face value and also, theprivatefew defaults markets.

to the Inter-American Devel-

face full financial autarky. The fact that countries can obtain multilateral funds after

opment Bank never involved debt write-downs. Likewise, Schlegl et al. (2019) underscore

defaulting8:to Multilateral

private lendersfunding reduces is the cost of of default, as highlighted

funding by Hatchondo

thatFact

the IMF and the World Bank havepart only grantedthe regular

debt write-downs of countries

exceptionally

et al. (2017).

rather than an occasional bailout. Multilateral institutions

under the Multilateral Debt Relief Initiative from 2005, but, as tend to act asbylong-term

highlighted Cordella

lenders

and Powellthat(2021),

fund either

who specific

also show projects

similarorfindings,

provide the budget support,

countries thatwhile the IMF

benefited fromtends

this

to Additionally,

act as did

a bailout in order

agency. to make seniority relevant in the model, I introduce recovery

program not have accessIntothis regard, as highlighted

international private financial in Horn et al. (2021) “In 1944,

markets.

ratesIMF

the for both types of with

was founded debt, thewhichaimis of

a novelty

providing in this type of official

short-term models.funds Whentodefaults

countriesto

both temporary

with lenders occur, countries must repay

balance-of-payments multilateral lenders

with in full before re-accessing,

Fact 8: Multilateral funding problems,

is part of alongside

the regular the World

funding Bank that was

of countries

first multilateral,

intended to provide and second development

long-term private financial and markets.

reconstruction This assumption ofetfull

al.,repay-

rather than an occasional bailout. Multilateral institutionsfunds” tend to (Horn

act as 2021,

long-term

ment

p. 8). to multilateral

Thus, even either

thoughlenders

someismultilateral

supported by the empirical

agencies may have evidence,

bailout as shownasabove.

programs well,

lenders that fund specific projects or provide budget support, while the IMF tends

Furthermore,

it I also include positiveIn recovery rates for private lenders to replicate what is

to isact

not

as the core

a bailout ofagency.

their lending.

In this regard,this asregard, Horn

highlighted etinal. (2021)

Horn et al.distinguish

(2021) “Inamong1944,

found

several in empirical data and in order to maintain consistency between the characteristics

the IMFtypes was of official with

founded financing

the aimaccording to theirshort-term

of providing objective. official

These funds

includeto“economic

countries

of multilateral and private lenders. 12

development” and “financial rescue” loans. The first category —closer to the activity of

with temporary balance-of-payments problems, alongside with the World Bank that was

8

multilateral developments institutions— tends to be substantially higher than the latter

intended to provide long-term development and reconstruction funds” (Horn et al., 2021,

Thanks

—closer to this

to the IMFnewrole— framework,

from the Ififties,

show and thatexcept

the inclusion of multilateral

in the years of the Great lenders pro-

Financial

p. 8). Thus, even though some multilateral agencies may have bailout programs as well,

duces higher

Crisis when theylevelsbecome

of public verydebt and realistic default probabilities, with a discount factor

similar.

it is not the core of their lending. In this regard, Horn et al. (2021) distinguish among

12

Horn et al. (2021) distinguish among several types of official financing according to their objective,

several types of development”

such as “economic official financing according

and “financial to their

rescue” objective.

loans which These

they define include“The

as follows: “economic

category

In order

economic to reproduce

development includes the

loansfacts shownextended

and grants in this for

section, I include

the financing within

of projects a DSGE

in developing

countries ranging from infrastructure investments to state-building activities. [...] financial rescue loans

sovereign default

covers loans, grants model a multilateral

and guarantees

8 that

lender

during currency, debt offers loans crises,

and banking with typically lower in-

including balance-of-

payment crises, as well as general budget support” (Horn et al., 2021, p. 14).

terest

13 rates (as long as private debt is not very low), that imposes no conditionality13

Many authors, such as Boz (2011) or Fink and Scholl (2016) among others, include conditionality in

their13

and models

that

BANCO DE ESPAÑA

is for bailout

senior. loans,this

Also, andmultilateral

even though conditionality

DOCUMENTO DE TRABAJO N.º 2301

creditor does is not

not present in most

penalize multilateral

countries after loans,

they

it might be included as a feature of this model. In principle, conditionality would make multilateral

funds relatively

default less attractive.

to private lenders and However, the overall

continues offeringgeneral equilibrium

funding to themeffects of event

in the conditionality would

of a default

depend on the different modeling choices of such conditionality and its calibration.

to private creditors. However, if countries default to the multilateral institution, theyCrisis when they become very similar.

In order to reproduce the facts shown in this section, I include within a DSGE

12

development”

sovereign andmodel

default “financial rescue” loans.

a multilateral lenderThe

thatfirst category

offers loans —closer to the activity

with typically lower in-of

multilateral

that

terestisrates developments

relatively

(as long institutions—

highasinprivate

sovereign

debtdefault tends

is not verytolow),

models. beFurthermore,

substantially

that imposes higher

this than

nopaper the latter

contributes

conditionality 13

—closer

to

andthe to theliterature

existing

that IMFAlso,

is senior. role—on from

the

this the of

role fifties, and except

multilateral

multilateral creditor debtinnot

does inthe years ofeconomies.

emerging

penalize the Greatafter

countries Financial

It is they

well

Crisis when

established

default inthey

to private become

thelenders very

literature

and similar.

that privateoffering

continues debt tends to to

funding be them

procyclical. However,

in the event to the

of a default

best

to of my creditors.

private knowledge,However,

the cyclicality of multilateral

if countries banks’

default to lending (notinstitution,

the multilateral of IMF lending,

they

which

face In order

has

full to widely

been reproduce

financial autarky. the

The facts

covered) fact shown

and that

how it in this with

relates

countries section,

can I include

the cyclicality

obtain within a DSGE

of private

multilateral funds debt

after

sovereign

has

defaulting default

only been model

approached

to private a in

lendersmultilateral

the thelender

empirical

reduces that offers

literature,

cost of loans

but as

default, inwith typically

nothighlighted

a DSGE lowerde-

bysovereign

Hatchondoin-

13

terest

fault

et rates (as

al. model.

(2017). Butlong

withas private

this debt

setting, is not

I show thatvery low), thatlending

multilateral imposes no conditionality

tends to be acyclical

and

or that is senior. acting

countercyclical, Also, this multilateral

as an insurance creditor doesfornot

mechanism penalizethat

countries countries

allowsafter

themthey

to

default

maintain tohigher

private

Additionally, inlenders

levels andmake

of total

order to continues offering

debt.seniority funding

relevant to them

in the in the

model, event of recovery

I introduce a default

to private

rates creditors.

for both types of However,

debt, whichif countries default

is a novelty totype

in this the of

multilateral institution,

models. When defaultsthey

to

faceThis

both full paper

financial

lenders occur, autarky.

is organized The

countriesas fact

follows:

must that

repay countries

Section can

2 provides

multilateral obtain multilateral

a general

lenders in full overview

before funds

of theafter

lit-

re-accessing,

defaulting

erature;

first to private

Section

multilateral, 3 and lenders

presents

second reduces

theprivate the cost4markets.

model;financial

Section ofshows

default,

the as

main

This highlighted

results ofby

assumption Hatchondo

thefull

of model as

repay-

et al.asto

well

ment (2017).

the calibrationlenders

multilateral and theisempirical

supportedevidence

by the supporting the findings;

empirical evidence, and Section

as shown above.5

concludes.

Furthermore, I also include positive recovery rates for private lenders to replicate what is

Additionally,

found in empiricalindata

order

andtoinmake

orderseniority relevant

to maintain in the model,

consistency betweenI the

introduce recovery

characteristics

rates for both and

of typesprivate

of debt, which is a novelty in this type of models. When defaults to

2 multilateral

A Review of lenders.

the Literature

both lenders occur, countries must repay multilateral lenders in full before re-accessing,

firstThanks

The multilateral,

canonical

to this and

new second

sovereign private

default

framework, modelsfinancial

I show ofthat markets.

Arellano

the This

(2008)

inclusion and

of assumption

Aguiar and

multilateral of full repay-

Gopinath

lenders pro-

14

ment higher

to do

multilateral lenders is and

supported

(2006)

duces not tackle

levels the different

of public debt types ofby

realistic the empirical

creditors

default evidence,

that a country

probabilities, aasdiscount

withmay shownnamely

have, above.

factor

Furthermore, I alsocreditors. 15

include positive recovery rates for private

official

that and private Nevertheless, the literature onlenders to replicate

the effect

12 is relatively high in sovereign default models. Furthermore, this paper contributes

of officialwhat

lend-is

Horn et al. (2021) distinguish among several types of official financing according to their objective,

such as “economic

found in development”

empirical hasand

data and in “financial

orderoftomultilateral

ing on sovereign default quite rescue”

inloans

maintain which they define

consistency as

between follows:

it“The

hasItcategory

the characteristics

to the existing literature on the roledeveloped recent

debtyears, even

in emerging though

economies.

economic development includes loans and grants extended for the financing of projects in developing

mainly

is well

of multilateral

focused

countries

established on bailout

ranging

in the andliterature

from private

loans fromlenders.

infrastructure international

that investments

private debttoinstitutions.

state-building

tends to beactivities.

procyclical.[...] financial

However, rescuetoloans

the

covers loans, grants and guarantees during currency, debt and banking crises, including balance-of-

payment

best of my crises, as well as general

knowledge, budget support”

the cyclicality (Horn et al.,

of multilateral 2021, lending

banks’ p. 14). (not of IMF lending,

13

Many authors, such as Boz (2011) or Fink and Scholl (2016) among others, include conditionality in

which

their

Thanks

One of the

has

models

to most

been this

widely

for bailout

new framework,

influential

covered)

loans, and evenpapers

and I show

how

though itthat

in this the of

strand

relates

conditionality

inclusion

isthe

withnotthe

of multilateral

literature,

cyclicality

present in most of lenders

Bozmultilateral

(2011),

private pro-

models

debt

loans,

itduces

mighthigher

be included

levels asofapublic

featuredebt of thisandmodel. In principle,

realistic default conditionality would

probabilities, amake multilateral

an

haseconomy

funds only been

relatively

that may

approached

less

borrow

attractive. in

from

the

However,

private

empirical lenders

the overallliterature,

and from

but

general equilibrium notan a with

inInternational

effects DSGE discount

sovereign

of conditionality

factor

Financialde-

would

depend

Institution on the(IFI)

different

which modeling choices of

represents such conditionality andisitsnon-defaultable

calibration.

fault 12

Horn

model. et al.But

(2021)

with distinguish

this amongIthe

setting, showIMF.

several types

that IFI’s debt

of official

multilateral financing

lendingaccording

tends to as

be aacyclical

totheir way of

objective,

such as “economic development” and “financial rescue” loans which they define as follows: “The category

capturing

oreconomic seniority.acting

countercyclical,

development To account

includes as loans for

andthe

an insurance conditionality

grants mechanism

9extended for forimposed

the countries by the

financing ofthat IMF,

allows

projects ifin countries

them to

developing

countries ranging from infrastructure investments to state-building activities. [...] financial rescue loans

decide

maintain to higher

borrowlevelsfrom thetotal IFI, debt.

they switch to a higher discount factor, since this involves

covers loans, grants and of guarantees during currency, debt and banking crises, including balance-of-

payment crises, as well as general budget support” (Horn et al., 2021, p. 14).

13

14 Manythough

Even authors, such and

Aguiar as Boz (2011) or

Gopinath Finkincorporate

(2006) and Scholl (2016)

bailoutsamong

from an others, includeagent,

unmodeled conditionality in

these take

their

the formmodels

of for bailout

transfers ratherloans,

than and even though conditionality is not present in most multilateral loans,

loans.

This paper is organized as follows: Section 2 provides a general overview of the lit-

it 15

might be included

An important as a to

attempt feature

address of heterogeneous

this model. In principle,

lending conditionality

through would make

the lens of seniority, multilateral

but abstracting

funds

from relatively

official versusless attractive.

private However,

creditors, is the

Bolton overall

and general

Jeanne equilibrium

(2009).

erature; Section 3 presents the model; Section 4 shows the main results of the model They effects

consider of conditionality

two types would

of lenders,

as

depend

one withon the different

whom modeling choices

debt renegotiation of such

is possible andconditionality

another withand whomits calibration.

it is not. Bolton and Jeanne

well assomehow

(2009) the calibration and the

represent banks empirical

as creditors withevidence

whom debt supporting

renegotiation theisfindings;

possible, and andbondholders

Section 5

as disperse lenders for whom the coordination of a renegotiation process is difficult.

14

concludes.

BANCO DE ESPAÑA DOCUMENTO DE TRABAJO N.º 2301 9

10You can also read